Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Circular5 2003

Caricato da

Gavin HenningDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Circular5 2003

Caricato da

Gavin HenningCopyright:

Formati disponibili

The South African Institute of Chartered Accountants Circular 5/2003

ALIGNMENT OF THE TEXT OF

STATEMENTS OF GENERALLY

ACCEPTED ACCOUNTING

PRACTICE WITH THAT OF

INTERNATIONAL FINANCIAL

REPORTING STANDARDS

Introduction

Statements of Generally Accepted Accounting Practice (GAAP) have .01

been harmonised with International Financial Reporting Standards

(IFRS), issued by the International Accounting Standards Board

(IASB). As a result, there are very few differences between Statements

of GAAP and IFRS. However certain differences remain, notably in

respect of AC 133 – Financial Instruments: Recognition and

Measurement.

The differences that currently exist between Statements of GAAP and .02

IFRS include editorial differences, implementation dates and additional

disclosure requirements.

The JSE Securities Exchange’s revised Listing Requirements require .03

listed companies to comply with IFRS for financial periods

commencing on or after 1 January 2005. Consequently the

Accounting Practices Board took a decision to, in future, issue the text

of IFRS in South Africa, without any amendments. Future Statements

of GAAP will therefore be the exact replica of the relevant IFRS. To

indicate this, every Statement of GAAP will have a dual numbering

system to refer to both the IFRS and the Statements of GAAP

numbers.

Process to align text

This process to align the text will commence when the revised .04

Statements of GAAP are issued as a result of the IASB’s

improvements project, as proposed in ED 155 – Improvements and ED

157 – Proposed Improvements to Financial Instruments: Disclosure

and Presentation and Financial Instruments: Recognition and

1 Issued November 2003

CIRCULAR 5/2003 ALIGNMENT OF THE TEXT OF STATEMENTS

OF GAAP WITH THAT OF INTERNATIONAL

FINANCIAL REPORTING STANDARDS

Measurement. In addition the IASB will issue further revised IFRSs by

March 2004 and the relevant Statements of GAAP will accordingly be

issued in South Africa.

.05 The remaining Statements of GAAP, which will not be revised within

the near future, will be re-issued to align the text thereof with the

equivalent IFRS. Exposure Draft 167 – Alignment of the text of

Statements of GAAP with that of International Financial Reporting

Standards serves this purpose.

.06 The AC 400-series, Interpretations of Statements of GAAP, is exposed

through a similar process. ED 170 - Alignment of the text of

Interpretations of Statements of Generally Accepted Accounting

Practice with that of Interpretations of International Financial

Reporting Standards, proposes changes to those interpretations that

will remain in force after standards affected by the improvements

project and other revised standards have been issued.

.07 The AC 500-series will be utilised for Statements of GAAP and

Interpretations of Statements of GAAP to address South African

specific matters, not addressed in IFRS.

Compliance with IFRS

.08 Where a South African entity issues financial statements for the first

time in terms of IFRS, it has to follow the principles in IFRS 1

(AC 138) – First-time adoption of International Financial Reporting

Standards.

.09 In terms of Section 286(3) of the Companies Act 61 of 1973 (the Act)

“the annual financial statements of a company shall, in conformity

with generally accepted accounting practice, fairly present the state of

affairs of the company and its business as at the end of the financial

year concerned and the profit or loss of the company for that financial

year and shall for that purpose be in accordance with and include at

least the matters prescribed by Schedule 4, in so far as they are

applicable, and comply with any other requirements of this Act”.

Issued November 2 003 2

ALIGNMENT OF THE TEXT OF STATEMENTS CIRCULAR 5/2003

OF GAAP WITH THAT OF INTERNATIONAL

FINANCIAL REPORTING STANDARDS

In terms of Paragraph 5 of Schedule 4 of the Act “if it appears to the .10

directors of a company that there are reasons for departing from any

of the accounting concepts stated in Statements of Generally Accepted

Accounting Practice approved by the Accounting Practices Board,

where such appropriate Statements exist, in preparing the company’s

financial statements in respect of any accounting period they may do

so, but particulars of the departure, the effects and the reasons for it

shall be given”.

