Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Chapter 4 Partnership.

Caricato da

Wonde BiruDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Chapter 4 Partnership.

Caricato da

Wonde BiruCopyright:

Formati disponibili

CHAPTER 4

ACCOUNTING FOR PARTNERSHIPS

A partnership is defined as “an association of two or more persons to carry on as co-owners of

a business for profit based on a legally binding contract”.

Partnership Characteristics

Ease of formation

Voluntary association

Articles of partnership

Mutual agency

Unlimited liability: each partner is personally/individually liable for all partnership liabilities

Co-ownership of property: partnership assets are co-owned by the partners. Partnership net

income (or net loss) is also co-owned. If the partnership agreement does not specify to the

contrary, the partners share all net income or net loss equally.

Income participation

Limited life: It may be ended (dissolved) through acceptance of a new partner or withdrawal

of an existing partner. Dissolution does not necessarily mean that the business ends

Advantages and Disadvantages of the Partnership

Advantages

Capitalization

Combined experience and talent

Ease of formation

Cost of organization

Tax advantages

Less government supervision

Disadvantages

Loss of freedom

Limited life

Unlimited Liability

Mutual Agency

Division of authority

Accounting for Partnerships 1

The partnership Agreement

The written agreement often referred to as the partnership agreement or articles of co-

partnership contains such basic information as the name and location of the firm, the purpose

of the business, date of inception, and division of income and loss etc.

Partnership Accounting

Accounting for a partnership is the same as accounting for a proprietorship except for

transactions directly affecting partners’ equity. Because ownership rights in a partnership are

divided among partners, partnership accounting:

❑ Partnership accounting requires establishing a separate capital and a separate

withdrawals account for each partner.

❑ Allocates net income or loss to partners according to the partnership agreement

Partnership Formation /Recording Investments

When a partnership is formed, a journal entry is made to record the assets contributed by each

partner and the liabilities of each partner that are assumed by the partnership. A separate

entry is made for the investment of each partner in a partnership.

GAAP require that non-cash assets contributed by individual partners be valued at their fair

value on the date they are transferred to the partnership.

Example

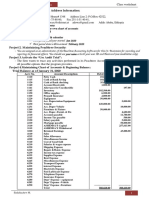

On April 1 of the current year, Fassil and Selamawit agreed to combine their existing business

and form a partnership. The partners are to contribute the assets of their previous business.

It is agreed that the liabilities of the proprietorships will be assumed by the partnership. The

contribution made by each partner is as follows.

Amount

Asset contributed Fassil Selamawit

Cash 3,500 5,700

Accounts Receivable 7,600 4,200

Merchandise inventory 15,900 11,000

Supplies 700 300

Equipment 8,500 -

Building - 55,000

Land - 16,000

Liability assumed

Account payable 3,100 -

Notes payable - 19,600

Accounting for Partnerships 2

The journal entries to open the accounts of the partnership are:

April 1. Cash 3,500

Account Receivable 7,600

Merchandise inventory 15,900

Supplies 700

Equipment 8,500

Account payable 3,100

Fassil, capital 33,100

(To record the investment of Fassil)

April 1. Cash 5,700

Account Receivable 4,200

Merchandise Inventory 11,000

Supplies 3,00

Building 55,000

Land 16,000

Notes payable 19,600

Selamawit, capital 72,600

(To record the investment of Selamawit)

Division of Net income or Net loss

Income division is the manner in which profits and losses are allocated to individual partners.

The method of dividing partnership income should be stated in the partnership agreement. In

the absence of an agreement or if the agreement is silent on dividing net income or net losses,

all partners share equally.

Methods to divide income or lose use:

A. Division based on fractional share to each partner.

B. Division based on the ratio of capital invested.

C. Division based on salary allowances. Technically, partners’ salaries are profit shares, not

expenses of the business.

D. Division based on interest allowances.

E. Division based on both salary and interest allowances. Salary and interest allowances

exceed the amount of net income; the excess net income will simply be negative.

Income Division: Services of partners

Salary Allowance

Articles of partnership often provide for the division of a portion of net income to the partners

in the form of a salary allowance taking into account the ability and amount of time devoted to

the business.

Accounting for Partnerships 3

Example

Assume that the articles of partnership of Alem and Tesfaye provide for monthly salary

allowance or $ 2,000 and $ 3,000 respectively, with the balance of the net income to be divided

equally. The net income for the year is $ 90,000. The division of the $ 90,000 net income is a

follows. Net income to divide $90,000

Division of net income Alem Tesfaye Total

Salary Allowance $ 24,000 $ 36,000 $ 60,000

Remaining income 15,000 15,000 30,000

Partners shares $ 39,000 $ 51,000 $ 90,000

The division of net income is recorded as a closing entry, regardless of whether the partners actually withdraw

the amounts of their salary allowances. The entry for the division of net income is as follows.

