Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Godrej Consumer Products Limited: Recovery Likely by Q1FY2021

Caricato da

anjugaduTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Godrej Consumer Products Limited: Recovery Likely by Q1FY2021

Caricato da

anjugaduCopyright:

Formati disponibili

Stock Update

Godrej Consumer Products Limited

Recovery likely by Q1FY2021

The global Coronavirus outbreak has resulted in an increased demand for

Sector: Consumer Goods

personal care and hygiene products. Godrej Consumer Products Limited’s

Company Update (GCPL’s) management witnessed a significant increase in sales of small

soaps, hand washes and hand sanitisers in the past two months (hand

Change sanitiser sales surged 10x the normal sales). The company is ramping up its

production capacity for sanitisers in own units and through vendor partners.

Reco: Buy It is also optimising distribution channels to meet rising demand. A surge in

CMP: Rs. 639 demand for hygiene products would result in incremental sales for domestic

business in Q4FY2020. Moreover, the company has also hiked soap prices

Price Target: Rs. 865 by 5% to pass on an increase in palm oil derivatives, which is expected

á Upgrade No change â Downgrade to drive value growth. Soaps have been gaining market share over the

quarters and the company expects the momentum to sustain. Globally, the

Company details performance of the Indonesia business has been stable and has not been

impacted by the Coronavirus. Small opportunities were witnessed in Africa

Market cap: Rs. 65,326 cr due to reduced competitive intensity from Chinese players but the overall

environment remains soft. With an expected revival in domestic demand in

52-week high/low: Rs. 772/557 another two quarters and gradual recovery in the HI category, we expect

domestic volume growth to sustain at 7-9% in the coming quarters.

NSE volume: (No of

11.6 lakh Recovery in demand likely by Q1FY2021: As per the management, sector

shares)

slowdown persists due to slowdown in rural growth (which slowed to 0.5x

BSE code: 532424 urban as compared to 1.2x earlier) and liquidity pressure. However, the

company has been witnessing a gradual recovery in demand. With a good rabi

NSE code: GODREJCP crop and government efforts to boost rural consumption, it expects demand

to start recovering by Q1FY2021. This along with better performance of the

Sharekhan code: GODREJCP international business, good response to new products and the narrowing

gap between volume growth and value growth in the domestic market is

Free float: (No of

37.6 cr likely to help the revenue growth trajectory improve in the coming quarters.

shares)

Our Call

Valuation – Maintain Buy with an unchanged PT of Rs. 865: GCPL’s

Shareholding (%) management has maintained its thrust on delivering consistent volume

Promoters 63.2 growth in the domestic market, accelerate growth in key international markets

and maintain operating margins at consolidated levels. Thus, we expect the

FII 27.8 company to report revenue and earnings CAGR of 9.1% and 15.7%, respectively.

The stock has corrected by ~19% from its recent high and is currently trading

DII 2.2 at 33.7x its FY2021E and 28.5x its FY2022E earnings, which is at a discount to

its historical average. We maintain our Buy recommendation on the stock with

Others 6.8 an unchanged PT of Rs. 865.

Key Risks

Price chart Fluctuation in currencies of key markets, including Africa and Indonesia

800 will affect revenue growth and profitability of the international business.

750

Increased prices of key raw materials such as palm oil would affect

700

profitability and earnings growth.

650

600

550

500

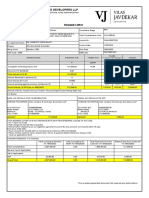

Valuation (Consolidated) Rs cr

Mar-19

Mar-20

Jul-19

Nov-19

Particulars FY18 FY19 FY20E FY21E FY22E

Revenue 9,937 10,314 10,400 11,815 13,382

Price performance OPM (%) 21.1 20.7 21.8 22.4 23.1

Adjusted PAT 1,493 1,479 1,608 1,938 2,288

(%) 1m 3m 6m 12m Adjusted EPS (Rs.) 14.6 14.5 15.7 19.0 22.4

P/E (x) 43.7 44.2 40.6 33.7 28.5

Absolute -3.2 -8.9 9.0 -5.9

P/B (x) 7.0 9.0 8.3 7.4 6.4

Relative to EV/EBIDTA (x) 22.9 32.4 30.5 26.0 22.2

2.7 -3.2 4.0 -12.6

Sensex RoNW (%) 25.8 21.9 21.2 23.2 24.1

RoCE (%) 17.4 17.5 17.9 20.2 22.1

Sharekhan Research, Bloomberg

Source: Company; Sharekhan estimates

March 06, 2020 2

Stock Update

Financials in charts

Revenue was flat in Q3FY2020 Volume growth sustained at 7% in Q3FY2020

10 20 18.0

8.1

8 5.8 14.0

5.2 15

6

3.6

4

2 0.6 1.0 10 6.0 7.0 7.0

(%)

