Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

FINTECH

Caricato da

Sagar Talreja IprTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

FINTECH

Caricato da

Sagar Talreja IprCopyright:

Formati disponibili

The emergence of disruptive technological innovation in the financial sector:

Impact on bank business models and the regulatory framework.

Coordinator: Flavio Bazzana

Research group: FinTech

The financial sector is currently affected by the emergence of disruptive new technologies

– so-called “FinTech” – which look set to profoundly reshape the structure of financial in-

termediation.

FinTech now spreads across financial market segments and along the value chain. It is

present, albeit still at an early stage, in payments, credit provision, investment and financial

advice, insurance. And FinTech innovations are increasingly cascading into new areas. For

example, the development of instant payments infrastructures has helped develop new mar-

kets for mobile payment solutions, which may become a new standard of payments in some

areas.

FinTech is a positive development for the financial sector. It leads to greater efficiency,

better products and lower prices for consumers. It also has the potential to support financial

inclusion, as the impressive development of mobile banking networks in Kenya clearly

demonstrates.

FinTech presents an opportunity for new start-ups to compete with established financial

institutions in specific financial services, but without the costs of legacy IT systems and a

compliance-oriented business culture. FinTech also opens the market for “BigTech” firms

such as Apple, Google and Amazon, which have an in-built advantage in digital technology.

This threatens to take business away from banks which traditionally offered a package of

services, potentially weakening their business models.

What is more, over the longer-term technological innovations, such as distributed ledger

technologies (DLTs), originally developed for virtual currencies, such as Bitcoin, could have

profound impacts on financial intermediation. Through decentralised update and validation

of records, they may even challenge the basic business models of intermediaries or central

market infrastructures.

Despite growing awareness of the topic among top global banks and international forums,

the impact of this wave of technical innovation on the financial sector remains uncertain. In

Academia, FinTech has received limited coverage. This proposal aims at supporting a pro-

ject by a PhD student in a new and promising stream of research.

Possible research questions may be related to a pair of general issues:

(1) Banks facing questions about their business models should see the new wave of inno-

vation as an opportunity – to reach out to new customers, to increase efficiency, to

revamp their business models. FinTech may be exactly the shock the sector needs to

restructure after the crisis. What kind of bank business model may emerge after the

FinTech revolution?

(2) Policymakers and supervisors also need to monitor developments closely. The new

approaches should provide full legal certainty to market participants. How will regu-

latory space evolve in order to let innovation develop without hindering financial sta-

bility? How tech change may reshape banking systems in terms of their characteriz-

ing features (specialization, concentration, risk management, etc.)

Projects along this research proposal will be financially supported by the FinTech re-

search group at the Department of Economics and Management at the University of Trento.

Potrebbero piacerti anche

- Bcas Code of EthicsDocumento48 pagineBcas Code of EthicsSagar Talreja IprNessuna valutazione finora

- IAPM BMS Semester V and VI Syllabus To Be Implememnted 2018 2019Documento2 pagineIAPM BMS Semester V and VI Syllabus To Be Implememnted 2018 2019Sagar Talreja IprNessuna valutazione finora

- IAPM BMS Semester V and VI Syllabus To Be Implememnted 2018 2019Documento2 pagineIAPM BMS Semester V and VI Syllabus To Be Implememnted 2018 2019Sagar Talreja IprNessuna valutazione finora

- Accounting and Reality 2014Documento15 pagineAccounting and Reality 2014Sagar Talreja IprNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- SME Banking of Agrani Bank LTD PDFDocumento49 pagineSME Banking of Agrani Bank LTD PDFjoyNessuna valutazione finora

- Online Mobile Recharge - Postpaid, DTH & Datacard Bill Payments at Paytm PDFDocumento2 pagineOnline Mobile Recharge - Postpaid, DTH & Datacard Bill Payments at Paytm PDFvijaykumarzNessuna valutazione finora

- Package Paymeent Method Reserve Your Seats Today!: Accelerating Growth and Cooperation For A Win-Win SituationDocumento1 paginaPackage Paymeent Method Reserve Your Seats Today!: Accelerating Growth and Cooperation For A Win-Win SituationNinerMike MysNessuna valutazione finora

