Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

2020 Intrinsic Value Calculator

Caricato da

Mick Barroga0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

18 visualizzazioni4 pagineintrinsic value

Copyright

© © All Rights Reserved

Formati disponibili

XLSX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentointrinsic value

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato XLSX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

18 visualizzazioni4 pagine2020 Intrinsic Value Calculator

Caricato da

Mick Barrogaintrinsic value

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato XLSX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 4

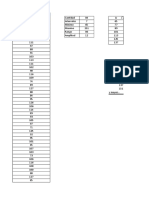

Inputs

Growth Rate (yrs 1 -5) 12% Year FCF

Growth rate (yrs 6 - 10) 7% 1 59

Discount Rate 10% 2 66

Terminal Value (multiple of FCF) 15 3 74

Year 1 Free Cash Flow 58.896 4 83

Excess Capital (Cash) 107.16 5 93

Stock Ticker AAPL 6 99

7 106

8 114

9 121

10 130

10 1950

Present Value of Future Cash Flows

Intrinsic Value (Market Cap)

PV

54

55

56

57

58

56

54

53

52

50

752

$ 1,294

$ 1,401

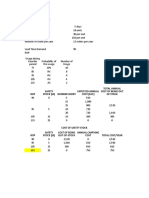

Inputs

Growth Rate (yrs 1 -5) 12% Year FCF

Growth rate (yrs 6 - 10) 7% 1 59

Discount Rate 10% 2 66

Terminal Value (multiple of FCF) 15 3 74

Year 1 Free Cash Flow (billions) 58.896 4 83

Stock Ticker AAPL 5 93

6 99

7 106

8 114

9 121

10 130

10 1950

Intrinsic Value (Enterprise Value)

PV

$ 54

$ 55

$ 56

$ 57

$ 58

$ 56

$ 54

$ 53

$ 52

$ 50

$ 752

$ 1,294

Potrebbero piacerti anche

- Equity Valuation: Models from Leading Investment BanksDa EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNessuna valutazione finora

- 2020 Intrinsic Value CalculatorDocumento4 pagine2020 Intrinsic Value CalculatorManas BhatnagarNessuna valutazione finora

- EPS (TTM) 11.89 Growth Rate 12% Minimum Rate of Return 15% Margin of Safety 50%Documento19 pagineEPS (TTM) 11.89 Growth Rate 12% Minimum Rate of Return 15% Margin of Safety 50%Neeraj PaliwalNessuna valutazione finora

- May 2015 Q3Documento3 pagineMay 2015 Q3Chahak BhallaNessuna valutazione finora

- MFA Homework 8 - With With Equity and Multiple DebtDocumento3 pagineMFA Homework 8 - With With Equity and Multiple DebtRehan AsifNessuna valutazione finora

- Model Formule - ExerciseDocumento8 pagineModel Formule - Exercisemaxball53000Nessuna valutazione finora

- 62 Loan Repayment ScheduleDocumento5 pagine62 Loan Repayment Schedulevpincometax10Nessuna valutazione finora

- Ytm, Ytc - Bey&eay 2Documento6 pagineYtm, Ytc - Bey&eay 2aaafrinamNessuna valutazione finora

- Brand CoDocumento7 pagineBrand CoCamila VillamilNessuna valutazione finora

- NPV and IrrDocumento7 pagineNPV and IrrSakshi SharmaNessuna valutazione finora

- Shorenstein Yale Slides 2Documento15 pagineShorenstein Yale Slides 2Anton FortichNessuna valutazione finora

- Sebastian Hidalgo Control1.Documento6 pagineSebastian Hidalgo Control1.Jocelyn Cifuentes BarraNessuna valutazione finora

- Mergerd SND Acquisitions Case Study: ABC's Acquisitions of Xyx Submitted by Kinay Dave .No 36Documento7 pagineMergerd SND Acquisitions Case Study: ABC's Acquisitions of Xyx Submitted by Kinay Dave .No 36akshayNessuna valutazione finora