(%)

0 5.0 5.0

-2 -1.1 5

1.0 1.0

-4 -2.6

-6 -4.9 0

Q3FY18

Q4FY18

Q1FY19

Q2FY19

Q3FY19

Q4FY19

Q1FY20

Q2FY20

Q3FY20

Q3FY18

Q4FY18

Q1FY19

Q2FY19

Q3FY19

Q4FY19

Q1FY20

Q2FY20

Q3FY20

Value Growth (%) Volume Growth (%)

Source: Company, Sharekhan Research Source: Company, Sharekhan Research

OPM improved to 22.7% in Q3FY2020 HI category witnessed recovery

26 30 25

23.9 23.6

24 22.8 22.6 22.7 25

21.9 20 17

22 15

19.5

20 10

18.1 18.3 4 3

(%)

5

(%)

18

0

16 -5 -2

-5 -4

-10 -6

14

Q4FY18

Q1FY19

Q2FY19

Q3FY19

Q4FY19

Q1FY20

Q2FY20

Q3FY20

Q3FY18

Q4FY18

Q1FY19

Q2FY19

Q3FY19

Q4FY19

Q1FY20

Q2FY20

Q3FY20

OPM (%) Household Insecticides (HI)

Source: Company, Sharekhan Research Source: Company, Sharekhan Research

Soaps and Hair colour sales were subdued Working capital cycle remained stable

25 21 60 48

20

15 12 11 40

10

10 7

5 2 1 3 2 20 11

(%)

0

Days

0

-5

-5 -1 0

-4 -4 -4 -11

-10

-20

Q1FY19

Q2FY19

Q3FY19

Q4FY19

Q1FY20

Q2FY20

Q3FY20

FY16 FY17 FY18 FY19

Soaps Hair Colour Working Capital Days

Source: Company, Sharekhan Research Source: Company, Sharekhan Research

March 06, 2020 3

Stock Update

Outlook

Domestic volume growth to remain at 7-9% in the near term: GCPL’s domestic volume growth improved

to 7% in Q3FY2020. Higher sale of small soaps, hand wash and hand sanitizers due to the virus outbreak

will result in incremental sales for the domestic business in Q4FY2020. OPM for 9MFY2020 stood at 21.5%

and the company expects the margins to sustain, backed by cost efficiencies. With a good rabi crop and

the government’s efforts to boost rural consumption, the company expects demand to gradually recover

by Q1FY2021. With a good response to new products, expected improvement in the domestic demand

environment, likely narrowing of current volume growth and value growth gap in the domestic market, the

revenue growth trajectory is likely to improve in the coming quarters. We expect domestic volume growth to

sustain at 7-9% in the coming quarters and gradually improve as the scale of the HI and hair colour businesses

increases. On the other hand, the Indonesia business will continue to post double-digit revenue growth and

the Africa business would see improvement in sales growth by FY2021. We expect consolidated OPM to stand

at 22-23% in the near term.

Valuation

Maintain Buy with an unchanged PT of Rs. 865: GCPL’s management has maintained its thrust on delivering

consistent volume growth in the domestic market, accelerate growth in key international markets and maintain

operating margins at consolidated levels. Thus, we expect the company to report revenue and earnings

CAGR of 9.1% and 15.7%, respectively. The stock has corrected by ~19% from its recent high and is currently

trading at 33.7x its FY2021E and 28.5x its FY2022E earnings, which is at a discount to its historical average.

We maintain our Buy recommendation on the stock with an unchanged PT of Rs. 865.

