Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Assignment in Capital Investment

Caricato da

Liberty VeluntaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Assignment in Capital Investment

Caricato da

Liberty VeluntaCopyright:

Formati disponibili

Assignment in Capital Investment

1. Dukes Company is considering the acquisition of a machine that costs P375,000. The machine is

expected to have a useful life of 6 years, a negligible residual value, an annual cash flow of

P150,000, and annual operating income of P87,500. What is the estimated cash payback period for

the machine?

2. What is the expected average rate of return for a proposed investment of P4,800,000 in a fixed asset,

using straight line depreciation, with a useful life of 20 years, no residual value, and an expected

total net income of P12,000,000?

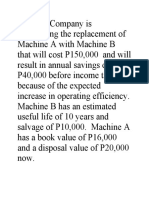

3. The management of Arnold Corporation is considering the purchase of a new machine costing

P400,000. The company's desired rate of return is 10%. The present value factors for P1 at

compound interest of 10% for 1 through 5 years are 0.909, 0.826, 0.751, 0.683, and 0.621,

respectively. In addition to the foregoing information, use the following data in determining the

acceptability in this situation:

Income from Net Cash

Year Operations Flow

1 P100,000 P180,000

2 40,000 120,000

3 20,000 100,000

4 10,000 90,000

5 10,000 90,000

a. What is the cash payback period for this investment?

b. What is the average rate of return for this investment?

4. The management of Arnold Corporation is considering the purchase of a new machine costing

P430,000. The company's desired rate of return is 10%. The present value factors for P1 at

compound interest of 10% for 1 through 5 years are 0.909, 0.826, 0.751, 0.683, and 0.621,

respectively. In addition to the foregoing information, use the following data in determining the

acceptability in this situation:

Income from Net Cash

Year Operations Flow

1 P100,000 P180,000

2 40,000 120,000

3 20,000 100,000

4 10,000 90,000

5 10,000 90,000

What is the net present value for this investment?

Potrebbero piacerti anche

- ACCA F9 Mock Examination 2Documento5 pagineACCA F9 Mock Examination 2daria0% (1)

- 10 FS Analysis Sample Exam Discussion KEYDocumento10 pagine10 FS Analysis Sample Exam Discussion KEYrav danoNessuna valutazione finora

- Liabilities ExplainedDocumento5 pagineLiabilities ExplainedShantalNessuna valutazione finora

- UST Golden Notes - Corporation LawDocumento75 pagineUST Golden Notes - Corporation Lawaugustofficials100% (8)

- 02-Stock Basics-Tutorial PDFDocumento14 pagine02-Stock Basics-Tutorial PDFbassmastahNessuna valutazione finora

- FFM Updated AnswersDocumento79 pagineFFM Updated AnswersSrikrishnan SNessuna valutazione finora

- Endterm ExamDocumento6 pagineEndterm ExamMasTer PanDaNessuna valutazione finora

- Fast-Track Tax Reform: Lessons from the MaldivesDa EverandFast-Track Tax Reform: Lessons from the MaldivesNessuna valutazione finora

- Wrigley Case AnswerDocumento4 pagineWrigley Case AnswerYehan MatuilanaNessuna valutazione finora

- Statement of Cash Flows: Preparation, Presentation, and UseDa EverandStatement of Cash Flows: Preparation, Presentation, and UseNessuna valutazione finora

- FINANCIAL STATEMENT ANALYSIS - Practice Set PDFDocumento4 pagineFINANCIAL STATEMENT ANALYSIS - Practice Set PDFDwight Manikan EchagueNessuna valutazione finora

- Msdi Alcala de Henares, SpainDocumento24 pagineMsdi Alcala de Henares, SpainVineet NairNessuna valutazione finora

- Toaz - Info Elec 1 Capital Budgeting Exercise Dec 6 2020 Bsa2 Answer Key PRDocumento9 pagineToaz - Info Elec 1 Capital Budgeting Exercise Dec 6 2020 Bsa2 Answer Key PRJasper Gerald Q. OngNessuna valutazione finora

- Responsibility AccountingDocumento6 pagineResponsibility Accountingrodell pabloNessuna valutazione finora

