Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

HP - Argus PDF

Caricato da

Jeff SturgeonTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

HP - Argus PDF

Caricato da

Jeff SturgeonCopyright:

Formati disponibili

NYSE: HP

HELMERICH AND PAYNE INC Report created Feb 14, 2020 Page 1 OF 5

Founded in 1920 and headquartered in Tulsa, Oklahoma, Helmerich & Payne, Inc. (H&P) is a petroleum Argus Recommendations

contract drilling company focused on oil and gas well drilling. As of the end of 2018, the company's U.S.

Land division had 238 contracted rigs.

Twelve Month Rating SELL HOLD BUY

Analyst's Notes Five Year Rating SELL HOLD BUY

Analysis by Bill Selesky, February 14, 2020

Under Market Over

ARGUS RATING: HOLD Sector Rating Weight Weight Weight

• Reaffirming HOLD following 1Q20 results Argus assigns a 12-month BUY, HOLD, or SELL rating to each

• Helmerich & Payne has been hurt by persistent oil price volatility and reduced capital spending by its stock under coverage.

E&P customers. This has lowered demand for its drill rigs, resulting in falling utilization rates and • BUY-rated stocks are expected to outperform the market (the

benchmark S&P 500 Index) on a risk-adjusted basis over the

declining margins and earnings. next year.

• On February 3 after the close, Helmerich & Payne reported an adjusted fiscal 1Q20 net profit (for the • HOLD-rated stocks are expected to perform in line with the

period ended December 31, 2019) of $12.3 million or $0.13 per share, compared to an adjusted net market.

loss of $12.7 million or $0.10 per share in the prior-year quarter. EPS missed our estimate of $0.15 • SELL-rated stocks are expected to underperform the market

on a risk-adjusted basis.

but topped the consensus of $0.07.

The distribution of ratings across Argus' entire company

• The swing to an operating profit was attributable to lower operating expenses in both the U.S. Land universe is: 66% Buy, 34% Hold, 0% Sell.

and International Land businesses, as well as higher operating revenues in H&P Technologies and

Offshore Operations. However, total operating revenues declined 17% $614.7 million, above the

consensus of $604.6 million. Key Statistics

Key Statistics pricing data reflects previous trading day's closing

• We are lowering our FY20 EPS estimate to $0.47 from $0.75 based on the weak first-quarter 2020 price. Other applicable data are trailing 12-months unless

results relative to our estimate and our expectations for weaker rig demand in the near term. The otherwise specified

current consensus forecast is $0.50. Market Overview

Price $45.40

INVESTMENT THESIS Target Price --

We are reaffirming our HOLD rating on contract drilling company Helmerich & Payne 52 Week Price Range $35.74 to $64.80

Inc. (NYSE: HP) following fiscal first-quarter 2020 results. HP has been hurt by persistent Shares Outstanding 108.88 Million

oil price volatility and reduced capital spending by its E&P customers. This has lowered Dividend $2.84

demand for its drill rigs, resulting in falling utilization rates and declining margins and Sector Overview

weaker profits. We expect these weak industry conditions to continue over at least the next Sector Energy

several quarters. Sector Rating MARKET WEIGHT

On the positive side, the company has a strong balance sheet and an attractive dividend Total % of S&P 500 Market Cap. 3.00%

yield of about 6.5%. Financial Strength

RECENT DEVELOPMENTS Financial Strength Rating MEDIUM-HIGH

Debt/Capital Ratio 10.7%

HP shares have outperformed thus far in 2020, falling 0.1% while the S&P 500 Energy

Return on Equity 2.1%

index has decreased 9.5%. However, they have underperformed over the past year, Net Margin -0.8%

Payout Ratio 6.04

Market Data Pricing reflects previous trading week's closing price. Current Ratio 2.72

200-Day Moving Average 52 Week High: $46.78 52 Week Low: $39.00 Closed at $42.65 on 2/7 Revenue $2.67 Billion

Price After-Tax Income -$22.01 Million

($)

70

Valuation

Current FY P/E 96.60

60 Prior FY P/E 34.14

50 Price/Sales 1.85

Price/Book 1.24

40

Book Value/Share $36.51

Market Capitalization $4.94 Billion

Rating BUY

HOLD

SELL Forecasted Growth

EPS 1 Year EPS Growth Forecast

($) -64.66%

0.13 0.12 0.11 0.12 0.15 5 Year EPS Growth Forecast

-0.02 -0.04 -0.01 0.19 -0.10 0.56 0.51 0.36 0.19 0.20 0.24

10.00%

Quarterly

0.12 1.33 0.47 ( Estimate) 0.77 ( Estimate)

1 Year Dividend Growth Forecast

Annual

0%

Revenue

($ in Mil.) Risk

Beta 1.15

Quarterly 564.0 577.0 649.0 697.0 741.0 721.0 688.0 649.0 615.0 606.5 620.0 625.8 630.0 628.0 643.6 655.6 Institutional Ownership 90.78%

Annual 2487.0 2799.0 2467.3 ( Estimate) 2557.3 ( Estimate)

FY ends Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Sept 30 2018 2019 2020 2021

