Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Proforma Financial Statements

Caricato da

Aadi Khan0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

26 visualizzazioni7 pagineCopyright

© © All Rights Reserved

Formati disponibili

XLSX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato XLSX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

26 visualizzazioni7 pagineProforma Financial Statements

Caricato da

Aadi KhanCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato XLSX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 7

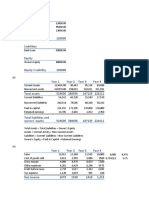

BALNCE SHEET 2006 Assumptions 2007

13 Cash 10000 1M Increase 11000

14 Accounts Receivable 21250 8.5% of Sales 27625

15 Inventory 25000 10% of sales 32500

16 Current assets 56250 71125

6 Gross fixed assets 80000 20 M Increase 100000

9 less:acumulated depriciation 20000 15M dep Increase 35000

10 Net fixed assets 60000 65000

Total Assets 116250 136125

LIABILITIES AND EQUITY 2006 Assumptions 2007

17 Accounts Payable 19500 12% of CGS 25350

22 Credit line 5000 3306.25

21 Current long-term liabilities 5000 5000

23 Current liabilities 29500 33656.25

18 Long-term debt 20000 5M Decrease 15000

20 Common stock 20200 20200

19 Retained earning 46550 20718 add in RE 67268.75

Total liabilities and equity 116250 136125

INCOME STATEMENT 2006 Assumptions 2007

1 SALES 250000 30%Increase 325000

3 LESS: CGS 162500 211250

2 Gross profit 87500 35% of sales 113750

4 Less: Operating exp 25000 10% of sales 32500

5 Less: Interest exp 3000 10% of LTD & Credit line 2500

7 Less: Depriciation exp 10000 5M increase 15000

8 Pretax income 49500 63750

11 Less: Taxes 17325 35% tax 22312.5

12 Net Income 32175 41437.5

19 Dividend 50% of NI 20718.75

20 Income after dividend 20718.75

Table 1 shows the financial statements of 2006. Generate a Proforma Financial Stat

1

2

3

4

5

6

7

8

9

10

11

12

13

Table 1 shows the financial statements of 2006. Generate a Proforma Financial Statements for 2007 by usin

Zinsmeister plans to increase sales by 30% in 2007

The company grossprofit margin will be remain at 35%

Operating expenses will equal 10% of sales as they did in 2006

Zinsmeister pays 10% interest on both its long debt and its credit line

Zinemeister will invest an addational $20 million in fixed asset in 2007,which will increase dep expense from $10 to

The company faces a 35% tax rate.

The company plans to increse cash holdings by $1 million in next year.

Accounts Recviebles equals 8.5 % of sales.

Inventrioes equal 10% of sales.

Account payables equal 12% of CGS.

The company will repay an addational $5 million in long term debt in 2007.

The company will payout 50% of its net income as a cash dividend

The company plan to use its credit line as the plug figure

35%.

