Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

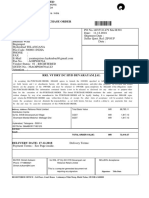

Greater Visakhapatnam Municipal Corporation Vacant Land Tax Form

Caricato da

gg0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

58 visualizzazioni1 paginaThis document is a self-assessment form for vacant land tax that property owners in the Greater Visakhapatnam Municipal Corporation must complete. The form collects information about the location and details of the vacant land including the owner's name and address, property identification numbers, land area, ownership status, documents, date of possession, market value, usage, and condition. It also has sections for tax inspectors and revenue officers to note the land condition, make remarks, and calculate the vacant land tax to be levied at 0.5% of capital value for excess land or 0.25% as a penalty.

Descrizione originale:

Titolo originale

Revenue_ Jul_748

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThis document is a self-assessment form for vacant land tax that property owners in the Greater Visakhapatnam Municipal Corporation must complete. The form collects information about the location and details of the vacant land including the owner's name and address, property identification numbers, land area, ownership status, documents, date of possession, market value, usage, and condition. It also has sections for tax inspectors and revenue officers to note the land condition, make remarks, and calculate the vacant land tax to be levied at 0.5% of capital value for excess land or 0.25% as a penalty.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

58 visualizzazioni1 paginaGreater Visakhapatnam Municipal Corporation Vacant Land Tax Form

Caricato da

ggThis document is a self-assessment form for vacant land tax that property owners in the Greater Visakhapatnam Municipal Corporation must complete. The form collects information about the location and details of the vacant land including the owner's name and address, property identification numbers, land area, ownership status, documents, date of possession, market value, usage, and condition. It also has sections for tax inspectors and revenue officers to note the land condition, make remarks, and calculate the vacant land tax to be levied at 0.5% of capital value for excess land or 0.25% as a penalty.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

GREATER VISAKHAPATNAM MUNICIPAL CORPORATION

Self-Assessment of Vacant Land Tax Form / Return

(Information required to be filed by Owner/Occupied/Lessee)

Under section 212 & 213 of the HMC Act, 1955

I. Location Details:

1) Name of the owner of the Property

2) Sub Zone No. 3) Ward No. 4) Block / Locality No.

5) Street Name 6) Street No.

7) Nearest / Adjacent House No. if any

8) Full residential address for communication

Telephone No. Cell No.

II. Vacant Land Details:

1) Patta No. 2) Survey & Sub Division No.

3) Name of the owner of the property if reporting person is different

4) Address

5) Area of Vacant Land in Sq. Yds.:

a) Extent of excess vacant land occupied as an appurtenant Sq. Yds.

to building exceeding 3 times the plinth area of building.

b) Extent of vacant land which is not adjusted or apparent Sq. Yds.

to building (separate property)

6) Status of owner ship: a) Own b) Lease

7) If land is taken on lease, name & address of owner:

8) Documentary evidence enclosed: a) Register Document:

b) Un Register Document c) Patta d) other (specify)

9) Date of possession

10) Market value as per Registration Department rate (Rs.)

11) Nature of usage: a) Vacant b) Using for any purpose (specify)

12) Weather keeping in good condition without creating unhygienic

conditions to the environment and surrounding public. Yes No

Date: Signature of the Owner / Occupier / Lessee

III. For Office Purpose:

1) Remarks on condition of vacant site

regarding un hygienic condition and

dumping of garbage etc., in the land.

2) Remarks of Tax Inspector /Revenue

Office

3) To levy VLT @ 0.50% on capital value on the excess a) Extent

vacant land occupied as an appurtenant to building

exceeding 3 times the plinth area of building on b) Rate per Sq.Yd.

4) To levy VLT @ 0.25% on capital value as penalty a) Extent

VLT under section 212 sub section 2 provision 1.

b) Rate per Sq.Yd.

