Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

PWM Sunil and Nishi Gupta

Caricato da

swetaagarwal2706Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

PWM Sunil and Nishi Gupta

Caricato da

swetaagarwal2706Copyright:

Formati disponibili

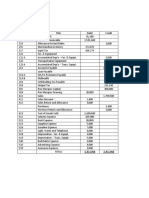

Sunil and Nishi Gupta

Personal Wealth Statement

March 31, 2010

Assets Rs. Rs. Percent

Liquid Assets

Savings A/C Balance 19,400 0.37

Cash in hand 3,400 0.07

Money Market Mutual Fund Balance 100,000 1.93

Cash Value of Life Insurance 0

Total Liquid Assets 122,800

Real Estate

Current Value of House 3,920,000 3,920,000 75.69

Personal Possessions

Car 280,000 5.41

Household Furnishings 180,000 3.48

Cable TV 19,200 0.37

Jewellery 80,000 1.54

Total Household Assets 559,200

Investment Assets

Paid up Value of Life Insurance Policy

Equity 300,000 5.79

Retirement Accounts 277,000 5.35

Long term Investment

Total Investment Accounts 577,000 11.14

Total Assets 5,179,000 100.00

Liabilities

Current Liabilities

Travel and entertainment card balance 80,000 1.54

Credit Card Balance 115,400 2.23

Total Current Liabilities 195,400

Long-Term Liabilities

Balance due on Car loan 106,000 2.05

Home loan 3,477,600 67.15

Total Long-Term Liabilites 3,583,600

Net Worth 1,400,000 1,400,000 27.03

Total Liabilities 5,179,000 100.00

Projections for the next years

March 31, 2011

Rs. Percent

57,144 0.96 107144

50,000 0.84 kept in hand because hospital expense may be needed

100,000 1.68 bought 1 lakh from cash surplus

0 nil as after 3 yrs

207,144 3.49

0.00

4,312,000 72.60 10% value appreciates

0.00

252,000 4.24 depreciate by 10 %

212,000 3.57 depreciate by 10 %

19,200 0.32 same

assume to be 80000 80,000 1.35 same

563,200 9.48

0.00

30000 0.51

300,000 5.05 investment of extra 1 lakh and 2 lakh of previous year

327,000 5.51 increase by 50000

200,000 3.37 increased fixed deposit by 1 lakh and last year 1 lakh

857,000 14.43

5,939,344 100.00

0.00 reduced to nil by paying off from savings

0 0.00 reduced to nil by paying off from money market fund

0 0.00

0.00

20,000 0.34

3402400 57.29

3,422,400 57.62

2,516,944 42.38

0.00

5,939,344 100.00

ense may be needed emergency

kh of previous year

nd last year 1 lakh

money market fund

Sunil and Nishi Gupta

Cash Flow Statement for the year ended Ma

Income (Cash Inflows) Rs. Rs.

Salary 2490000

Less:

Income Tax 493000

Social Security 215000

Total Deductions 708000

Take-Home pay 1782000

Interest earned on Savings 5000

Income from Investments 54000

Income from Investments: Equity@16% 48000

Income from fixed deposits @9% -

Income from money market @6% 6000

Total Income 1841000 1841000

Cash Outflows

Fixed Expenses

Home loan payment 376,000

Home insurance premium 32,000

Car insurance premium 16,000

Car loan payment 86,000

Medical insurance premium

Life Insurance Premium 0

Total Fixed Outflows 510,000 510000

Variable Expenses

Food and Clothing 260,000

Utilities 79,600

Telephone 25,600

Medical Expenses 24,000

Transportation 112,000

Trip to US and Canada 200,000

Recreation and Entertainment 160,000

Cable TV 19,200

Household Furnishings

Miscellaneous Payments 107,800

Total Variable Outflows 988,200

Total Outflows 1,498,200

Cash Surplus + (or deficit - ) 342,800

Allocation of Surplus

Emergency Fund Savings

Cash and Bank Balance 22800

Savings for short-term / Intermediate financial goals

Investment in Equity Shares 300,000

Addition to Mutual Fund 20,000

Savings / investing for long-term financial security

here of 2011 surplus 1 lakh to be used to pay of card balance

Projection for the next year

he year ended March 31, 2010

March 31, 2011

Percent Rs. Percent

2181000 15 % increase for sunil and 6 mo

350000

200000

550000

100.00 1631000 100

0.28 5000 0.31

3.03 total 41000 2.51

2.69 3 lakh equity 32000 1.96 2 lakh in equity

9000 0.55 1 lakh in fixed

0.34 1 lakh money 0 0.00 money market fund of 1 lakh pai

103.31 1677000 102.82

21.10 376,000 23.05

1.80 32,000 1.96

0.90 16,000 0.98

4.83 86,000 5.27

6,000 0.37

0.00 none 30,000 1.84 assume lic premium

28.62 546,000 33.48

0.00 Though it may increase due to in

14.59 240000 14.71 cut down by 60000 and increase

4.47 63176 3.87 cut down by 20000 and increase

1.44 27136 1.66 increase by 6 %

1.35 50440 3.09 normal 6% increase and 25000 f

6.29 83104 5.10 normal 6 % increase but as nishi

11.22 - cancelled

8.98 80000 4.90 cut down to half

1.08 0.00

50,000 3.07 household buy for kid

6.05 assume to be this 80,000 4.90

55.45 623,856 38.25

84.07 1,169,856 71.73

0.00

19.24 507,144 31.09

0.00

0.00

1.28 107,144 6.57

0.00 0.00

16.84 100000 6.13

1.12 100,000 6.13

0.00 100,000 6.13

next year

% increase for sunil and 6 months salary for nishi

h in equity

h in fixed

ey market fund of 1 lakh paid to pay credit card balance

me lic premium

ugh it may increase due to inflation we have to cut all expenses down

down by 60000 and increase of 20%

down by 20000 and increase of 6%

ease by 6 %

mal 6% increase and 25000 for hospital charges

mal 6 % increase but as nishi not so cut down by 30 %

down to half

ehold buy for kid

Err:509

RATIOS

Debt Ratio = Liabilities / Net Worth

Debt Ratio = (Current Liabilities + Long term Liabilities) / Net Worth

Debt Ratio

Current Ratio= Liquid Assets / Current Liabilities

Current Ratio

Liquidity Ratio = Liquid Assets / Expenses (also known as basic solvency ratio)

or Liquid Assets / Net Worth

Liquidity Ratio (in months)

Debt Payments Ratio = Credit Payments / Take-Home Pay

or Debt to Income Ratio

Debt Payments Ratio (in %)

Savings Ratio = Amount Saved / Gross Income

Savings Ratio (in %)

Debt to Assets Ratio = Total Liabilities / Total Assets

Debt to Assets Ratio

Solvency Ratio = Total Net Worth / Total Assets

Solvency Ratio (in %)

FY 2009 FY 2010 FY 2011

2.70 1.65 1.34

0.63 2.86 1.89

8.77 12.80 7.09

25.93 28.33 30.70

22.40 25.74 15.62

0.73 0.62 0.57

27.03 37.73 42.76

ANNUAL BUDGET

Budgeted Amounts

Rs. Percent

Projected Inflows

Salary 1,782,000

Interest on Savings 5,000

Income from Investments 40,000

Total Inflows 1,827,000 100

Projected Outflows

Emergency Fund and Savings:

Emergency Fund Savings 70,000 3.83

Investment in Equity Shares 300,000 16.42

Addition to Mutual Fund 29,800 1.63

Savings for risk cover 100,000 5.47

Total Savings 499800 27.36

Home loan payment 376,000 20.58

Home insurance premium 32,000 1.75

Car insurance premium 16,000 0.88

Car loan payment 86,000 4.71

Total Fixed Expenses 510,000 27.91

Food and Clothing 200,000 10.95

Utilities 79,600 4.36

Telephone 25,600 1.40

Medical Expenses 24,000 1.31

Transportation 84,000 4.60

Trip to US and Canada 200,000 10.95

Recreation and Entertainment 120,000 6.57

Miscellaneous Payments 84,000 4.60

Total Variable Outflows 817,200 44.73

Total Outflows 1,827,000 100

Actual Variance

Amounts

Rs.

1,782,000

5,000

40,000

1,827,000

22800 47,200

300,000 0

20,000 9,800

0 100,000

342800 157000

376,000 0

32,000 0

16,000 0

86,000 0

510,000 0

260,000 -60,000

79,600 0

25,600 0

24,000 0

112,000 -28,000

200,000 0

160,000 -40,000

113,000 -29,000

974,200 -157,000

1,984,000 157,000

Potrebbero piacerti anche

- Persfin 5&6Documento3 paginePersfin 5&6Vicente BerdanNessuna valutazione finora

- 1Documento20 pagine1Denver AcenasNessuna valutazione finora

- Insurance QuestionsDocumento2 pagineInsurance Questionsmarkobare2019Nessuna valutazione finora

- Midterm Excel Worksheet - OlivieriDocumento14 pagineMidterm Excel Worksheet - OlivieriEmanuele OlivieriNessuna valutazione finora

- Lt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Documento5 pagineLt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Arif HossainNessuna valutazione finora

- INCOTAXDocumento4 pagineINCOTAXnicole bancoroNessuna valutazione finora

- Ch5 Additional Q OnlyDocumento13 pagineCh5 Additional Q OnlynigaroNessuna valutazione finora

- Trial Balance February 28, 20X1Documento3 pagineTrial Balance February 28, 20X1Angelica MaeNessuna valutazione finora

- Annual Accounts - Wishlist Ltd.Documento4 pagineAnnual Accounts - Wishlist Ltd.shreevarshashankarNessuna valutazione finora

- Villena Stephanie A12-02 QA2 Attempt2Documento8 pagineVillena Stephanie A12-02 QA2 Attempt2Stephanie VillenaNessuna valutazione finora

- 027 Practice Test 09 Accounting Test Solution Subjective Udesh RegularDocumento6 pagine027 Practice Test 09 Accounting Test Solution Subjective Udesh Regulardeathp006Nessuna valutazione finora

