Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Dissolution - Purchase of Interest PDF

Caricato da

Nicole Galvez0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

26 visualizzazioni2 pagineTitolo originale

Dissolution - Purchase of Interest.pdf

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

26 visualizzazioni2 pagineDissolution - Purchase of Interest PDF

Caricato da

Nicole GalvezCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

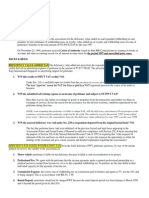

DISSOLUTION - PURCHASE OF INTEREST

Dissolution – A change in partnership structure; effect is as if a new partnership is being established

FIVE CASES TO BE DISCUSSED:

1. The new partner purchases some of the capital of the old partners (interest)

2. New partner invests assets to the partnership

3. Retirement of a partner

4. Partner dies – settlement through estate

5. Incorporation of a partnership

ACCOUNTING PROCEDURES BEFORE DISSOLUTION

1.) Revalue assets

2.) Distribute profits (from last SFP to dissolution date)

3.) Close drawing accounts

ENTRIES TO UPDATE PARTNERS’ EQUITY

1.) Adjusting the asset value and charging the increase or decrease to the capital accounts

2.) Distribution of profit – close income summary balance and credit to partner drawing accounts

3.) Closing the drawing accounts to the capital accounts

CASE 1. Purchase of Interest. Dito, bibilhin lang nung bagong partner yung capital ng isang existing

partner. PERSONAL ang transaction, hindi tayo magdedebit ng cash kasi ang magbubulsa nung cash

ay yung kung sino ang nagbebenta ng capital nya.

CASE 1A. Amount Paid = Capital or Interest Purchased. Kapag ganito, wala naman masyadong

problema kasi equal naman pala. So wala kailangan irevalue. In short, babawasan mo ang capital nung

partner na nagbebenta with the amount paid and dadagdagan (icecredit) mo naman ang capital ni

bagong partner with the same amount.

CASE 1B. Amount Paid > Capital or Interest Purchased, no asset reval. Dito, mas mataas ang binayad

ni ateng new partner compared sa binibili nya. Pwedeng maraming factor. Sikat si new partner,

magaling sumayaw, ewan haha basta kapag ganito, same entry pa rin naman with Case 1A. Tandaan

nyo na personal transaction yung purchase, lipatan lang din ng capital ang magaganap. Yung excess,

ibubulsa na din ni ateng new partner. Wala yung effect sa partnership assets.

CASE 1C. Assets need revaluation. Ito na yung madugo, pero di na kayo bago dito. May example na

rin naman sa libro. Minsan, si bagong partner, mas mataas ang ibabayad compared sa actual amount

ng capital na pinupurchase kasi yun pala, sa partnership books, hindi pala updated yung capital ni old

partner. Kaya pala babayad ng mas mataas kasi tumaas din yung value ng assets nila. Tandaan na lang

ang mga formula, in addition sa formula na nasa libro nyo na.

Total Revised Partners’ Equity = Amount paid / New partner’s P/L ratio

How to determine new partner’s P/L ratio?

New partner’s P/L Ratio = Old partner’s P/L ratio (seller’s orig ratio) * % being purchased by new

partner

Lucas’s P/L ratio = Sarah’s P/L Ratio * % being purchased by Lucas

Lucas’s P/L ratio = 2/5 * ½ (half)

Luca’s P/L ratio = 1/5 or 20%

Total Revised Partners’ Equity = Amount paid / New partner’s P/L ratio

Total Revised Partners’ Equity = 15,000/20%

Total Revised Partners’ Equity = 75,000

Revaluation amount = Revised Partners’ Equity – Original Partners’ Equity

Revaluation amount = 75,000 – (30,000 + 20,000)

Revaluation amount = 25,000

Partner’s share in revaluation = revaluation amount * P/L ratio

Partner’s revised equity, individual = Original capital + Partner’s share in revaluation

(If revaluation LOSS, deduct instead of adding)

Entries

1.) Revaluation of the asset involved – charge to old partners’ capital

2.) Transfer of capital, using the ACTUAL AMOUNT PAID (not the original capital share).

Again, partnership assets are not affected by the sale itself.

