Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

TAXATION 2 Chapter 12 Output VAT Zero Rated Sales

Caricato da

Kim Cristian MaañoDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

TAXATION 2 Chapter 12 Output VAT Zero Rated Sales

Caricato da

Kim Cristian MaañoCopyright:

Formati disponibili

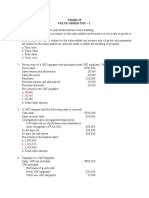

VALUE-ADDED TAX COMPUTATION

1. On July 2018, Mr. Pascua opted to register as a VAT taxpayer. He had the following inventory

balances as of June 30, 2018:

Goods purchased from VAT Registered Taxpayer P 240,000

Goods purchased from Non-VAT Taxpayer 160,000

Services purchased from VAT Registered Taxpayer 112,000

Total P 232,000

Requirement: Compute the claimable Input VAT for the month of July 2018.

2. Tayabas Oil Milling Corporation, a VAT-registered CNO manufacturer, purchased (exclusive of

VAT) the following materials and supplies in the processing of CNO during the month:

Copra P 980,000

Hexane solvent 160,000

Containers 120,000

Sodium hydroxide/carbonate 90,000

Activated Carbon 130,000

Total P 1,480,000

The oil mill produced 10,000 containers of CNO and sold 8,600 containers to various customers for

P260.00 per container.

Requirement: Compute the VAT Payable for the month.

3. CJ Construction Company made a contract with the Department of Public Works and Highways

(DPWH) amounting to P1,000,000 exclusive of VAT. Actual vat paid of CJ Construction in relation

with the contract amounting to P80,000.

DPWH withheld the equivalent 5% of the contract amount and paid P1,050,000 net proceeds to CJ

Construction.

Requirement: Compute the VAT Payable still due and payable of CJ Construction.

4. On April 20, 2018 the taxpayer filed its first quarter Value-Added Tax Return. Hereunder are the

additional information:

Output Vat Input VAT

First quarter P 280,000 P 320,000

Second quarter:

April 2018 P 90,000 P 60,000

May 2018 83,000 65,000

June 2018 98,000 88,000

Total for the second quarter P 271,000 P 213,000

Requirement: Compute the VAT payable for the quarter ending June 30, 2018.

5. On January 12, 2018 Araneta Company purchased goods from a VAT registered Taxpayer amounting

to P50,000 (exclusive of 12% VAT). On January 20, 2018 Araneta Company sold the goods with a

total invoice price of P62,000.

Requirement: Compute the VAT payable for the month of January.

BUSINESS AND TRANSFER TAXATION 2019

Chapter 12

OUTPUT VAT ON ZERO-RATED SALES

THE ZERO-RATED VAT

Foreign consumption like export of goods or services is not charged with consumption tax. Hence,

the export sales of non-VAT taxpayers are VAT exempt. The export sales of VAT-registered

taxpayers are subjected to a zero-rated VAT.

VAT exemption vs. Zero-rating

Both VAT exemption and zero-rating effectively result in no payment of VAT. The defference lies

on the treatment of input VAT. VAT exemption actually results in partial relief but zero-rating

results in total relief.

The input VAT on exempt transactions is claimable as a deduction against gross income. The

taxpayer recovers only the income tax benmefit of the deduction. Conversely, input VAT on zero-

rated sales is recoverable in full via tax refund or tax credit certificate.

Table of comparison

VAT exemption Zero-rating

Output VAT No output VAT No output VAT

Input VAT treatment Deductible against gross Creditable or refundable

income

Extent of tax relief Partial Total

ZERO-RATED SALES

Zero-rated sales are foreign consumptions such as export sales and other sales to non-residents

including transactions that are granted with a zero-rating status by special law or by international

agreement to which the Philippines is a signatory.

Categories of zero-rated sales

A. Zero-rated sales of goods and properties

B. Zero-rated sales of services

ZERO-RATED SALES OF GOODS OR PROPERTIES

Caterories of Zero-rated sales of goods or properties:

1. Export sales

2. Foreign currency denominated sales

3. Sales to tax-exempt persons or entities under special laws or international agreements

EXPORT SALES

Under the NIRC as amended, “export sales” shall mean:

1. Direct export

2. Indirect export

3. Sale of raw materials or packaging materials to an export-oriented enterprise

4. Sale of gold to the Bangko Sentral ng Pilipinas (BSP)

5. Those considered export sales under E.O. 226 (The Omnibus Investment Code of 1987),

and other special laws

6. Sale of goods or properties, supplies, equipment and fuel to persons engaged in

international shipping or international air transport operations.