Dec 31 Income Summary 90,000

Alem, capital 39,000

Tesfaye, capital 51,000

Income Division: services of partners and investment

Partners may agree that the most equitable plan of dividing income is to provide for:

1. Salary allowance and

2. Interest on capital investments.

Any remaining net income is then divided as agreed.

Example

Assume that the partnership agreement for Alem and Tesfaye divides income as follows.

1. Monthly salary allowances of $ 2,000 for Alem and $ 3,000 for Tesfaye.

2. Interest of 10% on each partner’s capital balance on January 1.

3. Any remaining net income divided equally between the partners.

Alem had a credit balance of $ 70,000 in her capital account on January 1 of the current fiscal

year, and Tesfaye had a credit balance of $ 90,000 in his capital account. The $ 90,000 net

income for the year is divided in the following schedule.

Net income $ 90,000

Division of net income

Alem Tesfaye Total

Annual salary allowance $ 24,000 $ 36,000 $ 60,000

Interest allowance 7,000 9,000 16,000

Remaining income 7,000 7,000 14,000

Net income $ 38,000 $ 52,000 $ 90,000

$ 70,000 x 10% = $ 7,000

$ 90,000 x 10% = 9,000

For the above example, the entry to close the income summary account is shown below.

Dec 31. Income summary $ 90,000

Alem, capital 38,000

Accounting for Partnerships 4

Tesfaye, capital 52,000

Income Division: Allowances Exceed Net Income

In the examples so far, the net income has exceeded the total of the salary and interest

allowances. If the net income is less than the total o the allowances, the remaining balance will

be a negative amount. This amount must be divided among the partners as though it were a

net loss.

Example:

Assume the same salary and interest allowances as in the above example, but assume that the

net income is $ 50,000. The salary and interest allowances total $ 31,000 for Alem and $

45,000 for Tesfaye. The sum of these amounts, $ 76,000, exceeds the net income of $ 50,000

by $ 26,000. It is necessary to divide the $ 26,000 excess between Alem and Tesfaye. Under

the partnership agreement, any net income or net loss remaining after deducting the

allowances is divided equally between Alem and Tesfaye. Thus each partner is allocated one-

half of the $ 26,000 and $ 13,000 is deducted from each partner’s share of the allowances. The

final division of net income between Alem and Tesfaye is shown below.

Net income 50,000

Division of Net income

Alem Tesfaye Total

Annual salary allowance $ 24,000 $ 36,000 $ 60,000

Interest allowance 7,000 9,000 16,000

Total $ 31,000 $ 45,000 $ 76,000

Excess of allowances over income (13,000) (13,000) (26,000)

Net income $ 18,000 $ 32,000 $ 50,000

The entry to close the income summary account

Dec 31 Income summary 50,000

Alem, capital 18,000

Tesfaye, capital 32,000

Partnership Dissolution

When a partnership dissolves, its affairs are not necessarily wound up. When a partner is

added or a partner withdraws, the old partnership ends. Stills, the business can continue to

operate as a new partnership among the remaining partners.

Admission of a partner

There are two ways a new partner is admitted to a partnership with the consent of all the

current partners.

1. Purchasing an interest from one or more of the current.

2. Contributing investing partners’ cash or other assets to the partnership.

Accounting for Partnerships 5

Purchasing an interest in a partnership

The purchase of partnership interest is a personal transaction between one or more current

partners and the new partner.

The capital interest of the incoming partner is reallocated and obtained from current partner

Neither the total assets nor the total owner’s equity of the business is affected.

Example

Assume that partners Abraham and Kebede have capital balance of $ 100,00 and $ 75,000

respectively. On September1, Abraham sells one-half of his interest for $60,000 and Kebede

sells one-fifth of his equity for $ 20,000 to Nardos. The exchange of cash is not a partnership

transaction and thus is not recorded by the partnership. The only entry required in the

partnership accounts is as follows.

Sept 1. Abraham capital 50,000

Kebede, capital 15,000

Nardos, capital 65,000

To record admission of Nardos by purchase.

Partnership Accounts

Abraham, capital Kebede, capital Nardos, capital

50,000 100,000 15,000 75,000 65,000

Investing/contributing Assets to a partnership

Admitting a partner by accepting assets is a transaction between the new partner and the

partnership. The invested assets become partnership property.

