Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

ICICI - FY2003-profitlossbalsheet

Caricato da

Manish MannaDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

ICICI - FY2003-profitlossbalsheet

Caricato da

Manish MannaCopyright:

Formati disponibili

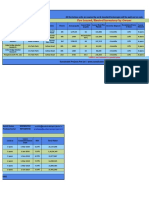

ICICI BANK LIMITED

Balance Sheet as on March 31, 2003

Rupees in '000s

As On As On

31.03.2003 31.03.2002

CAPITAL AND LIABILITIES Schedule

Capital 1 9,626,600 9,625,472

Reserves and Surplus 2 63,206,538 56,324,080

Deposits 3 481,693,063 320,851,111

Borrowings 4 343,024,203 492,186,592

Other liabilities and provisions 5 170,569,258 162,075,756

TOTAL 1,068,119,662 1,041,063,011

ASSETS

Cash and balance with Reserve Bank of India 6 48,861,445 17,744,682

Balances with banks and money at call and short notice 7 16,028,581 110,118,817

Investments 8 354,623,002 358,910,797

Advances 9 532,794,144 470,348,661

Fixed Assets 10 40,607,274 42,393,443

Other Assets 11 75,205,216 41,546,611

TOTAL 1,068,119,662 1,041,063,011

Contingent liabilities 12 894,385,070 394,465,858

Bills for collection 13,367,843 13,234,184

Significant Accounting Policies and Notes to Accounts 18

Cash Flow Statement 19

The Schedules referred to above form an integral part of the Balance Sheet

As per our Report of even date For and on behalf of the Board of Directors

For N. M. RAIJI & Co. N. Vaghul K. V. Kamath Lalita D. Gupte

Chartered Accountants Chairman Managing Director & CEO Joint Managing Director

Jayesh M. Gandhi

Partner

For S. R. Batliboi & Co. Kalpana Morparia Nachiket Mor Chanda D. Kochhar S. Mukherji

Chartered Accountants Executive Director Executive Director Executive Director Executive Director

per Viren H. Mehta

a Partner Balaji Swaminathan N. S. Kannan Jyotin Mehta G. Venkatakrishnan

Place : Mumbai Senior General Manager Chief Financial Officer & General Manager & General Manager - Accounting &

Date : April 25, 2003 Treasurer Company Secretary Taxation Group

ICICI BANK LIMITED

Profit and Loss Account for the year ended March 31, 2003.

Rupees in '000s

Year ended Year ended

31.03.2003 31.03.2002

Schedule

I. INCOME

Interest earned 13 93,680,561 21,519,297

Other income 14 19,677,741 5,746,598

Profit on sale of shares of ICICI Bank Limited held by erstwhile ICICI Limited 11,910,517 ..

TOTAL 125,268,819 27,265,895

II. EXPENDITURE

Interest expended 15 79,439,989 15,589,235

Operating expenses 16 20,116,900 6,225,770

Provisions and contingencies 17 13,650,139 2,867,900

TOTAL 113,207,028 24,682,905

III. PROFIT/LOSS

Net profit for the year 12,061,791 2,582,990

Profit brought forward 195,614 8,294

TOTAL 12,257,405 2,591,284

IV. APPROPRIATIONS/TRANSFERS

Statutory Reserve 3,020,000 650,000

Transfer from Debenture Redemption Reserve (100,000) ..

Capital Reserves 2,000,000 ..

Investment Fluctuation Reserve 1,000,000 160,000

Special Reserve 500,000 140,000

Revenue and other Reserves 600,000 960,000

Proposed equity share Dividend 4,597,758 ..

Proposed preference share Dividend 35 ..

Interim dividend paid .. 440,717

Corporate dividend tax 589,092 44,953

Balance carried over to Balance Sheet 50,520 195,614

TOTAL 12,257,405 2,591,284

Significant Accounting Policies and Notes to Accounts 18

Cash Flow Statement 19

Earning per Share (Refer note B. 9 )

Basic (Rs.) 19.68 11.61

Diluted (Rs.) 19.65 11.61

The Schedules referred to above form an integral part of the Profit and Loss Account

As per our Report of even date For and on behalf of the Board of Directors

For N. M. RAIJI & Co. N. Vaghul K. V. Kamath Lalita D. Gupte

Chartered Accountants Chairman Managing Director & CEO Joint Managing Director

Jayesh M. Gandhi

Partner

For S. R. Batliboi & Co. Kalpana Morparia Nachiket Mor Chanda D. Kochhar S. Mukherji

