Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Performance Analysis of Nationalized Banks in Pakistan

Caricato da

geetakhianiDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Performance Analysis of Nationalized Banks in Pakistan

Caricato da

geetakhianiCopyright:

Formati disponibili

Performance Analysis of Nationalized Banks in Pakistan:

An Application of CAMEL Model

Objective of Study

The present study is an attempt to examine the performance of nationalized banks in

terms of CAR, Asset Quality, Management, Earning, Liquidity and Sensitivity to

market risk.

Objectives of the Study

Objectives are the guiding light of a project in the light of which all the relevant steps

are taken. The objectives of this study were as follows:

• To assess the performance of nationalized banks on the basis of

CAMEL model

• To rank the banks on the basis of various parameters suggested by CAMEL

model

• To rate top five and bottom five banks on the basis of their performance for

each year

• To suggest various measures to improve the performance of the nationalized

Banks

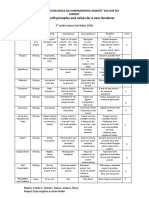

The acronym "CAMEL" refers to the five components of a bank's condition

that are assessed: Capital adequacy, Asset quality, Management, Earnings, and

Liquidity. A sixth component, a bank's Sensitivity to market risk was added in 1997;

hence the acronym was changed to CAMEL. CAMEL’ model is basically a ratiobased

model for evaluating the performance of banks. Various ratios forming this

model are explained below:

“CAMELS RATING SYSTEM AND FORECASTING PERFORMANCE OF

COMMERCIAL BANKING SECTOR”

“Performance Analysis of top 5 Banks in Pakistan:

An Application of CAMEL Model”

“Performance Analysis of top 5 Banks in Pakistan

Before and during Financial crisis Using CAMEL model”

The main objective can be broken down into the following:

1. To identify which bank’s asset quality is higher during the period of the

study;

2. To determine whether capital adequacy of commercial banks has affected

their performance during the study period;

3. To examine whether bank management influences the performance of

banks;

4. To demonstrate that liquidity of the commercial banks has improved and

has contributed to the performance of the banks under study.

The data for financial ratios are obtained from the respective banks’ annual

report each year for

the period from 2005 until 2009.

Dependent variables:

Among the most important ratio measures of bank profitability used today

are the following:

1. Return on shareholder’s equity {Return on equity capital (ROE) = (net

income) / (total equity capital)}

2. managerial efficiency --------{Return on assets (ROA) = (net income) /

(total assets)}

Independent variables:

1. capital adequacy

2. asset quality

3. management

4. earnings

5. Liquidity

H1 – There is a significant relationship between Capital Adequacy

ratios and

Performance of the banks.

Correlation:

Growth in CAR is independent of return on assets

CAR ratio increases do not depend positively on ROE.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- 02 Slide Pengenalan Dasar MapinfoDocumento24 pagine02 Slide Pengenalan Dasar MapinfoRizky 'manda' AmaliaNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Technical Manual - C&C08 Digital Switching System Chapter 2 OverviewDocumento19 pagineTechnical Manual - C&C08 Digital Switching System Chapter 2 OverviewSamuel100% (2)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- DOE Tank Safety Workshop Presentation on Hydrogen Tank TestingDocumento36 pagineDOE Tank Safety Workshop Presentation on Hydrogen Tank TestingAlex AbakumovNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- Astm D7928 - 17Documento25 pagineAstm D7928 - 17shosha100% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- CBT For BDDDocumento13 pagineCBT For BDDGregg Williams100% (5)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Techniques in Selecting and Organizing InformationDocumento3 pagineTechniques in Selecting and Organizing InformationMylen Noel Elgincolin ManlapazNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Iphoneos 31Documento159 pagineIphoneos 31Ivan VeBoNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Photosynthesis Lab ReportDocumento7 paginePhotosynthesis Lab ReportTishaNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Endangered EcosystemDocumento11 pagineEndangered EcosystemNur SyahirahNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- What's Wrong With American Taiwan Policy: Andrew J. NathanDocumento14 pagineWhat's Wrong With American Taiwan Policy: Andrew J. NathanWu GuifengNessuna valutazione finora

- EXPERIMENT 4 FlowchartDocumento3 pagineEXPERIMENT 4 FlowchartTRISHA PACLEBNessuna valutazione finora

- Dep 32.32.00.11-Custody Transfer Measurement Systems For LiquidDocumento69 pagineDep 32.32.00.11-Custody Transfer Measurement Systems For LiquidDAYONessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Problem Set SolutionsDocumento16 pagineProblem Set SolutionsKunal SharmaNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Rubric 5th GradeDocumento2 pagineRubric 5th GradeAlbert SantosNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Pemaknaan School Well-Being Pada Siswa SMP: Indigenous ResearchDocumento16 paginePemaknaan School Well-Being Pada Siswa SMP: Indigenous ResearchAri HendriawanNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- SiloDocumento7 pagineSiloMayr - GeroldingerNessuna valutazione finora

- Wheeled Loader L953F Specifications and DimensionsDocumento1 paginaWheeled Loader L953F Specifications and Dimensionssds khanhNessuna valutazione finora

- Cab&Chaissis ElectricalDocumento323 pagineCab&Chaissis Electricaltipo3331100% (13)

- MA1201 Calculus and Basic Linear Algebra II Solution of Problem Set 4Documento10 pagineMA1201 Calculus and Basic Linear Algebra II Solution of Problem Set 4Sit LucasNessuna valutazione finora

- Condition Based Monitoring System Using IoTDocumento5 pagineCondition Based Monitoring System Using IoTKaranMuvvalaRaoNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Week 15 - Rams vs. VikingsDocumento175 pagineWeek 15 - Rams vs. VikingsJMOTTUTNNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- GP Rating GSK Exit ExamDocumento108 pagineGP Rating GSK Exit ExamMicle VM100% (4)

- Flexible Regression and Smoothing - Using GAMLSS in RDocumento572 pagineFlexible Regression and Smoothing - Using GAMLSS in RDavid50% (2)

- 2021 Impact of Change Forecast Highlights: COVID-19 Recovery and Impact On Future UtilizationDocumento17 pagine2021 Impact of Change Forecast Highlights: COVID-19 Recovery and Impact On Future UtilizationwahidNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- CFO TagsDocumento95 pagineCFO Tagssatyagodfather0% (1)

- Desana Texts and ContextsDocumento601 pagineDesana Texts and ContextsdavidizanagiNessuna valutazione finora

- Oxygen Cost and Energy Expenditure of RunningDocumento7 pagineOxygen Cost and Energy Expenditure of Runningnb22714Nessuna valutazione finora

- N4 Electrotechnics August 2021 MemorandumDocumento8 pagineN4 Electrotechnics August 2021 MemorandumPetro Susan BarnardNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Mutual Fund PDFDocumento22 pagineMutual Fund PDFRajNessuna valutazione finora

- 4 Factor DoeDocumento5 pagine4 Factor Doeapi-516384896Nessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)