Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

GWC Fact Sheet 31 2018 EN PDF

Caricato da

pranav prakashTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

GWC Fact Sheet 31 2018 EN PDF

Caricato da

pranav prakashCopyright:

Formati disponibili

As of 31 December 2018

FACT SHEET

ABOUT GWC CHAIRMAN

Sheikh Abdulla bin Fahad J.J. Al-Thani

GROUP CEO

GWC is the leading provider of logistics and supply chain solutions in the State of Ranjeev Menon

Qatar. Established as a Qatari public shareholding company in 2004; the company

offers highquality warehousing and distribution services, hazmat logistics, freight BOARD OF DIRECTORS

forwarding, project logistics, sports and event logistics, equestrian logistics, Sheikh Abdulla bin Fahad J.J. Al-Thani

fine art logistics, supply chain consulting, transportation management, records Chairman

management, and doorto-door moving and relocation services. GWC delivers this Sheikh Fahad bin Hamad J.J. Al-Thani

by understanding the clients’ needs and by leveraging a global shipping network Vice Chairman

through Agility. Being a trend setter, andraising the bar for the industry standards Ahmed Mubarak Al-Ali Al-Maadid

and practices, GWC has become the Authorized Service Contractor (ASC) for UPS Dr. Hamad Saad M. Al-Saad

in the State of Qatar since 2015. The company is backed by a team of committed Jassim Sultan J. Al-Rimaihi

Mohammed Hassan Al-Emadi

and innovative experts in the field and supported by state-of-the-art IT systems

Henadi Al-Saleh

and logistical infrastructure. To get GWC news and updates, please follow us on Abdulaziz Mohammed Jabor Al Sulaiti

YouTube and Social Media @gwclogistics Faisal Mohammed Ali Al Emadi

FUNDAMENTALS

INDUSTRY YEAR OF FOUNDATION GROSS REVENUE 2018 NET PROFIT 2018 TOTAL ASSETS 2018

Logistics and Supply

2004 1232.2 237.5 3.7

QAR

QAR

QAR

MILL

MILL

BILL

Chain Solutions

EARNINGS PER SHARE 2018 STAFF LOCATIONS ISIN STOCK EXCHANGE

4.04 2,400+ 19 QA000A0KD6H9 Qatar Stock

QAR

Exchange

Gulf Warehousing Company QPSC Page 1 of 2

As of 31 December 2018

FACT SHEET

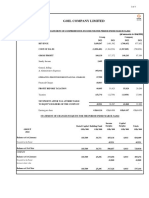

FINANCIAL FIGURES

in QAR million 2018 2017 2016 2015 2014

Revenue 1,232 981 849 788 657

Direct costs (814) (617) (541) (501) (431)

Gross profit 418 364 308 287 226

Other income 3 1 19 19 16

Fair value gains in investment property - - - 12 15

Administrative and other expenses (113) (104) (94) (98) (80)

Provision - Impairment of trade receivables/(Made) 6 (2) - - -

Operating profit 314 259 233 220 177

Finance costs, net (76) (44) (28) (35) (36)

Profit for the year 238 215 205 185 141

ASSETS

Property, plant and equipment 2,590 1,960 1,463 1,306 1,126

Capital work-in progress 57 769 1,096 251 251

Investment property 38 37 37 186 173

Intangible assets and goodwill 131 119 126 129 135

Refundable deposits 18

Non - current assets 2,834 2,885 2,722 1,872 1,685

Inventories 11 11 9 9 8

Trade and other receivables 420 525 521 513 250

Cash and cash equivalents 427 352 489 586 160

Current assets 858 888 1,019 1,108 418

Total assets 3,692 3,773 3,741 2,980 2,103

EQUITY & LIABILITIES

Share capital 586 586 586 476 476

Share subscribed but not issued - - 429 -

Legal reserve 552 553 553 238 238

Retained earnings 594 497 381 268 159

Equity attributable to the owners of the Company 1,732 1,636 1,520 1,411 873

Non- controlling interests (3) (4) (4) (4) (4)

