Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Afar 107 - Business Combination Part 2

Caricato da

Maria LopezDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Afar 107 - Business Combination Part 2

Caricato da

Maria LopezCopyright:

Formati disponibili

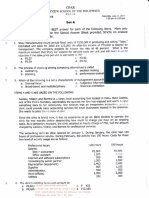

BUSINESS COMBINATION

EXERCISE 1

On January 1, 2017, BABA Co. acquired 80% of interest in BABY, Inc. by issuing

5,000 shares with fair value of P60 per share and par value of P40 per share.

The financial statements of BABA Co. and BABY, Inc. immediately before the

acquisition are shown below:

BABA Co. BABY, Inc.

Cash 40,000 20,000

Accounts Receivable 120,000 48,000

Inventory 160,000 92,000

Equipment 800,000 200,000

Accumulated Depreciation (80,000) (40,000)

TOTAL ASSETS 1,040,000 320,000

Accounts Payable 80,000 24,000

Bonds Payable 120,000

Share Capital 480,000 200,000

Share Premium 160,000

Retained Earnings 200,000 96,000

TOTAL LIABILITIES AND EQUITY 1,040,000 320,000

On January 1, 2017 the fair value of the assets and liabilities of BABY, Inc.

were determined by appraisal, as follows:

Carrying Fair Fair value

amounts values increment

Cash 20,000 20,000 -

Accounts Receivable 48,000 48,000 -

Inventory 92,000 124,000 32,000

Equipment 200,000 240,000 40,000

Accumulated Depreciation (40,000) (48,000) (8,000)

Accounts Payable (24,000) (24,000) -

Net Assets 296,000 360,000 64,000

The equipment has a remaining useful life of 4 years from January 1, 2017.

Case 1. BABA Co. elects to measure non-controlling interest as its

proportionate share in BABY, Inc.’s net identifiable assets.

1. How much is the consolidated total assets as of January 1, 2017?

2. How much is the consolidated total equity as of January 1, 2017?

Case 2. BABA Co. elects to measure non-controlling interest at fair value

based on the consideration transferred.

1. How much is the consolidated total assets as of January 1, 2017?

2. How much is the consolidated total equity as of January 1, 2017?

EXERCISE 2

On January 1, 2017, House Stark acquired 80% interest in House Lannister by

issuing 5,000 shares with fair value of P60 per share and par value of P40

per share. On the acquisition date, House Stark elected to measure non-

controlling interest as its proportionate share in House Lannister’s net

identifiable assets.

House Lannister shareholder’s equity as of January 1, 2017 comprise the

following:

At Carrying amount

Share Capital 200,000

Retained Earnings 96,000

Total Equity 296,000

ADVANCED FINANCIAL ACCOUNTING 1

BUSINESS COMBINATION

On January 1, 2017 the fair value of the assets and liabilities of House

Lannister, Inc. were determined by appraisal, as follows:

Carrying Fair Fair value

amounts values increment

Cash 20,000 20,000 -

Accounts Receivable 48,000 48,000 -

Inventory 92,000 124,000 32,000

Equipment 200,000 240,000 40,000

Accumulated Depreciation (40,000) (48,000) (8,000)

Accounts Payable (24,000) (24,000) -

Net Assets 296,000 360,000 64,000

The equipment has a remaining useful life of 4 years.

During 2017, no dividends were declared by either House Stark or House

Lannister. There were also no inter-company transactions. The group determined

that there is no goodwill impairment.

House Stark and House Lannister individual financial statements at year end

are shown below.