Please see important information about this report on page 5

©2020 Argus Research Company Argus Analyst Report

NYSE: HP

HELMERICH AND PAYNE INC Report created Feb 14, 2020 Page 2 OF 5

Analyst's Notes...Continued

declining 20.3% while the Energy index has fallen 13.6%. The Offshore drilling segment reported 1Q operating income of

On February 3 after the close, Helmerich & Payne reported an $6.33 million, down from $7.17 million in the prior-year period.

adjusted fiscal 1Q20 net profit (for the period ended December 31, The decline was driven by higher operating expenses, including

2019) of $12.3 million or $0.13 per share, compared to an expenses for unexpected downtime.

adjusted net loss of $12.7 million or $0.10 per share in the The International Land segment reported a first-quarter

prior-year quarter. EPS missed our estimate of $0.15 but topped operating profit of $3.12 million, compared to a profit of $6.63

the consensus of $0.07. million a year earlier. The decline was largely attributable to lower

The swing to an operating profit was attributable to lower revenues booked in the quarter, which fell 30% from the prior-year

operating expenses in both the U.S. Land and International Land quarter. Foreign currency exchange was unfavorable for the

businesses, as well as higher operating revenues in H&P quarter.

Technologies and Offshore Operations. However, total operating The H&P Technologies segment reported a first-quarter pro

revenues declined 17% $614.7 million, above the consensus of forma operating loss of $4.55 million, compared to an operating

$604.6 million. loss of $6.38 million in the year-earlier quarter. The narrower loss

Helmerich & Payne's segments are U.S. Land (85% of FY19 reflected benefits from a change in the fair value of a contingent

sales), Offshore (5%), and International Land (8%), and H&P liability.

Technologies (2%). We discuss fiscal 1Q20 results for these EARNINGS & GROWTH ANALYSIS

segments below.

The U.S. Land segment posted an operating profit of $56.7 On the 1Q20 conference call to discuss performance results and

million in fiscal 1Q20, down from $75.8 million in 1Q19. The the outlook looking ahead, CEO John Lindsay noted that business

decline reflected lower revenue days and lower rig margins. conditions remained challenging due to reduced capital spending

Operating revenues fell 18% in 1Q20, while rig utilization by E&P operators and were likely to remain so through at least the

averaged 64%, down from 68% in the year-earlier period. As of first half of FY20.

February 3, 2020, the U.S. Land division had 197 contracted rigs We are lowering our FY20 EPS estimate to $0.47 from $0.75

(128 on term contract and 69 on spot contract) generating revenue. based on the weak first-quarter 2020 results relative to our

This compares to 194 contracted rigs at the end of September estimate and our expectations for weaker rig demand in the near

2019. term. The current consensus forecast is $0.50.

Growth & Valuation Analysis Financial & Risk Analysis

GROWTH ANALYSIS

($ in Millions, except per share data) 2015 2016 2017 2018 2019

FINANCIAL STRENGTH 2017 2018 2019

Revenue 3,162 1,624 1,805 2,487 2,798

Cash ($ in Millions) 521 284 348

COGS 2,312 1,497 1,835 2,236 2,371

Working Capital ($ in Millions) 891 738 705

Gross Profit 850 127 -30 251 427

Current Ratio 3.59 2.96 2.72

SG&A 135 146 148 199 194

LT Debt/Equity Ratio (%) 11.8 11.3 11.9

R&D 16 10 12 18 27

Total Debt/Equity Ratio (%) 11.8 11.3 11.9

Operating Income 699 -30 -190 33 205

Interest Expense 9 20 14 16 16 RATIOS (%)

Pretax Income 662 -73 -185 16 -51 Gross Profit Margin -1.7 10.1 15.3

Income Taxes 241 -20 -57 -477 -19 Operating Margin -10.5 1.3 7.3

Tax Rate (%) 36 — — — — Net Margin -7.2 19.2 -1.3

Net Income 420 -57 -128 483 -34 Return On Assets -2.0 7.6 -0.6

Diluted Shares Outstanding 109 108 109 109 109 Return On Equity -3.0 11.2 -0.9

EPS 3.85 -0.54 -1.20 4.37 -0.34

RISK ANALYSIS

Dividend 2.75 2.76 2.80 2.81 2.84

Cash Cycle (days) 72.3 70.4 68.7

GROWTH RATES (%) Cash Flow/Cap Ex 0.9 1.2 1.9

Revenue -15.0 -48.8 11.3 38.0 12.6 Oper. Income/Int. Exp. (ratio) -8.3 1.7 -1.0

Operating Income -32.4 — — — 513.8 Payout Ratio — 76.1 62.9

Net Income -40.5 — — — —

EPS -40.2 — — — — The data contained on this page of this report has been

Dividend 12.8 0.5 1.3 0.4 1.1 provided by Morningstar, Inc. (© 2020 Morningstar, Inc.