- Notes To Financial StatementsDocumento3 pagineNotes To Financial StatementsJohn Glenn100% (1)

- Template For The Articles of Incorporation of A Non-Stock Non-Profit Philippine CorporationDocumento9 pagineTemplate For The Articles of Incorporation of A Non-Stock Non-Profit Philippine CorporationEnergyte Baldonado0% (2)

- Confidential Term Sheet for $750K Convertible Note OfferingDocumento1 paginaConfidential Term Sheet for $750K Convertible Note OfferingbrentbushnellNessuna valutazione finora

- Investment in AssetsDocumento21 pagineInvestment in AssetsAlthon JayNessuna valutazione finora

- Take Home QuizDocumento5 pagineTake Home QuizMA ValdezNessuna valutazione finora

- Capital Budgeting: Even Cash Flow Uneven Cash FlowDocumento2 pagineCapital Budgeting: Even Cash Flow Uneven Cash FlowKeno OcampoNessuna valutazione finora

- FM Capital Budgeting SumsDocumento4 pagineFM Capital Budgeting SumsRahul GuptaNessuna valutazione finora

- CapbudexercisesDocumento5 pagineCapbudexercisesJhaister Ashley LayugNessuna valutazione finora

- Mas MidtermsDocumento4 pagineMas MidtermsClaudine DelacruzNessuna valutazione finora

- Capital Budgeting ExercisesDocumento5 pagineCapital Budgeting ExercisesSophia ManglicmotNessuna valutazione finora

- Investment Decision QuestionsDocumento44 pagineInvestment Decision QuestionsAkash JhaNessuna valutazione finora

- Capital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFDocumento7 pagineCapital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFutsavNessuna valutazione finora

- c3 Mergers and Acquisitions Review QuestionsDocumento7 paginec3 Mergers and Acquisitions Review Questionscharlesmicky82Nessuna valutazione finora

- Capital Budgeting LectureDocumento3 pagineCapital Budgeting Lectureamormi2702Nessuna valutazione finora

- PEC-VCM Quiz (Finals) General Instructions: Read Each Item Carefully and Answer What Is Being Asked. Provide Solutions For EveryDocumento2 paginePEC-VCM Quiz (Finals) General Instructions: Read Each Item Carefully and Answer What Is Being Asked. Provide Solutions For EveryAlysia RabinaNessuna valutazione finora

- Calculating weighted average cost of capital and optimal capital structureDocumento4 pagineCalculating weighted average cost of capital and optimal capital structureMandar SangleNessuna valutazione finora

- Strategic Business AnalysisDocumento8 pagineStrategic Business AnalysisAdora Chielka SalesNessuna valutazione finora

- Chapter 15Documento7 pagineChapter 15Nasrima MauteNessuna valutazione finora

- Capital Budgeting for Msc Finance Basic Revision Sums.docxDocumento5 pagineCapital Budgeting for Msc Finance Basic Revision Sums.docxkimjethaNessuna valutazione finora

- Addtl Exercises 10 12Documento5 pagineAddtl Exercises 10 12John Lester C AlagNessuna valutazione finora

- FM Smart WorkDocumento17 pagineFM Smart WorkmaacmampadNessuna valutazione finora

- Module 5: Advanced Corporate Valuation TechniquesDocumento5 pagineModule 5: Advanced Corporate Valuation TechniquesNaimeesha MattaparthiNessuna valutazione finora

- Financial Analysis - RATIOSDocumento55 pagineFinancial Analysis - RATIOSRoy YadavNessuna valutazione finora

- MASDocumento7 pagineMASHelen IlaganNessuna valutazione finora

- The Title of KingdomDocumento6 pagineThe Title of KingdomKailash RNessuna valutazione finora

- Du Pont Analysis and Financial Ratios for Lollar CorporationDocumento3 pagineDu Pont Analysis and Financial Ratios for Lollar CorporationJonna Mae Bandoquillo100% (1)

- TERMINAL OUTPUT FOR THE FINAL TERM (2ND SY 2018-2019Documento3 pagineTERMINAL OUTPUT FOR THE FINAL TERM (2ND SY 2018-2019Millen Austria0% (1)