N.B: In this case, both the assets and the owner’s equity of the firm increase.

Example: -

Assume that partners Genet (with a $ 72,000 capital) and Sisay (with a $ 84,000) agreed to

accept Nebyat as a partner with her investment of $ 34,000 on March 1. The entry to record

Nebiyat’s investment is:

March 1. Cash 34,000

Nebiyat capital 34,000

To record admission of Nebiyat by investment.

Partnership Accounts

Net Assets Genet, capital Sisay, capital Nebyat, capital

156,00 72,000 84,000 34,000

34,00

Revaluation of Assets

A partnership’s asset account balances should be stated at current values when a new partner

is admitted. The net adjustment (increase or decrease) in asset values is divided among the

capital accounts of the existing partners according to their income-sharing ratio.

Accounting for Partnerships 6

Example:

Assume that in the preceding example for Genet & Sisay partnership, the balance of the

merchandise inventory account is $25,000 and the current replacement value is $ 29,000.

Prior to Nebyat’s admission, the revolution would be recorded as follows, assuming that Genet

& Sisay share net income equally.

March 1. Merchandise Inventory 4,000

Genet, capital 2,000

Sisay, capital 2,000

Partner Bonuses

When a new partner is admitted to a partnership, the incoming partner may pay a bonus to the

existing partners for the privilege of joining the partnership.

Existing partners can pay a bonus to a new partner. This usually occurs when they need

additional cash or the new partner has exceptional or special talents & skill.

The amount of any bonus paid to the partnership is distributed among the partner capital

accounts.

Bonus to old partners

Assume that on June 1 the partnership of Asenafi and Dereje is considering admitting a new

partner, Hiwot. After the assets of the partnership has been adjusted to current market values,

the capital balance of Ashenafi is $150,000 and the capital balance of Dereje $ 30,000.

Ashenafi and Derege agree to admit Hiwot to the partnership for $ 80,000. In return, Hiwot

will receive a 25% share in both equity and partnership income or losses.

Hiwot’s equity is determined as follows:

Equity of existing partners:

Ashenafi $ 150,000

Dereje 30,000

Investment of new partner, Hiwot 80,000

Total partnership equity $ 260,000

Equity of Hiwot (25% of total) $ 65,000

Contribution of Hiwot $ 80,000

Hiwot’s equity after admission 65,000

Bonus paid to Ashenafi & Derege $ 15,000

The bonus is distributed to Ashenafi and Dereje according to their income-sharing ratio.

Assume that Ashenafi & Dereje share profits and losses in the ration of 5:1; the entry to record

the admission of Hiwot to the partnership is as follows:

June1. Cash 80,000

Hiwot, capital 65,000

Ashenafi, capital 12,500

Derege, capital 2,500

(To record admission of Hiwot and bonus to old partners)

Accounting for Partnerships 7

Bonus to New partner

The new partner gets a larger share of equity than the amount invested (contributed).

Example:

Let’s say, from the preceding example, Ashenafi and Dereje agree toaccept HIwot as a partner

with a 25% interest in both the partnership’s income or loss and equity, but they require Hiwot

to only invest % 20,000. Hiwot’s equity is determined as:

Equities of existing partners ( $ 150,000 + $ 30,000) $ 180,000

Investment of new partner, Hiwot 20,000

Total partnership equity $ 200,000

Equiity of Hiwot (25% x $200,000) $ 50,000

Bonus to new partner, (Hiwot) ($50,000-$20,000) = $ 30,000

The entry to record Hiwot’s investment is

June 1. Cash 20,000

Asenafi, capital ($30,000 x 5/6) 25,000

Dereje, capital ($ 30,000x 1/6) 5,000

Hiwot, capital 50,000

(To record Hiwot’s admission and bonus)

Withdrawal of a partner

There are several ways in which an individual can withdraw from a partnership. A partner can:

1. Sell his or her interest to another partner or to an outsider with the consent of the other

partners, the transaction is personal.

2. Withdraw assets equal to his or her capital balances (No bonus).

3. Withdraw assets that are less than his or her capital balance (Bonus to remaining partners)

4. Withdraw assets that are greater than his or her capital balance (Bonus to withdrawing

partner)

Example

Let’s assume that the capital balances of the partners Genet, Sisay, and Nebiyat are $ 86,000,

$ 125,000, and $ 60,000, respectively, a total of $ 271,000. Genet Wants to withdraw from the

partnership on March 31.Required: Record the necessary five offers for her interest.

