Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Partnership Q3

Caricato da

Lorraine Mae Robrido0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

77 visualizzazioni2 paginegfguy

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentogfguy

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

77 visualizzazioni2 paginePartnership Q3

Caricato da

Lorraine Mae Robridogfguy

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

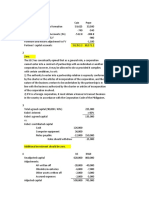

Partnership Formation – Q3 d.

Accrued expenses of P2,000 and P5,000 in US’ and

IRAN’s books are to be recognized.

1) On March 1, 2020, Cain and Pepe decides to combine their e. Goodwill is to be recognized to equalize their capital

businesses and form a partnership. Statement of financial accounts after the above adjustments.

position on March 1, before adjustments, showed the following: How much is the amount of goodwill to be recognized?

Cain Pepe

Cash 9,000 3,750 5) On March 1, 2020, Bush and Fire decides to combine their

Accounts receivable 18,500 13,500 business to form a partnership. Statement of financial position

Inventories 30,000 19,500 on March 1 before the formation, showed the following:

Furniture and fixtures 30,000 9,000 Bush Fire

(net) Cash 9,000 3,750

Office equipment (net) 11,500 2,750 Accounts receivable 18,500 13,500

Prepaid expenses 6,375 3,000 Inventories 30,000 19,500

Total 105,375 51,500 Furniture and fixtures 30,000 9,000

Accounts payable 45,750 18,000 (net)

Capital 59,625 33,500 Office equipment (net) 11,500 2,750

Total 105,375 51,500 Prepaid expenses 6,375 3,000

They agreed to provide 3% for doubtful accounts after writing Total 105,375 51,500

off 4% of their respective accounts receivables, and also agree Accounts payable 45,750 18,000

that Pepe’s furniture and fixture, whose fair value at the date of Capital 59,625 33,500

partnership formation is P7,000, are underdepreciated by Total 105,375 51,500

P900. If each partner’s share in equity is to be equal to the net They agreed to the following adjustments before the formation:

assets invested, what are the capital accounts of Cain and a. Provide 2% allowance for doubtful accounts.

Pepe, respectively? b. Bush’s furniture should be valued at P31,000, while Fire’s

office equipment is underdepreciated by P250.

2) On July 1, 2020, JB Company and BJ Corporation decided c. Rent expense incurred previously by Bush was not yet

to form a partnership, agreeing to share profits and losses in recorded amounting to P1,000, while salary expense

the ratio of 4:6, respectively. JB plans to contribute a parcel of incurred by Fire was not also recorded amounting to

land that cost him P25,000. BJ, on his part, will contribute P800.

P50,000 cash. The land was sold for P50,000 on July 1, 2020 d. The fair value of inventories amounted to P29,500 for Fire

four hours after JB decided to enter into a partnership with BJ. and P21,000 for Bush.

How much should be recorded in JB partner’s capital account? What is the net (debit) credit adjustment to each partner’s

capital account?

3) Kobe and Bryant have just formed a partnership. Kobe

contributed cash of P126,000 and computer equipment that Questions 6 and 7 are based on the following information:

cost P54,000. The computer had been used in his sole On June 1, 2019, Honda and Yamaha formed a partnership.

proprietorship and had been depreciated to P24,000. The fair Honda is to invest assets at fair value which are yet to be

value of the equipment is P36,000. Kobe also contributed a agreed upon. He is to transfer his liabilities and is to contribute

note payable of P12,000 to be assumed by the partnership. sufficient cash to bring his total capital to P210,000 which is

Kobe is to have 60% interest in the partnership. Bryant 70% of the total capital of the partnership. Details regarding

contributed only P90,000 cash. How much should Kobe’s the book values of Honda’s business assets and liabilities and

additional investment be to bring their initial capital balances their corresponding valuations are:

according to their agreement? Book Fair Agreed

values values valuation

4) On September 1, 2019, the business assets and liabilities of s

US and IRAN were as follows: Accounts receivable 58,000 59,000 60,000

US IRAN Allowance for doubtful 7,000 6,000 5,000

Cash 28,000 62,000 accounts

Accounts receivable 200,000 600,000 Merchandise inventory 98,400 110,000 107,000

Inventories 120,000 200,000 Store equipment 32,500 31,700 32,000

Land 600,000 AD – Store equipment 19,000 21,100 19,300

Building 500,000 Office equipment 27,000 29,000 27,000

Furniture and 50,000 35,000 AD – Office equipment 14,200 8,600 8,600

fixtures Accounts payable 56,000 56,000 56,000

Other assets 2,000 3,000 Yamaha agrees to invest cash of P69,000 and merchandise

Accounts payable 180,000 250,000 valued at current market price.

