Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

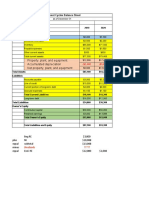

Dr. ($) Cr. ($) Dr. ($) Cr. ($) Dr. ($) Cr. ($)

Caricato da

Ishrat Jahan Papiya0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

14 visualizzazioni3 pagineThe document contains a trial balance, adjustments, adjusted trial balance, journal entries, income statement, owner's equity statement, and balance sheet for a business. The trial balance shows opening balances for cash, supplies, equipment, unearned revenue, notes payable, and capital. Adjustments are made for supplies, unearned revenue, accounts receivable, interest payable, depreciation, and accumulated depreciation. The adjusted trial balance reflects the updated account balances.

Descrizione originale:

Titolo originale

Trial balance.docx

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThe document contains a trial balance, adjustments, adjusted trial balance, journal entries, income statement, owner's equity statement, and balance sheet for a business. The trial balance shows opening balances for cash, supplies, equipment, unearned revenue, notes payable, and capital. Adjustments are made for supplies, unearned revenue, accounts receivable, interest payable, depreciation, and accumulated depreciation. The adjusted trial balance reflects the updated account balances.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

14 visualizzazioni3 pagineDr. ($) Cr. ($) Dr. ($) Cr. ($) Dr. ($) Cr. ($)

Caricato da

Ishrat Jahan PapiyaThe document contains a trial balance, adjustments, adjusted trial balance, journal entries, income statement, owner's equity statement, and balance sheet for a business. The trial balance shows opening balances for cash, supplies, equipment, unearned revenue, notes payable, and capital. Adjustments are made for supplies, unearned revenue, accounts receivable, interest payable, depreciation, and accumulated depreciation. The adjusted trial balance reflects the updated account balances.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 3

Sl.

Particulars Trial Balance Adjustment Adjustment Trial

No Balance

. Dr. ($) Cr. ($) Dr. ($) Cr. ($) Dr. ($) Cr. ($)

1. Cash 8,250 8,250

2. Supplies 1,000 350 650

3. Equipment 18,000 18,000

4. Unearned 2,000 2,000

Revenue

5. Note 9,000 9,000

Payable

6. Capital 15,000 15,000

7. Service 5,000 3,500 8,500

Revenue

8. Advertising 250 250

Expense

9. Wages 2,000 2,000

Expense

10. Dividends 1,500 1,500

11. Accounts 1,500 1,500

Receivable

12. Supplies 350 350

Expenses

13. Interest 45 45

Expenses

14. Interest 45 45

Payable

15. Depreciation 600 600

Expenses

16. Accumulate 600 600

d

Depreciation

($)31,00 ($)31,00 ($)4,49 ($)4,49 ($)33,14 ($)33,14

0 0 5 5 5 5

Journal

Date Particulars Ref. Dr. ($) Cr. ($)

1. Unearned Revenue- Dr. 2,000

Service Revenue- Cr. 2,000

2. Accounts Receivable – Dr. 1,500

Service Revenue ---Cr. 1,500

3. Supplies expenses – Dr. 350

Supplies--- Cr. 350

{($1000- $650) = $350}

4. Interest expenses---Dr. 45

Interest payable---Cr. 45

{(19000 x 6% x ½) = 45}

5. Depreciation Expense--Dr. 600

Accumulated depreciation--Cr. 600

Income Statement

Particulars Amount Amount

Service Revenue $ 8,500

Expenses:

Advertising Expenses $ 250

Depreciation Expenses $ 600

Interest Expenses $ 45

Salaries Expenses $ 2,000

Supply Expenses $ 350

Total Expenses $ 3,245

Net Income $ 5,255

Owner’s Equity Statement

Particulars Amount Amount

Opening Capital

Additional during the period $ 15,000

Net profit during the period $ 5,255

Capital at the end period $ 20,255

Balance Sheet

Particulars Amount Amount

Assets:

Non-Current Assets:

Equipment $ 18,000

Less: Accumulated Depreciation ($ 600)

Total Non-Current Assets = $ 17,400

Current Assets:

Cash $ 250

Account Receivable $ 1,500

Supplies $ 650

Total Current Assets = $ 10,400

Total Assets = $ 27,800

Liabilities and Capital:

Current Liabilities:

Interest Payable $ 45

Notes Payable $ 9,000

Total current Liabilities = $ 9,045

Shareholder’s Equity:

Capital $ 15,000

Retained Earnings $ 3,755

Total Shareholder’s Equity = $ 18,755

Total Liability & Equity = $ 27,800

Potrebbero piacerti anche

- SolotionsDocumento34 pagineSolotionsabdulrahman Abdullah100% (1)

