Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Collector Vs Benipayo

Caricato da

Arnold Jose0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

159 visualizzazioni2 pagineTitolo originale

Collector vs Benipayo.docx

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

159 visualizzazioni2 pagineCollector Vs Benipayo

Caricato da

Arnold JoseCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

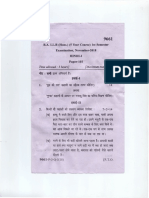

193. Collector vs.

Benipayo (4 SCRA 182)

Facts:

Respondent is the owner and operator of the Lucena Theater located in the municipality

of Lucena, Quezon. On October 3, 1953 Internal Revenue Agent Romeo de Guia

investigated respondent's amusement tax liability in connection with the operation of said

theater during the period from August, 1952 to September, 1953. His finding was that

during the years 1949 to 1951 the average ratio of adults and children patronizing the

Lucena Theater was 3 to 1, i.e., for every three adults entering the theater, one child was

also admitted, while during the period in question. the proportion was reversed—three

children to one adult. From this he concluded that respondent must have fraudulently sold

two tax-free 20-centavo tickets, in order to avoid payment of the amusement tax

prescribed in Section 260 of the National Internal Revenue Code.

On July 14, 1954. petitioner issued a deficiency amusement tax assessment against

respondent, demanding from the latter the payment of the total sum of P12,152.93 within

thirty days from receipt thereof. On August 16, 1954, respondent filed the corresponding

protest with the Conference Staff of the Bureau of Internal Revenue.

Issue:

Whether or not there is sufficient evidence in the record showing that respondent, during

the period under review, sold and issued to his adult customers two tax-free 20-centavo

children's tickets, instead of one 40-centavo ticket for each adult customer; to cheat or

defraud the Government.

Held:

The assessment has no factual bases. Assessments should not be based on mere

presumptions no matter how reasonable or logical said presumptions may be. Assuming

arguendo that the average ratio of adults and children patronizing the Lucena Theater

from 1949 to 1951 was 3 to 1, the same does not give rise to the inference that the same

conditions existed during the years in question (1952 and 1953). The fact that almost the

same ratio existed during the month of July, 1955 does not provide a sufficient inference

on the conditions in 1952 and 1953. x x x

"In order to stand the test of judicial scrutiny, the assessment must be based on actual

facts. The presumption of correctness of assessment being a mere presumption cannot be

made to rest on another presumption that the circumstances in 1952 and 1953 are

presumed to be the same as those existing in 1949 to 1951 and July 1955. In the case

under consideration there are no substantial facts to support the assessment in question. x

x x."

Fraud is a serious charge and, to be sustained, it must be supported by clear and

convincing proof which, in the present case, is 'lacking.

Potrebbero piacerti anche

- Carl Miller - Right To Travel Without A License PlateDocumento2 pagineCarl Miller - Right To Travel Without A License Platejoerocketman91% (11)

- People Vs BalagtasDocumento2 paginePeople Vs BalagtasBilly100% (2)

- CIR v. Hedcor Sibulan, Inc.Documento2 pagineCIR v. Hedcor Sibulan, Inc.SophiaFrancescaEspinosa100% (1)

- Digest San Juan Vs CastroDocumento2 pagineDigest San Juan Vs CastroRyan AcostaNessuna valutazione finora

- Civil Service Commission v. Richard S. RebongDocumento4 pagineCivil Service Commission v. Richard S. RebongSimeon Dela CruzNessuna valutazione finora

- 08 City of Iriga v. Camarines Sur III Electric Cooperative, Inc.Documento2 pagine08 City of Iriga v. Camarines Sur III Electric Cooperative, Inc.Rem SerranoNessuna valutazione finora

- CIR VS. Sekisui Jushi Philippines, Inc.Documento1 paginaCIR VS. Sekisui Jushi Philippines, Inc.Abdulateef SahibuddinNessuna valutazione finora

- Republic V Acebedo G.R No. L-20477 March 29, 1968Documento2 pagineRepublic V Acebedo G.R No. L-20477 March 29, 1968PJ HongNessuna valutazione finora

- Abci V Cir DigestDocumento9 pagineAbci V Cir DigestSheilaNessuna valutazione finora

- BPI vs. CIRDocumento2 pagineBPI vs. CIRAldrin TangNessuna valutazione finora

- Phil Journalists Inc V CIRDocumento2 paginePhil Journalists Inc V CIRsmtm06Nessuna valutazione finora