Tax Inspector Revenue Officer Asst. Commissioner Dy.Commissioner(R)

Potrebbero piacerti anche

- (FORM 50 (See Rule 150-B) (Application For Constructing The Water Course)Documento4 pagine(FORM 50 (See Rule 150-B) (Application For Constructing The Water Course)ShobhnaNessuna valutazione finora

- Form V Property Tax ReturnDocumento5 pagineForm V Property Tax ReturnsharadNessuna valutazione finora

- Petitioner Vs Vs Respondent: First DivisionDocumento15 paginePetitioner Vs Vs Respondent: First DivisionbimiliciousNessuna valutazione finora

- Requirements for Zoning ClearanceDocumento2 pagineRequirements for Zoning ClearanceMichael Alinao100% (2)

- First Division (G.R. No. 168973, August 24, 2011)Documento15 pagineFirst Division (G.R. No. 168973, August 24, 2011)JB AndesNessuna valutazione finora

- 22a DraftDocumento23 pagine22a DraftRDO Office DHARMAVARAMNessuna valutazione finora

- REQUIREMENTS TITLINGDocumento4 pagineREQUIREMENTS TITLINGD GNessuna valutazione finora

- Assessment ReAssessment of PropertyTaxDocumento2 pagineAssessment ReAssessment of PropertyTaxJaffar SadiqBaigNessuna valutazione finora

- SAndeep VermaDocumento16 pagineSAndeep VermaRajwinder SInghNessuna valutazione finora

- Points of Land Law - 5Documento6 paginePoints of Land Law - 5Vyankatesh GotalkarNessuna valutazione finora

- New Return 24 08 21 Final 1Documento9 pagineNew Return 24 08 21 Final 1Rainbow Construction LtdNessuna valutazione finora

- ApartmrnyDocumento3 pagineApartmrnyPragash MaheswaranNessuna valutazione finora

- Zoning ordinance details residential land classificationDocumento20 pagineZoning ordinance details residential land classificationAngel CabanNessuna valutazione finora

- City of Dumaguete vs. Pilippines Ports AuthorityDocumento15 pagineCity of Dumaguete vs. Pilippines Ports AuthorityRafael SampayanNessuna valutazione finora

- FORM 3 (CItizen) - Claims Under Andhra Pradesh Dotted Lands (Updation in Re-Settlement Register) Rules, 2017Documento1 paginaFORM 3 (CItizen) - Claims Under Andhra Pradesh Dotted Lands (Updation in Re-Settlement Register) Rules, 2017viswa kNessuna valutazione finora

- Valuation PerformaDocumento9 pagineValuation PerformanitinNessuna valutazione finora

- City of Dumaguete V PPADocumento15 pagineCity of Dumaguete V PPAOcho SimNessuna valutazione finora

- Kerala Land Reforms Act Bhoopariskarana Niyamam Ceiling Procedures Uploaded by T James Joseph AdhikarathilDocumento17 pagineKerala Land Reforms Act Bhoopariskarana Niyamam Ceiling Procedures Uploaded by T James Joseph AdhikarathilJames Adhikaram100% (1)

- Rights in Land and Pattadar Pass Books Rules 1989Documento42 pagineRights in Land and Pattadar Pass Books Rules 1989raju634Nessuna valutazione finora

- Philippine Supreme Court Decision on Dumaguete City Land CaseDocumento18 paginePhilippine Supreme Court Decision on Dumaguete City Land CaseAlan Vincent FontanosaNessuna valutazione finora

- Certificate Of: Land Use Rights Dwelling House Ownership and Other Assets Attached To LandDocumento2 pagineCertificate Of: Land Use Rights Dwelling House Ownership and Other Assets Attached To LandAN ĐẶNGNessuna valutazione finora

- App Doc CancelDocumento1 paginaApp Doc CancelsanthoshputhoorNessuna valutazione finora

- Guidelines Land Conversion PermitDocumento3 pagineGuidelines Land Conversion PermitReetesh DabeedeenNessuna valutazione finora

- Affby Vinod-MergedDocumento29 pagineAffby Vinod-MergedAnush BasavarajuNessuna valutazione finora

- Form 7 Lease - Draft 21.11.23Documento44 pagineForm 7 Lease - Draft 21.11.23acftravel23Nessuna valutazione finora

- Unit 2 (DISPOSAL OF LAND BY ALIENATION)Documento23 pagineUnit 2 (DISPOSAL OF LAND BY ALIENATION)Zara Nabilah89% (19)

- Application For Regularization of Plots/ Buildings in Unauthorized ColoniesDocumento2 pagineApplication For Regularization of Plots/ Buildings in Unauthorized ColoniesRandeep KumarNessuna valutazione finora

- Form - VIIDocumento2 pagineForm - VIITelugu Noob GamerNessuna valutazione finora

