Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Income Tax Calculation Worksheet: Thermax LTD Ascent Payroll

Caricato da

Anurag0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

133 visualizzazioni1 paginaXcopvfd

Titolo originale

PDFContent (1)

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoXcopvfd

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

133 visualizzazioni1 paginaIncome Tax Calculation Worksheet: Thermax LTD Ascent Payroll

Caricato da

AnuragXcopvfd

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

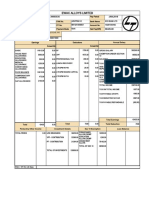

Income Tax Calculation Worksheet

THERMAX LTD Ascent Payroll

PAN : AAACT3910D/ TAN : PNET00017D F.Y. : 2019-20 / A.Y. : 2020-21

Employee: T6865 Anurag Pandey Calculation Month: February-2020

Date of Joining: 11/05/2015 PAN: CLQPP8341G Tax Category: MEN

1. Gross Salary Actual(Rs.) Projection(Rs.) Total(Rs.)

Basic 169,235 16,253 185,488

House Rent Allowance 38,885 3,535 42,420

Lunch Allowance 4,000 0 4,000

Conveyance 6,400 0 6,400

Special Allowance 11,214 1,602 12,816

Arrears Basic 4,536 0 4,536

Arrears Lunch -4,000 0 -4,000

Arrears Conveyance -6,400 0 -6,400

Arrears Special 6,408 0 6,408

Bonus 26,698 0 26,698

Adj- Special Allowance 136 0 136

Totals: 257,112 21,390 278,502

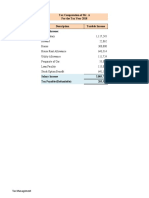

WORKSHEET :

1. Gross Salary 278,502

2. Less: Allowances Exempt Under Section 10

3. Balance (1-2) 278,502

4. Deductions:

Standard Deduction 50,000

5. Aggregate of 4 50,000

6. Income chargeable under the head 'Salaries' (3-5) 228,502

7. Add: Any other income reported by the employee

8. Gross total income (6+7) 228,502

9. Deductions under Chapter VI-A Qualifying Deductible

Gross Amount

(A) Section 80C, 80CCC and 80CCD Amount Amount

(a) Section 80 C

a. Provident Fund 22,937 22,937

Total of Section 80C, 80CCC and 80CCD 22,937 22,937 22,937

(B) Other Sections under Chapter VI-A

a. Sec 80D (Mediclaim Family) 1,200 1,200

Total of Other Sections under Chapter VI-A 1,200 1,200 1200

10. Aggregate of deductible amount under Chapter VIA 24,137

11. Total Income (8-10) 204,370

12. Tax on total income 0

13. Less: rebate u/s 87A 0

*

14. Tax payable and surcharge thereon 0 + 0 0

15. Add: Education CESS 4.00% on (14) 0

16. Less: Rebate Under Section 89 0

17. Total Tax Liability (14+15-16) 0

18. Less Tax deducted at source till January-2020 0

19. Tax payable/refundable (17-18) 0

20. Tax payable/refundable this month 0

Printed On 03/03/2020 12:39:44 PM Calculation based on Actual Declaration (Standard) Page 1 of 1

Potrebbero piacerti anche

- Tata Consultancy Services Payslip August 2017Documento2 pagineTata Consultancy Services Payslip August 2017Ajay Chowdary Ajay Chowdary79% (14)

- TCS Feb Payslip PDFDocumento2 pagineTCS Feb Payslip PDFNikhilreddy SingireddyNessuna valutazione finora

- Vodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021Documento1 paginaVodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021sanket shah100% (1)

- Josh-Tarasoff Markel InsuranceDocumento25 pagineJosh-Tarasoff Markel InsuranceCanadianValue50% (2)

- Naga 1Documento1 paginaNaga 1Anonymous IaKbBoPRNessuna valutazione finora

- C - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFDocumento5 pagineC - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFPrudhvi Raj ChowdaryNessuna valutazione finora

- Swot Analysis of NestleDocumento33 pagineSwot Analysis of NestleDani Qureshi100% (1)

- Apr 2022Documento1 paginaApr 2022Rohit AdnaikNessuna valutazione finora

- Income Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollDocumento2 pagineIncome Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollShiva098Nessuna valutazione finora

- HTMLReportsDocumento1 paginaHTMLReportsRashmi Awanish PandeyNessuna valutazione finora

- Form 1625062023 043026Documento2 pagineForm 1625062023 043026SHIV BHAJANNessuna valutazione finora

- Form 1621052023 115217Documento2 pagineForm 1621052023 115217sandeep kumarNessuna valutazione finora

- STEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Documento1 paginaSTEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Amaresh NayakNessuna valutazione finora

- Details of Salary Paid and Any Other Income and Tax DeductedDocumento3 pagineDetails of Salary Paid and Any Other Income and Tax DeductedRajesh KharmaleNessuna valutazione finora