- ANSWERS To CHAPTER 2 (Financial Statements, Taxes and Cash Flows)Documento13 pagineANSWERS To CHAPTER 2 (Financial Statements, Taxes and Cash Flows)senzo scholarNessuna valutazione finora

- HW 4Documento4 pagineHW 4Mishalm96Nessuna valutazione finora

- FABM2 Module 02 (Q1-W2-3)Documento9 pagineFABM2 Module 02 (Q1-W2-3)Christian Zebua100% (1)

- SAP CostingDocumento35 pagineSAP Costingshantanujana1988100% (1)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsDa EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNessuna valutazione finora

- Coca-Cola Strategic PlanDocumento17 pagineCoca-Cola Strategic Planapi-326272121100% (1)

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocumento6 pagineProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNessuna valutazione finora

- Gitman IM Ch03Documento15 pagineGitman IM Ch03tarekffNessuna valutazione finora

- Asset Conversion CycleDocumento12 pagineAsset Conversion Cyclessimi137Nessuna valutazione finora

- As-9 Revenue RecognitionDocumento40 pagineAs-9 Revenue Recognitionkailash_yds67% (3)

- Chapter 1 - Formation of PartnershipDocumento31 pagineChapter 1 - Formation of PartnershipAisyah Basir33% (3)

- Project RAR IntegerationDocumento25 pagineProject RAR IntegerationAl-Mahad International School100% (1)

- CHAPTER 4 (Accounts)Documento14 pagineCHAPTER 4 (Accounts)lcNessuna valutazione finora

- Some Solved Problems and Statement From Tabular AnalysisDocumento9 pagineSome Solved Problems and Statement From Tabular AnalysisSubrata RoyNessuna valutazione finora

- 6 DesemberDocumento8 pagine6 DesemberKezia N. ApriliaNessuna valutazione finora

- Professor Office's Beach Cabana Balance Sheets As of December 31, 2014 and 2013Documento3 pagineProfessor Office's Beach Cabana Balance Sheets As of December 31, 2014 and 2013Precious Uminga100% (1)

- ExerciseDocumento12 pagineExercisesde.ofcl20Nessuna valutazione finora

- Unadjusted Trial BalanceDocumento10 pagineUnadjusted Trial BalanceMingxNessuna valutazione finora

- Chapter 1 - Some Solved ProblemsDocumento12 pagineChapter 1 - Some Solved ProblemsBracu 2023Nessuna valutazione finora

- Assignment in Buscom at Acquisition and SubsequentDocumento15 pagineAssignment in Buscom at Acquisition and SubsequentToni MarquezNessuna valutazione finora

- Pelenio - Abm 12-ADocumento2 paginePelenio - Abm 12-AAAAAANessuna valutazione finora

- Class Problems CH 4Documento9 pagineClass Problems CH 4Eduardo Negrete100% (2)

- AFM AssignmentDocumento7 pagineAFM AssignmentMudit BhargavaNessuna valutazione finora

- Answers To Concepts Review and Critical Thinking QuestionsDocumento6 pagineAnswers To Concepts Review and Critical Thinking QuestionsHimanshu KatheriaNessuna valutazione finora

- Confra Financial StatementsDocumento3 pagineConfra Financial StatementsPia ChanNessuna valutazione finora

- Statement of Change in Working Capital & Inflows/Outflows of Working CapitalDocumento5 pagineStatement of Change in Working Capital & Inflows/Outflows of Working CapitalChandani DesaiNessuna valutazione finora

- 010-18 Section-A Assignment 3Documento5 pagine010-18 Section-A Assignment 3VallabhRemaniNessuna valutazione finora

- Latihan & Pembahasan Soal S4-2Documento3 pagineLatihan & Pembahasan Soal S4-2Diana ZulhamNessuna valutazione finora

- Exercise 1: On December 31, Bryniuk's Company, The Accounting Records Showed The Following InformationDocumento10 pagineExercise 1: On December 31, Bryniuk's Company, The Accounting Records Showed The Following InformationJohn Kenneth Bohol50% (2)

- Issued & Paid Up Capital: 14 Schedual of Fixed AssetsDocumento6 pagineIssued & Paid Up Capital: 14 Schedual of Fixed AssetsShoukat KhaliqNessuna valutazione finora

- Financial Accounting - Chapter 4Documento14 pagineFinancial Accounting - Chapter 4Phưn ĂnNessuna valutazione finora

- Kelompok 4 Advance Ko HarDocumento8 pagineKelompok 4 Advance Ko HarAngel HambaliNessuna valutazione finora

- How To Prepare A Trial BalanceDocumento3 pagineHow To Prepare A Trial Balancecloudgrim5Nessuna valutazione finora