Revised Profit and Loss Ratio – if these is no P/L agreement, distribution after dissolution is based on

original capital ratios.

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Memo of UnderstandingDocumento4 pagineMemo of UnderstandingRaheem Drayton100% (1)

- Negotiable Instruments Law EssentialsDocumento13 pagineNegotiable Instruments Law EssentialsSitti Sarah SaripNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Bir Form 2307Documento2 pagineBir Form 2307Dave Pagara100% (4)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Financial Management and Financial ObjectivesDocumento78 pagineFinancial Management and Financial Objectivesnico_777Nessuna valutazione finora

- 3 Step Land Development Process Flow ChartDocumento1 pagina3 Step Land Development Process Flow ChartWahid Rahman Rahmani67% (3)

- Bond-CDS Basis Trading HandbookDocumento92 pagineBond-CDS Basis Trading HandbookFutrbllnr75% (4)

- DrVijayMalik Company Analyses Vol 1Documento231 pagineDrVijayMalik Company Analyses Vol 1dhavalNessuna valutazione finora

- Chart of Entity ComparisonDocumento4 pagineChart of Entity ComparisonDee BeldNessuna valutazione finora

- Articlesofincorporation PDFDocumento13 pagineArticlesofincorporation PDFJowi SuNessuna valutazione finora

- IRR of AMLADocumento86 pagineIRR of AMLAMaeNessuna valutazione finora

- PCI Leasing and Finance Vs Giraffe-X Creative ImagingDocumento4 paginePCI Leasing and Finance Vs Giraffe-X Creative ImagingBernadetteGalera100% (1)

- Capital Market: Unit II: PrimaryDocumento55 pagineCapital Market: Unit II: PrimaryROHIT CHHUGANI 1823160Nessuna valutazione finora

- Sony v. CIRDocumento2 pagineSony v. CIRMaya Julieta Catacutan-EstabilloNessuna valutazione finora

- CRG - ManualDocumento24 pagineCRG - ManualshapnokoliNessuna valutazione finora

- Financial Services Competency ModelDocumento10 pagineFinancial Services Competency ModelDon CamNessuna valutazione finora

- PHD Thesis On Investment BankingDocumento4 paginePHD Thesis On Investment BankingSara Alvarez100% (2)

- 53066331Documento132 pagine53066331Michael Robert HusseyNessuna valutazione finora

- January 13, 2021 Philippine Stock ExchangeDocumento5 pagineJanuary 13, 2021 Philippine Stock Exchangekjcnawkcna calkjwncaNessuna valutazione finora

- Technopreneurship WK13Documento96 pagineTechnopreneurship WK13Juvill VillaroyaNessuna valutazione finora

- Chapter 12-Eneman20Documento3 pagineChapter 12-Eneman20Reynald John PastranaNessuna valutazione finora

- PION Cautionary StatementDocumento1 paginaPION Cautionary StatementBusiness Daily ZimbabweNessuna valutazione finora

- Chapter 22Documento6 pagineChapter 22JOANNE PEÑARANDANessuna valutazione finora

- Working Capital MGTDocumento14 pagineWorking Capital MGTrupaliNessuna valutazione finora

- إمكانية تطبيق نماذج القيمة العادلة في قياس القيمة الحقيقية للأسهم العادية 2016Documento24 pagineإمكانية تطبيق نماذج القيمة العادلة في قياس القيمة الحقيقية للأسهم العادية 2016Ro'ya Abd ElhafezNessuna valutazione finora

- Ifrs Edition: Preview ofDocumento33 pagineIfrs Edition: Preview ofwtfNessuna valutazione finora

- Sula Vineyards Limited RHPDocumento483 pagineSula Vineyards Limited RHPRahul MehtaNessuna valutazione finora

- CH 11 PDFDocumento33 pagineCH 11 PDFRizal SyaifuddinNessuna valutazione finora

- Lecture Notes Stochastic CalculusDocumento365 pagineLecture Notes Stochastic Calculusdaselknam100% (2)

- HCAD Property Correction FormDocumento1 paginaHCAD Property Correction FormO'Connor AssociateNessuna valutazione finora