Service Shoe Corporation

BALNCE SHEET 2006 Assumptions 2007

13 Cash 10000 1M Increase 11000

14 A/R 21250 8.5% of Sales 27625

15 Inventory 25000 10% of sales 32500

16 Current assets 56250 71125

6 Gross fixed assets 80000 20 M Increase 100000

9 less:acumulated depriciation 20000 15M dep Increase 35000

10 Net fixed assets 60000 65000

Total Assets 116250 136125

LIABILITIES AND EQUITY 2006 Assumptions 2007

17 A/p 19500 12% of CGS 25350

22 Credit line 5000 3307

21 Current long-term liabilities 5000 5000

23 Current liabilities 29500

18 Long-term debt 20000 5M Decrease 15000

20 Common stock 20200 20200

19 Retained earning 46550 20718 add in RE 67268.75

Total liabilities and equity 116250 136125

INCOME STATEMENT 2006 Assumptions 2007

1 SALES 250000 30%Increase 325000

3 LESS: CGS 162500 211250

2 Gross profit 87500 35% of sales 113750

4 Less: Operating exp 25000 10% of sales 32500

5 Less: Interest exp 3000 10% of LTD & Credit line 2500

7 Less: Depriciation exp 10000 5M increase 15000

8 Pretax income 49500 63750

11 Less: Taxes 17325 35% tax 22312.5

12 Net Income 32175 41437.5

19 Dividend 50% of NI 20718.75

20 Income after dividend 20718.75

Potrebbero piacerti anche

- Service Shoe Corporation Balnce Sheet 2006 2007Documento1 paginaService Shoe Corporation Balnce Sheet 2006 2007Areeqa MehmoodNessuna valutazione finora

- Kelompok 5 Group Balance Sheet and Income Statement ProjectionsDocumento2 pagineKelompok 5 Group Balance Sheet and Income Statement ProjectionsMelinda AndrianiNessuna valutazione finora

- ComparitiveDocumento6 pagineComparitivesanath vsNessuna valutazione finora

- Revenue Growth AnalysisDocumento5 pagineRevenue Growth Analysisyarsuthit279Nessuna valutazione finora

- Assignment 6.1Documento9 pagineAssignment 6.1Abigail ConstantinoNessuna valutazione finora

- Chapter AssignmentDocumento3 pagineChapter AssignmentSwati PorwalNessuna valutazione finora

- FNCE371 Assignment 1: Case 3: Credit Policy ManagementDocumento18 pagineFNCE371 Assignment 1: Case 3: Credit Policy ManagementsmaNessuna valutazione finora

- Common Size Statement AnalysisDocumento2 pagineCommon Size Statement AnalysisRevati ShindeNessuna valutazione finora

- Module-10 Additional Material FSA Template - Session-11 vrTcbcH4leDocumento6 pagineModule-10 Additional Material FSA Template - Session-11 vrTcbcH4leBhavya PatelNessuna valutazione finora

- Financial WorksheetDocumento4 pagineFinancial WorksheetCarla GonçalvesNessuna valutazione finora

- 12222Documento9 pagine12222Alexander QuemadaNessuna valutazione finora

- My Work BookDocumento8 pagineMy Work BookNana Quarmi Agyim100% (1)

- Ratio Analysis - Team E - Last FinalDocumento17 pagineRatio Analysis - Team E - Last Finalyarsuthit279Nessuna valutazione finora

- Esmeralda Springs SurpriseDocumento8 pagineEsmeralda Springs Surpriseflorinmen1Nessuna valutazione finora

- Phuket Beach Hotel - 2022Documento10 paginePhuket Beach Hotel - 2022Gavani Durga SaiNessuna valutazione finora

- Urban Water PartnersDocumento2 pagineUrban Water Partnersutskjdfsjkghfndbhdfn100% (2)

- Assignment N3Documento12 pagineAssignment N3Maiko KopadzeNessuna valutazione finora

- Key Financial Metrics and RatiosDocumento55 pagineKey Financial Metrics and RatiosSunaina MandhwaniNessuna valutazione finora

- The Forecast For A Company's P&L Is Provided Below. Forecast The Operating Cash Flow For 2021Documento11 pagineThe Forecast For A Company's P&L Is Provided Below. Forecast The Operating Cash Flow For 2021ShivamNessuna valutazione finora

- Sunset Boards Financial Analysis and Statements for ExpansionDocumento4 pagineSunset Boards Financial Analysis and Statements for ExpansionAhsan MubeenNessuna valutazione finora

- Income Tax Sample ProblemsDocumento12 pagineIncome Tax Sample ProblemsYellow BelleNessuna valutazione finora

- Case StudyDocumento2 pagineCase Studyの変化 ナザレNessuna valutazione finora

- Fm-Answer-Key 2Documento5 pagineFm-Answer-Key 2Kitheia Ostrava Reisenchauer100% (3)