Sustainable Growth Rate 2.5 -3.9 — 4.2 -5.4 All Rights Reserved). This data (1) is proprietary to

VALUATION ANALYSIS Morningstar and/or its content providers; (2) may not be

Price: High $79.90 $85.78 $81.30 $75.02 $64.80 copied or distributed; and (3) is not warranted to be

Price: Low $46.16 $40.02 $42.16 $44.56 $35.74 accurate, complete or timely. Neither Morningstar nor its

content providers are responsible for any damages or

Price/Sales: High-Low 2.7 - 1.6 5.7 - 2.7 4.9 - 2.5 3.3 - 2.0 2.5 - 1.4

losses arising from any use of this information. Past

P/E: High-Low 20.8 - 12.0 —-— —-— 17.2 - 10.2 —-—

performance is no guarantee of future results. This data

Price/Cash Flow: High-Low 6.1 - 3.5 12.3 - 5.7 24.7 - 12.8 15.1 - 9.0 8.3 - 4.6 is set forth herein for historical reference only and is not

necessarily used in Argus’ analysis of the stock set forth

on this page of this report or any other stock or other

security. All earnings figures are in GAAP.

Please see important information about this report on page 5

©2020 Argus Research Company Argus Analyst Report

NYSE: HP

HELMERICH AND PAYNE INC Report created Feb 14, 2020 Page 3 OF 5

Analyst's Notes...Continued

We are also reducing our FY21 EPS estimate to $0.77 from MANAGEMENT & RISKS

$1.03 to reflect ongoing challenging conditions within the sector John W. Lindsay became chief executive officer of Helmerich &

and our assumptions for a continued weak margin environment for Payne in March 2014 succeeding Hans Helmerich. Mr. Lindsay

drill rig providers. The current FY21 consensus forecast is $0.69. joined the company in 1987 as a drilling engineer.

FINANCIAL STRENGTH & DIVIDEND The Oil Services, Drilling and Equipment industry is one of the

We rate HP's financial strength as Medium-High, the most volatile and unpredictable industries in the S&P 500. The

second-highest rating on our five-point scale. The company's debt main investment risk is the overall health of the global economy,

is rated BBB+/stable by Standard & Poor's and Baa1/stable by though the industry also faces significant geopolitical risk.

Moody's. COMPANY DESCRIPTION

At the end of fiscal 1Q20, HP's total debt/capitalization ratio Founded in 1920 and headquartered in Tulsa, Oklahoma,

was 11.8%, up from 10.2% a year earlier. The total debt/cap ratio Helmerich & Payne, Inc. (H&P) is a petroleum contract drilling

remains well below the peer average and has averaged 10.3% over company focused on oil and gas well drilling. As of the end of

the past five years. 2018, the company's U.S. Land division had 238 contracted rigs.

Helmerich & Payne had total debt of $531.54 million at the

end of 1Q20, compared to $499.81 million at the end of 1Q19. VALUATION

The company has access to $750 million in liquidity under its new HP shares have traded between $35.74 and $64.80 over the

revolving credit facility. past 52 weeks and are currently 11% below the midpoint of the

HP had cash and cash equivalents of $355 million at the end of range. The shares reached a near-term peak in late April but fell

1Q20, compared to $229 million at the end of 1Q19. Cash from below $37 in early September and again in early October on

operating activities totaled $112 million in 1Q20, compared to investor concerns about falling E&P capital budgets in 2020. The

$210 million a year earlier. shares have recovered modestly over the last several weeks.

In August 2018, Helmerich & Payne raised its quarterly P/E multiples are not particularly useful for valuation purposes

dividend by 1.4% to $0.71 per share or $2.84 annually, for a yield given our relatively low EPS estimates for both FY20 and FY21.

of about 6.4%. Our dividend estimates are $2.84 for both FY20 The shares are trading at a trailing price/book multiple of 1.2, at

and FY21. the low end of the historical range of 1.2-2.0; at a price/sales

Peer & Industry Analysis

The graphics in this section are designed to

P/E

allow investors to compare HP versus its Growth

industry peers, the broader sector, and the HP vs.

market as a whole, as defined by the Argus Market

NOV

Universe of Coverage. HP vs.

1,000 Sector

• The scatterplot shows how HP stacks up More Value More Growth

versus its peers on two key

characteristics: long-term growth and Price/Sales

value. In general, companies in the lower HP vs.

left-hand corner are more value-oriented, Market

while those in the upper right-hand corner 500 HP vs.

are more growth-oriented. Sector

More Value More Growth

• The table builds on the scatterplot by

displaying more financial information. Price/Book

• The bar charts on the right take the HP

BKR SLB

HAL HP vs.

analysis two steps further, by broadening 0 RIG Market

the comparison groups into the sector HP vs.

level and the market as a whole. This tool Sector

is designed to help investors understand More Value More Growth

Value

P/E

how HP might fit into or modify a PEG

5 10 15

diversified portfolio.

5-yr Growth Rate(%) HP vs.

Market

5-yr Net 1-yr EPS HP vs.

Market Cap Growth Current Margin Growth Argus Sector

More Value More Growth

Ticker Company ($ in Millions) Rate (%) FY P/E (%) (%) Rating

SLB Schlumberger Ltd. 48,001 8.0 20.6 -30.8 18.5 BUY 5 Year Growth

HAL Halliburton Co. 19,525 8.0 17.8 -5.0 4.0 HOLD HP vs.

