Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

INCOTAX - 06 - Individuals, Estates, Trusts

Caricato da

Jainder de GuzmanTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

INCOTAX - 06 - Individuals, Estates, Trusts

Caricato da

Jainder de GuzmanCopyright:

Formati disponibili

TAXATION: Individuals, Estates, Trusts

Batangas CPA Review Center

Tanauan City, Batangas

“Committed to your CPA review needs”

JVR

How to Tax an Individual?

Remember that if the income is already subject to final taxes, such income cannot be reported in regular

income taxation.

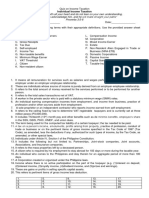

Individual with Compensation Income Only

Gross Compensation Income xxxx

Less: Exempt Compensation Income (xxx)

Taxable Compensation Income xxxx

Individual with Business Income only (may use Itemized or OSD)

Gross Sales/Gross Receipts/Gross Revenues xxxx

Less: Cost of Sales/Services (xxx)

Gross Profit from business/profession xxxx

Add: Non-Operating Income xxxx

Gross Income xxxx

Less: (1) Itemized Deduction (xxx)

Taxable Net Income xxxx

If he avails 8% preferential income tax:

Gross Sales/Gross Receipts xxxx

Add: Non-operating income xxxx

Less: 250,000 exemption (xxx)

Taxable Income xxxx

Individual with Mixed Income – graduated tax

Gross Sales/Gross Receipts/Gross Revenues xxxx

Less: Cost of Sales/Services (xxx)

Gross Profit from business/profession xxxx

Add: (1) Taxable Gross Compensation Income xxxx

(2) Non-Operating Income xxxx

Gross Income xxxx

Less: (1) Itemized Deduction (xxx)

Taxable Net Income xxxx

Individual with Mixed Income – 8% preferential tax

For Compensation:

Gross Compensation Income xxxx

Less: Exempt Compensation Income (xxx)

Taxable Compensation Income xxxx

For business/professional income:

Gross Sales/Gross Receipts xxxx

Add: Non-operating income (xxx)

Taxable Income xxxx

Incidental Sales/Receipts/Revenues are to be included in Gross Sales/Gross Receipts/Gross Revenues

Note that if the Net Operating Income is negative, this is treated as net operating loss, to be deducted in the

next 3 consecutive years.

OLD LAW

PERSONAL AND ADDITIONAL EXEMPTION

These are fixed amounts allowed, in lieu of personal and family expenses, to be deducted from taxable gross

compensation income and/or net business/professional income, as the case may be, of an individual taxpayer.

See the table below for application of exemptions to different classification of individual taxpayers:

RC NRC RA NRAETB NRANETB/SAE

Basic Personal Allowed Allowed Allowed Allowed, subject Not Allowed

Exemption to reciprocity

Additional Allowed Allowed Allowed Not Allowed* Not Allowed

Exemption

Additional Exemption for Dependents

These are additional exemptions allowed for supporting child/children as well as persons with disabilities

within the fourth civil degree. The additional exemptions, not exceeding P100,000, shall be allowed to only

one of the spouses. The proper claimant of the additional exemptions is the husband, unless:

(1) The husband waives his right.

(2) The husband has no taxable income subject to regular tax.

TAX by Jonas POGI Reyes, CPA Page 1

TAXATION: Individuals, Estates, Trusts

In case of legally separated spouses, the additional exemption shall be claimed by the spouse who has

custody over the child/children or Persons with Disability within the fourth civil degree (PWD). However, the

total combined additional exemption cannot exceed P100,000.

