Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Proposal Template PCL 105: Title: Stock Price Prediction Using Moving Average and Auto-Regressive

Caricato da

Navik BhandariDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Proposal Template PCL 105: Title: Stock Price Prediction Using Moving Average and Auto-Regressive

Caricato da

Navik BhandariCopyright:

Formati disponibili

Proposal Template

PCL 105

Title: Stock price prediction using Moving Average and Auto-Regressive

Time Series Model

Team Members: Frodo Baggins, Mowgli Pandey, Julia Roberts, and That Guy.

Department: Department of Philosophical Engineering.

Abstract:

Stock price prediction is an important aspect of Financial Engineering. Businesses and

economies around the world depend on accurate forecasting

of stocks of different kinds. However, prices of stocks and shares depend on a variety of

seemingly unrelated factors and may be influenced by random events,

rare events, seasonal and periodic trends, shocks, etc. This makes prediction of

stock prices and shares a difficult task. This presents lucrative monetary payoffs

for designing models that make accurate forecasting. We propose two models for stock price

prediction, viz. moving average and auto-regressive models and test these models against real

data.

Description of data:

We will primarily use data from the database of stocks and shares maintained by

the International Forum for Economic and Business Activities (IFEBA). The database is

available at www.yankeedoodle.com/database. This database contains records of all stock

exchanges of major economies from the past 50 years. The data is arranged into three columns

containing the name of the listed company, share price and month/year.

Statistical Model:

We propose to implement a MA(p) and an AR(q) model to the data. We will use the partial

autocorrelation function as a diagnostic to chose the order p and q of our models. We will also

discuss other techniques to estimate the order of the models, namely: the matter of factor

method and the Bhangra-Pale method. A detailed comparison of all these above mentioned

methods will be presented in the form of a table and the most suitable approach will be

employed.

Deliverables and Ouput:

The MA(p) and AR(q) models will be used for forecasting of future stock prices. In order to test

the efficacy of each of these two methods, a test database will be used. The test database is not

taken from the database that is used to estimate the parameters of the time series models and

is independent of the model construction procedure. The results of the MA(p) and AR(q)

forecasting models will be presented in terms of an error function defined based on the Humpty-

Dumpty distance metric. We will conclude with a commentary on the suitability of different time

series models for different types of datasets.

Potrebbero piacerti anche

- Process Performance Models: Statistical, Probabilistic & SimulationDa EverandProcess Performance Models: Statistical, Probabilistic & SimulationNessuna valutazione finora

- Prediction of Stock Market Using Machine Learning AlgorithmsDocumento12 paginePrediction of Stock Market Using Machine Learning AlgorithmsterranceNessuna valutazione finora

- Emehss2022 231 242Documento12 pagineEmehss2022 231 242nutirabiskaNessuna valutazione finora

- NIPS 2017 TSW Paper 46Documento5 pagineNIPS 2017 TSW Paper 46Grady_209Nessuna valutazione finora

- Types of Performance ModellingDocumento3 pagineTypes of Performance ModellingZeeNessuna valutazione finora

- Stock Price Prediction ThesisDocumento4 pagineStock Price Prediction Thesisracheldavisbaltimore100% (2)

- Stock Price Prediction Using Machine LearningDocumento15 pagineStock Price Prediction Using Machine LearningIJRASETPublications100% (1)

- Stock Price Prediction - Machine Learning Project in PythonDocumento14 pagineStock Price Prediction - Machine Learning Project in PythonVedant KohliNessuna valutazione finora

- Machine Learning Algorithms For Stock Market PredictionDocumento3 pagineMachine Learning Algorithms For Stock Market PredictionMahima MurthyNessuna valutazione finora

- 7 Methods To Improve Forecasting AccuracyDocumento8 pagine7 Methods To Improve Forecasting AccuracympashosNessuna valutazione finora

- What If AnalysisDocumento12 pagineWhat If AnalysisSourabh JainNessuna valutazione finora

- A-CAT Corp Forecasting Paper - FinalDocumento16 pagineA-CAT Corp Forecasting Paper - FinalunveiledtopicsNessuna valutazione finora

- SSRN Id4444871Documento9 pagineSSRN Id4444871Vrinda VashishthNessuna valutazione finora

