Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

P6-18 Unrealized Profit On Upstream Sales

Caricato da

w3n123Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

P6-18 Unrealized Profit On Upstream Sales

Caricato da

w3n123Copyright:

Formati disponibili

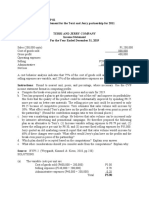

P6-18 Unrealized Profit on Upstream Sales

20X2

Ending

Total = Re-sold + Inventory

Sales 200,000 130,000 70,000

COGS 160,000 104,000 56,000

Gross Profit 40,000 26,000 14,000

Gross Profit % 20.00%

20X3

Ending

Total = Re-sold + Inventory

Sales 175,000 70,000 105,000

COGS 140,000 56,000 84,000

Gross Profit 35,000 14,000 21,000

Gross Profit % 20.00%

20X4

Ending

Total = Re-sold + Inventory

Sales 225,000 105,000 120,000

COGS 180,000 84,000 96,000

Gross Profit 45,000 21,000 24,000

Gross Profit % 20.00%

20X 20X 20X

2 3 4

Operating income reported by Parade $150, $240, $300,

000 000 000

Net income reported by Summer 100, 160,

000 90,00 000

0

$250, $330, $460,

000 000 000

Inventory profit, December 31, 20X2

$70,000 - ($70,000 / 1.25) (14,0 14,00

00) 0

Inventory profit, December 31, 20X3

$105,000 - ($105,000 / 1.25) (21,0 21,00

00) 0

Inventory profit, December 31, 20X4

$120,000 - ($120,000 / 1.25) (24,

000)

Consolidated net income $236, $323, $457,

000 000 000

Income to noncontrolling interest:

($100,000 - $14,000) x 0.40 (34,4

00)

($90,000 + $14,000 - $21,000) x 0.40 (33,2

00)

($160,000 + $21,000 - $24,000) x 0.40 (62,

800)

Income to controlling interest $201, $289, $394,

600 800 200

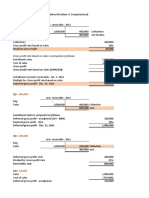

P6-21 Incomplete Data

a. Increase in fair value of buildings and

equipment:

Consolidated total $ 680,000

Balance reported by Peace (400,000)

Balance reported by Symbol (240,000)

Increase in value $ 40,000

b. Accumulated depreciation for

consolidated entity:

Accumulated depreciation reported $180,000

by Peace

Accumulated depreciation reported 110,000

by Symbol

Cumulative write-off of differential

($5,000 x 6 years) 30,000

Accumulated depreciation for $320,000

consolidated entity

c. Amount paid by Peace to acquire

ownership in Symbol:

Common stock outstanding $ 60,000

Retained earnings at acquisition 30,000

Total book value at acquisition $ 90,000

Increase in value of buildings and 40,000

equipment

Fair value of net assets acquired $130,000

Proportion of ownership acquired x 0.75

Amount paid by Peace $ 97,500

d. Investment in Symbol Company stock reported at

December 31, 20X6:

Symbol's common stock outstanding $ 60,000

December 31, 20X6

Symbol's retained earnings reported 112,000

December 31, 20X6

Total book value $172,000

Proportion of ownership held by x 0.75

Peace

Peace's share of net book value $129,000

Unamortized differential ($5,000 x 2 7,500

years) x 0.75

20X6 Gross Profit Deferral on (3,000)

Upstream Sale *

Investment in Symbol Company $133,500

stock

* See part f. for Unrealized inventory

profit calculation. Total unrealized is

$4,000 and Peace owns 75% of

Symbol so the total gross profit

deferral in the investment account

would be $3,000 ($4,000 X 75%).

e. Intercorporate sales of inventory in

20X6:

Sales reported by Peace $420,000

Sales reported by Symbol 260,000

Total sales $680,000

Sales reported in consolidated (650,000)

income statement

Intercompany sales during 20X6 $ 30,000

P6-21 (continued)

f. Unrealized inventory profit, December 31, 20X6:

Inventory reported by Peace

Inventory reported by Symbol

Total inventory

Inventory reported in consolidated balance sheet

Unrealized inventory profit, December 31, 20X6

g. Consolidation entry to remove the effects of intercompany inventory

sales during 20X6:

Sales

Cost of Goods Sold

Inventory

The basic entry (not shown) would be adjusted by 4,000 of deferred profit

to complete the elimination process.

