Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Exercise 3 Adjusting Entries - Service Business

Caricato da

Marc ViduyaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Exercise 3 Adjusting Entries - Service Business

Caricato da

Marc ViduyaCopyright:

Formati disponibili

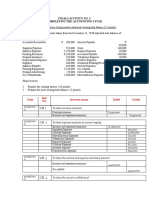

Exercise 3: ADJUSTING ENTRIES – SERVICE BUSINESS

Problem 1

Listed below are the transactions of Jessica Company in 2019:

Jul 1 Received a check from Cebu Ferries in the amount of P270,000 for professional services to be

rendered over the next 18 months.

Oct 1 Paid P135,000 advertising to be provided for the next 9 months.

Dec 31 At December 31, 2019, P230,000 of the salaries have accrued. Assuming that payday is on

January 4, 2020 and P620,000 in salaries were paid on that date.

Required:

1. Assume that the transactions were initially recorded in the balance sheet accounts, record the

adjusting entries. Also, record the January 4, 2020payment of salaries.

2. Now, assume that these transactions were initially recorded in income statement accounts,

record the adjusting entries. Also, record the January 1, 2020 reversing entry and January 4,

2020 payment of salaries.

Problem 2

Edgar Detoya, a tax consultant, began his practice on December 31, 2019. The transactions of the firm

are as follows:

Dec 1 Detoya invested P150,000 to the firm.

2 Paid rent for December to Recoletos Realty, P8,000.

2 Purchased supplies on account, P7,200.

3 Acquired P75,000 of office equipment, paying P37,000 down with the balance due on 30

days.

8 Paid P7,200 on account for supplies purchased.

14 Paid assistant’s salaries for 2 weeks, P6,000.

20 Performed consulting services for cash, P20,000.

28 Paid assistant’s salaries for 2 weeks, P6,000.

30 Billed clients for December consulting services, P48,000.

31 Detoya withdrew P12,000 from the business.

Required:

1. Prepare journal entries to record the December transactions.

2. Post the December transactions into T-accounts.

3. Prepare unadjusted trial balance as of December 31, 2019.

4. Prepare adjusting entries for the following:

a. Supplies on hand as of December 31 amounted to P4,700.

b. Salaries of P1,800 have accrued at month end.

c. Depreciation is P800 for December.

d. Detoya has spent 20 hours on a tax fraud case during December. When completed in

January, his work will be billed at P500 per hour. The firm uses the account “Fees

Receivable” to reflect the amounts earned but not yet billed.

5. Prepared adjusted trial balance as of December 31, 2019.

6. Prepare am income statement, statement of changes in equity, and balance sheet as of

December 31, 2019.

Potrebbero piacerti anche

- Financial Statement Worksheet DetoyaDocumento8 pagineFinancial Statement Worksheet Detoyasharon emailNessuna valutazione finora

- ACT1101, PRB, Midterm, Wit Ans KeyDocumento5 pagineACT1101, PRB, Midterm, Wit Ans KeyDyen100% (1)

- Mariano Lerin Bookstore Chart of AccountsDocumento15 pagineMariano Lerin Bookstore Chart of AccountsMaria Beatriz Aban Munda75% (4)

- Ricardo Pangan Company Journals FrenzairenDocumento15 pagineRicardo Pangan Company Journals FrenzairenRain Marie DumasNessuna valutazione finora

- AC1Documento1 paginaAC1Lyanna Mormont25% (4)

- ASP Notes Page 16Documento2 pagineASP Notes Page 16Jeizel ConcepcionNessuna valutazione finora

- Rosalie Balhag Cleaners Year-End Financial ReportDocumento1 paginaRosalie Balhag Cleaners Year-End Financial ReportDominique Abrajano100% (1)

- Recording Transactions in A Financial Transaction WorksheetDocumento1 paginaRecording Transactions in A Financial Transaction WorksheetSHENessuna valutazione finora

- G e A e C A E: Merchandi at TH ND The PeriodDocumento8 pagineG e A e C A E: Merchandi at TH ND The Periodkakao67% (3)