- The Unadjusted Trial Balance of Farish Investment Advisers at December 31, 2018, FollowsDocumento3 pagineThe Unadjusted Trial Balance of Farish Investment Advisers at December 31, 2018, Followsb1112014041Nessuna valutazione finora

- Chapter - 1Documento23 pagineChapter - 1Kumar AmitNessuna valutazione finora

- RWJJ Chapter 2: Solutions To Assigned Questions and ProblemsDocumento9 pagineRWJJ Chapter 2: Solutions To Assigned Questions and ProblemsvzzrNessuna valutazione finora

- Tugas MK11Documento2 pagineTugas MK11Nan BaeeeNessuna valutazione finora

- Clairemont Co Ejercio de Practica MartesDocumento2 pagineClairemont Co Ejercio de Practica Martescarlos huertasNessuna valutazione finora

- Solutions Chapter 2Documento8 pagineSolutions Chapter 2Vân Anh Đỗ LêNessuna valutazione finora

- Johnson - Cassandra - AC556 Assignment Unit 6Documento9 pagineJohnson - Cassandra - AC556 Assignment Unit 6ctp4950_552446766Nessuna valutazione finora

- Sadecki Corporation Balance Sheets Dec-31 Assets 2014 2013Documento9 pagineSadecki Corporation Balance Sheets Dec-31 Assets 2014 2013mohitgaba19Nessuna valutazione finora

- Exercise For Financial Statement Analysis and RatiosDocumento15 pagineExercise For Financial Statement Analysis and RatiosViren JoshiNessuna valutazione finora

- Practice Prepare FSDocumento8 paginePractice Prepare FSĐạt LêNessuna valutazione finora

- Working CapitalDocumento6 pagineWorking CapitalElizabeth Sanabria AriasNessuna valutazione finora

- Adjusting Entries ConstantinoDocumento5 pagineAdjusting Entries ConstantinoKyla Lyn OclaritNessuna valutazione finora

- Purchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalanceDocumento14 paginePurchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalancesallyNessuna valutazione finora

- Financial Statements and Cash Flow: Solutions To Questions and ProblemsDocumento10 pagineFinancial Statements and Cash Flow: Solutions To Questions and ProblemsTing-An KuoNessuna valutazione finora

- Solutions Unit 2,8,9,10,11,16,19Documento58 pagineSolutions Unit 2,8,9,10,11,16,19Thảo TrangNessuna valutazione finora

- Answer 4 - Excel For Diff. Acctg.Documento42 pagineAnswer 4 - Excel For Diff. Acctg.Rheu ReyesNessuna valutazione finora

- Solution Manual For Corporate Finance Canadian 7th Edition by Ross Westerfield Jaffe Robertsl ISBN 0071339574 9780071339575Documento36 pagineSolution Manual For Corporate Finance Canadian 7th Edition by Ross Westerfield Jaffe Robertsl ISBN 0071339574 9780071339575stephanievargasogimkdbxwn100% (20)

- Tarea Taller 1 FINA 503Documento4 pagineTarea Taller 1 FINA 503Hugo LombardiNessuna valutazione finora

- CH 2 - HomeworkDocumento5 pagineCH 2 - HomeworkAxel OngNessuna valutazione finora

- Financial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsDocumento9 pagineFinancial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsJulyMoon RMNessuna valutazione finora

- Gina Purdiyanti - 20181211031 Asdos AKL2Documento6 pagineGina Purdiyanti - 20181211031 Asdos AKL2gina amsyarNessuna valutazione finora

- The Role of Working Capital: Bordenk@unk - EduDocumento7 pagineThe Role of Working Capital: Bordenk@unk - EduAntonio FrancoNessuna valutazione finora

- M3 - Nila Savitri - 21221488 - 2EB09 (AKM 1)Documento6 pagineM3 - Nila Savitri - 21221488 - 2EB09 (AKM 1)rully movizarNessuna valutazione finora

- Pacilio Securtiy Service Accounting EquationDocumento11 paginePacilio Securtiy Service Accounting EquationKailash KumarNessuna valutazione finora

- Financial Accounting - Assignment #1#Documento5 pagineFinancial Accounting - Assignment #1#Hasan NajiNessuna valutazione finora

- Acc HWDocumento5 pagineAcc HWHasan NajiNessuna valutazione finora

- Assignment Part OneDocumento3 pagineAssignment Part Onetovi0821Nessuna valutazione finora

- Chapter 1 Answer KeyDocumento18 pagineChapter 1 Answer KeyZohaib SiddiqueNessuna valutazione finora

