Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

State Bank of Pakistan (8)

Caricato da

Corporate IncomeTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

State Bank of Pakistan (8)

Caricato da

Corporate IncomeCopyright:

Formati disponibili

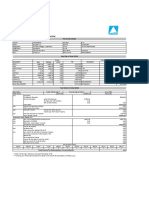

Circulars/Notifications - Payment System Department

PSD Circular No. 04 of 2020 March 28, 2020

The Presidents /CEOs

Clearing House(s) and its Members,

Dear Sirs/ Madams,

Facilitation regarding Paper-based Clearing Operations in the wake of COVID-19

To combat the potential spread of COVID-19 pandemic by limiting person-to-person interactions and to provide ease of services to the customers,

Banks/MFBs are allowed to provide the following services to their customers:

2. Direct Cheque Deposit Facility under which:

a) A crossed cheque may be presented by payee/beneficiary directly into the paying/drawee bank, instead of their bank branches as per the

existing practice.

b) In this case, funds may be transferred by the paying/drawee bank either through RTGS customer fund transfer - MT102 or Over the Counter

(OTC) IBFT or Bank’s internal online system (in case both payer & payee banks are the same).

c) Before debiting their customer’s account, the paying/drawee bank must take all necessary precautions including but not limited to

customer call back or multifactor authentication to verify the authenticity/genuineness of the instrument and verification of their respective

customers. Similarly, before crediting the customer account, the payee/beneficiary bank must ensure the authenticity of the customer’s

credentials as well.

3. Doorstep Cheque Collection Facility under which Banks/MFBs may make arrangements to collect cheque from registered addresses of their

customers upon their request.

4. Drop box Cheque Collection Facility under which customers may drop their cheques in drop boxes of their Banks, installed in selected

branches.

5. Banks may allow their Corporates/Priority customers to send them the scanned image of the cheque along with relevant details of the

Beneficiary either through registered emails or through mobile Apps of their banks to push funds from their accounts to the payee bank.

However, such arrangement must be duly agreed with the customer under proper Terms & Conditions along with complete disclosure of

risks and liabilities. The Paying/Drawee bank shall implement all necessary controls including call back confirmation or multifactor

authentication to ascertain the authenticity and genuineness of the instrument and identity of the payee. Upon satisfactory validation,

Paying/drawee bank may transfer funds to beneficiary bank using MT 102 of RTGS (PRISM).

6. The recommended modus opernadi for options 2 to 5 is attached at Annexure-A. However, banks are encouraged to implement additional

risk mitigating measures as per their internal policies while offering these services to their customers.

7. Further, to minimize person-to-person interaction, Banks/MFBs may also make arrangements with the Clearing House (NIFT) for clearing

their cheques through Image Based Clearing (IBC) functionality as per the agreed SOPs between NIFT and banks.

8. While transferring funds through RTGS, the concerned Banks/MFBs shall ensure compliance with relevant clauses of PSD Circular No. 3 of

2018 on “Electronic Fund Transfers Regulations”. Further, Banks/MFBs are advised to follow all relevant laws, rules and regulations issued by

SBP from time to time.

9. Above mentioned measures may be made part of campaigns to create awareness in order to promote the use of clearing options as per PSD

Circular No. 2 of 2020.

10. For any clarification, please contact Syed Muhammad Taha, Joint Director, Payment Systems Department (email: syed.taha@sbp.org.pk

Phone: 021-3311-3497).

Sincerely

Sd/-

(Syed Sohail Javaad)

Director

Home Laws & Regulations What's New? Library

About SBP Monetary Policy Speeches Rupey ko Pehchano

Publications Help Desk Online Tenders Events

Economic Data SBP Videos Web Links Zahid Husain Memorial Lecture

Press Releases Feedback Educational Resources Careers

Circulars/Notifications Contact us Regulatory Returns Sitemap

Best view Screen Resolution : 1024 * 768

Copyright © 2016. All Rights Reserved.