Statement of Financial Position

As at December 31, 2017

Stark Lannister

Cash 92,000 228,000

Accounts Receivable 300,000 88,000

Inventory 420,000 60,000

Investment in Subsidiary 300,000 -

Equipment 800,000 200,000

Accumulated Depreciation (240,000) (80,000)

TOTAL ASSETS 1,672,000 496,000

Accounts Payable 172,000 120,000

Bonds Payable 120,000 -

Share Capital 680,000 200,000

Share Premium 260,000

Retained Earnings 440,000 176,000

TOTAL LIABILITIES AND EQUITY 1,672,000 496,000

Statement of profit or loss

For the year ended December 31, 2017

Stark Lannister

Sales 1,200,000 480,000

Cost of Goods Sold (660,000) (288,000)

Gross Profit 540,000 192,000

Depreciation Expense (160,000) (40,000)

Distribution Costs (128,000) (72,000)

Interest Expense (12,000) -

Profit for the year 240,000 80,000

1. How much is the consolidated profit for 2017?

2. How much is the consolidated assets as of December 31, 2017?

3. How much is the consolidated total equity as of December 31, 2017?

ADVANCED FINANCIAL ACCOUNTING 2

BUSINESS COMBINATION

EXERCISE 3

On January 1, 2017, Peter Co. acquired 90% ownership interest in Simon Co.

for P488,000. Peter Co elected to measure NCI at fair value. NCI was assigned

a fair value of P60,000.

On January 1, 2017, the fair values of the assets and liabilities of Simon

Co. were determined as follows:

Carrying Fair Fair value

amounts values increment

Cash 40,000 40,000 -

Accounts Receivable 60,000 60,000 -

Inventory 100,000 124,000 24,000

Equipment 240,000 360,000 120,000

Accumulated Depreciation (80,000) (120,000) (8,000)

Patent - 80,000 80,000

Accounts Payable (24,000) (24,000) -

Net Assets 336,000 520,000 184,000

The remaining useful life of the equipment is 5 years while the patent has a

remaining legal and useful life of 8 years. Simon’s share capital has a balance

of P200,000.

Among the transaction of Peter and Simon during 2017 were the following.

1. Peter’s accounts receivable includes a receivable from Simon amounting

to P12,000 while Simon’s accounts payable include a payable to Peter

amounting to P8,000. The difference was due to a check amounting to

P4,000 deposited by Simon directly to Peter’s bank account which was not

yet recorded by Peter in its books. The check has already cleared in

Simon’s bank account.

2. Peter sold goods costing P80,000 to Simon for P128,000. One-third of the

inventory remains as of December 31, 2017.

3. Simon sold goods costing P40,000 to Peter for P60,000. One-half of the

goods remain in inventory as of December 31, 2017.

4. On January 1, 2017, Simon sold to Peter equipment for P20,000. The

equipment had a historical cost of P40,000 and accumulated depreciation

of P16,000 and a remaining useful life of 5 years on the date of sale.

5. On July 1, 2017 Simon Co. purchased 50% of the outstanding bonds of Peter

Co. from the open market for P240,000. The interest income accruing on

the bonds for the year was received by Simon from Peter.

6. The bonds payable carry an interest rate of 10% and were originally

issued by Peter at face amount.

7. Peter declared dividends of P160,000.

8. Simon declared dividends of P80,000.

9. Goodwill is impaired by P8,000.

10. There have been no changes in Simon’s capital.

The individual financial statements of the entities at December 31, 2017 are

shown below.

Statement of Financial Position

As at December 31, 2017

ASSETS Peter Simon

Cash 1,448,000 85,200

Accounts Receivable 712,000 20,000

Inventory 440,000 268,000

Investment in Bonds - 238,000

Investment in Subsidiary 488,000 -

Equipment 4,020,000 200,000

Accumulated Depreciation (1,444,000) (91,200)

TOTAL ASSETS 5,664,000 720,000

ADVANCED FINANCIAL ACCOUNTING 3

BUSINESS COMBINATION

LIABILITIES AND EQUITY

Accounts Payable 284,000 83,200

Bonds Payable 400,000 -

Total Liabilities 684,000 83,200

Share Capital 3,200,000 200,000

Retained Earnings 1,780,000 436,800

TOTAL Equity 4,980,000 636,800

TOTAL LIABILITIES AND EQUITY 5,664,000 720,000

Statement of profit or loss

For the year ended December 31, 2017

Peter Simon

Sales 3,728,000 1,020,000

Cost of Goods Sold (1,700,000) (472,000)

Gross Profit 2,028,000 548,000

Interest Income 8,000

Depreciation Expense (644,000) (27,200)

Distribution Costs (256,000) (144,000)

Interest Expense (40,000)

Loss on sale of equipment (4,000)

Dividend Income 72,000

Profit for the year 1,160,000 380,800

Determined the following.