Equity 1,729 1,632 1,516 1,407 869

Liabilities

Bank loans 1,462 1,525 1,682 1,231 995

Provision for employees’ end of service benefits 37 31 26 23 18

Non - current Liabilities 1,499 1,556 1,708 1,254 1,013

Bank loans 222 261 194 142 68

Trade and Other Payables 242 324 323 177 153

Current liabilities 464 585 517 319 221

Total liabilities 1,963 2,141 2,225 1,573 1,234

Total equity and liabilities 3,692 3,773 3,741 2,980 2,103

Cash and cash equivalents at 1 January 352 489 586 160 175

Net cash from operating activities 438 411 497 63 258

Net cash used in investing activities (75) (278) (953) (270) (289)

Net cash from financing activities (288) (270) 359 633 16

Net (decrease) / Increase in cash and cash Equivalents 75 (137) (97) 426 (15)

Cash and cash equivalents at 31 December 427 352 489 586 160

IR contact

Rajeswar Govindan

Chief Operating Officer

D Ring Road - Doha, Qatar

P.O. Box: 24434 | Tel: +97444493000 | Fax: +97444493100

Email: rajeswar.govindan@gwclogistics.com

Gulf Warehousing Company QPSC Page 2 of 2

Potrebbero piacerti anche

- PARCO ProjectDocumento6 paginePARCO ProjectQasim MalikNessuna valutazione finora

- TPG - Annual Report 2020 Income Statemnt 1Documento2 pagineTPG - Annual Report 2020 Income Statemnt 1Pei Ling Ch'ngNessuna valutazione finora

- La-1l:,zru, I LL Raka LL Raka: AccountantsDocumento4 pagineLa-1l:,zru, I LL Raka LL Raka: AccountantsSayeedMdAzaharulIslamNessuna valutazione finora

- PBCC ActivitiesDocumento25 paginePBCC ActivitiesykwaiNessuna valutazione finora

- Byco Data PDFDocumento32 pagineByco Data PDFMuiz SaddozaiNessuna valutazione finora

- Finance AssignmentDocumento14 pagineFinance Assignment4brc4jywtmNessuna valutazione finora

- Annual Report 2018 20191561456240Documento144 pagineAnnual Report 2018 20191561456240hinbox7Nessuna valutazione finora

- AMTEXDocumento87 pagineAMTEXBilal Ahmed KhanNessuna valutazione finora

- 219680Documento22 pagine219680wajahatwajahat07Nessuna valutazione finora

- IHC Financial Statments For Period Ended 30 September 2020 - English PDFDocumento40 pagineIHC Financial Statments For Period Ended 30 September 2020 - English PDFHafisMohammedSahibNessuna valutazione finora

- Knitware Ms FormatDocumento29 pagineKnitware Ms FormatMD. Borhan UddinNessuna valutazione finora

- ABC Cement FM (Final)Documento24 pagineABC Cement FM (Final)Muhammad Ismail (Father Name:Abdul Rahman)Nessuna valutazione finora

- PLCL Issued FS - 2018Documento30 paginePLCL Issued FS - 2018Shah JehanNessuna valutazione finora

- English Q3 2018 Financials For Galfar WebsiteDocumento24 pagineEnglish Q3 2018 Financials For Galfar WebsiteMOORTHYNessuna valutazione finora

- Mobile Telecommunications Company Saudi ArabiaDocumento28 pagineMobile Telecommunications Company Saudi ArabiaAliNessuna valutazione finora

- M4 Example 2 SDN BHD FSADocumento38 pagineM4 Example 2 SDN BHD FSAhanis nabilaNessuna valutazione finora

- National College of Business Administration & Economics Front Lane Campus (FLC)Documento7 pagineNational College of Business Administration & Economics Front Lane Campus (FLC)Abdul RehmanNessuna valutazione finora

- Complete Spreadsheet - From 2020Documento233 pagineComplete Spreadsheet - From 2020cpacpacpaNessuna valutazione finora

- Balance Sheet & P & LDocumento3 pagineBalance Sheet & P & LSatish WagholeNessuna valutazione finora

- Saudi Aramco 9m 2019 Summary Financials PDFDocumento4 pagineSaudi Aramco 9m 2019 Summary Financials PDFakshay_kapNessuna valutazione finora

- Directors' Report: For The Period Ended 31 March 2018Documento24 pagineDirectors' Report: For The Period Ended 31 March 2018Asma RehmanNessuna valutazione finora

- Goil Company Limited: Group Unaudited Statement of Comprehensive Income For The Period Ended March 31,2022Documento4 pagineGoil Company Limited: Group Unaudited Statement of Comprehensive Income For The Period Ended March 31,2022Fuaad DodooNessuna valutazione finora