h. Unrealized inventory profit at January 1, 20X6:

Cost of goods sold reported by Peace

Cost of goods sold reported by Symbol

Reduction of cost of goods sold for intercompany

sales during 20X6

Adjusted cost of goods sold

Cost of goods sold reported in consolidated

income statement

Additional adjustment to cost of goods sold

due to unrealized profit in beginning inventory

i. Accounts receivable reported by Peace at December 31, 20X6:

Accounts receivable reported for consolidated entity

Accounts receivable reported by Symbol

Difference

Adjustment for intercompany receivable/payable:

Accounts payable reported by Peace

Accounts payable reported by Symbol

Total reported accounts payable

Accounts payable reported for consolidated

entity

Adjustment for intercompany receivable/payable

Accounts receivable reported by Peace

Potrebbero piacerti anche

- Product Recall SOPDocumento3 pagineProduct Recall SOPvioletaflora81% (16)

- Test Bank 2 - Ia 3Documento31 pagineTest Bank 2 - Ia 3Xiena100% (6)

- Chapter 6 Integer Linear Programming: Multiple-ChoiceDocumento39 pagineChapter 6 Integer Linear Programming: Multiple-Choicew3n123100% (5)

- Answers - Activity 2.4 2.5 and 3.1Documento38 pagineAnswers - Activity 2.4 2.5 and 3.1Tine Vasiana Duerme83% (6)

- Sol. Man. Chapter 4 Consol. Fs Part 1Documento37 pagineSol. Man. Chapter 4 Consol. Fs Part 1itsmenatoy43% (7)

- A Good Team Player - Case Study On LeadershipDocumento3 pagineA Good Team Player - Case Study On LeadershipFaria Zafar0% (3)

- Chapter-2 Solution For 27 and 28Documento6 pagineChapter-2 Solution For 27 and 28Tarif IslamNessuna valutazione finora

- Problem SolvingDocumento10 pagineProblem SolvingRegina De LunaNessuna valutazione finora

- Ma Bep01Documento4 pagineMa Bep01Grace SimonNessuna valutazione finora

- Activity - Penury CompanyDocumento1 paginaActivity - Penury CompanyLydevia Kigangan DiwanNessuna valutazione finora

- Assignment: 1: Submitted By: Reema Saju STUDENT ID:301119165 Submitted To: Prof - Neha KohliDocumento5 pagineAssignment: 1: Submitted By: Reema Saju STUDENT ID:301119165 Submitted To: Prof - Neha KohliReema SajuNessuna valutazione finora

- Use The Following Information For The Next Three Questions:: Rainy SunnyDocumento14 pagineUse The Following Information For The Next Three Questions:: Rainy SunnyAndy Lalu100% (3)

- QVCDocumento5 pagineQVCw3n123Nessuna valutazione finora

- Bài tập chương 13Documento10 pagineBài tập chương 132021agl12.phamhoangdieumyNessuna valutazione finora

- 1 - Accounting Information Systems Problems With SolutionsDocumento22 pagine1 - Accounting Information Systems Problems With Solutionsbusiness docNessuna valutazione finora

- P6Documento3 pagineP6Jessica HutabaratNessuna valutazione finora

- Homework Ch. 7 and 13Documento24 pagineHomework Ch. 7 and 13L100% (1)

- Assign 2 Chapter 5 Understanding The Financial Statements Prob 8 Answer Cabrera 2019-2020Documento5 pagineAssign 2 Chapter 5 Understanding The Financial Statements Prob 8 Answer Cabrera 2019-2020mhikeedelantar100% (1)

- Problem 3: Multiple Choice - COMPUTATIONAL 1. BDocumento10 pagineProblem 3: Multiple Choice - COMPUTATIONAL 1. BCharizza Amor TejadaNessuna valutazione finora

- Solutions Ch08Documento19 pagineSolutions Ch08KyleNessuna valutazione finora

- ACCT 203 (Assignment 3)Documento4 pagineACCT 203 (Assignment 3)koftaNessuna valutazione finora

- Tugasan 6 Bab 6Documento4 pagineTugasan 6 Bab 6azwan88Nessuna valutazione finora

- Intermediate Accounting Exam 2 SolutionsDocumento5 pagineIntermediate Accounting Exam 2 SolutionsAlex SchuldinerNessuna valutazione finora

- Chapter 5 Tutorial ExerciseDocumento5 pagineChapter 5 Tutorial ExerciseFarheen AkramNessuna valutazione finora