- Eva Cammayo Supply Company Journal Entry May 2021 Agnes Ramos Company Journal Entry May 2021Documento7 pagineEva Cammayo Supply Company Journal Entry May 2021 Agnes Ramos Company Journal Entry May 2021Stephen ReloxNessuna valutazione finora

- Revenue Recognition and Accounting ProcessDocumento5 pagineRevenue Recognition and Accounting ProcessJoy Dhemple LambacoNessuna valutazione finora

- Buenaventuraej Bsa1bmidterm Activity 1 Edgar DetoyaDocumento21 pagineBuenaventuraej Bsa1bmidterm Activity 1 Edgar DetoyaAnonnNessuna valutazione finora

- Guzon Book Distributors General Journal Date Particulars PR Debit CreditDocumento8 pagineGuzon Book Distributors General Journal Date Particulars PR Debit CreditNermeen C. AlapaNessuna valutazione finora

- Trade and Cash Discount, Problem #1Documento1 paginaTrade and Cash Discount, Problem #1Feiya LiuNessuna valutazione finora

- Buenaflor WorksheetDocumento10 pagineBuenaflor WorksheetRaff LesiaaNessuna valutazione finora

- Learning Task 2 Financial Statements of Rosalina Besario SurveyorsDocumento6 pagineLearning Task 2 Financial Statements of Rosalina Besario SurveyorsNeil Matundan100% (1)

- Chapter 8-Problem 9Documento4 pagineChapter 8-Problem 9kakaoNessuna valutazione finora

- Error in Recording & Posting: Fabm 2Documento17 pagineError in Recording & Posting: Fabm 2Earl Hyannis Elauria0% (1)

- 9 Problems After Accounting Cycle Book1Documento7 pagine9 Problems After Accounting Cycle Book1Efi of the IsleNessuna valutazione finora

- On June 1, 2019, ELENO BURAY, JR. Forest Products Sol Sold Merchandise With A P120,000 List PriceDocumento63 pagineOn June 1, 2019, ELENO BURAY, JR. Forest Products Sol Sold Merchandise With A P120,000 List PriceDachell Chiva SantiagoNessuna valutazione finora

- Accounting For A Service BusinessDocumento7 pagineAccounting For A Service BusinessAndrea Joy ReyNessuna valutazione finora

- Edgar Detoya's Tax Consultancy FinancialsDocumento16 pagineEdgar Detoya's Tax Consultancy FinancialsMARY GRACE VARGASNessuna valutazione finora

- General Journal: (To Purchase Equipment Paid With Cash and Account Payable For The Balance)Documento7 pagineGeneral Journal: (To Purchase Equipment Paid With Cash and Account Payable For The Balance)Montibon El100% (1)

- Marichu Fornolles Novelties Transactions in December 2020: Date Particulars DebitDocumento4 pagineMarichu Fornolles Novelties Transactions in December 2020: Date Particulars DebitHannah Pearl Flores Villar100% (1)

- Jose Rizal Heavy BombersDocumento10 pagineJose Rizal Heavy BombersClaud NineNessuna valutazione finora

- ACTIVITY NO1and2Documento5 pagineACTIVITY NO1and2Patricia Nicole Barrios100% (1)

- Step-by-Step Bookkeeping InstructionsDocumento38 pagineStep-by-Step Bookkeeping InstructionsMomo HiraiNessuna valutazione finora

- Edgar Detoya Tax Consultant (Acca101)Documento56 pagineEdgar Detoya Tax Consultant (Acca101)Hannah Pearl Flores VillarNessuna valutazione finora

- Arib Business Chart of AccountsDocumento9 pagineArib Business Chart of Accountskakao100% (1)

- Paid Amount Due To Sanny Co. For The Purchase of Dec. 29, 2019 Less Discounts. Issued Check No. 83Documento3 paginePaid Amount Due To Sanny Co. For The Purchase of Dec. 29, 2019 Less Discounts. Issued Check No. 83Catherine Acutim100% (1)

- Accounting FinalsDocumento10 pagineAccounting FinalsrixaNessuna valutazione finora