Chapter 12 – Output VAT (Zero-rated Sales) Page 2

BUSINESS AND TRANSFER TAXATION 2019

EXPORT SALES – SALES TO NON-RESIDENTS

Direct export is the sale and actual shipment of goods from the Philippines to a foreign country,

irrespective of the shipping arrangement.

Indirect export is the sale ofr raw materials or packaging materials to a non-resident buyer for

delivery to a resident local-export oriented enterprise to be used in manufacturing, processing,

packing or repacking in the Philippines of the said buyers.

Requirement for zero-rating of export sales to non-residents:

a. The sale must have been paid for in acceptable foreign currency or its equivalent in good or

services.

b. The sale must be accounted for under the rules of the BSP.

SALES TO RESIDENTS CONSIDERED EXPORT SALES

Sale to an export-oriented enterprise

The sale of raw materials or packaging materials to an export-oriented enterprise whose sales exceed

seventy percent (70%) of total annual production is subject to zero-rated VAT.

Any enterprise whose export sales exceed 70% of the total annual production of the prededing

taxable year shall be considered an “export-oriented enterprise”. A certification to this effect is

issued by the pertinent government agency.

Sale of goods, properties or services to a BOI-registered manufacturer or producer

The sale of goods, properties or services made by a VAT-registered supplier to a BOI-registered

manufacturer/producer whose products are 100% exported are considered export sales. A

certification to this effect which is good for one year must be issued by the BOI.

FOREIGN CURRENCY DENOMINATED SALE

The term “Foreign currency denominated sale” means sale to non-residents of goods, except

export of automobiles and non-essential commodities, assembled or manufactured in the Philippines

for delivery to a resident in the Philippines, paid for in acceptable foreign currency and accounted for

in accordance with the rules and regulations of the BSP.

Sales under the Internal Export Program of the government

Sales of locally manufactured or assembled goods for household and personal use to Filipinos abroad

and other non-residents of the Philippines as well as returning Overseas Filipinos under the Internal

Export Program of the government paid for in convertible foreign currencies and accounted for with

the rules and regulations of the BSP shall also be considered export sales.

SALES TO TAX-EXEMPT PERSONS OR ENTITIES UNDER SPECIAL LAWS OR

INTERNATIONAL AGREEMENTS

Sales to persons or entities deemed tax-exempt under special laws or international agreement shall be

effectively subject to VAT at zero-rate.

Tax-exempt entities under special laws:

a. Subic Bay Metropolitan Authority (SBMA) – reistered enterprises

b. Philippine Economic Zone Authority (PEZA) – registered enterprises

c. Philippine National Red Cross (PNRC) – Sec. 5 (c) RA 10072

d. Philippine Amusement and Gaming Corporation (PAGCOR) and its licensees or contractors-

PD1869

Chapter 12 – Output VAT (Zero-rated Sales) Page 3

BUSINESS AND TRANSFER TAXATION 2019

Tax-exempt entities under international agreements:

a. Asian Development Bank (ADB)

b. International Rice Research Institute (IRRI)

c. United Nation (UN) and its various organizations, such as:

a. World Health Organization

b. UNICEF

d. United States Agency for International Development (USAID) and its personnel and

contractors (RMC 40-07)

e. Embasies, qualified employees and dependents – subject to the reciprocity rule

ZERO-RATED SALES OF SERVICES

Categories of zero-rated sale of services:

1. Sale of services to non-residents

2. Effectively zero-rated sales of services

3. Transport of passengers and cargoes by domestic air or sea carriers from the

Philippines to a foreign country

4. Sale of power or fuel generated from renewable sources of energy

Sales of services to non-residents

1. Processing, manufacturing or repacking goods for other persons doing business outside the

Philippines, which goods are subsequently exported

2. Services other than processing, manufacturing or repacking rendered to a person engaged in

business conducted outside the Philippines or to a non-resident person not-engaged in

business who is outside the Philippines when the services are performed.

Effectively zero-rated sales of services

The term ”effectively zero-rated sales of services” shall refer to the local sale of services to a person

or entity who was granted indirect tax exemption under specail laws or international agreements.

