Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Corporate Banking Chapter 2 PDF

Caricato da

Muhammad shazib0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

48 visualizzazioni38 pagineA charge refers to a legal right over assets given as security for a bank loan. It allows the bank to take possession of the asset if the borrower defaults and sell it to recover amounts owed. There are different types of charges including lien, pledge, hypothecation, mortgage, and floating charge. A pledge involves bailment of goods to secure a debt, with the pawnee holding the right to sell the goods if the debt is not repaid. Hypothecation creates a charge over movable property without transfer of ownership or possession, requiring only a letter from the borrower detailing the assets hypotheecated. Banks must take precautions like periodic inspection and insurance of hypothecated goods to protect

Descrizione originale:

Titolo originale

Corporate Banking Chapter 2.pdf

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoA charge refers to a legal right over assets given as security for a bank loan. It allows the bank to take possession of the asset if the borrower defaults and sell it to recover amounts owed. There are different types of charges including lien, pledge, hypothecation, mortgage, and floating charge. A pledge involves bailment of goods to secure a debt, with the pawnee holding the right to sell the goods if the debt is not repaid. Hypothecation creates a charge over movable property without transfer of ownership or possession, requiring only a letter from the borrower detailing the assets hypotheecated. Banks must take precautions like periodic inspection and insurance of hypothecated goods to protect

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

48 visualizzazioni38 pagineCorporate Banking Chapter 2 PDF

Caricato da

Muhammad shazibA charge refers to a legal right over assets given as security for a bank loan. It allows the bank to take possession of the asset if the borrower defaults and sell it to recover amounts owed. There are different types of charges including lien, pledge, hypothecation, mortgage, and floating charge. A pledge involves bailment of goods to secure a debt, with the pawnee holding the right to sell the goods if the debt is not repaid. Hypothecation creates a charge over movable property without transfer of ownership or possession, requiring only a letter from the borrower detailing the assets hypotheecated. Banks must take precautions like periodic inspection and insurance of hypothecated goods to protect

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 38

CHARGE

Learning Objectives:

To understand the meaning of a

charge

To understand the different

types of charges

Chapter 2 Corporate Banking 1

CHARGE

• 2.1 Introduction

• The term charge refers to a legal

right on the assets that have

been given by the borrower as

security for the loan/advance/

facility extended by the bank.

• The charge gives the bank the

right/ability to possess the

asset should the borrower default

and to sell the asset in order to

realize the amount due.

Chapter 2 Corporate Banking 2

CHARGE

• KINDS OF CHARGE

• The different kinds of charges made to secure

loans are as follows:

Lien

Pledge

Hypothecation

Mortgage

Sub Mortgage

Chapter 2 Corporate Banking 3

CHARGE

• KINDS OF CHARGE : contd

Assignment

First charge

Second charge

Pari passu charge

Floating charge

Trust receipt

Chapter 2 Corporate Banking 4

CHARGE

• Lien

• The banker gets the right to retain the security

in the capacity of a lender till payment is

made by the borrower.

• If a loan is taken pledging fixed deposits the

customer has with the bank, the bank usually

takes the fixed deposit receipt from the

customer and stamps it with the words “on

lien”.

Chapter 2 Corporate Banking 5

CHARGE

• Pledge :Section 172 of the Indian Contract Act,

1872 defines pledge as “bailment of goods as

security for payment of a debt or performance of

a promise”.

• Pawner or Pledger = Person who offers the

security

• Pawnee or Baille or Pledgee = Person who

accepts the security as bailment.

• Objective of bailment = To hold goods as security

for the payment of debt or for the performance

of a promise.

Chapter 2 Corporate Banking 6

CHARGE

• Bailment: Section 148 of Indian Contract Act,

1872 defines bailment as , “delivery of goods

from one person to another for some purpose

upon the contract that the goods be returned

back when the purpose is accomplished or

otherwise disposed of according to the

instructions of the bailor.”