- Alicia Reyes Control 1.Documento5 pagineAlicia Reyes Control 1.ali97Nessuna valutazione finora

- Assumptions: Cell LockDocumento21 pagineAssumptions: Cell LockUmar YaqoobNessuna valutazione finora

- Harmony 3Documento5 pagineHarmony 3BurnedTacoSauceNessuna valutazione finora

- Case Study On Tottenham Hotspur PLCDocumento5 pagineCase Study On Tottenham Hotspur PLCClaudia CarrascoNessuna valutazione finora

- Colgate Palmolive ModelDocumento51 pagineColgate Palmolive ModelAde FajarNessuna valutazione finora

- Sinking Fund (Annuity of A Future Value)Documento3 pagineSinking Fund (Annuity of A Future Value)Sandeep Guha NiyogiNessuna valutazione finora

- BREIT Monthly Performance - February 2020Documento26 pagineBREIT Monthly Performance - February 2020MAYANK AGGARWALNessuna valutazione finora

- MTP 2 SolDocumento12 pagineMTP 2 SolItikaa TiwariNessuna valutazione finora

- INEOS StyrolutDocumento6 pagineINEOS StyrolutPositive ThinkerNessuna valutazione finora

- Ayleen PorraControl 1Documento7 pagineAyleen PorraControl 1ayleenporraNessuna valutazione finora

- Cash Return On Invested CapitalDocumento2 pagineCash Return On Invested CapitalMichael JacopinoNessuna valutazione finora

- Previous Years : Reliance Industrie SDocumento13 paginePrevious Years : Reliance Industrie SAditya KumarNessuna valutazione finora

- DCF ModellDocumento7 pagineDCF ModellziuziNessuna valutazione finora

- DCF ModellDocumento7 pagineDCF Modellsandeep0604Nessuna valutazione finora

- K (D1/P0) + G: WockhardtDocumento2 pagineK (D1/P0) + G: WockhardtYYASEER KAGDINessuna valutazione finora

- Ratio Analysis: Profitability & Return RatiosDocumento37 pagineRatio Analysis: Profitability & Return RatiosT M Nikhil SaiNessuna valutazione finora

- Task 3 - Model AnswerDocumento4 pagineTask 3 - Model AnswerHarry SinghNessuna valutazione finora

- Analyst Presentation June10Documento30 pagineAnalyst Presentation June10Ubaid Muneer RajaNessuna valutazione finora

- Unit3 Topic4 AnnuitiesDocumento44 pagineUnit3 Topic4 AnnuitiesBuhle HlongwaneNessuna valutazione finora

- Case 1Documento3 pagineCase 1Naveen AttigeriNessuna valutazione finora

- NBA Happy Hour Co - DCF Model - Task 4 - Revised TemplateDocumento10 pagineNBA Happy Hour Co - DCF Model - Task 4 - Revised Templateww weNessuna valutazione finora

- Analysis: MRF Limited: Reader's QueryDocumento20 pagineAnalysis: MRF Limited: Reader's Querysubrato KrNessuna valutazione finora

- DCF Valuation TemplateDocumento15 pagineDCF Valuation TemplateDEV DUTT VASHIST 22111116Nessuna valutazione finora

- SoloDocumento8 pagineSoloLuis Yael HernandezNessuna valutazione finora

- Qatar Electric Water Co 05oct11Documento24 pagineQatar Electric Water Co 05oct11xtrooz abiNessuna valutazione finora

- DCF ModellDocumento7 pagineDCF ModellVishal BhanushaliNessuna valutazione finora

- Question 8Documento1 paginaQuestion 8Ping PingNessuna valutazione finora

- Marriott Corporation (A) Harvard Business School Case 9-394-085 Courseware 9-307-703Documento3 pagineMarriott Corporation (A) Harvard Business School Case 9-394-085 Courseware 9-307-703CH NAIR100% (1)