Meaning of Qualified Dependents

In case of Child/Children

The child must be:

(1) Legitimate child, illegitimated child, legally adopted child, or foster child of the claimant

(2) The child is:

(a) Living with the taxpayer

(b) Dependent for the taxpayer’s chief support

(c) Not More than 21 years of age

(d) Even if more than 21 years of age, the child is incapable of self-support due to mental or physical

defects

(e) Not Married

(f) Not Gainfully Employed

In case of PWD

The PWD must be:

(1) Relative by consanguinity or affinity within the fourth civil degree

(2) Living with the taxpayer and dependent upon the taxpayer’s chief support

(3) Not Married

(4) Not Gainfully Employed

(5) A Filipino citizen

Illustration A

In 2017, X, CPA, is a widower who supports the following dependents living with him:

A – Mother of deceased wife, 65 years old, unemployed

B – legitimate child of deceased wife with her first husband, 20 years old

C – Legitimate child, 18 years old

D – Legitimate new born child

E – Brother, 24 years old, physically defective, gainfully employed

F – Nephew, 2 years old, with hearing disability, illegitimate son of his deceased sister

G – Sister, 26 years old, widow, with speech impairment, unemployed

H – Legitimate daughter of his widowed sister, 3 years old

I – Foster child, 5 years old

In September 2017, C married and G became gainfully employed

How much is the additional exemptions allowed to X in 2017 and 2018?

Illustration B

X and Y are husband and wife with six minor children. They were legally separated in 2017, where the custody

of five children were awarded by the court to X, and one child to Y. Y supports her brother Z, who is deaf

mute, unmarried, unemployed and living with her. How much basic and additional exemptions are allowed to

X and Y, respectively?

Illustration C

X, a CPA, and Y, an employee are husband and wife with four minor children. Y supports her 14 year old

brother A, a PWD, living with them. X claims the additional exemptions for their four children. Can Y claim for

additional exemption for her brother who is a PWD?

Assuming they only have 3 children, can Y claim additional exemption for her brother?

EFFECT of Change in Status

(1) The taxpayer marries

The taxpayer may still claim the personal exemption of P50,000. In case the taxpayer has a qualified

dependent before the marriage, he may still claim the additional exemption.

(2) Birth of a Child

The taxpayer may claim the additional exemption in the year the child is born, as if the child is born at

the beginning of the year

(3) Death of a Dependent

The taxpayer may still claim the additional exemption in the year the dependent dies, as if the

dependent died at the end of the year.

(4) The taxpayer dies during the year

Illustration D

Assuming X died in June 1, 2017. He left properties which still earned income after death.

Premium Payments on Health or Hospitalization Insurance (PHHI)

The amount of premiums not to exceed Two thousand four hundred pesos (P2,400) per family or Two hundred

pesos (P200) a month paid during the taxable year for health and/or hospitalization insurance taken by the

TAX by Jonas POGI Reyes, CPA Page 2

TAXATION: Individuals, Estates, Trusts

taxpayer for himself, including his family, shall be allowed as a deduction from his gross income: Provided,

That said family has a gross income of not more than Two hundred fifty thousand pesos (P250,000) for the

taxable year: Provided, finally, That in the case of married taxpayers, only the spouse claiming the additional

exemption for dependents shall be entitled to this deduction.

If the individual opted to claim OSD, PHHI may still be claimed as deduction.

Illustration E

Assuming POGI and SEXY are husband and wife. They have 6 children qualified as dependents. The wife pays

P300 per month as premium for health and hospitalization insurance. The insurance payment began in the

month of May during the year. The husband earned P80,000 taxable gross compensation income for the year.

The wife earned P90,000 taxable gross compensation income for the year. How much PHHI may the husband

claim?

Assuming that the husband waives his right to claim additional exemption, how much PHHI may

the wife claim?

Illustration F Individual earning Compensation Income and Professional Income

Assuming POGI, employed as a manager, has the following data for the year 2018:

Salaries 1,200,000

13th month pay 100,000

Gain on exercise of stock option, granted by employer 300,000

Fee received as reviewer of Taxation, gross of 10% CWT 1,000,000

Illegal Cockfight Winnings 200,000

Winnings from horse racing bet 100,000

Interest income from long term deposit 200,000

Prize from chess tournament in Spain 2,000,000

Assuming the employer did not withhold tax on compensation.

Required:

(1) How much is the taxable net income to be reported by POGI in 2018?

