Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Nikon Revised FY2020 Forecast

Caricato da

Michael Zhang0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

19K visualizzazioni1 paginaNikon's revised financial forecast for the year ending March 31st, 2020 takes into account the financial impact of COVID-19

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoNikon's revised financial forecast for the year ending March 31st, 2020 takes into account the financial impact of COVID-19

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

19K visualizzazioni1 paginaNikon Revised FY2020 Forecast

Caricato da

Michael ZhangNikon's revised financial forecast for the year ending March 31st, 2020 takes into account the financial impact of COVID-19

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

May 12, 2020

Notice Regarding Revision of the Consolidated Financial Forecast for the Fiscal Year Ended

March 31, 2020 and Recognition of Impairment Losses

This is to announce that the consolidated financial forecast announced on February 6, 2020 is revised as below, reflecting our

recent business performance trend, and to disclose that impairment losses are expected to be recognized.

1. Revision of the Consolidated Financial Forecast

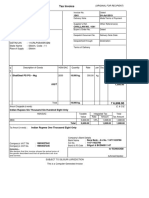

Revised Consolidated Financial Forecast for the Fiscal Year Ended March 31, 2020 (From April 1, 2019 to March 31, 2020)

Basic Earnings per

Profit Before Profit Attributable to

Revenue Operating Profit Share Attributable to

Income Taxes Owners of the Parent

(Millions of yen) (Millions of yen) Owners of the Parent

(Millions of yen) (Millions of yen)

(Yen)

Previous Forecast (A) 620,000 20,000 23,000 17,000 43.26

Revised Forecast (B) 591,000 6,000 11,000 7,000 18.13

Difference (B)-(A) (29,000) (14,000) (12,000) (10,000) -

Change (%) (4.7)% (70.0)% (52.2)% (58.8)% -

(Reference)

The Fiscal Year Ended 708,660 82,653 87,915 66,513 167.86

March 31, 2019

2. Reason for Revision of the Consolidated Financial Forecast

Decrease in revenue is expected due to factors such as the delay in installations of FPD lithography system,

affected by the spread of COVID-19. In addition, operating profit, profit before income taxes and profit attributable

to owners of the parent are also expected to be lower than the previous forecast due to the recognition of impairment

losses of 11.1 billion yen for non-current assets, as indicated below in “3. The Recognition of Impairment Losses.”

Based on these situations, the consolidated financial forecast announced on February 6, 2020 is revised as above.

3. Recognition of Impairment Losses

For the fiscal year ended March 31, 2020, indication of impairment for non-current assets was examined based

on its future utilization and the impact caused by the spread of COVID-19 on business operations. As a result of

measuring the recoverable amount of the cash-generating units in which impairment was indicated, a sufficient

recoverable amount was not estimated in the Imaging Products Business and the Industrial Metrology Business and

Others. Therefore, impairment losses of 11.1 billion yen are to be recognized. In the Imaging Products Business,

impairment losses of 7.5 billion yen mainly for property, plant and equipment and intangible assets are to be

recognized. In the Industrial Metrology Business and Others, impairment losses of 3.6 billion yen mainly for goodwill,

property, plant and equipment and intangible assets are to be recognized.

Forecast in this disclosure is made by management in light of information currently available. A number of factors could cause actual results

to differ materially from those disclosed as above.

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Managing corporate treasury risks with TableauDocumento46 pagineManaging corporate treasury risks with TableauIonNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Parts ListDocumento1 paginaParts ListMichael ZhangNessuna valutazione finora

- Astronomy Guide 2021-2022 by TelescopeGuideDocumento12 pagineAstronomy Guide 2021-2022 by TelescopeGuideMichael Zhang0% (1)

- Prototype Technical Report 1976 Sasson - ReportDocumento47 paginePrototype Technical Report 1976 Sasson - ReportMichael Zhang100% (1)

- Sedlik v. Kat Von D ComplaintDocumento31 pagineSedlik v. Kat Von D ComplaintMichael ZhangNessuna valutazione finora

- Aperture GuideDocumento1 paginaAperture GuideMichael ZhangNessuna valutazione finora

- THEME 6 Caribbean EconomydocxDocumento15 pagineTHEME 6 Caribbean EconomydocxJacob seraphineNessuna valutazione finora

- A1 ISMS Manual - v1Documento13 pagineA1 ISMS Manual - v1Rharif AnassNessuna valutazione finora