Transport of passengers and cargo by domestic air or sea carriers from the Philippines to a

foreign country

The outgoing transport services of domestic air carrier or sea carrier constitute services rendered in

the Philippines to non-residents. It is therefore subject to zero-rated VAT.

Sale of power or fuel generated through renewable sources of energy

The sale of power or fuel from renewable sources of energy isa zero-rated. Renewable sources of

energy may include, but is not limited to, biomass, solar, wind, hydropower, geothermal and steam,

ocean energy and other emerging sources using technologies such as fuel cells and hydrogen

fuels.(RA 9513 & RA 9337)

The zero-rating treatment is limited on sale of power and does not extend to sale of services related to

the maintenance or operation of plants generating said fuel.

Types of businesses in the electricity business:

a. Generation companies- refers to persons or entities authorized by the Energy Regulatory

Commission (ERC) to operate a facility used in the production of electricity.

b. Transmission companies- refers to any person or entity that owns and conveys electricity

through the high voltage backbone system and or subtransmission assets.

c. Distribution companies- refers to persons or entities including a distribution utility such as

electric cooperative which operates a distribution system with the provision of RA 9136

(EPIRA law).

Chapter 12 – Output VAT (Zero-rated Sales) Page 4

Potrebbero piacerti anche

- CH11 - Value Added TaxDocumento33 pagineCH11 - Value Added TaxDimple AtienzaNessuna valutazione finora

- Impact Assessment AAK: Taxes and the Local Manufacture of PesticidesDa EverandImpact Assessment AAK: Taxes and the Local Manufacture of PesticidesNessuna valutazione finora

- Transfer and Business Taxation HOMEWORK 006 (HW006)Documento3 pagineTransfer and Business Taxation HOMEWORK 006 (HW006)sora cabreraNessuna valutazione finora

- 1040 Exam Prep Module X: Small Business Income and ExpensesDa Everand1040 Exam Prep Module X: Small Business Income and ExpensesNessuna valutazione finora

- Output Vat - Zero-Rated SalesDocumento36 pagineOutput Vat - Zero-Rated SalesCoreen Samaniego0% (2)

- TAX2UNIT9TO12Documento4 pagineTAX2UNIT9TO12Catherine Joy VasayaNessuna valutazione finora

- VAT ReviewDocumento8 pagineVAT ReviewabbyNessuna valutazione finora

- PrefinalDocumento7 paginePrefinalLeisleiRagoNessuna valutazione finora

- Output TaxDocumento15 pagineOutput TaxAmie Jane MirandaNessuna valutazione finora

- VAT ReviewDocumento10 pagineVAT ReviewRachel LeachonNessuna valutazione finora

- DocxDocumento28 pagineDocxGrace Managuelod GabuyoNessuna valutazione finora

- Value Added Tax - : - Output VAT: Zero-Rated SalesDocumento23 pagineValue Added Tax - : - Output VAT: Zero-Rated SalesAjey MendiolaNessuna valutazione finora

- Quiz 4 VATDocumento3 pagineQuiz 4 VATAsiong Salonga100% (2)

- Tax2 FinalsDocumento8 pagineTax2 FinalsKevin Elrey Arce100% (2)

- M13 Output VAT Regular Sales Students Copy 1Documento28 pagineM13 Output VAT Regular Sales Students Copy 1Tokis SabaNessuna valutazione finora

- Written ReportDocumento10 pagineWritten ReportSamantha TayoneNessuna valutazione finora

- Tax2 Quiz2 FinalsDocumento11 pagineTax2 Quiz2 Finalsishinoya keishiNessuna valutazione finora

- Value Added Tax - Part 1: - The Regular Output VATDocumento25 pagineValue Added Tax - Part 1: - The Regular Output VATAjey MendiolaNessuna valutazione finora

- VAT - CPA Reviewer in Taxation - Enrico D. Tabag PDFDocumento103 pagineVAT - CPA Reviewer in Taxation - Enrico D. Tabag PDFDGAENessuna valutazione finora

- Tax CDocumento18 pagineTax Calmira garciaNessuna valutazione finora

- HANDOUT-business TaxesDocumento29 pagineHANDOUT-business TaxesGianJoshuaDayrit67% (3)

- Act184 Quiz 3Documento4 pagineAct184 Quiz 3Cardo DalisayNessuna valutazione finora

- Value Added Tax PracticeDocumento7 pagineValue Added Tax PracticeSelene DimlaNessuna valutazione finora