Chartered Accountants Executive Director Executive Director Executive Director Executive Director

per Viren H. Mehta

a Partner Balaji Swaminathan N. S. Kannan Jyotin Mehta G. Venkatakrishnan

Place : Mumbai Senior General Manager Chief Financial Officer & General Manager & General Manager - Accounting &

Date : April 25, 2003 Treasurer Company Secretary Taxation Group

Potrebbero piacerti anche

- 2005 06 Standalone BSDocumento1 pagina2005 06 Standalone BSkum_praNessuna valutazione finora

- Consolidated Financial Statements of ICICI Bank Limited and Its SubsidiariesDocumento56 pagineConsolidated Financial Statements of ICICI Bank Limited and Its SubsidiariesKartikeya Shedhani VijayvargiyaNessuna valutazione finora

- Axis Bank - AR21 - Consolidated Financial StatementsDocumento48 pagineAxis Bank - AR21 - Consolidated Financial StatementsRakeshNessuna valutazione finora

- Title Design Final - CDR AkDocumento9 pagineTitle Design Final - CDR AkLeo SaimNessuna valutazione finora

- Axis Bank AR 2021-22 - Standalone Financial StatementsDocumento81 pagineAxis Bank AR 2021-22 - Standalone Financial StatementsMathar100% (1)

- Axis Bank - AR21 - Standalone Financial StatementsDocumento80 pagineAxis Bank - AR21 - Standalone Financial StatementsArbaz TaiNessuna valutazione finora

- Name - Samsh Sayyed Roll No-333 Std-Ty Bbi Subject - Financial Reporting and Analysis (FRA) Submitted To - Vaishali Bahere MamDocumento9 pagineName - Samsh Sayyed Roll No-333 Std-Ty Bbi Subject - Financial Reporting and Analysis (FRA) Submitted To - Vaishali Bahere MamSam SayyedNessuna valutazione finora

- Bs Mach2009Documento1 paginaBs Mach2009saraths87Nessuna valutazione finora

- Afs Ekcl 2017Documento67 pagineAfs Ekcl 2017Tonmoy ParthoNessuna valutazione finora

- Icici Bank Balance Sheet 2019Documento2 pagineIcici Bank Balance Sheet 2019Smart Earn 2020 ONLINENessuna valutazione finora

- Allied LatterDocumento58 pagineAllied LatterahmedkanewwiseNessuna valutazione finora

- Csibl Y04Documento34 pagineCsibl Y04mukarram123Nessuna valutazione finora

- Audited Consolidated Financial Statements For The Year Ended 31 October 2009Documento32 pagineAudited Consolidated Financial Statements For The Year Ended 31 October 2009amitkanhere4397Nessuna valutazione finora

- Bank Reporting Example NABILDocumento54 pagineBank Reporting Example NABILSujit KoiralaNessuna valutazione finora

- M. M. Rahman Co.: Statement of Financial PositionDocumento5 pagineM. M. Rahman Co.: Statement of Financial PositionAsiful IslamNessuna valutazione finora

- Standalone Financials 20240111 (Final)Documento55 pagineStandalone Financials 20240111 (Final)Sadikshya KhawasNessuna valutazione finora

- Laporan Keuangan MFMI 31 Des 2019Documento46 pagineLaporan Keuangan MFMI 31 Des 2019Eric SantosaNessuna valutazione finora

- HMB Q1 23Documento86 pagineHMB Q1 23Hassaan AhmedNessuna valutazione finora

- ARL Annual 2017Documento97 pagineARL Annual 2017rehan naeemNessuna valutazione finora

- M. M. Rahman Co.: Statement of Financial PositionDocumento5 pagineM. M. Rahman Co.: Statement of Financial PositionAsiful IslamNessuna valutazione finora

- HBL 2005Documento46 pagineHBL 2005Momna AmjadNessuna valutazione finora

- Accounts June 2011Documento61 pagineAccounts June 2011Fazal4822Nessuna valutazione finora

- 195879Documento69 pagine195879Irfan MasoodNessuna valutazione finora

- Laporan Keuangan MFMI 301 Des 2020Documento66 pagineLaporan Keuangan MFMI 301 Des 2020Eric SantosaNessuna valutazione finora

- Key Financial Indicators: Statement of Financial PositionDocumento2 pagineKey Financial Indicators: Statement of Financial PositionZahid UsmanNessuna valutazione finora

- Overseas BankingDocumento16 pagineOverseas BankingafzalhashimNessuna valutazione finora

- UPFL Half Year Report - 2010 - tcm96-232813Documento11 pagineUPFL Half Year Report - 2010 - tcm96-232813hirasuhailahmedmemonNessuna valutazione finora