One-year forward P/E (x) band

1000

950

900 48x

850

800 42x

750

700 36x

650

600

550 30x

500

450

400

350

300

250

200

150

100

Sep-15

Sep-18

Jun-16

Jun-19

Dec-14

Dec-17

Mar-14

Mar-17

Mar-20

Source: Sharekhan Research

Peer Comparison

P/E (x) EV/EBIDTA (x) RoCE (%)

Particulars

FY19 FY20E FY21E FY19 FY20E FY21E FY19 FY20E FY21E

HUL 75.7 63.1 53.7 53.6 45.3 39.1 113.2 115.3 106.2

Dabur India 59.2 54.4 45.4 49.6 44.4 37.0 28.1 29.2 30.5

Marico India 38.9 34.6 30.8 28.2 24.8 22.4 40.6 40.5 40.0

Godrej Consumer Products 44.2 40.6 33.7 32.4 30.5 26.0 17.5 17.9 20.2

Source: Company, Sharekhan estimates

March 06, 2020 4

Stock Update

About company

GCPL is a leading emerging market company with a turnover of more than Rs. 10,000 crore. The group enjoys

the patronage of 1.15 billion consumers globally across businesses. GCPL is present in key product categories

such as soaps, hair colour and household insecticides. The company’s power brands include Godrej No.1

soap, Godrej expert range of hair colours and Good Knight. GCPL operates internationally in Indonesia, Latin

America and GAUM (Africa, U.S. and Middle East) regions.

Investment theme

GCPL has a ‘3 by 3’ approach to international expansion by building presence in ‘3’ emerging markets (Asia,

Africa and Latin America) across ‘3’ categories (home care, personal wash and hair care products). The

company has a leadership position in most categories in the domestic and international markets. Sustained

innovation, cross pollination, enhanced distribution reach and foray into new categories have remained the

company’s key growth pillars. The company has started seeing recovery in key domestic categories such as

HI and international markets (including Indonesia and Africa), which will drive earnings growth in the near

term.

Key Risks

Currency fluctuation in key international markets including Africa and Indonesia will affect earnings

performance.

Increased prices of key raw materials such as palm oil would affect profitability and earnings growth.

Increased competition in highly penetrated categories such as soaps would threaten revenue growth or

any competition from illegal entrants in the HI category would affect its performance.

Additional Data

Key management personnel

Adi Godrej Chairman

Nisaba Godrej Executive Chairperson

Vivek Gambhir Managing Director and CEO

V Srinivasan CFO and Company Secretary

Source: Company Website

Top 10 shareholders

Sr. No. Holder Name Holding (%)

1 First State Investments ICVC 2.5

2 Temasek Holdings Pte Ltd 2.5

3 Arisaig India Fund Limited 1.5

4 Vanguard Group Inc 1.4

5 Republic of Singapore 1.3

6 Capital Group Cos Inc 1.1

7 BlackRock Inc 1.1

8 Kotak Mahindra Asset Management Co 0.6

9 Standard Life Aberdeen PLC 0.6

10 Mitsubishi UFJ Financial Group Inc 0.6

Source: Bloomberg

Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article.

March 06, 2020 5

Know more about our products and services

For Private Circulation only

Disclaimer: This document has been prepared by Sharekhan Ltd. (SHAREKHAN) and is intended for use only by the person or entity

to which it is addressed to. This Document may contain confidential and/or privileged material and is not for any type of circulation

and any review, retransmission, or any other use is strictly prohibited. This Document is subject to changes without prior notice.

This document does not constitute an offer to sell or solicitation for the purchase or sale of any financial instrument or as an official

confirmation of any transaction. Though disseminated to all customers who are due to receive the same, not all customers may

receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is obtained from publicly available data or other sources believed to be reliable and SHAREKHAN

has not independently verified the accuracy and completeness of the said data and hence it should not be relied upon as such. While

we would endeavour to update the information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated companies,

their directors and employees (“SHAREKHAN and affiliates”) are under no obligation to update or keep the information current. Also,

there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and affiliates from doing so. This document is

prepared for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Recipients

of this report should also be aware that past performance is not necessarily a guide to future performance and value of investments

can go down as well. The user assumes the entire risk of any use made of this information. Each recipient of this document should

make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies

referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and

risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to

advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach

different conclusions from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any

locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation

or which would subject SHAREKHAN and affiliates to any registration or licensing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession

this document may come are required to inform themselves of and to observe such restriction.