• The borrower and lender should have an oral

or written contract to pledge the property

Chapter 2 Corporate Banking 7

CHARGE

• The Banker as a pledgee :

• The Banker as a pledgee has the right to retain

the goods pledged for payment of debt or

performance of promise.

• The banker can retain the goods as security

for the amount of interest and the expenses

incurred in connection with the possession

and upkeep of the goods pledged.

Chapter 2 Corporate Banking 8

CHARGE

• WHO CAN PLEDGE GOODS?

• Goods can be pledged by anyone who is in

legal possession of the same namely :

The owner of goods

The mercantile agent of the owner

Joint owner with the consent of the co-owner

AND MANY MORE..

Chapter 2 Corporate Banking 9

CHARGE

• Important Legal aspects of pledge:

• The pawner or pledger remains with the

owner of the property except to the extent of

interest which rests with the pledge because

of the loan borrowed from the bank.

• Pledge is not created in respect of future

goods. The goods must be specific and be

capable of identification

Chapter 2 Corporate Banking 10

CHARGE

• Rights of a banker as pledgee :

• Right to retain the goods pledged for the

payment of the debt or performance of the

promise and also the amount of interest due on

the debt and expenses incurred by him that are

required in relation to goods.

• Right to either file a civil suit against the pledger

for the amount due and retain the goods as a

collateral security or the right to sell the goods

pledged after giving the pledger reasonable

notice.

Chapter 2 Corporate Banking 11

CHARGE

• Rights of a banker as pledgee :contd.

If the pledgee suffers some loss due to the non-

disclosure of information by the pledger then the

pledger will be held responsible.

If the title of the pledger to the goods pledged is

defective and if the pledgee suffers any loss due

to this fact,the pledger will be responsible.

If the pledgee has consented due to inducement

by fraud or misrepresentation by the pledger, the

contract is voidable at the option of the pledgee.

Chapter 2 Corporate Banking 12

CHARGE

• Rights of a banker as pledgee :contd

• A pledgee’s rights are not limited to his

interest in the pledged goods. He would have

all the remedies that the owner of the goods

would have against a third person for

deprivation of goods or injury to them.

Chapter 2 Corporate Banking 13

CHARGE

• Duties of a Pledgee :

The pledgee is bound to return the goods on

payment of the debt.

It is the duty of the pledgee to restore the

goods to the pledger or to deliver the goods

according to the directions of the pleger as

soon as the obligation to repay the amount is

discharged.

Chapter 2 Corporate Banking 14

CHARGE

• Duties of a Pledgee :

The pledge is responsible to the pledger for any

loss, destruction or deterioration of the goods, if

the goods are not returned by the pledgee at the

proper time.

The pledgee is bound to use the goods pledged

according to the agreement between the two

parties. He is also liable to make compensation to

the pledger if he suffers any damage due to

unapproved use of goods pledged.

Chapter 2 Corporate Banking 15

CHARGE

• Duties of a Pledgee :

The pledgee is also bound to deliver to the

pledger any increase of profit which may have

incurred from the goods bailed in absence of an

agreement to the contrary.

The pledgee is bound to take as much care of the

goods as a man of ordinary prudence would,

under similar circumstances, take of his own

goods of the same bulk, quantity and value as the

pledged goods.

Chapter 2 Corporate Banking 16

CHARGE

• Advantages of pledge:

The goods will be in possession of the bank and it

can be liquidated at the instance of the banker.

Whenever the borrower is at default, the banker

can immediately clear the stock and appropriate

the proceeds towards the loan outstanding.

Whenever stock is pledged it cannot be

misappropriated as it will be under the control of

the banker.

Chapter 2 Corporate Banking 17

CHARGE

• Advantages of pledge:

A second charge of the pledged property is not

possible as the banker holds possession of the

property.

