Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Book Value Per Share

Caricato da

Glen Javellana100%(1)Il 100% ha trovato utile questo documento (1 voto)

911 visualizzazioni2 pagineThe document provides information on the equity balances of various companies to calculate book value per share (BVPS) of preference and ordinary shares under different conditions. It defines BVPS as the amount a shareholder would receive if the company liquidated and divides the equity by the number of shares outstanding. Several practice calculations are provided to determine the BVPS of preference and ordinary shares based on the capital structure, dividends paid, liquidation preferences, and other features of the preference shares.

Descrizione originale:

Titolo originale

BOOK VALUE PER SHARE

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThe document provides information on the equity balances of various companies to calculate book value per share (BVPS) of preference and ordinary shares under different conditions. It defines BVPS as the amount a shareholder would receive if the company liquidated and divides the equity by the number of shares outstanding. Several practice calculations are provided to determine the BVPS of preference and ordinary shares based on the capital structure, dividends paid, liquidation preferences, and other features of the preference shares.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

100%(1)Il 100% ha trovato utile questo documento (1 voto)

911 visualizzazioni2 pagineBook Value Per Share

Caricato da

Glen JavellanaThe document provides information on the equity balances of various companies to calculate book value per share (BVPS) of preference and ordinary shares under different conditions. It defines BVPS as the amount a shareholder would receive if the company liquidated and divides the equity by the number of shares outstanding. Several practice calculations are provided to determine the BVPS of preference and ordinary shares based on the capital structure, dividends paid, liquidation preferences, and other features of the preference shares.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

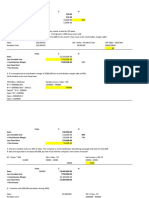

BOOK VALUE PER SHARE 3.

Equity balances f Leslie Company as of the end of the

reporting period follow:

The shareholders’ equity in the statement of financial 12% preference share capital,

position on December 31, 2019 showed the following 200,000 shares, par P100 P20, 000, 000

Ordinary share capital, 500,000 50,000,000

Preference share capital, 12% P100 par,

Shares, par P100

25,000 shares 2,500,000

Share premium 10,000,000

Ordinary share capital 5,000,000

Retained earnings 15,000,000

Share premium 600,000

Retained earnings 3,000,000 The preference shares have a call price of P130, a

Total shareholders’ equity 11,100,000 liquidation price of 115 and dividends have not been paid

for 3 years. The book value per share of preference shares

Dividend have been paid on the preference share up to should be

December 31, 2017.

a. 127 c. 151

Compute the book value per ordinary share and per b. 112 d. 115

preference share under each of the following conditions

with respect to preference share: 4. The shareholders equity of gloomy company on

December 31, 2019 consisted of the following:

1. Preference share is noncumulative and Preference share capital, P100 par

nonparticipating Value. 12% annual dividend 5,000,000

2. Preference share is cumulative and Ordinary share capital, P100 par 15,000,000

nonparticipating Share premium 3,000,000

3. Preference share is cumulative and participating Retained earnings 4,000,000

4. Preference share is cumulative and participating Total 27.000.000

up to 16%

5. Preference share is cumulative, nonparticipating The preference share is noncumulative and

and with liquidation value of P106 per share nonparticipating with a liquidation value of P120 per

share. Preference dividends have been paid up to

December 31, 2019. What is the book value per share of

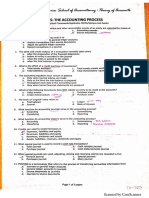

1. Which statement is incorrect regarding book value ordinary?

per share a. 140.00 c. 146.67

a. BVPS is a measure of the level of safety associated b. 136.00 d. 142.67

with each individual share after all debts are paid

accordingly 5. The shareholder equity of Windy Company on

b. BVPS is the amount that a shareholder would get December 31, 2019, consists of the following capital

if the entity were to liquidate. balances:

c. BVPS is computed based on the assumption that Preference share capital, 10%

the amount available for distribution to owners is Cumulative, 3 years in arrears,