The analyst certifies that the analyst has not dealt or traded directly or indirectly in securities of the company and that all of the

views expressed in this document accurately reflect his or her personal views about the subject company or companies and its or

their securities and do not necessarily reflect those of SHAREKHAN. The analyst further certifies that neither he or its associates

or his relatives has any direct or indirect financial interest nor have actual or beneficial ownership of 1% or more in the securities of

the company at the end of the month immediately preceding the date of publication of the research report nor have any material

conflict of interest nor has served as officer, director or employee or engaged in market making activity of the company. Further, the

analyst has also not been a part of the team which has managed or co-managed the public offerings of the company and no part

of the analyst’s compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this

document. Sharekhan Limited or its associates or analysts have not received any compensation for investment banking, merchant

banking, brokerage services or any compensation or other benefits from the subject company or from third party in the past twelve

months in connection with the research report.

Either SHAREKHAN or its affiliates or its directors or employees / representatives / clients or their relatives may have position(s), make

market, act as principal or engage in transactions of purchase or sell of securities, from time to time or may be materially interested

in any of the securities or related securities referred to in this report and they may have used the information set forth herein before

publication. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company

mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved

in, or related to, computing or compiling the information have any liability for any damages of any kind.

Compliance Officer: Mr. Joby John Meledan; Tel: 022-61150000; email id: compliance@sharekhan.com;

For any queries or grievances kindly email igc@sharekhan.com or contact: myaccount@sharekhan.com

Registered Office: Sharekhan Limited, 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg

Railway Station, Kanjurmarg (East), Mumbai – 400042, Maharashtra. Tel: 022 - 61150000. Sharekhan Ltd.: SEBI Regn. Nos.: BSE

/ NSE / MSEI (CASH / F&O / CD) / MCX - Commodity: INZ000171337; DP: NSDL/CDSL-IN-DP-365-2018; PMS: INP000005786;

Mutual Fund: ARN 20669; Research Analyst: INH000006183;

Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and the T&C on www.sharekhan.com;

Investment in securities market are subject to market risks, read all the related documents carefully before investing.

Potrebbero piacerti anche

- Sharekhan's Research Report On Godrej Consumer Products-Godrej-Consumer-Products-26-03-2021-khanDocumento9 pagineSharekhan's Research Report On Godrej Consumer Products-Godrej-Consumer-Products-26-03-2021-khansaran21Nessuna valutazione finora

- Britannia Industries: IndiaDocumento6 pagineBritannia Industries: Indiasps fetrNessuna valutazione finora

- Maruti Suzuki India LTD: ESG Disclosure ScoreDocumento7 pagineMaruti Suzuki India LTD: ESG Disclosure ScorebdacNessuna valutazione finora

- Hindustan Unilever: Better Performance in An Uncertain EnvironmentDocumento7 pagineHindustan Unilever: Better Performance in An Uncertain EnvironmentUTSAVNessuna valutazione finora

- United Spirits: Inflationary Pressures Darken Near-Term Outlook Retaining A HoldDocumento6 pagineUnited Spirits: Inflationary Pressures Darken Near-Term Outlook Retaining A HoldSatya JagadishNessuna valutazione finora

- GSK Consumer-Feb07 2020Documento5 pagineGSK Consumer-Feb07 2020Sasidharan Sajeev ChathathuNessuna valutazione finora

- V-Guard Industries: Operationally Strong QuarterDocumento5 pagineV-Guard Industries: Operationally Strong QuarterUmesh ThawareNessuna valutazione finora

- P.I. Industries (PI IN) : Q1FY21 Result UpdateDocumento7 pagineP.I. Industries (PI IN) : Q1FY21 Result UpdatewhitenagarNessuna valutazione finora

- Reliance Industries (RIL IN) : Q1FY21 Result UpdateDocumento7 pagineReliance Industries (RIL IN) : Q1FY21 Result UpdatewhitenagarNessuna valutazione finora

- Britannia Industries: Steady Performance in Tough EnvironmentDocumento6 pagineBritannia Industries: Steady Performance in Tough EnvironmentdarshanmadeNessuna valutazione finora

- IEA Report 3rd FebruaryDocumento24 pagineIEA Report 3rd FebruarynarnoliaNessuna valutazione finora

- ICICI Securities Galaxy Surfactant Q3FY23 ResultsDocumento6 pagineICICI Securities Galaxy Surfactant Q3FY23 Resultssouheet.basuNessuna valutazione finora

- Strides Pharma Science - Elara Securities - 7 February 2021Documento7 pagineStrides Pharma Science - Elara Securities - 7 February 2021Ranjan BeheraNessuna valutazione finora