(2) How much is the Income tax payable?

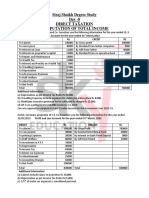

A. GRADUATED TAX TABLE (OLD LAW)

Sec. 24 (A) – The tax shall be computed on taxable income in accordance with and at the rates established in the

following schedule:

Over But not over The tax shall be Plus of excess over

- P10,000 5% - -

P10,000 30,000 P 500 10% P10,000

30,000 70,000 2,500 15% 30,000

70,000 140,000 8,500 20% 70,000

140,000 250,000 22,500 25% 140,000

250,000 500,000 50,000 30% 250,000

500,000 - 125,000 32% 500,000

Illustration G Individual Earning business income, other income and compensation income

Assuming POGI, employed as a rank and file employee, conducts his own business. The following data are

available for 2018:

Gross Sales 1,000,000

Cost of Sales 400,000

Interest Income earned abroad 200,000

Interest income from long term deposit 500,000

Interest income from domestic bonds 80,000

Dividend Income from domestic corporation 100,000

Share from net income of GPP 200,000

Salaries from employer 800,000

Interest expense 200,000

Bad debts expense 100,000

Depreciation expense 100,000

Additional information:

(1) POGI donated P100,000 to a private educational institution.

(2) POGI also donated 100,000 to an accredited non-stock non-profit charitable institution.

(3) POGI sold a real property classified as capital asset for P2,000,000. Assessed Value is P1,800,000 and

Zonal Value is P2,100,000.

(4) POGI also sold a non-depreciable vehicle at a gain of P400,000. Holding Period is 2 years.

(5) POGI has an investment in stocks in LUGE Corporation. Cost is P300,000. LUGE Corporation became

bankrupt, thereby rendering the stocks worthless. Holding period is 2 years.

Assuming the employer did not withhold tax on compensation.

Required:

(1) How much is taxable net income of POGI?

(2) Assuming POGI opted to use OSD, how much is the taxable net income?

TAX by Jonas POGI Reyes, CPA Page 3

TAXATION: Individuals, Estates, Trusts

Illustration H Income of Husband and Wife

Mr. And Mrs. Delos Reyes, both CPA’s and residents of the Philippines had the following data for taxable year

2018:

Salaries, Mrs. P150,000

Bonus (13th month pay),Mrs. 42,000

Income from practice of Profession, Mr. & Mrs.

(net of 10% withholding tax) 450,000

Expenses – professional practice 120,000

Rental income (net of 5% withholding tax) 190,000

Rental expenses 80,000

Other income, Mr. 80,000

20% of the other income is non-taxable. They have 12 minor children.

Required: Determine the taxable net income of husband and wife.

FILING of RETURNS

Income Tax Return

BIR Form 1700 For Individuals without Due Date - On or before April 15 of next calendar

business; and those not year

qualified under

substituted filing

BIR Form 1701Q For Individuals with Due Date

business, trade or First Quarter – On or before May 15 of the

profession, including non- calendar year

operating income Second Quarter - On or before August 15 of the

calendar year

Third Quarter – On or before November 15 of the

calendar year

BIR Form 1701A For Individuals with Due Date – On or before April 15 of next calendar

business, trade or year

profession, including

compensation income

and non-operating

income

PROBLEM 1

Mr. Jonas POGI created two (2) trusts designating Atty. Amado Villegas and the POGI Trust Company as

trustees. The common beneficiary of the two (2) trusts was his son, Jonas II, married, and with two (2)

qualified dependent children. The following data were made available for the current year:

Trust No. 1 Trust No. 2

Gross Income P 600,000 P 700,000

Business Expenses 300,000 400,000

Income distribution to beneficiary 100,000 200,000

Jonas POGI II

Gross Income P 800,000

Business Expenses 250,000

Income distribution received, gross of

15% creditable withholding tax 300,000

1. How much was the taxable income of trust 1?

2. How much was the taxable income of trust 2?

3. Using the same data in Problem 1, how much was the tax payable of trust No. 1 after considering their

share in the consolidated income tax?

