Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Payroll Processing Tagmemics in SAP HR: J. Anitha, J. Saritha and Namkyun Baik

Caricato da

Uday KiranTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Payroll Processing Tagmemics in SAP HR: J. Anitha, J. Saritha and Namkyun Baik

Caricato da

Uday KiranCopyright:

Formati disponibili

International Journal of Advanced Science and Technology

Vol.111 (2018), pp.55-72

http://dx.doi.org/10.14257/ijast.2018.111.06

Payroll Processing Tagmemics in SAP HR

1

J. Anitha1, J. Saritha2 and Namkyun Baik3*

1

Department of Information Technology, Vignan’s Institute of Information

Technology, Visakhapatnam, AP, India

2

Sr. SAP HR Consultant, SAP - Payroll, ADP, India

3

Korea Advanced Agency of Convergence Technology,

IT Venture Tower, 135 Jungdae-ro, Songpa-gu, Seoul, South Korea

1

anithanv28@gmail.com, 2saritha.jalumuri@gmail.com,

3

white-knight@naver.com

Abstract

This paper explains the basic Concepts of Payroll and the terms & terminologies used

in Payroll processing. To Understand the Payroll concepts in SAP HR and have a

complete overview of the different features in the Payroll module. SAP ERP is built on the

NetWeaver technology. SAPNetWeaver is used as a technology platform for integration

and as an application infrastructure with open connections to Microsoft .NET and IBM

WebSphere. The Payroll relies upon an all inclusive fund driver. This back driver is

adjusted for each country. The country specific fund drivers consider the statutory and

administrative bearings of a country. Since the back driver has a confined structure, you

can use the Customizing abilities to quickly change the fund methodology to meet the

particular requirements of your wander. Back DRIVER is a Special report for Payroll.

SAP has made country specific back drivers, which rely upon report RPCALCx0. With

country specific reports the penultimate character in the name insinuates the country

pointer (for example, D for Germany, F for France). Report RPCALCx0 can figure

irregular portions and moreover off-cycle fund runs (Bonus figurings). The country

specific back drivers contain the data. After the fund run, you can trade the fund results to

Financial Accounting.

Keywords: Enterprise Resource Planning (ERP), Systems Application Product (SAP),

HR, Wagetype, Payroll processing, Payroll control record, Income Tax computation,

Posting to Accounts

1. Introduction to WAGETYPES

In a wide sense, a wagetype essentially holds a bit of information, for example, rate,

number, as well as sum. Be that as it may, all the more particularly, a wagetype has many

characteristics that control how it is controlled and prepared. At last however, it winds up

as a question in the finance comes about database that stores a rate, number, or potentially

sum.

The most commonplace utilization of a wagetype is to store the measures of income,

conclusions and duties in a workers paycheck. A people base pay is put away in a

wagetype, the measure of their United Way finding is put away in a wagetype, and their

assessable wages and charges are put away in wagetypes. Wagetypes, as the essential

information component for representative paychecks, are likewise mapped to FI/CO

Received (November 30, 2017), Review Result (January 6, 2018), Accepted (January 17, 2018)

*

Corresponding Author

ISSN: 2005-4238 IJAST

Copyright ⓒ 2018 SERSC Australia

International Journal of Advanced Science and Technology

Vol.111 (2018)

records to record the charges and credits coming about because of the paycheck and

provided details regarding the W-2 and other tax documents.

Wagetypes can likewise be utilized to store measurable information, for example, the

quantity of hours worked in a payroll interval, the normal week after week compensation

for as far back as a half year, or the measure of wages qualified for a benefit sharing

figuring. Wagetype properties are put away in a few tables, yet the focal table is T512W.

Considerably more time will be spent on different parts of T512W.

There are three classes of wagetypes model, specialized, and client. Show wagetypes

are conveyed by SAP for clients to use as rules for making their own particular

wagetypes. They generally begin with a letter and SAP may include, erase or refresh them

in framework redesigns or HRSPs. Specialized wagetypes dependably begin with

the/image, and are conveyed by SAP. They are planned for certain standard preparing in

finance, and keeping in mind that you can alter them, SAP may likewise refresh them

amid redesigns or HRSPs. So in the event that you ever (I mean EVER) change a

specialized wagetype, check it after each update or HRSP to ensure regardless it has the

characteristics you need. What's more, never erase a specialized wagetype. Client

wagetypes dependably begin with a number and these are wagetypes that SAP does not

change amid updates and HRSPs SAP infrequently transforms them in redesigns and

HRSPs. Client wagetypes are for all the organization particular finance installments and

derivations.

Wagetypes denote various payments and deductions that are applicable in an

organization context. System generates various wagetypes in the context of gross and net

payroll processing.

/101 – Gross Payroll

/3F1 – Employee PF

/3F2 – Employee Voluntary PF

/3E1 – Employee ESI Contbn.

/3W1 – Employee LWF Contbn.