- V Guard IndustriesDocumento7 pagineV Guard IndustriesSandeep GoyalNessuna valutazione finora

- Nestle India LTD: ESG Disclosure ScoreDocumento5 pagineNestle India LTD: ESG Disclosure Scorekrishna_buntyNessuna valutazione finora

- Nirmal Bang On CCL Products - Upside of 20%Documento7 pagineNirmal Bang On CCL Products - Upside of 20%Alok DashNessuna valutazione finora

- Jyothy Laboratories LTD Accumulate: Retail Equity ResearchDocumento5 pagineJyothy Laboratories LTD Accumulate: Retail Equity Researchkishor_warthi85Nessuna valutazione finora

- 211428182023567dabur India Limited - 20230808Documento5 pagine211428182023567dabur India Limited - 20230808Jigar PitrodaNessuna valutazione finora

- GNA Axles Q1 Result UpdateDocumento8 pagineGNA Axles Q1 Result UpdateshrikantbodkeNessuna valutazione finora

- Can Fin Homes Ltd-4QFY23 Result UpdateDocumento5 pagineCan Fin Homes Ltd-4QFY23 Result UpdateUjwal KumarNessuna valutazione finora

- 1182311122021672glenmark Pharma Q2FY22Documento5 pagine1182311122021672glenmark Pharma Q2FY22Prajwal JainNessuna valutazione finora

- Vinati Organics LTD: Growth To Pick-Up..Documento5 pagineVinati Organics LTD: Growth To Pick-Up..Bhaveek OstwalNessuna valutazione finora

- Punjab National Bank: Merger To Present Further ChallengesDocumento5 paginePunjab National Bank: Merger To Present Further ChallengesdarshanmadeNessuna valutazione finora

- HSIE Results Daily - 10 Feb 24-202402100803391611264Documento11 pagineHSIE Results Daily - 10 Feb 24-202402100803391611264adityazade03Nessuna valutazione finora

- Engineers India-ICICI DirectDocumento5 pagineEngineers India-ICICI DirectSalman KhanNessuna valutazione finora

- HSIE Results Daily: Result ReviewsDocumento13 pagineHSIE Results Daily: Result ReviewsKiran KudtarkarNessuna valutazione finora

- Jyothy Laboratories LTDDocumento5 pagineJyothy Laboratories LTDViju K GNessuna valutazione finora

- Dabur India (DABUR IN) : Analyst Meet UpdateDocumento12 pagineDabur India (DABUR IN) : Analyst Meet Updatesaran21Nessuna valutazione finora

- Diwali PicksDocumento21 pagineDiwali PicksMj MahesaniyaNessuna valutazione finora

- Stock Update: Jyothy LaboratoriesDocumento4 pagineStock Update: Jyothy LaboratoriesjeetchauhanNessuna valutazione finora

- Rel in HDFC SecuritiesDocumento9 pagineRel in HDFC Securitiesopemperor06Nessuna valutazione finora

- Sheela Foam: Newer Long-Term Opportunities Are (Likely) Opening UpDocumento6 pagineSheela Foam: Newer Long-Term Opportunities Are (Likely) Opening UpshahavNessuna valutazione finora

- Zomato LTD.: Investing Key To Compounding Long Term GrowthDocumento5 pagineZomato LTD.: Investing Key To Compounding Long Term GrowthAvinash GollaNessuna valutazione finora

- Quarterly Update Report SVL Q3 FY24Documento7 pagineQuarterly Update Report SVL Q3 FY24ravirameshkumarNessuna valutazione finora

- Agri Inputs: Sector Valuations Price in A Good SeasonDocumento12 pagineAgri Inputs: Sector Valuations Price in A Good SeasonPrahladNessuna valutazione finora

- Nirmal Bang On United SpiritsDocumento6 pagineNirmal Bang On United SpiritsamsukdNessuna valutazione finora

- Indian Hotels Company: Cost Optimization - Driver of ProfitabilityDocumento6 pagineIndian Hotels Company: Cost Optimization - Driver of ProfitabilityArjun TalwarNessuna valutazione finora

- Stock Update: Divis LaboratoriesDocumento3 pagineStock Update: Divis LaboratoriesdarshanmadeNessuna valutazione finora

- Greenlam Q1 Result UpdateDocumento7 pagineGreenlam Q1 Result UpdateshrikantbodkeNessuna valutazione finora