4. Using the same data in Problem 1, how much was the tax payable of trust No. 2 after considering their

share in the consolidated income tax?

5. Using the same data in Problem 1, how much was the tax payable of Jonas II?

PROBLEM 2

Mr. POGI designated two trusts as follows:

Trust Beneficiary Details

Trust 1 Jonas, his son Irrevocable, however Mr. POGI reserves the power to

revest to himself 1/3 of the corpus or income

Trust 2 Jon, his another son Irrevocable, except that P40,000 of the annual income

will be used to pay Mr. POGI’s life insurance premium

Trust 1 and Trust 2 earned P300,000 and P600,000 during the year, respectively. Distributions made by Trust

1 to Jonas amounted to P60,000. Distributions made by Trust 2 to Jon amounted to P50,000.

Required:

TAX by Jonas POGI Reyes, CPA Page 4

TAXATION: Individuals, Estates, Trusts

1. Determine the taxable income of both trusts.

PROBLEM 3

Mr. POGI has a business and at the same time is employed as a tax professor in POGI University. Data for

2018 is as follows:

POGI’s payslip is shown below:

Gross Salaries 5,000,000

Less: Absences 100,000

Net Salaries 4,900,000

Less:

SSS contributions 200,000

HDMF contributions 150,000

PhilHealth contributions 200,000

Labor union contributions 200,000

Company loan payments 100,000

SSS loan payments 100,000

Take Home pay 3,950,000

His business data is shown below:

Gross Sales 10,000,000

Cost of Sales 2,000,000

Operating Expenses 1,000,000

General and Administrative expenses 1,000,000

Withholding taxes by customers 100,000

January to September income tax payments 500,000

January to December VAT payments 960,000

Aside from those data above, POGI also has interest income from customer’s notes amounting to 500,000.

How much is the withholding tax on compensation?

How much is the taxable net income of POGI to be reported in 1701A?

How much is the income tax payable by POGI for 2018?

TRAIN LAW EXERCISES

TRAIN LAW INDIVIDUAL GRADUATED TAX RATES

Over Not Over Basic Tax Additional Rate Of Excess Over

250,000 400,000 0 20% 250,000

400,000 800,000 30,000 25% 400,000

800,000 2,000,00 130,000 30% 800,000

2,000,000 8,000,000 490,000 32% 2,000,000

8,000,000 - 2,410,000 35% 8,000,000

STRAIGHT PROBLEMS

PROBLEM 1

Ms. EBQ operates a convenience store while she offers bookkeeping services to her clients. In 2018, her gross

sales amounted to P800,000.00, in addition to her receipts from bookkeeping services of P300,000.00. She

already signified her intention to be taxed at 8% income tax rate in her 1st quarter return.

How much is income tax due?

PROBLEM 2

Mr. A signified his intention to be taxed at 8% income tax rate on gross sales in his 1st quarter return. He has

no other source of income. His total sales for the first 3 quarters amounted to 3,000,000 with 4th quarter

sales of P3,500,000

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

Total Sales 500,000 500,000 2,000,000 3,500,000

Less: cost of Sales (300,000) (300,000) (1,200,000) (1,200,000)

Gross Income 200,000 200,000 800,000 2,300,000

Less: Operating Expenses (120,000) (120,000) (480,000) (720,000)

Taxable Income 80,000 80,000 320,000 1,580,000

Determine income tax payable every quarter._____________________

TAX by Jonas POGI Reyes, CPA Page 5

TAXATION: Individuals, Estates, Trusts

PROBLEM 3

In 2018, Mr. A owns a nightclub and videoke bar, with gross sales/receipts of P2,500,000. His cost of sales

and operating expenses are P1,000,000 and P600,000, respectively, and with non-operating income of

P100,000.