- Honda Balance SheetDocumento2 pagineHonda Balance Sheetmeri4uNessuna valutazione finora

- Financial Analysis: A Study of J & K Bank Limited: AbhinavDocumento6 pagineFinancial Analysis: A Study of J & K Bank Limited: AbhinavSanjay SaqlainNessuna valutazione finora

- Berger Paints Bangladesh Limited Statement of Financial PositionDocumento8 pagineBerger Paints Bangladesh Limited Statement of Financial PositionrrashadattNessuna valutazione finora

- LLP Audit Report FormatDocumento13 pagineLLP Audit Report FormatBijay ShresthaNessuna valutazione finora

- Daffodil Computers Limited Balance Sheet As at 30 June 2007: Aziz Halim Khair ChoudhuryDocumento20 pagineDaffodil Computers Limited Balance Sheet As at 30 June 2007: Aziz Halim Khair ChoudhuryShafayet JamilNessuna valutazione finora

- Bajaj Auto International Holdings B.V.: Balance SheetDocumento22 pagineBajaj Auto International Holdings B.V.: Balance SheetPhani TejaNessuna valutazione finora

- Nestle Financial StatementDocumento48 pagineNestle Financial Statementjhenkq100% (2)

- Axis Bank AR 2021-22 - Consolidated Financial StatementsDocumento50 pagineAxis Bank AR 2021-22 - Consolidated Financial StatementsPooja SoniNessuna valutazione finora

- Annual Report 2007Documento118 pagineAnnual Report 2007Enamul HaqueNessuna valutazione finora

- Standard Chartered Bank - India BranchesDocumento2 pagineStandard Chartered Bank - India Branchesharish srinivasanNessuna valutazione finora

- 3rd QTR Report 21 22Documento13 pagine3rd QTR Report 21 22mayajogiNessuna valutazione finora

- Vap & Associates: Company SecretariesDocumento5 pagineVap & Associates: Company Secretariesvivek singhNessuna valutazione finora

- Annualrpt2018 PDFDocumento270 pagineAnnualrpt2018 PDFHelenNessuna valutazione finora

- LCPL Annual Report 2016Documento57 pagineLCPL Annual Report 2016nasiralisauNessuna valutazione finora

- Byco Data PDFDocumento32 pagineByco Data PDFMuiz SaddozaiNessuna valutazione finora

- Salman Traders 2022 3 YearsDocumento14 pagineSalman Traders 2022 3 Yearsvayave5454Nessuna valutazione finora

- Balance SheetDocumento1 paginaBalance SheetJack DawsonNessuna valutazione finora

- Standard Chartered Bank-India BranchesDocumento42 pagineStandard Chartered Bank-India BranchesdudepraveenNessuna valutazione finora

- Balance Sheet & SPL - EchoDocumento59 pagineBalance Sheet & SPL - EchoPunkstaz Mevil BcharyaNessuna valutazione finora

- Nabil Bank Q1 FY 2021Documento28 pagineNabil Bank Q1 FY 2021Raj KarkiNessuna valutazione finora

- CIMB FinancialStatements13 PDFDocumento468 pagineCIMB FinancialStatements13 PDFEsplanadeNessuna valutazione finora

- PT Winner Nusantara Jaya TBK 31 Mar 2023 - FinalDocumento81 paginePT Winner Nusantara Jaya TBK 31 Mar 2023 - FinalTryout Stan On LineNessuna valutazione finora

- M. M. Rahman Co.: Statement of Financial PositionDocumento5 pagineM. M. Rahman Co.: Statement of Financial PositionAsiful IslamNessuna valutazione finora

- ABL LimitedDocumento72 pagineABL LimitedBadarMoonNessuna valutazione finora

- DSML Mar 07Documento1 paginaDSML Mar 07usman_dhilloNessuna valutazione finora

- Condensed Quarterly Accounts (Un-Audited)Documento10 pagineCondensed Quarterly Accounts (Un-Audited)Perah ShaikhNessuna valutazione finora

- NIB Financial Statements 2017Documento12 pagineNIB Financial Statements 2017rahim Abbas aliNessuna valutazione finora

- Annual 2014-15 Bestway Cements Accounts PDFDocumento49 pagineAnnual 2014-15 Bestway Cements Accounts PDFjamalNessuna valutazione finora

- Packaging Company FinancialsDocumento7 paginePackaging Company Financialstmir_1Nessuna valutazione finora

- Statement of Financial Position: Samba Bank Annual Report 2021Documento2 pagineStatement of Financial Position: Samba Bank Annual Report 2021Ahmad KhalidNessuna valutazione finora