- CA Sales - Results 2019 PDFDocumento2 pagineCA Sales - Results 2019 PDFgarag muniNessuna valutazione finora

- Consolidation Model - Exercise 1Documento7 pagineConsolidation Model - Exercise 1subhash dalviNessuna valutazione finora

- Annual Report 2022Documento216 pagineAnnual Report 2022sharveenanaiduNessuna valutazione finora

- Dec09 Inv Presentation GAAPDocumento23 pagineDec09 Inv Presentation GAAPOladipupo Mayowa PaulNessuna valutazione finora

- LACER - FS and Notes 2018 PDFDocumento13 pagineLACER - FS and Notes 2018 PDFErben ReyesNessuna valutazione finora

- QNFS31Dec2013 25 2 14 400pm2Documento60 pagineQNFS31Dec2013 25 2 14 400pm2AamirKhanNessuna valutazione finora

- Kuwait Privatization Projects Holding Co.: Financial Statement - 2006Documento21 pagineKuwait Privatization Projects Holding Co.: Financial Statement - 2006phckuwaitNessuna valutazione finora

- M. M. Rahman Co.: Statement of Financial PositionDocumento5 pagineM. M. Rahman Co.: Statement of Financial PositionAsiful IslamNessuna valutazione finora

- 2016 Nestle ExtratedDocumento7 pagine2016 Nestle ExtratednesanNessuna valutazione finora

- 3rd Quarter Report 2018Documento1 pagina3rd Quarter Report 2018Tanzir HasanNessuna valutazione finora

- Unaudited Consolidated Financial Statements: For The Quarter Ended 31 March 2022Documento7 pagineUnaudited Consolidated Financial Statements: For The Quarter Ended 31 March 2022Fuaad DodooNessuna valutazione finora

- MBA5002 Sample Case Study 2Documento13 pagineMBA5002 Sample Case Study 2Mohamed NaieemNessuna valutazione finora

- CHB Dec18Documento15 pagineCHB Dec18Sajeetha MadhavanNessuna valutazione finora

- Hong Fok Corporation Limited: Revenue (Note 1)Documento8 pagineHong Fok Corporation Limited: Revenue (Note 1)Theng RogerNessuna valutazione finora

- Case Study Part 1 Financial AnalysisDocumento4 pagineCase Study Part 1 Financial AnalysisNikola PavlovskaNessuna valutazione finora

- Yongnam Holdings Limited: Financial Statements Announcement For The Year Ended 31 December 2019Documento8 pagineYongnam Holdings Limited: Financial Statements Announcement For The Year Ended 31 December 2019Batu GajahNessuna valutazione finora

- Elgood Effective Learning, 32 West Street, Tadley, Hants, RG26 3SXDocumento8 pagineElgood Effective Learning, 32 West Street, Tadley, Hants, RG26 3SXakiyama madokaNessuna valutazione finora

- Elgood Effective Learning, 32 West Street, Tadley, Hants, RG26 3SXDocumento8 pagineElgood Effective Learning, 32 West Street, Tadley, Hants, RG26 3SXakiyama madokaNessuna valutazione finora

- Millat Tractors Ltd.Documento21 pagineMillat Tractors Ltd.Isma IshtiaqNessuna valutazione finora

- Edited Final RatiosDocumento68 pagineEdited Final RatiosHammad KhanNessuna valutazione finora

- Inbamfi Equity CaseDocumento19 pagineInbamfi Equity CaseBinsentcaragNessuna valutazione finora

- Bangladesh q1 Report 2020 Tcm244 553014 enDocumento7 pagineBangladesh q1 Report 2020 Tcm244 553014 entdebnath_3Nessuna valutazione finora

- Netflix Inc.: Balance SheetDocumento16 pagineNetflix Inc.: Balance SheetLorena JaupiNessuna valutazione finora

- Adobe Scan Sep 29, 2023Documento16 pagineAdobe Scan Sep 29, 2023SaloniPatilNessuna valutazione finora

- Zeal Pak Cement Factory Ltd. Project Feasibility StudyDocumento38 pagineZeal Pak Cement Factory Ltd. Project Feasibility StudyIrfan NasrullahNessuna valutazione finora