- Tax Lecture VATDocumento4 pagineTax Lecture VATRozzane Ann RomaNessuna valutazione finora

- BLT Business TaxesDocumento10 pagineBLT Business TaxesjennyMBNessuna valutazione finora

- Universal College of Parañaque: Value Added TaxDocumento14 pagineUniversal College of Parañaque: Value Added TaxDin Rose Gonzales67% (3)

- Additional Vat MSQ PDFDocumento14 pagineAdditional Vat MSQ PDFPrincesNessuna valutazione finora

- Multiple Choice QuestionsDocumento14 pagineMultiple Choice QuestionsVince ManahanNessuna valutazione finora

- 1.2. Problems On VAT - For Tax ReviewDocumento19 pagine1.2. Problems On VAT - For Tax ReviewJem ValmonteNessuna valutazione finora

- Chapter 9 Part 1 Input VatDocumento25 pagineChapter 9 Part 1 Input VatChristian PelimcoNessuna valutazione finora

- TBLTAX Chapter 4 Input and Output TaxDocumento16 pagineTBLTAX Chapter 4 Input and Output TaxBeny MiraflorNessuna valutazione finora

- Value Added TaxDocumento5 pagineValue Added TaxRaven Vargas DayritNessuna valutazione finora

- Taxation CPALE by WMGDocumento19 pagineTaxation CPALE by WMGJona Celle Castillo100% (1)

- Vat ReviewDocumento4 pagineVat ReviewVensen FuentesNessuna valutazione finora

- Quiz - Business TaxesDocumento4 pagineQuiz - Business TaxesFery Ann C. BravoNessuna valutazione finora

- Question Bank VatDocumento14 pagineQuestion Bank VatLeonard Cañamo90% (10)

- Tax Review - Overview Vat and Opt (Quiz)Documento4 pagineTax Review - Overview Vat and Opt (Quiz)Lovenia Magpatoc100% (7)

- VAT QuizzerDocumento16 pagineVAT QuizzerAnonymous 2ajCCT03VM50% (6)

- Chapter 8 Zero Rated SalesDocumento39 pagineChapter 8 Zero Rated SalesCathy Marie Angela ArellanoNessuna valutazione finora

- Bustamante TAX CDocumento19 pagineBustamante TAX CJean Rose Tabagay BustamanteNessuna valutazione finora

- Tax QuizzerDocumento33 pagineTax QuizzerClarisse Peter86% (14)

- Value Added TaxDocumento6 pagineValue Added TaxjamNessuna valutazione finora

- VAT (Theory & Problem)Documento10 pagineVAT (Theory & Problem)dimpy dNessuna valutazione finora

- Tax 2 PDFDocumento16 pagineTax 2 PDFLeah MoscareNessuna valutazione finora

- Business TaxDocumento26 pagineBusiness Taxanor.aquino.upNessuna valutazione finora

- Chapter 7 - TBTDocumento14 pagineChapter 7 - TBTKatKat Olarte0% (3)

- Input Vat: Prepared By: Mrs. Nelia I. Tomas, CPA, LPTDocumento28 pagineInput Vat: Prepared By: Mrs. Nelia I. Tomas, CPA, LPTAjey MendiolaNessuna valutazione finora

- VAT IntroductionDocumento22 pagineVAT IntroductionMa.annNessuna valutazione finora

- Module 6 Chapter 8 Output VAT Zero Rated SalesDocumento5 pagineModule 6 Chapter 8 Output VAT Zero Rated SalesChris SumandeNessuna valutazione finora

- Vat 4Documento4 pagineVat 4Allen KateNessuna valutazione finora

- VAT AND OPT Monthly EXAMDocumento20 pagineVAT AND OPT Monthly EXAMAlexandra Nicole IsaacNessuna valutazione finora

- 93-13 - VatDocumento19 pagine93-13 - VatJuan Miguel UngsodNessuna valutazione finora

- Transfer and Business Taxation - MIDTERMDocumento14 pagineTransfer and Business Taxation - MIDTERMYvette Pauline JovenNessuna valutazione finora

- Chapter 8 Output Vat Zero Rated SalesDocumento29 pagineChapter 8 Output Vat Zero Rated SalesChristian PelimcoNessuna valutazione finora

- Lyceum-Northwestern University: L-NU AA-23-02-01-18Documento10 pagineLyceum-Northwestern University: L-NU AA-23-02-01-18Amie Jane MirandaNessuna valutazione finora