According to legal opinion obtained by SAICA in September 1999 (as .11

noted in Circular 8/99), “in order for directors to meet the

requirements of the Companies Act, the financial statements should be

prepared and presented in accordance with gaap. However, if they

materially depart from Statements of GAAP, the financial statements

should provide disclosure of the departure, the particulars thereof, the

reasons therefore and the effect of such departure on the financial

statements.”

Once the text of Statements of GAAP have been aligned with IFRS, in .12

accordance with a decision of the Accounting Practices Board,

compliance with IFRS when adopted in terms of IFRS 1 (AC 138) –

First-time Adoption of International Financial Reporting Standards is

equivalent to compliance with Statements of GAAP in so far as the

entity is also in compliance with specific local Statements and

Interpretations issued as part of the AC 500-series.

In order to state compliance with the Act, including Schedule 4, an .13

entity may be required to provide additional disclosures in terms of the

Act.

Effective dates

It should be noted that the original effective dates, applicable to each of .14

the South African Statements of GAAP have not been changed. If an

3 Issued November 2003

CIRCULAR 5/2003 ALIGNMENT OF THE TEXT OF STATEMENTS

OF GAAP WITH THAT OF INTERNATIONAL

FINANCIAL REPORTING STANDARDS

entity chooses to comply with South African Statements of GAAP and

not IFRS, it must use those effective dates, which will be indicated as

a footnote in the statement.

Johannesburg I Sehoole

November 2003 Executive President

Issued November 2 003 4

Potrebbero piacerti anche

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Linux For Beginners - Shane BlackDocumento165 pagineLinux For Beginners - Shane BlackQuod Antichristus100% (1)

- 1934 PARIS AIRSHOW REPORT - Part1 PDFDocumento11 pagine1934 PARIS AIRSHOW REPORT - Part1 PDFstarsalingsoul8000Nessuna valutazione finora

- Termination LetterDocumento2 pagineTermination Letterultakam100% (1)

- Deed of Assignment CorporateDocumento4 pagineDeed of Assignment CorporateEric JayNessuna valutazione finora

- Recall, Initiative and ReferendumDocumento37 pagineRecall, Initiative and ReferendumPhaura Reinz100% (1)

- HSBC in A Nut ShellDocumento190 pagineHSBC in A Nut Shelllanpham19842003Nessuna valutazione finora

- Sweet Biscuits Snack Bars and Fruit Snacks in MexicoDocumento17 pagineSweet Biscuits Snack Bars and Fruit Snacks in MexicoSantiagoNessuna valutazione finora

- Guideline On Fees For Audits Done On Behalf of The Auditor-GeneralDocumento5 pagineGuideline On Fees For Audits Done On Behalf of The Auditor-GeneralGavin HenningNessuna valutazione finora

- Final Circ2 2004Documento6 pagineFinal Circ2 2004Gavin HenningNessuna valutazione finora

- Circular 1 2006Documento9 pagineCircular 1 2006Gavin HenningNessuna valutazione finora

- Continuing Professional Education: Competence Self-AppraisalDocumento5 pagineContinuing Professional Education: Competence Self-AppraisalGavin HenningNessuna valutazione finora

- Circular4 07 Letters For AuditorsDocumento9 pagineCircular4 07 Letters For AuditorsGavin HenningNessuna valutazione finora

- Statement of Generally Accepted Accounting Practice For Small and Medium-Sized Entities (Smes)Documento7 pagineStatement of Generally Accepted Accounting Practice For Small and Medium-Sized Entities (Smes)Gavin HenningNessuna valutazione finora