- Asian Paints JefferiesDocumento12 pagineAsian Paints JefferiesRajeev GargNessuna valutazione finora

- AngelTopPicks Sep 2022Documento12 pagineAngelTopPicks Sep 2022Guru S SankarNessuna valutazione finora

- Stock Update: Ashok LeylandDocumento3 pagineStock Update: Ashok LeylandEr Vinay SinghNessuna valutazione finora

- Hindustan Unilever: CMP: INR1,604Documento10 pagineHindustan Unilever: CMP: INR1,604Vishakha RathodNessuna valutazione finora

- Reliance Industries - Q1FY23 - HSIE-202207250637049258859Documento9 pagineReliance Industries - Q1FY23 - HSIE-202207250637049258859tmeygmvzjfnkqcwhgpNessuna valutazione finora

- Upll 2 8 20 PL PDFDocumento9 pagineUpll 2 8 20 PL PDFwhitenagarNessuna valutazione finora

- Havells India LTD (HAVL) PDFDocumento5 pagineHavells India LTD (HAVL) PDFViju K GNessuna valutazione finora

- IDirect GSKConsumer ICDocumento26 pagineIDirect GSKConsumer ICChaitanya JagarlapudiNessuna valutazione finora

- Godrej Agrovet IC Jan18Documento49 pagineGodrej Agrovet IC Jan18S KNessuna valutazione finora

- Bajaj Finance: Strong Fundamentals But Environment Appears ChallengingDocumento4 pagineBajaj Finance: Strong Fundamentals But Environment Appears ChallengingdarshanmadeNessuna valutazione finora

- Nocil LTD.: Margins Have Bottomed Out, Import Substitution in PlayDocumento8 pagineNocil LTD.: Margins Have Bottomed Out, Import Substitution in PlaySadiq SadiqNessuna valutazione finora

- Dabindia 20100917Documento2 pagineDabindia 20100917veer0015Nessuna valutazione finora

- Diwali Muhurat Fundamental 2021Documento22 pagineDiwali Muhurat Fundamental 2021Swasthyasudha AyurvedNessuna valutazione finora

- Nirmal Bang Berger Paints Q3FY22 Result Update 11 February 2022Documento11 pagineNirmal Bang Berger Paints Q3FY22 Result Update 11 February 2022Shinde Chaitanya Sharad C-DOT 5688Nessuna valutazione finora

- KRChoksey CreditAccess Grameen LTD ReportDocumento25 pagineKRChoksey CreditAccess Grameen LTD ReportspryaaNessuna valutazione finora

- Polycab India Limited: Business Dynamics Strong, Retain BuyDocumento8 paginePolycab India Limited: Business Dynamics Strong, Retain Buyshankar alkotiNessuna valutazione finora

- Aarti Industries: All Round Growth ImminentDocumento13 pagineAarti Industries: All Round Growth ImminentPratik ChhedaNessuna valutazione finora

- Grasim 3R Feb14 - 2023Documento7 pagineGrasim 3R Feb14 - 2023Rajavel GanesanNessuna valutazione finora

- BP Wealth On Hikal - 06.11.2020Documento7 pagineBP Wealth On Hikal - 06.11.2020VM ONessuna valutazione finora

- Vaibhav Global Research ReportDocumento4 pagineVaibhav Global Research ReportVikrant SadanaNessuna valutazione finora

- Economic Indicators for East Asia: Input–Output TablesDa EverandEconomic Indicators for East Asia: Input–Output TablesNessuna valutazione finora

- Indian Railway Catering and Tourism Corporation (IRCTC IN) : Q3FY20 Result UpdateDocumento7 pagineIndian Railway Catering and Tourism Corporation (IRCTC IN) : Q3FY20 Result UpdateanjugaduNessuna valutazione finora

- Ipca Laboratories Limited: Promising OutlookDocumento8 pagineIpca Laboratories Limited: Promising OutlookanjugaduNessuna valutazione finora

- Apollo Hospitals: Numbers Continue To StrengthenDocumento13 pagineApollo Hospitals: Numbers Continue To StrengthenanjugaduNessuna valutazione finora

- Dhanuka Agritech (DAGRI IN) : Q3FY20 Result UpdateDocumento7 pagineDhanuka Agritech (DAGRI IN) : Q3FY20 Result UpdateanjugaduNessuna valutazione finora