- 3.2 Business Profit TaxDocumento53 pagine3.2 Business Profit TaxBizu AtnafuNessuna valutazione finora

- Chapter 13 Mixed Business TransactionsDocumento10 pagineChapter 13 Mixed Business TransactionsGeraldNessuna valutazione finora

- Business TaxDocumento116 pagineBusiness TaxScarlett FernandezNessuna valutazione finora

- CombinepdfDocumento129 pagineCombinepdfMary Jane G. FACERONDANessuna valutazione finora

- Northern Cpa Review: First Pre-Board ExaminationDocumento13 pagineNorthern Cpa Review: First Pre-Board ExaminationKim Cristian MaañoNessuna valutazione finora

- MASedited 2nd Pre-Board ExamsDocumento12 pagineMASedited 2nd Pre-Board ExamsKim Cristian MaañoNessuna valutazione finora

- On December 31, 20x1, ABC Has Total Expenses of P1,000,000 Before Possible Adjustment For The FollowingDocumento12 pagineOn December 31, 20x1, ABC Has Total Expenses of P1,000,000 Before Possible Adjustment For The FollowingKim Cristian MaañoNessuna valutazione finora

- Practical Accounting II - 2nd PreboardDocumento9 paginePractical Accounting II - 2nd PreboardKim Cristian Maaño0% (1)

- Mas Second PB 03-11Documento12 pagineMas Second PB 03-11Kim Cristian MaañoNessuna valutazione finora

- 5rd Batch - P2 Final Pre-Boards - Wid ANSWERDocumento11 pagine5rd Batch - P2 Final Pre-Boards - Wid ANSWERKim Cristian MaañoNessuna valutazione finora

- AUDITING PROBLEMS - 2nd Preboard Suggested AnswersDocumento3 pagineAUDITING PROBLEMS - 2nd Preboard Suggested AnswersKim Cristian MaañoNessuna valutazione finora

- 1st Pre-Board - MAS October 2011 BatchDocumento8 pagine1st Pre-Board - MAS October 2011 BatchKim Cristian MaañoNessuna valutazione finora

- Aud ThEORY - 2nd PreboardDocumento11 pagineAud ThEORY - 2nd PreboardKim Cristian MaañoNessuna valutazione finora

- 5rd Batch - AP - Final Pre-Boards - EditedDocumento11 pagine5rd Batch - AP - Final Pre-Boards - EditedKim Cristian Maaño100% (1)

- 5rd Batch - P1 - Final Pre-Boards - EditedDocumento11 pagine5rd Batch - P1 - Final Pre-Boards - EditedKim Cristian Maaño0% (1)

- Auditing Problems Key Answers/solutions: Problem No. 1 1.A, 2.C, 3.B, 4.B, 5.DDocumento14 pagineAuditing Problems Key Answers/solutions: Problem No. 1 1.A, 2.C, 3.B, 4.B, 5.DKim Cristian MaañoNessuna valutazione finora

- Solutions Manual Short-Term Sources For Financing Current AssetsDocumento2 pagineSolutions Manual Short-Term Sources For Financing Current AssetsKim Cristian MaañoNessuna valutazione finora

- AT - First Preboard (October 2011)Documento12 pagineAT - First Preboard (October 2011)Kim Cristian MaañoNessuna valutazione finora

- 1st Tax Pre-Board Exam - October 2011 BatchDocumento5 pagine1st Tax Pre-Board Exam - October 2011 BatchKim Cristian MaañoNessuna valutazione finora

- Aud ThEORY - 2nd PreboardDocumento11 pagineAud ThEORY - 2nd PreboardKim Cristian MaañoNessuna valutazione finora

- 1st Pre-Board - P2 October 2011 BatchDocumento8 pagine1st Pre-Board - P2 October 2011 BatchKim Cristian MaañoNessuna valutazione finora

- Northern Cpa Review Center: Auditing ProblemsDocumento12 pagineNorthern Cpa Review Center: Auditing ProblemsKim Cristian MaañoNessuna valutazione finora

- Final May 11, Questions and Answers Final May 11, Questions and AnswersDocumento9 pagineFinal May 11, Questions and Answers Final May 11, Questions and AnswersKim Cristian MaañoNessuna valutazione finora

- Aud Prob - 2nd PreboardDocumento13 pagineAud Prob - 2nd PreboardKim Cristian MaañoNessuna valutazione finora

