Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Kotak Mahindra Bank - Moratorium Policy

Caricato da

CNBCTV18 DigitalCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Kotak Mahindra Bank - Moratorium Policy

Caricato da

CNBCTV18 DigitalCopyright:

Formati disponibili

Dated: March 31, 2020

SUBJECT: Regulatory measures and reliefs announced by RBI in view of

COVID 19 –Bank’s Policy for implementation.

BRIEF BACKGROUND:

RBI Governor’s Bi-Monthly Monetary Policy Statement issued on March 27, 2020 had

announced certain regulatory measures to mitigate the debt-servicing burden on

borrowers in view of the disruptions brought out by the current situation. As a follow

up RBI has also issued a circular DOR.No.BP.BC.47/21.04.048/2019-20, dated March

27, 2020, detailing the guidelines.

Relief provided by RBI in the circular:

RBI has enabled banks to allow a one-time re-schedulement of payments by way of

a) Moratorium of three months on payment of all term loan instalments falling due

between March 1, 2020 and May 31, 2020 for all term loans. Instalments include

all principal and interest payments, bullet repayments, EMIs, and credit card dues

falling due between these dates. The repayment schedule for such loans as also

the residual tenor, will be shifted across the board by three months after the

moratorium period. Interest shall continue to accrue on the outstanding portion of

the term loans during the moratorium period.

b) Defer the recovery of interest applied in respect of all working capital facilities

during the period from March 1, 2020 up to May 31, 2020 in respect of facilities

sanctioned in the form of cash credit / over-draft (CC/OD).

c) Recalculate the ‘drawing power’ by reducing the margins and/or by reassessing

the working capital cycle for all the existing CC/OD borrowers. This relief shall be

available in respect of all such changes effected up to May 31, 2020 and shall be

contingent on the lending institutions satisfying themselves that the same is

necessitated on account of the economic fallout from COVID-19.

d) Since the moratorium/deferment/recalculation of the ‘drawing power’/ reassessing

the working capital cycle are being provided specifically to enable the borrowers

to tide over economic fallout from COVID-19, the same will not be treated as

One-time Restructuring Policy due to COVID-19 Page 1

concession or change in terms and conditions of loan agreements due to financial

difficulty of the borrower. Hence, these reliefs will not result in downgrading of

asset classification of the borrower.

e) This also will not qualify as a default for reporting to Credit Information Companies

and also under supervisory reporting

Bank’s policy for providing the said relief to borrowers:

This policy applies to all credit facilities granted and disbursed by the Bank and

outstanding as on March 31, 2020. This is not applicable to loan disbursements to be

made in April 2020 and thereafter. This will also apply to all borrowers of GIFT City

branch (subject to applicable laws) and applies to foreign currency denominated

facilities of domestic offices/branches. The Bank would provide separate terms and

conditions for different types of loan. Other credit conditions in the sanction letters

already issued would remain unchanged.

The Bank will offer to all borrowers who wish to avail of the facility of moratorium (for

term loan instalments and credit card dues falling due between March 1, 2020 and

May 31, 2020) and / or deferment of interest for the months of March to May 2020 to

all borrowers who availed working capital facilities.

The Bank would be charging the interest, at the original contracted rate, for the

moratorium period on the outstanding amount of loan to all those who avail the relief

as provided in the RBI circular. This interest has to be paid by the customers as

prescribed in this policy.

All customers who desire to avail the relief under the policy can send an email from

their registered mail id to pay.later@kotak.com quoting the Loan account / APAC

number.

A. Moratorium for Term loans:

The repayment schedule of term loans will shift by up to three months and

the tenor of the term loan will be commensurately extended. The instalment

One-time Restructuring Policy due to COVID-19 Page 2

amounts / EMIs will be appropriately recalculated, including interest during

moratorium period.

If borrowers have already paid their instalments or serviced their interest for

March 2020, such borrowers can avail moratorium for installments falling

due in April and May 2020.