1. Consolidated Sales

2. Consolidated Cost of Sales

3. Consolidated Ending Inventory

4. Goodwill in the December 31, 2017 consolidated financial statements.

5. How much is the NCI in net assets as of December 31, 2017?

6. Consolidated retained earnings as of December 31, 2017.

7. Consolidated profit or loss as of December 31, 2017.

8. How much is the attributable to the owners of the parent and to NCI

respectively?

9. Consolidated Assets as of December 31, 2017.

10. Consolidated Liabilities as of December 31, 2017.

ADVANCED FINANCIAL ACCOUNTING 4

Potrebbero piacerti anche

- ProblemsDocumento12 pagineProblemsJoy MarieNessuna valutazione finora

- Afar 2701 PartnershipDocumento57 pagineAfar 2701 PartnershipJoshmyrrh Richwel GammadNessuna valutazione finora

- Business Combination and Consolidated FS Part 1Documento6 pagineBusiness Combination and Consolidated FS Part 1markNessuna valutazione finora

- AainvtyDocumento4 pagineAainvtyRodolfo SayangNessuna valutazione finora

- Decided To Open A Branch in ManilaDocumento2 pagineDecided To Open A Branch in Manilaasdfghjkl zxcvbnmNessuna valutazione finora

- Chapter 12-14Documento18 pagineChapter 12-14Serena Van Der WoodsenNessuna valutazione finora

- Chapter 2 Partnership OperationsDocumento24 pagineChapter 2 Partnership OperationsChelsy SantosNessuna valutazione finora

- Accounting For Special Transactions:: Corporate LiquidationDocumento28 pagineAccounting For Special Transactions:: Corporate LiquidationKim EllaNessuna valutazione finora

- Set DDocumento6 pagineSet DJeremiah Navarro PilotonNessuna valutazione finora

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocumento7 pagineAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNessuna valutazione finora

- LiabilitiesDocumento2 pagineLiabilitiesFrederick AbellaNessuna valutazione finora

- CMPC131Documento15 pagineCMPC131Nhel AlvaroNessuna valutazione finora

- Accounting For Special Transactions and Cost Accounting and ControlDocumento12 pagineAccounting For Special Transactions and Cost Accounting and ControlRNessuna valutazione finora

- Chapter 09Documento16 pagineChapter 09FireBNessuna valutazione finora

- Chapter 17 - Consol. Fs Part 2Documento6 pagineChapter 17 - Consol. Fs Part 2PutmehudgJasdNessuna valutazione finora

- Activity #4 Corporate LiquidationDocumento3 pagineActivity #4 Corporate LiquidationddddddaaaaeeeeNessuna valutazione finora

- Bus Com 12Documento3 pagineBus Com 12Chabelita MijaresNessuna valutazione finora

- ACTExamsDocumento36 pagineACTExamsKaguraNessuna valutazione finora

- Partnership Dissolution 4Documento6 paginePartnership Dissolution 4Karl Wilson GonzalesNessuna valutazione finora

- Quiz in Business Combi, Conso and Corpo LiqDocumento11 pagineQuiz in Business Combi, Conso and Corpo LiqExequielCamisaCrusperoNessuna valutazione finora

- DBP V ArcillaDocumento137 pagineDBP V ArcillajeysonregNessuna valutazione finora

- AC 3101 Discussion ProblemDocumento1 paginaAC 3101 Discussion ProblemYohann Leonard HuanNessuna valutazione finora

