Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Example of Tax

Caricato da

Ejoyce KimTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Example of Tax

Caricato da

Ejoyce KimCopyright:

Formati disponibili

Anilao, Elijah Joyce M.

Income Taxation

1. Revenue Regulations

2019 REVENUE REGULATIONS

No. of Subject Matter Date of

Issuance Issue

RR No. 1- February 8,

2019 Further amends certain provisions of RR No. 2-98 as 2019

amended by RR No. 11-2018, which implemented the

provisions of RA No. 10963 (TRAIN Law), relative to some

changes in the rate of Creditable Withholding Tax on

certain income payments

(Published in Manila Bulletin on February 11, 2019)

RR No. 4- Implements the Rules and Regulations of RA No. 11213 April 8,

2019 (Tax Amnesty Act), Providing for the Guidelines on the 2019

Processing of Tax Amnesty Application on Tax

Delinquencies

(Published in Malaya Business Insight on April 9, 2019)

RR No. 3- Prescribes the use of the Electronic Certificate Authorizing March 28,

2019 Registration System relative to transactions involving 2019

registration and transfer of real and personal properties

pursuant to Section 5(B) of the NIRC of 1997, as amended,

and in relation to Sections 58(E), 95 and 97 of the same

Code

(Published in Manila Bulletin on April 1, 2019)

RR No. 4- Implements the Rules and Regulations of RA No. 11213 April 8,

2019 (Tax Amnesty Act), Providing for the Guidelines on the 2019

Processing of Tax Amnesty Application on Tax

Delinquencies

(Published in Malaya Business Insight on April 9, 2019)

RR No. 5- Implements the tax incentives provisions of RA No. 10771 April 12,

2019 (Philippine Green Jobs Act of 2016) 2019

(Published in Malaya Business Insight on April 16, 2019

RR No. 6- Implements the provisions of Estate Tax Amnesty pursuant May 31,

2019 to Republic Act No. 11213 (Tax Amnesty Act) 2019

(Published in Malaya Business Insight on May 31, 2019

RR No. 7- Amends pertinent provisions of Section 2 under RR No. 11- June 13,

2019 2018 specifically on the requirements for top withholding 2019

agents

(Published in Malaya Business Insight on June 14, 2019

RR No. 8- Amends pertinent provisions of Sections 9 and 10 under June 25,

2019 RR No. 12-2018 2019

(Published in Malaya Business Insight on June 26, 2019

RR No. 9- Amends Sections 2, 3 and 7 of RR No. 5-2017 relative to August 27,

2019 rules and regulations implementing RA No. 10754 entitled 2019

"An Act Expanding the Benefits and Privileges of Persons

with Disability (PWD)" relative to the tax privileges of PWD

and tax incentives for establishments granting sales

discount and prescribing the guidelines for the availment

thereof, amending RR No. 1-2009

(Published in Malaya Business Insight on August 28, 2019

RR No. Amends pertinent provision of RR No. 4-2000, as amended December

10-2019 by RR No. 7-2005, by providing a new format for the Notice 2, 2019

to the Public to be exhibited at place of business

(Published in Malaya Business Insight on December 3,

2019 and Manila Standard on December 13, 2019

2. Revenue Memorandum Orders

3. Revenue Memorandum Rulings

2001 REVENUE MEMORANDUM RULINGS

No. of Subject Matter Date of

Issuance Issue

RMR No. Consolidates, provides, clarifies and harmonizes the December

1-200 existing guidelines on the tax consequences of a non- 5, 200

recognition transaction consisting of a tax-free exchange

of property for shares of stock of a controlled corporation.

4. Revenue Memorandum Circulars

5. Revenue Bulletins

2003 REVENUE BULLETINS

No. of Subject Matter Date of Issue

Issuance

RB No. 1- Prescribes the procedures and guidelines for the July 14, 200

200 proper handling of requests for rulings which are

determined as "No Ruling Areas.

RB No. 2- Amends Section 6 of Revenue Bulletin No. 1-2003 September

200 15, 200

6. BIR Rulings

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Ontario G1 TEST PracticeDocumento9 pagineOntario G1 TEST Practicen_fawwaazNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Manuel S. Enverga University Foundation College of Business & Accountancy ScoreDocumento2 pagineManuel S. Enverga University Foundation College of Business & Accountancy ScoreEjoyce KimNessuna valutazione finora

- Swot of ICICI BankDocumento12 pagineSwot of ICICI Bankynkamat100% (6)

- 2020-10-22 CrimFilingsMonthly - WithheadingsDocumento579 pagine2020-10-22 CrimFilingsMonthly - WithheadingsBR KNessuna valutazione finora

- The Industrial Revolution and Its Impact On SocietyDocumento18 pagineThe Industrial Revolution and Its Impact On Societypeteatkinson@gmail.comNessuna valutazione finora

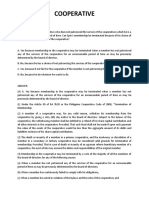

- CooperativeDocumento34 pagineCooperativeEjoyce KimNessuna valutazione finora

- Multiple Choice QuestionsDocumento3 pagineMultiple Choice QuestionsEjoyce KimNessuna valutazione finora

- Japanese Global Companies: Toyota MotorsDocumento7 pagineJapanese Global Companies: Toyota MotorsEjoyce KimNessuna valutazione finora

- The Third Phase of The Audit Is The Communication of ResultsDocumento3 pagineThe Third Phase of The Audit Is The Communication of ResultsEjoyce KimNessuna valutazione finora

- Operations AuditingDocumento14 pagineOperations AuditingEjoyce KimNessuna valutazione finora

- Sony CorporationDocumento2 pagineSony CorporationEjoyce KimNessuna valutazione finora