/3P1 – Profession Tax

/460 – Income Tax

/462 – Voluntary Income Tax

/550 – Statutory Net Pay

/110 – Non Statutory Deductions

/560 – Net Pay

/559 – Bank Transfer Amount

/557 – Net Pay in Cash

SAP Allowance Grouping:

Grouping of employees for whom the following are similar

Applicability of Payments

Computation methodology of

Payments

Computation Number for the

Payment

Allowance grouping definition for India

ESG for CAP – 3

Pay Scale Type

56 Copyright ⓒ 2018 SERSC Australia

International Journal of Advanced Science and Technology

Vol.111 (2018)

Pay Scale Area

01 – Hyderabad

02 – Pune

03 – All India

Pay Scale Group

01 –Hyd Workmen

02 –Hyd Casual

03 –Hyd Contract

04 –Staff M6-M8

05 –Staff M1–M5

06 –Hwr SSW

07 –Hwr SW1

08 –Hwr SW2

09 –Hwr HSW

10 –Workmen

11 –M1-M8

12 –Staff Trainee

13 - Temporary Staff

Table 1. Salary Structure

Pay Scale Pay ESG Gpg. Pay ALGRP Key ALGRP

Area Scale For CAP Scale Definition

Type Group

01 01 3 01 AL01 VtzWorkmen

01 01 3 02 AL02 Vtz Casual

01 01 3 03 AL03 Vtz Contract

01 01 3 10 AL10 Vtz M6_ M8

02 01 3 06 AL06 Vtz M1-M5

02 01 3 07 AL07 Hwr SSW

02 01 3 08 AL08 Hwr SW1

02 01 3 09 AL09 Hwr SW2

99 01 3 04 AL04 Hwr HSW

99 01 3 05 AL05 Workman

99 02 3 11 AL11

M1-M8

99 02 3 12 AL12 Trainee

99 01 3 13 AL13 Vtz Temporary

staff

Copyright ⓒ 2018 SERSC Australia 57

International Journal of Advanced Science and Technology

Vol.111 (2018)

Payroll Areas:

Payroll areas are used to group together employees for whom payroll is performed at

the same time, and also to set the dates for the payroll period. Employees from different

employee subgroups can belong to the same payroll area.

Payroll Area Description

01 VignanVtz-Workmen

02 VignanVtz Staff

03 Vignan Senior Mgt

04 VignanHwr Workmen

05 VignanHwr Staff

06 M1 to M6

07 Others

99 No Payroll

SAP Payroll Process:

The payroll program reads the master data and time data infotypes, which means

thatchanges effected during the payroll run could jeopardize the accuracy of the

payroll results.

It also means that payroll should not be run duringmaster data maintenance. This is

controlled by Payroll Control Record.

Figure 1. Payroll Process

2. Payroll Simulation

Transaction – ZHRPAYROLL [with Test Run (no update) option selected]

Simulating a payroll run enables users to display and print remuneration

statements

Master Data and Time Data are not locked

58 Copyright ⓒ 2018 SERSC Australia

International Journal of Advanced Science and Technology

Vol.111 (2018)

Payroll periods are not counted in payroll control record

A Simulation Payroll Run (without Display Log and Payslip options) is

recommended.

Figure 2. SAP HR Service Package

Release Payroll:

Transaction – PC00_M99_PA03_RELEA or PA03

When a Payroll Area is Released forPayroll, users are prevented from changing

infotype data records if such changes affect the payroll past or present

Off Cycle payroll cannot be run in thatmonth for the Payroll Area for which the

Payroll Control Record has been released for Regular Payroll

Payroll Area should be released forPayroll only when the monthly regular payroll

processing is due.

Figure 3. SAP HR Service Package

Copyright ⓒ 2018 SERSC Australia 59

International Journal of Advanced Science and Technology

Vol.111 (2018)

SAP Start Payroll:

Transaction – ZHRPAYROLL(without selection of Test Run option)

Always select ‘Current Period’ only Do not enter Personnel Numbers if you are

running for the entire Payroll Area

Do the first run without Display Log and Payslip Options

If payroll run indicates errors, re-run payroll only for the error employees

withDisplay Log and Payslip option (if the no. Oferror cases is upto 30 employees)

After ‘Release for Corrections’, re-runpayroll for all employees in a payroll

arearather than error employees only.

Figure 4. SAP Start Payroll

3. SAP Check Results

Transaction – PC00_M99_PA03_CHECK or PA03

Once the payroll is run for all employees in a payroll area, the status can be set to

Check Results

This status prevents running of Payroll too

Results of the Payroll Run can be analysed using Wagetype Reporter

(ZHRWTREP).

Comparison across payroll periods also can be done to using this report.

60 Copyright ⓒ 2018 SERSC Australia

International Journal of Advanced Science and Technology

Vol.111 (2018)

SAP Payroll Log:

The payroll results are displayed in a tree structure. This makes it easier for you to

analyze and get an overview of the payroll results

The log includes a table of contents, which is presented as tree structure. The nodes

within the tree structure enable you to access the detailed information that you

require. The headers within the structure are designed to help user with

troubleshooting and to facilitate navigation within the log.

