Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Asasassa

Caricato da

Iden PratamaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Asasassa

Caricato da

Iden PratamaCopyright:

Formati disponibili

Tugas Kelompok ke-4

(Minggu 10)

Case 1

A comparative statement of financial position for Hartman Corporation is presented below:

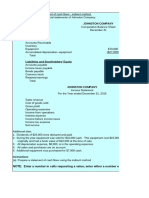

HARTMAN CORPORATION

Comparative statement of financial position

2014 2013

Assets

Land 18,000 40,000

Equipment 70,000 60,000

Accumulated depreciation (20,000) (13,000)

Prepaid insurance 25,000 17,000

Accounts receivable (net) 80,000 60,000

Cash 36,000 31,000

Total Assets $209,000 $195,000

Equity and Liabilities

Share capital-ordinary $140,000 $115,000

Retained earnings 31,000 55,000

Bonds payable 27,000 19,000

Accounts payable 11,000 6,000

Total equity and liabilities $209,000 $195,000

Additional information:

1. Net loss for 2014 is $15,000.

2. Cash dividends of $9,000 were declared and paid in 2014.

ACCT6174 – Introduction to Financial Accounting

3. Land was sold for cash at a loss of $7,000. This was the only land transaction during the

year.

4. Equipment with a cost of $15,000 and accumulated depreciation of $10,000 was sold for

$5,000 cash.

5. $12,000 of bonds were retired during the year at carrying (book) value.

6. Equipment was acquired for ordinary shares. The fair value of the shares at the time of

the exchange was $25,000.

Instructions

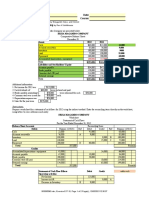

Prepare a statement of cash flows for the year ended 2014, using the indirect method.

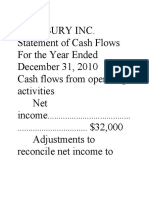

Case 2

Newman Corporation's comparative statement of financial position are presented below.

NEWMAN CORPORATION

Comparative Statement of Financial Position

December 31

2014 2013

Equipment $ 60,000 $ 70,000

Accumulated depreciation (14,000) (10,000)

Investments 25,000 16,000

Accounts receivable 25,200 22,300

Cash 12,200 17,700

Total $108,400 $116,000

Share capital-ordinary $ 50,000 $ 45,000

Retained earnings 33,800 29,900

Bonds payable 10,000 30,000

Accounts payable 14,600 11,100

Total $108,400 $116,000

ACCT6174 – Introduction to Financial Accounting

Additional information:

1. Net income was $19,300. Dividends declared and paid were $15,400.

2. Equipment which cost $10,000 and had accumulated depreciation of $2,200 was sold

for $3,800.

3. All other changes in non-current account balances had a direct effect on cash flows,

except the change in accumulated depreciation.

Instruction

(a) Prepare a statement of cash flows for 2014 using the indirect method.

(b) Compute free cash flow.

Case 3

Unduh Laporan Keuangan (yang di audit) dari Bank Mandiri tahun 2014. Hitung rasio-rasio

profitabilitas, solvabilitas, dan likuiditas untuk tahun 2014, serta berikan analisa mengenai

keadaan keuangan Bank Mandiri pada tahun 2014 dibandingkan dengan tahun 2013.

ACCT6174 – Introduction to Financial Accounting

Potrebbero piacerti anche

- Revision Questions - CH 17 - SolutionsDocumento4 pagineRevision Questions - CH 17 - SolutionsMinh ThưNessuna valutazione finora

- Revision Questions - CH 17 - QuestionsDocumento3 pagineRevision Questions - CH 17 - QuestionsMinh ThưNessuna valutazione finora

- Janjua CompanyDocumento3 pagineJanjua CompanySyed Muhammad Ali OmerNessuna valutazione finora

- SolotionsDocumento34 pagineSolotionsabdulrahman Abdullah100% (1)

- Assessed Coursework 2 - S2 2020 UpdateDocumento7 pagineAssessed Coursework 2 - S2 2020 UpdateArmaghan Ali MalikNessuna valutazione finora

- ACCT10002 Tutorial 9 ExercisesDocumento6 pagineACCT10002 Tutorial 9 ExercisesJING NIENessuna valutazione finora

- Chapter 12 ExercisesDocumento2 pagineChapter 12 ExercisesAreeba QureshiNessuna valutazione finora