If the pledger becomes insolvent, the banker is

secured to the extent of the value of the goods

pledged and the pledged goods cannot be taken

possession of by the official receiver.

In case of loss of goods, the amount can be

claimed from the insurance company.

Chapter 2 Corporate Banking 18

CHARGE

• Hypothecation :

Hypothecation is a charge against movable

property for an amount of debt where neither

ownership nor possession is passed to the

creditor.

It is also called as open loan.

The borrower gives a letter stating that the

goods are hypothecated to the banker as

security for the loan granted.

Chapter 2 Corporate Banking 19

CHARGE

• Letter of Hypothecation:

• Empowers the banker to take possession of the property whenever

there is a default in repayment the amount advanced order to

liquidate the balance of the amount advanced.

• States that the property is free from encumbrances.

• Contains description of goods, their quality, quantity, value etc and

a confirmation that the particulars provided are true.

• Provision to apply the sale proceeds of the property hypothecated

towards satisfaction of the claim of the banker.

• Property hypothecated as security should be a continuing security,

for the balance due from time to time.

• Stipulate various other borrower’s responsibilities

Chapter 2 Corporate Banking 20

CHARGE

• Precautions to be taken by banker:

• Banker should ask the borrower to submit a letter that the

goods hypothecated are not hypothecated to any other

bank and obtain periodical statements from the borrower.

• Bankers should make personal inspection of the

hypothecated goods and may ask for additional stock if he

feels that goods hypothecated are depreciating or its value

has gone down.

• Banks should place a board stating ‘hypothecated

to…bank’ in vicinity where the hypothecated property is

stocked.

• Hypothecated goods should be insured against burglary,

theft, fire, for full value.

Chapter 2 Corporate Banking 21

CHARGE

• Precautions to be taken by banker:

• If the goods are owned by a joint stock company, the

charge created against the goods should be registered

within 30 days from such creation with the Registrar of

Companies. Otherwise the liquidator and the creditor

will claim the property.

• The banker should obtain the personal guarantee of

the directors of a company if the financial position of

the company is weak.

• The banker should keep the continuing security against

the advance made.

Chapter 2 Corporate Banking 22

CHARGE

• Guidelines issued by RBI against risk of double financing:

• Restrict borrowing to only one bank as far as possible.

• Obtain written application accompanied by declaration

about existing credit arrangements and undertaking that

stocks will not be hypothecated to any other bank.

• In case the borrower is allowed to avail himself of credit

facilities against hypothecation of socks from various

banks, it should be ensured that stocks are segregated or

demarcated in different godowns/shops and same are

properly recorded in separate stock books so as to

facilitate easy verification by the bank officials.

Chapter 2 Corporate Banking 23

CHARGE

• Mortgage :

• Section 58 of the Transfer of Property Act,

1882 defines mortgage as “the transfer of

interest in specific immovable property for the

purpose of securing the payment of money,

advanced or to be advanced by way of a loan,

an existing or future debt or the performance

of an engagement which may give rise to a

pecuniary liability.”

Chapter 2 Corporate Banking 24

CHARGE

• Characteristics of Mortgage :

Transfer of an interest in a specific immovable property.

The object behind the transfer of interest in the property

must be to secure a loan or to ensure the performance of

an engagement resulting in monetary obligation.

The mortgagee has the right to recover the amount of loan

out of the sale proceeds of the mortgaged property.

The actual possession of the property need not always be

transferred to the mortgagee.

The interest in the mortgaged property is re-conveyed to

the mortgagee on the repayment of the amount of the

loan with interest thereon.

Chapter 2 Corporate Banking 25

CHARGE

• Kinds of Mortgage :

1. Simple Mortgage

2. Mortgage by conditional sale

3. Usufructuary mortgage

4. English Mortgage

5. Mortgage by deposit of title deeds or

equitable mortgage

6. Anomalous mortgage

7. Sub-mortgage

Chapter 2 Corporate Banking 26

CHARGE

• 1. Simple Mortgage : The mortgager binds himself to pay

the mortgage money but does not give possession of

property. The property should be registered irrespective of

the amount of money involved

• 2. Mortgage by conditional sale : The mortgager

ostensibly (conditionally) sells the mortgaged property.