- CMAPart1F (Long Term Finance and Capital Structure) AnswersDocumento43 pagineCMAPart1F (Long Term Finance and Capital Structure) AnswersKim Cristian MaañoNessuna valutazione finora

- TAXATION 2 Chapter 6 Introduction To Donation and Donors Tax PDFDocumento7 pagineTAXATION 2 Chapter 6 Introduction To Donation and Donors Tax PDFKim Cristian MaañoNessuna valutazione finora

- Fin 300 CH 1-4 Fin 300 CH 1-4Documento17 pagineFin 300 CH 1-4 Fin 300 CH 1-4Kim Cristian MaañoNessuna valutazione finora

- Lecture Notes 1 - Finance - Principles of Finance Lecture Notes 1 - Finance - Principles of FinanceDocumento7 pagineLecture Notes 1 - Finance - Principles of Finance Lecture Notes 1 - Finance - Principles of FinanceKim Cristian MaañoNessuna valutazione finora

- Sample Valuation Exam With Solutions Sample Valuation Exam With SolutionsDocumento11 pagineSample Valuation Exam With Solutions Sample Valuation Exam With SolutionsKim Cristian MaañoNessuna valutazione finora

- TAXATION 2 Chapter 9 Exempt SalesDocumento5 pagineTAXATION 2 Chapter 9 Exempt SalesKim Cristian MaañoNessuna valutazione finora

- TAXATION 2 Chapter 4 Estate Tax Deductions From Gross EstateDocumento8 pagineTAXATION 2 Chapter 4 Estate Tax Deductions From Gross EstateKim Cristian MaañoNessuna valutazione finora

- TAXATION 2 Chapter 8 Percentage Tax PDFDocumento4 pagineTAXATION 2 Chapter 8 Percentage Tax PDFKim Cristian MaañoNessuna valutazione finora

- TAXATION 2 Chapter 10 Value Added TaxDocumento7 pagineTAXATION 2 Chapter 10 Value Added TaxKim Cristian MaañoNessuna valutazione finora

- Singapore Property Weekly Issue 59Documento17 pagineSingapore Property Weekly Issue 59Propwise.sgNessuna valutazione finora

- 651593285MyGov 5th September, 2023 & Agenda KenyaDocumento29 pagine651593285MyGov 5th September, 2023 & Agenda KenyaJudy KarugaNessuna valutazione finora

- Agenda Demo DayDocumento1 paginaAgenda Demo DayyuritziacostaNessuna valutazione finora

- Chap016 Managerial ControlDocumento40 pagineChap016 Managerial ControlHussain Ali Y AlqaroosNessuna valutazione finora

- Assignment Entp Uzair Pathan 18330Documento4 pagineAssignment Entp Uzair Pathan 18330syed ali mujtabaNessuna valutazione finora

- Consumer Durable IndustryDocumento20 pagineConsumer Durable Industryvipul tutejaNessuna valutazione finora

- Taxation Law CIA 1 (B) Salary AnalysisDocumento3 pagineTaxation Law CIA 1 (B) Salary Analysisawinash reddyNessuna valutazione finora

- Taxguru - In-Power of Commissioner To Reduce or Waive Income Tax PenaltyDocumento9 pagineTaxguru - In-Power of Commissioner To Reduce or Waive Income Tax PenaltyRakesh Kumar SinghalNessuna valutazione finora

- Travel and Tourism Notes For Gate College StudentDocumento106 pagineTravel and Tourism Notes For Gate College StudentSandesh Shrestha100% (1)

- Meeting The Challenges of Global Climate Change and Food Security Through Innovative Maize Research. Proceedings of The National Maize Workshop of Ethiopia, 3 Addis Ababa, Ethiopia 18-20 April, 2011Documento300 pagineMeeting The Challenges of Global Climate Change and Food Security Through Innovative Maize Research. Proceedings of The National Maize Workshop of Ethiopia, 3 Addis Ababa, Ethiopia 18-20 April, 2011International Maize and Wheat Improvement CenterNessuna valutazione finora

- Plotics of DevelopmentDocumento13 paginePlotics of DevelopmentAbdela Aman MtechNessuna valutazione finora

- VP Commercial Real Estate Finance in NYC Resume Todd BakerDocumento2 pagineVP Commercial Real Estate Finance in NYC Resume Todd BakerToddBaker1Nessuna valutazione finora