Potrebbero piacerti anche

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- KPRA Sales Tax On ServicesDocumento1 paginaKPRA Sales Tax On Servicesshahnawazhassan.khanNessuna valutazione finora

- All SCMDocumento23 pagineAll SCMthkim8Nessuna valutazione finora

- Article On Section 194Q and Common Queries TheretoDocumento5 pagineArticle On Section 194Q and Common Queries TheretonamanojhaNessuna valutazione finora

- Fee VoucherDocumento1 paginaFee Vouchermuhammad.wajahat194Nessuna valutazione finora

- 15 010 International Tax Policy and Double Tax Treaties Final Web PDFDocumento36 pagine15 010 International Tax Policy and Double Tax Treaties Final Web PDFHanif ajalaahNessuna valutazione finora

- Activity 4 Bank Reconciliation PDFDocumento4 pagineActivity 4 Bank Reconciliation PDFSharmin ReulaNessuna valutazione finora

- ZOL customer invoiceDocumento2 pagineZOL customer invoiceCharlieEleerNessuna valutazione finora

- Your Vodafone Bill: Amount DueDocumento1 paginaYour Vodafone Bill: Amount DueBeyza GemiciNessuna valutazione finora

- Voucher Anjani - TV - Net HOTSPOT VOCHER Rp.2000 VC 698 08.22.22Documento9 pagineVoucher Anjani - TV - Net HOTSPOT VOCHER Rp.2000 VC 698 08.22.22pathul azizNessuna valutazione finora

- UnionPay and Visa Credit Cards TC ENGDocumento21 pagineUnionPay and Visa Credit Cards TC ENGZaw Ko Ko OoNessuna valutazione finora

- Cash JournalDocumento7 pagineCash JournalASHOKA GOWDANessuna valutazione finora

- Accounting Cycle of A Service Business-Step 5-Adjusting EntriesDocumento18 pagineAccounting Cycle of A Service Business-Step 5-Adjusting EntriesdelgadojudithNessuna valutazione finora

- Account Statement From 1 Aug 2023 To 4 Dec 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocumento15 pagineAccount Statement From 1 Aug 2023 To 4 Dec 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancePraveen SainiNessuna valutazione finora

- SA106 NotesDocumento20 pagineSA106 Notesjacopo1967Nessuna valutazione finora

- Philippine Economic Zone Authority (PEZA)Documento7 paginePhilippine Economic Zone Authority (PEZA)LeaNessuna valutazione finora

- Himachal Taxi Rates for Popular DestinationsDocumento5 pagineHimachal Taxi Rates for Popular DestinationsKshitiz SharmaNessuna valutazione finora

- E-Banking Ref No: Recurring Deposit Installment ReportDocumento2 pagineE-Banking Ref No: Recurring Deposit Installment ReportSaurabh JainNessuna valutazione finora

- Account Statement2Documento31 pagineAccount Statement2Parminder SinghNessuna valutazione finora

- Receipt From STC Pay: Transaction ID: 51265302 Amount 11765.30 PKR MTCN 1343290412Documento1 paginaReceipt From STC Pay: Transaction ID: 51265302 Amount 11765.30 PKR MTCN 1343290412Imran AliNessuna valutazione finora

- MTDC Resort Reservation ReceiptDocumento2 pagineMTDC Resort Reservation ReceiptdarshansjNessuna valutazione finora

- Presentation of Francisco Delgado IV at The 2nd Subic Bay Maritime Conference and ExhibitDocumento42 paginePresentation of Francisco Delgado IV at The 2nd Subic Bay Maritime Conference and ExhibitPortCallsNessuna valutazione finora

- Night Audit Report for 10/01/23Documento1 paginaNight Audit Report for 10/01/23Vivek BhadviyaNessuna valutazione finora

- 02b Deterministic Inventory ModelsDocumento51 pagine02b Deterministic Inventory ModelskaustavpalNessuna valutazione finora

- Presentación Argos INGLESDocumento10 paginePresentación Argos INGLESCarlos Alberto SilvaNessuna valutazione finora

- Inv#27-0119 - PhoenixDocumento1 paginaInv#27-0119 - PhoenixNitesh RokadeNessuna valutazione finora

- Shri Krishnam HDFCDocumento10 pagineShri Krishnam HDFCSimi AroraNessuna valutazione finora

- Statement - XXXX XXXX 0561 - 15mar2024 - 17 - 44Documento25 pagineStatement - XXXX XXXX 0561 - 15mar2024 - 17 - 44dipakk21051994Nessuna valutazione finora

- Altruist Customer Management India PVT LTD: Personal DetailsDocumento1 paginaAltruist Customer Management India PVT LTD: Personal DetailsSampathKPNessuna valutazione finora

- BRT vs Light Rail Costs: Which is Cheaper to OperateDocumento11 pagineBRT vs Light Rail Costs: Which is Cheaper to Operatejas rovelo50% (2)

- Value Added Tax-Day2Documento22 pagineValue Added Tax-Day2Brian Reyes GangcaNessuna valutazione finora