1. To sell her interest to Sisay for $ 90,000.

2. To sell her interest to Hagos, an outsider, for $100,000

3. To take cash equal to her equity.

4. To take $70,000 in cash

5. To take $ 102,000 in cash

Accounting for Partnerships 8

Death of a partner

A partner’s death dissolves a partnership. The accounts should be closed as of the death of the

partner and the partners’ capital accounts be updated.

The balance in the capital account of the decreased partner is then transferred to a liability

account with the deceased’s estate. The remaining partners may purchase the deceased’s

equity, sell it to outsiders, or deliver certain business assets to the estate.

Liquidation of a partnership

Liquidation of a partnership is the process of ending the business, of selling enough assets to

pay the partnership’s liabilities and distributing any remaining assets among the partners.

Liquidation is a special form of dissolution. When a partnership is liquidated, the business will

not continue. When a partnership is liquidated, its business is ended. Four steps are involved:

1. Non-cash assets are sold for cash and a gain or loss on liquidation is recorded.

2. Gain or loss on liquidation is allocated to partners using their income-and –loss ration.

3. Liabilities are paid.

4. Remaining cash is distributed to partners based on theirs capital balances.

The sale of the assets is called realization. In liquidation, some gains or losses commonly

result from the sale of non-cash assets.

Example: -

Assume that Fassil, Tahir, and Kassa share income and losses in a ratio of 4:4:2 (4/10, 4/10.

2/10). On May 12, 2002 after discontinuing business operations of the partnership and closing

the accounts, the following summarized trial balance was prepared.

Cash 3,000

Non-cash Assets 24,000

Liabilities 6,000

Fassil, capital 10,000

Tahir, capital 8,000

Kassa, capital 3,000

Total $ 27,000 $ 27,000

Between May 13 and May 31 required sell all non cash assets of the year 2002, Fassil, Tahir

and Kassa based on the above facts and taking different selling prices for the non cash assets,

prepared a statement of partnership liquidation & make the necessary journal entries to

account for the liquidating process if the non-cash assets are sold for:

1. $ 29,000, Gain on realization

2. $ 20,000, Loss on realization

3. $ 4,000, Loss on realization- capital deficiency

(Note: - capital deficiency means that at least one partner has a debit balance in his or her

capital account at the final distribution of a cash)

Accounting for Partnerships 9

a. Partner pays deficiency

b. Partner can’t pay deficiency

Any uncollected deficiency becomes a loss to the partnership and is divided among the

remaining partners’ and is divided among the remaining partners’ capital balances, based on

their income-sharing ration.

1. Gain on Realization

Fassil, Tahir, and Kassa

Statement of partnership Liquidation

For Period May 13, 31, 2002

Assets Capital

Non cash = Liabilities Fassil Tahir Kassa

Cash + Assets 40% 40% 20%

Balance before realization $3,000 $ 24,000 $ 6,000 $ 10,000 $ 8,000 $ 3,000

Sale of assets & division of gain +29,000 - 24,000 + 2,000 + 2,000 + 1,000

Balance after realization $ 32,000 $0 $6,000 $ 12,000 $ 10,000 $ 4,000

Payment of liabilities -6,000 - -6,000 - - -

Balance after payment of liabilities $ 26,000 $0 $0 $ 12,000 $10,000 $ 4,000

Cash distributed to partners -26,000 - - -12,000 -10,000 - 4,000

Final balance $0 $0 $0 $0 $0 $0

The entries to record the steps in the liquidating process are as follows:

Cash 29,000

Non cash Assets 24,000

Gain on Realization 5,000

(To record selling of assets)

Gain on Realization 5,000

Fassil, capital 2,000

Tahir, capital 2,000

Kassa, capital 1,000

(To record Division of gain from sale of assets)

Liabilities 6,000

Cash 6,000

(To record Payment of Liabilities)

Fassil, capital 12,000

Tahir, capital 10,000

Kassa, capital 4,000

Cash 26,000

(To record Distribution of cash to partners)

Accounting for Partnerships 10

2. Loss of Realization

Fassil, Tahir, and Kassa

Statement of partnership Liquidation

For Period May 13-31, 2002

Assets Capital

Cash + Non cash = Liabilities + Fassil Tahir Kassa

Assets 40% 40% 20%

Balance before realization $3,000 $ 24,000 $ 6,000 $ 10,000 $ 8,000 $ 3,000

Sale of assets & division of loss +20,000 - 24,000 - - 1,600 - 1,600 - 800

Balance after realization $ 23,000 $0 $6,000 $ 8,400 $ 6,400 $ 2,200

Payment of liabilities -6,000 - -6,000 - - -

Balance after payment of liabilities $ 17,000 $0 $0 $ 8,400 $6,400 $ 2,200

Cash distributed to partners -17,000 - - -8,400 -6,400 - 2,200

Final balance $0 $0 $0 $0 $0 $0

The entries to liquidate the partnership are as follows

Cash 20,000

Loss on Realization 4,000

Non cash Asets 24,000

(To record Selling of Assets)