- 271 (2012) 3 CLJ Uptown Properties SDN BHD v. Pentadbir Tanah Wilayah Persekutuan & OrsDocumento22 pagine271 (2012) 3 CLJ Uptown Properties SDN BHD v. Pentadbir Tanah Wilayah Persekutuan & Orshusni zulafifNessuna valutazione finora

- Form A DeclarationDocumento10 pagineForm A DeclarationRasid MondalNessuna valutazione finora

- Building Application ScrutinyDocumento13 pagineBuilding Application Scrutinyharish babu aluruNessuna valutazione finora

- Public Land ApplicationDocumento26 paginePublic Land ApplicationBaquer LautNessuna valutazione finora

- Strata TitleDocumento12 pagineStrata TitlegurL23Nessuna valutazione finora

- Performa For Valuation of SiteDocumento2 paginePerforma For Valuation of SitenitinNessuna valutazione finora

- Land User Application HMDADocumento4 pagineLand User Application HMDAvmandava0720Nessuna valutazione finora

- Format PNB FlatDocumento4 pagineFormat PNB FlatSatyanarayana Moorthy PiratlaNessuna valutazione finora

- Strata TitleDocumento12 pagineStrata TitlegurL23Nessuna valutazione finora

- POTA Exec InstructionsDocumento3 paginePOTA Exec InstructionsRavi100% (1)

- Registered Land - Karannie NotesDocumento30 pagineRegistered Land - Karannie Notesblah92100% (2)

- RFP Cemetery Land Registration Process For Phase 3 V1Documento13 pagineRFP Cemetery Land Registration Process For Phase 3 V1Raja BotoNessuna valutazione finora

- Appraisers Sample Questionnaires in Land Registration Atty. BuanDocumento38 pagineAppraisers Sample Questionnaires in Land Registration Atty. BuanWendz Gatdula100% (1)

- HLURB - Requirements PDFDocumento3 pagineHLURB - Requirements PDFMaria Vivencia LayosaNessuna valutazione finora

- Anjali Khendalwal Versus IREO Grace Realtech Pvt. Ltd.Documento19 pagineAnjali Khendalwal Versus IREO Grace Realtech Pvt. Ltd.SUKHBIR YADAV ADVNessuna valutazione finora

- County Application for Real Property Tax ExemptionDocumento4 pagineCounty Application for Real Property Tax ExemptionAnthony Juice Gaston BeyNessuna valutazione finora

- Lot - 119 - Official Copy (Register) - NGL160224Documento3 pagineLot - 119 - Official Copy (Register) - NGL160224TeliviNessuna valutazione finora

- The A.P.Rights in Land and Pattadar Pass Books Act, 1971Documento42 pagineThe A.P.Rights in Land and Pattadar Pass Books Act, 1971Ravi Pamula100% (1)

- Checklist for Tamil Nadu layout applicationsDocumento3 pagineChecklist for Tamil Nadu layout applicationsraj kumarNessuna valutazione finora

- Form I Application For Regularisation of Plot and LayoutDocumento4 pagineForm I Application For Regularisation of Plot and Layoutsvcsekar78% (9)

- Steps to complete land titling for agricultural landDocumento2 pagineSteps to complete land titling for agricultural landCharlotte Gallego100% (1)

- LRS ApplicationformDocumento9 pagineLRS Applicationformbarkalyan100% (1)

- City of Dumaguete v. PPADocumento16 pagineCity of Dumaguete v. PPAApril IsidroNessuna valutazione finora

- Format For A-42 FormDocumento8 pagineFormat For A-42 FormrooproxNessuna valutazione finora

- Alienation Proposals CircularDocumento6 pagineAlienation Proposals CircularjanardhangonigntlaNessuna valutazione finora

- WWW - Ghmc.gov - in Downloads CSC Applications TP001Documento9 pagineWWW - Ghmc.gov - in Downloads CSC Applications TP001Phillip Mcintyre100% (1)

- The Law of Allotments and Allotment Gardens (England and Wales)Da EverandThe Law of Allotments and Allotment Gardens (England and Wales)Nessuna valutazione finora

- The Law of Property Valuation and Planning in South AfricaDa EverandThe Law of Property Valuation and Planning in South AfricaNessuna valutazione finora

- Supreme Court Eminent Domain Case 09-381 Denied Without OpinionDa EverandSupreme Court Eminent Domain Case 09-381 Denied Without OpinionNessuna valutazione finora