BKR Baker Hughes Co 14,429 5.0 16.7 .5 25.0 BUY Market

HP vs.

NOV National Oilwell Varco Inc. 9,008 7.0 1,167.0 -71.9 3,750.0 BUY Sector

HP Helmerich & Payne, Inc. 4,943 10.0 96.6 -.8 63.8 HOLD More Value More Growth

RIG Transocean Ltd 2,851 15.0 -3.7 -47.5 55.2 HOLD Debt/Capital

Peer Average 16,460 8.8 219.2 -25.9 652.7

HP vs.

Market

HP vs.

Sector

More Value More Growth

Please see important information about this report on page 5

©2020 Argus Research Company Argus Analyst Report

NYSE: HP

HELMERICH AND PAYNE INC

Report created Feb 14, 2020 Page 4 OF 5

Analyst's Notes...Continued

multiple of 1.8, below the low end of the range of 1.9-3.6; and at a

price/cash flow multiple of 6.4, below the midpoint of the range of

5.9-11.4.

Despite these relatively low multiples, we believe that weak

E&P capital spending will lower demand for the company's

FlexRigs in the coming quarters. We also believe that improvement

in E&P spending will require sustainable oil prices near $60 per

barrel. As such, we are maintaining our HOLD rating on HP.

On February 14 at midday, HOLD-rated HP traded at $45.14,

down $0.26.

Please see important information about this report on page 5

©2020 Argus Research Company Argus Analyst Report

NYSE: HP

METHODOLOGY & DISCLAIMERS Report created Feb 14, 2020 Page 5 OF 5

About Argus

Argus Research, founded by Economist Harold Dorsey in 1934, And finally, Argus’ Valuation Analysis model integrates a

has built a top-down, fundamental system that is used by Argus historical ratio matrix, discounted cash flow modeling, and peer

analysts. This six-point system includes Industry Analysis, Growth comparison.

Analysis, Financial Strength Analysis, Management Assessment, THE ARGUS RESEARCH RATING SYSTEM

Risk Analysis and Valuation Analysis. Argus uses three ratings for stocks: BUY, HOLD, and SELL.

Utilizing forecasts from Argus’ Economist, the Industry Analysis Stocks are rated relative to a benchmark, the S&P 500.

identifies industries expected to perform well over the next • A BUY-rated stock is expected to outperform the S&P 500 on

one-to-two years. a risk-adjusted basis over a 12-month period. To make this

The Growth Analysis generates proprietary estimates for determination, Argus Analysts set target prices, use beta as the

companies under coverage. measure of risk, and compare expected risk-adjusted stock

In the Financial Strength Analysis, analysts study ratios to returns to the S&P 500 forecasts set by the Argus Market

understand profitability, liquidity and capital structure. Strategist.

During the Management Assessment, analysts meet with and • A HOLD-rated stock is expected to perform in line with the

familiarize themselves with the processes of corporate management S&P 500.

teams. • A SELL-rated stock is expected to underperform the S&P 500.

Quantitative trends and qualitative threats are assessed under

the Risk Analysis.

Argus Research Disclaimer

Argus Research Co. (ARC) is an independent investment research provider whose parent company, Argus Investors’ Counsel, Inc. (AIC), is registered with the U.S. Securities and

Exchange Commission. Argus Investors’ Counsel is a subsidiary of The Argus Research Group, Inc. Neither The Argus Research Group nor any affiliate is a member of the FINRA or

the SIPC. Argus Research is not a registered broker dealer and does not have investment banking operations. The Argus trademark, service mark and logo are the intellectual

property of The Argus Research Group, Inc. The information contained in this research report is produced and copyrighted by Argus Research Co., and any unauthorized use,

duplication, redistribution or disclosure is prohibited by law and can result in prosecution. The content of this report may be derived from Argus research reports, notes, or analyses.

The opinions and information contained herein have been obtained or derived from sources believed to be reliable, but Argus makes no representation as to their timeliness,

accuracy or completeness or for their fitness for any particular purpose. In addition, this content is not prepared subject to Canadian disclosure requirements. This report is not an

offer to sell or a solicitation of an offer to buy any security. The information and material presented in this report are for general information only and do not specifically address

individual investment objectives, financial situations or the particular needs of any specific person who may receive this report. Investing in any security or investment strategies

discussed may not be suitable for you and it is recommended that you consult an independent investment advisor. Nothing in this report constitutes individual investment, legal or

tax advice. Argus may issue or may have issued other reports that are inconsistent with or may reach different conclusions than those represented in this report, and all opinions are

reflective of judgments made on the original date of publication. Argus is under no obligation to ensure that other reports are brought to the attention of any recipient of this report.

Argus shall accept no liability for any loss arising from the use of this report, nor shall Argus treat all recipients of this report as customers simply by virtue of their receipt of this

material. Investments involve risk and an investor may incur either profits or losses. Past performance should not be taken as an indication or guarantee of future performance.