- Feastival 2019 InvoiceDocumento1 paginaFeastival 2019 InvoiceAnonymous 31FcJqNessuna valutazione finora

- Windy A. Malapit: Oblicon Case DigestDocumento10 pagineWindy A. Malapit: Oblicon Case DigestWindy Awe MalapitNessuna valutazione finora

- Iiw-Aws 2015Documento2 pagineIiw-Aws 2015fishy18Nessuna valutazione finora

- Capstone ProjectDocumento48 pagineCapstone ProjectTulika Agrawal Rawool0% (1)

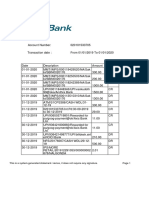

- BNI Mobile Banking: Histori TransaksiDocumento3 pagineBNI Mobile Banking: Histori TransaksiMas CaturNessuna valutazione finora

- Insurance Capsule For NICL AODocumento19 pagineInsurance Capsule For NICL AOmanishNessuna valutazione finora

- Star-Digi Productwise Contact DetailsDocumento6 pagineStar-Digi Productwise Contact Detailsmadirajunaveen100% (1)

- Gsis LawDocumento17 pagineGsis LawJohn Ree Esquivel DoctorNessuna valutazione finora

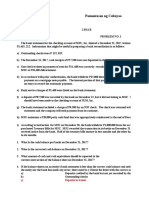

- Hon Supp ProbDocumento9 pagineHon Supp ProbNeLson ALcanarNessuna valutazione finora

- Bangkok Residential MarketView Q3 2017Documento4 pagineBangkok Residential MarketView Q3 2017AnthonNessuna valutazione finora

- Test For Students of Tourism Industry Tests - 14360Documento4 pagineTest For Students of Tourism Industry Tests - 14360Sofia GaleanoNessuna valutazione finora

- Chapter 02Documento68 pagineChapter 02loveshare100% (1)

- DPC Act 1971Documento26 pagineDPC Act 1971ShivendraMoreNessuna valutazione finora

- Assign SCB IndicatorsDocumento2 pagineAssign SCB IndicatorsFernandoRieraJuradoNessuna valutazione finora

- Job Order Costing - QuestionsDocumento3 pagineJob Order Costing - QuestionsMadiha Maddy100% (3)

- Prelim-Pr 2a14fb4488c3b5b235Documento11 paginePrelim-Pr 2a14fb4488c3b5b235Romina LopezNessuna valutazione finora

- Customer Risk Profile FormDocumento3 pagineCustomer Risk Profile FormRaja DuraiNessuna valutazione finora

- GCB BANK TAKES OVER UT BANK AND CAPITAL BANK - Frequently Asked QuestionsDocumento3 pagineGCB BANK TAKES OVER UT BANK AND CAPITAL BANK - Frequently Asked QuestionsGhanaWebNessuna valutazione finora

- Damage Claim Form R2Documento4 pagineDamage Claim Form R2hazwan jalaniNessuna valutazione finora

- MotorDocumento51 pagineMotoranirudhalcNessuna valutazione finora

- MERS Member - Banks - BoardDocumento3 pagineMERS Member - Banks - BoardregeurksNessuna valutazione finora

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocumento16 pagineThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureVinod DharavathNessuna valutazione finora

- 1receipt For Payment PDFDocumento2 pagine1receipt For Payment PDFAnn SCNessuna valutazione finora

- Audit Committee 20feb18Documento52 pagineAudit Committee 20feb18Anupam KulshreshthaNessuna valutazione finora

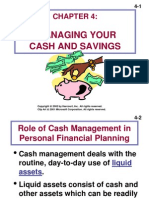

- Managing Your Cash and SavingsDocumento11 pagineManaging Your Cash and SavingsMoi WarheadNessuna valutazione finora

- Neft ProjectDocumento69 pagineNeft ProjectArshad ShakeelNessuna valutazione finora