- Tariff Information File PDFDocumento46 pagineTariff Information File PDFggNessuna valutazione finora

- 4d15 PDFDocumento9 pagine4d15 PDFSruthiNessuna valutazione finora

- Signature Not VerifiedDocumento12 pagineSignature Not VerifiedggNessuna valutazione finora

- Andhra PrasastiDocumento76 pagineAndhra Prasastibharathayyawar100% (2)

- Summary of Budget 2020 21 PDFDocumento5 pagineSummary of Budget 2020 21 PDFvijay bhandareNessuna valutazione finora

- 0b8aofam8 Ev Mwvwwlu0uhjrakuDocumento56 pagine0b8aofam8 Ev Mwvwwlu0uhjrakuRajeev ThakurNessuna valutazione finora

- Static GK FinalDocumento47 pagineStatic GK FinalRohit JuyalNessuna valutazione finora

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocumento1 paginaIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruggNessuna valutazione finora

- Yojana Jan 2020Documento13 pagineYojana Jan 2020Manas MRBNessuna valutazione finora

- IAS4Sure Value Addition Material Vol 2 For Mains 2019Documento9 pagineIAS4Sure Value Addition Material Vol 2 For Mains 2019ggNessuna valutazione finora

- Telugu: Telugu Syllabus For UPSC Main ExaminationDocumento3 pagineTelugu: Telugu Syllabus For UPSC Main ExaminationggNessuna valutazione finora

- State of Agriculture in IndiaDocumento29 pagineState of Agriculture in IndiaVarun BhagiNessuna valutazione finora

- Join Our Telegram Channel For Instant UpdatesDocumento19 pagineJoin Our Telegram Channel For Instant UpdatesggNessuna valutazione finora

- Highlights of The President's Speech 2020-21Documento2 pagineHighlights of The President's Speech 2020-21ggNessuna valutazione finora

- Join Our Telegram Channel For Instant UpdatesDocumento19 pagineJoin Our Telegram Channel For Instant UpdatesggNessuna valutazione finora

- New Text DocumentDocumento20 pagineNew Text DocumentRohit ReddyNessuna valutazione finora

- Budget Speech Piyush GoyalDocumento22 pagineBudget Speech Piyush GoyalnapinnvoNessuna valutazione finora

- Kurukshetra Summary December 2018Documento24 pagineKurukshetra Summary December 2018ggNessuna valutazione finora

- My DocumentDocumento1 paginaMy DocumentggNessuna valutazione finora

- Kurukshetra Summary March 2019 PDFDocumento18 pagineKurukshetra Summary March 2019 PDFBharaNessuna valutazione finora

- June 2019 - Compiled MPRDocumento13 pagineJune 2019 - Compiled MPRAbhishek RaviNessuna valutazione finora

- My DocumentDocumento1 paginaMy DocumentggNessuna valutazione finora

- STAMP DUTY SCHEDULE FOR ANDHRA PRADESHDocumento21 pagineSTAMP DUTY SCHEDULE FOR ANDHRA PRADESHrajugs_lgNessuna valutazione finora

- Pib Monthly Compilation From 16 To 30 Sept 2019Documento20 paginePib Monthly Compilation From 16 To 30 Sept 2019AnchalNessuna valutazione finora

- Kurukshetra Summary December 2018Documento24 pagineKurukshetra Summary December 2018ggNessuna valutazione finora

- International Current Affairs and Events - January 2020Documento2 pagineInternational Current Affairs and Events - January 2020ggNessuna valutazione finora

- Webland Bank Charge Creation User ManualDocumento28 pagineWebland Bank Charge Creation User Manualgg100% (2)

- Syllabus PDFDocumento8 pagineSyllabus PDFdahiphalehNessuna valutazione finora

- My DocumentDocumento1 paginaMy DocumentggNessuna valutazione finora

- 1956 of 2021Documento61 pagine1956 of 2021sunnyvanee83Nessuna valutazione finora

- Aligarh Muslim University: Crimnal Procedure Code OnDocumento8 pagineAligarh Muslim University: Crimnal Procedure Code OnHanzalaahmedNessuna valutazione finora

- LLM in American Law ProgramDocumento2 pagineLLM in American Law ProgramBrice MassambaNessuna valutazione finora