- Exhibit 17. Goodwill Calculation and The Consolidated Balance SheetDocumento4 pagineExhibit 17. Goodwill Calculation and The Consolidated Balance SheetЭниЭ.Nessuna valutazione finora

- E5 8, E5 11, P5 3, P5 6Documento12 pagineE5 8, E5 11, P5 3, P5 6CellinejosephineNessuna valutazione finora

- 3 - Cash Flow Statement - Indirect Method - QuestionsDocumento3 pagine3 - Cash Flow Statement - Indirect Method - Questionsmikheal beyber100% (1)

- Llagas 01 Laboratory Exercise 1Documento5 pagineLlagas 01 Laboratory Exercise 1Angela Fye LlagasNessuna valutazione finora

- Session 11,12&13 AssignmentDocumento3 pagineSession 11,12&13 AssignmentMardi SutiosoNessuna valutazione finora

- Lan Services Incorporated Income Statement For The Year Ended December 31,2020Documento5 pagineLan Services Incorporated Income Statement For The Year Ended December 31,2020Jasmine ActaNessuna valutazione finora

- Clarke Inc. HighlightedDocumento4 pagineClarke Inc. HighlightedAdams BruinsNessuna valutazione finora

- Cash Flow - HandoutDocumento3 pagineCash Flow - HandoutMichelle ManuelNessuna valutazione finora

- Comparative Financial Statements: Heritage Antiquing Services Comparative Balance Sheet (Dollars in Thousands)Documento2 pagineComparative Financial Statements: Heritage Antiquing Services Comparative Balance Sheet (Dollars in Thousands)Rose BaynaNessuna valutazione finora

- CH 13Documento4 pagineCH 13Sri HimajaNessuna valutazione finora

- FAOMA Part 3 Quiz Complete SolutionsDocumento3 pagineFAOMA Part 3 Quiz Complete SolutionsMary De JesusNessuna valutazione finora

- Garing, Aireen - Sa No.13 Statement of CashflowsDocumento3 pagineGaring, Aireen - Sa No.13 Statement of CashflowsAireen GaringNessuna valutazione finora

- E5-11 (Statement of Financial Position Preparation) Presented Below Is TheDocumento7 pagineE5-11 (Statement of Financial Position Preparation) Presented Below Is Thedebora yosika100% (1)

- Class Problems CH 4Documento9 pagineClass Problems CH 4Eduardo Negrete100% (2)

- Akuntansi Keuangan 1 TUGAS E5.11, E5.12, E5.15 DAN E5.16 Kelas ADocumento8 pagineAkuntansi Keuangan 1 TUGAS E5.11, E5.12, E5.15 DAN E5.16 Kelas ADedep0% (1)

- Statement of Cash Flow - SolutionDocumento8 pagineStatement of Cash Flow - SolutionHân NabiNessuna valutazione finora

- Financial Accounting HomeworkDocumento9 pagineFinancial Accounting HomeworkDương Nguyễn BìnhNessuna valutazione finora

- Ch23 StatementofCashFlowExamples Zeke and ZoeDocumento4 pagineCh23 StatementofCashFlowExamples Zeke and ZoeHossein ParvardehNessuna valutazione finora

- Assignment 03Documento7 pagineAssignment 03Nadeera GalagedarageNessuna valutazione finora

- Accounting Sharim Final ExamDocumento5 pagineAccounting Sharim Final ExamsubhanNessuna valutazione finora

- AC213 Ch03 ExerciseSolutionsDocumento24 pagineAC213 Ch03 ExerciseSolutionsJoshua Miguel R. SevillaNessuna valutazione finora

- FM1 ActivityDocumento4 pagineFM1 ActivityChieMae Benson Quinto100% (1)

- Financial Statement Analysis QuestionsDocumento4 pagineFinancial Statement Analysis QuestionsRisha OsfordNessuna valutazione finora

- Chapter 8Documento27 pagineChapter 8Francesz VirayNessuna valutazione finora

- Cada IntmgtAcctg3Exer1Documento7 pagineCada IntmgtAcctg3Exer1KrishNessuna valutazione finora

- ABM 14 - Casañas - BALANCE SHEETDocumento1 paginaABM 14 - Casañas - BALANCE SHEETCasañas, Gillian DrakeNessuna valutazione finora

- Statement of Change in Working Capital & Inflows/Outflows of Working CapitalDocumento5 pagineStatement of Change in Working Capital & Inflows/Outflows of Working CapitalChandani DesaiNessuna valutazione finora

