Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Balance Sheet of State Bank of India

Caricato da

Husen AliTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Balance Sheet of State Bank of India

Caricato da

Husen AliCopyright:

Formati disponibili

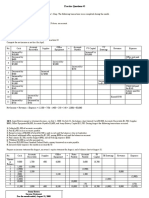

Balance sheet of state bank of India

Amt in Rs.(Cr)

Equities and

March-18 March-17

capital

Equities share 892.46 797.35

capital

Total Share

892.46 797.35

Capital

Revaluation

24,847.99 31,585.65

Reserve

Reserves and

1,93,388.12 1,55,903.06

Surplus

Total Reserves

2,18,236.10 1,87,488.71

and Surplus

Total Share

2,19,128.56 1,88,286.06

Holders Funds

Deposits 27,06,343.29 20,44,751.39

Borrowings 3,62,142.07 3,17,693.66

Other

Liabilities and 1,67,138.08 1,55,235.19

Provisions

Total Capital

34,54,752.00 27,05,966.30

and Liabilities

ASSETS

Cash and

Balances with

1,50,397.18 1,27,997.62

Reserve Bank

of India

Balances with

Banks Money

41,501.46 43,974.03

at Call and

Short Notice

Investments 10,60,986.72 7,65,989.63

Advances 19,34,880.19 15,71,078.38

Fixed Assets 39,992.25 42,918.92

Other Assets 2,26,994.20 1,54,007.72

Total Assets 34,54,752.00 27,05,966.30

Analysis of state bank of India (SBI):

❖ In financial year 2017-18 company share capital was 797Cr and 892 Cr where it

shows that Company share capital has increased by almost 95 Cr in 2018.

❖ Talking about the reserve and surplus, in financial year 2017-2018 the total reserve

and surplus was 155903 Cr and 193388 Cr which clearly depict that bank is having

sufficient fund which can be utilize in case of any shortage or illiquidation.

❖ In financial year 2017-2018 the total borrowing was almost 317693 Cr and 362142 Cr

which indicate that bank has taken almost 44449 Cr more as compare to 2017 and

somehow its not good for bank, because it a kind of debt which bank has to pay it

back to lender.

❖ Talking about the liabilities of the bank, it has taken around 2705966 Cr in 2017 and

3454752Cr in 2018 where it reflects bank is some how in bad situation as compare to

financial 2017 and its not good for any company nor any bank .

❖ In asset side ,Bank has invested almost Rs.765989 Cr in 2017 and 1060986 Cr in 2018

which indicates there is slight difference of 294997 Cr which shows that bank has

started focusing on investing some other sector which is good for bank because by

investing into other sector it can be able generate more income which would be external

sources for them.

❖ Talking about the total asset it has slightly changes from 2705966 Cr to 3454752 Cr in

financial year 2017-2018 which indicates that bank is having that much of asset which

he can be used in case of any future uncertainty or any losses.

❖ In nutshell, somehow bank was trying to manage their situation by investing more in

various sectors which would be better for them for future perspective, along with them

it got shortage or we can say that took a loan more in 2018 as compare to 2017 to

maintain the balance of bank. As we have seen that there are many banks who have

given the money to the needy people and they would not have able recover it, by

performing such activities they would have suffered huge loss at end got shut down due

to shortage of reserve and surplus. In the same scenario SBI is performing it well to

maintain the situation by maintaining the reserve and surplus which would help in

future uncertainty.

Potrebbero piacerti anche

- Regional Rural Banks of India: Evolution, Performance and ManagementDa EverandRegional Rural Banks of India: Evolution, Performance and ManagementNessuna valutazione finora

- Capital Budgeting or Capital ExpenditureDocumento18 pagineCapital Budgeting or Capital ExpenditurePooja VaidyaNessuna valutazione finora

- Customer Satisfaction at The Jalgaon People'S Co-Op BANK LTD., JalgaonDocumento10 pagineCustomer Satisfaction at The Jalgaon People'S Co-Op BANK LTD., JalgaonwanipareshdNessuna valutazione finora

- Financial Performence of KesoramDocumento97 pagineFinancial Performence of KesoramBasinepalli Sathish ReddyNessuna valutazione finora