- 7 CIR V PhoenixDocumento1 pagina7 CIR V PhoenixFrancesca Isabel MontenegroNessuna valutazione finora

- CIR v. Cadiz Sugar FarmersDocumento6 pagineCIR v. Cadiz Sugar Farmersamareia yap100% (1)

- A) CIR Vs Sony PhilippinesDocumento2 pagineA) CIR Vs Sony PhilippinesLanz OlivesNessuna valutazione finora

- Cir Vs Standard CharteredDocumento1 paginaCir Vs Standard CharteredJeng RoqueNessuna valutazione finora

- Tax 2 Digest (0202) GR 151135 070204 Contex Vs CirDocumento2 pagineTax 2 Digest (0202) GR 151135 070204 Contex Vs CirAudrey Deguzman67% (3)

- Digest of Ramsay vs. CIR, CTA Case No. 8456, September 17, 2015Documento2 pagineDigest of Ramsay vs. CIR, CTA Case No. 8456, September 17, 2015Michael Joseph NogoyNessuna valutazione finora

- Kepco Vs CIR Case DigestDocumento2 pagineKepco Vs CIR Case DigestFrancisca Paredes100% (1)

- Edison (Bataan) Cogeneration Corporation v. CIR, G.R. No. 210665, 30 August 2017Documento2 pagineEdison (Bataan) Cogeneration Corporation v. CIR, G.R. No. 210665, 30 August 2017Jarleine Junio BeringuelNessuna valutazione finora

- 23 Cir Vs Mindanao Sanitarium and HospitalDocumento5 pagine23 Cir Vs Mindanao Sanitarium and HospitalSecret Secret0% (1)

- Samar-I Electric Coop V CIR (2014) DigestDocumento2 pagineSamar-I Electric Coop V CIR (2014) Digestviktoriavillo67% (3)

- ETPI Vs CIRDocumento2 pagineETPI Vs CIRSophiaFrancescaEspinosaNessuna valutazione finora

- CIR vs. Transitions Optical Philippines, IncDocumento13 pagineCIR vs. Transitions Optical Philippines, IncJoy Ben-at100% (1)

- BPI v. CIR (2005)Documento2 pagineBPI v. CIR (2005)JP Murao IIINessuna valutazione finora

- Accenture vs. CIRDocumento3 pagineAccenture vs. CIRJOHN SPARKS100% (1)

- Silicon Philippines V CirDocumento2 pagineSilicon Philippines V CirKia BiNessuna valutazione finora

- Miramar Fish Company, Inc. V Cir G.R. No. 185432, June 04, 2014 Perez, J.Documento2 pagineMiramar Fish Company, Inc. V Cir G.R. No. 185432, June 04, 2014 Perez, J.Kate GaroNessuna valutazione finora

- CONTEXT CORP. v. CIR - DigestDocumento2 pagineCONTEXT CORP. v. CIR - DigestMark Genesis RojasNessuna valutazione finora

- Lazaro vs. Agustin 618 SCRA 298, April 15, 2010Documento5 pagineLazaro vs. Agustin 618 SCRA 298, April 15, 2010HaroldDeLeonNessuna valutazione finora

- American Express International v. CIR CTA Case No. 6099 (April 19, 2002)Documento2 pagineAmerican Express International v. CIR CTA Case No. 6099 (April 19, 2002)Francis Xavier Sinon100% (1)

- Kepco vs. CIR Case DigestDocumento2 pagineKepco vs. CIR Case DigestJeremiah Trinidad100% (2)

- Estate of Reyes V CIR Case DigestDocumento2 pagineEstate of Reyes V CIR Case DigestAlexis Anne P. ArejolaNessuna valutazione finora

- CIR Vs Perf RealtyDocumento2 pagineCIR Vs Perf RealtyEnav LucuddaNessuna valutazione finora

- CIR Vs PhilamlifeDocumento2 pagineCIR Vs PhilamlifeBreAmberNessuna valutazione finora

- Angeles City v. Angeles Electric CorporationDocumento4 pagineAngeles City v. Angeles Electric CorporationOmsimNessuna valutazione finora

- Gregorio Estrada V. Proculo Noble (Ca) 49 O.G. 139: G.R. No. L-2726. September 29, 1950Documento3 pagineGregorio Estrada V. Proculo Noble (Ca) 49 O.G. 139: G.R. No. L-2726. September 29, 1950Thea Jane MerinNessuna valutazione finora