- Tax Homework Chapter 4Documento7 pagineTax Homework Chapter 4RosShanique ColebyNessuna valutazione finora

- DAIBB MA Math Solutions 290315Documento11 pagineDAIBB MA Math Solutions 290315joyNessuna valutazione finora

- Practice Exam Chapters 1-5 (2) Solutions: Problem IDocumento4 paginePractice Exam Chapters 1-5 (2) Solutions: Problem IAtif RehmanNessuna valutazione finora

- VARAIBLE COSTING (Solutions)Documento8 pagineVARAIBLE COSTING (Solutions)Mohammad UmairNessuna valutazione finora

- Ma - Bep01 - LucioDocumento4 pagineMa - Bep01 - LucioGrace SimonNessuna valutazione finora

- Acc108 Gen 008 p3 Questions and AnswersDocumento26 pagineAcc108 Gen 008 p3 Questions and AnswersdgdeguzmanNessuna valutazione finora

- Tutorial 1 27 April 2022Documento6 pagineTutorial 1 27 April 2022Swee Yi LeeNessuna valutazione finora

- Consolidated Income Statement or Statement of Profit or Loss and Other Comprehensive IncomeDocumento4 pagineConsolidated Income Statement or Statement of Profit or Loss and Other Comprehensive IncomeOmolaja IbukunNessuna valutazione finora

- Intercompany DividendsDocumento6 pagineIntercompany DividendsClauie BarsNessuna valutazione finora

- Solutions To ProblemsDocumento22 pagineSolutions To ProblemsSyeed AhmedNessuna valutazione finora

- AC and VC Plus CVPDocumento6 pagineAC and VC Plus CVPEunice CoronadoNessuna valutazione finora

- AKL Kelompok 2Documento11 pagineAKL Kelompok 2Wbok ZapztwvNessuna valutazione finora

- Quiz Chapter 5 Consol. Fs Part 2Documento7 pagineQuiz Chapter 5 Consol. Fs Part 2Meagan AndesNessuna valutazione finora

- Installment Sales MethodDocumento11 pagineInstallment Sales MethodJanella Umieh De UngriaNessuna valutazione finora

- Problem 1answerDocumento2 pagineProblem 1answerFrhea Love AbelloNessuna valutazione finora

- Chapter 4 - Consolidated Financial Statements (Part 1)Documento32 pagineChapter 4 - Consolidated Financial Statements (Part 1)Philip RososNessuna valutazione finora

- Profe03 Activity Chapter 7Documento5 pagineProfe03 Activity Chapter 7eloisa celisNessuna valutazione finora

- Assignment For InternshipDocumento3 pagineAssignment For InternshipDrishtiNessuna valutazione finora

- 04 Fischer10e SM Ch04 FinalDocumento79 pagine04 Fischer10e SM Ch04 FinalSoc MontemayorNessuna valutazione finora

- CH 27 - Ex 6Documento11 pagineCH 27 - Ex 6Khandarmaa LkhagvaNessuna valutazione finora

- Final Exam Intermediate Acctg. 3 Copy of Long ProblemsDocumento3 pagineFinal Exam Intermediate Acctg. 3 Copy of Long ProblemsFerlyn Trapago ButialNessuna valutazione finora

- Semi-Finals Solutions MartinezDocumento10 pagineSemi-Finals Solutions MartinezGeraldine Martinez DonaireNessuna valutazione finora

- Solution Manual For Cfin 4 4Th Edition Besley by Besley and Brigham Isbn 1285434544 9781285434544 Full Chapter PDFDocumento30 pagineSolution Manual For Cfin 4 4Th Edition Besley by Besley and Brigham Isbn 1285434544 9781285434544 Full Chapter PDFtiffany.kunst387100% (12)

- CFIN 4th Edition Besley by Besley and Brigham ISBN Solution ManualDocumento9 pagineCFIN 4th Edition Besley by Besley and Brigham ISBN Solution Manualrussell100% (27)

- Quiz Chapter 5 Consol. Fs Part 2Documento14 pagineQuiz Chapter 5 Consol. Fs Part 2Maryjoy Sarzadilla JuanataNessuna valutazione finora

- A1c019112 Jeremy Christ Manuel AklDocumento21 pagineA1c019112 Jeremy Christ Manuel AklJeremy Christ ManuelNessuna valutazione finora

- Chapter 5 - AfaDocumento6 pagineChapter 5 - AfaNguyễn Phương ThảoNessuna valutazione finora