Argus has provided independent research since 1934. Argus officers, employees, agents and/or affiliates may have positions in stocks discussed in this report. No Argus officers,

employees, agents and/or affiliates may serve as officers or directors of covered companies, or may own more than one percent of a covered company’s stock. Argus Investors’

Counsel (AIC), a portfolio management business based in Stamford, Connecticut, is a customer of Argus Research Co. (ARC), based in New York. Argus Investors’ Counsel pays Argus

Research Co. for research used in the management of the AIC core equity strategy and model portfolio and UIT products, and has the same access to Argus Research Co. reports as

other customers. However, clients and prospective clients should note that Argus Investors’ Counsel and Argus Research Co., as units of The Argus Research Group, have certain

employees in common, including those with both research and portfolio management responsibilities, and that Argus Research Co. employees participate in the management and

marketing of the AIC core equity strategy and UIT and model portfolio products.

Morningstar Disclaimer

© 2020 Morningstar, Inc. All Rights Reserved. Certain financial information included in this report: (1) is proprietary to Morningstar and/or its content providers; (2) may not be

copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising

from any use of this information. Past performance is no guarantee of future results.

©2020 Argus Research Company Argus Analyst Report

Potrebbero piacerti anche

- How to Select Investment Managers and Evaluate Performance: A Guide for Pension Funds, Endowments, Foundations, and TrustsDa EverandHow to Select Investment Managers and Evaluate Performance: A Guide for Pension Funds, Endowments, Foundations, and TrustsNessuna valutazione finora

- EPD - Argus PDFDocumento5 pagineEPD - Argus PDFJeff SturgeonNessuna valutazione finora

- Argus Analyst ReportDocumento7 pagineArgus Analyst ReportEr DiNessuna valutazione finora

- OKE - ArgusDocumento5 pagineOKE - ArgusJeff SturgeonNessuna valutazione finora

- Options As A Strategic Investment PDFDocumento5 pagineOptions As A Strategic Investment PDFArjun Bora100% (1)

- Hi-Crush Partners LP: U.S. ResearchDocumento6 pagineHi-Crush Partners LP: U.S. ResearchtheredcornerNessuna valutazione finora

- Argus - DLR PDFDocumento5 pagineArgus - DLR PDFJeff SturgeonNessuna valutazione finora

- Digital Realty Trust Inc: Analyst's NotesDocumento5 pagineDigital Realty Trust Inc: Analyst's NotesJeff SturgeonNessuna valutazione finora

- United Spirits: Inflationary Pressures Darken Near-Term Outlook Retaining A HoldDocumento6 pagineUnited Spirits: Inflationary Pressures Darken Near-Term Outlook Retaining A HoldSatya JagadishNessuna valutazione finora

- AMAZON 040809 Earnings PreviewDocumento13 pagineAMAZON 040809 Earnings PreviewBrian BolanNessuna valutazione finora

- Owl Rock Capital Corporation: Quarterly Earnings PresentationDocumento18 pagineOwl Rock Capital Corporation: Quarterly Earnings PresentationMiguel RamosNessuna valutazione finora

- Gridsum Holding Inc.Documento254 pagineGridsum Holding Inc.vicr100Nessuna valutazione finora

- S&P Morning Briefing 20 November 2018Documento7 pagineS&P Morning Briefing 20 November 2018Abdullah18Nessuna valutazione finora

- MongoDB ProspectusDocumento210 pagineMongoDB ProspectusTorrey NommesenNessuna valutazione finora

- Managerial Accounting 16th Ed Textbook Solutions Manual Chapter 15Documento51 pagineManagerial Accounting 16th Ed Textbook Solutions Manual Chapter 15car itselfNessuna valutazione finora

- OKE - SchwabDocumento5 pagineOKE - SchwabJeff SturgeonNessuna valutazione finora

- Goldman Sachs Group Inc (The) : Stock Report - September 24, 2016 - NYS Symbol: GS - GS Is in The S&P 500Documento11 pagineGoldman Sachs Group Inc (The) : Stock Report - September 24, 2016 - NYS Symbol: GS - GS Is in The S&P 500derek_2010Nessuna valutazione finora

- Unit 5 Steps of Credit Analysis Profitability AnalysisDocumento4 pagineUnit 5 Steps of Credit Analysis Profitability AnalysisVISHAL VERMANessuna valutazione finora

- Housing Development Finance Corporation: Growth With QualityDocumento5 pagineHousing Development Finance Corporation: Growth With QualitydarshanmadeNessuna valutazione finora

- CohenSteers Covered Call 2019 3 FCDocumento2 pagineCohenSteers Covered Call 2019 3 FCA RNessuna valutazione finora

- MDP - SchwabDocumento5 pagineMDP - SchwabJeff SturgeonNessuna valutazione finora

- Weather Dominates Fundamentals: Global Equity ResearchDocumento19 pagineWeather Dominates Fundamentals: Global Equity ResearchForexliveNessuna valutazione finora

- AngelTopPicks N 2022Documento12 pagineAngelTopPicks N 2022Venkatesh BudhaNessuna valutazione finora

- The Home Depot Inc.Documento13 pagineThe Home Depot Inc.snazruli67% (3)

- "4Q08 Earnings Update": Long Term Rating: Market Underperform Long Term Target Price: $45Documento8 pagine"4Q08 Earnings Update": Long Term Rating: Market Underperform Long Term Target Price: $45Brian BolanNessuna valutazione finora