The Bank would be presenting the post-dated cheques / actioning ECS or

NACH -mandates etc., provided by the customers, for collection as per the

respective due dates. Customers that are desirous of availing the relief

under the RBI circular, should send a communication to the Bank within

seven days (or extended date as may be permitted by the Bank) from their

first due date falling on or after April 1, 2020 through a mail from their

registered mail id to pay.later@kotak.com. Customers, whose instrument

so sent for collection is not cleared, will be deemed to have availed of the

moratorium and necessary relief would be provided as per the RBI

guidelines. .

Credit card customers will be given an option to avail of relief under the RBI

circular will be sent instructions along with their first statement falling due on

or after April 1, 2020. Customers who do not pay their total amount due, as

payable in the months of March, April, May would be automatically enrolled

for the Moratorium. Customers desirous of availing the relief should send a

communication to the Bank within seven days (or extended date as may be

permitted by the Bank) from their first due date falling after April 1, 2020

through a mail from their registered mail id to pay.later@kotak.com.

B. Relief for working capital facilities:

(a) Deferment of interest:

In the case of Overdraft / Cash Credit, including KCC Loans, the Bank will

offer deferment of interest applied to all borrowers for the months of March

2020, April 2020 and May 2020.

The accumulated interest for this three-month period should be serviced by

the borrower immediately after the moratorium period.

(b) Reduction of margin:

One-time Restructuring Policy due to COVID-19 Page 3

For customers facing stress on account of the economic fallout of the pandemic,

the Bank will consider reduction of margin on stocks/receivables/other eligible

securities, etc., for the purpose of computation of Drawing Power (DP) for

OD/CC limits and allow higher DP than earlier, based on impact on borrower

basis due credit assessment.

Such concession in reduction of margin would be valid in respect of all changes

effected up to 31st May 2020 for such period as the Bank assesses or such

extended time as per the impact assessment on working capital cycle. After

such period, the margin would be reverted to pre-relief margin stipulated by the

Bank.

(c) Reassessment of working capital cycle / limits

For customers facing stress on account of the economic fallout of the pandemic,

the Bank may re-assess the working capital cycle factoring the COVID19

impact on customer’s business

In case the working capital arrangement is under a Consortium, the

reassessment of limits will need to be harmonized with the assessment of the

Lead Bank of the Consortium.

Once the original limit is reinstated, any further concession / enhancement

would have to be dealt with as per the usual restructuring norms stipulated by

RBI.

Eligibility to avail relief under B (b) and (c)

All borrowers availing working capital facilities in the nature of :

CC or OD or

EPC/ PCFC or

bill discounting / Letters of Credit / Gold Metal Loans etc., and whose working

capital requirement / cycle is impacted by the pandemic, resulting in:

cancellation / deferment / re-schedulement of orders

shutdown of unit / work place,

One-time Restructuring Policy due to COVID-19 Page 4

non-availability of manpower/ transportation to complete the manufacturing

/ sale of goods / services,

non-realization of debtors or elongation of realization period

will be eligible for requesting for relief under this provision,

The bank will grant such relief under paras B (b) and (c) subject to meeting the

credit assessment of the Bank.

C. Common conditions for availing the policy:

The Bank will take into account the stress on the borrowers on account of the

pandemic.

The borrower should not be under IBC proceedings.

The borrower should not have been classified as willful defaulter/ RFA/ Fraud

classified by KMBL or other Banks

D. Legal & documentation matters:

Loan specific conditions may be laid down by the Bank for the above relief.

In respect of concessions/reliefs granted under this policy, requisite

documentation f may be taken by the Bank, including through electronic form.

The Bank may examine if any SBLC/corporate guarantee backed facilities

require extension of the tenor of SBLC/ CG with due approval of the provider of

such comfort which involve modification of their terms. Wherever required by

the Bank, such approval shall be obtained upfront.

E. Validity of the policy:

This policy shall be valid up to 31st May 2020 or further period as may be extended by

RBI.

F. Prudential norms:

One-time Restructuring Policy due to COVID-19 Page 5

The moratorium/deferment granted to borrowers will not qualify as default on

the part of borrowers for the purposes of supervisory reporting and reporting to

credit information companies (CICs).