If an error occurs when a personnel number is processed, the log is expanded at the

appropriate place and an error message is displayed

Do not run Payroll ‘with log’ for more than 30 employees at a time, as this might

impact

Copyright ⓒ 2018 SERSC Australia 61

International Journal of Advanced Science and Technology

Vol.111 (2018)

Figure 5. Payroll Log

62 Copyright ⓒ 2018 SERSC Australia

International Journal of Advanced Science and Technology

Vol.111 (2018)

Figure 6. Income Tax Computation

Figure 7. Income Tax Computation

Release for Correction:

If errors are identified during ‘Check Payroll Results’, the Payroll Control Record

should be ‘Released for Correction’

When the status of Payroll Control Record is ‘Released for Correction’ users can

carry out employee master data changes in the payroll past and present

Once master data corrections are completed, Payroll Area should be ‘Released for

Payroll’

Everytime user goes through the cycle of ‘Released for Correction – Released for

Payroll’, the Run count gets incremented.

It is recommended that a Simulation Payroll with Payslip is option is run (for

employees for whom corrections were carried out) prior to Release for Payroll. This

is to optimize on no. of Payroll Runs.

Copyright ⓒ 2018 SERSC Australia 63

International Journal of Advanced Science and Technology

Vol.111 (2018)

Test Pre DME

Preliminary Data Medium Exchange program should be run prior to Exit of Payroll

with TEST selected and

‘Set flag for transfers’ not selected

This is to ensure that Address Detail has been maintained for all employees for

whom payroll has been processed as part of payroll run.

Non maintenance of Address Data for an employee will impact generation of Bank

Transfer Statement for that employee

Test Posting

Transaction –With ‘Type of Document Creation’ as T

Test Posting Run should bedone prior to Exit of Payroll

This is to ensure that all creditsand debits match as part of

Payroll Posting

Enter Doc Date as last date ofthe month under consideration

Output Log should be enabledto analyse error employees(not exceeding 30

employees at atime)

4. Simulation Posting

Transaction –With ‘Type of Document Creation’ as S

Simulation Posting Run should be done prior to Exit of Payroll

This is to ensure that all employees have been attached to a Cost Center

Enter Doc Date as last date of the month under consideration

Output Log should be enabled only to analyze error employees (not exceeding 30

employees at a time)

64 Copyright ⓒ 2018 SERSC Australia

International Journal of Advanced Science and Technology

Vol.111 (2018)

Exit Payroll

Transaction – PC00_M99_PA03_END or PA03

Exit Payroll function enables user to rerelease infotypes so that they can be

maintained for the past and present.

User cannot choose this function until the payroll has run successfully for all of the

personnel numbers assigned to the selected payroll accounting area. If you attempt

to choose this function and rejected personnel numbers exist, the system displays an

error message. The error employees list can be obtained by clicking on icon in

Payroll Control Record

After payroll has been exited, user can change data for the period in question by

performing retroactive accounting in a subsequent payroll period.

Preliminary DME

Transaction –(without ‘TEST’ option selected)

Preliminary Data Medium Exchange program should be run after to Exit of Payroll

without TEST selected and

‘Set flag for transfers’ selected

The net pay of the employee along with Bank Details is stored in BT table of payroll

cluster

Preliminary DME is to transfer the BT table contents to three FI tables viz. REGUH,

REGUP and REGUV

Upon completion of Actual Pre DME, note down the Run Identification Number as

seen in the log, which is used to generate Bank Statement.

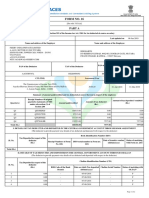

Bank Statements:

Transaction – ZHRBANKST (without ‘TEST’ option selected)

Enter Payroll Area, Current Period, Company Code

Enter the Run ID generated during actual Pre DME

Select the appropriate Bank Key for generating the statement

Statement will be generated as per requirement of bank selected

Covering letter will also be generated as part of thestatement

Option to Print or Download as Electronic Statement

Copyright ⓒ 2018 SERSC Australia 65

International Journal of Advanced Science and Technology

Vol.111 (2018)

Figure 7. Bank Statement

Posting to Finance (FI)

Transaction – ZHRPOST With ‘Type of Document Creation’ as P

Live Posting Run should be run after Exit of Payroll

The following activities must be performed when posting payroll results to

accounting:

Create posting run

Edit posting run

Check posting run

Check posting documents

Release posting documents

Post posting run

Check completeness of postings

Document Type for Payroll Posting .Documents will be Payoll (PY)

Edit Posting Run

Transaction – PCP0

After creating the posting run, you can check whether the payroll results for all

employees have been correctly evaluated.

Display the list of posting runs

Check the required posting runs

Status: If the posting run has a status other than "Documents Created", an error has

occurred when creating the posting runs.

History: Choose 'Display History’

Attributes; Display attributes of a posting run

The standard system only displays the posting runs that have been created and not

yet posted. You can use a filter to change the display criteria for the list of posting

runs. For example, you can display all posting runs, orposting runs that have been

posted or deleted.