- Project of Accounting Dep: ADP (Accounting & Finance) Section: 2 Grey Group Members Faraz Ali (068) Zain Asghar (067) Bilal (0Documento6 pagineProject of Accounting Dep: ADP (Accounting & Finance) Section: 2 Grey Group Members Faraz Ali (068) Zain Asghar (067) Bilal (0Faraz AliNessuna valutazione finora

- HBL FSAnnouncement 3Q2016Documento9 pagineHBL FSAnnouncement 3Q2016Ryan Hock Keong TanNessuna valutazione finora

- MR D.I.Y. Group (M) Berhad: Interim Financial Report For The Third Quarter Ended 30 September 2020Documento15 pagineMR D.I.Y. Group (M) Berhad: Interim Financial Report For The Third Quarter Ended 30 September 2020Mzm Zahir MzmNessuna valutazione finora

- Financial Statement 7EDocumento9 pagineFinancial Statement 7ENurin SyazarinNessuna valutazione finora

- 0202 - RGTECH - QR - 2020-12-31 - Radiant Globaltech Berhad - Quarterly Results - 31.12.2020 - 670632592Documento20 pagine0202 - RGTECH - QR - 2020-12-31 - Radiant Globaltech Berhad - Quarterly Results - 31.12.2020 - 670632592Iqbal YusufNessuna valutazione finora

- Taliworks Q4FY19Documento28 pagineTaliworks Q4FY19Gan ZhiHanNessuna valutazione finora

- Earnings Quality Score % 84 72: PT Kalbe Farma TBKDocumento5 pagineEarnings Quality Score % 84 72: PT Kalbe Farma TBKHari HikmawanNessuna valutazione finora

- LWL Dec2021Documento7 pagineLWL Dec2021Shabry SamoonNessuna valutazione finora

- Annual Report - PadiniDocumento23 pagineAnnual Report - PadiniCheng Chung leeNessuna valutazione finora

- AppendixDocumento30 pagineAppendixLeigh Arrel DivinoNessuna valutazione finora

- AppendixDocumento30 pagineAppendixLeigh Arrel DivinoNessuna valutazione finora

- Reliance Industries LTD.: Balance SheetDocumento10 pagineReliance Industries LTD.: Balance SheetAayush PeriwalNessuna valutazione finora

- BASF Tarragona (La Canonja) Production CenterDocumento9 pagineBASF Tarragona (La Canonja) Production Centerpranav prakashNessuna valutazione finora

- LEADSReports 2022 19april2023Documento231 pagineLEADSReports 2022 19april2023pranav prakashNessuna valutazione finora

- BASF in Tarragona Presentation EnglishDocumento21 pagineBASF in Tarragona Presentation Englishpranav prakashNessuna valutazione finora

- 2nd Q 2017Documento37 pagine2nd Q 2017pranav prakashNessuna valutazione finora

- GWCBuSulba Brochure EN 2017Documento9 pagineGWCBuSulba Brochure EN 2017pranav prakashNessuna valutazione finora

- Floor Plan PDFDocumento1 paginaFloor Plan PDFpranav prakashNessuna valutazione finora

- Ddi Documentation English Microdata 3056Documento9 pagineDdi Documentation English Microdata 3056pranav prakashNessuna valutazione finora

- ChemDocumento20 pagineChemoptisearchNessuna valutazione finora

- Report of Master Plan For Delhi - 2021 (Updated Incorporating Notifications Till 31st December 2018)Documento310 pagineReport of Master Plan For Delhi - 2021 (Updated Incorporating Notifications Till 31st December 2018)pranav prakashNessuna valutazione finora

- ICT Casestudy Pranav Prakash RatnadeepDocumento4 pagineICT Casestudy Pranav Prakash Ratnadeeppranav prakashNessuna valutazione finora

- CaseStudy Getmyparking Group-3Documento3 pagineCaseStudy Getmyparking Group-3pranav prakash100% (1)

- BKAL1013 Syllabus A191 - StudentsDocumento6 pagineBKAL1013 Syllabus A191 - Students一鸿Nessuna valutazione finora

- KietPHMSS170832 ACC101 Individual AssignmentDocumento17 pagineKietPHMSS170832 ACC101 Individual AssignmentMinh Kiet Pham HuuNessuna valutazione finora