- Bhagat Co BankDocumento57 pagineBhagat Co BankSyaape100% (1)

- Manappuram Finance: Positive All-Round Results Should Set The ToneDocumento8 pagineManappuram Finance: Positive All-Round Results Should Set The Tonevikasaggarwal01Nessuna valutazione finora

- Bank of Maharashtra PDFDocumento76 pagineBank of Maharashtra PDFPRATIK BhosaleNessuna valutazione finora

- Comparative Financial Analysis of Three Banks of India PDFDocumento86 pagineComparative Financial Analysis of Three Banks of India PDFSamiksha Gawas100% (1)

- Credit SaraswatDocumento77 pagineCredit Saraswatsahil1508Nessuna valutazione finora

- Master in Businessadministrat Ion: "Study of Working Capital Management of Jain Irrigation System Ltd. (Jisl) "Documento78 pagineMaster in Businessadministrat Ion: "Study of Working Capital Management of Jain Irrigation System Ltd. (Jisl) "Rig VedNessuna valutazione finora

- Trikuta Degree College: Employees'S Job Satisfaction in Ellaquai Dehati BankDocumento64 pagineTrikuta Degree College: Employees'S Job Satisfaction in Ellaquai Dehati BankSwyam DuggalNessuna valutazione finora

- Project Report On Impact of NPA in The Performance of Financial InstitutionDocumento96 pagineProject Report On Impact of NPA in The Performance of Financial InstitutionManu Yuvi100% (1)

- Comparative Analysis of Bank of BarodaDocumento5 pagineComparative Analysis of Bank of BarodaArpita ChristianNessuna valutazione finora

- Mba ProjeactDocumento39 pagineMba Projeactkurapati AdiNessuna valutazione finora

- Axis Bank FinalDocumento109 pagineAxis Bank Finalashu1630100% (9)

- Ratio Analysis in HDFC BankDocumento82 pagineRatio Analysis in HDFC BankTanvir KhanNessuna valutazione finora

- Project On Financial AnalysisDocumento68 pagineProject On Financial AnalysisSharn GillNessuna valutazione finora

- 10 - Chapter 3 KVB ShodhgangaDocumento50 pagine10 - Chapter 3 KVB ShodhgangaPankaj SinghNessuna valutazione finora

- Project Cash Management in Banks ProjectDocumento45 pagineProject Cash Management in Banks Projectkedar dhuriNessuna valutazione finora

- A Study On Cash Management On The Flavors India (P) LTD, PuducherryDocumento65 pagineA Study On Cash Management On The Flavors India (P) LTD, PuducherrymanhattanreviewNessuna valutazione finora

- Working Capital of Borrower-Bank of BarodaDocumento82 pagineWorking Capital of Borrower-Bank of BarodaRaj KopadeNessuna valutazione finora

- Ratio Analysis ProjectDocumento40 pagineRatio Analysis ProjectAnonymous g7uPednINessuna valutazione finora

- Ratio Analysis of Bajaj Auto LTDDocumento4 pagineRatio Analysis of Bajaj Auto LTDRadhika KadamNessuna valutazione finora

- CMS Report 1Documento101 pagineCMS Report 1Kamal PurohitNessuna valutazione finora

- Finance ProjectDocumento58 pagineFinance ProjectMuhammed Althaf VK0% (1)

- Comparitive Analysis of Mutual Fund of HDFC and Icici: Submitted To:-Department of Business AdministrationDocumento22 pagineComparitive Analysis of Mutual Fund of HDFC and Icici: Submitted To:-Department of Business AdministrationRashi GuptaNessuna valutazione finora

- HDFC Report by Anmol KansalDocumento79 pagineHDFC Report by Anmol KansalAnmol KansalNessuna valutazione finora

- A Study On Financial Performance Analysis With Reference To TNSC Bank Chennai Ijariie10138Documento7 pagineA Study On Financial Performance Analysis With Reference To TNSC Bank Chennai Ijariie10138Jeevitha MuruganNessuna valutazione finora

- "A Study On Working Capital Management of Itc LTD": Project Report Submitted ToDocumento58 pagine"A Study On Working Capital Management of Itc LTD": Project Report Submitted Tominal shaw100% (1)