- Cash BasisDocumento4 pagineCash BasisMark DiezNessuna valutazione finora

- Partnership DissolutionDocumento3 paginePartnership DissolutionDan RyanNessuna valutazione finora

- Jun Zen Ralph Yap BSA - 3 Year Let's CheckDocumento2 pagineJun Zen Ralph Yap BSA - 3 Year Let's CheckJunzen Ralph Yap100% (1)

- Audit of Investments May 2028Documento8 pagineAudit of Investments May 2028kmarisseeNessuna valutazione finora

- Review QuestionairesDocumento18 pagineReview QuestionairesAngelica DuarteNessuna valutazione finora

- Accounting 12Documento4 pagineAccounting 12Breathe ArielleNessuna valutazione finora

- Afar 02 P'ship Operation QuizDocumento4 pagineAfar 02 P'ship Operation QuizJohn Laurence LoplopNessuna valutazione finora

- Buscom Quiz 2 MidtermDocumento2 pagineBuscom Quiz 2 MidtermRafael Capunpon VallejosNessuna valutazione finora

- Activity - Chapter 4Documento2 pagineActivity - Chapter 4Greta DuqueNessuna valutazione finora

- Chapter 4 - Partnership LiquidationDocumento4 pagineChapter 4 - Partnership LiquidationMikaella BengcoNessuna valutazione finora

- Peter and Ronald Are PartnersDocumento1 paginaPeter and Ronald Are PartnersJessie jorgeNessuna valutazione finora

- Consolidated Net IncomeDocumento1 paginaConsolidated Net IncomePJ PoliranNessuna valutazione finora

- Practical Accounting 2 - ExaminationDocumento10 paginePractical Accounting 2 - ExaminationPrincess Claris ArauctoNessuna valutazione finora

- Module 3Documento6 pagineModule 3trixie maeNessuna valutazione finora

- Consolidated BS - Date of AcquisitionDocumento2 pagineConsolidated BS - Date of AcquisitionKharen Valdez0% (1)

- Chapter 13 DayagDocumento8 pagineChapter 13 DayagMel ChuaNessuna valutazione finora

- Consolidating Balance SheetsDocumento4 pagineConsolidating Balance Sheetsangel2199Nessuna valutazione finora

- Revenue Recognition: Long Term ConstructionDocumento3 pagineRevenue Recognition: Long Term ConstructionLee SuarezNessuna valutazione finora

- Trial Balance Home Office DR (CR) Branch Office DR (CR)Documento2 pagineTrial Balance Home Office DR (CR) Branch Office DR (CR)Adriana CarinanNessuna valutazione finora

- HB Quiz 2020Documento4 pagineHB Quiz 2020Allyssa Kassandra LucesNessuna valutazione finora

- Advanced Accounting Part 2 Dayag 2015 Chapter 4 (2022)Documento68 pagineAdvanced Accounting Part 2 Dayag 2015 Chapter 4 (2022)Mazikeen DeckerNessuna valutazione finora

- Practical Accounting 1 First Pre-Board ExaminationDocumento14 paginePractical Accounting 1 First Pre-Board ExaminationKaren EloisseNessuna valutazione finora

- Home Office, Branches and AgenciesDocumento5 pagineHome Office, Branches and AgenciesBryan ReyesNessuna valutazione finora

- Quiz 2Documento19 pagineQuiz 2Quendrick SurbanNessuna valutazione finora

- Chapter 16 - Bus Com Part 3 - Afar Part 2Documento5 pagineChapter 16 - Bus Com Part 3 - Afar Part 2Emman ElagoNessuna valutazione finora

- Finals Quiz 2 Buscom Version 2Documento3 pagineFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNessuna valutazione finora

- Non-Profit OrganizationsDocumento44 pagineNon-Profit OrganizationsJayvee BernalNessuna valutazione finora

- Psa 550 FNDocumento1 paginaPsa 550 FNkristel-marie-pitogo-4419Nessuna valutazione finora