- Chap007 Principle of Corporate FinanceDocumento41 pagineChap007 Principle of Corporate FinanceMc LeeNessuna valutazione finora

- A2 Mbag183002Documento24 pagineA2 Mbag183002Hashim EjazNessuna valutazione finora

- Narration Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18Documento38 pagineNarration Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18AbhijitChandraNessuna valutazione finora

- DCF ModelDocumento6 pagineDCF ModelKatherine ChouNessuna valutazione finora

- Particulars Amount (INR CRS.) WACC - 9.5% Amount (INR CRS.) WACC - 8.75% Essar's Value at 81.4%Documento1 paginaParticulars Amount (INR CRS.) WACC - 9.5% Amount (INR CRS.) WACC - 8.75% Essar's Value at 81.4%Puneet MittalNessuna valutazione finora

- Form 6-A (Revised) (For Un-Exempted Establishment)Documento4 pagineForm 6-A (Revised) (For Un-Exempted Establishment)srikanth reddyNessuna valutazione finora

- Cost of DebtDocumento10 pagineCost of DebtOlivier MNessuna valutazione finora

- Task 3 - DCF ModelDocumento10 pagineTask 3 - DCF Modeldavin nathanNessuna valutazione finora

- Stuti Mehta pgmb2149 FinanceDocumento12 pagineStuti Mehta pgmb2149 FinanceStutiNessuna valutazione finora

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocumento27 pagineTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener Tutorialrahul wareNessuna valutazione finora

- BoeingDocumento11 pagineBoeingPreksha GulatiNessuna valutazione finora

- Complete DCF Template v3Documento1 paginaComplete DCF Template v3javed PatelNessuna valutazione finora

- Sampa Video Inc Case StudyDocumento26 pagineSampa Video Inc Case StudyMegha BepariNessuna valutazione finora

- Free Cash Flow Estimate (In INR CRS) : The Discounted Cash Flow (DCF) Model Module 3, Chapter 15Documento9 pagineFree Cash Flow Estimate (In INR CRS) : The Discounted Cash Flow (DCF) Model Module 3, Chapter 15MBA grievanceNessuna valutazione finora

- 6 Polaroid Corporation 1996Documento64 pagine6 Polaroid Corporation 1996jk kumarNessuna valutazione finora

- MPPDocumento5 pagineMPPMadurai AlaguNessuna valutazione finora

- FX Trades Monitoring Qlik-View Data EntitiesDocumento3 pagineFX Trades Monitoring Qlik-View Data Entitiessimha1177Nessuna valutazione finora

- NBA Happy Hour Co - DCF Model v2Documento10 pagineNBA Happy Hour Co - DCF Model v2Siddhant Aggarwal50% (2)

- Sem-1 Syllabus Distribution 2021Documento2 pagineSem-1 Syllabus Distribution 2021Kishan JhaNessuna valutazione finora

- Unit 2 Consumer BehaviourDocumento14 pagineUnit 2 Consumer Behaviournileshstat5Nessuna valutazione finora

- NOVARTIS Bangladesh Pharmaceutical Marketplace AnalysisDocumento23 pagineNOVARTIS Bangladesh Pharmaceutical Marketplace AnalysisAisha ZainNessuna valutazione finora

- Relationship Marketing: Challenges For The Organization: Christian Gro NroosDocumento9 pagineRelationship Marketing: Challenges For The Organization: Christian Gro NroosrnaganirmitaNessuna valutazione finora

- Group Asignment Questions LawDocumento3 pagineGroup Asignment Questions LawKcaj WongNessuna valutazione finora

- Twofour54 Tadreeb Corporate Overview PDFDocumento17 pagineTwofour54 Tadreeb Corporate Overview PDFSolo PostNessuna valutazione finora

- Acquisition Plan TemplateDocumento13 pagineAcquisition Plan TemplateMuhammad Sajid SaeedNessuna valutazione finora

- Strategic Assignment FullDocumento50 pagineStrategic Assignment FullFitriana AnnisaNessuna valutazione finora