- Judicial Reforms in IndiDocumento1 paginaJudicial Reforms in IndiArsalan KhanNessuna valutazione finora

- Form 1607062022 182100Documento2 pagineForm 1607062022 182100Manveer Rori AlaNessuna valutazione finora

- Form 16 - BLMPB2218K - 2019-20 - Part B PDFDocumento6 pagineForm 16 - BLMPB2218K - 2019-20 - Part B PDFUmair BaigNessuna valutazione finora

- Form16 1951051 17631 04570193K 2021 2022Documento2 pagineForm16 1951051 17631 04570193K 2021 2022Ranjeet RajputNessuna valutazione finora

- Form 1622052023 130017Documento3 pagineForm 1622052023 130017Amit Singh NegiNessuna valutazione finora

- Form 1602102023 160124Documento3 pagineForm 1602102023 160124isantbasnet3561Nessuna valutazione finora

- Form 1617082023 112227Documento2 pagineForm 1617082023 112227rinsha.sherinNessuna valutazione finora

- Pay Slip For The Month of February 2018: Earnings Deductons ReimbursementsDocumento1 paginaPay Slip For The Month of February 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANENessuna valutazione finora

- Form 1626042024 112515Documento2 pagineForm 1626042024 112515harshkaliramna2007.hkNessuna valutazione finora

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocumento3 pagineIncome From Salaries: Rs. Rs. Rs. SCH - NoBilalNessuna valutazione finora

- Pay Slip For The Month of January 2018: Earnings Deductons ReimbursementsDocumento1 paginaPay Slip For The Month of January 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANENessuna valutazione finora

- IT Calculator 2018 LiteDocumento6 pagineIT Calculator 2018 LiteHr PoonamNessuna valutazione finora

- Form 1615052023 141937Documento3 pagineForm 1615052023 141937Pawan KumarNessuna valutazione finora

- Form 1615012023 135230 PDFDocumento3 pagineForm 1615012023 135230 PDFSahil ThakurNessuna valutazione finora

- Salary SlipDocumento1 paginaSalary SlipAnkit SinghNessuna valutazione finora

- Form 1622072023 022228Documento2 pagineForm 1622072023 022228Kajal RandiveNessuna valutazione finora

- Doc-20230725-Wa0011. (2)Documento1 paginaDoc-20230725-Wa0011. (2)s0026637Nessuna valutazione finora

- Razorpay Software P.L: Pay Slip For The Month of April 2021Documento1 paginaRazorpay Software P.L: Pay Slip For The Month of April 2021ARSHU . SNessuna valutazione finora

- PL and Balance Sheet Detailed FormatDocumento5 paginePL and Balance Sheet Detailed FormatPradeep G MenonNessuna valutazione finora

- September 2022Documento1 paginaSeptember 2022amitdesai92Nessuna valutazione finora

- Ewac Alloys Limited: Uan No Aadhar NoDocumento1 paginaEwac Alloys Limited: Uan No Aadhar NoNapoleon DasNessuna valutazione finora

- Form16 1945007 JC570193L 2020 2021Documento2 pagineForm16 1945007 JC570193L 2020 2021Ranjeet RajputNessuna valutazione finora

- Form 1606032021 195902Documento3 pagineForm 1606032021 195902Kalyan KumarNessuna valutazione finora

- Booklet of Forms For House Building AdvanceDocumento2 pagineBooklet of Forms For House Building AdvanceJITHU MNessuna valutazione finora

- Provisional Taxsheet Mar 2020Documento1 paginaProvisional Taxsheet Mar 2020vivianNessuna valutazione finora

- Quarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeDocumento2 pagineQuarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeSanjoy SamantaNessuna valutazione finora

- TM PQsDocumento10 pagineTM PQsAnooshayNessuna valutazione finora

- Pay SlipDocumento1 paginaPay SlipSonuNessuna valutazione finora

- Vinod Singh Computation Revised-3Documento4 pagineVinod Singh Computation Revised-3vinodNessuna valutazione finora

- Form 1612052021 111453Documento3 pagineForm 1612052021 111453SandhyaNessuna valutazione finora

- April Payment SleepDocumento1 paginaApril Payment Sleepizajahamed1Nessuna valutazione finora

- PR MR PT Payslip GeneralDocumento1 paginaPR MR PT Payslip GeneralArun PVNessuna valutazione finora

- Form 1609042024 112352Documento3 pagineForm 1609042024 112352rs3071029Nessuna valutazione finora

- 2021-2022 Shrikant Jadhav Form 16-Part B PDFDocumento6 pagine2021-2022 Shrikant Jadhav Form 16-Part B PDFVidya JadhavNessuna valutazione finora