- CohenSteers Convertible Inc 2019-2 FCDocumento2 pagineCohenSteers Convertible Inc 2019-2 FCA RNessuna valutazione finora

- Insurance Stocks AnalysisDocumento38 pagineInsurance Stocks AnalysisAnjaiah PittalaNessuna valutazione finora

- Adobe Systems Inc: Stock Report - August 12, 2017 - NNM Symbol: ADBE - ADBE Is in The S&P 500Documento9 pagineAdobe Systems Inc: Stock Report - August 12, 2017 - NNM Symbol: ADBE - ADBE Is in The S&P 500Santi11052009Nessuna valutazione finora

- J.P. 摩根-美股-保险行业-2021年财险预览:商业再保险保险价格和自动频率顺风顺水-2021.1.4-83页Documento85 pagineJ.P. 摩根-美股-保险行业-2021年财险预览:商业再保险保险价格和自动频率顺风顺水-2021.1.4-83页HungNessuna valutazione finora

- OTB - 170623 - Still A Nice Cup of Coffee - ADBSDocumento10 pagineOTB - 170623 - Still A Nice Cup of Coffee - ADBSNishanth K SNessuna valutazione finora

- DDR RVT Spin Dec 2017 Presentation Deck PDFDocumento31 pagineDDR RVT Spin Dec 2017 Presentation Deck PDFAla BasterNessuna valutazione finora

- MGY March2020 Investor PresentationDocumento26 pagineMGY March2020 Investor PresentationDan NadNessuna valutazione finora

- First Solar, Inc. (FSLR) : 3 - NeutralDocumento6 pagineFirst Solar, Inc. (FSLR) : 3 - NeutralCarlos TresemeNessuna valutazione finora

- IUBAV - Lecture 4 - Module 2 Financial Ratios Analysis and Market Tests (S1 2023 2024)Documento27 pagineIUBAV - Lecture 4 - Module 2 Financial Ratios Analysis and Market Tests (S1 2023 2024)nguyengianhi1913316118Nessuna valutazione finora

- Philippine Market Strategy: Adjusting Estimates On Rollover To 2020Documento4 paginePhilippine Market Strategy: Adjusting Estimates On Rollover To 2020JNessuna valutazione finora

- Sanofi Sa: Analyst's NotesDocumento5 pagineSanofi Sa: Analyst's NotesJeff SturgeonNessuna valutazione finora

- Argus - SNY PDFDocumento5 pagineArgus - SNY PDFJeff SturgeonNessuna valutazione finora

- AbacusShortTakes 09082022Documento7 pagineAbacusShortTakes 09082022ignaciomannyNessuna valutazione finora

- 财务、企业理财、权益、其他Documento110 pagine财务、企业理财、权益、其他Ariel MengNessuna valutazione finora

- IDirect BoI ShubhNivesh 15jan24Documento4 pagineIDirect BoI ShubhNivesh 15jan24Naveen KumarNessuna valutazione finora

- Anexo (-) - Barclays - Still Early Days On Pricing Mechanism PDFDocumento36 pagineAnexo (-) - Barclays - Still Early Days On Pricing Mechanism PDFAnonymous ljwrO9yFNessuna valutazione finora

- GAAP (India V/s US)Documento17 pagineGAAP (India V/s US)rochu88Nessuna valutazione finora

- Vanguard Dividend Growth Fund Investor (VDIGX) : Ranking CommentaryDocumento6 pagineVanguard Dividend Growth Fund Investor (VDIGX) : Ranking Commentarydarwin12Nessuna valutazione finora

- CohenSteers Convertible Inc 2019-4 FCDocumento2 pagineCohenSteers Convertible Inc 2019-4 FCA RNessuna valutazione finora

- J.P. 摩根-美股-保险行业-2021年寿险业展望:L-T基本面不佳,但业绩改善和估值低迷是利好-2021.1.5-102页Documento104 pagineJ.P. 摩根-美股-保险行业-2021年寿险业展望:L-T基本面不佳,但业绩改善和估值低迷是利好-2021.1.5-102页HungNessuna valutazione finora

- Stock Update: Divis LaboratoriesDocumento3 pagineStock Update: Divis LaboratoriesdarshanmadeNessuna valutazione finora

- Restaurant Brands International: Investment BriefDocumento4 pagineRestaurant Brands International: Investment BriefrickescherNessuna valutazione finora

- Ratio AnalysisDocumento14 pagineRatio AnalysissnsahuNessuna valutazione finora

- 2020-06-30-PGOLD - PS-Sadif Analytics Prim-Will Puregold Price Club Inc Deliver Long-Term Returns-88986263Documento12 pagine2020-06-30-PGOLD - PS-Sadif Analytics Prim-Will Puregold Price Club Inc Deliver Long-Term Returns-88986263PatrickBeronaNessuna valutazione finora

- Cie LKPDocumento9 pagineCie LKPRajiv HandaNessuna valutazione finora

- CohenSteers Convertible Inc 2019-3 FCDocumento2 pagineCohenSteers Convertible Inc 2019-3 FCA RNessuna valutazione finora