- MASDocumento2 pagineMASClarisse AlimotNessuna valutazione finora

- AFARicpaDocumento23 pagineAFARicpaRegine YbañezNessuna valutazione finora

- Audit ReviewDocumento9 pagineAudit ReviewephraimNessuna valutazione finora

- Sample Probles For Corpo Liquidation Part 2Documento1 paginaSample Probles For Corpo Liquidation Part 2Kezia GuevarraNessuna valutazione finora

- LTCC Quiz W AnsDocumento4 pagineLTCC Quiz W AnsalyNessuna valutazione finora

- Competency Appraisal UM Digos (PARTNERSHIP)Documento10 pagineCompetency Appraisal UM Digos (PARTNERSHIP)Diana Faye CaduadaNessuna valutazione finora

- 3rd NCR Cup Junior Edition Quiz Bee KPMGDocumento17 pagine3rd NCR Cup Junior Edition Quiz Bee KPMGrcaa04100% (1)

- Quiz - Consolidated FS Part 2Documento3 pagineQuiz - Consolidated FS Part 2skyieNessuna valutazione finora

- Sorsogon State College: Republic of The Philippines Bulan Campus Bulan, SorsogonDocumento8 pagineSorsogon State College: Republic of The Philippines Bulan Campus Bulan, SorsogonTine Griego0% (1)

- Buscom DiscussionDocumento3 pagineBuscom DiscussionLorie Grace LagunaNessuna valutazione finora

- Article 1179: Section 1: Pure & Conditional ObligationsDocumento67 pagineArticle 1179: Section 1: Pure & Conditional ObligationsMaria LopezNessuna valutazione finora

- Philippine Laws, Statutes & Codes: Republic ActsDocumento11 paginePhilippine Laws, Statutes & Codes: Republic ActsMaria LopezNessuna valutazione finora

- LiquidationDocumento2 pagineLiquidationMaria LopezNessuna valutazione finora

- Republic Act No. 386 An Act To Ordain and Institute The Civil Code of The PhilippinesDocumento5 pagineRepublic Act No. 386 An Act To Ordain and Institute The Civil Code of The PhilippinesMaria LopezNessuna valutazione finora

- Answer Key For CPA Board Exam Reviewer 1. A 2. C 3. C 4.C 5. D 6. D 7. A 8. B 9. D 10. CDocumento1 paginaAnswer Key For CPA Board Exam Reviewer 1. A 2. C 3. C 4.C 5. D 6. D 7. A 8. B 9. D 10. CMaria LopezNessuna valutazione finora

- Partnership FormationDocumento2 paginePartnership FormationMaria LopezNessuna valutazione finora

- Deductions: Philippines Gross Estate World Gross Estate Deductible LITDocumento3 pagineDeductions: Philippines Gross Estate World Gross Estate Deductible LITMaria LopezNessuna valutazione finora

- P3.37 P3.s9 Controlling B.planning - D.pedormanceevaluation Focus C'Documento8 pagineP3.37 P3.s9 Controlling B.planning - D.pedormanceevaluation Focus C'Maria LopezNessuna valutazione finora

- Answer Key For Cpa Board Exam ReviewerDocumento4 pagineAnswer Key For Cpa Board Exam ReviewerMaria LopezNessuna valutazione finora

- Kukurija: Shuyu KanaokaDocumento10 pagineKukurija: Shuyu KanaokaMarshal MHVHZRHLNessuna valutazione finora

- Ganal Vs PeopleDocumento8 pagineGanal Vs PeopleGyan PascualNessuna valutazione finora

- COM379 Essay 7Documento5 pagineCOM379 Essay 7Ali RungeNessuna valutazione finora

- Dreaded Homework Crossword ClueDocumento9 pagineDreaded Homework Crossword Clueafnahsypzmbuhq100% (1)

- Strategic Action Plans and Alignment GuideDocumento13 pagineStrategic Action Plans and Alignment GuideAbeer AzzyadiNessuna valutazione finora