- August 2022Documento1 paginaAugust 2022amitdesai92Nessuna valutazione finora

- N01887estax2007 09Documento2 pagineN01887estax2007 09api-3747051100% (1)

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocumento2 pagineIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriNessuna valutazione finora

- Share Toaz - Info Tata Consultancy Services Payslip PRDocumento4 pagineShare Toaz - Info Tata Consultancy Services Payslip PRMohit ChahalNessuna valutazione finora

- Pricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementDocumento15 paginePricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementRajat SinghNessuna valutazione finora

- CONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Documento2 pagineCONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Akshay ShettyNessuna valutazione finora

- 1519732537814Documento1 pagina1519732537814vinod kumarNessuna valutazione finora

- ATPL10060 - Kolli Sravani - JUNE - 2018 PDFDocumento1 paginaATPL10060 - Kolli Sravani - JUNE - 2018 PDFsravani kolliNessuna valutazione finora

- Form 1601012023 101258Documento3 pagineForm 1601012023 101258Bhura SinghNessuna valutazione finora

- Form 1607022022 205546Documento2 pagineForm 1607022022 205546Mahesh VayiboyinaNessuna valutazione finora

- Oho Shop CoiDocumento5 pagineOho Shop CoiJAY K SHAH & ASSOCIATESNessuna valutazione finora

- 2023 11 qWIavwwVV0gWRmwVnoUpdgDocumento1 pagina2023 11 qWIavwwVV0gWRmwVnoUpdgnsmankr1Nessuna valutazione finora

- Revision TXDocumento26 pagineRevision TXFatemah MohamedaliNessuna valutazione finora

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineDa EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNessuna valutazione finora

- 18thexam ResultsDocumento2 pagine18thexam ResultsAnuragNessuna valutazione finora

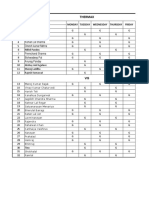

- General Shift ScheduleDocumento2 pagineGeneral Shift ScheduleAnuragNessuna valutazione finora

- Advt 05 - 2020 Engl PDFDocumento23 pagineAdvt 05 - 2020 Engl PDFRitesh SinghNessuna valutazione finora

- The Biomechanics of Stretching: Duane KnudsonDocumento10 pagineThe Biomechanics of Stretching: Duane KnudsonAnuragNessuna valutazione finora

- Anurag Pandey Resume - PDFDocumento2 pagineAnurag Pandey Resume - PDFAnuragNessuna valutazione finora

- 23Documento8 pagine23AnuragNessuna valutazione finora

- List of Candidates Shortlisted For Interview (To Be Conducted On VC Mode) & Details of Process, Date Etc. Will Be Intimated Through Email/smsDocumento4 pagineList of Candidates Shortlisted For Interview (To Be Conducted On VC Mode) & Details of Process, Date Etc. Will Be Intimated Through Email/smsAnuragNessuna valutazione finora

- The Biomechanics of Stretching: Duane KnudsonDocumento10 pagineThe Biomechanics of Stretching: Duane KnudsonAnuragNessuna valutazione finora

- Syllabus For Online Screening Test-Experienced Engineer Post PDFDocumento9 pagineSyllabus For Online Screening Test-Experienced Engineer Post PDFNaga SiddhardhNessuna valutazione finora

- Planning Maintenance SheetDocumento3 paginePlanning Maintenance SheetAnuragNessuna valutazione finora

- Self Declaration Form by Employees Resuming WorkDocumento2 pagineSelf Declaration Form by Employees Resuming WorkAnuragNessuna valutazione finora

- 214646Documento3 pagine214646Aliza Noor100% (1)

- Printed by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsDocumento1 paginaPrinted by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsAnuragNessuna valutazione finora

- Practical Power System Protection IDCDocumento20 paginePractical Power System Protection IDCMonish Krishna0% (1)

- 7B011117 px160 para Flex ElementDocumento2 pagine7B011117 px160 para Flex ElementAnuragNessuna valutazione finora

- Total Harmonic DistortionDocumento4 pagineTotal Harmonic DistortionVivek KaushikNessuna valutazione finora

- EIC 09 - Stator Winding Hipot TestingDocumento5 pagineEIC 09 - Stator Winding Hipot Testingmanoharig7578Nessuna valutazione finora

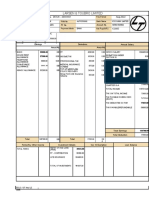

- Pay Slip For February 2020: Empno Anurag Pandey T6865 NameDocumento1 paginaPay Slip For February 2020: Empno Anurag Pandey T6865 NameAnuragNessuna valutazione finora

- Cable RatingDocumento1 paginaCable Ratingamitd_hupar666Nessuna valutazione finora

- LEESON Frame SizesDocumento3 pagineLEESON Frame SizesAnuragNessuna valutazione finora