- Annual Report 2006Documento223 pagineAnnual Report 2006shakeel481Nessuna valutazione finora

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionDa EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionValutazione: 5 su 5 stelle5/5 (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineDa EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNessuna valutazione finora

- Step 1 Analsis of Source DocumentsDocumento5 pagineStep 1 Analsis of Source DocumentsSittie Hafsah100% (1)

- Effects of InflationDocumento3 pagineEffects of InflationonenumbNessuna valutazione finora

- Corporate Advisory Services: Determining Financial Structure Portfolio ManagementDocumento3 pagineCorporate Advisory Services: Determining Financial Structure Portfolio ManagementK-Ayurveda WelexNessuna valutazione finora

- FranchisorDocumento5 pagineFranchisorNaly YanoNessuna valutazione finora

- Proposal 2017Documento29 pagineProposal 2017Faysal100% (1)

- Prelim ExamDocumento13 paginePrelim ExamNah HamzaNessuna valutazione finora

- Balnce Sheet Sam 3Documento2 pagineBalnce Sheet Sam 3Samuel DebebeNessuna valutazione finora

- Tcs Report On Ratio AnalysisDocumento40 pagineTcs Report On Ratio Analysisami100% (1)

- Nestle India Valuation ReportDocumento10 pagineNestle India Valuation ReportSIDDHANT MOHAPATRANessuna valutazione finora

- MBA Syllabus 21-08-2020 FinalDocumento160 pagineMBA Syllabus 21-08-2020 Finalgundarapu deepika0% (1)

- Contemporary Economic Issues Facing The Filipino EntrepreneurDocumento16 pagineContemporary Economic Issues Facing The Filipino EntrepreneurNicole EnriquezNessuna valutazione finora

- Entrepreneurship Simulation The Startup Game - Wharton University of PennsylvaniaDocumento46 pagineEntrepreneurship Simulation The Startup Game - Wharton University of PennsylvaniaMetin ReyhanogluNessuna valutazione finora

- True-False Questions: Supply-Chain StrategyDocumento3 pagineTrue-False Questions: Supply-Chain Strategysarakhan0622Nessuna valutazione finora

- Sample Loan ProposalDocumento20 pagineSample Loan Proposalhardmoneyteam94% (16)

- QSRSAI Q1 2023 - DARPO Davao OrientalDocumento33 pagineQSRSAI Q1 2023 - DARPO Davao OrientalLouie Mark lligan (COA - Louie Mark Iligan)Nessuna valutazione finora

- Periodic MethodDocumento14 paginePeriodic MethodRACHEL DAMALERIONessuna valutazione finora

- Statement of Financial PositionDocumento24 pagineStatement of Financial Positionheart lelim73% (11)

- Budget 2024 HighlightsDocumento14 pagineBudget 2024 HighlightsSunnyNessuna valutazione finora

- T24 System Build Credit V1.0Documento30 pagineT24 System Build Credit V1.0Quoc Dat Tran50% (2)

- 98 2 Fin Homework Part 04Documento6 pagine98 2 Fin Homework Part 04Yan Ho YeungNessuna valutazione finora

- Inflation Instruments OpenGammaDocumento4 pagineInflation Instruments OpenGammadondan123Nessuna valutazione finora

- MRK - Fall 2019 - HRM630 - 1 - MC180203268Documento2 pagineMRK - Fall 2019 - HRM630 - 1 - MC180203268Z SulemanNessuna valutazione finora

- Jim Cramers 10 Rules of InvestingDocumento15 pagineJim Cramers 10 Rules of Investing2008cegs100% (2)

- Public Finance Course OutlineDocumento2 paginePublic Finance Course Outlinetuffoman100% (1)

- Sustainable Pre Leased 06122019Documento2 pagineSustainable Pre Leased 06122019vaibhav vermaNessuna valutazione finora

- Reverse Takeovers - An ExplanationDocumento6 pagineReverse Takeovers - An ExplanationMohsin AijazNessuna valutazione finora

- Salary Packaging - Smart SalaryDocumento9 pagineSalary Packaging - Smart SalaryraogongfuNessuna valutazione finora

- Book4time 25.06.2020 PDFDocumento1 paginaBook4time 25.06.2020 PDFCira ShotadzeNessuna valutazione finora

- Deutsche Finan ExcelDocumento6 pagineDeutsche Finan ExcelAnonymous VVSLkDOAC1Nessuna valutazione finora

- Ch.2 Accounting For Bonus and Right IssueDocumento12 pagineCh.2 Accounting For Bonus and Right IssueAmrit SarkarNessuna valutazione finora