Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Class Notes Investment PDF

Caricato da

Mohaiminul Islam Shuvra0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

24 visualizzazioni1 paginaTitolo originale

Class notes investment.pdf

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

24 visualizzazioni1 paginaClass Notes Investment PDF

Caricato da

Mohaiminul Islam ShuvraCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

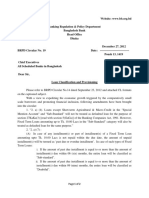

Intercorporate Investments

Level of Security Characteristics Reporting Balance Sheet Income Statement

Involvement Type Category

Little Amount Debt HTM Cost Method Amortized Interest received

(Passive < 20% Cost +/- Amortization

equity of

interest) Discount/Premium

Debt/Equity HFT, Market Fair Value Unrealized

Designated as Method gain/losses

Fair Value included in

earnings

Debt/Equity AFS Market Fair Value Unrealized

Method gain/losses

reported in equity

Significant Equity 20%-50% Equity Investment at Report Income

Influence Method Cost – Div +/- equal to

Proportionate proportionate

share of share of investee’s

investee’s profit

profit/loss

Joint Venture Equity Shared US GAAP: Proportionate consolidation:

Control Equity Include proportionate share of

Method assets, liabilities, revenue and

expense in investor’s financial

IFRS: Equity statements.

or

Proportionate

Consolidation

Control Equity >50% Consolidate Report Report income

Balance sheet statement of

of Subsidiary Subsidiary

together with together with

parent parent

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Financial Ratio Analysis - BestDocumento50 pagineFinancial Ratio Analysis - BestAmit87% (45)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Initial Public Offering (IPO) ProjectDocumento80 pagineInitial Public Offering (IPO) ProjectRajesh Kumar J64% (14)

- COst of CapitalDocumento3 pagineCOst of CapitalLito Jose Perez Lalantacon100% (1)

- Net Income ApproachDocumento6 pagineNet Income ApproachDisha Ganatra80% (5)

- The ProtectorDocumento38 pagineThe ProtectorAVINESH KUMAR75% (4)

- Exercise 1 - Transaction AnalysisDocumento2 pagineExercise 1 - Transaction AnalysistmhoangvnaNessuna valutazione finora

- List of Mining and Coal Company 2015Documento9 pagineList of Mining and Coal Company 2015Muhammad Rizqi Siregar100% (1)

- Evsjv 'K E VSK: Cöavb KVH©VJQDocumento6 pagineEvsjv 'K E VSK: Cöavb KVH©VJQMohaiminul Islam ShuvraNessuna valutazione finora

- BRPD Circular No. 19 (2012)Documento2 pagineBRPD Circular No. 19 (2012)Mohaiminul Islam ShuvraNessuna valutazione finora

- E Vswks Cöwewa I BXWZ Wefvm Evsjv 'K E VSK Cöavb KVH©VJQ XVKVDocumento6 pagineE Vswks Cöwewa I BXWZ Wefvm Evsjv 'K E VSK Cöavb KVH©VJQ XVKVZahirul Islam JewelNessuna valutazione finora

- BRPD Circular No.14 Dated September 23, 2012 Attached CL FormatsDocumento3 pagineBRPD Circular No.14 Dated September 23, 2012 Attached CL FormatsMohaiminul Islam ShuvraNessuna valutazione finora

- BD Report PDFDocumento5 pagineBD Report PDFrased_00Nessuna valutazione finora

- May 292013 BRPD 06 eDocumento2 pagineMay 292013 BRPD 06 edurerpakhiNessuna valutazione finora

- BRPD Circular No. 05 (2015)Documento1 paginaBRPD Circular No. 05 (2015)Mohaiminul Islam ShuvraNessuna valutazione finora

- BRPD Circular No. 01 (2018)Documento1 paginaBRPD Circular No. 01 (2018)Mohaiminul Islam ShuvraNessuna valutazione finora

- Intercorporate Investments PDFDocumento1 paginaIntercorporate Investments PDFMohaiminul Islam ShuvraNessuna valutazione finora

- CFA Level 1 LOS Changes PDFDocumento51 pagineCFA Level 1 LOS Changes PDFMohaiminul Islam ShuvraNessuna valutazione finora

- Cfa-Planner Created by MajnuDocumento6 pagineCfa-Planner Created by MajnuMohaiminul Islam ShuvraNessuna valutazione finora

- AF Note-2Documento3 pagineAF Note-2Mohaiminul Islam ShuvraNessuna valutazione finora

- Valuation Is An ArtDocumento26 pagineValuation Is An ArtRage EzekielNessuna valutazione finora