- Camel ResearchDocumento62 pagineCamel ResearchPuja AwasthiNessuna valutazione finora

- NPA PROJECT For Surat Dist Co-Op BankDocumento62 pagineNPA PROJECT For Surat Dist Co-Op BankVijay Gohil33% (3)

- MBA FinanceDocumento11 pagineMBA Financeranjithc240% (1)

- A Study On Working Capital Management in STATE BANK OF IndiaDocumento4 pagineA Study On Working Capital Management in STATE BANK OF Indiaarijit2422Nessuna valutazione finora

- Chapter - 01 Introduction of BankDocumento37 pagineChapter - 01 Introduction of BankJeeva JeevaNessuna valutazione finora

- Raichur District Center Co-Operative Bank LTDDocumento74 pagineRaichur District Center Co-Operative Bank LTDSuresh Babu Reddy100% (2)

- Credit SaraswatDocumento76 pagineCredit Saraswatsahil1508100% (1)

- Finance (MBA) 154Documento80 pagineFinance (MBA) 154SreekanthNessuna valutazione finora

- IL & FS Investsmart: "Analysis of Mutual Fund & Customer Preference Towards Mutual Fund"Documento56 pagineIL & FS Investsmart: "Analysis of Mutual Fund & Customer Preference Towards Mutual Fund"Vijetha EdduNessuna valutazione finora

- A Study On Cash Management OnDocumento65 pagineA Study On Cash Management OnAnoop KrishnanNessuna valutazione finora

- Indusind Bank Internship PresentationDocumento19 pagineIndusind Bank Internship Presentationcharu kapoorNessuna valutazione finora

- Axis BankDocumento91 pagineAxis BankKushambu SinghNessuna valutazione finora

- (Federal Bank - A Financial AnalysisDocumento11 pagine(Federal Bank - A Financial AnalysisutkarshNessuna valutazione finora

- 06 Chapter 3Documento31 pagine06 Chapter 3Kiran VinnuNessuna valutazione finora

- CAMELSDocumento5 pagineCAMELSAmmar Arif100% (1)

- Financial Performance of Sri Bharamaramba Pattina Souharda Sahakari Niyamita MaskiDocumento3 pagineFinancial Performance of Sri Bharamaramba Pattina Souharda Sahakari Niyamita MaskiBasavaraj KustagiNessuna valutazione finora

- Karur AR2013-14Documento112 pagineKarur AR2013-14HitechSoft HitsoftNessuna valutazione finora

- Project Report On: By-Deepak Verma Amrit Kumar Shubham Gupta PriyaDocumento12 pagineProject Report On: By-Deepak Verma Amrit Kumar Shubham Gupta PriyaDeepzz SanguineNessuna valutazione finora

- A Project Report On: Project Guide Date of Submission 12 September 2007 Prepared by Name of The Students. Roll NoDocumento12 pagineA Project Report On: Project Guide Date of Submission 12 September 2007 Prepared by Name of The Students. Roll NoChirag GogriNessuna valutazione finora

- Federal Bank Research Report: Group 7Documento12 pagineFederal Bank Research Report: Group 7Srishti RanjanNessuna valutazione finora

- Financial Analysis (Ratios Calculations)Documento35 pagineFinancial Analysis (Ratios Calculations)SAL MANNessuna valutazione finora

- Press Release - Q2 TMBDocumento9 paginePress Release - Q2 TMBDhanush Kumar RamanNessuna valutazione finora

- Analysis of Financial Performance of SbiDocumento5 pagineAnalysis of Financial Performance of SbiMAYANK GOYALNessuna valutazione finora

- B. Financial Structure Analysis: I. Asset Structure AnalysisDocumento6 pagineB. Financial Structure Analysis: I. Asset Structure AnalysisThu Võ ThịNessuna valutazione finora

- Press Release Q4FY 25 April 14Documento7 paginePress Release Q4FY 25 April 14Anjali Angel ThakurNessuna valutazione finora

- A Consolidated Balance SheetDocumento1 paginaA Consolidated Balance SheetSagar YadavNessuna valutazione finora