- Circ11 94Documento7 pagineCirc11 94Gavin HenningNessuna valutazione finora

- Circ8 2006Documento7 pagineCirc8 2006Gavin HenningNessuna valutazione finora

- Circ9 2006Documento6 pagineCirc9 2006Gavin HenningNessuna valutazione finora

- Implications of The Small Business Tax Amnesty On Accounting, Auditing, Legislation and EthicsDocumento23 pagineImplications of The Small Business Tax Amnesty On Accounting, Auditing, Legislation and EthicsGavin HenningNessuna valutazione finora

- Instructions For Microsoft Teams Live Events: Plan and Schedule A Live Event in TeamsDocumento9 pagineInstructions For Microsoft Teams Live Events: Plan and Schedule A Live Event in TeamsAnders LaursenNessuna valutazione finora

- L1 L2 Highway and Railroad EngineeringDocumento7 pagineL1 L2 Highway and Railroad Engineeringeutikol69Nessuna valutazione finora

- M2 Economic LandscapeDocumento18 pagineM2 Economic LandscapePrincess SilenceNessuna valutazione finora

- 7 TariffDocumento22 pagine7 TariffParvathy SureshNessuna valutazione finora

- BST Candidate Registration FormDocumento3 pagineBST Candidate Registration FormshirazNessuna valutazione finora

- Edita's Opertionalization StrategyDocumento13 pagineEdita's Opertionalization StrategyMaryNessuna valutazione finora

- Sterling B2B Integrator - Installing and Uninstalling Standards - V5.2Documento20 pagineSterling B2B Integrator - Installing and Uninstalling Standards - V5.2Willy GaoNessuna valutazione finora

- Basics: Define The Task of Having Braking System in A VehicleDocumento27 pagineBasics: Define The Task of Having Braking System in A VehiclearupNessuna valutazione finora

- Strobostomp HD™ Owner'S Instruction Manual V1.1 En: 9V DC Regulated 85maDocumento2 pagineStrobostomp HD™ Owner'S Instruction Manual V1.1 En: 9V DC Regulated 85maShane FairchildNessuna valutazione finora

- RENCANA KERJA Serious Inspeksi#3 Maret-April 2019Documento2 pagineRENCANA KERJA Serious Inspeksi#3 Maret-April 2019Nur Ali SaidNessuna valutazione finora

- 90FF1DC58987 PDFDocumento9 pagine90FF1DC58987 PDFfanta tasfayeNessuna valutazione finora

- Accomplishment ReportDocumento1 paginaAccomplishment ReportMaria MiguelNessuna valutazione finora

- Engine Diesel PerfomanceDocumento32 pagineEngine Diesel PerfomancerizalNessuna valutazione finora

- RevisionHistory APFIFF33 To V219Documento12 pagineRevisionHistory APFIFF33 To V219younesNessuna valutazione finora

- CoDocumento80 pagineCogdayanand4uNessuna valutazione finora

- Hip NormDocumento35 pagineHip NormAiman ArifinNessuna valutazione finora

- Ajp Project (1) MergedDocumento22 pagineAjp Project (1) MergedRohit GhoshtekarNessuna valutazione finora

- Astm E53 98Documento1 paginaAstm E53 98park991018Nessuna valutazione finora

- MORIGINADocumento7 pagineMORIGINAatishNessuna valutazione finora

- Rating SheetDocumento3 pagineRating SheetShirwin OliverioNessuna valutazione finora

- Group 1 Disaster Management Notes by D. Malleswari ReddyDocumento49 pagineGroup 1 Disaster Management Notes by D. Malleswari Reddyraghu ramNessuna valutazione finora

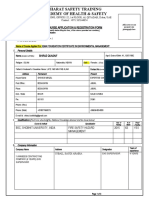

- TEVTA Fin Pay 1 107Documento3 pagineTEVTA Fin Pay 1 107Abdul BasitNessuna valutazione finora

- Dissertation On Indian Constitutional LawDocumento6 pagineDissertation On Indian Constitutional LawCustomPaperWritingAnnArbor100% (1)