- Installment T SalesDocumento31 pagineInstallment T SalesNiki DimaanoNessuna valutazione finora

- ACCCOB3Documento10 pagineACCCOB3Jenine YamsonNessuna valutazione finora

- Solutions To Problems AFAR2 Chap4Documento7 pagineSolutions To Problems AFAR2 Chap4Sassy GirlNessuna valutazione finora

- AKL 2 - Tugas 5 Marselinus A H T (A31113316)Documento4 pagineAKL 2 - Tugas 5 Marselinus A H T (A31113316)Marselinus Aditya Hartanto TjungadiNessuna valutazione finora

- C6-Intercompany Inventory Transactions PDFDocumento43 pagineC6-Intercompany Inventory Transactions PDFVico JulendiNessuna valutazione finora

- Bud GettingDocumento8 pagineBud GettingLorena Mae LasquiteNessuna valutazione finora

- IA3 Engaging Activity, PT1 PT2 PT3 & QUIZDocumento8 pagineIA3 Engaging Activity, PT1 PT2 PT3 & QUIZKaye Ann Abejuela RamosNessuna valutazione finora

- Intermediate Accounting Exam 3 SolutionsDocumento7 pagineIntermediate Accounting Exam 3 SolutionsAlex SchuldinerNessuna valutazione finora

- Answer-Key-Chapter-5-BC DeJesusDocumento15 pagineAnswer-Key-Chapter-5-BC DeJesusMerel Rose FloresNessuna valutazione finora

- Chapter 4Documento36 pagineChapter 4MARRIETTE JOY ABADNessuna valutazione finora

- Problem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementDocumento4 pagineProblem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementRavena ReyesNessuna valutazione finora

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsDa EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNessuna valutazione finora

- Chapter 2 Introduction To Optimization and Linear Programming Solutions To Supplementary ExercisesDocumento1 paginaChapter 2 Introduction To Optimization and Linear Programming Solutions To Supplementary Exercisesw3n123Nessuna valutazione finora

- Tutorial 4 PDFDocumento8 pagineTutorial 4 PDFw3n123Nessuna valutazione finora

- Assessment of Implementation Level of The Physical Education Program in Selangor Secondary Schools, MalaysiaDocumento18 pagineAssessment of Implementation Level of The Physical Education Program in Selangor Secondary Schools, Malaysiaw3n123Nessuna valutazione finora

- Nonprofit Organisation Accounting TreatmentDocumento3 pagineNonprofit Organisation Accounting Treatmentw3n123Nessuna valutazione finora

- Connect RegistrationDocumento20 pagineConnect Registrationw3n123Nessuna valutazione finora

- Liquidating DividendDocumento2 pagineLiquidating Dividendw3n123Nessuna valutazione finora

- Intermediate: AccountingDocumento46 pagineIntermediate: Accountingw3n123Nessuna valutazione finora

- A Review of International Development in SWM - IsWA Globalisation Task Foroce - September 2014 FINALDocumento48 pagineA Review of International Development in SWM - IsWA Globalisation Task Foroce - September 2014 FINALw3n123Nessuna valutazione finora

- Chapter 23: Accounting Changes and Error Analysis: Intermediate Accounting, 10th Edition Kieso, Weygandt, and WarfieldDocumento25 pagineChapter 23: Accounting Changes and Error Analysis: Intermediate Accounting, 10th Edition Kieso, Weygandt, and Warfieldw3n123Nessuna valutazione finora

- Case 4 PixarDocumento6 pagineCase 4 Pixarw3n123Nessuna valutazione finora

- Democracy Beyond The Nation State? Transnational Actor S and Global GovernanceDocumento15 pagineDemocracy Beyond The Nation State? Transnational Actor S and Global Governancew3n123Nessuna valutazione finora

- Internal Control Weakness and Bank Loan Contracting Evidence From SOX Section 404 DisclosuresDocumento32 pagineInternal Control Weakness and Bank Loan Contracting Evidence From SOX Section 404 Disclosuresw3n123Nessuna valutazione finora

- The Measurement of Service Quality With Servqual For Different Domestic Airline Firms in TurkeyDocumento12 pagineThe Measurement of Service Quality With Servqual For Different Domestic Airline Firms in TurkeySanjeev PradhanNessuna valutazione finora

- INI-NSQCS Reg. 10, BuildingDocumento1 paginaINI-NSQCS Reg. 10, BuildingMark Allen FlorNessuna valutazione finora