Check Posting Documents

To display posting documents, double- click on

66 Copyright ⓒ 2018 SERSC Australia

International Journal of Advanced Science and Technology

Vol.111 (2018)

posting run

Posting Documents contained in the Posting Run are displayed

Double click on the Posting Document to check

Double click on line item within chosen Posting Document for details

Copyright ⓒ 2018 SERSC Australia 67

International Journal of Advanced Science and Technology

Vol.111 (2018)

Release Documents

Select the documents contained in a Posting Run

Click on button to release documents

Confirm Release of Documents in the pop up by system

Documents status changes from Created to Released

5. Post Posting Run

Select the Posting Run to Post

Click on button to post Posting Run

Select option to post Immediately in the system pop up

Posting Run status changes to Documents Posted

68 Copyright ⓒ 2018 SERSC Australia

International Journal of Advanced Science and Technology

Vol.111 (2018)

Displaying Accounting Documents

Double click on the relevantPosting Run

Select the Documentcorresponding to which

Accounting Document needs tobe viewed

Select Go To ->AccountingDocuments from Menu Bar

Select Accounting or Costing Document to view

Payslip

Transaction – ZHRPAYSLIP

A clear list of payments and deductions effected during a payroll run for an

employee are published in the Payslip

Payslip also carries Leave and Loan Details

Form 16 Summary is published in Payslip for employees to carry out tax planning

Payslips will be generated in PDF format and stored in the local disk of the user

computer

Notification in Payslip

Maintain employee specific notifications in infotype 0128 –subtype 2 (Personal

Notifications)

Maintain generic notifications in the ‘Messages’ space provided in ZHRPAYSLIP

selection screen

Off Cycle Payroll

Irregular payments like claims, advances, bonus etc. can be paid to employees

through off cycle payroll, on any day prior to monthly regular payroll

Any off cycle payment or deduction can be made only through Additional Offcycle

Payments (infotype 0267)

Pre-condition to run off cycle payroll is that the payroll control record should be

in‘ExitPayoll’ status for the preceding month

Offcycle payroll cannot be run in a month once the payroll control record is

‘Released for Payroll’ for that month

Off cycle reason will always be 0002 – Bonus in case of India

The following are the steps involved in offcycle payroll

Start Payroll

Copyright ⓒ 2018 SERSC Australia 69

International Journal of Advanced Science and Technology

Vol.111 (2018)

Test Posting

Simulation Posting

Test Pre DME

Live Posting

Live Pre DME

Bank Statements

Payslip Generation

Full and Final Statement

Full and Final Settlement is to be done through Regular Payroll

In case of mid month separation, payroll user can run full and final settlement

workbench

Subsequently, HR user can run the Separation Action

Once these two activities are complete, payroll user can run a Simulation Payroll

with Payslip option, to ascertain the Net Pay for the employee

Payroll user can process the Net Pay as an offcycle payment, using info type

0267and wagetype 1317 (Salary Advance)

Payroll user can also print the payslip generated during Simulation Payroll and hand

over to the separating employee.

Subsequently, payroll user will have to record a recovery of the same Net Pay

amount through Salary Advance wage type in infotype 0015

When the monthly regular payroll run is done subsequently, the Net Pay for the

separated employee will be zero

Also payroll accounting for full and final settlement will be taken care at the time of

regular payroll.

6. MIS Reports

7. Conclusion

This paper clarifies the Payroll processing and HR solutions available in SAP (System

Application Product) – ERP (enterprise Resource Planning), to assist internal and external

needs of an organization. Payroll is country specific as it must be adapted to the laws and

regulations of each particular country. Due to this country dependency, SAP has created a

wage type catalog per country, as well as a country specific schema within the standard

solution. SAP offers global Payroll solution and this global solution can be used for

countries or as an example of re-usable development that can be adapted for those

70 Copyright ⓒ 2018 SERSC Australia

International Journal of Advanced Science and Technology

Vol.111 (2018)

countries where a standard solution does not exist. The Payroll End user should now have

the capacity to acknowledge and understand the Payroll processing and its requirements,

payslip generation, postings to financial accounting, reports and other Payroll validations.

The end user/client ought to likewise have the capacity to portray reporting and analysis

solutions available in SAP ERP to support various internal and external reporting needs of

an organization.

References

[1] P. Bernus, “GERAM: Generalised Enterprise Reference Architecture and Methodology”, Google

Scholar.

[2] B.F. Van Dongen, A.K.A. de Medeiros, H.M.W. Verbeek, A.J.M.M. Weijters and W.M.P. van der

Aalst, “The ProM framework: A new era in process mining tool support”, In: Ciardo, G., Darondeau, P.

(eds.) ICATPN 2005. LNCS, Springer, Heidelberg, – Cross RefGoogle Scholar, vol. 3536, (2005), pp.

444–454.

[3] L. Silverston, “The Data Model Resource Book. A Library of Universal Data Models for all

Enterprises”, (revised edition) Google Scholar, vol. 1, (2001).

[4] B.F. Van Dongen, W.M.P. van der Aalst and H.M.W(E.) Verbeek, “Verification of ePCs: Using

reduction rules and petri nets”, In: Pastor, Ó ., Falcão e Cunha, J. (eds.) CAiSE 2005. LNCS, vol. 3520,

pp. 372–386. Springer, Heidelberg, CrossRefGoogle Scholar, (2005).