- Prediction of Stock Market Prices Using Machine Learning-1Documento17 paginePrediction of Stock Market Prices Using Machine Learning-1errorfinder22Nessuna valutazione finora

- Stock Price Prediction - Links and How To Approach .Documento3 pagineStock Price Prediction - Links and How To Approach .Nikher VermaNessuna valutazione finora

- Garch Model Literature ReviewDocumento7 pagineGarch Model Literature Reviewea3f29j7100% (1)

- A Robust Predictive Model For Stock Price ForecastiDocumento12 pagineA Robust Predictive Model For Stock Price Forecastichan angusNessuna valutazione finora

- A Robust Predictive Model For Stock Price Forecasting: Jaydip SenDocumento12 pagineA Robust Predictive Model For Stock Price Forecasting: Jaydip SenDessy ParamitaNessuna valutazione finora

- Python Will Make You Rich in The Stock MarketDocumento8 paginePython Will Make You Rich in The Stock Marketpradiprane85Nessuna valutazione finora

- Building Rating and Data Analysis Module For The Distributor and Seller Product HandlingDocumento20 pagineBuilding Rating and Data Analysis Module For The Distributor and Seller Product Handlinggattus123Nessuna valutazione finora

- Machine Learning Algorithms For Stock Market PredictionDocumento3 pagineMachine Learning Algorithms For Stock Market PredictionMahima MurthyNessuna valutazione finora

- Stock Market Indices Direction Prediction Time Series, Macro Economic Factors and Distributed Lag ModelsDocumento9 pagineStock Market Indices Direction Prediction Time Series, Macro Economic Factors and Distributed Lag ModelsIJRASETPublicationsNessuna valutazione finora

- Narratives ECA MODEL - MODULE 5Documento15 pagineNarratives ECA MODEL - MODULE 5araya tekaNessuna valutazione finora

- 基于autoencoder的利率期限结构预测 PDFDocumento37 pagine基于autoencoder的利率期限结构预测 PDF郑笑非Nessuna valutazione finora

- Machine Learning Algorithms For Stock Market PredictionDocumento3 pagineMachine Learning Algorithms For Stock Market PredictionMahima MurthyNessuna valutazione finora

- A Time Series Analysis-Based Stock Price Prediction Using Machine Learning and Deep Learning ModelsDocumento46 pagineA Time Series Analysis-Based Stock Price Prediction Using Machine Learning and Deep Learning ModelsYONG POH YEN STUDENTNessuna valutazione finora

- Econometrics Assign Here-WPS OfficeDocumento3 pagineEconometrics Assign Here-WPS OfficeSalem AhmedNessuna valutazione finora

- Predicting The Present With Bayesian Structural Time Series PDFDocumento21 paginePredicting The Present With Bayesian Structural Time Series PDFbillpetrrieNessuna valutazione finora

- Comparison of Financial Models For Stock Price PredictionDocumento20 pagineComparison of Financial Models For Stock Price PredictionLe Cong Nhat MinhNessuna valutazione finora

- AI ProjectResearchPaperDocumento9 pagineAI ProjectResearchPapermedisecureeeNessuna valutazione finora

- ECF41330 Project Topic 2022-23Documento4 pagineECF41330 Project Topic 2022-23Priyank ShahNessuna valutazione finora

- Predictable Variation and Pro"table Trading of US Equities: A Trading Simulation Using Neural NetworksDocumento19 paginePredictable Variation and Pro"table Trading of US Equities: A Trading Simulation Using Neural NetworksJulio OliveiraNessuna valutazione finora

- Graduate Diploma in Business & Management: Course Name: Business Analysis and Decision Making (Question 1)Documento11 pagineGraduate Diploma in Business & Management: Course Name: Business Analysis and Decision Making (Question 1)Pramget KaurNessuna valutazione finora

- 19 Stock Price Trend Predictionusing Multiple Linear RegressionDocumento6 pagine19 Stock Price Trend Predictionusing Multiple Linear Regressionnhoxsock8642Nessuna valutazione finora