- Keyboard Shortcuts - Lightroom ClassicDocumento17 pagineKeyboard Shortcuts - Lightroom ClassicMichael ZhangNessuna valutazione finora

- Facebook Revised FTC ComplaintDocumento80 pagineFacebook Revised FTC ComplaintMichael ZhangNessuna valutazione finora

- Accounting For Factory OverheadDocumento6 pagineAccounting For Factory OverheadJocel Ann GuerraNessuna valutazione finora

- Capture One 21 Exporter Update 1440Documento1 paginaCapture One 21 Exporter Update 1440Michael ZhangNessuna valutazione finora

- Omega Contrast Filter Holder TemplateDocumento1 paginaOmega Contrast Filter Holder TemplateMichael ZhangNessuna valutazione finora

- Instagram Teen Annotated Research Deck 1Documento27 pagineInstagram Teen Annotated Research Deck 1Michael ZhangNessuna valutazione finora

- 20 915 Unicolors Opinion FinalDocumento18 pagine20 915 Unicolors Opinion FinalMichael ZhangNessuna valutazione finora

- Patent Dept Request For Invention DisclosureDocumento1 paginaPatent Dept Request For Invention DisclosureMichael ZhangNessuna valutazione finora

- 1976 Letter To Mon Pere About 1st PatentDocumento2 pagine1976 Letter To Mon Pere About 1st PatentMichael ZhangNessuna valutazione finora

- UnicolorsAmicus Main EFILE Aug 10 21Documento38 pagineUnicolorsAmicus Main EFILE Aug 10 21Michael ZhangNessuna valutazione finora

- Large-Format PrintersDocumento2 pagineLarge-Format PrintersPhet CopywayNessuna valutazione finora

- 0301 Letter Nppa - GTNPDocumento4 pagine0301 Letter Nppa - GTNPMichael ZhangNessuna valutazione finora

- A Recent Entrance To ParadiseDocumento7 pagineA Recent Entrance To ParadiseMichael ZhangNessuna valutazione finora

- Emilee Carpenter Photography V James Decision and Order 2021-12-13Documento46 pagineEmilee Carpenter Photography V James Decision and Order 2021-12-13George StockburgerNessuna valutazione finora

- Warhol GoldsmithDocumento65 pagineWarhol GoldsmithMichael Zhang100% (1)

- Emile e Carpenter ComplaintDocumento57 pagineEmile e Carpenter ComplaintRicca PrasadNessuna valutazione finora

- Guest Presence LetterDocumento1 paginaGuest Presence LetterMichael ZhangNessuna valutazione finora

- Guerriero v. Sony Electronics Inc., 7 - 21-Cv-02618, No. 1 (S.D.N.Y. Mar. 26, 2021)Documento6 pagineGuerriero v. Sony Electronics Inc., 7 - 21-Cv-02618, No. 1 (S.D.N.Y. Mar. 26, 2021)Michael ZhangNessuna valutazione finora

- Interim Report: January 1-March 31, 2021Documento18 pagineInterim Report: January 1-March 31, 2021Michael ZhangNessuna valutazione finora

- Designing A High-Resolution, LEGO-based MicroscopeDocumento12 pagineDesigning A High-Resolution, LEGO-based MicroscopeMichael ZhangNessuna valutazione finora

- CASE ActDocumento63 pagineCASE ActMichael ZhangNessuna valutazione finora

- ILFORD 35 II Instruction ManualDocumento2 pagineILFORD 35 II Instruction ManualMichael ZhangNessuna valutazione finora

- Crash StoryDocumento2 pagineCrash StoryMichael Zhang100% (1)

- Leica PetaPixel ResponseDocumento3 pagineLeica PetaPixel ResponseMichael ZhangNessuna valutazione finora

- HydroChrome Liquid Guide 200929Documento3 pagineHydroChrome Liquid Guide 200929Michael ZhangNessuna valutazione finora

- If 10340Documento3 pagineIf 10340Michael ZhangNessuna valutazione finora

- Tax Invoice DetailsDocumento2 pagineTax Invoice DetailsLama RessuNessuna valutazione finora

- Chetan & DR Hemant SharmaDocumento16 pagineChetan & DR Hemant SharmaHemant SharmaNessuna valutazione finora

- HELLA Group OverviewDocumento8 pagineHELLA Group OverviewViruxy ViruxNessuna valutazione finora