- AssetsDocumento2 pagineAssetsKim DoyoungNessuna valutazione finora

- Keith Corporation Generates Significant Positive Cash FlowsDocumento24 pagineKeith Corporation Generates Significant Positive Cash FlowsMaiko KopadzeNessuna valutazione finora

- ForecastingDocumento1 paginaForecastingKwaku Obeng-AppiahNessuna valutazione finora

- Horizontal and Vertical ActivityDocumento4 pagineHorizontal and Vertical ActivityKarlla ManalastasNessuna valutazione finora

- FSA - Intro PDFDocumento10 pagineFSA - Intro PDFsingh somyadeepNessuna valutazione finora

- IS, SOFP, SCE My WorkDocumento6 pagineIS, SOFP, SCE My WorkoluwapelumiotunNessuna valutazione finora

- Chapter 13Documento11 pagineChapter 13MekeniMekeniNessuna valutazione finora

- Profit Margin Ratio Profit Margin Ratio: Profit Margin Asset Turnover Return On Assets or Return On InvestmentsDocumento4 pagineProfit Margin Ratio Profit Margin Ratio: Profit Margin Asset Turnover Return On Assets or Return On InvestmentsAbhishek GoelNessuna valutazione finora

- AA367Documento11 pagineAA367Meena DasNessuna valutazione finora

- FRA Ratio AnalysisDocumento4 pagineFRA Ratio AnalysisSrishTi RaiNessuna valutazione finora

- 322 Assignment 2 SubmissionDocumento9 pagine322 Assignment 2 SubmissionMirza Mushahid BaigNessuna valutazione finora

- Financial Statement Analysis: by Ghanendrafago Mba, M PhilDocumento19 pagineFinancial Statement Analysis: by Ghanendrafago Mba, M Philits4krishna3776Nessuna valutazione finora

- Maynard Solutions Ch05Documento17 pagineMaynard Solutions Ch05Anton VitaliNessuna valutazione finora

- RatioDocumento13 pagineRatioKaren Joyce Sinsay50% (2)

- ProformaDocumento4 pagineProformadevanmadeNessuna valutazione finora

- BusFin PT 5Documento5 pagineBusFin PT 5Nadjmeah AbdillahNessuna valutazione finora

- Group4 SectionA SampavideoDocumento5 pagineGroup4 SectionA Sampavideokarthikmaddula007_66Nessuna valutazione finora

- Assignment # 3: AssetsDocumento7 pagineAssignment # 3: AssetsUsman GhaniNessuna valutazione finora

- Lab 221 HS10002Documento7 pagineLab 221 HS10002aayush.5.parasharNessuna valutazione finora

- Capital Budgeting SolutionDocumento6 pagineCapital Budgeting SolutionAsad AliNessuna valutazione finora

- Assets and FS Cash PPE Template CLASS Day 15Documento41 pagineAssets and FS Cash PPE Template CLASS Day 15Hrishikesh MahapatraNessuna valutazione finora

- Group 4 - Sa4307 - mrf2180 - nr2761 - ms6659 - NestleDocumento20 pagineGroup 4 - Sa4307 - mrf2180 - nr2761 - ms6659 - Nestlesa4307Nessuna valutazione finora

- Assignment Capital BudgetingDocumento29 pagineAssignment Capital BudgetingYasha Sahu0% (1)

- Financial ModelingDocumento3 pagineFinancial ModelingPriyansh shrivastavaNessuna valutazione finora

- Liabilites 2000 2001 Assets 2000 2001: Balance SheetDocumento9 pagineLiabilites 2000 2001 Assets 2000 2001: Balance SheetGiri SukumarNessuna valutazione finora

- LBO Valuation Case INPUT SHEETDocumento2 pagineLBO Valuation Case INPUT SHEETAmir AhmedNessuna valutazione finora

- MBA 5015 Managerial Finance-Lesson 1-HomeworkDocumento3 pagineMBA 5015 Managerial Finance-Lesson 1-HomeworkpravinNessuna valutazione finora