- Business Combination - GROUP 1Documento4 pagineBusiness Combination - GROUP 1Ejoyce KimNessuna valutazione finora

- JajaDocumento3 pagineJajaEjoyce KimNessuna valutazione finora

- Final ExamDocumento10 pagineFinal ExamEjoyce KimNessuna valutazione finora

- Problem 2Documento1 paginaProblem 2Ejoyce KimNessuna valutazione finora

- Case Study - Strategic ManagementDocumento7 pagineCase Study - Strategic ManagementEjoyce KimNessuna valutazione finora

- AP Cash Bank Recon O2020 MSEUFDocumento5 pagineAP Cash Bank Recon O2020 MSEUFEjoyce KimNessuna valutazione finora

- Colle Ge of Business and Accountancy Pacucoa Level IV Reaccredited ScoreDocumento2 pagineColle Ge of Business and Accountancy Pacucoa Level IV Reaccredited ScoreEjoyce KimNessuna valutazione finora

- PUBLICITYDocumento20 paginePUBLICITYEjoyce KimNessuna valutazione finora

- NSSF ActDocumento38 pagineNSSF Actokwii2839Nessuna valutazione finora

- Presentation Mini Case MeDocumento10 paginePresentation Mini Case MeMohammad Osman GoniNessuna valutazione finora

- CloverfieldDocumento1 paginaCloverfieldKaran HanamanNessuna valutazione finora

- Saharish Del-Bom 5:6:21Documento2 pagineSaharish Del-Bom 5:6:21Sohaib DurraniNessuna valutazione finora

- Henna Residence BriefDocumento56 pagineHenna Residence BrieffendeysanNessuna valutazione finora

- 122661-2006-Twin Ace Holdings Corp. v. Rufina Co.20180326-1159-RlgzhkDocumento7 pagine122661-2006-Twin Ace Holdings Corp. v. Rufina Co.20180326-1159-RlgzhkMarjorie BaquialNessuna valutazione finora

- Beebe ME Chain HoistDocumento9 pagineBeebe ME Chain HoistDan VekasiNessuna valutazione finora

- AP Euro Chapter 13 Outline Notes TemplateDocumento8 pagineAP Euro Chapter 13 Outline Notes TemplateEstdur Keem100% (1)

- StepanFormulation149 Liquid Soap PDFDocumento2 pagineStepanFormulation149 Liquid Soap PDFeduardoaffreNessuna valutazione finora

- Ethics and Truths in Indian Advertising PDFDocumento2 pagineEthics and Truths in Indian Advertising PDFTrevorNessuna valutazione finora

- Installation of Baikal On Synology DSM5Documento33 pagineInstallation of Baikal On Synology DSM5cronetNessuna valutazione finora

- (Onati International Series in Law and Society) Eric L. Jensen, Jorgen Jepsen - Juvenile Law Violators, Human Rights, and The Development of New Juvenile Justice Systems - Hart Publishing (2006)Documento497 pagine(Onati International Series in Law and Society) Eric L. Jensen, Jorgen Jepsen - Juvenile Law Violators, Human Rights, and The Development of New Juvenile Justice Systems - Hart Publishing (2006)Cristelle FenisNessuna valutazione finora

- Mathematical Solutions - Part ADocumento363 pagineMathematical Solutions - Part ABikash ThapaNessuna valutazione finora

- 11i Implement Daily Business Intelligence: D17008GC30 Edition 3.0 April 2005 D 41605Documento14 pagine11i Implement Daily Business Intelligence: D17008GC30 Edition 3.0 April 2005 D 41605Bala KulandaiNessuna valutazione finora

- HyiDocumento4 pagineHyiSirius BlackNessuna valutazione finora

- Od126200744691887000 4Documento1 paginaOd126200744691887000 4Swyam SaxenaNessuna valutazione finora

- Full Download Family Therapy Concepts and Methods Nichols 10th Edition Test Bank PDF Full ChapterDocumento36 pagineFull Download Family Therapy Concepts and Methods Nichols 10th Edition Test Bank PDF Full Chaptercategory.torskhwbgd100% (15)

- Strategic Litigation Impacts, Insight From Global ExperienceDocumento144 pagineStrategic Litigation Impacts, Insight From Global ExperienceDhanil Al-GhifaryNessuna valutazione finora

- Hearing Committee On Environment and Public Works United States SenateDocumento336 pagineHearing Committee On Environment and Public Works United States SenateScribd Government DocsNessuna valutazione finora

- Fourth Commandment 41512Documento11 pagineFourth Commandment 41512Monica GodoyNessuna valutazione finora

- Bill Overview: Jlb96Kutpxdgxfivcivc Ykpfi9R9Ukywilxmvbj5Wpccvgaqc7FDocumento5 pagineBill Overview: Jlb96Kutpxdgxfivcivc Ykpfi9R9Ukywilxmvbj5Wpccvgaqc7FMani KalpanaNessuna valutazione finora

- Constituents of Human Acts: IgnoranceDocumento4 pagineConstituents of Human Acts: IgnoranceTRISHA MARIE OASAYNessuna valutazione finora

- Examiner's Indorsement To Collector For Processing of Alert Order - Al KongDocumento5 pagineExaminer's Indorsement To Collector For Processing of Alert Order - Al Kongmitch galaxNessuna valutazione finora

- A Project Report On Labour LawDocumento4 pagineA Project Report On Labour LawSaad Mehmood SiddiquiNessuna valutazione finora

- Solvency PPTDocumento1 paginaSolvency PPTRITU SINHA MBA 2019-21 (Kolkata)Nessuna valutazione finora

- 14 Solid - Homes - Inc. - v. - Payawal PDFDocumento6 pagine14 Solid - Homes - Inc. - v. - Payawal PDFcelNessuna valutazione finora