- Solutions Manual Chapter Twenty-Three: Answers To Chapter 23 QuestionsDocumento12 pagineSolutions Manual Chapter Twenty-Three: Answers To Chapter 23 QuestionsBiloni KadakiaNessuna valutazione finora

- Peter LynchDocumento2 paginePeter LynchShiv PratapNessuna valutazione finora

- Presentation On Financial InstrumentsDocumento20 paginePresentation On Financial InstrumentsMehak BhallaNessuna valutazione finora

- An Introduction To ReinsuranceDocumento188 pagineAn Introduction To Reinsurancecruzer11290Nessuna valutazione finora

- Fsac 230Documento11 pagineFsac 230mahssounys.mNessuna valutazione finora

- Barringer Ent6 03Documento41 pagineBarringer Ent6 03ghufran almazNessuna valutazione finora

- Nike Pestle AnalysisDocumento11 pagineNike Pestle AnalysisdarshininambiarNessuna valutazione finora

- Sapp - Deloitte Entrance TestDocumento19 pagineSapp - Deloitte Entrance TestKim Ngan LeNessuna valutazione finora

- Target BeneficiariesDocumento2 pagineTarget BeneficiariesMeowiiNessuna valutazione finora

- Ch. 1: Conceptual Framework: Intermediate Accounting I Spring 2017Documento38 pagineCh. 1: Conceptual Framework: Intermediate Accounting I Spring 2017Dyana AlkarmiNessuna valutazione finora

- Make in India Advantages, Disadvantages and Impact On Indian EconomyDocumento8 pagineMake in India Advantages, Disadvantages and Impact On Indian EconomyAkanksha SinghNessuna valutazione finora

- Evergreen Event Driven Marketing PDFDocumento2 pagineEvergreen Event Driven Marketing PDFEricNessuna valutazione finora

- Leins - 2020 - Responsible Investment' ESG and The Post-CrisisDocumento22 pagineLeins - 2020 - Responsible Investment' ESG and The Post-Crisisjuliette.geisingerNessuna valutazione finora

- 20170927090928talent Management W2Documento19 pagine20170927090928talent Management W2Bum MieNessuna valutazione finora

- Over Not Over Tax: Basic Income Table (Tax Code, Section 24 A)Documento2 pagineOver Not Over Tax: Basic Income Table (Tax Code, Section 24 A)Juliana ChengNessuna valutazione finora

- Financial Statement Analysis Lenovo Final 1Documento18 pagineFinancial Statement Analysis Lenovo Final 1api-32197850550% (2)

- Entrepreneurship-11 12 Q2 SLM WK2Documento6 pagineEntrepreneurship-11 12 Q2 SLM WK2MattNessuna valutazione finora

- Unit 18 Grammar ExercisesDocumento4 pagineUnit 18 Grammar ExercisesMaria MontesNessuna valutazione finora

- How to get US Bank Account for Non US ResidentDa EverandHow to get US Bank Account for Non US ResidentValutazione: 5 su 5 stelle5/5 (1)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingDa EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingValutazione: 4.5 su 5 stelle4.5/5 (98)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorDa EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorValutazione: 4.5 su 5 stelle4.5/5 (132)

- Introduction to Negotiable Instruments: As per Indian LawsDa EverandIntroduction to Negotiable Instruments: As per Indian LawsValutazione: 5 su 5 stelle5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDa EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNessuna valutazione finora

- Ben & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooDa EverandBen & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooValutazione: 5 su 5 stelle5/5 (2)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyDa EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNessuna valutazione finora

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProDa EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProValutazione: 4.5 su 5 stelle4.5/5 (43)

- Tax Savvy for Small Business: A Complete Tax Strategy GuideDa EverandTax Savvy for Small Business: A Complete Tax Strategy GuideValutazione: 5 su 5 stelle5/5 (1)

- The Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersDa EverandThe Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersNessuna valutazione finora

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCDa EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCValutazione: 4 su 5 stelle4/5 (5)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsDa EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsValutazione: 5 su 5 stelle5/5 (24)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorDa EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorValutazione: 4.5 su 5 stelle4.5/5 (63)

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationDa EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNessuna valutazione finora

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessDa EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessValutazione: 5 su 5 stelle5/5 (5)

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessDa EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessNessuna valutazione finora

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyDa EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyValutazione: 4 su 5 stelle4/5 (52)

- The SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsDa EverandThe SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsNessuna valutazione finora