- Analisis Keberlanjutan Aksesibilitas Angkutan Umum Di Kota SukabumiDocumento19 pagineAnalisis Keberlanjutan Aksesibilitas Angkutan Umum Di Kota Sukabumisahidan thoybahNessuna valutazione finora

- Appendix F Preparation of Interim Payment Certificates: GeneralDocumento4 pagineAppendix F Preparation of Interim Payment Certificates: GeneralOrebic ViganjNessuna valutazione finora

- Valuation Differences Between Bonds and Equity SharesDocumento2 pagineValuation Differences Between Bonds and Equity SharesAbhishek ChoudharyNessuna valutazione finora

- Nang Cao Doc Hieu Chu de Job and Employment Key Ms Lieu Pham 631792874405 1603969702Documento10 pagineNang Cao Doc Hieu Chu de Job and Employment Key Ms Lieu Pham 631792874405 1603969702Phuong UyennNessuna valutazione finora

- Editable CV FormatDocumento1 paginaEditable CV Formatneha mundraNessuna valutazione finora

- Goal Incongruence and Roi Bleefi Corporation Manufactures FurniDocumento1 paginaGoal Incongruence and Roi Bleefi Corporation Manufactures Furnitrilocksp SinghNessuna valutazione finora

- Environmental Testing - Part 2-27: Tests - Test Ea and Guidance: Shock (IEC 60068-2-27:2008 (EQV) )Documento16 pagineEnvironmental Testing - Part 2-27: Tests - Test Ea and Guidance: Shock (IEC 60068-2-27:2008 (EQV) )GM QCNessuna valutazione finora

- Optimize Oracle R12 Financials Performance with Proven Tuning MethodsDocumento26 pagineOptimize Oracle R12 Financials Performance with Proven Tuning MethodsSubrahmanyam KandulaNessuna valutazione finora

- English 3Documento20 pagineEnglish 3Shanggavee VelooNessuna valutazione finora

- Final ResearchDocumento45 pagineFinal ResearchFrances Cleo TubadaNessuna valutazione finora

- Globe MindoroDocumento6 pagineGlobe MindoroMarnyNessuna valutazione finora

- NISM-Series-XXII: Fixed Income Securities Certification ExaminationDocumento5 pagineNISM-Series-XXII: Fixed Income Securities Certification ExaminationVinay ChhedaNessuna valutazione finora

- Practice Financial ManagementDocumento12 paginePractice Financial ManagementWilliam OConnorNessuna valutazione finora

- SGS Vs NLRC Version 2.0 HahahaDocumento1 paginaSGS Vs NLRC Version 2.0 HahahaDianne YcoNessuna valutazione finora

- 20-0453 RPT LAFD 05-15-2020Documento41 pagine20-0453 RPT LAFD 05-15-2020deeperNessuna valutazione finora

- 6.type and Basic Characterstics of Companies in Ethiopia Types of Business OrganizationsDocumento14 pagine6.type and Basic Characterstics of Companies in Ethiopia Types of Business OrganizationsTamene Tekile86% (7)

- The Role of Trade Finance in Promoting Trade and The Implications of Covid-19Documento13 pagineThe Role of Trade Finance in Promoting Trade and The Implications of Covid-19comesa cmiNessuna valutazione finora

- Ohs-Pr-09-26-F01 Initial Incident Notification 26.1 (2022)Documento2 pagineOhs-Pr-09-26-F01 Initial Incident Notification 26.1 (2022)Shafie ZubierNessuna valutazione finora

- QNAS HOTEL Registration FormDocumento1 paginaQNAS HOTEL Registration FormAnnalyn PeñaNessuna valutazione finora

- JIT, Creation of Manufacturing Cells, Behavioral Considerations, Impact On Costing PracticesDocumento2 pagineJIT, Creation of Manufacturing Cells, Behavioral Considerations, Impact On Costing PracticesKim FloresNessuna valutazione finora

- HPA 14 Due Oct 7thDocumento3 pagineHPA 14 Due Oct 7thcNessuna valutazione finora

- Activist Spotlight - Abhilasha - A - SinghDocumento14 pagineActivist Spotlight - Abhilasha - A - SinghSikh Parent LeaderNessuna valutazione finora

- AEG Enterprises Financial AnalysisDocumento5 pagineAEG Enterprises Financial AnalysisGing freexNessuna valutazione finora