- Manual of Seamanship PDFDocumento807 pagineManual of Seamanship PDFSaad88% (8)

- 11 - Comment Review SheetDocumento1 pagina11 - Comment Review SheetMohamed ShokryNessuna valutazione finora

- Percentage and Profit and LossDocumento7 paginePercentage and Profit and LossMuhammad SamhanNessuna valutazione finora

- Abbreviations Related To Hotel Management 14.09.2018Documento5 pagineAbbreviations Related To Hotel Management 14.09.2018Anonymous BkRbHIeyqnNessuna valutazione finora

- Quality & Inspection For Lead-Free Assembly: New Lead-Free Visual Inspection StandardsDocumento29 pagineQuality & Inspection For Lead-Free Assembly: New Lead-Free Visual Inspection Standardsjohn432questNessuna valutazione finora

- Reflection (The Boy Who Harnessed The Wind)Documento1 paginaReflection (The Boy Who Harnessed The Wind)knightapollo16Nessuna valutazione finora

- Army Aviation Digest - Jan 1994Documento56 pagineArmy Aviation Digest - Jan 1994Aviation/Space History Library100% (1)

- S F R S (I) 1 - 2 1: Accounting For The Effects of Changes in Foreign Currency Exchange RatesDocumento40 pagineS F R S (I) 1 - 2 1: Accounting For The Effects of Changes in Foreign Currency Exchange RatesRilo WiloNessuna valutazione finora

- Trade Infrastructure (Maharashtra)Documento5 pagineTrade Infrastructure (Maharashtra)RayNessuna valutazione finora

- Test Bank - Chapter 16Documento25 pagineTest Bank - Chapter 16Jihad NakibNessuna valutazione finora

- Creating A Carwash Business PlanDocumento7 pagineCreating A Carwash Business PlanChai Yeng LerNessuna valutazione finora

- Signal Man For RiggerDocumento1 paginaSignal Man For RiggerAndi ZoellNessuna valutazione finora

- Kansai Survival Manual CH 15Documento2 pagineKansai Survival Manual CH 15Marcela SuárezNessuna valutazione finora

- TrerwtsdsDocumento167 pagineTrerwtsdsvinicius gomes duarteNessuna valutazione finora

- Debit Card Replacement Kiosk Locations v2Documento3 pagineDebit Card Replacement Kiosk Locations v2aiaiyaya33% (3)

- Library Management System For Stanford - WriteupDocumento15 pagineLibrary Management System For Stanford - WriteupJoseph OlaleNessuna valutazione finora

- Zero Trust Deployment Plan 1672220669Documento1 paginaZero Trust Deployment Plan 1672220669Raj SinghNessuna valutazione finora

- Students and Sports Betting in Nigeria (2020)Documento57 pagineStudents and Sports Betting in Nigeria (2020)Nwaozuru JOHNMAJOR Chinecherem100% (1)

- IdeologyandHistoryofKalarippayattaMartialArtinKerala Ilovepdf CompressedDocumento9 pagineIdeologyandHistoryofKalarippayattaMartialArtinKerala Ilovepdf CompressedPratyush Suman MohantyNessuna valutazione finora

- Local Labor Complaint FormDocumento1 paginaLocal Labor Complaint FormYVONNE PACETENessuna valutazione finora

- MH15 - Street WarsDocumento78 pagineMH15 - Street WarsBrin Bly100% (1)

- Bakst - Music and Soviet RealismDocumento9 pagineBakst - Music and Soviet RealismMaurício FunciaNessuna valutazione finora

- Health CertsxDocumento2 pagineHealth Certsxmark marayaNessuna valutazione finora

- Descriptive Text TaskDocumento12 pagineDescriptive Text TaskM Rhaka FirdausNessuna valutazione finora

- Faith in GenesisDocumento5 pagineFaith in Genesischris iyaNessuna valutazione finora