[5] , B.F. Van Dongen and M.H. Vullers-Jansen, “EPC Verification in the ARIS for MySAP reference

model database”, In: BETA Working Paper Series, WP 142, Eindhoven University of Technology,

Eindhoven, Google Scholar, (2005).

[6] P. Fettke and P.Loos, “Classification of Reference Models - a methodology and its application”,

Information Systems and e-Business Management, CrossRefGoogle Scholar, vol. 1, no. 1, (2003), pp.

35–53.

[7] G. Keller, M. Nüttgens and A.W. Scheer, “SemantischeProcessmodellierung auf der

GrundlageEreignisgesteuerterProcessketten (EPK)”, In: Veröffentlichungen des

InstitutsfürWirtschaftsinformatik, Heft 89 (in German), University of Saarland, SaarbrückenGoogle

Scholar, (1992).

[8] G. Keller and T. Teufel, “SAP R/3 Process Oriented Implementation”, Addison-Wesley, Reading,

Google Scholar, (1998).

[9] F. Leymann and D. Roller, “Production Workflow: Concepts and Techniques”, Prentice-Hall PTR,

Englewood Cliffs, Google Scholar, (1999).

[10] , M. Rosemann, “Application Reference Models and Building Blocks for Management and Control

(ERP systems)”, Springer, Berlin, Google Scholar, (2003), pp. 595–616.

[11] M. Rosemann and W.M.P. van der Aalst, “A Configurable Reference Modelling Language. QUT

Technical report”, FIT-TR-2003-05, Queensland University of Technology, Brisbane, - Google Scholar,

(2003).

[12] W. Sadiq and M.E. Orlowska, “Modeling and verification of workflow graphs. Technical Report No.

386”, Department of Computer Science, The University of Queensland, Australia, Google Scholar,

(1996).

[13] A.W. Scheer, “Business Process Engineering, Reference Models for Industrial Enterprises”, Springer,

BerlinGoogle Scholar, (1994).

[14] A.W. Scheer, “Business Process Modelling”, 3rd edn., Google Scholar, (2000).

[15] L. Silverston, “The Data Model Resource Book. A Library of Data Models for Specific Industries”,

(revised edition)Google Scholar, vol. 2, (2001).

[16] SAP Library - Payroll India (PY-IN) - SAP Help Portal.

https://help.sap.com/saphelp_erp2005/helpdata/en/72/.../frameset.htm.

[17] SAP HCM Payroll India - ERP Human Capital Management - SCN Wiki.

https://wiki.scn.sap.com/wiki/display/ERPHCM/SAP+HCM+Payroll+India.

[18] SAP Library - Payroll India (PY-IN) - SAP Help Portal.

help.sap.com/erp_hcm_ias_2013_02/helpdata/en/ac/.../frameset.htm.

Copyright ⓒ 2018 SERSC Australia 71

International Journal of Advanced Science and Technology

Vol.111 (2018)

Authors

J. Anitha, she is working as Associate Professor in Vignan’s

Institute of Information Technology Vishakapatnam, Completed

her M.Tech from Andhra University in the year 2007 & Received

her Doctrate from Andhra University in 2016.. Her Interests

include Data Mining, Artificial Intelligence, Natural Language

Processing.

J. Saritha, she has done her MBA from Osmania University in

the year 2004 and working as SAP HR consultant in SAR Payroll

in ADP since 2008. Her area of interest is in payroll system.

72 Copyright ⓒ 2018 SERSC Australia

Potrebbero piacerti anche

- Siebel Incentive Compensation Management ( ICM ) GuideDa EverandSiebel Incentive Compensation Management ( ICM ) GuideNessuna valutazione finora

- Rolling 12-Month Forecast TemplateDocumento26 pagineRolling 12-Month Forecast TemplateWafae BoussalemNessuna valutazione finora

- Solutions for Forecasting Manpower Needs in an Organization!Da EverandSolutions for Forecasting Manpower Needs in an Organization!Nessuna valutazione finora

- SAP HR and Payroll ProcessingDocumento4 pagineSAP HR and Payroll ProcessingBharathk KldNessuna valutazione finora

- High Velocity Itsm: Agile It Service Management for Rapid Change in a World of Devops, Lean It and Cloud ComputingDa EverandHigh Velocity Itsm: Agile It Service Management for Rapid Change in a World of Devops, Lean It and Cloud ComputingNessuna valutazione finora

- Error FAGL - POST - SERVICE-012 During Asset Postings After You Switch To Asset Accounting (New)Documento3 pagineError FAGL - POST - SERVICE-012 During Asset Postings After You Switch To Asset Accounting (New)Ivan SulychNessuna valutazione finora

- Financial Steering: Valuation, KPI Management and the Interaction with IFRSDa EverandFinancial Steering: Valuation, KPI Management and the Interaction with IFRSNessuna valutazione finora

- E - 20201002 - RFUMSV50 Reverse Charge Tax Code SupportDocumento15 pagineE - 20201002 - RFUMSV50 Reverse Charge Tax Code SupportRangabashyamNessuna valutazione finora