- Cashflow Practice Solution-AdditionalDocumento5 pagineCashflow Practice Solution-AdditionalNadjah JNessuna valutazione finora

- Chapter 16 Cash FlowsDocumento4 pagineChapter 16 Cash Flowsjou20220354Nessuna valutazione finora

- Problem 1: Cash Flow Statement (Class Practice)Documento2 pagineProblem 1: Cash Flow Statement (Class Practice)ronamiNessuna valutazione finora

- Property, Plant, Equipment: Abbey Corporation Statement of Financial Position DECEMBER 31,2015 AssetDocumento4 pagineProperty, Plant, Equipment: Abbey Corporation Statement of Financial Position DECEMBER 31,2015 AssetAstri KaruniaNessuna valutazione finora

- Cashflow Exercise - RocastleDocumento1 paginaCashflow Exercise - RocastleAbrashiNessuna valutazione finora

- Revision - Additional ExercisesDocumento2 pagineRevision - Additional ExercisesĐào Huyền Trang 4KT-20ACNNessuna valutazione finora

- Chapter 7Documento4 pagineChapter 7Aisha AlarimiNessuna valutazione finora

- Finacct+202 F03Documento4 pagineFinacct+202 F03LijelNessuna valutazione finora

- Activity-13 GreenDocumento3 pagineActivity-13 GreenLaura KissNessuna valutazione finora

- Class 12 Accountancy CBSE Cash Flow StatementDocumento7 pagineClass 12 Accountancy CBSE Cash Flow StatementSarvesh SreedharNessuna valutazione finora

- Liquidity Ratios - Practice QuestionsDocumento14 pagineLiquidity Ratios - Practice QuestionsOsama SaleemNessuna valutazione finora

- Debit Balances Increase (Decrease) Credit Balances Increase (Decrease)Documento7 pagineDebit Balances Increase (Decrease) Credit Balances Increase (Decrease)Shane TabunggaoNessuna valutazione finora

- Latihan 3Documento3 pagineLatihan 3Radit Ramdan NopriantoNessuna valutazione finora

- University of Business& Technology: Worksheet # 4Documento3 pagineUniversity of Business& Technology: Worksheet # 4nikowawaNessuna valutazione finora

- p5 6Documento10 paginep5 6/// MASTER DOGENessuna valutazione finora

- Addtional Cash Flow Problems and SolutionsDocumento7 pagineAddtional Cash Flow Problems and SolutionsHossein ParvardehNessuna valutazione finora

- 1712 Acct6174 Tmba TK4-W10-S15-R2 Team2Documento7 pagine1712 Acct6174 Tmba TK4-W10-S15-R2 Team2Adzinta Syamsa100% (1)

- PA Biweekly5 G1Documento3 paginePA Biweekly5 G1Quang NguyenNessuna valutazione finora

- 5th Year Pre-Final ExamDocumento3 pagine5th Year Pre-Final ExamJoshua UmaliNessuna valutazione finora

- Group Assignment: Financial AccountingDocumento4 pagineGroup Assignment: Financial AccountingNguyen HuongNessuna valutazione finora

- Latih Soal Kieso E5-6 E5-12Documento4 pagineLatih Soal Kieso E5-6 E5-12Agung Setya NugrahaNessuna valutazione finora

- Quiz 1Documento2 pagineQuiz 1jevieconsultaaquino2003Nessuna valutazione finora

- Name: Date: Instructor: Course: Accounting Principles Primer On Using Excel in AccountingDocumento2 pagineName: Date: Instructor: Course: Accounting Principles Primer On Using Excel in AccountingHernando MaulanaNessuna valutazione finora

- Cash Flow - Additional Exercises - SOLDocumento5 pagineCash Flow - Additional Exercises - SOLMathieu HindyNessuna valutazione finora

- Tugas MK11Documento2 pagineTugas MK11Nan BaeeeNessuna valutazione finora

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionDa EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionValutazione: 2.5 su 5 stelle2.5/5 (2)

- Factoring GeneralDocumento4.211 pagineFactoring Generalwilmer Gabriel Negron VelasquezNessuna valutazione finora

- List of Top UAE CompaniesDocumento8 pagineList of Top UAE CompaniesTauheedalHasan58% (19)

- Laddering Is A Qualitative Marketing Research TechniqueDocumento3 pagineLaddering Is A Qualitative Marketing Research TechniqueUsman AsifNessuna valutazione finora

- How Conversational Business Can Help You Get - and Stay - Closer To Your CustomersDocumento6 pagineHow Conversational Business Can Help You Get - and Stay - Closer To Your CustomersJodh SinghNessuna valutazione finora