Fassil, capital 1,600

Tahir, capital 1,600

Kassa, capital 800

Loss of Realization 4,000

(To record loss on realization of assets)

Liabilities 6,000

Cash 6,000

(To record Payment of liabilities)

Fassil, capital 8,400

Tahir, capital 6,400

Kassa, capital 2,200

Cash 17,000

(To record Distribution of cash to partners)

Accounting for Partnerships 11

3. Loss on Realization- capital Deficiency

a. Partner pays Deficiency

Fassil, Tahir, and Kassa

Statement of partnership Liquidation

For Period May 13-31, 2002

Assets Capital

Cash Non cash Liabilities+ Fassil Tahir Kassa

40% 40% 20%

Balance before realization $3,000 $ 24,000 $ 6,000 $ 10,000 $ 8,000 $ 3,000

Sale of assets & division of loss +4,000 - 24,000 ____ - 8,000 - 8,000 - 4,000

Balance after realization $ 7,000 $0 $6,000 $ 2,000 $0 $ (1,000)

Payment of liabilities -6,000 - -6,000 - - -

Balance after payment of liabilities $ 1,000 $0 $0 $ 2,000 $0 $ (1,000)

Receipt of deficiency +1,000 - - - - +1,000

Balances $ 2,000 $0 $0 -2,000 $0 $0

Cash distributed to partners -2,000 - - -2,000 - -

Final balance $0 $0 $0 $0 $0 $0

The entries to record the liquidation are as follows:

Cash 4,000

Loss on Realization 20,000

Non cash Assets 24,000

(To record Selling of assets)

Fassil, capital 8,000

Tahir, capital 8,000

Kassa, capital 4,000

Loss on Realization 20,000

(To record Division of loss from sale of assets)

Liabilities 6,000

Cash 6,000

(To record Payment of liabilities)

Cash 1,000

Kassa, capital 1,000

(To record Receipt of cash from deficient partner)

Fassil, capital 2,000

Cash 2,000

(To record Distribution of cash to partner)

Accounting for Partnerships 12

Potrebbero piacerti anche

- Unit 3Documento33 pagineUnit 3YonasNessuna valutazione finora

- CH 5 HP TestingDocumento29 pagineCH 5 HP TestingWonde Biru100% (1)

- Chillers, Fcu'S & Ahu'S: Yasser El Kabany 35366866 010-9977779 35366266Documento31 pagineChillers, Fcu'S & Ahu'S: Yasser El Kabany 35366866 010-9977779 35366266mostafaabdelrazikNessuna valutazione finora

- Kesari Tours and Travel: A Service Project Report OnDocumento15 pagineKesari Tours and Travel: A Service Project Report OnShivam Jadhav100% (3)

- CHAPTER 4 Accounting For Partnership 2011Documento20 pagineCHAPTER 4 Accounting For Partnership 2011Mathewos Woldemariam BirruNessuna valutazione finora

- CHAPTER 4 Partiner ShipDocumento22 pagineCHAPTER 4 Partiner ShipTolesa Mogos100% (1)

- Chapter 4 Partnership MarituDocumento12 pagineChapter 4 Partnership MarituMamaru SewalemNessuna valutazione finora

- Principles of Accounting IIDocumento36 paginePrinciples of Accounting IIedo100% (2)

- Advance Chapter OneDocumento42 pagineAdvance Chapter OneSolomon Abebe100% (4)

- Unit 3: General Fund & Special Revenue FundsDocumento28 pagineUnit 3: General Fund & Special Revenue Fundsayele gebremichael50% (2)

- Management Accounting Versus Financial Accounting.: Takele - Fufa@aau - Edu.et...... orDocumento6 pagineManagement Accounting Versus Financial Accounting.: Takele - Fufa@aau - Edu.et...... orDeselagn TefariNessuna valutazione finora

- COC LEVEL-3 PracticalDocumento81 pagineCOC LEVEL-3 PracticalMohammed AbduramanNessuna valutazione finora

- Poa IIACCOUNTING FOR PARTNERSHIPS &corporationDocumento74 paginePoa IIACCOUNTING FOR PARTNERSHIPS &corporationHussen Abdulkadir100% (2)