- Dynamics 365 Field Service: Implementing Business Solutions for the EnterpriseDa EverandDynamics 365 Field Service: Implementing Business Solutions for the EnterpriseNessuna valutazione finora

- SAP-HR Mydoc 2Documento15 pagineSAP-HR Mydoc 2Rajiv KumarNessuna valutazione finora

- SF Ecpay ScopeDocumento22 pagineSF Ecpay ScopeDeepthiNessuna valutazione finora

- Time ManagementDocumento10 pagineTime ManagementSandeep YaddanapalliNessuna valutazione finora

- E - 20201002 - RFUMSV50 Legal Change Spain (Non-Deductible+date Check For Old Unpaid Invoices)Documento22 pagineE - 20201002 - RFUMSV50 Legal Change Spain (Non-Deductible+date Check For Old Unpaid Invoices)RangabashyamNessuna valutazione finora

- En S4 SCC Configuration 02Documento24 pagineEn S4 SCC Configuration 02joeindNessuna valutazione finora

- Payroll - Configuration - V0 01Documento38 paginePayroll - Configuration - V0 01Abdul WahabNessuna valutazione finora

- Reconciliation Prior To S/4HANA Conversion: SymptomDocumento8 pagineReconciliation Prior To S/4HANA Conversion: SymptomMRTNessuna valutazione finora

- Operation & Supply Chian Management: Assignment#2Documento8 pagineOperation & Supply Chian Management: Assignment#2Akshat Bansal50% (2)

- Strategy Formulation and Implementation For JSW SteelDocumento40 pagineStrategy Formulation and Implementation For JSW SteelVIPUL GUPTA0% (1)

- SAP Time Management - Questions With AnswersDocumento33 pagineSAP Time Management - Questions With AnswersPradeep KumarNessuna valutazione finora

- SLA Part 3 - Journal Line Definition PDFDocumento7 pagineSLA Part 3 - Journal Line Definition PDFsoireeNessuna valutazione finora

- SAP Payroll Basics - Part 1 - Insight Consulting PartnersDocumento2 pagineSAP Payroll Basics - Part 1 - Insight Consulting PartnersDionisis Panagopoulos100% (1)

- SAP Service Configurations in SAP MM - Part 1 - SAP BlogsDocumento12 pagineSAP Service Configurations in SAP MM - Part 1 - SAP BlogsSidharth KumarNessuna valutazione finora

- .......................................... Kapil .................... SAP HR Consultant. .. . 07715995386 .. Kapil - Saphr@yahoo - Co.ukDocumento5 pagine.......................................... Kapil .................... SAP HR Consultant. .. . 07715995386 .. Kapil - Saphr@yahoo - Co.ukapi-3805059100% (1)

- OpEx Planning TemplateDocumento24 pagineOpEx Planning TemplateWafae BoussalemNessuna valutazione finora

- Notes On Accounting For LaborDocumento15 pagineNotes On Accounting For LaborMathew LumapasNessuna valutazione finora

- SF ECP EndContract PDFDocumento6 pagineSF ECP EndContract PDFJoana MataNessuna valutazione finora

- HR Analytics at ScaleneWorks - Case ReportDocumento10 pagineHR Analytics at ScaleneWorks - Case ReportGary R100% (1)

- Chapter 5 Personnel Planning and Recruiting FinalDocumento43 pagineChapter 5 Personnel Planning and Recruiting FinalSiti Namira AisyahNessuna valutazione finora

- Stock Reconciliation WM - IM With Handling Units: SymptomDocumento3 pagineStock Reconciliation WM - IM With Handling Units: SymptomAyazNessuna valutazione finora

- Product Enhancement Process: Info-Teamdagene 2017Documento40 pagineProduct Enhancement Process: Info-Teamdagene 2017Raju YarlagaddaNessuna valutazione finora

- VRV Asia Om&paDocumento84 pagineVRV Asia Om&paShiva KumarNessuna valutazione finora

- Sap NotesDocumento38 pagineSap NotesJyotirmay SahuNessuna valutazione finora

- Capstone Interim Report - HR CTC PredictionDocumento16 pagineCapstone Interim Report - HR CTC Predictionchinudash75% (8)

- Processing ClassDocumento6 pagineProcessing ClassVishalNessuna valutazione finora

- GST India TDS Data Dictionary Activities For Maintaining GST TDS RegistrationDocumento6 pagineGST India TDS Data Dictionary Activities For Maintaining GST TDS RegistrationRangabashyamNessuna valutazione finora

- Performance of ReschedulingDocumento3 paginePerformance of ReschedulingSzymonNessuna valutazione finora

- FAQ On Budget 2023-2024: SymptomDocumento4 pagineFAQ On Budget 2023-2024: SymptomSrinivasNessuna valutazione finora

- Interview Questions With Answer.Documento7 pagineInterview Questions With Answer.Nikhil KushwahaNessuna valutazione finora

- Enhancements in The Document Split FunctionDocumento8 pagineEnhancements in The Document Split Functionantonio xavierNessuna valutazione finora

- SAP MM - Service ProcurementDocumento5 pagineSAP MM - Service ProcurementSAP E-learnNessuna valutazione finora