Determine the income tax due______________________

PROBLEM 4

Mr. A, an officer of ABC Corporation, earned in 2018 an annual compensation of P1,200,000, inclusive of 13th

mo. and OB of P120,000. Aside from employment, he owns a farm, with gross sales of 3,500,000. His cost of

sales and operating expenses are P1,000,000 and P600,000, respectively, and with non-operating income of

P100,000.

Determine the income tax due.________________

Can the taxpayer avail the 8% preferential tax? _________________

PROBLEM 5

Mr. A, a Financial Comptroller, earned annual compensation income in 2018 of P1,500,000, inclusive of 13th

month and other benefits of P120,000 but net of mandatory contributions to SSS and Philhealth. Aside from

employment income, he owns a convenience store with gross sales of P2,400,000. His Cost of Sales and

Operating Expenses are P1,000,000 and P600,000, respectively, and with non-operating income of P100,000.

Assuming the taxpayer opted for 8% income tax rate, how much is the income tax due?______________

TAX by Jonas POGI Reyes, CPA Page 6

Potrebbero piacerti anche

- Introduction To Regular Income TaxDocumento44 pagineIntroduction To Regular Income TaxGabriel Trinidad Soniel0% (1)

- Copy Individual Income TaxDocumento10 pagineCopy Individual Income TaxMari Louis Noriell MejiaNessuna valutazione finora

- Regular Income TaxDocumento11 pagineRegular Income Taxwhat ever100% (4)

- The Regular Income TaxDocumento4 pagineThe Regular Income TaxJean Diane JoveloNessuna valutazione finora

- Computed Using Classification and Globalization Rule: or Business Income Such As Passive IncomeDocumento10 pagineComputed Using Classification and Globalization Rule: or Business Income Such As Passive IncomelcNessuna valutazione finora

- Chapter 3Documento8 pagineChapter 3Eunice SerneoNessuna valutazione finora

- Individual Income Taxation-ComputationDocumento27 pagineIndividual Income Taxation-ComputationeuniNessuna valutazione finora

- TaxaoneDocumento20 pagineTaxaonedianne ballonNessuna valutazione finora

- Income and Business TaxationDocumento1 paginaIncome and Business TaxationTomo Euryl San JuanNessuna valutazione finora

- Abm 11 - Fabm2 2ND Semester Finals Module 4 (Pielago)Documento11 pagineAbm 11 - Fabm2 2ND Semester Finals Module 4 (Pielago)edjay.mercado85Nessuna valutazione finora

- Notes Income Taxation IndividualDocumento10 pagineNotes Income Taxation IndividualTriscia QuiñonesNessuna valutazione finora

- Taxation HandoutDocumento9 pagineTaxation HandoutTricia mae DingsitNessuna valutazione finora

- Procedure BIR Form To Submit: Fill in Both Forms For (A) & (B)Documento21 pagineProcedure BIR Form To Submit: Fill in Both Forms For (A) & (B)TenNessuna valutazione finora

- Computation of Total IncomeDocumento15 pagineComputation of Total Incomekhushi shahNessuna valutazione finora

- Income Tax of IndividualsDocumento27 pagineIncome Tax of IndividualsChristmaNessuna valutazione finora

- Taxation of IndividualsDocumento23 pagineTaxation of IndividualsKristyl CernaNessuna valutazione finora

- Co-Ownership, Estates and TrustsDocumento13 pagineCo-Ownership, Estates and TrustsRoronoa Zoro100% (1)

- Income Taxation: Gross Revenue PXXXXX Deductions XXXXXDocumento8 pagineIncome Taxation: Gross Revenue PXXXXX Deductions XXXXXPSHNessuna valutazione finora

- Chapter 7 Regular Income TaxationDocumento4 pagineChapter 7 Regular Income TaxationMary Jane Pabroa100% (1)

- Forecast in Taxation Law: Atty. Raegan L. CapunoDocumento47 pagineForecast in Taxation Law: Atty. Raegan L. CapunoFrance SanchezNessuna valutazione finora