Notes payable 200,000 350,000 6) How much cash is to be invested by Honda?

US and IRAN agreed to form a partnership contributing their 7) What is the value of the merchandise to be invested by

respective assets and liabilities subject to the following Yamaha?

agreements:

a. Accounts receivable of P20,000 in US’ books and P40,000 8) Bri and Ara are beauty queens. They decided to form a

in IRAN’s books are uncollectible. partnership business of selling their own brand of beauty

b. Inventories of P6,000 and P7,000 are obsolete in US’ and products and named it “BRIARA” Cosmetics. Bri is to

IRAN’s respective books. contribute cash of P500,000 and her laptop computer originally

c. Other assets of P2,000 and P3,000 in US’ and IRAN’s costing P100,000 but has a second hand value of P75,000.

respective books are to be written off. Ara, whose family is selling computers, is to contribute cash of

P250,000 and a brand new computer plus printer with regular

price at P160,000 but which cost their family’s computer

dealership, P140,000. What are the capital balances of each

partner at partnership formation?

-JMR

Potrebbero piacerti anche

- Summer 2020 Exercise9bDocumento3 pagineSummer 2020 Exercise9bMiko ArniñoNessuna valutazione finora

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionDa EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNessuna valutazione finora

- 2021 Act130 Prelim ExaminationDocumento13 pagine2021 Act130 Prelim ExaminationMica R.Nessuna valutazione finora

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeDa EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNessuna valutazione finora

- Partnership Formation: AssignmentDocumento6 paginePartnership Formation: AssignmentLee SuarezNessuna valutazione finora

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineDa EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNessuna valutazione finora

- Partnership Formation Activity 1 January 28 2023Documento12 paginePartnership Formation Activity 1 January 28 2023Jerlyn SaynoNessuna valutazione finora

- Activity Partnership Formation and OperationDocumento8 pagineActivity Partnership Formation and OperationSharon AnchetaNessuna valutazione finora

- Acco 30103 Partnership Formation and Operations 04-2022Documento3 pagineAcco 30103 Partnership Formation and Operations 04-2022Zyrille Corrine GironNessuna valutazione finora

- Activity 1 PartnershipDocumento4 pagineActivity 1 PartnershipJanet AnotdeNessuna valutazione finora

- Afar - Partnership Formation - BagayaoDocumento2 pagineAfar - Partnership Formation - BagayaoRejay VillamorNessuna valutazione finora

- Partneship Handout Without Answer KeyDocumento10 paginePartneship Handout Without Answer KeyAirah Manalastas0% (1)

- Partnership Formation, Operation, Dissolution, and Liquidation by Lump Sum OnlyDocumento11 paginePartnership Formation, Operation, Dissolution, and Liquidation by Lump Sum OnlyJoyce Ann Cortez100% (2)

- Accounting QuizDocumento5 pagineAccounting QuizLloyd Lameon0% (1)

- Midterm Exam Accntg For Special TransactionsDocumento8 pagineMidterm Exam Accntg For Special TransactionsJustine FloresNessuna valutazione finora

- Practical Accounting 2: Angelito R. Punzalan, CPA, MBADocumento33 paginePractical Accounting 2: Angelito R. Punzalan, CPA, MBADaniella Mae Elip100% (1)

- QuizDocumento5 pagineQuizmiss independent100% (1)

- Activity 2 FormationDocumento4 pagineActivity 2 FormationCris TineNessuna valutazione finora

- AFAR - PartnershipDocumento19 pagineAFAR - PartnershipAlisonNessuna valutazione finora

- AdVacc Q1Documento5 pagineAdVacc Q1Red Yu100% (1)