- How To Calculate Your Quota and Levy Bill: Guidelines For Employers of Work Permit and S Pass HoldersDocumento15 pagineHow To Calculate Your Quota and Levy Bill: Guidelines For Employers of Work Permit and S Pass Holderssiva shankerNessuna valutazione finora

- HRP Session 4 - 5Documento32 pagineHRP Session 4 - 5Manan PCE/ME/14/047Nessuna valutazione finora

- TA - Team Structure Vs ProposedDocumento6 pagineTA - Team Structure Vs ProposedTilak RajNessuna valutazione finora

- Additional Performance Measurement 123Documento7 pagineAdditional Performance Measurement 123Aditi AggarwalNessuna valutazione finora

- 0: Valuation Basis /1: Cumulation Wage Type /2: Averages /3,/4,/6: Taxation /5: Retroactive Handling or Net /8: Factoring Wage Types /a,/x Outflow Wage Types /559 Stands For Bank PaymentDocumento5 pagine0: Valuation Basis /1: Cumulation Wage Type /2: Averages /3,/4,/6: Taxation /5: Retroactive Handling or Net /8: Factoring Wage Types /a,/x Outflow Wage Types /559 Stands For Bank PaymentLokesh DerashriNessuna valutazione finora

- Staff Management Notes 6 4Documento8 pagineStaff Management Notes 6 4Albert PuigvertNessuna valutazione finora

- Monthly Safety Training Report Apr'2023 - (CHANDERIA)Documento17 pagineMonthly Safety Training Report Apr'2023 - (CHANDERIA)drpariharyNessuna valutazione finora

- Nota Detalle Registros LSDDocumento9 pagineNota Detalle Registros LSDClara SackNessuna valutazione finora

- SAP IntroductionDocumento51 pagineSAP IntroductionankitavengNessuna valutazione finora

- SAP Payroll BasicsDocumento19 pagineSAP Payroll Basicsprdeshpande100% (3)

- ERPtips SAP Training Manual SAMPLE CHAPTER From Basic PayrollDocumento20 pagineERPtips SAP Training Manual SAMPLE CHAPTER From Basic Payrollravibabu1620Nessuna valutazione finora

- ERPtips SAP Training Manual SAMPLE CHAPTER From Basic PayrollDocumento20 pagineERPtips SAP Training Manual SAMPLE CHAPTER From Basic PayrollaijlalNessuna valutazione finora

- Chap006 Supplement2 2Documento15 pagineChap006 Supplement2 2abhishek jainNessuna valutazione finora

- Multiple Shift DepreciationDocumento10 pagineMultiple Shift DepreciationRanjit Raje100% (2)

- 4.1 Payroll PDFDocumento19 pagine4.1 Payroll PDFjfmorales100% (1)

- Sap Fico Go Live DetailedCutover ActivitiesDocumento4 pagineSap Fico Go Live DetailedCutover Activitiesanand chawanNessuna valutazione finora

- Daily Activity Tracker. - R - 13072020 - MayDocumento39 pagineDaily Activity Tracker. - R - 13072020 - Maysurnis4onkarNessuna valutazione finora

- Basic Functions in Corporate Finance ManagementDocumento296 pagineBasic Functions in Corporate Finance Managementraky0369Nessuna valutazione finora

- Gratuity ConfigurationDocumento8 pagineGratuity ConfigurationPraveenNessuna valutazione finora

- Manpower Calculator Introduction V1.5Documento18 pagineManpower Calculator Introduction V1.5lisahunNessuna valutazione finora

- Book 1Documento4 pagineBook 1Uday KiranNessuna valutazione finora

- E-Mail: Vimal56@yahoo - Co.in: - 640/7, RAJVIR CLY DELHI-96 Near Mayur Vihar Phase-Iii Contact No: 9873546154 9953778728Documento5 pagineE-Mail: Vimal56@yahoo - Co.in: - 640/7, RAJVIR CLY DELHI-96 Near Mayur Vihar Phase-Iii Contact No: 9873546154 9953778728Uday KiranNessuna valutazione finora

- SAP Payroll Schema. Functions, Rules and Operations - An OverviewDocumento21 pagineSAP Payroll Schema. Functions, Rules and Operations - An OverviewUday KiranNessuna valutazione finora

- Relevant Cases Have To Be Discussed in Each Unit and in Examination Case Is Compulsory From Any UnitDocumento11 pagineRelevant Cases Have To Be Discussed in Each Unit and in Examination Case Is Compulsory From Any UnitUday KiranNessuna valutazione finora

- Read 9788120338722 Sap HR India Payroll Technical Reference and Lea PDFDocumento1 paginaRead 9788120338722 Sap HR India Payroll Technical Reference and Lea PDFUday KiranNessuna valutazione finora

- Mobile Services: Your Account Summary This Month'S ChargesDocumento15 pagineMobile Services: Your Account Summary This Month'S ChargesUday KiranNessuna valutazione finora

- ZTE ZXHN-F660-FTTH-router-English PDFDocumento3 pagineZTE ZXHN-F660-FTTH-router-English PDFUday KiranNessuna valutazione finora