- NeuStar Argus 12.6.08Documento8 pagineNeuStar Argus 12.6.08Dinesh MoorjaniNessuna valutazione finora

- Money Manifesto First Issue VolDocumento15 pagineMoney Manifesto First Issue VolKiran MaadamshettiNessuna valutazione finora

- Harvard Simulation Explanation SheetDocumento2 pagineHarvard Simulation Explanation SheetBansil GhodasaraNessuna valutazione finora

- RBC - ARCC - Revision - 3Q20 Review - 13 PagesDocumento13 pagineRBC - ARCC - Revision - 3Q20 Review - 13 PagesSagar PatelNessuna valutazione finora

- Ares Investor Presentation: March 2018Documento37 pagineAres Investor Presentation: March 2018sandipktNessuna valutazione finora

- Astrazeneca PLC: Analyst's NotesDocumento5 pagineAstrazeneca PLC: Analyst's NotesgogojamzNessuna valutazione finora

- AFC Gamma Inc. $16.08 Rating: Positive Very PositiveDocumento3 pagineAFC Gamma Inc. $16.08 Rating: Positive Very Positivephysicallen1791Nessuna valutazione finora

- Financial Management 9Documento23 pagineFinancial Management 9charithNessuna valutazione finora

- Heinz Research Report JP MorganDocumento9 pagineHeinz Research Report JP MorganKeshav soodNessuna valutazione finora

- MMP - RatingsDocumento4 pagineMMP - RatingsJeff SturgeonNessuna valutazione finora

- Schwab Ratios User GuideDocumento2 pagineSchwab Ratios User GuideJeff SturgeonNessuna valutazione finora

- EPD - Schwab PDFDocumento16 pagineEPD - Schwab PDFJeff SturgeonNessuna valutazione finora

- HEP - Ratings PDFDocumento4 pagineHEP - Ratings PDFJeff SturgeonNessuna valutazione finora

- OHI - RatingsDocumento4 pagineOHI - RatingsJeff SturgeonNessuna valutazione finora

- OKE - SchwabDocumento5 pagineOKE - SchwabJeff SturgeonNessuna valutazione finora

- OKE - RatingsDocumento4 pagineOKE - RatingsJeff SturgeonNessuna valutazione finora

- MDP - SchwabDocumento5 pagineMDP - SchwabJeff SturgeonNessuna valutazione finora

- Cfra - TmusDocumento9 pagineCfra - TmusJeff SturgeonNessuna valutazione finora

- MMP - SchwabDocumento17 pagineMMP - SchwabJeff SturgeonNessuna valutazione finora

- MDP - RatingsDocumento4 pagineMDP - RatingsJeff SturgeonNessuna valutazione finora

- Leibold RF Weaver 3B Collins 2B Jackson LF Felsch CF Gandil 1B Risberg SS Schalk C PDocumento12 pagineLeibold RF Weaver 3B Collins 2B Jackson LF Felsch CF Gandil 1B Risberg SS Schalk C PJeff SturgeonNessuna valutazione finora

- Aztec Gold Dry RubDocumento9 pagineAztec Gold Dry RubJeff SturgeonNessuna valutazione finora

- Morningstar - TMUSDocumento15 pagineMorningstar - TMUSJeff SturgeonNessuna valutazione finora

- Betts RF Benintendi LF Bogearts SS Martinez DH Devers 3B Nunez 2B Holt 1B Leon C Bradley Jr. CFDocumento16 pagineBetts RF Benintendi LF Bogearts SS Martinez DH Devers 3B Nunez 2B Holt 1B Leon C Bradley Jr. CFJeff SturgeonNessuna valutazione finora

- Byrne 3B Leach CF Clarke LF Wagner SS Miller 2B Abstein 1B Wilson RF Gibson C PDocumento12 pagineByrne 3B Leach CF Clarke LF Wagner SS Miller 2B Abstein 1B Wilson RF Gibson C PJeff SturgeonNessuna valutazione finora

- Slagle CF Sheckard LF Schulte RF Chance 1B Steinfeldt 3B Tinker SS Evers 2B Kling C PDocumento12 pagineSlagle CF Sheckard LF Schulte RF Chance 1B Steinfeldt 3B Tinker SS Evers 2B Kling C PJeff SturgeonNessuna valutazione finora

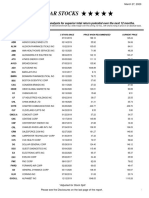

- Five Star StocksDocumento5 pagineFive Star StocksJeff SturgeonNessuna valutazione finora

- Argus - TMUSDocumento6 pagineArgus - TMUSJeff SturgeonNessuna valutazione finora

- Browne RF Donlin CF Mcgann 1B Mertes LF Dahlen Ss Devlin 3B Gilbert 2B Bresnahan C PDocumento12 pagineBrowne RF Donlin CF Mcgann 1B Mertes LF Dahlen Ss Devlin 3B Gilbert 2B Bresnahan C PJeff SturgeonNessuna valutazione finora

- Digital Realty Trust Inc: Analyst's NotesDocumento5 pagineDigital Realty Trust Inc: Analyst's NotesJeff SturgeonNessuna valutazione finora