- A Stochastic Model To Study The Dynamics of Stock Prices in The Nairobi Securities Exchange For ForecastingDocumento22 pagineA Stochastic Model To Study The Dynamics of Stock Prices in The Nairobi Securities Exchange For ForecastingNahashon KimaniNessuna valutazione finora

- SSRN Id937847Documento18 pagineSSRN Id937847Srinu BonuNessuna valutazione finora

- Stock Price Prediction Using Attention-Based Multi-Input LSTMDocumento16 pagineStock Price Prediction Using Attention-Based Multi-Input LSTMMahendra VarmanNessuna valutazione finora

- Technical Report Writing For Ca2 ExaminationDocumento6 pagineTechnical Report Writing For Ca2 ExaminationAishee DuttaNessuna valutazione finora

- Probabilistic Fuzzy Logic Based Stock Price Prediction: V. Govindasamy P. Thambidurai, PH.DDocumento5 pagineProbabilistic Fuzzy Logic Based Stock Price Prediction: V. Govindasamy P. Thambidurai, PH.DMohamedNessuna valutazione finora

- $0Rqwh&Duor&Rpsdulvrq Ehwzhhqwkh) Uhh&Dvk) Orzdqg 'LVFRXQWHG&DVK) Orz $ssurdfkhvDocumento17 pagine$0Rqwh&Duor&Rpsdulvrq Ehwzhhqwkh) Uhh&Dvk) Orzdqg 'LVFRXQWHG&DVK) Orz $ssurdfkhvbharat005Nessuna valutazione finora

- Time Series Prediction Algorithms Literature ReviewDocumento4 pagineTime Series Prediction Algorithms Literature ReviewaflsmawldNessuna valutazione finora

- SAE MLP PaperDocumento61 pagineSAE MLP PaperBartosz BieganowskiNessuna valutazione finora

- Valuation Stocks Using DCF TechniqueDocumento9 pagineValuation Stocks Using DCF TechniqueDaris Purnomo JatiNessuna valutazione finora

- Stock Market Analysis Using Supervised Machine LearningDocumento6 pagineStock Market Analysis Using Supervised Machine LearningAbishek Pangotra (Abi Sharma)Nessuna valutazione finora

- Stock Trend Prediction Using News Sentim PDFDocumento8 pagineStock Trend Prediction Using News Sentim PDFadsNessuna valutazione finora

- 3: Research MethodologyDocumento2 pagine3: Research MethodologyKashif KhurshidNessuna valutazione finora

- Anshul Dyundi Predictive Modelling Alternate Project July 2022Documento11 pagineAnshul Dyundi Predictive Modelling Alternate Project July 2022Anshul DyundiNessuna valutazione finora

- Partial Least Square - Structural Equation ModelingDocumento4 paginePartial Least Square - Structural Equation ModelingKapish UpadhyayNessuna valutazione finora

- Literature ReviewDocumento12 pagineLiterature ReviewaquaomzNessuna valutazione finora

- Global Term Structure ModellingDocumento13 pagineGlobal Term Structure ModellingduffiekanNessuna valutazione finora

- BS 6 Definition Redefinition of Forecast ModelsDocumento2 pagineBS 6 Definition Redefinition of Forecast Modelsvikas agnihotriNessuna valutazione finora

- Prediction of Stock Price Based On Financial Data and TweetsDocumento5 paginePrediction of Stock Price Based On Financial Data and TweetsDivakar RajaNessuna valutazione finora

- Investment Ideas - Capital Market Assumptions (CMA) Methodology - 5 July 2012 - (Credit Suisse) PDFDocumento24 pagineInvestment Ideas - Capital Market Assumptions (CMA) Methodology - 5 July 2012 - (Credit Suisse) PDFQuantDev-MNessuna valutazione finora

- SQLDocumento3 pagineSQLAzhar AnsariNessuna valutazione finora

- BP Alg in Neural Network - Elsiever2021Documento18 pagineBP Alg in Neural Network - Elsiever2021r.durgameenaNessuna valutazione finora

- Project Report-Stock-Price-PredictionDocumento2 pagineProject Report-Stock-Price-PredictionapurvaNessuna valutazione finora