- Statement of Cash Flows: Balances Accounts Jan 1, 2015 Dec 31, 2015Documento2 pagineStatement of Cash Flows: Balances Accounts Jan 1, 2015 Dec 31, 2015Alyssa AlejandroNessuna valutazione finora

- Solutions To End-Of-Chapter ProblemsDocumento14 pagineSolutions To End-Of-Chapter ProblemsTushar MalhotraNessuna valutazione finora

- Latihan Soal Kombis (Answered)Documento6 pagineLatihan Soal Kombis (Answered)Fajar IskandarNessuna valutazione finora

- Solutions To Exercises and Problems Exercises E5.1 Combination and Consolidation, Date of Acquisition (See Related E3.1)Documento36 pagineSolutions To Exercises and Problems Exercises E5.1 Combination and Consolidation, Date of Acquisition (See Related E3.1)sunnyauliaNessuna valutazione finora

- Ron's Reclamation YardDocumento3 pagineRon's Reclamation YardChâu LêNessuna valutazione finora

- Generally Accepted Accounting Principles Refer To TheDocumento55 pagineGenerally Accepted Accounting Principles Refer To TheVimala Selvaraj VimalaNessuna valutazione finora

- Chapter 9 - Prospective AnalysisDocumento4 pagineChapter 9 - Prospective AnalysisjonaxxNessuna valutazione finora

- Cash Flow Problems and SolutionsDocumento23 pagineCash Flow Problems and SolutionsSangetaSinghNessuna valutazione finora

- Vertical Analysis of URC Income StatementDocumento1 paginaVertical Analysis of URC Income StatementMalou De MesaNessuna valutazione finora

- Oipbotoy2023 2Documento29 pagineOipbotoy2023 2Shiela IgnacioNessuna valutazione finora

- Tutorial Week 3 QuestionsDocumento9 pagineTutorial Week 3 QuestionsShermaine WanNessuna valutazione finora

- CH 11 and 11A - CLASS NOTES - MOS 3370 - KINGS - FALL 2023-1Documento55 pagineCH 11 and 11A - CLASS NOTES - MOS 3370 - KINGS - FALL 2023-1niweisheng28Nessuna valutazione finora

- Accounting ExamDocumento13 pagineAccounting ExamLowry GuettaNessuna valutazione finora

- (Hyundai Glovis) Kis London NDRDocumento23 pagine(Hyundai Glovis) Kis London NDRpravanthbabuNessuna valutazione finora

- Basic AccoDocumento27 pagineBasic AccoJasmine ActaNessuna valutazione finora

- Chapter 5 Question Review 11th EditionDocumento10 pagineChapter 5 Question Review 11th EditionEmiraslan MhrrovNessuna valutazione finora

- Israr Ahmed BBA Finance Final Report On NBPDocumento55 pagineIsrar Ahmed BBA Finance Final Report On NBPWaqas AhmadNessuna valutazione finora

- Human Resource Management - Comparison of PSO With Shell Pakistan Ltd.Documento45 pagineHuman Resource Management - Comparison of PSO With Shell Pakistan Ltd.Sabeen Javaid0% (1)

- Morebusiness Manufacturing Business Plan TemplateDocumento12 pagineMorebusiness Manufacturing Business Plan TemplateYOSEPH TIDARUNessuna valutazione finora

- Petro Rio S.A. - June 30, 2021 Financial StatementsDocumento55 paginePetro Rio S.A. - June 30, 2021 Financial StatementsTheodore H. CallisterNessuna valutazione finora

- Smart Task 2 OF Project Finance by (Vardhan Consulting Engineers)Documento8 pagineSmart Task 2 OF Project Finance by (Vardhan Consulting Engineers)devesh bhattNessuna valutazione finora

- 3 - Analysis of Financial Statements 2Documento2 pagine3 - Analysis of Financial Statements 2Axce1996Nessuna valutazione finora

- Cash Flows and Accrual Accounting in Predicting Future Cash FlowsDocumento210 pagineCash Flows and Accrual Accounting in Predicting Future Cash Flows129935Nessuna valutazione finora

- Cash Flow Statements Bas 7Documento12 pagineCash Flow Statements Bas 7Hasnain MahmoodNessuna valutazione finora

- IPSAS 1 Disclosure ChecklistDocumento10 pagineIPSAS 1 Disclosure ChecklistReview Cpa TNessuna valutazione finora

- Financial Management Note Week 1 PDFDocumento46 pagineFinancial Management Note Week 1 PDFJiaXinLimNessuna valutazione finora

- SM ch04Documento54 pagineSM ch04Rendy Kurniawan100% (1)

- Accounting For Non-Profit Organisations Concepts and BasicsDocumento15 pagineAccounting For Non-Profit Organisations Concepts and BasicsDibyansu KumarNessuna valutazione finora