- Exercise 1 Merchandising UpdatedDocumento5 pagineExercise 1 Merchandising UpdatedShiela RengelNessuna valutazione finora

- Joannamarie Uy ProblemDocumento1 paginaJoannamarie Uy ProblemFeiya Liu50% (2)

- Abm Q4Documento3 pagineAbm Q4Brandon Choi100% (1)

- Accounting Sample ProblemsDocumento1 paginaAccounting Sample ProblemsKeitheia QuidlatNessuna valutazione finora

- Pamantasan NG Lungsod NG Valenzuela: Financial Accounting and Reporting I (FAR I)Documento5 paginePamantasan NG Lungsod NG Valenzuela: Financial Accounting and Reporting I (FAR I)Mariane Manangan100% (2)

- Teresita Buenaflor ShoesDocumento30 pagineTeresita Buenaflor ShoesHannah Pearl Flores Villar100% (1)

- Chapter 9Documento10 pagineChapter 9Kanton FernandezNessuna valutazione finora

- C3 - Problem 17 - Correcting A Trial BalanceDocumento2 pagineC3 - Problem 17 - Correcting A Trial BalanceLorence John Imperial0% (1)

- Henri Emanuel Reforba - Learning Task #2Documento6 pagineHenri Emanuel Reforba - Learning Task #2Rhea BernabeNessuna valutazione finora

- Sales Receipts October 2015Documento18 pagineSales Receipts October 2015AlvinNoay100% (2)

- Accounting Problems and Solutions: Income Statements, Balance Sheets, Adjusting Entries, and MoreDocumento13 pagineAccounting Problems and Solutions: Income Statements, Balance Sheets, Adjusting Entries, and MoreRhoda Claire M. Gansobin86% (7)

- Nerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Documento3 pagineNerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Mica Mae Correa100% (1)

- Perpetual System, Problem #17Documento2 paginePerpetual System, Problem #17Feiya LiuNessuna valutazione finora

- Ricardo Pangan Final Exam Fabm - ShairamaeobligaDocumento39 pagineRicardo Pangan Final Exam Fabm - ShairamaeobligaShaira Mae Obliga100% (1)

- Chapter 9 Special and Combination Journals, and Voucher SystemDocumento3 pagineChapter 9 Special and Combination Journals, and Voucher SystemZyrene Kei Reyes100% (3)

- Accounting HomeworkDocumento6 pagineAccounting HomeworkGavin Ramos100% (2)

- Basic Accounting With Basic Corporate Accounting (ACCT 101)Documento24 pagineBasic Accounting With Basic Corporate Accounting (ACCT 101)Harvy TorreburgerNessuna valutazione finora

- Orca Share Media1583067447855Documento6 pagineOrca Share Media1583067447855Zoya Romelle Besmonte100% (1)

- Act3 StatDocumento33 pagineAct3 StatAllecks Juel Luchana0% (1)

- Accounting 1 ReviewDocumento13 pagineAccounting 1 ReviewAlyssa Lumbao100% (1)

- Noel Hungria, Adjusting EntriesDocumento1 paginaNoel Hungria, Adjusting EntriesFeiya Liu100% (4)

- Mads Rialubin Travel Agency WORKSHEET FS TRIAL BALANCEDocumento3 pagineMads Rialubin Travel Agency WORKSHEET FS TRIAL BALANCEJowe Ringor Casignia100% (1)

- Practice Problem 1Documento1 paginaPractice Problem 1Desree Gale0% (2)

- Acctgchap 2Documento15 pagineAcctgchap 2Anjelika ViescaNessuna valutazione finora

- Final RequirementsDocumento1 paginaFinal RequirementsJohn Lester SuarezNessuna valutazione finora

- Comprehensive ProblemDocumento1 paginaComprehensive ProblemRonah SabanalNessuna valutazione finora

- Robredo Consulting Firm's Comprehensive Accounting ProblemDocumento1 paginaRobredo Consulting Firm's Comprehensive Accounting ProblemDavid Con RiveroNessuna valutazione finora

- ACCTG1 PrefinalsDocumento23 pagineACCTG1 PrefinalsJAN RAY CUISON VISPERAS100% (1)