- Argus - DLR PDFDocumento5 pagineArgus - DLR PDFJeff SturgeonNessuna valutazione finora

- Argus - SNY PDFDocumento5 pagineArgus - SNY PDFJeff SturgeonNessuna valutazione finora

- Sanofi Sa: Analyst's NotesDocumento5 pagineSanofi Sa: Analyst's NotesJeff SturgeonNessuna valutazione finora

- Home Price Indices DefineDocumento2 pagineHome Price Indices DefineanandubeyNessuna valutazione finora

- Employee Communication EffectivenessDocumento118 pagineEmployee Communication EffectivenessRaja Reddy100% (1)

- Yankee Candle Brand AuditDocumento7 pagineYankee Candle Brand AuditLaurenHouseNessuna valutazione finora

- Financial Model - Colgate Palmolive (Solved) : Prepared by Dheeraj Vaidya, CFA, FRMDocumento27 pagineFinancial Model - Colgate Palmolive (Solved) : Prepared by Dheeraj Vaidya, CFA, FRMMehmet Isbilen100% (1)

- Updates (Company Update)Documento6 pagineUpdates (Company Update)Shyam SunderNessuna valutazione finora

- A 4.5 FM Notes UNIT 1-2-3Documento28 pagineA 4.5 FM Notes UNIT 1-2-3Gaurav vaidyaNessuna valutazione finora

- Financial System of ColombiaDocumento14 pagineFinancial System of ColombiaSantiago Aguirre CastiblancoNessuna valutazione finora

- The Equity Method of Accounting For Investments: Chapter OneDocumento40 pagineThe Equity Method of Accounting For Investments: Chapter Onerendy adiwigunaNessuna valutazione finora

- (Marat Terterov) Ukraine Since The Orange RevolutiDocumento55 pagine(Marat Terterov) Ukraine Since The Orange Revoluti13SNicholasNessuna valutazione finora

- 4dbe52c73b395 - Company Act (Dhivehi)Documento26 pagine4dbe52c73b395 - Company Act (Dhivehi)Mohamed MiuvaanNessuna valutazione finora

- Nama: Putri Nabilah NIM: 041911333169 Tanggal: 27 Maret 2020Documento5 pagineNama: Putri Nabilah NIM: 041911333169 Tanggal: 27 Maret 2020Putri NabilahNessuna valutazione finora

- List I List II (Personality) (Portfolio)Documento14 pagineList I List II (Personality) (Portfolio)Ratnesh TiwariNessuna valutazione finora

- Mathematics: Dispersion Trading Based On The Explanatory Power of S&P 500 Stock ReturnsDocumento22 pagineMathematics: Dispersion Trading Based On The Explanatory Power of S&P 500 Stock ReturnsArnaud FreycenetNessuna valutazione finora

- Chapter 1 SubmittedDocumento23 pagineChapter 1 SubmittedChu ChuNessuna valutazione finora

- Unit 3-Time Value of MoneyDocumento12 pagineUnit 3-Time Value of MoneyGizaw BelayNessuna valutazione finora

- Case Study by MINDADocumento4 pagineCase Study by MINDAakhileshguptamnreNessuna valutazione finora

- Run of River PowerplantDocumento22 pagineRun of River PowerplantPatrick John WorsoeNessuna valutazione finora

- Novation of ContractDocumento2 pagineNovation of ContractZaman Ali100% (1)

- Investment Property - DQDocumento3 pagineInvestment Property - DQKryztal TalaveraNessuna valutazione finora

- Medtech Startup For Cardiomo Raised A New Round of InvestmentsDocumento2 pagineMedtech Startup For Cardiomo Raised A New Round of InvestmentsPR.comNessuna valutazione finora

- Introduction To InsuranceDocumento308 pagineIntroduction To InsuranceBOB JAHANABADNessuna valutazione finora

- Tutorial 10 PFPDocumento6 pagineTutorial 10 PFPWinjie PangNessuna valutazione finora

- Nepalese Film Industries - EssayDocumento4 pagineNepalese Film Industries - EssayRex ShresthaNessuna valutazione finora

- Economics Report Group 4Documento14 pagineEconomics Report Group 4AKSHAY SURANA100% (1)

- For UPSDocumento16 pagineFor UPSkeyur0% (1)

- Blackbook M&aDocumento74 pagineBlackbook M&aSiddhartha100% (1)

- Estimating The Demand Elasticity of Cinema AttendanceDocumento13 pagineEstimating The Demand Elasticity of Cinema AttendancePaul WillisNessuna valutazione finora

- The Joyful Heart by Schauffler, Robert Haven, 1879-1964Documento68 pagineThe Joyful Heart by Schauffler, Robert Haven, 1879-1964Gutenberg.orgNessuna valutazione finora

- The Political and Legal Environments Facing BusinessDocumento3 pagineThe Political and Legal Environments Facing BusinessKuthubudeen T MNessuna valutazione finora

- Test Bank Chapter 7 Investment BodieDocumento44 pagineTest Bank Chapter 7 Investment BodieTami Doan100% (1)