- Nambala - Viswa Kala: Seeking Assignments As Sr. HR Position in HR Department With A High Growth Oriented OrganizationDocumento6 pagineNambala - Viswa Kala: Seeking Assignments As Sr. HR Position in HR Department With A High Growth Oriented OrganizationUday KiranNessuna valutazione finora

- Larry Williams Accumulation DistributionDocumento22 pagineLarry Williams Accumulation DistributionLupistrikis hernandezNessuna valutazione finora

- Elec Midterm ReviewerDocumento16 pagineElec Midterm ReviewerArgie DeguzmanNessuna valutazione finora

- Ihab Yacoub - Resume - JoDocumento5 pagineIhab Yacoub - Resume - JoMuthanna AladwanNessuna valutazione finora

- C0079 ADS Medical Catalog v5 Download SecureDocumento60 pagineC0079 ADS Medical Catalog v5 Download SecureRobertYinglingNessuna valutazione finora

- New CORPORATE INTERNSHIP PROJECT REPORT-2 PDFDocumento82 pagineNew CORPORATE INTERNSHIP PROJECT REPORT-2 PDFAshok KumarNessuna valutazione finora

- Lesson 3 Cost Volume Profit AnalysisDocumento7 pagineLesson 3 Cost Volume Profit AnalysisklipordNessuna valutazione finora

- Cameron MctaggartDocumento2 pagineCameron MctaggartJoao SousaNessuna valutazione finora

- Effectiveness of Social Media As A Marketing Tool An Empirical StudyDocumento9 pagineEffectiveness of Social Media As A Marketing Tool An Empirical StudyJamila Mesha Bautista OrdonezNessuna valutazione finora

- Plag 16-40 PDFDocumento18 paginePlag 16-40 PDFSarthak BharsakaleNessuna valutazione finora

- JomPAY GuideDocumento6 pagineJomPAY GuideSai Arein KiruvanantharNessuna valutazione finora

- A Guide To Claims - FIDIC Red Book 1999Documento14 pagineA Guide To Claims - FIDIC Red Book 1999Ibrahim MohdNessuna valutazione finora

- Mass Media and Society PPT (Grp. 1)Documento25 pagineMass Media and Society PPT (Grp. 1)JeNnifer ManuelNessuna valutazione finora

- Atos SyntelDocumento2 pagineAtos SyntelSharad MoreNessuna valutazione finora

- Sebi Consultation PaperDocumento19 pagineSebi Consultation Paperblack venomNessuna valutazione finora

- Valiant Organics ET (Q4-FY 22)Documento20 pagineValiant Organics ET (Q4-FY 22)beza manojNessuna valutazione finora

- Nbaa SyllabusDocumento133 pagineNbaa SyllabusjoelvalentinorNessuna valutazione finora

- (Nov 11, 2016) CMR - Cash Out To Marek PDFDocumento2 pagine(Nov 11, 2016) CMR - Cash Out To Marek PDFDavid HundeyinNessuna valutazione finora

- What Is ChangeDocumento3 pagineWhat Is ChangeCalonneFrNessuna valutazione finora

- AFAR04-10 Business Combination Date of AcquisitionDocumento3 pagineAFAR04-10 Business Combination Date of AcquisitioneildeeNessuna valutazione finora

- Wallstreetjournaleurope 20160819 The Wall Street Journal EuropeDocumento36 pagineWallstreetjournaleurope 20160819 The Wall Street Journal EuropestefanoNessuna valutazione finora

- Software Requirements:: Goal Oriented REDocumento20 pagineSoftware Requirements:: Goal Oriented REMUHAMMAD AWAIS AFZALNessuna valutazione finora

- INTERNATIONAL TRADE LAW - HTML PDFDocumento111 pagineINTERNATIONAL TRADE LAW - HTML PDFVinod Thomas EfiNessuna valutazione finora

- Form16 Fiserv 2018-19Documento8 pagineForm16 Fiserv 2018-19SiddharthNessuna valutazione finora

- Entertainment-City-Jan 2019 BRICKWORKDocumento6 pagineEntertainment-City-Jan 2019 BRICKWORKPuneet367Nessuna valutazione finora

- A Case Study Ford Motor CompanyDocumento5 pagineA Case Study Ford Motor Companysaleem razaNessuna valutazione finora

- Hesham Saafan - MSC - CPL - Othm: ContactDocumento3 pagineHesham Saafan - MSC - CPL - Othm: Contactnemoo80 nemoo90Nessuna valutazione finora

- Unit 2: Supply, Demand, and Consumer Choice: Do You See The Cow?Documento26 pagineUnit 2: Supply, Demand, and Consumer Choice: Do You See The Cow?ARINNessuna valutazione finora

- ThePowerMBA GLOBALDocumento6 pagineThePowerMBA GLOBALrosadomingobernausNessuna valutazione finora

- eBayReturnLabel 5135454522 PDFDocumento2 pagineeBayReturnLabel 5135454522 PDFsherry webberNessuna valutazione finora

- Ms Thesis Last Final FinalDocumento54 pagineMs Thesis Last Final FinalgizaskenNessuna valutazione finora