- Practice Questions: Adjusting EntriesDocumento5 paginePractice Questions: Adjusting EntriesRize Takatsuki100% (1)

- Topic 2 Practice Test 2Documento3 pagineTopic 2 Practice Test 2Marc ViduyaNessuna valutazione finora

- Floor PlanDocumento1 paginaFloor PlanMarc ViduyaNessuna valutazione finora

- GDP Accounts Plotting and CalculationsDocumento1 paginaGDP Accounts Plotting and CalculationsMarc ViduyaNessuna valutazione finora

- GDP Accounts Plotting and CalculationsDocumento1 paginaGDP Accounts Plotting and CalculationsMarc ViduyaNessuna valutazione finora

- Viduya BME1101 Sec34 PracSet3.1Documento2 pagineViduya BME1101 Sec34 PracSet3.1Marc ViduyaNessuna valutazione finora

- Viduya, Marc Jeric Young - M3 - P4Documento1 paginaViduya, Marc Jeric Young - M3 - P4Marc ViduyaNessuna valutazione finora

- Viduya MGT1109Sec2 CompInterestDocumento1 paginaViduya MGT1109Sec2 CompInterestMarc ViduyaNessuna valutazione finora

- Summative Assessment 1Documento2 pagineSummative Assessment 1Marc ViduyaNessuna valutazione finora

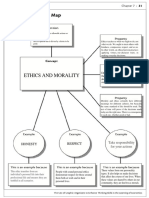

- Ethics and Morality: Honesty RespectDocumento1 paginaEthics and Morality: Honesty RespectMarc ViduyaNessuna valutazione finora

- Viduya BME1101 Sec34 PracSet6.1Documento2 pagineViduya BME1101 Sec34 PracSet6.1Marc ViduyaNessuna valutazione finora

- The Problem: Kahinaan NG Solusyon Na NapiliDocumento1 paginaThe Problem: Kahinaan NG Solusyon Na NapiliMarc ViduyaNessuna valutazione finora

- Unending Corruption in The PhilippinesDocumento2 pagineUnending Corruption in The PhilippinesMarc ViduyaNessuna valutazione finora

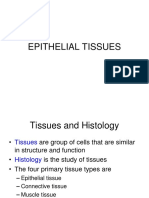

- 11 Epithelial TissuesDocumento76 pagine11 Epithelial TissuesMarc ViduyaNessuna valutazione finora

- Exercise 3 Adjusting Entries - Service BusinessDocumento2 pagineExercise 3 Adjusting Entries - Service BusinessMarc Viduya75% (4)

- Exercise 2 Income Statement - MerchandisingzzzsDocumento2 pagineExercise 2 Income Statement - MerchandisingzzzsMarc Viduya0% (1)

- Bone Marrow Hematopoiesis ReviewDocumento7 pagineBone Marrow Hematopoiesis ReviewMarc ViduyaNessuna valutazione finora

- 01 The Principles of HematologyDocumento10 pagine01 The Principles of HematologyMarc ViduyaNessuna valutazione finora

- WorksheetDocumento3 pagineWorksheetMarc ViduyaNessuna valutazione finora

- Question Bank of NMIMS Assignment June 2020Documento103 pagineQuestion Bank of NMIMS Assignment June 2020AiDLoNessuna valutazione finora

- Allianz - A Strong Community: Analyst Conference Call February 26, 2015Documento131 pagineAllianz - A Strong Community: Analyst Conference Call February 26, 2015John GrundNessuna valutazione finora

- Bank reserves and balance sheet calculationsDocumento2 pagineBank reserves and balance sheet calculationsAHMED MOHAMED YUSUFNessuna valutazione finora

- Term Structure of Interest RateDocumento2 pagineTerm Structure of Interest RateRehabUddinNessuna valutazione finora

- Week 2 Tutorial Solutions PDFDocumento23 pagineWeek 2 Tutorial Solutions PDFalexandraNessuna valutazione finora

- Sure Repair LectureDocumento10 pagineSure Repair LectureKaye Villaflor80% (5)

