Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Masterbudget Acct2020

Caricato da

api-249190933Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Masterbudget Acct2020

Caricato da

api-249190933Copyright:

Formati disponibili

Introduction to Management Accounting Solutions Manual

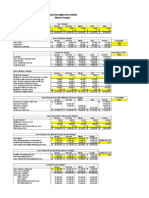

WASATCH MANUFACTURING

Master Budget

Sales Budget

December January February March April May

Unit sales 8,444 8,900 9,900 9,200 9,500 8,600

Unit selling price $ 9 $ 9 $ 9 $ 9 $ 9 $ 9

Total sales Revenue $ 76,000 $ 80,100 $ 89,100 $ 82,800 $ 85,500 $ 77,400

Req. 1

Cash Collections Budget

January February March Quarter

Cash sales $20,025 $22,275 $20,700 $63,000

Credit sales $57,000 $60,075 $66,825 $183,900

Total collections $77,025 $82,350 $87,525 $246,900

Req. 2

Production Budget

January February March Quarter

Unit sales 8,900 9,900 9,200 28,000

Plus: Desired ending inventory 1,485 1,380 1,425 1,425

Total needed 10,385 11,280 10,625 29,425

Less: Beginning inventory 1,335 1,485 1,380 1,335

Units to produce 9,050 9,795 9,245 28,090

Req. 3

Direct Materials Budget

January February March Quarter

Units to be produced 9,050 9,795 9,245 28,090

Multiply by: Quantity of DM needed per unit 2 2 2 2

Quantity of DM needed for production 18,100 19,590 18,490 56,180

Plus: Desired ending inventory of DM 1,959 1,849 1,873 1,873

Total quantity of DM needed 20,059 21,439 20,363 58,053

Less: Beginning inventory of DM 1,810 1,959 1,849 1,810

Quantity of DM to purchase 18,249 19,480 18,514 56,243

Multiply by: Cost per pound $1.50 $1.50 $1.50 $1.50

Total cost of DM purchases $27,374 $29,220 $27,771 $84,365

April May

Unit Sales 9,500 8,600

Plus: Desired End Inventory 1,290

Total Needed 10,790

Less: Beginning Inventory 1,425

Units to produce 9,365

DM needed per unit 2

Quantity of DM needed for production 18,730

Req. 4

Cash Payments for Direct Material Purchases Budget

January February March Quarter

December purchases (From AP) $22,000 $22,000

January purchases $8,212 $19,161 $27,374

February purchases $8,766 $20,454 $29,220

March purchases $8,331 $8,331

Total disbursements $30,212 $27,927 $28,785 $86,925

Req. 5

Cash Payments for Direct Labor Costs

January February March Quarter

Direct Labor $3,530 $3,820 $3,606 $10,955

Chapter 9: The Master Budget and Responsibility Accounting 1

Introduction to Management Accounting Solutions Manual

Req. 6

Cash Payments for Manufacturing Overhead Budget

January February March Quarter

Rent (fixed) $6,500 $6,500 $6,500 $19,500

Other MOH (fixed) $2,100 $2,100 $2,100 $6,300

Variable manufacturing overhead $12,670 $13,713 $12,943 $39,326

Total disbursements $21,270 $22,313 $21,543 $65,126

Req. 7

Cash Payments for Operating Expenses Budget

January February March Quarter

Variable operating expenses $ 10,680 $ 11,880 $ 11,040 $ 33,600

Fixed operating expenses $ 1,400 $ 1,400 $ 1,400 $ 4,200

Total disbursements $ 12,080 $ 13,280 $ 12,440 $ 37,800

Req. 8

Combined Cash Budget

January February March Quarter

Cash balance, beginning $6,000 $4,933 $5,143 $6,000

Plus: cash collections (req. 1) 77,025 82,350 87,525 246,900

Total cash available 83,025 87,283 92,668 252,900

Less cash payments:

DM purchases (req. 4) 30,212 27,927 28,785 86,925

Direct labor (req. 5) 3,530 3,820 3,606 10,955

MOH costs (req 6) 21,270 22,313 21,543 65,126

Operating expenses (req 7) 12,080 13,280 12,440 37,800

Tax payment 10,800 10,800

Equipment purchases 15000 6,000 4000 25,000

Total cash payments 82,092 84,141 70,374 236,606

Ending cash before financing 933 3,143 22,294 16,294

Financing:

Borrowings 4,000 2,000 6,000

Repayments -6000 -6,000

Interest -240 -240

Total financing 4,000 2,000 -6,240 -240

Cash balance, ending $4,933 $5,143 $16,054 $16,054

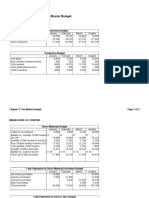

Req. 9

Budgeted Manufacturing Cost per Unit

Direct materials cost per unit $3.00

Direct labor cost per unit $0.39

Variable MOH cost per unit $1.40

Fixed MOH per unit (given in problem) $0.80

Cost of manufacturing each unit $5.59

Req. 10

Damon Manufacturing

Budgeted Income Statement

For the Quarter Ended March 31

Sales $252,000

Cost of goods sold 156,520

Gross profit 95,480

Operating expenses 37,800

Depreciation expense 5,200

Operating income 52,480

Less: interest expense -240

Less: provision for income tax 14,627

Net income $37,613

Chapter 9: The Master Budget and Responsibility Accounting 2

Sales & Collections

Actual sales in December were $76,000. Selling price per unit is projected

to remain stable at $9 per unit throughout the budget period. Sales for the

first five months of the upcoming year are budgeted to be as follows:

Month January February March April May

Total Sales $80,100 $89,100 $82,800 $85,500 $77,400

Sales are 25% cash and 75% credit. All credit sales are collected in the

month following the sale.

Production & Materials

Wasatch Manufacturing has a policy that states that each month’s ending

inventory of finished goods should be 15% of the following month’s sales

(in units).

Of each month’s direct materials purchases, 30% are paid for in the month

of purchase, while the remainder is paid for in the month following

purchase. Two pounds of direct materials is needed per unit at $1.50 per

pound. Ending inventory of direct materials should be 10% of next

month’s production needs.

Conversion Costs

Most of the labor at the manufacturing facility is indirect, but there is

some direct labor incurred. Each unit requires .03 direct labor hours. The

direct labor wage rate is $13 per hour. All direct labor is paid for in the

month in which the work is performed.

Monthly manufacturing overhead costs are $6,500 for factory rent, $2,100

for other fixed manufacturing expenses, and $1.40 per unit for variable

manufacturing overhead. No depreciation is included in these figures. All

expenses are paid for in the month in which they are incurred.

Operating Expense

Operating expenses are budgeted to be $1.20 per unit sold plus fixed

operating expenses of $1,400 per month. All operating expenses are paid

in the month in which they are incurred.

Cash

Computer equipment for the administrative offices will be purchased in

the upcoming quarter. In January, Wasatch Manufacturing will purchase

equipment for $15,000 (cash), while February’s cash expenditures will be

$6,000, and March’s cash expenditure will be $4,000.

Computer equipment for the administrative offices will be purchased in

the upcoming quarter. In January, Wasatch Manufacturing will purchase

equipment for $15,000 (cash), while February’s cash expenditures will be

$6,000, and March’s cash expenditure will be $4,000.

Wasatch Manufacturing has a policy that the ending cash balance in each

month must be at least $4,400. It has a line of credit with a local bank. The

company can borrow in increments of $1,000 at the beginning of each

month, up to a total outstanding loan balance of $100,000. The interest

rate on these loans is 1.5% per month simple interest (not compounded).

The company would pay down on the line of credit balance in increments

of $1,000 if it has excess funds at the end of the quarter. The company

would also pay the accumulated interest at the end of the quarter on the

funds borrowed during the quarter.

Income Statement

Depreciation on the building and equipment for the general and

administrative offices is budgeted to be $5,200 for the entire quarter,

which includes depreciation on new acquisitions.

The company’s income tax rate is projected to be 28% of operating

income less interest expense. The company pays $10,800 cash at the end

of February in estimated taxes.

Potrebbero piacerti anche

- Ivan Madrigals Comprehensive Master Budget Project Version ADocumento5 pagineIvan Madrigals Comprehensive Master Budget Project Version Aapi-315768301Nessuna valutazione finora

- Excel Budget ProblemDocumento5 pagineExcel Budget Problemapi-313254091Nessuna valutazione finora

- Budget Assignment Norma GDocumento5 pagineBudget Assignment Norma Gapi-242614310Nessuna valutazione finora

- Comprehensive BudgetDocumento5 pagineComprehensive Budgetapi-317125310Nessuna valutazione finora

- Excel Budget ProjectDocumento6 pagineExcel Budget Projectapi-314303195Nessuna valutazione finora

- Master Budget ProjectDocumento7 pagineMaster Budget Projectapi-404361400Nessuna valutazione finora