- Operation Management Assignment - 5Documento4 pagineOperation Management Assignment - 5Mauro BezerraNessuna valutazione finora

- Gete Ermias - ProposalDocumento22 pagineGete Ermias - ProposalTise TegyNessuna valutazione finora

- ABM 221 Managerial AccountingDocumento136 pagineABM 221 Managerial AccountingTimothy MaluwaNessuna valutazione finora

- Awb - 176 0469 7836Documento1 paginaAwb - 176 0469 7836Adil Rasheed KhanNessuna valutazione finora

- Project Records From A Delay Analysis Perspective: Haris KatostarasDocumento2 pagineProject Records From A Delay Analysis Perspective: Haris KatostarasMariana MoreiraNessuna valutazione finora

- Bri OktoberDocumento3 pagineBri OktoberMobilkamu JakartaNessuna valutazione finora

- Final Term Assignment 3 On Cost of Production Report - FIFO CostingDocumento2 pagineFinal Term Assignment 3 On Cost of Production Report - FIFO CostingUchiha GokuNessuna valutazione finora

- Business Judgement Rule Dikaitkan Dengan Tindak Pidana Korupsi Yang Dilakukan Oleh Direksi Badan Usaha Milik Negara Terhadap Keputusan Bisnis Yang DiambilDocumento12 pagineBusiness Judgement Rule Dikaitkan Dengan Tindak Pidana Korupsi Yang Dilakukan Oleh Direksi Badan Usaha Milik Negara Terhadap Keputusan Bisnis Yang DiambilWied WidayatNessuna valutazione finora

- SWECOM Public ReviewDocumento110 pagineSWECOM Public Reviewsaif1270% (1)

- Data Migration Concepts & ChallengesDocumento15 pagineData Migration Concepts & ChallengesGayathri Chennabathini100% (1)

- Next Generation Internal AuditDocumento22 pagineNext Generation Internal AuditWajahat Ali100% (2)

- The Philippine Stock Exchange (PSE) Is The Only Stock Exchange in The Philippines. It Is One of The OldestDocumento7 pagineThe Philippine Stock Exchange (PSE) Is The Only Stock Exchange in The Philippines. It Is One of The OldestDaren TolentinoNessuna valutazione finora

- Entrepreneurship Quarter 1 - Module 2 - Lesson 1: The Potential Market and The Market NeedsDocumento8 pagineEntrepreneurship Quarter 1 - Module 2 - Lesson 1: The Potential Market and The Market NeedsJason Banay0% (1)

- NestleDocumento8 pagineNestleYasmin khanNessuna valutazione finora

- ForexSecrets15min enDocumento19 pagineForexSecrets15min enAtif ChaudhryNessuna valutazione finora

- (Seamgen) SOW Template ExampleDocumento6 pagine(Seamgen) SOW Template ExampleIon GîleaNessuna valutazione finora

- AIKEZ Retail Store General Journal For The Month of January 2021 Date Particulars F Debit CreditDocumento20 pagineAIKEZ Retail Store General Journal For The Month of January 2021 Date Particulars F Debit CreditHasanah AmerilNessuna valutazione finora

- Elsewedy Electric Cables International Business and Global Strategy Final VersionDocumento73 pagineElsewedy Electric Cables International Business and Global Strategy Final VersionMohamed RaheemNessuna valutazione finora

- SLBMDocumento11 pagineSLBMkurdiausha29Nessuna valutazione finora

- RENEWAL Business RegistrationDocumento2 pagineRENEWAL Business RegistrationJasmine JacksonNessuna valutazione finora

- Sap CMLDocumento5 pagineSap CMLabir_finance16Nessuna valutazione finora

- Vendor RFP TemplateDocumento5 pagineVendor RFP Templatewww.GrowthPanel.com100% (1)

- HP Case Write UpDocumento3 pagineHP Case Write UpAditya Anshuman DashNessuna valutazione finora

- Carrie Lee The President of Lee Enterprises Was Concerned AbouDocumento1 paginaCarrie Lee The President of Lee Enterprises Was Concerned AbouAmit PandeyNessuna valutazione finora

- Adrenalin Functional Document - Sonali Bank PDFDocumento8 pagineAdrenalin Functional Document - Sonali Bank PDFAhsan ZamanNessuna valutazione finora

- Présentation 1 CarrefourDocumento28 paginePrésentation 1 CarrefourJulien LucianiNessuna valutazione finora