- Cost Accounting: Sixteenth EditionDocumento30 pagineCost Accounting: Sixteenth EditionHIMANSHU AGRAWALNessuna valutazione finora

- Investment TheoriesDocumento6 pagineInvestment Theoriesapi-3706559Nessuna valutazione finora

- Book Value Per Common Share - BVPS Definition - InvestopediaDocumento5 pagineBook Value Per Common Share - BVPS Definition - InvestopediaBob KaneNessuna valutazione finora

- Applied Auditing Review Course Pre-Board - Answer KeyDocumento13 pagineApplied Auditing Review Course Pre-Board - Answer KeyROMAR A. PIGANessuna valutazione finora

- Reduce: Bharti Infratel Bhin inDocumento11 pagineReduce: Bharti Infratel Bhin inashok yadavNessuna valutazione finora

- Seminar 11 QuestionsDocumento3 pagineSeminar 11 QuestionsYong RenNessuna valutazione finora

- Accounting Standards (Satyanath Mohapatra)Documento39 pagineAccounting Standards (Satyanath Mohapatra)smrutiranjan swain100% (1)

- Chapter5-Capitalization - Discount Rates (NACVA, 2003) - National Association of Certified Valuation AnalysisDocumento32 pagineChapter5-Capitalization - Discount Rates (NACVA, 2003) - National Association of Certified Valuation AnalysisMichael SmithNessuna valutazione finora

- Acc 101 Final Exam PrintDocumento11 pagineAcc 101 Final Exam Printchristian garciaNessuna valutazione finora

- VAT Handouts TaxDocumento9 pagineVAT Handouts TaxRenmar CruzNessuna valutazione finora

- 1901 Jan 2018 ENCS V4 - 03.04.2019Documento1 pagina1901 Jan 2018 ENCS V4 - 03.04.2019Andoy Domingo Carullo83% (6)

- On January 1 2014 Perini Company Purchased An 85 InterestDocumento1 paginaOn January 1 2014 Perini Company Purchased An 85 InterestMuhammad ShahidNessuna valutazione finora

- Ws Ans Thm01 Les03Documento2 pagineWs Ans Thm01 Les03Reynalyn Layron ReyesNessuna valutazione finora

- Financial Performance of Wigan Settlers CooperativeDocumento6 pagineFinancial Performance of Wigan Settlers CooperativeDick Jefferson Ocampo PatingNessuna valutazione finora

- Customs Valuation - Frequently Asked Questions PDFDocumento23 pagineCustoms Valuation - Frequently Asked Questions PDFTravis Opiz50% (2)

- Solution Aud589 - Jan 2018Documento5 pagineSolution Aud589 - Jan 2018LANGITBIRUNessuna valutazione finora

- Lease Kebede MekoninDocumento24 pagineLease Kebede MekoninSileshi Angerasa100% (1)

- Managerial Accounting 9Th Edition Crosson Test Bank Full Chapter PDFDocumento67 pagineManagerial Accounting 9Th Edition Crosson Test Bank Full Chapter PDFKimberlyLinesrb100% (11)

- Forecasting Financial Statements StepsDocumento7 pagineForecasting Financial Statements Stepspallavi thakurNessuna valutazione finora

- Audit workpapers of Tanglaw ng Panunulyan CenterDocumento95 pagineAudit workpapers of Tanglaw ng Panunulyan CenterIsaac Dominic MacaranasNessuna valutazione finora

- Audit Program - Amusement TaxDocumento9 pagineAudit Program - Amusement TaxNanette Rose HaguilingNessuna valutazione finora

- Bennett Jones - Ontario and Toronto Land Transfer TaxDocumento30 pagineBennett Jones - Ontario and Toronto Land Transfer TaxRogaes EnpédiNessuna valutazione finora

- Module 3 Investment ManagementDocumento17 pagineModule 3 Investment ManagementJennica CruzadoNessuna valutazione finora

- Fidelity Overview of Factor InvestingDocumento8 pagineFidelity Overview of Factor InvestingAndrew LeeNessuna valutazione finora