- Excel Budget Problem TemplateDocumento2 pagineExcel Budget Problem Templateapi-324651338Nessuna valutazione finora

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualDocumento12 pagineWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-356769323Nessuna valutazione finora

- Excel Budget ProjectDocumento7 pagineExcel Budget Projectapi-341205347Nessuna valutazione finora

- Acct 2020 Excel Budget Problem Student Template 1Documento5 pagineAcct 2020 Excel Budget Problem Student Template 1api-316764247Nessuna valutazione finora

- Problems: Set A: SolutionDocumento8 pagineProblems: Set A: Solutionapi-395519937Nessuna valutazione finora

- Chapter 9 HomeworkDocumento2 pagineChapter 9 Homeworkapi-311464761Nessuna valutazione finora

- Acct 2020 Excel Master BudgetDocumento6 pagineAcct 2020 Excel Master Budgetapi-302665852Nessuna valutazione finora

- Tanner McqueenDocumento4 pagineTanner Mcqueenapi-242859321Nessuna valutazione finora

- Acct 2020 Excel Budget ProblemDocumento6 pagineAcct 2020 Excel Budget Problemapi-307661249Nessuna valutazione finora

- P9-57a 5th Ed Blank Worksheet OnlyDocumento7 pagineP9-57a 5th Ed Blank Worksheet Onlyapi-2483356370% (1)

- Presidio Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualDocumento28 paginePresidio Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualMarc Jim Gregorio100% (1)

- Cameron Fisher Excel Budget ProjectDocumento2 pagineCameron Fisher Excel Budget Projectapi-340519862Nessuna valutazione finora

- Managerial Accounting Final ProjectDocumento5 pagineManagerial Accounting Final Projectapi-382641983Nessuna valutazione finora

- Acct 2020 EportfolioDocumento5 pagineAcct 2020 Eportfolioapi-311375616Nessuna valutazione finora

- Ponderosa-IncDocumento6 paginePonderosa-IncpompomNessuna valutazione finora

- Business Name Patatasty Currency Symbol P Year End Month December Reporting Year 2020 Year End Reporting Date 29 February 2020Documento35 pagineBusiness Name Patatasty Currency Symbol P Year End Month December Reporting Year 2020 Year End Reporting Date 29 February 2020Raschelle MayugbaNessuna valutazione finora

- Numbers Sheet Name Numbers Table NameDocumento8 pagineNumbers Sheet Name Numbers Table NameAhmed MahmoudNessuna valutazione finora

- Enter The Data Only in The Yellow Cells.: Agg Plan - ChaseDocumento6 pagineEnter The Data Only in The Yellow Cells.: Agg Plan - ChaseJason RobillardNessuna valutazione finora

- Key To Corrections - LEVEL 2 MODULE 7Documento9 pagineKey To Corrections - LEVEL 2 MODULE 7UFO CatcherNessuna valutazione finora

- Master Decker: Expansion Opporttunities: Calculation of Differential Analysis For Deck BuildingDocumento13 pagineMaster Decker: Expansion Opporttunities: Calculation of Differential Analysis For Deck BuildingRitam ChatterjeeNessuna valutazione finora

- Bigbud 4th Ed Womack BaileyDocumento26 pagineBigbud 4th Ed Womack Baileyapi-356759536Nessuna valutazione finora

- ASYNCHRONOUS ACTIVITY 4 WorksheetsDocumento12 pagineASYNCHRONOUS ACTIVITY 4 WorksheetsAbejero Trisha Nicole A.Nessuna valutazione finora

- Enter The Data Only in The Yellow Cells.: Agg Plan - LevelDocumento7 pagineEnter The Data Only in The Yellow Cells.: Agg Plan - LevelJason RobillardNessuna valutazione finora

- BigbudhunterkaarlsenDocumento25 pagineBigbudhunterkaarlsenapi-356428418Nessuna valutazione finora

- Jjcute Functional Budget SolutionDocumento4 pagineJjcute Functional Budget Solutionjanjan3256Nessuna valutazione finora

- Budgeting ExerciseDocumento2 pagineBudgeting Exercisekristel bulalacaoNessuna valutazione finora

- Financial Accounting - Tugas 2 - 28 Agustus 2019Documento3 pagineFinancial Accounting - Tugas 2 - 28 Agustus 2019AlfiyanNessuna valutazione finora

- Tutorial #3 - Group 5 - PA1 - MarkedDocumento8 pagineTutorial #3 - Group 5 - PA1 - MarkedThanh NguyenNessuna valutazione finora