- Global College: Learning GuideDocumento23 pagineGlobal College: Learning Guideembiale ayaluNessuna valutazione finora

- Acb3 01Documento41 pagineAcb3 01lidetu100% (3)

- Unity University College School of Distance and Continuing Education Worksheet For Advanced Accounting I (Acct 401)Documento4 pagineUnity University College School of Distance and Continuing Education Worksheet For Advanced Accounting I (Acct 401)Sisay Tesfaye100% (2)

- How To Prepare A Bank ReconciliationDocumento6 pagineHow To Prepare A Bank ReconciliationMk Fisiha100% (1)

- Code 5: Project 1: Bank Reconciliation Statement and Transaction (Level III V5)Documento7 pagineCode 5: Project 1: Bank Reconciliation Statement and Transaction (Level III V5)Aye Tube100% (2)

- 4 6026199395324659830Documento30 pagine4 6026199395324659830Beka Asra100% (1)

- Level 4 Code 1Documento51 pagineLevel 4 Code 1Edom67% (3)

- Principle of Accounting 2 - Unit 8Documento28 paginePrinciple of Accounting 2 - Unit 8Yeron GeseNessuna valutazione finora

- Governmental & Not-For-Profit Accounting: By: Gurmu - EphDocumento66 pagineGovernmental & Not-For-Profit Accounting: By: Gurmu - EphBeka Asra50% (2)

- COC Training ExcercisesDocumento8 pagineCOC Training ExcercisesGuddataa DheekkamaaNessuna valutazione finora

- Advanced Financial Accounting (Acfn3151)Documento2 pagineAdvanced Financial Accounting (Acfn3151)alemayehu100% (4)

- Accounting Department Basic Accounting Works Level Ii: Global College Ambo CampusDocumento20 pagineAccounting Department Basic Accounting Works Level Ii: Global College Ambo Campusembiale ayalu0% (1)

- Unit 5: Accounting SystemsDocumento22 pagineUnit 5: Accounting SystemsYonas100% (2)

- 4 5805514475188521062Documento3 pagine4 5805514475188521062eferem100% (5)

- Adowa Peachtree Class ExcerciseDocumento4 pagineAdowa Peachtree Class ExcerciseAbel Hailu100% (1)

- Acct II Chapter 3edDocumento11 pagineAcct II Chapter 3edmubarek oumer100% (2)

- 4 5958412768305481502Documento3 pagine4 5958412768305481502Misiker100% (2)

- Cost Accounting 2 Final ExamDocumento6 pagineCost Accounting 2 Final ExamCynthia Yeung100% (1)

- CVP AnalysisDocumento30 pagineCVP AnalysisBinyam Ayele100% (1)

- CH 03Documento7 pagineCH 03Kanbiro Orkaido50% (2)

- Exam 3 Coc Level 3Documento4 pagineExam 3 Coc Level 3tamene wolde100% (1)

- Chapter 3: Business Combination: Based On IFRS 3Documento38 pagineChapter 3: Business Combination: Based On IFRS 3ሔርሞን ይድነቃቸውNessuna valutazione finora

- Fa Ii Final ExamDocumento4 pagineFa Ii Final ExamIfa100% (1)

- Level Four Code 3Documento3 pagineLevel Four Code 3biniamNessuna valutazione finora

- Principles of AccountingDocumento72 paginePrinciples of AccountingedoNessuna valutazione finora

- Solo Level3Documento70 pagineSolo Level3mulugetaNessuna valutazione finora

- Unit 3. Accounting For Merchandising BusinessesDocumento33 pagineUnit 3. Accounting For Merchandising BusinessesYonas100% (1)

- AKDocumento9 pagineAKAnonymous cJogAxQnNessuna valutazione finora

- Level 4 Code 1Documento6 pagineLevel 4 Code 1biniamNessuna valutazione finora

- Fundamental CH 4Documento8 pagineFundamental CH 4Tasfa ZarihunNessuna valutazione finora

- Level Three Theory (Knowledge) ChoiceDocumento17 pagineLevel Three Theory (Knowledge) ChoiceYaa Rabbii100% (1)

- ADV Accounting IIDocumento177 pagineADV Accounting IIbrook buta100% (1)

- Fa I MidDocumento7 pagineFa I MidFãhâd Õró ÂhmédNessuna valutazione finora

- Saving Account Advantage: Project 1 Work Effectively in The Financial Sector and Customer Account Task1.1Documento3 pagineSaving Account Advantage: Project 1 Work Effectively in The Financial Sector and Customer Account Task1.1yoniakia2124Nessuna valutazione finora

- CH 3Documento9 pagineCH 3yebegashet67% (3)