- Alno Presentasi July 2020Documento16 pagineAlno Presentasi July 2020Iznan KholisNessuna valutazione finora

- Ganga - Due Diligence Borrower & GuarantorsDocumento5 pagineGanga - Due Diligence Borrower & GuarantorsHero HeroNessuna valutazione finora

- Masterclass 3.2Documento6 pagineMasterclass 3.2Amit PrasadNessuna valutazione finora

- Chapter IiDocumento27 pagineChapter IiGElla BarRete ReQuilloNessuna valutazione finora

- Certificate Cum Policy Schedule: MOTOR 2 WHEELER (PACKAGE POLICY) - UIN NO. IRDAN137RP0017V01200809 - SAC Code. 997134Documento1 paginaCertificate Cum Policy Schedule: MOTOR 2 WHEELER (PACKAGE POLICY) - UIN NO. IRDAN137RP0017V01200809 - SAC Code. 997134Rohit YadavNessuna valutazione finora

- Business Environment Analysis of ItalyDocumento14 pagineBusiness Environment Analysis of ItalyAnkit TiwariNessuna valutazione finora

- Product Development - FIDocumento25 pagineProduct Development - FIFounder InstituteNessuna valutazione finora

- Module 1Documento40 pagineModule 1shiva56348Nessuna valutazione finora

- Proforma Invoice: Bill ToDocumento3 pagineProforma Invoice: Bill ToInstaMaskNessuna valutazione finora

- Sample Ethics Cases: Case #1Documento7 pagineSample Ethics Cases: Case #1CelenaNessuna valutazione finora

- Telia Hinnasto MHS 03 2018 ENDocumento4 pagineTelia Hinnasto MHS 03 2018 ENEduardo SantosNessuna valutazione finora

- Code of EthicsDocumento2 pagineCode of EthicsHimani sailabNessuna valutazione finora

- Pathways and Pitfalls: The International Politics of Lebanon's Energy CrisisDocumento20 paginePathways and Pitfalls: The International Politics of Lebanon's Energy CrisisHoover InstitutionNessuna valutazione finora

- Microsof e WaseDocumento2 pagineMicrosof e Waseapi-241952519Nessuna valutazione finora

- Analisis SWOT Untuk Pengembangan Objek Wisata Geopark Silokek Di Nagari Silokek Oleh Dinas Pariwisata Pemuda Dan Olahrga Kabupaaten SijunjungDocumento7 pagineAnalisis SWOT Untuk Pengembangan Objek Wisata Geopark Silokek Di Nagari Silokek Oleh Dinas Pariwisata Pemuda Dan Olahrga Kabupaaten Sijunjungdina marianaNessuna valutazione finora

- Financial Reporting 2 Final Exam 2020Documento3 pagineFinancial Reporting 2 Final Exam 2020kateNessuna valutazione finora

- HORNILLA V. SALUNAT A.C. No. 5804 July 1, 2003Documento1 paginaHORNILLA V. SALUNAT A.C. No. 5804 July 1, 2003Donna Grace GuyoNessuna valutazione finora

- Iesco Online BillDocumento1 paginaIesco Online BillZohaib AliNessuna valutazione finora

- UCSP - Second Quarter - M07Documento19 pagineUCSP - Second Quarter - M07Clyde Lester GabitoNessuna valutazione finora

- M3 Assignment Internal Control Group 9 AUDIT SPECIAL INDUSTRYDocumento5 pagineM3 Assignment Internal Control Group 9 AUDIT SPECIAL INDUSTRYReginald ValenciaNessuna valutazione finora

- Basic Concepts in Reverse EngineeringDocumento15 pagineBasic Concepts in Reverse EngineeringMohannadNessuna valutazione finora

- Monsoon Sim Data Presentation and AnalysisDocumento16 pagineMonsoon Sim Data Presentation and AnalysisMa. Eunice CajesNessuna valutazione finora

- Welcome To Everest Insurance CoDocumento2 pagineWelcome To Everest Insurance Cosrijan consultancyNessuna valutazione finora

- Chapter 2Documento52 pagineChapter 2Mehedi Hasan FoyshalNessuna valutazione finora

- Theory and Practice of Model Risk Management: Riccardo RebonatoDocumento25 pagineTheory and Practice of Model Risk Management: Riccardo RebonatobionicturtleNessuna valutazione finora

- Grand Jury Finds Manteca's City Government in 'Turmoil'Documento15 pagineGrand Jury Finds Manteca's City Government in 'Turmoil'FOX40 News100% (1)

- M Marketing 4th Edition Grewal Solutions ManualDocumento26 pagineM Marketing 4th Edition Grewal Solutions Manualjesseluongk6q100% (22)

- Buenaseda Vs Bowen Co (1960)Documento4 pagineBuenaseda Vs Bowen Co (1960)Joshua DulceNessuna valutazione finora