The relief given as above as per the special dispensation given by RBI will not

result in any downgrade of asset classification.

However, if there is an existing default like interest/principal due up to February

29, 2020, the usual asset classification and provisioning norms will apply.

While this policy outlines the broad internal guidance that the Bank will follow to take

decisions regarding moratorium, the Bank retains the discretion to take decisions

regarding this policy depending on case specific issues or nuances . Bank reserves

the right to amend the policy within the framework of RBI regulations.

One-time Restructuring Policy due to COVID-19 Page 6

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Budget 1977 78 InterimDocumento260 pagineBudget 1977 78 InterimCNBCTV18 DigitalNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

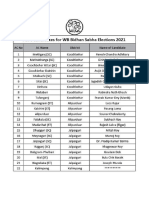

- TMC Candidate 1Documento13 pagineTMC Candidate 1CNBCTV18 DigitalNessuna valutazione finora

- MHA GuidelinesDocumento2 pagineMHA GuidelinesCNBCTV18 DigitalNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- TMC Candidate 1Documento13 pagineTMC Candidate 1CNBCTV18 DigitalNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Venugopal Dhoot ProposalDocumento4 pagineVenugopal Dhoot ProposalCNBCTV18 DigitalNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Frequently Asked Questions On COVID-19 Vaccine: Target Group: General Public S. No. Potential ResponseDocumento8 pagineFrequently Asked Questions On COVID-19 Vaccine: Target Group: General Public S. No. Potential ResponseCNBCTV18 DigitalNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Maharashtra Lockdown 4.0Documento1 paginaMaharashtra Lockdown 4.0CNBCTV18 DigitalNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- DCP Mumbai Police Issues Fresh Lockdown Orders.Documento2 pagineDCP Mumbai Police Issues Fresh Lockdown Orders.CNBCTV18 Digital100% (4)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- FM Letter To StatesDocumento4 pagineFM Letter To StatesCNBCTV18 DigitalNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- 1978 Swadeshi Implementation-1Documento20 pagine1978 Swadeshi Implementation-1CNBCTV18 DigitalNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Amit Mitra LetterDocumento3 pagineAmit Mitra LetterCNBCTV18 DigitalNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- PNBDocumento2 paginePNBCNBCTV18 DigitalNessuna valutazione finora

- Lockdown Extension: Ready ReckonerDocumento1 paginaLockdown Extension: Ready ReckonerCNBCTV18 DigitalNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Flight Plan For Return of Indian NationalDocumento11 pagineFlight Plan For Return of Indian NationalExpress Web91% (11)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- ICICI Bank Moratorium FAQsDocumento8 pagineICICI Bank Moratorium FAQsCNBCTV18 DigitalNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- ICRA: List of Companies That Availed RBI MoratoriumDocumento10 pagineICRA: List of Companies That Availed RBI MoratoriumCNBCTV18 DigitalNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Containment of HotspotsDocumento20 pagineContainment of HotspotsCNBCTV18 DigitalNessuna valutazione finora

- SBI EMI Moratorium FAQsDocumento4 pagineSBI EMI Moratorium FAQsCNBCTV18 DigitalNessuna valutazione finora

- ICICI Bank Moratorium FAQsDocumento8 pagineICICI Bank Moratorium FAQsCNBCTV18 DigitalNessuna valutazione finora

- Notification - Transmission Charges For DICs - Billing Month - August - 2021Documento34 pagineNotification - Transmission Charges For DICs - Billing Month - August - 2021Yogesh MuleNessuna valutazione finora

- Concrete Prestressed Panel & Rocket WallingDocumento32 pagineConcrete Prestressed Panel & Rocket WallingWayne StevensonNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Practical QuestionsDocumento5 paginePractical QuestionsBui Thi Lan Anh (FGW HCM)Nessuna valutazione finora

- Bola Pelang IDocumento9 pagineBola Pelang Iivan rasyidNessuna valutazione finora