- Developing Understanding of Taxation AssignmentDocumento2 pagineDeveloping Understanding of Taxation Assignmentnigus100% (2)

- Advance Financial Accounting (Assignment)Documento3 pagineAdvance Financial Accounting (Assignment)asegidNessuna valutazione finora

- Advance I Ch-IDocumento63 pagineAdvance I Ch-IUtban Ashab100% (1)

- Coc Project Level Three: Project One Koket Company Post Closing Trial Balance SEPTEMBER 20,2018Documento4 pagineCoc Project Level Three: Project One Koket Company Post Closing Trial Balance SEPTEMBER 20,2018Aye Tube100% (5)

- Make-Up AssignmentDocumento5 pagineMake-Up AssignmentRileyNessuna valutazione finora

- Assignment Bank Reconciliation and Payroll New 1Documento5 pagineAssignment Bank Reconciliation and Payroll New 1Dagnachew WeldegebrielNessuna valutazione finora

- Assignment Accounting 2023Documento8 pagineAssignment Accounting 2023teddy100% (1)

- Which of The Followin Level IVDocumento2 pagineWhich of The Followin Level IVGuddataa Dheekkamaa100% (2)

- The Role of Accounting and Auditing Board of Ethiopia (AABE) in Enhancing The Accounting ProfessionDocumento13 pagineThe Role of Accounting and Auditing Board of Ethiopia (AABE) in Enhancing The Accounting Professionhabtamu100% (2)

- CH 1Documento15 pagineCH 1Hussen AbdulkadirNessuna valutazione finora

- 310 Balance Cash HoldingsDocumento21 pagine310 Balance Cash Holdingsdawit TerefeNessuna valutazione finora

- FMA - Ethical Case A, RevisedDocumento12 pagineFMA - Ethical Case A, RevisedYezena Tegegne75% (4)

- Chapter 4 Partnership-1Documento12 pagineChapter 4 Partnership-1Birhanu FelekeNessuna valutazione finora

- Chjapter 1-Partnership FinalDocumento14 pagineChjapter 1-Partnership Finalkefyalew TNessuna valutazione finora

- CHAPTER Five-PartnershipDocumento11 pagineCHAPTER Five-Partnershipአንተነህ የእናቱNessuna valutazione finora

- Chapter 3 Ethiopian Payroll SystemDocumento10 pagineChapter 3 Ethiopian Payroll SystemWonde Biru89% (46)

- Chapter 2 Plant Asset PDFDocumento20 pagineChapter 2 Plant Asset PDFWonde Biru100% (1)

- Chapter 3 Ethiopian Payroll SystemDocumento10 pagineChapter 3 Ethiopian Payroll SystemWonde Biru89% (46)

- Chapter 3 Ethiopian Payroll SystemDocumento10 pagineChapter 3 Ethiopian Payroll SystemWonde Biru89% (46)

- Cost I Chapter 1Documento13 pagineCost I Chapter 1Wonde BiruNessuna valutazione finora

- Working Capital ManagementDocumento11 pagineWorking Capital ManagementWonde BiruNessuna valutazione finora

- Cash ManagementDocumento11 pagineCash ManagementWonde Biru100% (1)

- Chapter 4 TVM EditedDocumento24 pagineChapter 4 TVM EditedWonde BiruNessuna valutazione finora

- Cost I Chapter 4 EditedDocumento10 pagineCost I Chapter 4 EditedWonde BiruNessuna valutazione finora

- Stat For Fin CH 5Documento9 pagineStat For Fin CH 5Wonde Biru100% (1)

- Stat For Fin CH 4 PDFDocumento17 pagineStat For Fin CH 4 PDFWonde BiruNessuna valutazione finora

- Chapter - 1-Accounting For InventoriesDocumento40 pagineChapter - 1-Accounting For InventoriesWonde BiruNessuna valutazione finora

- CH 4 Estimation.Documento48 pagineCH 4 Estimation.Wonde Biru100% (1)

- Chapter PDFDocumento55 pagineChapter PDFWonde BiruNessuna valutazione finora

- CorporationDocumento14 pagineCorporationWonde BiruNessuna valutazione finora

- Stat CH 6 Chi-SquareDocumento23 pagineStat CH 6 Chi-SquareWonde BiruNessuna valutazione finora

- Risk Chapter 2Documento27 pagineRisk Chapter 2Wonde Biru100% (1)

- Risk Chapter 2Documento27 pagineRisk Chapter 2Wonde BiruNessuna valutazione finora