- Partnership THEORIES AND PROBLEMSDocumento5 paginePartnership THEORIES AND PROBLEMSMa Teresa B. CerezoNessuna valutazione finora

- Midterm Exam Accntg For Special TransactionsDocumento8 pagineMidterm Exam Accntg For Special TransactionsJustine Flores100% (1)

- Reviewer Partnership Formation 1Documento6 pagineReviewer Partnership Formation 1Joshua SolayaoNessuna valutazione finora

- St. Scholasticas College: Leon Guinto, ManilaDocumento13 pagineSt. Scholasticas College: Leon Guinto, Manilamaria evangelistaNessuna valutazione finora

- Chapter 1 - Partnership Formation Partnerhsip Formation - Individual vs. IndividualDocumento3 pagineChapter 1 - Partnership Formation Partnerhsip Formation - Individual vs. IndividualCamille Stephan BenigaNessuna valutazione finora

- Set A - Prelim Exam in COGM6Documento5 pagineSet A - Prelim Exam in COGM6kaii 1234Nessuna valutazione finora

- Partnership Formation 001Documento20 paginePartnership Formation 001Ma Teresa B. Cerezo50% (2)

- PARTNERSHIPDocumento153 paginePARTNERSHIPJoen SinamagNessuna valutazione finora

- Basic Concepts of PartnershipDocumento5 pagineBasic Concepts of PartnershipKyla DizonNessuna valutazione finora

- Partnership FormationDocumento5 paginePartnership FormationMary Elisha PinedaNessuna valutazione finora

- Pamantasan NG CabuyaoDocumento2 paginePamantasan NG CabuyaoHhhhhNessuna valutazione finora

- AFAR-01 (Partnership Formation & Operation)Documento6 pagineAFAR-01 (Partnership Formation & Operation)Jezzie Santos100% (1)

- Bsa Partnership Multiple Choice QuestionsDocumento42 pagineBsa Partnership Multiple Choice QuestionsKath CamacamNessuna valutazione finora

- Fair Value of The Property: Partner's Drawing, DebitDocumento12 pagineFair Value of The Property: Partner's Drawing, DebitAera GarcesNessuna valutazione finora

- Quizzer WK 1 - 1A FORMATIONDocumento5 pagineQuizzer WK 1 - 1A FORMATIONRonalyn BayucanNessuna valutazione finora

- Accounting For Partnership FARDocumento31 pagineAccounting For Partnership FARlousevero10Nessuna valutazione finora

- Farparcor 2 Chapter 1 Exercises Problem AnswersDocumento10 pagineFarparcor 2 Chapter 1 Exercises Problem AnswersWillnie Shane LabaroNessuna valutazione finora

- Afar I. Partnership FormationDocumento4 pagineAfar I. Partnership FormationIrish SantiagoNessuna valutazione finora

- AFAR Finals With SolutionsDocumento16 pagineAFAR Finals With SolutionsJr TanNessuna valutazione finora

- Integrated Accounting Review - AFAR T1, AY 2023-2024Documento40 pagineIntegrated Accounting Review - AFAR T1, AY 2023-2024Conteza EliasNessuna valutazione finora

- Reviewer For Accounting StudentsDocumento12 pagineReviewer For Accounting StudentsAaliyah ManuelNessuna valutazione finora

- Advanced Financial Accounting and Reporting: G.P. CostaDocumento27 pagineAdvanced Financial Accounting and Reporting: G.P. CostaryanNessuna valutazione finora

- ACCTSPTRANS All About PartnershipDocumento7 pagineACCTSPTRANS All About PartnershipShailene David0% (1)

- Partnership Formation AssignmentDocumento3 paginePartnership Formation AssignmentAHMUDINNHOR DUMASILNessuna valutazione finora

- Act. Partnership AccountDocumento10 pagineAct. Partnership AccountPaupau100% (1)

- ACC 110 - CFE - 21 22 With ANSWERSDocumento25 pagineACC 110 - CFE - 21 22 With ANSWERSGiner Mabale Steven100% (2)

- Acctng 304Documento3 pagineAcctng 304Lloyd Lameon0% (1)