- Divis-Laboratories 24022020Documento6 pagineDivis-Laboratories 24022020anjugaduNessuna valutazione finora

- Shree Cement: Treading Smoothly On The Growth PathDocumento6 pagineShree Cement: Treading Smoothly On The Growth Pathanjugadu100% (1)

- S Chand and Company (SCHAND IN) : Q3FY20 Result UpdateDocumento6 pagineS Chand and Company (SCHAND IN) : Q3FY20 Result UpdateanjugaduNessuna valutazione finora

- Symphony: Back On The Fast LaneDocumento18 pagineSymphony: Back On The Fast LaneanjugaduNessuna valutazione finora

- Tata Global Beverages 01082019Documento9 pagineTata Global Beverages 01082019anjugaduNessuna valutazione finora

- P.I. Industries (PI IN) : Q3FY20 Result UpdateDocumento8 pagineP.I. Industries (PI IN) : Q3FY20 Result UpdateanjugaduNessuna valutazione finora

- Inox Leisure: Growth Outlook Healthy Despite Short-Term HiccupsDocumento6 pagineInox Leisure: Growth Outlook Healthy Despite Short-Term HiccupsanjugaduNessuna valutazione finora

- Hindustan-Unilever 28022020Documento5 pagineHindustan-Unilever 28022020saran21Nessuna valutazione finora

- Ambuja Cement: Volume Push Drives Topline Maintain HOLDDocumento9 pagineAmbuja Cement: Volume Push Drives Topline Maintain HOLDanjugaduNessuna valutazione finora

- Heidelberg Cement India (HEIM IN) : Q3FY20 Result UpdateDocumento6 pagineHeidelberg Cement India (HEIM IN) : Q3FY20 Result UpdateanjugaduNessuna valutazione finora

- 9th April 2020 Equity 360: Nifty LevelDocumento6 pagine9th April 2020 Equity 360: Nifty LevelanjugaduNessuna valutazione finora

- Asian Paints: Volume Led Growth ContinuesDocumento9 pagineAsian Paints: Volume Led Growth ContinuesanjugaduNessuna valutazione finora

- Infosys: Digital Trajectory Intact, Revises Guidance UpwardsDocumento11 pagineInfosys: Digital Trajectory Intact, Revises Guidance UpwardsanjugaduNessuna valutazione finora

- Lupin (LPC IN) : Event UpdateDocumento6 pagineLupin (LPC IN) : Event UpdateanjugaduNessuna valutazione finora

- Dhanuka-Agritech 20022020Documento7 pagineDhanuka-Agritech 20022020anjugaduNessuna valutazione finora

- Stock Update: Greaves CottonDocumento3 pagineStock Update: Greaves CottonanjugaduNessuna valutazione finora

- Pidilite Industries 15112019Documento9 paginePidilite Industries 15112019anjugaduNessuna valutazione finora

- Voltamp Transformers 26112019Documento5 pagineVoltamp Transformers 26112019anjugaduNessuna valutazione finora

- India in Numbers - Oct 2019Documento40 pagineIndia in Numbers - Oct 2019anjugaduNessuna valutazione finora

- Infosys (INFO IN) : Event UpdateDocumento7 pagineInfosys (INFO IN) : Event UpdateanjugaduNessuna valutazione finora

- KEC International LTD (KEC) : Continued Traction in Railway & Civil Help Post Stable PerformanceDocumento4 pagineKEC International LTD (KEC) : Continued Traction in Railway & Civil Help Post Stable PerformanceanjugaduNessuna valutazione finora

- DCB Bank: Healthy Growth in Balance Sheet C/I Continues To ImproveDocumento4 pagineDCB Bank: Healthy Growth in Balance Sheet C/I Continues To ImproveanjugaduNessuna valutazione finora

- Bajaj Holdings Investment 24042019Documento3 pagineBajaj Holdings Investment 24042019anjugaduNessuna valutazione finora

- Essel Propack LTD: Blackstone Acquires Promoter's StakeDocumento4 pagineEssel Propack LTD: Blackstone Acquires Promoter's StakeanjugaduNessuna valutazione finora

- Supreme Industries LTD Hold: Retail Equity ResearchDocumento5 pagineSupreme Industries LTD Hold: Retail Equity ResearchanjugaduNessuna valutazione finora

- ProfitMart DEMATDocumento24 pagineProfitMart DEMATProfit CircleNessuna valutazione finora