- Code of Ethics: Vi. Members Sometimes Coped With Pressures by Using Subtle and Ambiguous LanguageDocumento5 pagineCode of Ethics: Vi. Members Sometimes Coped With Pressures by Using Subtle and Ambiguous LanguageMohaiminul Islam ShuvraNessuna valutazione finora

- AF Note-3Documento4 pagineAF Note-3kazimeister1Nessuna valutazione finora

- GIPS Required Disclosures and AMC Code of ConductDocumento8 pagineGIPS Required Disclosures and AMC Code of ConductMohaiminul Islam ShuvraNessuna valutazione finora

- Risk, Return and Cost of Capital ExplainedDocumento97 pagineRisk, Return and Cost of Capital ExplainedIvecy ChilalaNessuna valutazione finora

- AssignmentDocumento7 pagineAssignmentDikshita JainNessuna valutazione finora

- Introduction to Business FinanceDocumento11 pagineIntroduction to Business FinanceAnthony BalandoNessuna valutazione finora

- RSTV The Big Picture Privatisation of Public Sector EnterprisesDocumento4 pagineRSTV The Big Picture Privatisation of Public Sector EnterprisesAbhishekNessuna valutazione finora

- List of Interested Party Transactions To Be Possibly Entered Into by JSC VTB Bank During Its Standard Commercial ActivitiesDocumento40 pagineList of Interested Party Transactions To Be Possibly Entered Into by JSC VTB Bank During Its Standard Commercial ActivitiesJose CastroNessuna valutazione finora

- AssignmentDocumento3 pagineAssignmentJayzell MonroyNessuna valutazione finora

- Leadership Practices of PepsiCo CEO Indra NooyiDocumento21 pagineLeadership Practices of PepsiCo CEO Indra NooyiMasudurce10Nessuna valutazione finora

- Reaction Paper - Cost CapitalDocumento1 paginaReaction Paper - Cost CapitalMerrylyn VargasNessuna valutazione finora

- Week 1 Notes: Financial MarketingDocumento6 pagineWeek 1 Notes: Financial MarketingPulkit AggarwalNessuna valutazione finora

- Yash Agarwal B-97 SipDocumento49 pagineYash Agarwal B-97 SipSushant KumarNessuna valutazione finora

- Sweat EquityDocumento17 pagineSweat EquitygeddadaarunNessuna valutazione finora

- Escorts Mutual Fund: ADDENDUM - I/2010Documento5 pagineEscorts Mutual Fund: ADDENDUM - I/201022ranjhaNessuna valutazione finora

- African Alliance Retail Card Web - 0Documento2 pagineAfrican Alliance Retail Card Web - 0Daud Farook IINessuna valutazione finora

- Pre-Test 6 SolutionsDocumento3 paginePre-Test 6 SolutionsBLACKPINKLisaRoseJisooJennieNessuna valutazione finora

- Essential Guide to Understanding InvestmentsDocumento4 pagineEssential Guide to Understanding InvestmentsRamesh babuNessuna valutazione finora

- I'm SO Excited That You're Called To Enroll MORE Clients in Your $20k-$50k Programs, WhileDocumento7 pagineI'm SO Excited That You're Called To Enroll MORE Clients in Your $20k-$50k Programs, WhileEllen CostaNessuna valutazione finora

- 2021-03-25 - Complaint (File Stamped)Documento55 pagine2021-03-25 - Complaint (File Stamped)Shima MediaNessuna valutazione finora

- The - Hollywood - R Magazine - 06 - 05 - 2020Documento60 pagineThe - Hollywood - R Magazine - 06 - 05 - 2020Mat davvNessuna valutazione finora

- Aaron H. Zabala - Counter-Affidavit - AlvinDocumento5 pagineAaron H. Zabala - Counter-Affidavit - AlvinGibb Andrew MarcialesNessuna valutazione finora

- Subject: Accountancy: Timings Allowed: 1 HR 30 Minutes Total Marks: 100Documento5 pagineSubject: Accountancy: Timings Allowed: 1 HR 30 Minutes Total Marks: 100darla85nagarajuNessuna valutazione finora

- Our Lady of Fatima University Quezon City Campus: ST STDocumento5 pagineOur Lady of Fatima University Quezon City Campus: ST STIts meh SushiNessuna valutazione finora

- Module 4 Mutual FundsDocumento19 pagineModule 4 Mutual FundsVelante IrafrankNessuna valutazione finora

- FS Analysis Quiz RatiosDocumento2 pagineFS Analysis Quiz RatiosNovia AndiniNessuna valutazione finora