- Intro RIT - Exclusion in GIDocumento23 pagineIntro RIT - Exclusion in GIdelacruzrojohn600Nessuna valutazione finora

- Department of Accountancy Income Taxation - Quizzer Answer Key Case 1Documento11 pagineDepartment of Accountancy Income Taxation - Quizzer Answer Key Case 1Dominic BulaclacNessuna valutazione finora

- Individual Income TaxDocumento12 pagineIndividual Income TaxNica Jane MacapinigNessuna valutazione finora

- CorporationDocumento23 pagineCorporationLiyana Chua50% (2)

- Chapter 13 - DeductionsDocumento5 pagineChapter 13 - DeductionsDeviane CalabriaNessuna valutazione finora

- Heads of Income - Income From SalaryDocumento10 pagineHeads of Income - Income From SalaryBhavesh KhillareNessuna valutazione finora

- Income Tax of IndividualsDocumento4 pagineIncome Tax of IndividualsBhabhing EnriquezNessuna valutazione finora

- Income Taxation IndividualDocumento6 pagineIncome Taxation IndividualJessa BeloyNessuna valutazione finora

- Module 7 Tax On IndividualsDocumento25 pagineModule 7 Tax On IndividualsAbegail Jenn Elis MulderNessuna valutazione finora

- Clwtaxn - Lecture Week4Documento17 pagineClwtaxn - Lecture Week4Maria Angelika ArcillaNessuna valutazione finora

- IT Module No. 7: Introduction To Regular Income TaxDocumento13 pagineIT Module No. 7: Introduction To Regular Income TaxjakeNessuna valutazione finora

- Prelim Take Home ExamDocumento11 paginePrelim Take Home ExamPATATASNessuna valutazione finora

- Income Taxation (Income Tax On Individuals)Documento3 pagineIncome Taxation (Income Tax On Individuals)Isabelle HanNessuna valutazione finora

- Morales Taxation Topic 5 Allowable DeductionsDocumento33 pagineMorales Taxation Topic 5 Allowable DeductionsMary Joice Delos santosNessuna valutazione finora

- Q and A TaxationDocumento22 pagineQ and A TaxationJayson Pajunar ArevaloNessuna valutazione finora

- Personal Exemptions: UK: Income Tax ExemptionsDocumento4 paginePersonal Exemptions: UK: Income Tax ExemptionsLuiza ŢîmbaliucNessuna valutazione finora

- Taxation 8-Preferential Taxation: Pre-TestDocumento4 pagineTaxation 8-Preferential Taxation: Pre-TestCharles Decripito Flores100% (1)

- Train Law WordDocumento12 pagineTrain Law WordIsaac CursoNessuna valutazione finora

- Saint John School: Learning Kit 1 - Fundamentals of Accountancy, Business and Management 2Documento7 pagineSaint John School: Learning Kit 1 - Fundamentals of Accountancy, Business and Management 2Cynthia SantosNessuna valutazione finora

- Prelim Take-Home ExamDocumento12 paginePrelim Take-Home ExamAmbassador WantedNessuna valutazione finora

- Dealon Prelim Take Home ExamDocumento12 pagineDealon Prelim Take Home ExamPATATASNessuna valutazione finora

- Compensation IncomeDocumento21 pagineCompensation IncomeRyDNessuna valutazione finora

- RC Nirc, Ra, Nra-Etb Nra-Netb: Taxpayer Tax Base Source of Taxable IncomeDocumento7 pagineRC Nirc, Ra, Nra-Etb Nra-Netb: Taxpayer Tax Base Source of Taxable IncomeGwyneth GloriaNessuna valutazione finora

- Allowable DeductionsDocumento17 pagineAllowable DeductionsShanelle SilmaroNessuna valutazione finora

- Computation of Taxable Income and Tax LiabilityDocumento9 pagineComputation of Taxable Income and Tax LiabilityaNessuna valutazione finora

- 1 Deductions From Gross Income-FinalDocumento24 pagine1 Deductions From Gross Income-FinalSharon Ann BasulNessuna valutazione finora