- 1577168581final Exam Routine - Mor ShiftDocumento19 pagine1577168581final Exam Routine - Mor ShiftNafiz Iqbal MugdhoNessuna valutazione finora

- BOLD Drilling Corporate Presentation 201501Documento13 pagineBOLD Drilling Corporate Presentation 201501Aamir ShahzadNessuna valutazione finora

- Consumer BehaviourDocumento75 pagineConsumer BehaviourarvrrawatNessuna valutazione finora

- Description: Proprietary Timber Roof Truss SystemDocumento7 pagineDescription: Proprietary Timber Roof Truss SystemWEIQIN CHANNessuna valutazione finora

- Anthony Mosha CVDocumento6 pagineAnthony Mosha CVanthony_mosha2445Nessuna valutazione finora

- C TSCM62 65 Sample QuestionsDocumento7 pagineC TSCM62 65 Sample QuestionsAnand Iyer100% (2)

- Lecture 33434434313545Documento10 pagineLecture 33434434313545Christelle Marie Aquino Beroña100% (3)

- Asset Issuance SlipDocumento105 pagineAsset Issuance SlipMuneer HussainNessuna valutazione finora

- Venture Capital & Ventre Capitalist: Made By: Gagan Vats Priyanka Tuteja Achal Jain Akshat DhallDocumento24 pagineVenture Capital & Ventre Capitalist: Made By: Gagan Vats Priyanka Tuteja Achal Jain Akshat DhalltarunshridharNessuna valutazione finora

- Project Change ManagementDocumento15 pagineProject Change ManagementTaskia FiraNessuna valutazione finora

- North Philippines Visitors Bureau: Department of TourismDocumento33 pagineNorth Philippines Visitors Bureau: Department of TourismdiscardmailNessuna valutazione finora

- TASK 2 - BSBMGT517 Manage Operational Plan TASK 2 - BSBMGT517 Manage Operational PlanDocumento14 pagineTASK 2 - BSBMGT517 Manage Operational Plan TASK 2 - BSBMGT517 Manage Operational PlanVioleta Hoyos Lopez68% (19)

- Bus Ticket Invoice 1673864116Documento2 pagineBus Ticket Invoice 1673864116SP JamkarNessuna valutazione finora

- Pert 1 - AKL - CH 3 - 2019-2020Documento2 paginePert 1 - AKL - CH 3 - 2019-2020Nova Yuliani0% (1)

- CE462-CE562 Principles of Health and Safety-Birleştirildi PDFDocumento663 pagineCE462-CE562 Principles of Health and Safety-Birleştirildi PDFAnonymous MnNFIYB2Nessuna valutazione finora

- B.C. Liquor Control and Licensing Branch Documents About The 2011 Stanley Cup RiotDocumento98 pagineB.C. Liquor Control and Licensing Branch Documents About The 2011 Stanley Cup RiotBob MackinNessuna valutazione finora

- Case General Motors Onstar ProjectDocumento10 pagineCase General Motors Onstar ProjectSergio IvánNessuna valutazione finora

- Quiz in AgencyDocumento3 pagineQuiz in AgencyPrincessAngelaDeLeonNessuna valutazione finora

- Trendyol Helped Create 1.1 Million Jobs in TurkeyDocumento3 pagineTrendyol Helped Create 1.1 Million Jobs in TurkeyTigist AbebeNessuna valutazione finora

- Declaration of Travis Crabtree - Trademark EngineDocumento4 pagineDeclaration of Travis Crabtree - Trademark EngineLegalForce - Presentations & ReleasesNessuna valutazione finora

- Revised Accreditation Form 1 Pharmacy Services NC IIIDocumento23 pagineRevised Accreditation Form 1 Pharmacy Services NC IIICamillNessuna valutazione finora

- Cash Management: Strategies To Manage CashDocumento6 pagineCash Management: Strategies To Manage CashRamalingam ChandrasekharanNessuna valutazione finora