- Financial Analysis: 3.1. Consolidated Statement of Financial PositionDocumento14 pagineFinancial Analysis: 3.1. Consolidated Statement of Financial PositionTalha Iftekhar Khan SwatiNessuna valutazione finora

- BST PROJECT FileDocumento5 pagineBST PROJECT FileAR MASTERRNessuna valutazione finora

- Annual Report 2009-10 of Federal BankDocumento88 pagineAnnual Report 2009-10 of Federal BankLinda Jacqueline0% (1)

- Vikrant Singh Tomar (19MBAR0331)Documento8 pagineVikrant Singh Tomar (19MBAR0331)Vikrant SinghNessuna valutazione finora

- ERP Sytem in CG GroupDocumento3 pagineERP Sytem in CG GroupHusen Ali50% (2)

- S. No Roll No Objective Sof Academic Activity Topic Evaluation ParametersDocumento4 pagineS. No Roll No Objective Sof Academic Activity Topic Evaluation ParametersHusen AliNessuna valutazione finora

- Submitted To: Submitted byDocumento12 pagineSubmitted To: Submitted byHusen AliNessuna valutazione finora

- of Business EnvironmentDocumento11 pagineof Business EnvironmentHusen AliNessuna valutazione finora

- Bussiness Environment AssignmengtDocumento17 pagineBussiness Environment AssignmengtHusen AliNessuna valutazione finora

- Lovely Professional University (Phagwara, Punjab)Documento8 pagineLovely Professional University (Phagwara, Punjab)Husen AliNessuna valutazione finora

- Cover Page of Summer ReportDocumento1 paginaCover Page of Summer ReportHusen AliNessuna valutazione finora

- With MaterialDocumento1 paginaWith MaterialHusen AliNessuna valutazione finora

- Annx IV PDFDocumento1 paginaAnnx IV PDFHusen AliNessuna valutazione finora

- Annx VDocumento1 paginaAnnx VHusen AliNessuna valutazione finora

- Annx IDocumento1 paginaAnnx IHusen AliNessuna valutazione finora

- F4E Market AssignmentDocumento17 pagineF4E Market AssignmentHusen AliNessuna valutazione finora

- Annx IVDocumento1 paginaAnnx IVHusen AliNessuna valutazione finora

- Top 10 Most Luxurious TrainsDocumento74 pagineTop 10 Most Luxurious TrainsHusen AliNessuna valutazione finora

- HMT 803Documento19 pagineHMT 803Husen AliNessuna valutazione finora

- Annx IiiDocumento2 pagineAnnx IiiHusen AliNessuna valutazione finora

- ERP Sytem in CG GroupDocumento3 pagineERP Sytem in CG GroupHusen Ali50% (2)

- The History of Indian Insurance Industry: Life InsuranceDocumento10 pagineThe History of Indian Insurance Industry: Life InsuranceHusen AliNessuna valutazione finora

- HMT803 ReportDocumento17 pagineHMT803 ReportHusen AliNessuna valutazione finora

- FIN209 CA2 Group-1 EUR-USD PDFDocumento12 pagineFIN209 CA2 Group-1 EUR-USD PDFHusen AliNessuna valutazione finora

- FIN-310 Report PDFDocumento15 pagineFIN-310 Report PDFHusen AliNessuna valutazione finora

- Commodity Market Report PDFDocumento8 pagineCommodity Market Report PDFHusen AliNessuna valutazione finora

- Assignment On Operations Management: OPR306 CA-3Documento7 pagineAssignment On Operations Management: OPR306 CA-3Husen AliNessuna valutazione finora

- QTTDocumento1 paginaQTTHusen AliNessuna valutazione finora

- Final HMT-801 ReportDocumento9 pagineFinal HMT-801 ReportHusen AliNessuna valutazione finora

- Accounting PrinciplesDocumento12 pagineAccounting PrinciplesAllecks Juel LuchanaNessuna valutazione finora

- Chapter 17 Advacc2 PDFDocumento58 pagineChapter 17 Advacc2 PDFJoyce Anne Garduque0% (1)

- Fund AccouningDocumento52 pagineFund Accouningvin5bandekarNessuna valutazione finora