- INCOMEDocumento6 pagineINCOMEMaris Joy BartolomeNessuna valutazione finora

- ERG TAX 7.0 CorporationDocumento22 pagineERG TAX 7.0 CorporationRiyo Mae MagnoNessuna valutazione finora

- Lecture 2 Income Taxation IndividualDocumento5 pagineLecture 2 Income Taxation IndividualJohn Daryl P. DagatanNessuna valutazione finora

- W4 Module 4-Concept of Income and Gross IncomeDocumento24 pagineW4 Module 4-Concept of Income and Gross IncomeElmeerajh JudavarNessuna valutazione finora

- PIT09 Tax ReducersDocumento8 paginePIT09 Tax ReducersAlellie Khay D JordanNessuna valutazione finora

- Abm Income TaxationDocumento8 pagineAbm Income TaxationNardsdel RiveraNessuna valutazione finora

- Taxation 4Documento8 pagineTaxation 4Bossx BellaNessuna valutazione finora

- Module 07 - Introduction To Regular Income TaxDocumento25 pagineModule 07 - Introduction To Regular Income TaxJANELLE NUEZNessuna valutazione finora

- Taxation of Individuals: Step 1 Step 2: Step 3Documento39 pagineTaxation of Individuals: Step 1 Step 2: Step 3Pratyanshi MehtaNessuna valutazione finora

- Deductions From Gross Income Lesson 13Documento72 pagineDeductions From Gross Income Lesson 13Mikaela SamonteNessuna valutazione finora

- Written Report Week 8 Income TaxDocumento16 pagineWritten Report Week 8 Income Taxdevy mar topiaNessuna valutazione finora

- Quiz On Income TaxationDocumento2 pagineQuiz On Income TaxationVergel Martinez100% (1)

- Landlord Tax Planning StrategiesDa EverandLandlord Tax Planning StrategiesNessuna valutazione finora

- Handout No. 7N: Point of Distinction Accomodation Party Regular PartyDocumento2 pagineHandout No. 7N: Point of Distinction Accomodation Party Regular PartyJainder de GuzmanNessuna valutazione finora

- INCOTAX - 06 - Individuals, Estates, TrustsDocumento6 pagineINCOTAX - 06 - Individuals, Estates, TrustsJainder de GuzmanNessuna valutazione finora

- Auditing CisDocumento15 pagineAuditing CisAnthony Arcilla Pulhin86% (7)

- Projected Cash Flow Statement Analysis Chapter 5.1Documento1 paginaProjected Cash Flow Statement Analysis Chapter 5.1Jainder de GuzmanNessuna valutazione finora

- Advanced Accounting Guerrero Peralta Volume 1 Solution Manual PDFDocumento189 pagineAdvanced Accounting Guerrero Peralta Volume 1 Solution Manual PDFRegina Fuertes Padilla100% (2)

- Article 1868 1875 Sales ReviewerDocumento3 pagineArticle 1868 1875 Sales ReviewerJainder de GuzmanNessuna valutazione finora

- Auditing Theory Review Notes PDFDocumento136 pagineAuditing Theory Review Notes PDFTricia Mae Fernandez100% (1)

- Reviewer - Intangible AssetsDocumento7 pagineReviewer - Intangible AssetsKim Nicole Reyes100% (4)

- TAX-801 (Sources of Income)Documento2 pagineTAX-801 (Sources of Income)Ciarie SalgadoNessuna valutazione finora

- Earnest Money Receipt AgreementDocumento2 pagineEarnest Money Receipt AgreementLex DagdagNessuna valutazione finora

- Donations and Gifts: T1-2019 Schedule 9Documento2 pagineDonations and Gifts: T1-2019 Schedule 9hypnotix-2000Nessuna valutazione finora

- Acctg 323 MT ExamDocumento10 pagineAcctg 323 MT ExamJoyluxxiNessuna valutazione finora

- 28123rmc No. 09-2006Documento5 pagine28123rmc No. 09-2006Kathrine Chin LuNessuna valutazione finora