- 08 Activity 1Documento4 pagine08 Activity 1Althea ObinaNessuna valutazione finora

- Aggregate PlanningDocumento6 pagineAggregate PlanningJason RobillardNessuna valutazione finora

- % July August September Forecasted Sales Gross ProfitDocumento8 pagine% July August September Forecasted Sales Gross ProfitГанбаяр АнударьNessuna valutazione finora

- Kelompok 2 MG322D Tugas 3Documento3 pagineKelompok 2 MG322D Tugas 3Tunggul Wibisono PriambudiNessuna valutazione finora

- Sales Budget Jan Feb Mar April May TotalDocumento2 pagineSales Budget Jan Feb Mar April May Totalwhat everNessuna valutazione finora

- Excel Project P9-59aDocumento3 pagineExcel Project P9-59aapi-272100463Nessuna valutazione finora

- 16 Emily LeiDocumento2 pagine16 Emily Leiiamfine253Nessuna valutazione finora

- EstadisticaDocumento2 pagineEstadisticaBub CrizNessuna valutazione finora

- WOODDocumento12 pagineWOODJayson ReyesNessuna valutazione finora

- COMM1170 Tutorial 10Documento10 pagineCOMM1170 Tutorial 10Lia LeNessuna valutazione finora

- Yarra Kira Adalia 2101646672 GSLC 30 April 2020 Excercise 10-12Documento3 pagineYarra Kira Adalia 2101646672 GSLC 30 April 2020 Excercise 10-12Yarra AdaliaNessuna valutazione finora

- Budgeting ProblemDocumento7 pagineBudgeting ProblemBest Girl RobinNessuna valutazione finora

- Managerial Accounting Chapter 7Documento4 pagineManagerial Accounting Chapter 7Neema MarkNessuna valutazione finora

- Acctg 202Documento9 pagineAcctg 202Lore Desa CenizaNessuna valutazione finora

- Sweat GaloreDocumento17 pagineSweat GaloreMuhdAfiq50% (2)

- CH 8 ExerciseshDocumento14 pagineCH 8 Exercisesh김가온Nessuna valutazione finora

- 01a Financial Statements - Income Statement - ch14pr01 - SoluDocumento2 pagine01a Financial Statements - Income Statement - ch14pr01 - SolumalvikatanejaNessuna valutazione finora

- Toy World - SudhanshuPani - 2021Documento20 pagineToy World - SudhanshuPani - 2021Safaljot Singh100% (1)

- SCM 10 Activity1Documento2 pagineSCM 10 Activity1Katelyn SungcangNessuna valutazione finora

- ACT2PROJDocumento8 pagineACT2PROJCedric RepradoNessuna valutazione finora

- Master Budget SolutionDocumento2 pagineMaster Budget SolutionAra FloresNessuna valutazione finora

- Budget ProjectDocumento18 pagineBudget Projectapi-318385102Nessuna valutazione finora

- Financial Template GuidelineDocumento4 pagineFinancial Template GuidelineMuhd IzamuddinNessuna valutazione finora

- 08 Task PerformanceDocumento3 pagine08 Task PerformanceBetchang AquinoNessuna valutazione finora

- Exercise 1 Margarett Company: Sales BudgetDocumento4 pagineExercise 1 Margarett Company: Sales BudgetHannaniah PabicoNessuna valutazione finora

- Signature AssignmentDocumento6 pagineSignature Assignmentapi-249190933Nessuna valutazione finora

- Chem Final EssayDocumento5 pagineChem Final Essayapi-249190933Nessuna valutazione finora

- Acct 2020 Excel Budget Problem Student TemplateDocumento12 pagineAcct 2020 Excel Budget Problem Student Templateapi-249190933Nessuna valutazione finora

- Spanish ResponseDocumento1 paginaSpanish Responseapi-249190933Nessuna valutazione finora

- Hlac EportfolioDocumento1 paginaHlac Eportfolioapi-249190933Nessuna valutazione finora

- Annotated BibliographyDocumento7 pagineAnnotated Bibliographyapi-249190933Nessuna valutazione finora

- My Fitness JournalDocumento9 pagineMy Fitness Journalapi-249190933Nessuna valutazione finora

- The Idea of Multiple IntelligencesDocumento2 pagineThe Idea of Multiple IntelligencesSiti AisyahNessuna valutazione finora