- Balance Sheet: Pyramid Analysis Exercise Year 1 Year 2 Year 3 Year 4Documento9 pagineBalance Sheet: Pyramid Analysis Exercise Year 1 Year 2 Year 3 Year 4PylypNessuna valutazione finora

- Accounting For Managers PPT 3Documento206 pagineAccounting For Managers PPT 3AbdiNessuna valutazione finora

- Solution Aassignments CH 13Documento2 pagineSolution Aassignments CH 13RuturajPatilNessuna valutazione finora

- Balanco Mrve3Documento6 pagineBalanco Mrve3Kelvis OliveiraNessuna valutazione finora

- Intermediate Accounting Solutions Chapter 3Documento27 pagineIntermediate Accounting Solutions Chapter 3jharris1063% (8)

- Napier Routledge Companion Chapter 4 Final VersionDocumento35 pagineNapier Routledge Companion Chapter 4 Final VersionammmajisNessuna valutazione finora

- Accounting Cycle of A Merchandising BusinessDocumento34 pagineAccounting Cycle of A Merchandising BusinessTariga, Dharen Joy J.Nessuna valutazione finora

- D6Documento11 pagineD6neo14Nessuna valutazione finora

- Dissolution Changes in OwnershipDocumento29 pagineDissolution Changes in OwnershipKenaniah SanchezNessuna valutazione finora

- Mezzanine Finance Explained PDFDocumento9 pagineMezzanine Finance Explained PDFCedric TiuNessuna valutazione finora

- Test Bank ch-5 PDFDocumento39 pagineTest Bank ch-5 PDFnirali17Nessuna valutazione finora

- Capital Expenditure - CapEx DefinitionDocumento4 pagineCapital Expenditure - CapEx DefinitionMali MedoNessuna valutazione finora

- Practice Questions # 3 - With AnswersDocumento14 paginePractice Questions # 3 - With AnswersAhadullah KhawajaNessuna valutazione finora

- Meanings and Importance of Financial Statement AnalysisDocumento5 pagineMeanings and Importance of Financial Statement AnalysisUzma AminNessuna valutazione finora

- Nestle Group FS AnalisysDocumento7 pagineNestle Group FS Analisysablay logene50% (2)

- ASMA Cooperative GuidelinesDocumento3 pagineASMA Cooperative GuidelinesDemuel MontejoNessuna valutazione finora

- Week 2 Accounting EquationDocumento19 pagineWeek 2 Accounting EquationNor LailyNessuna valutazione finora

- 1st Evals p2Documento10 pagine1st Evals p2Shiela MayNessuna valutazione finora

- Financial Projections Template 08Documento26 pagineFinancial Projections Template 08Clyde SakuradaNessuna valutazione finora

- Adobe Scan Aug 19, 2022Documento11 pagineAdobe Scan Aug 19, 2022Purushottam YadhuvanshiNessuna valutazione finora

- Analysis of Cash Flow Statement Havard Case StudyDocumento22 pagineAnalysis of Cash Flow Statement Havard Case StudyPrashant JainNessuna valutazione finora

- Cash and Cash Equivalents - Bank OverdraftsDocumento3 pagineCash and Cash Equivalents - Bank OverdraftsjdhfiEWNessuna valutazione finora

- Fin 1380Documento4 pagineFin 1380api-291884427Nessuna valutazione finora

- Kolitz, David L. - Financial Accounting - A Concepts-Based Introduction-Routledge - Taylor & Francis Group (2017)Documento631 pagineKolitz, David L. - Financial Accounting - A Concepts-Based Introduction-Routledge - Taylor & Francis Group (2017)murtadho75% (4)

- Chapter 03 - The Accounting Cycle: Capturing Economic EventsDocumento143 pagineChapter 03 - The Accounting Cycle: Capturing Economic EventsElio BazNessuna valutazione finora

- BDO Unibank 2021 Annual Report Financial Highlights PDFDocumento2 pagineBDO Unibank 2021 Annual Report Financial Highlights PDFJohn Michael Dela CruzNessuna valutazione finora

- AFE5008-B Exam Type Question-2-Model AnswerDocumento2 pagineAFE5008-B Exam Type Question-2-Model AnswerDiana TuckerNessuna valutazione finora