- Risk CHAPTER 1Documento10 pagineRisk CHAPTER 1Wonde BiruNessuna valutazione finora

- Public Finance Course Outline 2Documento2 paginePublic Finance Course Outline 2Wonde Biru0% (1)

- Risk Chapter 4Documento14 pagineRisk Chapter 4Wonde BiruNessuna valutazione finora

- Risk Chapter 6Documento27 pagineRisk Chapter 6Wonde BiruNessuna valutazione finora

- Teens Intermediate 5 (4 - 6)Documento5 pagineTeens Intermediate 5 (4 - 6)UserMotMooNessuna valutazione finora

- NIST SP 800-53ar5-1Documento5 pagineNIST SP 800-53ar5-1Guillermo Valdès100% (1)

- Pentesting ReportDocumento14 paginePentesting Reportazeryouness6787Nessuna valutazione finora

- C1 Level ExamDocumento2 pagineC1 Level ExamEZ English WorkshopNessuna valutazione finora

- Abrigo Vs Flores DigestDocumento4 pagineAbrigo Vs Flores DigestKatrina GraceNessuna valutazione finora

- Union Bank of The Philippines V CADocumento2 pagineUnion Bank of The Philippines V CAMark TanoNessuna valutazione finora

- General Concepts and Principles of ObligationsDocumento61 pagineGeneral Concepts and Principles of ObligationsJoAiza DiazNessuna valutazione finora

- The Key To The Magic of The Psalms by Pater Amadeus 2.0Documento16 pagineThe Key To The Magic of The Psalms by Pater Amadeus 2.0evitaveigasNessuna valutazione finora

- GR - 211015 - 2016 Cepalco Vs Cepalco UnionDocumento14 pagineGR - 211015 - 2016 Cepalco Vs Cepalco UnionHenteLAWcoNessuna valutazione finora

- Lipura Ts Module5EappDocumento7 pagineLipura Ts Module5EappGeniza Fatima LipuraNessuna valutazione finora

- Basic Accounting Equation Exercises 2Documento2 pagineBasic Accounting Equation Exercises 2Ace Joseph TabaderoNessuna valutazione finora

- EIB Pan-European Guarantee Fund - Methodological NoteDocumento6 pagineEIB Pan-European Guarantee Fund - Methodological NoteJimmy SisaNessuna valutazione finora

- UAS English For Acc - Ira MisrawatiDocumento3 pagineUAS English For Acc - Ira MisrawatiIra MisraNessuna valutazione finora

- The Mystical Number 13Documento4 pagineThe Mystical Number 13Camilo MachadoNessuna valutazione finora

- Dam Water SensorDocumento63 pagineDam Water SensorMuhammad RizalNessuna valutazione finora

- Ekotoksikologi Kelautan PDFDocumento18 pagineEkotoksikologi Kelautan PDFMardia AlwanNessuna valutazione finora

- eLTE5.0 DBS3900 Product Description (3GPP)Documento37 pagineeLTE5.0 DBS3900 Product Description (3GPP)Wisut MorthaiNessuna valutazione finora

- PMP PDFDocumento334 paginePMP PDFJohan Ito100% (4)

- Gujarat Technological UniversityDocumento5 pagineGujarat Technological Universityvenkat naiduNessuna valutazione finora

- BCLTE Points To ReviewDocumento4 pagineBCLTE Points To Review•Kat Kat's Lifeu•Nessuna valutazione finora

- Times Leader 03-16-2013Documento61 pagineTimes Leader 03-16-2013The Times LeaderNessuna valutazione finora

- AJWS Response To July 17 NoticeDocumento3 pagineAJWS Response To July 17 NoticeInterActionNessuna valutazione finora

- Report of Apple Success PDFDocumento2 pagineReport of Apple Success PDFPTRNessuna valutazione finora

- Power of Attorney UpdatedDocumento1 paginaPower of Attorney UpdatedHitalo MariottoNessuna valutazione finora

- Travisa India ETA v5Documento4 pagineTravisa India ETA v5Chamith KarunadharaNessuna valutazione finora

- Specpro.09.Salazar vs. Court of First Instance of Laguna and Rivera, 64 Phil. 785 (1937)Documento12 pagineSpecpro.09.Salazar vs. Court of First Instance of Laguna and Rivera, 64 Phil. 785 (1937)John Paul VillaflorNessuna valutazione finora

- Section 7 4 Part IVDocumento10 pagineSection 7 4 Part IVapi-196193978Nessuna valutazione finora

- Trifles Summary and Analysis of Part IDocumento11 pagineTrifles Summary and Analysis of Part IJohn SmytheNessuna valutazione finora