equal to the book value of equity. P100 par, P110 liquidation price

d. BVPS is computed by dividing the entity’s profit by 150,000 shares 15,000,000

the number of shares outstanding. Ordinary share capital, P100 par,

200,000 shares 20,000,000

2. The equity balances of Memory Company as of the Subscribed ordinary share capital, net

end of the reporting period are: Of subscription receivable of

Ordinary share capital, P100 par, P4,000,000 6,000,000

360,000 shares 36,000,000 Treasury shares-ordinary, 50,000

Subscribed ordinary share capital, Shares at cost 4,000,000

60,000 shares 6,000,000 Share premium 3,000,000

Subscriptions receivable 2,000,000 Retained earnings 20,000,000

Treasury shares. 20,000 shares, at Book value per share of ordinary is

Cost 3,000,000 a. 156.00 c. 172.00

Retained earnings 10,000,000 b. 190.00 d. 286.67

The book value per ordinary is

a. 122.50 c. 117.50

b. 130.00 d. 125.00

Potrebbero piacerti anche

- Int. Acctg. 3 - Valix2019 - Chapter18Documento29 pagineInt. Acctg. 3 - Valix2019 - Chapter18Toni Rose Hernandez LualhatiNessuna valutazione finora

- FAR-05 Book Value Per ShareDocumento2 pagineFAR-05 Book Value Per ShareKim Cristian MaañoNessuna valutazione finora

- Name: - Score: - Year/Course/Section: - ScheduleDocumento10 pagineName: - Score: - Year/Course/Section: - ScheduleYukiNessuna valutazione finora

- ULO A Analyze Act1Documento5 pagineULO A Analyze Act1Marian B TersonaNessuna valutazione finora

- Earnings Per ShareDocumento2 pagineEarnings Per Sharehae1234Nessuna valutazione finora

- LeasesDocumento5 pagineLeasesCamille BacaresNessuna valutazione finora

- Duyao - Yvonne - Antonette - M2ModuleAssignment-Data FilesDocumento14 pagineDuyao - Yvonne - Antonette - M2ModuleAssignment-Data FilesYvonne DuyaoNessuna valutazione finora

- CFASDocumento4 pagineCFASAlyssa Janette SantosNessuna valutazione finora

- Quiz ReorganizationDocumento7 pagineQuiz ReorganizationJam SurdivillaNessuna valutazione finora

- Chapter 22: Retained Earnings (Dividends)Documento12 pagineChapter 22: Retained Earnings (Dividends)Illion IllionNessuna valutazione finora

- San Beda College Alabang Homework Exercise-Act851RDocumento4 pagineSan Beda College Alabang Homework Exercise-Act851RJomel BaptistaNessuna valutazione finora

- Ch10&11. Shareholders' EquityDocumento29 pagineCh10&11. Shareholders' EquityHazell DNessuna valutazione finora

- Zoleta, Hannah Joy M. Weeks 2 - 3 - AssignmentsDocumento6 pagineZoleta, Hannah Joy M. Weeks 2 - 3 - AssignmentsHannah JoyNessuna valutazione finora

- 3rd ActivityDocumento2 pagine3rd Activitydar •Nessuna valutazione finora

- Bonds Payable: Intermediate Accounting 2Documento38 pagineBonds Payable: Intermediate Accounting 2Rolando Verano TanNessuna valutazione finora

- Use The Following Information For The Next Three Questions:: Book Value Per ShareDocumento6 pagineUse The Following Information For The Next Three Questions:: Book Value Per ShareYazNessuna valutazione finora

- LIABILITYDocumento8 pagineLIABILITYkaviyapriyaNessuna valutazione finora

- CVP Analysis 2 Amp Ratios ExcelDocumento53 pagineCVP Analysis 2 Amp Ratios ExcelSoahNessuna valutazione finora

- IA2 Quiz 1 QuestionsDocumento6 pagineIA2 Quiz 1 QuestionsJames Daniel SwintonNessuna valutazione finora

- Define Business Combination, Identify Its ElementsDocumento4 pagineDefine Business Combination, Identify Its ElementsAljenika Moncada GupiteoNessuna valutazione finora

- Retained Earnings: AssignmentDocumento2 pagineRetained Earnings: Assignmentmaria evangelistaNessuna valutazione finora

- Fixed Income Securities Assignment - Yashasvi Sharma-MBA (FA)Documento3 pagineFixed Income Securities Assignment - Yashasvi Sharma-MBA (FA)Diwakar SHARMANessuna valutazione finora

- Intermediate Accounting Chapters 19 21Documento61 pagineIntermediate Accounting Chapters 19 21Jonathan NavalloNessuna valutazione finora