Banker generally does not prefer this type of mortgage.

Foreclosure is the only remedy of the mortgagee.

• 3. Usufructuary mortgage: The mortgagor delivers or gives

possession or binds himself to deliver possession of the

mortgagee. The mortgagee retains possession until the

payment of the mortgage money. The mortgagee is also

entitled to receive rents and profits in lieu of interest, or

repayment of the mortgage money of both.

Chapter 2 Corporate Banking 27

CHARGE

• 4. English Mortgage: The mortgagor binds himself to repay the

mortgage money on a certain date and transfers the mortgaged property

absolutelyto the mortgagee on the condition that the mortgagee will

retransfer the property back to the mortgagor upon payment of the

mortgage money.

• 5. Mortgage by deposit of title deeds or equitable mortgage: Under this

mortgage, the person delivers to the creditor or his agent the document of

title to his immovable property with the intention of creating a security

and obtains a loan.

• 6. Anomalous mortgage: A mortgage which is not a simple mortgage, a

mortgage by conditional sale, a usufructuary mortgage, an English

mortgage or a mortgage by deposit of title deeds is called an anomalous

mortgage.

• 7. Sub-mortgage: Here the mortgagee transfers his interest in the

mortgaged property or creates a mortgage of a mortgage. This is known as

sub-mortgage.

Chapter 2 Corporate Banking 28

CHARGE

• Rights of a mortgagor:

• 1. Right of redemption

• 2. Right of accession of mortgaged property

• 3. Right to inspection and production of

documents:

Chapter 2 Corporate Banking 29

CHARGE

• Rights of a mortgagee :

• 1. Right to sue for mortgage money

• 2. Right to sale

• 3. Right of possession

• 4. Right in case of renewal of mortgaged

lease

• 5. Right of recovery of money spent on

mortgaged property

Chapter 2 Corporate Banking 30

CHARGE

• Assignment :

• Assignment is the transfer of a right, property

or debt – present or future. The transferor is

the assignor and the transferee is the

assignee.

Chapter 2 Corporate Banking 31

CHARGE

• Types of Assignment:

• (a) Legal Assignment : Legal assignment is an absolute

transfer of the actionable claim. It must be in writing

and signed by the assignor. The assignor informs the

debtor too of the assignment along with the assignor’s

name and address. The assignee would also serve a

notice on the debtor and seek his confirmation of the

balance.

• (b) Equitable Assignment : An equitable assignment is

one where the conditions for a legal assignment are

not met or fulfilled. The assignee cannot sue in his own

name.

Chapter 2 Corporate Banking 32

CHARGE

• Actionable claims :

• Section 3 of the Transfer of Property Acts defines actionable claim

as “ claim to any debt, other than a debt secured by mortgage of

immovable property not in the possession, either actual or

constructive of the claimant, which the civil court recognize as

affording ground for relief, whether such debt or beneficial interest

be existent, accruing, conditional or contingent.”

• Borrowers assign actionable claims to the bank from whom the

loan has been taken. Borrowers normally assign :

• Book debts

• Money due from government or semi government

organizations

• Life insurance policies

Chapter 2 Corporate Banking 33

CHARGE

• First charge :A first charge on the assets secured,

means that on default the bank can seize and sell

the asset.In case of winding up, the bank would

be able to possess the asset and sell it to realize

its dues. Hence a bank must always try to ensure

that it has a first charge on the assets secured.

• Second charge : A second charge on the assets

secured means that the bank is entitled to the

asset only after the claim of the holder of the first

or prior charge.

Chapter 2 Corporate Banking 34

CHARGE

• Pari passu charge :A pari passu charge on the

assets secured means that the claim on the

assets hypothecated are equal.