- Copper Reaction: Guillermo, Charles Hondonero, Christine Ilao, Ellaine Kim, Yumi Lambrinto, Arl JoshuaDocumento6 pagineCopper Reaction: Guillermo, Charles Hondonero, Christine Ilao, Ellaine Kim, Yumi Lambrinto, Arl JoshuaCharles GuillermoNessuna valutazione finora

- SBE13 CH 18Documento74 pagineSBE13 CH 18Shad ThiệnNessuna valutazione finora

- Ergonomics For The BlindDocumento8 pagineErgonomics For The BlindShruthi PandulaNessuna valutazione finora

- AdvacDocumento13 pagineAdvacAmie Jane MirandaNessuna valutazione finora

- Modern DrmaDocumento7 pagineModern DrmaSHOAIBNessuna valutazione finora

- Ottley Sandra 2009Documento285 pagineOttley Sandra 2009Lucas Fariña AlheirosNessuna valutazione finora

- Administrator's Guide: SeriesDocumento64 pagineAdministrator's Guide: SeriesSunny SaahilNessuna valutazione finora

- ChitsongChen, Signalsandsystems Afreshlook PDFDocumento345 pagineChitsongChen, Signalsandsystems Afreshlook PDFCarlos_Eduardo_2893Nessuna valutazione finora

- BhattacharyaDocumento10 pagineBhattacharyavoraciousvNessuna valutazione finora

- 1 Mark QuestionsDocumento8 pagine1 Mark QuestionsPhani Chintu100% (2)

- Configuration Steps - Settlement Management in S - 4 HANA - SAP BlogsDocumento30 pagineConfiguration Steps - Settlement Management in S - 4 HANA - SAP Blogsenza100% (4)

- 10-C# Forms InteractionDocumento22 pagine10-C# Forms InteractionMaria Anndrea MendozaNessuna valutazione finora

- Introduction To Public HealthDocumento54 pagineIntroduction To Public HealthKristelle Marie Enanoria Bardon50% (2)

- Economic Value Added in ComDocumento7 pagineEconomic Value Added in Comhareshsoni21Nessuna valutazione finora

- Payment Billing System DocumentDocumento65 paginePayment Billing System Documentshankar_718571% (7)

- Shrek FSCDocumento5 pagineShrek FSCMafer CastroNessuna valutazione finora

- AMCAT All in ONEDocumento138 pagineAMCAT All in ONEKuldip DeshmukhNessuna valutazione finora

- EELE 202 Lab 6 AC Nodal and Mesh Analysis s14Documento8 pagineEELE 202 Lab 6 AC Nodal and Mesh Analysis s14Nayr JTNessuna valutazione finora

- Respiratory Examination OSCE GuideDocumento33 pagineRespiratory Examination OSCE GuideBasmah 7Nessuna valutazione finora

- The Biofloc Technology (BFT) Water Quality, Biofloc Composition, and GrowthDocumento8 pagineThe Biofloc Technology (BFT) Water Quality, Biofloc Composition, and GrowthHafez MabroukNessuna valutazione finora

- Survey Results Central Zone First LinkDocumento807 pagineSurvey Results Central Zone First LinkCrystal Nicca ArellanoNessuna valutazione finora

- Talk 4Documento35 pagineTalk 4haryonoismanNessuna valutazione finora

- HRM and The Business EnvironmentDocumento18 pagineHRM and The Business Environmentsuzzette91Nessuna valutazione finora

- Communication and Globalization Lesson 2Documento13 pagineCommunication and Globalization Lesson 2Zetrick Orate0% (1)

- Master Books ListDocumento32 pagineMaster Books ListfhaskellNessuna valutazione finora

- Framework For Marketing Management Global 6Th Edition Kotler Solutions Manual Full Chapter PDFDocumento33 pagineFramework For Marketing Management Global 6Th Edition Kotler Solutions Manual Full Chapter PDFWilliamThomasbpsg100% (9)

- 2019 Ulverstone Show ResultsDocumento10 pagine2019 Ulverstone Show ResultsMegan PowellNessuna valutazione finora

- Teuku Tahlil Prosiding38491Documento30 pagineTeuku Tahlil Prosiding38491unosa unounoNessuna valutazione finora

- Storage Emulated 0 Android Data Com - Cv.docscanner Cache How-China-Engages-South-Asia-Themes-Partners-and-ToolsDocumento140 pagineStorage Emulated 0 Android Data Com - Cv.docscanner Cache How-China-Engages-South-Asia-Themes-Partners-and-Toolsrahul kumarNessuna valutazione finora