- Bvps and EpsDocumento30 pagineBvps and EpsRenzo Melliza100% (1)

- Quantitative TechiniquesDocumento7 pagineQuantitative TechiniquesJohn Nowell DiestroNessuna valutazione finora

- Auditing (Problems) Book Value Per ShareDocumento12 pagineAuditing (Problems) Book Value Per ShareJasper Bryan BlagoNessuna valutazione finora

- RFA 2 Part 2Documento26 pagineRFA 2 Part 2Kristelle OngNessuna valutazione finora

- Audit of Shareholders' Equity - July 22, 2021Documento35 pagineAudit of Shareholders' Equity - July 22, 2021Kathrina RoxasNessuna valutazione finora

- This Study Resource Was: Assessment Task 3Documento5 pagineThis Study Resource Was: Assessment Task 3maria evangelistaNessuna valutazione finora

- Mantuhac, Anthony BSA-3Documento3 pagineMantuhac, Anthony BSA-3Anthony Tunying MantuhacNessuna valutazione finora

- 62230126Documento20 pagine62230126ROMULO CUBIDNessuna valutazione finora

- Current LiabilitiesDocumento9 pagineCurrent LiabilitiesErine ContranoNessuna valutazione finora

- Chapter 22 - Retained EarningsDocumento35 pagineChapter 22 - Retained Earningswala akong pake sayoNessuna valutazione finora

- ExamDocumento7 pagineExamKristen WalshNessuna valutazione finora

- Shane CompanyDocumento1 paginaShane CompanyRhitzelynn Ann BarredoNessuna valutazione finora

- 03TaskPerformance1 FinMarDocumento3 pagine03TaskPerformance1 FinMarAilaJeanineNessuna valutazione finora

- Far 6660Documento2 pagineFar 6660Glessy Anne Marie FernandezNessuna valutazione finora

- Re & BVDocumento3 pagineRe & BV-100% (1)

- Switches Can Be Purchased For $8 Per Switch ($200,000) : Baron Co. Incurs The Following Costs To Make 25,000 SwitchesDocumento16 pagineSwitches Can Be Purchased For $8 Per Switch ($200,000) : Baron Co. Incurs The Following Costs To Make 25,000 SwitchesALI HAMEEDNessuna valutazione finora

- Cost Accounting - Exercise 1Documento2 pagineCost Accounting - Exercise 1Anna MaglinteNessuna valutazione finora

- Bonds PayableDocumento7 pagineBonds PayableCarl Yry BitengNessuna valutazione finora

- Ae 211 Solutions-PrelimDocumento10 pagineAe 211 Solutions-PrelimNhel AlvaroNessuna valutazione finora

- PPE Government Grant Borrowing Cost Intangible AssetsDocumento7 paginePPE Government Grant Borrowing Cost Intangible AssetsLian Garl100% (4)

- IA2 Prelim ExamDocumento7 pagineIA2 Prelim ExamJohn FloresNessuna valutazione finora

- Shareholders Equity Part 2Documento15 pagineShareholders Equity Part 2Aira Rhialyn MangubatNessuna valutazione finora

- Shareholders' Equity - ExercisesDocumento5 pagineShareholders' Equity - Exercisesjooo0% (1)

- Ae16 Interm AccDocumento15 pagineAe16 Interm Accana rosemarie enaoNessuna valutazione finora

- Far 129 Notes PayableDocumento3 pagineFar 129 Notes PayableJemwell Pagalanan100% (1)

- This Study Resource WasDocumento4 pagineThis Study Resource WasMarcus MonocayNessuna valutazione finora

- Cabug-Os, Lovely A. (Assignment 9)Documento2 pagineCabug-Os, Lovely A. (Assignment 9)Joylyn CombongNessuna valutazione finora

- Acc 224L 1st Laboratory ExamDocumento13 pagineAcc 224L 1st Laboratory ExamJuziel Rosel PadilloNessuna valutazione finora

- Cae05-Chapter 4 Notes Receivables & Payable Problem DiscussionDocumento12 pagineCae05-Chapter 4 Notes Receivables & Payable Problem DiscussionSteffany RoqueNessuna valutazione finora

- Nova Corporation Book ValueDocumento2 pagineNova Corporation Book ValueNicki Lyn Dela CruzNessuna valutazione finora