- Cash Flow EstimationDocumento14 pagineCash Flow Estimation0241ASHAYNessuna valutazione finora

- Excel Setup and Imp FunctionsDocumento28 pagineExcel Setup and Imp Functionskjvc0408Nessuna valutazione finora

- Bishnu Pashu Tatha Machha FirmDocumento238 pagineBishnu Pashu Tatha Machha FirmBIBUTSAL BHATTARAINessuna valutazione finora

- Valuation PracticeDocumento19 pagineValuation PracticeAkash PatilNessuna valutazione finora

- Income StatementDocumento3 pagineIncome StatementBiswajit SarmaNessuna valutazione finora

- Loan and capital projections for 5 yearsDocumento7 pagineLoan and capital projections for 5 yearssantosh hugarNessuna valutazione finora

- BTVN Chap 03Documento14 pagineBTVN Chap 03Nguyen Phuong Anh (K16HL)Nessuna valutazione finora

- Model 2 TDocumento6 pagineModel 2 TVidhi PatelNessuna valutazione finora

- Fast-Track Tax Reform: Lessons from the MaldivesDa EverandFast-Track Tax Reform: Lessons from the MaldivesNessuna valutazione finora

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineDa EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNessuna valutazione finora

- Tax Amnesty Scheme in PakistanDocumento5 pagineTax Amnesty Scheme in PakistanAadi KhanNessuna valutazione finora

- Mock Quiz (10) Assignment (30) ProjectDocumento9 pagineMock Quiz (10) Assignment (30) ProjectAadi KhanNessuna valutazione finora

- Causes of Tax Evasion in PakistanDocumento22 pagineCauses of Tax Evasion in PakistanAadi KhanNessuna valutazione finora

- Law SummaryDocumento3 pagineLaw SummaryAadi KhanNessuna valutazione finora

- Law SummaryDocumento3 pagineLaw SummaryAadi KhanNessuna valutazione finora

- Business Ethics Velasquez: Chapter 3: The Business System: Government, Markets, and International TadeDocumento28 pagineBusiness Ethics Velasquez: Chapter 3: The Business System: Government, Markets, and International TadeAadi KhanNessuna valutazione finora

- BSAF V Decision MakingDocumento5 pagineBSAF V Decision MakingAadi KhanNessuna valutazione finora

- Workload Comm Banking BSAF-5 17-02-20 To 21-02-20Documento3 pagineWorkload Comm Banking BSAF-5 17-02-20 To 21-02-20Aadi KhanNessuna valutazione finora

- A Coronavirus Was First Isolated in 1937 From An IDocumento2 pagineA Coronavirus Was First Isolated in 1937 From An IAadi KhanNessuna valutazione finora

- Bsaf 5 2Documento18 pagineBsaf 5 2Aadi KhanNessuna valutazione finora

- Bsaf 5 3Documento16 pagineBsaf 5 3Aadi KhanNessuna valutazione finora

- Bond ValuationDocumento20 pagineBond Valuationمحمد حمزه زاہدNessuna valutazione finora

- Currency War - Reasons and RepercussionsDocumento15 pagineCurrency War - Reasons and RepercussionsRaja Raja91% (11)

- This Study Resource Was: Easy Move On Consulting Company (Emoc)Documento4 pagineThis Study Resource Was: Easy Move On Consulting Company (Emoc)v lNessuna valutazione finora

- Meaning and Concepts of PrivatizationDocumento17 pagineMeaning and Concepts of Privatizationmohan reddyNessuna valutazione finora

- Overview of Financial ReportingDocumento47 pagineOverview of Financial Reportingdeepak joshi100% (1)

- Unit Trusts - February 26 2018Documento24 pagineUnit Trusts - February 26 2018Tiso Blackstar GroupNessuna valutazione finora