- StockRants CostBasisCalcDocumento2 pagineStockRants CostBasisCalcArvinNessuna valutazione finora

- ATT Receipt George PDFDocumento1 paginaATT Receipt George PDFBrennan BargerNessuna valutazione finora

- Comparative Balance Sheet: MeaningDocumento64 pagineComparative Balance Sheet: MeaningRahit MitraNessuna valutazione finora

- PricingDocumento2 paginePricingKishore kandurlaNessuna valutazione finora

- Villaluz Repair ShopDocumento5 pagineVillaluz Repair ShopJoy SantosNessuna valutazione finora

- 14643post 819 WircDocumento945 pagine14643post 819 WircRonak ShahNessuna valutazione finora

- Rex B. Banggawan, CPA, MBA: Business & Trasfer Tax Solutions Manual True or False: Part 1Documento5 pagineRex B. Banggawan, CPA, MBA: Business & Trasfer Tax Solutions Manual True or False: Part 1ela alan100% (2)

- Solved Exercises 2Documento10 pagineSolved Exercises 2ScribdTranslationsNessuna valutazione finora

- Framework For Preparation and Presentation of Financial StatementsDocumento5 pagineFramework For Preparation and Presentation of Financial Statementssamartha umbareNessuna valutazione finora

- Houzit Pty LTD: 1st Quarter Ended Sept - 2012 Actual Results Budget Q1 Actual Q1 $ VarianceDocumento4 pagineHouzit Pty LTD: 1st Quarter Ended Sept - 2012 Actual Results Budget Q1 Actual Q1 $ VarianceHamza Anees100% (1)

- VJ - Digital Demand For O3INV-00372-23 - 20230218T031404875Documento1 paginaVJ - Digital Demand For O3INV-00372-23 - 20230218T031404875Hardik RavalNessuna valutazione finora

- Associated Bank Vs CADocumento1 paginaAssociated Bank Vs CATine TineNessuna valutazione finora

- CH 6Documento32 pagineCH 6Zead MahmoodNessuna valutazione finora

- Merchandising Reviewer 2Documento5 pagineMerchandising Reviewer 2Sandro Marie N. ObraNessuna valutazione finora

- Audit of Inventories: The Use of Assertions in Obtaining Audit EvidenceDocumento9 pagineAudit of Inventories: The Use of Assertions in Obtaining Audit EvidencemoNessuna valutazione finora

- Depreciation, Impairments, and DepletionDocumento43 pagineDepreciation, Impairments, and DepletionuuuuufffffNessuna valutazione finora

- Real Estate Brokerage PracticeDocumento67 pagineReal Estate Brokerage PracticeLeslie Anne De JesusNessuna valutazione finora

- Hhtfa8e ch01 SMDocumento83 pagineHhtfa8e ch01 SMkbrooks323Nessuna valutazione finora

- Project On Comparison Between Diff BanksDocumento90 pagineProject On Comparison Between Diff BanksViPul67% (27)

- IBCC Challan FormDocumento1 paginaIBCC Challan FormSalman Ul Moazzam33% (15)

- Islamic Banking: Financial Institutions and Markets Final ProjectDocumento27 pagineIslamic Banking: Financial Institutions and Markets Final ProjectNaina Azfar GondalNessuna valutazione finora

- E-Fishery Case StudyDocumento15 pagineE-Fishery Case StudyMade Dananjaya100% (3)

- FY23 Maximus Investor Presentation - AugDocumento15 pagineFY23 Maximus Investor Presentation - AugMarisa DemarcoNessuna valutazione finora

- Working Capital ManagementDocumento34 pagineWorking Capital ManagementNirmal ShresthaNessuna valutazione finora

- Cash and Cash EquivalentsDocumento33 pagineCash and Cash EquivalentsMerry Julianne DaymielNessuna valutazione finora

- Republic Act No. 7279Documento25 pagineRepublic Act No. 7279Sharmen Dizon GalleneroNessuna valutazione finora

- Growth of Mutual Fund IndustryDocumento3 pagineGrowth of Mutual Fund Industryarpanad20104513Nessuna valutazione finora

- Tutorial 5 TVM Application - SVDocumento5 pagineTutorial 5 TVM Application - SVHiền NguyễnNessuna valutazione finora

- Bir 2Q 2020Documento4 pagineBir 2Q 2020Leo Archival ImperialNessuna valutazione finora