- PolicyDoc (10) - 1Documento2 paginePolicyDoc (10) - 1YES I WANT TO JOIN DEFENCENessuna valutazione finora

- Bambalan vs. MarambaDocumento2 pagineBambalan vs. MarambaCeasar PagapongNessuna valutazione finora

- 014 DBM V MANILA'S FINEST RETIREES ASSOCIATIONDocumento2 pagine014 DBM V MANILA'S FINEST RETIREES ASSOCIATIONLindonNessuna valutazione finora

- M.D. Fla. 21-cv-00764 DCKT 000032 - 000 Filed 2021-08-18Documento26 pagineM.D. Fla. 21-cv-00764 DCKT 000032 - 000 Filed 2021-08-18charlie minatoNessuna valutazione finora

- Bill of Rights Act 1688Documento8 pagineBill of Rights Act 1688bethhumphraol.comNessuna valutazione finora

- After The Diagnosis (Erica F. Wood)Documento36 pagineAfter The Diagnosis (Erica F. Wood)National Press FoundationNessuna valutazione finora

- 1 - Eristingcol v. CA - G.R. No. 167702Documento16 pagine1 - Eristingcol v. CA - G.R. No. 167702eiram23Nessuna valutazione finora

- 214 - Everette - ST - Accepted OfferDocumento8 pagine214 - Everette - ST - Accepted Offeramandasj1204Nessuna valutazione finora

- Memorandum of Understanding - Cellebrite Premium Extraction SoftwareDocumento2 pagineMemorandum of Understanding - Cellebrite Premium Extraction SoftwareWMBF NewsNessuna valutazione finora

- 4035311479Documento10 pagine4035311479K VinayNessuna valutazione finora

- Full Download Human Biology 13th Edition Mader Test BankDocumento13 pagineFull Download Human Biology 13th Edition Mader Test Banksheathe.zebrinny.53vubg100% (24)

- CAIR-Michigan ComplaintDocumento33 pagineCAIR-Michigan ComplaintWXYZ-TV Channel 7 DetroitNessuna valutazione finora

- WadwaDocumento154 pagineWadwaDinesh VishnoiNessuna valutazione finora

- JNMC09 Appellant - Petitioner PDFDocumento35 pagineJNMC09 Appellant - Petitioner PDFSANGRAM SINGH GAURNessuna valutazione finora

- Copyrights BelDocumento42 pagineCopyrights BelshaikhnazneenNessuna valutazione finora

- Decree Regulating PoloDocumento2 pagineDecree Regulating PoloMicsjadeCastilloNessuna valutazione finora

- House Rent Agreement NewDocumento2 pagineHouse Rent Agreement NewPrarthana Mohapatra100% (1)

- IBPS Law Officer Study Material Company Law MCQDocumento31 pagineIBPS Law Officer Study Material Company Law MCQRohanPuthalathNessuna valutazione finora

- People vs. NogposDocumento22 paginePeople vs. Nogposapplegee liboonNessuna valutazione finora

- VOL. 191, NOVEMBER 22, 1990 581: Pantranco South Express, Inc. vs. Board of TransportationDocumento11 pagineVOL. 191, NOVEMBER 22, 1990 581: Pantranco South Express, Inc. vs. Board of TransportationJane MaribojoNessuna valutazione finora

- Ethics and ObiconDocumento18 pagineEthics and ObiconGe LatoNessuna valutazione finora

- Hearing Clinic v. Lewis (Trial)Documento326 pagineHearing Clinic v. Lewis (Trial)Drew Hasselback100% (1)

- Motion For TikTok Doc Sexual Assault Plaintiff To Remain AnonymousDocumento8 pagineMotion For TikTok Doc Sexual Assault Plaintiff To Remain AnonymousKGW NewsNessuna valutazione finora

- Office Memorandum Example 3Documento2 pagineOffice Memorandum Example 3Mostez ChhangteNessuna valutazione finora

- HDFC FW Comprehensive MH70UVIVIGJ 1705417806189Documento2 pagineHDFC FW Comprehensive MH70UVIVIGJ 1705417806189f2994667Nessuna valutazione finora

- Fall 2017 Security InterestDocumento89 pagineFall 2017 Security InterestSarah EunJu LeeNessuna valutazione finora

- Prahalad Saran Gupta Case StudyDocumento13 paginePrahalad Saran Gupta Case Studyaridaman raghuvanshi0% (1)