- Accenture Vs CirDocumento2 pagineAccenture Vs CirCess EspinoNessuna valutazione finora

- Case #38 - CIR vs. United Cadiz SugarDocumento2 pagineCase #38 - CIR vs. United Cadiz SugarJeffrey Magada100% (2)

- Samar-I Electric Cooperative vs. CirDocumento2 pagineSamar-I Electric Cooperative vs. CirRaquel DoqueniaNessuna valutazione finora

- Systra Phils Inc v. CIRDocumento1 paginaSystra Phils Inc v. CIRBRYAN JAY NUIQUENessuna valutazione finora

- CIR v. CitytrustDocumento2 pagineCIR v. Citytrustpawchan02Nessuna valutazione finora

- G.R. No. 170257 September 7, 2011 Rizal Commercial Banking Corporation, vs. Commissioner of Internal RevenueDocumento1 paginaG.R. No. 170257 September 7, 2011 Rizal Commercial Banking Corporation, vs. Commissioner of Internal RevenueEdmerson Prix Sanchez CalpitoNessuna valutazione finora

- People vs. Kintanar Case DigestDocumento4 paginePeople vs. Kintanar Case DigestKatNessuna valutazione finora

- NIPPON EXPRESS (PHILIPPINES) CORPORATION v. CIRDocumento3 pagineNIPPON EXPRESS (PHILIPPINES) CORPORATION v. CIRlucky50% (2)

- Samar-I Electric Cooperative v. CIRDocumento2 pagineSamar-I Electric Cooperative v. CIRTzarlene Cambaliza100% (1)

- Cir Vs United Salvage and Towage Case DigestDocumento1 paginaCir Vs United Salvage and Towage Case DigestjovifactorNessuna valutazione finora

- 050 Smart Communications. Inc. v. Municipality of Malvar, Batangas, G.R. No. 204429, February18, 2014Documento5 pagine050 Smart Communications. Inc. v. Municipality of Malvar, Batangas, G.R. No. 204429, February18, 2014Jerome MoradaNessuna valutazione finora

- Cases 3 - Extinction or Survival of Civil Liability Ex-DelictoDocumento3 pagineCases 3 - Extinction or Survival of Civil Liability Ex-DelictoAllana NacinoNessuna valutazione finora

- 26) Aldamiz v. CFIDocumento1 pagina26) Aldamiz v. CFIPio Guieb AguilarNessuna valutazione finora

- Succession 7 CasesDocumento8 pagineSuccession 7 CasesNullus cumunisNessuna valutazione finora

- Nava Vs CIRDocumento9 pagineNava Vs CIRPia Christine BungubungNessuna valutazione finora

- Zapanta Vs Posadas Case DigestDocumento3 pagineZapanta Vs Posadas Case DigestGoodyNessuna valutazione finora

- CIR v. Fitness by DesignDocumento4 pagineCIR v. Fitness by DesignJesi CarlosNessuna valutazione finora

- Cir Vs Sekisui Jushi PH: Doctrine/SDocumento2 pagineCir Vs Sekisui Jushi PH: Doctrine/SIshNessuna valutazione finora

- RCBC vs. CIRDocumento1 paginaRCBC vs. CIRAldrin TangNessuna valutazione finora

- 05 CIR v. Metro Star Superama Inc.Documento2 pagine05 CIR v. Metro Star Superama Inc.Rem SerranoNessuna valutazione finora

- Phil Journalist Vs CIR - Case DigestDocumento2 paginePhil Journalist Vs CIR - Case DigestKaren Mae Servan100% (1)

- CIR vs. Hambrecht & Quist PHDocumento1 paginaCIR vs. Hambrecht & Quist PHmaica_prudente50% (2)

- Collector vs. HaygoodDocumento5 pagineCollector vs. HaygoodAJ AslaronaNessuna valutazione finora

- 6.18 CIR Vs BenipayoDocumento4 pagine6.18 CIR Vs BenipayoMeg VillaricaNessuna valutazione finora

- CIR V BenipayoDocumento4 pagineCIR V BenipayoJuris PasionNessuna valutazione finora

- Unregistered Cashew Nut Factories Prohibition Act 1967Documento9 pagineUnregistered Cashew Nut Factories Prohibition Act 1967Latest Laws TeamNessuna valutazione finora

- United States Court of Appeals, Third CircuitDocumento11 pagineUnited States Court of Appeals, Third CircuitScribd Government DocsNessuna valutazione finora