- Accounting-Chapter 3Documento53 pagineAccounting-Chapter 3Maisha Uddin100% (1)

- Form 16 FYbilDocumento8 pagineForm 16 FYbilBilalNessuna valutazione finora

- Facts 1 Armando Z and Lourdes K Gonzales Are Married and File A Joint Return Armando Is SelfDocumento4 pagineFacts 1 Armando Z and Lourdes K Gonzales Are Married and File A Joint Return Armando Is SelfCharlotteNessuna valutazione finora

- Statement of Cash FlowsDocumento2 pagineStatement of Cash FlowsMae MarinoNessuna valutazione finora

- Soal Pembekalan Skema Akuntansi PratamaDocumento30 pagineSoal Pembekalan Skema Akuntansi Pratamaranho jaelaniNessuna valutazione finora

- Property, Plant, and EquipmentDocumento3 pagineProperty, Plant, and EquipmentIzza Mae Rivera KarimNessuna valutazione finora

- Chapter 9 Part 1 Input VatDocumento25 pagineChapter 9 Part 1 Input VatChristian PelimcoNessuna valutazione finora

- Interim Financial Reporting: Indoyon - JaniolaDocumento11 pagineInterim Financial Reporting: Indoyon - JaniolaCaryl JANIOLANessuna valutazione finora

- Case Study: Dreamworld Amusement Park Dreamworld: Initial Years of OperationDocumento3 pagineCase Study: Dreamworld Amusement Park Dreamworld: Initial Years of OperationArnav MittalNessuna valutazione finora

- Cipla Standalone Balance Sheet - in Rs. Cr. - 1.equity & Liabilities A) Shareholder's FundDocumento6 pagineCipla Standalone Balance Sheet - in Rs. Cr. - 1.equity & Liabilities A) Shareholder's Fundmanwanimuki12Nessuna valutazione finora

- ACCOUNTDocumento2 pagineACCOUNTRenni SetianiiNessuna valutazione finora

- CARL of 1998 Sec 62-67Documento2 pagineCARL of 1998 Sec 62-67Elisa Dela FuenteNessuna valutazione finora

- Fee Structure NBADocumento2 pagineFee Structure NBAVenkiteshNessuna valutazione finora

- Kent County May ElectionsDocumento3 pagineKent County May ElectionsWXMINessuna valutazione finora

- Sea Tax Guide To Taxation in Sea 2022Documento219 pagineSea Tax Guide To Taxation in Sea 2022JosephNessuna valutazione finora

- Quiz 5Documento14 pagineQuiz 5Mina LouveryNessuna valutazione finora

- Republic of The Philippines v. Honorable E.L. Peralta, Et AlDocumento5 pagineRepublic of The Philippines v. Honorable E.L. Peralta, Et AlKriselNessuna valutazione finora

- LPPF LK TW Iii 2019Documento69 pagineLPPF LK TW Iii 2019Ori SutedjaNessuna valutazione finora

- Systems Understanding AidDocumento12 pagineSystems Understanding AidPayton CraigNessuna valutazione finora

- Day 8 TaxationDocumento2 pagineDay 8 TaxationKhan Shadab -27Nessuna valutazione finora

- FAF Tutorial 7 Deferred TaxationDocumento2 pagineFAF Tutorial 7 Deferred Taxation嘉慧Nessuna valutazione finora

- April Sathish Pay SlipDocumento1 paginaApril Sathish Pay Slipmsathish7428Nessuna valutazione finora

- Lecture Notes Estates and TrustDocumento3 pagineLecture Notes Estates and TrustNneka VillacortaNessuna valutazione finora

- Practice Exercises ON Income Tax BY Jeanefer B. Reyes Cpa MpaDocumento50 paginePractice Exercises ON Income Tax BY Jeanefer B. Reyes Cpa MpaErica NicolasuraNessuna valutazione finora

- Excercise 19Documento7 pagineExcercise 19raihan aqilNessuna valutazione finora