- Paper Title (24pt, Times New Roman, Upper Case, Line Spacing: Before: 8pt, After: 16pt)Documento6 paginePaper Title (24pt, Times New Roman, Upper Case, Line Spacing: Before: 8pt, After: 16pt)SHADAKSHARI ARUTAGINessuna valutazione finora

- Thesis On Financial Time SeriesDocumento7 pagineThesis On Financial Time Seriesmandycrosspeoria100% (2)

- Experimental Results For Case Study: The Financial Market Is A Complex, Evolutionary, and Non-Linear Dynamical SystemDocumento4 pagineExperimental Results For Case Study: The Financial Market Is A Complex, Evolutionary, and Non-Linear Dynamical SystemSri NivasNessuna valutazione finora

- Useful by ProductsDocumento5 pagineUseful by ProductsNavik BhandariNessuna valutazione finora

- Experimental Study On Partial Replacement of Cement Using AlccofineDocumento8 pagineExperimental Study On Partial Replacement of Cement Using AlccofineNavik BhandariNessuna valutazione finora

- ApplicationFormDraftPrintForAll PDFDocumento2 pagineApplicationFormDraftPrintForAll PDFNavik BhandariNessuna valutazione finora

- Cable Suspension BridgeDocumento25 pagineCable Suspension BridgeNavik BhandariNessuna valutazione finora

- Municipal Solid Waste Ash: R. Siddique, Waste Materials and By-Products in Concrete. 265 Springer 2008Documento2 pagineMunicipal Solid Waste Ash: R. Siddique, Waste Materials and By-Products in Concrete. 265 Springer 2008Navik BhandariNessuna valutazione finora

- Birla Institute of Technology and Science, Pilani Pilani Campus Instruction DivisionDocumento3 pagineBirla Institute of Technology and Science, Pilani Pilani Campus Instruction DivisionNavik BhandariNessuna valutazione finora

- Suspension Bridge: Presentation By: Momin Mohd. Zaki & Vinod YadavDocumento20 pagineSuspension Bridge: Presentation By: Momin Mohd. Zaki & Vinod YadavNavik BhandariNessuna valutazione finora

- Introductory Images For Basics of Airport Engineering: Tanuj ChopraDocumento43 pagineIntroductory Images For Basics of Airport Engineering: Tanuj ChopraNavik BhandariNessuna valutazione finora

- L3 - Airport Planning: For Internal Circulation Only at BITS PilaniDocumento11 pagineL3 - Airport Planning: For Internal Circulation Only at BITS PilaniNavik BhandariNessuna valutazione finora

- Forecasting & Methods: CE G545 Airport Planning and DesignDocumento23 pagineForecasting & Methods: CE G545 Airport Planning and DesignNavik BhandariNessuna valutazione finora

- Comparison of Three Different Methods in Investigating Shallow Shear-Wave Velocity Structures in (Ilan, Taiwan)Documento39 pagineComparison of Three Different Methods in Investigating Shallow Shear-Wave Velocity Structures in (Ilan, Taiwan)Navik BhandariNessuna valutazione finora

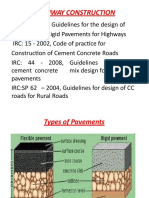

- Highway ConstructionDocumento82 pagineHighway ConstructionNavik BhandariNessuna valutazione finora

- D&D 5.0 Combat Reference Sheet Move Action: Interact With One Object Do Other Simple ActivtiesDocumento2 pagineD&D 5.0 Combat Reference Sheet Move Action: Interact With One Object Do Other Simple ActivtiesJason ParsonsNessuna valutazione finora

- 3D Printing & Embedded ElectronicsDocumento7 pagine3D Printing & Embedded ElectronicsSantiago PatitucciNessuna valutazione finora

- Song Book Inner PagesDocumento140 pagineSong Book Inner PagesEliazer PetsonNessuna valutazione finora

- PD3 - Strategic Supply Chain Management: Exam Exemplar QuestionsDocumento20 paginePD3 - Strategic Supply Chain Management: Exam Exemplar QuestionsHazel Jael HernandezNessuna valutazione finora

- State Space ModelsDocumento19 pagineState Space Modelswat2013rahulNessuna valutazione finora

- SubaruDocumento7 pagineSubaruclaude terizlaNessuna valutazione finora

- Best Mutual Funds For 2023 & BeyondDocumento17 pagineBest Mutual Funds For 2023 & BeyondPrateekNessuna valutazione finora