- Options Greeks CalculatorDocumento6 pagineOptions Greeks CalculatoranbuNessuna valutazione finora

- Report BE210 - Solution To The AnswersDocumento5 pagineReport BE210 - Solution To The AnswersWasim ShahzadNessuna valutazione finora

- Financial Management Economics For Finance 2023 1671444516Documento36 pagineFinancial Management Economics For Finance 2023 1671444516RADHIKANessuna valutazione finora

- 2019 Dse Bafs 2a (E)Documento10 pagine2019 Dse Bafs 2a (E)lehcarNessuna valutazione finora

- 5 - Financial Analysis of Combine Harvester DC 70Documento10 pagine5 - Financial Analysis of Combine Harvester DC 70metaladhayNessuna valutazione finora

- Nta Ugc CommerceDocumento26 pagineNta Ugc CommerceHilal AhmedNessuna valutazione finora

- 5 Years Financial HighlightsDocumento3 pagine5 Years Financial HighlightsMd. Shaikat Alam Joy 1421759030Nessuna valutazione finora

- Pas 20Documento20 paginePas 20Justine VeralloNessuna valutazione finora

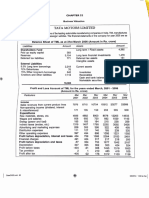

- Chapter13.BSNL Corporate Practice & AccountingDocumento24 pagineChapter13.BSNL Corporate Practice & AccountingBagavathy KumarNessuna valutazione finora

- Cash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Documento15 pagineCash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Đỗ LinhNessuna valutazione finora

- Jindal Steel Ratio AnalysisDocumento1 paginaJindal Steel Ratio Analysismir danish anwarNessuna valutazione finora

- Inventory and Inspection Report Form 1Documento2 pagineInventory and Inspection Report Form 1bryan rongcalesNessuna valutazione finora

- BinaDocumento3 pagineBinaTam sneakersNessuna valutazione finora

- Corporate Finance: Week 9-10 Does Debt Policy Matter?Documento31 pagineCorporate Finance: Week 9-10 Does Debt Policy Matter?Pol 馬魄 MattostarNessuna valutazione finora

- Claypool Hardware Is The Only Hardware Store in A RemoteDocumento1 paginaClaypool Hardware Is The Only Hardware Store in A Remotetrilocksp SinghNessuna valutazione finora

- R31 Free Cash Flow Valuation Q Bank PDFDocumento8 pagineR31 Free Cash Flow Valuation Q Bank PDFZidane Khan100% (1)

- Impairment of AssetsDocumento21 pagineImpairment of AssetsDeryl GalveNessuna valutazione finora

- Quiz TM 5 AKMDocumento2 pagineQuiz TM 5 AKMRani AdhirasariNessuna valutazione finora

- Chapter1-Finance ManagmentDocumento36 pagineChapter1-Finance ManagmentchandoraNessuna valutazione finora

- Quiz Budgeting and Standard CostingDocumento2 pagineQuiz Budgeting and Standard CostingAli SwizzleNessuna valutazione finora

- UTS AKL 2 - Resky Awaliah (A031181004)Documento3 pagineUTS AKL 2 - Resky Awaliah (A031181004)Resky AwaliahNessuna valutazione finora

- Health Development Corporation Spread Sheet (Sol)Documento8 pagineHealth Development Corporation Spread Sheet (Sol)Surya Kant100% (2)

- Igcse Accounting Sole Trader Revision Questions FDocumento56 pagineIgcse Accounting Sole Trader Revision Questions FAung Zaw Htwe100% (1)

- Accounting Principles: 11 Edition - US GAAPDocumento73 pagineAccounting Principles: 11 Edition - US GAAPPutu Deny WijayaNessuna valutazione finora

- 5202 Rashed, With Solution - 123541Documento10 pagine5202 Rashed, With Solution - 123541RashedNessuna valutazione finora

- Break Even Analysis TotalDocumento3 pagineBreak Even Analysis Totalm.rahimianNessuna valutazione finora

- Job Order Costing Exercises-Solved Problems-Home Work SolutionDocumento20 pagineJob Order Costing Exercises-Solved Problems-Home Work SolutionBasanta K Sahu100% (6)

- Accounts Payable Process FlowchartDocumento4 pagineAccounts Payable Process FlowchartNarayan KulkarniNessuna valutazione finora