- State of Michigan Court of Appeals: Avanagh Elly ORT OODDocumento7 pagineState of Michigan Court of Appeals: Avanagh Elly ORT OODzahra ANessuna valutazione finora

- Discipline and PunishDocumento34 pagineDiscipline and Punishfranzchikit100% (1)

- Fedor Sannikov: To Whom It May ConcernDocumento2 pagineFedor Sannikov: To Whom It May ConcernFedorSannikovNessuna valutazione finora

- People Vs BustineraDocumento24 paginePeople Vs BustineraNap Gonzales100% (1)

- Capital Punishment Lesson PlanDocumento3 pagineCapital Punishment Lesson Planapi-224474919Nessuna valutazione finora

- Case Digests Discovery: Montealto - 1Documento12 pagineCase Digests Discovery: Montealto - 1Ruby ReyesNessuna valutazione finora

- BBA+LLB Question Papers Nov 2018 PDFDocumento103 pagineBBA+LLB Question Papers Nov 2018 PDFSaNessuna valutazione finora

- Human Rights Case DigestsDocumento9 pagineHuman Rights Case DigestsEduard Loberez ReyesNessuna valutazione finora

- Sapp v. County of Alameda Et Al - Document No. 106Documento2 pagineSapp v. County of Alameda Et Al - Document No. 106Justia.comNessuna valutazione finora

- West Yorkshire Police Chief Faces Outside Force InvestigationDocumento5 pagineWest Yorkshire Police Chief Faces Outside Force InvestigationPoliceCorruptionNessuna valutazione finora

- Artemio Villareal vs. PeopleDocumento3 pagineArtemio Villareal vs. PeopleAreeya ManalastasNessuna valutazione finora

- Nevada Reports 1943-1945 (62 Nev.) PDFDocumento346 pagineNevada Reports 1943-1945 (62 Nev.) PDFthadzigsNessuna valutazione finora

- 29 Jessica Lucila Reyes V The Honorable Ombudsman G R No 212593 94 Jessica Lucila Reyes V The Honorable Sandiganbayan and The People of The PhiDocumento2 pagine29 Jessica Lucila Reyes V The Honorable Ombudsman G R No 212593 94 Jessica Lucila Reyes V The Honorable Sandiganbayan and The People of The PhiCROCS Acctg & Audit Dep't100% (4)

- Vicarious Liability - A StudyDocumento14 pagineVicarious Liability - A StudySubham DasNessuna valutazione finora

- Almazan V Atty FelipeDocumento1 paginaAlmazan V Atty FelipeRebecca FloresNessuna valutazione finora

- 1 - Artigas Losada v. Acenas, 78 Phil 228Documento3 pagine1 - Artigas Losada v. Acenas, 78 Phil 228gerlie22Nessuna valutazione finora

- Tiongko Vs AguilarDocumento5 pagineTiongko Vs AguilarJongJongNessuna valutazione finora

- C7Documento13 pagineC7EngHui EuNessuna valutazione finora

- National Appellate Board of NPC V MamauagDocumento14 pagineNational Appellate Board of NPC V MamauagJan Igor GalinatoNessuna valutazione finora

- Period of Limitation in Civil Cases According To Ethiopian LawDocumento2 paginePeriod of Limitation in Civil Cases According To Ethiopian LawmekonenNessuna valutazione finora

- 10 Sec05 04 Pinote-Vs-AycoDocumento6 pagine10 Sec05 04 Pinote-Vs-AycoGalilee RomasantaNessuna valutazione finora

- NewReview of Literature - Justifying The Lowering of The Age of Exemption From Criminal LiabilityDocumento10 pagineNewReview of Literature - Justifying The Lowering of The Age of Exemption From Criminal LiabilityRey LacadenNessuna valutazione finora

- Janamaithri PerinthalmannaDocumento94 pagineJanamaithri PerinthalmannaVishnu. PpNessuna valutazione finora

- The Burma Code Vol-8Documento459 pagineThe Burma Code Vol-8kerrypwlNessuna valutazione finora

- Marcos Vs Chief of StaffDocumento1 paginaMarcos Vs Chief of StaffDegardNessuna valutazione finora

- (Topic C Table 8) Ms. Nadzira Boenjamin, IndonesiaDocumento5 pagine(Topic C Table 8) Ms. Nadzira Boenjamin, IndonesiaMita BoenjaminNessuna valutazione finora

- Agcaoili V SuguitanDocumento1 paginaAgcaoili V SuguitanHylie HungNessuna valutazione finora