- Buniyad Corporate ProfileDocumento17 pagineBuniyad Corporate ProfileHimanshu GarkhelNessuna valutazione finora

- Top 10 FMCG Companies in The WorldDocumento8 pagineTop 10 FMCG Companies in The WorldSparsh AgarwalNessuna valutazione finora

- AC530 Accounting Theory Module 6 AssignmentDocumento3 pagineAC530 Accounting Theory Module 6 AssignmentMCNessuna valutazione finora

- Literature Review On Vodafone and AirtelDocumento4 pagineLiterature Review On Vodafone and Airtelafmzsprjlerxio100% (1)

- Park & Koh (2017) Exploring The Relationship Between Perceived Pace of Technology..Documento9 paginePark & Koh (2017) Exploring The Relationship Between Perceived Pace of Technology..GislayneNessuna valutazione finora

- Types of LeasingDocumento22 pagineTypes of LeasingRavish Chitgope100% (2)

- Hospital ProcurementDocumento16 pagineHospital ProcurementAbir UpadhyayNessuna valutazione finora

- Assignment 3 Questionnaire Unit 2 1st TryDocumento6 pagineAssignment 3 Questionnaire Unit 2 1st TryDiego ArmandoNessuna valutazione finora

- Jobdesk - (Qa) Quality AssuranceDocumento5 pagineJobdesk - (Qa) Quality AssuranceHasna KhairiyyahNessuna valutazione finora

- Freight Calculation - FCL - SolutionDocumento4 pagineFreight Calculation - FCL - SolutionTanisha AgarwalNessuna valutazione finora

- Analyst PresentationDocumento59 pagineAnalyst Presentationsoreng.anupNessuna valutazione finora

- Cerda, Ciernelle R. Far 2 Module TypeDocumento45 pagineCerda, Ciernelle R. Far 2 Module TypeKaloy HoodNessuna valutazione finora

- JD Capgemini Insurance PDFDocumento1 paginaJD Capgemini Insurance PDFSankar DasNessuna valutazione finora

- Adamco Agricultural Farm Machinery Trading Management SystemDocumento2 pagineAdamco Agricultural Farm Machinery Trading Management SystemSerious GamerNessuna valutazione finora

- SR - Joinery Estimation Engineer/QS: Nidheesh.TDocumento4 pagineSR - Joinery Estimation Engineer/QS: Nidheesh.TTaseer BuchhNessuna valutazione finora

- Boeing 777 - A Financial Analysis of New Product LaunchDocumento26 pagineBoeing 777 - A Financial Analysis of New Product LaunchChristian CabariqueNessuna valutazione finora

- Full Download Book Foundations of Business PDFDocumento41 pagineFull Download Book Foundations of Business PDFbeulah.howland471100% (13)

- Infor - ERP - VISUAL - Detailed Functionality - Version9Documento78 pagineInfor - ERP - VISUAL - Detailed Functionality - Version9CAT MINING SHOVELNessuna valutazione finora

- Pert.5 Activity-Based Costing and ManagementDocumento44 paginePert.5 Activity-Based Costing and ManagementHanis AryNessuna valutazione finora

- Front OfficeDocumento98 pagineFront Officebeatrice nyambura MaiteriNessuna valutazione finora

- EOQ in AGro IndustryDocumento4 pagineEOQ in AGro IndustryBesty HNessuna valutazione finora

- Full Solution Manual For Principles of Taxation For Business and Investment Planning 2020 Edition 23Rd Edition Sally Jones Shelley Rhoades Catanach Sandra Callaghan PDF Docx Full Chapter ChapterDocumento36 pagineFull Solution Manual For Principles of Taxation For Business and Investment Planning 2020 Edition 23Rd Edition Sally Jones Shelley Rhoades Catanach Sandra Callaghan PDF Docx Full Chapter Chapteraxinitestundist98wcz93% (14)

- Ranjit Atwal LinkedinDocumento2 pagineRanjit Atwal LinkedinAmar DoshiNessuna valutazione finora

- SFPP 3 Fold BrochureDocumento2 pagineSFPP 3 Fold BrochureAmii AmoreNessuna valutazione finora

- Citibank Case Study Group1Documento11 pagineCitibank Case Study Group1Deepaksayu100% (1)

- Myra Condovfqbp PDFDocumento2 pagineMyra Condovfqbp PDFOdgaardOgle5Nessuna valutazione finora