• Floating charge: In case of a floating charge on

the assets of the company, both present and

future, the bank does not have a specific charge

on any asset but has a claim on all the assets of a

company after the claims of those who have a

priori claim is satisfied.

• A floating charge is inferior to a first, second and

paripassu charge on the specific assets.

Chapter 2 Corporate Banking 35

CHARGE

• Trust receipt : A trust receipt is a document

executed by a customer stating that he holds

the goods “in trust” for the bank for the loan

advanced.

• The customer would agree to keep the goods

separate from his other goods and when ever

they are sold the bank would be paid to

reduce the customer’s indebtedness.

Chapter 2 Corporate Banking 36

CHARGE

• CERTAIN MATTERS SHOULD BE CONSIDERED BY A

BANKER BEFORE ACCEPTANCE OF A SECURITY AS

COLLATERAL FOR AN ADVANCE:

• 1. Ready conversion

• 2. No Encumbrance

• 3. Stable price

• 4. Safety

• 5. Return or yield

• 6. Margin

• 7. Valuation

• 8. Other aspects

Chapter 2 Corporate Banking 37

CHARGE

Next Chapter 3

‘Banking Facilities’ ’

Chapter 2 Corporate Banking 38

Potrebbero piacerti anche

- Mode of Charging of Security:: Pledge, Hypothecation, Mortgage, Lien, Assignment & Set OffDocumento28 pagineMode of Charging of Security:: Pledge, Hypothecation, Mortgage, Lien, Assignment & Set OffDeepak KathiresanNessuna valutazione finora

- BNK602SEM: Legal Aspects of Banking: TOPIC 7: Nature of SecurityDocumento36 pagineBNK602SEM: Legal Aspects of Banking: TOPIC 7: Nature of SecurityaliaNessuna valutazione finora

- SECURITIES Mode of Charging SecuritiesDocumento32 pagineSECURITIES Mode of Charging SecuritiesMohammad Shahnewaz HossainNessuna valutazione finora

- Banking 2nd IntDocumento23 pagineBanking 2nd IntChaitanya MedipallyNessuna valutazione finora

- Recovery in Credit GrantedDocumento21 pagineRecovery in Credit GrantedMaria Ysabella Yee80% (5)

- Payment: Extinguishment of ObligationsDocumento7 paginePayment: Extinguishment of ObligationsHannah Krisha AmoruNessuna valutazione finora

- Lien and MortgageDocumento17 pagineLien and MortgageTharani BalajiNessuna valutazione finora

- Unit - 1Documento5 pagineUnit - 1Sethu RNessuna valutazione finora

- Modes of Charging SecuritiesDocumento11 pagineModes of Charging SecuritiesKopal Agarwal50% (4)

- Types of SecuritiesDocumento8 pagineTypes of SecuritiesA U R U M MDNessuna valutazione finora

- Unit 3 BFSDocumento69 pagineUnit 3 BFSCHANDAN CHANDUNessuna valutazione finora

- Banking Law Assignment - ViswanathanDocumento6 pagineBanking Law Assignment - ViswanathanViswa NathanNessuna valutazione finora

- Modes of Creating ChargeDocumento22 pagineModes of Creating ChargeAdharsh Venkatesan100% (1)

- Banker & Customer RelationshipDocumento15 pagineBanker & Customer RelationshipManju KishoreNessuna valutazione finora

- Relationship Between Banker and CustomerDocumento10 pagineRelationship Between Banker and Customerswagat098Nessuna valutazione finora

- Banking Theory, Law and Practice - CCR8C43Documento68 pagineBanking Theory, Law and Practice - CCR8C43shahid3333Nessuna valutazione finora

- Cat 2Documento7 pagineCat 2Asmitha NNessuna valutazione finora

- Relation of A Debtor and A CreditorDocumento9 pagineRelation of A Debtor and A Creditorrkgupta.comNessuna valutazione finora