- Activity: Basic Earnings Per ShareDocumento2 pagineActivity: Basic Earnings Per Sharebi23450% (1)

- Abc 2Documento2 pagineAbc 2Kath LeynesNessuna valutazione finora

- Activity 3-4 SB CompensationDocumento3 pagineActivity 3-4 SB CompensationNhel Alvaro0% (1)

- She QuizDocumento4 pagineShe QuizJomar Villena100% (1)

- Discussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocumento1 paginaDiscussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNessuna valutazione finora

- The Book Value Per Share (BVPS)Documento3 pagineThe Book Value Per Share (BVPS)XienaNessuna valutazione finora

- Page 1 of 4 Chapter 4 - Intermediate Accounting 3Documento4 paginePage 1 of 4 Chapter 4 - Intermediate Accounting 3happy2408230% (1)

- Sworn DeclarationDocumento1 paginaSworn DeclarationGlen Javellana100% (1)

- Irr On Employees Credit LineDocumento2 pagineIrr On Employees Credit LineGlen JavellanaNessuna valutazione finora

- Statement of Management Responsibility For Annual Income Tax ReturnDocumento1 paginaStatement of Management Responsibility For Annual Income Tax ReturnGlen JavellanaNessuna valutazione finora

- Receipt TemplateDocumento1 paginaReceipt TemplateGlen JavellanaNessuna valutazione finora

- Books of Accounts - ManualDocumento4 pagineBooks of Accounts - ManualGlen JavellanaNessuna valutazione finora

- SMEs - TOA - VALIX 2018 PDFDocumento17 pagineSMEs - TOA - VALIX 2018 PDFHarvey Dienne Quiambao100% (1)

- Operations Operations Operations Operations Manual Manual Manual ManualDocumento2 pagineOperations Operations Operations Operations Manual Manual Manual ManualGlen JavellanaNessuna valutazione finora

- Format of Implementing Rules and RegulationsDocumento6 pagineFormat of Implementing Rules and RegulationsGlen JavellanaNessuna valutazione finora

- xxxSTATEMENT OF MANAGEMENT RESPONSIBILITY FOR ANNUAL INCOME TAX RETURNDocumento1 paginaxxxSTATEMENT OF MANAGEMENT RESPONSIBILITY FOR ANNUAL INCOME TAX RETURNGlen JavellanaNessuna valutazione finora

- 1365464987statement of Financial Positio 3Documento1 pagina1365464987statement of Financial Positio 3Glen JavellanaNessuna valutazione finora

- 3214649879operating SegmentDocumento1 pagina3214649879operating SegmentGlen JavellanaNessuna valutazione finora

- Steps in The Accounting Process (Cycle) : Lecture NotesDocumento12 pagineSteps in The Accounting Process (Cycle) : Lecture NotesGlen JavellanaNessuna valutazione finora

- 211toa PDFDocumento3 pagine211toa PDFGlen JavellanaNessuna valutazione finora

- Chart of Accounts List: AssetsDocumento18 pagineChart of Accounts List: AssetsGlen JavellanaNessuna valutazione finora

- 5134649879operating Segment FinalDocumento8 pagine5134649879operating Segment FinalGlen JavellanaNessuna valutazione finora

- Topic 26 Internal Control Sales Cycle PDFDocumento6 pagineTopic 26 Internal Control Sales Cycle PDFGlen JavellanaNessuna valutazione finora

- C. Either A or B.: Discussion ProblemsDocumento8 pagineC. Either A or B.: Discussion ProblemsGlen JavellanaNessuna valutazione finora

- 13213213operating SegmentDocumento2 pagine13213213operating SegmentGlen JavellanaNessuna valutazione finora

- Steps in The Accounting Process (Cycle) : Lecture NotesDocumento2 pagineSteps in The Accounting Process (Cycle) : Lecture NotesGlen JavellanaNessuna valutazione finora

- Corporation - Organization and FormationDocumento11 pagineCorporation - Organization and FormationJohncel TawatNessuna valutazione finora

- Banking Regulation Act 1949Documento19 pagineBanking Regulation Act 1949Muralidharprasad AyaluruNessuna valutazione finora

- November 2021Documento30 pagineNovember 2021Oni SegunNessuna valutazione finora