- Oriental General Insurance Executive SummaryDocumento30 pagineOriental General Insurance Executive SummaryRohit J SaraiyaNessuna valutazione finora

- 2013 11 Engineering EconomicsDocumento64 pagine2013 11 Engineering EconomicspganoelNessuna valutazione finora

- Exercise - Dilutive Securities - AdillaikhsaniDocumento4 pagineExercise - Dilutive Securities - Adillaikhsaniaidil fikri ikhsanNessuna valutazione finora

- How To Become A Great Boss Jeffrey J. FoxDocumento19 pagineHow To Become A Great Boss Jeffrey J. FoxFrancisco MoralesNessuna valutazione finora

- Financial Due Diligence Art NirmanDocumento41 pagineFinancial Due Diligence Art NirmanPravesh PangeniNessuna valutazione finora

- Dealing With Monopolistic and Distorted Supply ChainsDocumento20 pagineDealing With Monopolistic and Distorted Supply ChainsPratyasha PattanaikNessuna valutazione finora

- "WORKING CAPITAL MANAGEMENT"SumeshDocumento59 pagine"WORKING CAPITAL MANAGEMENT"Sumeshsumesh8940% (1)

- Financial Management Case 2: Modi Rubber vs. Financial InstitutionsDocumento28 pagineFinancial Management Case 2: Modi Rubber vs. Financial InstitutionsGaurav Agarwal100% (1)

- 14 May 09.new Head For QBE Re JapanDocumento2 pagine14 May 09.new Head For QBE Re JapanQBE European OperationsNessuna valutazione finora

- Factors of Production in Islam: Capitalist, Socialist and Islamic ViewsDocumento6 pagineFactors of Production in Islam: Capitalist, Socialist and Islamic ViewsAsh LayNessuna valutazione finora

- Trilateral CommissionDocumento8 pagineTrilateral Commissionmary engNessuna valutazione finora

- Philippine construction registrationDocumento2 paginePhilippine construction registrationMelanie TamayoNessuna valutazione finora

- ACC 111 Chapter 2 Lecture NotesDocumento5 pagineACC 111 Chapter 2 Lecture NotesLoriNessuna valutazione finora

- Jiksa 1Documento34 pagineJiksa 1Abdii DhufeeraNessuna valutazione finora

- A Dishonest Client Will Get The Best ofDocumento1 paginaA Dishonest Client Will Get The Best ofrewasNessuna valutazione finora

- Delong Holdings Annual Report 2008Documento92 pagineDelong Holdings Annual Report 2008WeR1 Consultants Pte LtdNessuna valutazione finora

- EMH Analysis of Indian Equity MarketsDocumento73 pagineEMH Analysis of Indian Equity MarketsAashutosh SinghNessuna valutazione finora

- UCC Secured Transactions Essay QuestionsDocumento23 pagineUCC Secured Transactions Essay QuestionsVictoria Liu0% (1)

- L6 P2 Fed Tapering v3Documento34 pagineL6 P2 Fed Tapering v3Ajay SinghNessuna valutazione finora

- LendIt PDFDocumento4 pagineLendIt PDFLuis GNessuna valutazione finora

- Nielsen VN - Vietnam Consumer Confidence - Quarter II 2010Documento3 pagineNielsen VN - Vietnam Consumer Confidence - Quarter II 2010OscarKhuongNessuna valutazione finora

- A222 Takehome AssignmentDocumento3 pagineA222 Takehome AssignmentjiehajamilNessuna valutazione finora

- Governance Anti Corruption Project DesignDocumento281 pagineGovernance Anti Corruption Project DesignJatmiko PrawiroNessuna valutazione finora

- International Monetary Systems & Foreign Exchange MarketsDocumento47 pagineInternational Monetary Systems & Foreign Exchange MarketsRavi SharmaNessuna valutazione finora

- Effects of Land TitlingDocumento30 pagineEffects of Land TitlingMicah Paula MilanteNessuna valutazione finora