- Ibo Chapter 2 FinalDocumento10 pagineIbo Chapter 2 FinalNeejan JackNessuna valutazione finora

- BRO Chapter TwoDocumento13 pagineBRO Chapter TwoRaghavendra JeevaNessuna valutazione finora

- Mode of Creation ChargeDocumento43 pagineMode of Creation ChargeSaurab JainNessuna valutazione finora

- Payyyyyying Banker and Collllllecting Banker by Chu PersonDocumento59 paginePayyyyyying Banker and Collllllecting Banker by Chu PersonSahirAaryaNessuna valutazione finora

- RES 3200 Chapter 2 Real Estate FinancingDocumento12 pagineRES 3200 Chapter 2 Real Estate FinancingbaorunchenNessuna valutazione finora

- Credit Operations and Management (COM)Documento4 pagineCredit Operations and Management (COM)Mamunur RahmanNessuna valutazione finora

- Creditors' Rights and Bankruptcy: W C I ADocumento21 pagineCreditors' Rights and Bankruptcy: W C I AHolli Boyd-White100% (1)

- Banking Theory Law and PracticeDocumento68 pagineBanking Theory Law and PracticeMasud Khan ShakilNessuna valutazione finora

- Contracts II: Pledge AND HypothecationDocumento15 pagineContracts II: Pledge AND HypothecationDipesh SinghalNessuna valutazione finora

- Banking Theory Law and PracticeDocumento68 pagineBanking Theory Law and PracticeHage Matin0% (1)

- PledgeDocumento10 paginePledgeChinmay AcharyaNessuna valutazione finora

- Banking Module 1Documento7 pagineBanking Module 1BINDU N.R.100% (1)

- Bank Customer RelationshipDocumento24 pagineBank Customer RelationshipGemechis BussaNessuna valutazione finora

- Deposit Chapter 1-Deposit & Its Different Kinds #1962 #1963Documento6 pagineDeposit Chapter 1-Deposit & Its Different Kinds #1962 #1963Zyra C.Nessuna valutazione finora

- Right of Lien by BankersDocumento13 pagineRight of Lien by Bankersgeegostral chhabraNessuna valutazione finora

- Module 3 Topic 2 Rights, Duties & Obligations of BankDocumento4 pagineModule 3 Topic 2 Rights, Duties & Obligations of Banksarthak chaturvediNessuna valutazione finora

- Banking LawDocumento11 pagineBanking LawArya ArNessuna valutazione finora

- Banking Law and PracticeDocumento59 pagineBanking Law and PracticeThanga Durai100% (2)

- Cridit Managment: MBA Banking & Finance 3 TermDocumento24 pagineCridit Managment: MBA Banking & Finance 3 Term✬ SHANZA MALIK ✬Nessuna valutazione finora

- Bank GuaranteeDocumento14 pagineBank GuaranteeharshNessuna valutazione finora

- B Lien Banking LawDocumento9 pagineB Lien Banking LawxyzNessuna valutazione finora

- Document (2) 1Documento28 pagineDocument (2) 1Bi bi fathima Bi bi fathimaNessuna valutazione finora

- PPB Module 2Documento18 paginePPB Module 2RAJNessuna valutazione finora

- Credit TransactionsDocumento5 pagineCredit TransactionsKersy Mere FajardoNessuna valutazione finora

- Practice of Banking Lecture Notes 2Documento30 paginePractice of Banking Lecture Notes 2Ganiyu TaslimNessuna valutazione finora

- Banker Customer RelationshipDocumento65 pagineBanker Customer RelationshipNeeta SharmaNessuna valutazione finora

- Commercial Credits & Sale of GoodsDocumento109 pagineCommercial Credits & Sale of GoodsRomsamBla100% (2)

- Contract of BailmentDocumento20 pagineContract of BailmentKomal Shah BukhariNessuna valutazione finora