- LectureDocumento34 pagineLectureAshish MalhotraNessuna valutazione finora

- © The Institute of Chartered Accountants of IndiaDocumento24 pagine© The Institute of Chartered Accountants of IndiaAniketNessuna valutazione finora

- Tutorial Question 2 NPV AnalysisDocumento8 pagineTutorial Question 2 NPV AnalysisTheva LetchumananNessuna valutazione finora

- Tutorial Question 2 201909 BBCA 2053Documento8 pagineTutorial Question 2 201909 BBCA 2053Theva LetchumananNessuna valutazione finora

- 01 LeveragesDocumento11 pagine01 LeveragesZerefNessuna valutazione finora

- Problems - Cash FlowDocumento5 pagineProblems - Cash FlowKevin JoyNessuna valutazione finora

- Mercader Cherry May LDocumento8 pagineMercader Cherry May LKindred WolfeNessuna valutazione finora

- MAS Part II Illustrative Examples (Capital Budgeting)Documento2 pagineMAS Part II Illustrative Examples (Capital Budgeting)Princess SalvadorNessuna valutazione finora

- Capital BudgetingDocumento3 pagineCapital BudgetingMahedi HasanNessuna valutazione finora

- The Commerce Villa: Time: 1.5 Hour Marks: 40 Topic: Ratio & Goodwill (AC - 07)Documento15 pagineThe Commerce Villa: Time: 1.5 Hour Marks: 40 Topic: Ratio & Goodwill (AC - 07)Shreyas PremiumNessuna valutazione finora

- Capital Budgeting-2Documento48 pagineCapital Budgeting-2Adarsh Singh RathoreNessuna valutazione finora

- Final Paper 2Documento258 pagineFinal Paper 2chandresh0% (1)

- Fina6000 Module 4 - Capital Budgeting BDocumento20 pagineFina6000 Module 4 - Capital Budgeting BMar SGNessuna valutazione finora

- Chapter 17 COSTDocumento3 pagineChapter 17 COSTDonna Mae SingsonNessuna valutazione finora

- AE23 Capital BudgetingDocumento4 pagineAE23 Capital BudgetingCheska AgrabioNessuna valutazione finora

- Accounting 2Documento18 pagineAccounting 2cherryannNessuna valutazione finora

- MOD2 Statement of Cash FlowsDocumento2 pagineMOD2 Statement of Cash FlowsGemma DenolanNessuna valutazione finora

- Cost of Capital, NPV, IRR, WACC, Payback Period, Dividend Growth ModelDocumento2 pagineCost of Capital, NPV, IRR, WACC, Payback Period, Dividend Growth ModeliyerchandraNessuna valutazione finora

- Illustration Cap BudDocumento2 pagineIllustration Cap Budansari.sl01Nessuna valutazione finora

- Interpretation of Public Sector Financial StatementsDocumento4 pagineInterpretation of Public Sector Financial StatementsEsther AkpanNessuna valutazione finora

- UNIT-II-Problems On Capital BudgetingDocumento2 pagineUNIT-II-Problems On Capital BudgetingGlyding FlyerNessuna valutazione finora

- Financial Statement AnalysisDocumento3 pagineFinancial Statement AnalysisAsad Rehman100% (1)

- Capital Budgeting ExercisesDocumento16 pagineCapital Budgeting ExercisesMhel EspanoNessuna valutazione finora

- Fin Man II Capital Budgeting DiscussionDocumento2 pagineFin Man II Capital Budgeting DiscussionCamille P. BonaguaNessuna valutazione finora

- FMC 2019Documento3 pagineFMC 2019Shweta ShrivastavaNessuna valutazione finora

- 6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Documento15 pagine6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Kashish GroverNessuna valutazione finora

- ACCA Financial Management: A Comprehensive GuideDa EverandACCA Financial Management: A Comprehensive GuideNessuna valutazione finora

- VELUNTA - Ass. in ASTDocumento4 pagineVELUNTA - Ass. in ASTLiberty VeluntaNessuna valutazione finora

- Revised Corporation Cod E: SECTION 45-69Documento39 pagineRevised Corporation Cod E: SECTION 45-69Liberty VeluntaNessuna valutazione finora

- Revised Corporation Cod E: SECTION 45-69Documento39 pagineRevised Corporation Cod E: SECTION 45-69Liberty VeluntaNessuna valutazione finora