- Quality Control of Rigid Pavements 1Documento58 pagineQuality Control of Rigid Pavements 1pranjpatil100% (1)

- UNIT 5-8 PrintingDocumento17 pagineUNIT 5-8 PrintingNOODNessuna valutazione finora

- Been There, Done That, Wrote The Blog: The Choices and Challenges of Supporting Adolescents and Young Adults With CancerDocumento8 pagineBeen There, Done That, Wrote The Blog: The Choices and Challenges of Supporting Adolescents and Young Adults With CancerNanis DimmitrisNessuna valutazione finora

- Imabalacat DocuDocumento114 pagineImabalacat DocuJänrëýMåmårìlSälängsàngNessuna valutazione finora

- I. Learning Objectives / Learning Outcomes: Esson LANDocumento3 pagineI. Learning Objectives / Learning Outcomes: Esson LANWilliams M. Gamarra ArateaNessuna valutazione finora

- Ultracold Atoms SlidesDocumento49 pagineUltracold Atoms SlideslaubbaumNessuna valutazione finora

- Csir Life Sciences Fresh Instant NotesDocumento4 pagineCsir Life Sciences Fresh Instant NotesAlps Ana33% (3)

- Lodge at The Ancient City Information Kit / Great ZimbabweDocumento37 pagineLodge at The Ancient City Information Kit / Great ZimbabwecitysolutionsNessuna valutazione finora

- China Training WCDMA 06-06Documento128 pagineChina Training WCDMA 06-06ryanz2009Nessuna valutazione finora

- KPI AssignmentDocumento7 pagineKPI AssignmentErfan Ahmed100% (1)

- The Mooring Pattern Study For Q-Flex Type LNG Carriers Scheduled For Berthing at Ege Gaz Aliaga LNG TerminalDocumento6 pagineThe Mooring Pattern Study For Q-Flex Type LNG Carriers Scheduled For Berthing at Ege Gaz Aliaga LNG TerminalMahad Abdi100% (1)

- Invisible CitiesDocumento14 pagineInvisible Citiesvelveteeny0% (1)

- Sample Learning Module As PatternDocumento23 pagineSample Learning Module As PatternWilliam BulliganNessuna valutazione finora

- PDFDocumento40 paginePDFAndi NursinarNessuna valutazione finora

- Culture 2007 2013 Projects Overview 2018-03-18Documento133 pagineCulture 2007 2013 Projects Overview 2018-03-18PontesDeboraNessuna valutazione finora

- SIVACON 8PS - Planning With SIVACON 8PS Planning Manual, 11/2016, A5E01541101-04Documento1 paginaSIVACON 8PS - Planning With SIVACON 8PS Planning Manual, 11/2016, A5E01541101-04marcospmmNessuna valutazione finora

- Derivational and Inflectional Morpheme in English LanguageDocumento11 pagineDerivational and Inflectional Morpheme in English LanguageEdificator BroNessuna valutazione finora

- Math F112Documento3 pagineMath F112ritik12041998Nessuna valutazione finora

- 2nd Term Project 4º Eso Beauty Canons 2015-16 DefinitivoDocumento2 pagine2nd Term Project 4º Eso Beauty Canons 2015-16 DefinitivopasferacosNessuna valutazione finora

- Catheter Related InfectionsDocumento581 pagineCatheter Related InfectionshardboneNessuna valutazione finora

- Dutch Iris Eng 9734 HappyPattyCrochetDocumento68 pagineDutch Iris Eng 9734 HappyPattyCrochetFrancisca Rico100% (6)

- Inspección, Pruebas, Y Mantenimiento de Gabinetes de Ataque Rápido E HidrantesDocumento3 pagineInspección, Pruebas, Y Mantenimiento de Gabinetes de Ataque Rápido E HidrantesVICTOR RALPH FLORES GUILLENNessuna valutazione finora

- The Checkmate Patterns Manual: The Ultimate Guide To Winning in ChessDocumento30 pagineThe Checkmate Patterns Manual: The Ultimate Guide To Winning in ChessDusen VanNessuna valutazione finora