- Chapter-4 Banker and The CustomerDocumento8 pagineChapter-4 Banker and The CustomerSamuel DebebeNessuna valutazione finora

- Banker-Customer RelationshipDocumento12 pagineBanker-Customer Relationshipnandhana madhuNessuna valutazione finora

- Bank Duties and RightsDocumento6 pagineBank Duties and RightsSthita Prajna Mohanty100% (1)

- Letters of Credit and Trust Receipt LawDocumento9 pagineLetters of Credit and Trust Receipt LawJovi PlatzNessuna valutazione finora

- Banker Customer RelationshipDocumento11 pagineBanker Customer Relationshipbeena antuNessuna valutazione finora

- 2019 Pre Week Lecture in MERCANTILE LAW MJRSI 11 15 19 PDFDocumento29 pagine2019 Pre Week Lecture in MERCANTILE LAW MJRSI 11 15 19 PDFFrankie BacangNessuna valutazione finora

- Various Types of Charges: What Is A Charge & What Is Its PurposeDocumento12 pagineVarious Types of Charges: What Is A Charge & What Is Its PurposevinodkulkarniNessuna valutazione finora

- Banker Customer RelationshipDocumento25 pagineBanker Customer Relationshiprajin_rammstein100% (1)

- AssignmentDocumento7 pagineAssignmentDeepanshu ParasharNessuna valutazione finora

- Different Modes of Charging Securities: HypothecationDocumento4 pagineDifferent Modes of Charging Securities: Hypothecationdinesh khatriNessuna valutazione finora

- Unit III Contract of Pledge and PawnDocumento16 pagineUnit III Contract of Pledge and PawnHemanta PahariNessuna valutazione finora

- How to Avoid Foreclosure in California, 2012 EditionDa EverandHow to Avoid Foreclosure in California, 2012 EditionNessuna valutazione finora

- CVJ 74805454 20230507121209Documento2 pagineCVJ 74805454 20230507121209Muhammad shazibNessuna valutazione finora

- Trade Based Money Laundering, Compliance and Related Risks: Mr. Salim ThobaniDocumento2 pagineTrade Based Money Laundering, Compliance and Related Risks: Mr. Salim ThobaniMuhammad shazibNessuna valutazione finora

- Terms and ConditionsDocumento16 pagineTerms and ConditionsMuhammad shazibNessuna valutazione finora

- Sme Financing and Npls in Pakistan: Nature and Characteristics ofDocumento48 pagineSme Financing and Npls in Pakistan: Nature and Characteristics ofMuhammad shazibNessuna valutazione finora

- 4-Vocabulaire Base ADocumento3 pagine4-Vocabulaire Base AMuhammad shazibNessuna valutazione finora

- Article For Words FormationsDocumento80 pagineArticle For Words FormationsMuhammad shazibNessuna valutazione finora

- District Council Multan: Bidding DocumentsDocumento92 pagineDistrict Council Multan: Bidding DocumentsMuhammad shazibNessuna valutazione finora

- 182 205 PDFDocumento24 pagine182 205 PDFMuhammad shazibNessuna valutazione finora

- IBP Book - LendingDocumento29 pagineIBP Book - LendingMuhammad shazibNessuna valutazione finora

- SWIFT Standards 2019 Annual MaintenanceDocumento49 pagineSWIFT Standards 2019 Annual MaintenanceFerjani RiahiNessuna valutazione finora

- Invoice - Packing List SATIDocumento3 pagineInvoice - Packing List SATIgunjan88Nessuna valutazione finora

- Legitimity of Origin of Funds CitigroupDocumento4 pagineLegitimity of Origin of Funds CitigroupNicolae DiaconuNessuna valutazione finora

- 8 - Interests CommissionsDocumento46 pagine8 - Interests Commissionsapi-267023512Nessuna valutazione finora