- SLOCPI Application For Life Insurance 14june2018Documento9 pagineSLOCPI Application For Life Insurance 14june2018Jovelyn ArgeteNessuna valutazione finora

- Wa0006.Documento5 pagineWa0006.shaniahNessuna valutazione finora

- Introduction To Financial Statements: Prepared by Carol A. Hartley Providence CollegeDocumento71 pagineIntroduction To Financial Statements: Prepared by Carol A. Hartley Providence CollegePraval SaiNessuna valutazione finora

- Banktivity 7 ManualDocumento365 pagineBanktivity 7 ManualSantos Torres Toro, MA Ed. Mus.Nessuna valutazione finora

- Class 11 Business Studies Chapter 8 - Revision NotesDocumento10 pagineClass 11 Business Studies Chapter 8 - Revision NotesJanani RNessuna valutazione finora

- Corporation_Chapter 7Documento8 pagineCorporation_Chapter 7Charles NavarroNessuna valutazione finora

- Project at A Glance TommDocumento5 pagineProject at A Glance TommRed BengalNessuna valutazione finora

- Cta Case No. 6862Documento17 pagineCta Case No. 6862matinikkiNessuna valutazione finora

- Module No 2 - INCOME TAXATION PART1ADocumento11 pagineModule No 2 - INCOME TAXATION PART1APrinces S. RoqueNessuna valutazione finora

- Chapter 7 SolutionsDocumento9 pagineChapter 7 SolutionsMuhammad Naeem100% (3)

- Budgeting 2018Documento13 pagineBudgeting 2018Joemar Santos TorresNessuna valutazione finora

- PTSMN - Bilingual - Konsol - 31 Dec 2019 - Released PDFDocumento153 paginePTSMN - Bilingual - Konsol - 31 Dec 2019 - Released PDFwardah arofahNessuna valutazione finora

- Ias 1 QuestionsDocumento7 pagineIas 1 QuestionsIssa AdiemaNessuna valutazione finora

- Lesson 03. Joint Arrangements - TLADocumento4 pagineLesson 03. Joint Arrangements - TLAMonique VillaNessuna valutazione finora

- Advanced 04 Advanced LBO Model Quiz PDFDocumento24 pagineAdvanced 04 Advanced LBO Model Quiz PDFVineetNessuna valutazione finora

- Motherson SumiDocumento18 pagineMotherson SumivishalNessuna valutazione finora

- CNTX - Icmd 2009 (B03) PDFDocumento4 pagineCNTX - Icmd 2009 (B03) PDFIshidaUryuuNessuna valutazione finora

- FDM Assignment ExampleDocumento31 pagineFDM Assignment ExampleNafiz FahimNessuna valutazione finora

- Please Fill Up Clearly in BLOCK LETTERS and Affix Signature(s) - This Form Is Only Applicable For Individual and In-Trust-For (ITF) AccountsDocumento1 paginaPlease Fill Up Clearly in BLOCK LETTERS and Affix Signature(s) - This Form Is Only Applicable For Individual and In-Trust-For (ITF) AccountsAimniel CacapNessuna valutazione finora

- Financial Statements - Basis of AnalysisDocumento44 pagineFinancial Statements - Basis of AnalysisJasmine ActaNessuna valutazione finora

- Wise & Co., Inc. v. Meer (June 30, 1947)Documento13 pagineWise & Co., Inc. v. Meer (June 30, 1947)Crizza RondinaNessuna valutazione finora

- Financial Accounting CFA510 October 2008Documento23 pagineFinancial Accounting CFA510 October 2008rain06021992Nessuna valutazione finora

- Hipotesis Perataan LabaDocumento7 pagineHipotesis Perataan LabaAchmad ArdanuNessuna valutazione finora

- 2016 4083 4th Evaluation ExamDocumento8 pagine2016 4083 4th Evaluation ExamPatrick ArazoNessuna valutazione finora

- Itc Balance SheetDocumento2 pagineItc Balance SheetRGNNishant BhatiXIIENessuna valutazione finora

- Corporate Governance (Pakistan Journal of Social Sciences) 2019Documento18 pagineCorporate Governance (Pakistan Journal of Social Sciences) 2019Areeba.SulemanNessuna valutazione finora

- FM-financial Statement AnalysisDocumento29 pagineFM-financial Statement AnalysisParamjit Sharma97% (32)