- ProblemsDocumento12 pagineProblemsJoy MarieNessuna valutazione finora

- 1 Partnership FormationDocumento7 pagine1 Partnership FormationJ MahinayNessuna valutazione finora

- Accounting+for+Business+Combination+HO+No 1Documento7 pagineAccounting+for+Business+Combination+HO+No 1secretary.feujpia2324Nessuna valutazione finora

- Partnership FormationDocumento13 paginePartnership FormationGround ZeroNessuna valutazione finora

- Problems Lecture - Partnership FormationDocumento4 pagineProblems Lecture - Partnership FormationNiccoRobDeCastroNessuna valutazione finora

- PARTNERSHIPDocumento46 paginePARTNERSHIPPrincess Diane Vicente0% (1)

- GshshshsDocumento7 pagineGshshshsMax Dela TorreNessuna valutazione finora

- Partnership Formation ProblemsDocumento3 paginePartnership Formation Problemsai kawaiiNessuna valutazione finora

- ACCO 101 Partnership Formation For Practice SolvingDocumento2 pagineACCO 101 Partnership Formation For Practice SolvingFionna Rei DeGaliciaNessuna valutazione finora

- Comprehensive Review QuestionsDocumento5 pagineComprehensive Review QuestionsJane Ruby JennieferNessuna valutazione finora

- Reviewer From Prelim To FinalsDocumento324 pagineReviewer From Prelim To FinalsRina Mae Sismar Lawi-an100% (1)

- Partnership FormationDocumento51 paginePartnership FormationGarp BarrocaNessuna valutazione finora

- Orca Share Media1583315619577Documento13 pagineOrca Share Media1583315619577Sebastian Vincent Pulga PedrosaNessuna valutazione finora

- Robrido, Lorraine Mae DiongzonDocumento2 pagineRobrido, Lorraine Mae DiongzonLorraine Mae RobridoNessuna valutazione finora

- Partnership Q6 SolutionDocumento4 paginePartnership Q6 SolutionLorraine Mae RobridoNessuna valutazione finora

- Partnership Q4Documento2 paginePartnership Q4Lorraine Mae Robrido100% (1)

- Partnership Q5Documento2 paginePartnership Q5Lorraine Mae RobridoNessuna valutazione finora

- Partnership Q6 SolutionDocumento4 paginePartnership Q6 SolutionLorraine Mae RobridoNessuna valutazione finora

- Partnership Q3 SolutionDocumento2 paginePartnership Q3 SolutionLorraine Mae RobridoNessuna valutazione finora

- Lecture - Law 21 - 04 - Nature and Effect of ObligationsDocumento123 pagineLecture - Law 21 - 04 - Nature and Effect of ObligationsLorraine Mae RobridoNessuna valutazione finora

- Partnership Q1 SolutionDocumento3 paginePartnership Q1 SolutionLorraine Mae RobridoNessuna valutazione finora

- Exercises and Quiz On InvestmentsDocumento13 pagineExercises and Quiz On InvestmentsPrince PierreNessuna valutazione finora

- Cash 2018 1 Q PDFDocumento4 pagineCash 2018 1 Q PDFLorraine Mae RobridoNessuna valutazione finora

- Partnership Q1Documento3 paginePartnership Q1Lorraine Mae RobridoNessuna valutazione finora

- CONFRASDocumento68 pagineCONFRASLorraine Mae RobridoNessuna valutazione finora

- Chap 7 Student Lecture NotesDocumento16 pagineChap 7 Student Lecture NotesLorraine Mae RobridoNessuna valutazione finora

- AR Practice Problems Solution PDFDocumento7 pagineAR Practice Problems Solution PDFLorraine Mae RobridoNessuna valutazione finora

- EDP101 EntrepreneurshipDocumento6 pagineEDP101 EntrepreneurshipLobzang DorjiNessuna valutazione finora

- Session 13 - NPDIDocumento8 pagineSession 13 - NPDIPRALHAD DASNessuna valutazione finora

- 1668685479145-Tender No 005 Supply of SmatrphonesDocumento31 pagine1668685479145-Tender No 005 Supply of SmatrphonesGeorge MbuthiaNessuna valutazione finora

- BoardSource 12 Principles of Governance PDFDocumento2 pagineBoardSource 12 Principles of Governance PDFKomathi Mathi100% (1)