- Questionnaire Art 23 44 PDFDocumento1 paginaQuestionnaire Art 23 44 PDFLiberty VeluntaNessuna valutazione finora

- Customer Value AnalysisDocumento14 pagineCustomer Value AnalysisLiberty VeluntaNessuna valutazione finora

- Customer Value AnalysisDocumento14 pagineCustomer Value AnalysisLiberty VeluntaNessuna valutazione finora

- FCL 400Documento1 paginaFCL 400Liberty VeluntaNessuna valutazione finora

- CA SFM Chapter 6 CompilationDocumento57 pagineCA SFM Chapter 6 CompilationRaul KarkyNessuna valutazione finora

- Ibm FinancialsDocumento132 pagineIbm Financialsphgiang1506Nessuna valutazione finora

- Cafta: Online Learning SeriesDocumento13 pagineCafta: Online Learning SeriesSourish Re-visitedNessuna valutazione finora

- NISM Series XX Taxation in Securities Markets Workbook June 2021Documento353 pagineNISM Series XX Taxation in Securities Markets Workbook June 2021Karthick S NairNessuna valutazione finora

- Parmesh Construction Co. LTD - (From 1-Apr-2015: Particulars Credit DebitDocumento3 pagineParmesh Construction Co. LTD - (From 1-Apr-2015: Particulars Credit DebitAshish MishraNessuna valutazione finora

- 4 5886424778507552732Documento46 pagine4 5886424778507552732Agidew Shewalemi100% (1)

- Investment Law Project On: A Legal Process of Inter-Corporate Loans and InvestmentDocumento18 pagineInvestment Law Project On: A Legal Process of Inter-Corporate Loans and InvestmentNitish GuptaNessuna valutazione finora

- MN4001 Week 1 (Lecture)Documento20 pagineMN4001 Week 1 (Lecture)Gabriele KaubryteNessuna valutazione finora

- 3214649879operating SegmentDocumento1 pagina3214649879operating SegmentGlen JavellanaNessuna valutazione finora

- Gross Profit Section of Income Statement-Periodic SystemDocumento3 pagineGross Profit Section of Income Statement-Periodic SystemMary67% (3)

- Vanguard S&P 500 ETFDocumento2 pagineVanguard S&P 500 ETFHeyu PermanaNessuna valutazione finora

- The Boeing 777Documento26 pagineThe Boeing 777Toyin AyeniNessuna valutazione finora

- Business FinanceDocumento22 pagineBusiness FinancenattoykoNessuna valutazione finora

- 1st Ass.Documento5 pagine1st Ass.Lorraine Millama Puray100% (1)

- Chapter 15Documento21 pagineChapter 15?????Nessuna valutazione finora

- Ind As 109Documento6 pagineInd As 109ashmit bahlNessuna valutazione finora

- IAS 21 Foreign SubsidiaryDocumento14 pagineIAS 21 Foreign SubsidiaryRoqayya FayyazNessuna valutazione finora

- FILREIT - SEC Form 17-C - Press Release - Filinvest REIT Declares Dividends (8.31.21)Documento4 pagineFILREIT - SEC Form 17-C - Press Release - Filinvest REIT Declares Dividends (8.31.21)Christian John RojoNessuna valutazione finora

- Ceylon Beverage Holdings PLC - Notice & Form of Proxy - 6108338117833530-8Documento4 pagineCeylon Beverage Holdings PLC - Notice & Form of Proxy - 6108338117833530-8safdfefNessuna valutazione finora

- Profitability Turnover RatiosDocumento32 pagineProfitability Turnover RatiosAnushka JindalNessuna valutazione finora

- Solved A Company Manufacturing Hockey Bags Registered Trademarks For 1 000 Cash PDFDocumento1 paginaSolved A Company Manufacturing Hockey Bags Registered Trademarks For 1 000 Cash PDFAnbu jaromiaNessuna valutazione finora

- Capital MarketDocumento4 pagineCapital MarketKimberly BastesNessuna valutazione finora

- Kelompok 5 Akl 2Documento4 pagineKelompok 5 Akl 2Khansa AuliaNessuna valutazione finora