- Financial Management Theory and Practice An Asia 1St Edition Brigham Test Bank Full Chapter PDFDocumento45 pagineFinancial Management Theory and Practice An Asia 1St Edition Brigham Test Bank Full Chapter PDFMeganPrestonceim100% (12)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Pestel Analysis of ZaraDocumento3 paginePestel Analysis of ZaraZain AliNessuna valutazione finora

- Gktoday November 2022Documento189 pagineGktoday November 2022Mahendra SwainNessuna valutazione finora

- Basic Economic Problems and The Philippine Socioeconomic Development in The 21st CenturyDocumento3 pagineBasic Economic Problems and The Philippine Socioeconomic Development in The 21st CenturyRobert BalinoNessuna valutazione finora

- FalseDocumento13 pagineFalseJoel Christian Mascariña100% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- The Importance of Government RegulationDocumento2 pagineThe Importance of Government RegulationAxel HagosojosNessuna valutazione finora

- Peter Crowns D I B SDocumento59 paginePeter Crowns D I B Shusserl01Nessuna valutazione finora

- Meterbill 6909Documento3 pagineMeterbill 6909vsinghrajput1983Nessuna valutazione finora

- Account Usage and Recharge Statement From 23-Jan-2022 To 21-Feb-2022Documento8 pagineAccount Usage and Recharge Statement From 23-Jan-2022 To 21-Feb-2022Lavatech TechnologyNessuna valutazione finora

- Jawaban Tabel MatkeuDocumento4 pagineJawaban Tabel MatkeuIntan Nur PutriNessuna valutazione finora

- Operations ManagementDocumento6 pagineOperations Managementashish sunnyNessuna valutazione finora

- Contemporary WorldDocumento35 pagineContemporary WorldtabiNessuna valutazione finora

- Prepare Financial Report IbexDocumento13 paginePrepare Financial Report Ibexfentahun enyewNessuna valutazione finora

- Service Concession ArrangementDocumento2 pagineService Concession Arrangementkim cheNessuna valutazione finora

- Fin 200 Time Value of Money Tutorial 2 Solutions 2021.Documento2 pagineFin 200 Time Value of Money Tutorial 2 Solutions 2021.Mtshidi Kewagamang100% (2)

- Nicolas Marié What Is The Relevance, Policy and Measurement Challenges Associated With Middle Classes (And Polarization) ?Documento3 pagineNicolas Marié What Is The Relevance, Policy and Measurement Challenges Associated With Middle Classes (And Polarization) ?Nicolas MariéNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Solved Using The Following Information For Gold Star National Bank CalculateDocumento1 paginaSolved Using The Following Information For Gold Star National Bank CalculateM Bilal SaleemNessuna valutazione finora

- Abe Ends Record Term at Japan Helm: The 300,000-Year Case For The 15-Hour WeekDocumento44 pagineAbe Ends Record Term at Japan Helm: The 300,000-Year Case For The 15-Hour WeekHoangNessuna valutazione finora

- Ola UberDocumento4 pagineOla UberAnil SinghNessuna valutazione finora

- G20 & IndiaDocumento2 pagineG20 & IndiaGRAMMAR SKILLNessuna valutazione finora

- Botswana Power SectorDocumento19 pagineBotswana Power SectorJeremiah MatongotiNessuna valutazione finora

- 32-4-3 - Social ScienceDocumento19 pagine32-4-3 - Social Sciencestudygirl03Nessuna valutazione finora

- What Is Global Banking?Documento2 pagineWhat Is Global Banking?Pinky GocoyoNessuna valutazione finora

- ECOM074: Bond Market StrategiesDocumento87 pagineECOM074: Bond Market StrategiesBen OusoNessuna valutazione finora

- Vedanta HW Price List 02.09.23Documento2 pagineVedanta HW Price List 02.09.23NikhilNessuna valutazione finora

- UCB - PrithiwishDocumento10 pagineUCB - PrithiwishPrithwish SinhaNessuna valutazione finora

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyDa EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyValutazione: 5 su 5 stelle5/5 (1)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantDa EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantValutazione: 4 su 5 stelle4/5 (104)