- Student Fees Guide Book Final Year 2022Documento98 pagineStudent Fees Guide Book Final Year 2022lindokuhlemashaba877Nessuna valutazione finora

- (See Rule 16CC and 17B) : 1. Substituted by The Income-Tax Amendment (3rd Amendment) Rules, 2023, W.E.FDocumento18 pagine(See Rule 16CC and 17B) : 1. Substituted by The Income-Tax Amendment (3rd Amendment) Rules, 2023, W.E.FRaghav TibdewalNessuna valutazione finora

- Applications of Business AnalyticsDocumento10 pagineApplications of Business AnalyticsMansha YadavNessuna valutazione finora

- Annual Report of Gulf Oil Private Limited.Documento152 pagineAnnual Report of Gulf Oil Private Limited.Arun100% (1)

- CHAPTER 1 - LatestDocumento93 pagineCHAPTER 1 - LatestMOHAMAD ZAIM BIN IBRAHIM MoeNessuna valutazione finora

- Bus Com Acq Date IllustrationDocumento1 paginaBus Com Acq Date IllustrationJhona May Golilao QuiamcoNessuna valutazione finora

- Tax467, Tax 267 Practice QuestionsDocumento4 pagineTax467, Tax 267 Practice QuestionsRISNATUL UZMA HELMI RIZALNessuna valutazione finora

- Summary Chapter 10 "Managing Digital Business Transformation and Growth Hacking"Documento2 pagineSummary Chapter 10 "Managing Digital Business Transformation and Growth Hacking"Aziz Putra AkbarNessuna valutazione finora

- Kingston Water Department Capital PlanDocumento11 pagineKingston Water Department Capital PlanDaily FreemanNessuna valutazione finora

- Manajemen Sarana Dan Prasarana Pendidikan Di Sma Institut Indonesia SemarangDocumento24 pagineManajemen Sarana Dan Prasarana Pendidikan Di Sma Institut Indonesia SemarangsakdeNessuna valutazione finora

- Strategic MarketingDocumento84 pagineStrategic MarketingKameshNessuna valutazione finora

- List of Government AgenciesDocumento55 pagineList of Government AgenciesOzilac JhsNessuna valutazione finora

- Assignment Group AfmDocumento10 pagineAssignment Group Afmamirul aizzatNessuna valutazione finora

- Balaji ResumeDocumento3 pagineBalaji ResumeNaveen KumarNessuna valutazione finora

- Chapter 2 LFADocumento34 pagineChapter 2 LFAmisganuabebeNessuna valutazione finora

- Mock Test Papers: Paper 7 - SMDocumento7 pagineMock Test Papers: Paper 7 - SMParasNessuna valutazione finora

- Beyond VaR OfficialDocumento76 pagineBeyond VaR OfficialmaleckicoaNessuna valutazione finora

- GuessDocumento20 pagineGuessRohit SainiNessuna valutazione finora

- Dudhsagar Dairy Mehsana District Co-Operative Milk Producers' Union LTDDocumento10 pagineDudhsagar Dairy Mehsana District Co-Operative Milk Producers' Union LTDHarsh gamingNessuna valutazione finora

- Yashna Bawa ResumeDocumento1 paginaYashna Bawa ResumeNitinNessuna valutazione finora

- KWL HomeworkDocumento2 pagineKWL HomeworkPatricia SantosNessuna valutazione finora

- 高顿财经ACCA acca.gaodun.cn: Advanced Performance ManagementDocumento13 pagine高顿财经ACCA acca.gaodun.cn: Advanced Performance ManagementIskandar BudionoNessuna valutazione finora

- Sick Leave Form For Rafiullah PDFDocumento1 paginaSick Leave Form For Rafiullah PDFRafiullahNessuna valutazione finora

- Secretos Indicador TDI MMMDocumento22 pagineSecretos Indicador TDI MMMLuiz Vinhas100% (2)

- Introduction To Hospitality 6th Edition Walker Test BankDocumento6 pagineIntroduction To Hospitality 6th Edition Walker Test Bankcherylsmithckgfqpoiyt100% (18)

- 16Documento1 pagina16Babu babuNessuna valutazione finora