- Bank of Baroda NEFT RTGS FormDocumento393 pagineBank of Baroda NEFT RTGS FormAman GoyalNessuna valutazione finora

- Chapter 3Documento2 pagineChapter 3Prakash SinghNessuna valutazione finora

- Don't ForgetDocumento2 pagineDon't Forgetcathy mcdanelNessuna valutazione finora

- Si 1Documento17 pagineSi 1surjeshnewNessuna valutazione finora

- Bank Guarantee Format Icc 458Documento3 pagineBank Guarantee Format Icc 458Priors Mortgages & Finance LtdNessuna valutazione finora

- Account Closure Form: Customer DetailsDocumento3 pagineAccount Closure Form: Customer DetailsAyan AcharyaNessuna valutazione finora

- USD TO INR FORECAST 2020, 2021, 2022, 2023, 2024 - Long ForecastDocumento7 pagineUSD TO INR FORECAST 2020, 2021, 2022, 2023, 2024 - Long ForecastShanMugamNessuna valutazione finora

- Deutsche BankDocumento3 pagineDeutsche BankRi BudhraniNessuna valutazione finora

- Format of The Case DigestDocumento11 pagineFormat of The Case DigestkuheDSNessuna valutazione finora

- Engineering Economy: Chapter 3: The Time Value of MoneyDocumento32 pagineEngineering Economy: Chapter 3: The Time Value of MoneyAhmad Medlej100% (1)

- Pprinciples of Macroeconomics - Assignment 1Documento7 paginePprinciples of Macroeconomics - Assignment 1rjrNessuna valutazione finora

- E00B0 Credit Risk Management - Axis BankDocumento55 pagineE00B0 Credit Risk Management - Axis BankwebstdsnrNessuna valutazione finora

- ResearchPaperonE BankingDocumento23 pagineResearchPaperonE BankingMaitry shethNessuna valutazione finora

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocumento15 pagineThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureASHISH PANDEYNessuna valutazione finora

- Loan Agreement - With Promissory NoteDocumento3 pagineLoan Agreement - With Promissory NoteMarvin Rhick Bulan100% (2)

- GM - 5.950% Senior Notes Due 2049 ProspectusDocumento4 pagineGM - 5.950% Senior Notes Due 2049 ProspectusjamesNessuna valutazione finora

- Tri Merge Credit Report SampleDocumento9 pagineTri Merge Credit Report SampleHimani SachdevNessuna valutazione finora

- 04-02-12 OUR Style Money Order For WebDocumento1 pagina04-02-12 OUR Style Money Order For WebSaleem Alhakim84% (19)

- Global Regulations of DaDocumento129 pagineGlobal Regulations of Daknop13Nessuna valutazione finora

- Bank Loans and OverdraftsDocumento11 pagineBank Loans and OverdraftsAsif AbdullaNessuna valutazione finora

- IDFCFIRSTBankstatement 10111794196Documento10 pagineIDFCFIRSTBankstatement 10111794196dabu choudharyNessuna valutazione finora

- What Is FirstcryDocumento11 pagineWhat Is Firstcryyogeshdhuri22Nessuna valutazione finora

- Estmt - 2022 08 29Documento8 pagineEstmt - 2022 08 29Carla Bermudez RamirezNessuna valutazione finora

- Betting On The Blind Side - Vanity FairDocumento3 pagineBetting On The Blind Side - Vanity FairSww WisdomNessuna valutazione finora

- Lab BillDocumento2 pagineLab Billg raghavNessuna valutazione finora

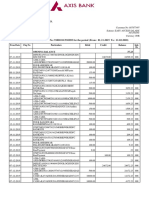

- Statement of Axis Account No:918010113912893 For The Period (From: 01-11-2019 To: 11-02-2020)Documento4 pagineStatement of Axis Account No:918010113912893 For The Period (From: 01-11-2019 To: 11-02-2020)Avinash DondapatyNessuna valutazione finora