- Advanced Accounting 2DDocumento5 pagineAdvanced Accounting 2DHarusiNessuna valutazione finora

- Question No 1: A-Gross PayDocumento6 pagineQuestion No 1: A-Gross PayArmaghan Ali MalikNessuna valutazione finora

- Question Bank - Financial Reporting and AnalysisDocumento8 pagineQuestion Bank - Financial Reporting and AnalysisSagar BhandareNessuna valutazione finora

- Statement AnalysisDocumento4 pagineStatement AnalysisrameelNessuna valutazione finora

- Cash Flow Tutorial QnsDocumento13 pagineCash Flow Tutorial QnsCristian Renatus100% (1)

- C 1Documento10 pagineC 1biniamNessuna valutazione finora

- 20211KOMPAK - TM04 List of AccountDocumento2 pagine20211KOMPAK - TM04 List of AccountMelani Siti NurfauziahNessuna valutazione finora

- Twice Incorporated: Percentage of Recov For USC W/o 35%Documento4 pagineTwice Incorporated: Percentage of Recov For USC W/o 35%Paolo LocquiaoNessuna valutazione finora

- Natal NeedsDocumento6 pagineNatal NeedsMARVIE JOY BALUMA CABIOCNessuna valutazione finora

- Problem 7-1 2019: Date Interest Received Interest Income Amortization Carrying ValueDocumento11 pagineProblem 7-1 2019: Date Interest Received Interest Income Amortization Carrying ValueJane Carla GarbidaNessuna valutazione finora

- Balance Sheet ExampleDocumento2 pagineBalance Sheet ExampleKC XitizNessuna valutazione finora

- Sample QuestionsDocumento3 pagineSample QuestionstulikaNessuna valutazione finora

- Assignment-5-Single-Entry-Method-students-DAVID FinalDocumento11 pagineAssignment-5-Single-Entry-Method-students-DAVID FinalJOY MARIE RONATONessuna valutazione finora

- v2 Assignment Due 26.3.2023Documento24 paginev2 Assignment Due 26.3.2023alisa rachelNessuna valutazione finora

- Particulers Quantity: Project CostDocumento26 pagineParticulers Quantity: Project CostRashan GidaNessuna valutazione finora

- Questions For Assignment 2078 (NOU, BBS 1st Yr, Account and Taxation, Account Part)Documento4 pagineQuestions For Assignment 2078 (NOU, BBS 1st Yr, Account and Taxation, Account Part)rishi dhungel100% (1)

- Financial Planning For Mr. John SharmaDocumento19 pagineFinancial Planning For Mr. John SharmaanushreegoNessuna valutazione finora

- Balance Sheet PT TCP M Arif Rahman - 2005151018 - Akp 3aDocumento1 paginaBalance Sheet PT TCP M Arif Rahman - 2005151018 - Akp 3aM Arif RahmanNessuna valutazione finora

- Balance Sheet PT TCP M Arif Rahman - 2005151018 - Akp 3aDocumento1 paginaBalance Sheet PT TCP M Arif Rahman - 2005151018 - Akp 3aM Arif RahmanNessuna valutazione finora

- Partnership Illustration 16102022Documento8 paginePartnership Illustration 16102022vladsteinarminNessuna valutazione finora

- Problems On Individual Taxation AY 2020-21 StudentsDocumento9 pagineProblems On Individual Taxation AY 2020-21 StudentsAminul Islam RubelNessuna valutazione finora

- Tutorial 4 - Consolidated Statement of Cash FlowsDocumento6 pagineTutorial 4 - Consolidated Statement of Cash FlowsFatinNessuna valutazione finora

- 5.0 Financial Plan: Chapter FiveDocumento6 pagine5.0 Financial Plan: Chapter FiveJane WangariNessuna valutazione finora

- Randall Corporation and Sharp Company Consolidation Worksheet December 31, 20X7Documento5 pagineRandall Corporation and Sharp Company Consolidation Worksheet December 31, 20X7Diane MagnayeNessuna valutazione finora

- FINAMAA Topic 2 Additional ActivityDocumento2 pagineFINAMAA Topic 2 Additional ActivityJeasmine Andrea Diane PayumoNessuna valutazione finora

- QuestionsDocumento13 pagineQuestionsAriaNessuna valutazione finora

- Soal AkuntansiDocumento4 pagineSoal AkuntansinairobiNessuna valutazione finora

- Buenaventura EJ BSA1-B Prob#8 Page159Documento6 pagineBuenaventura EJ BSA1-B Prob#8 Page159AnonnNessuna valutazione finora

- Bernardo Corporation Statement of Financial Position As of Year 2019 AssetsDocumento3 pagineBernardo Corporation Statement of Financial Position As of Year 2019 AssetsJean Marie DelgadoNessuna valutazione finora

- Additional Tutorial Question-Company AccountDocumento3 pagineAdditional Tutorial Question-Company AccountmaiNessuna valutazione finora

- Scenario Summary: Changing CellsDocumento10 pagineScenario Summary: Changing CellsLệ NguyễnNessuna valutazione finora

- Aldrich Magnaye BSA 1 B Problem 8 ActivityDocumento5 pagineAldrich Magnaye BSA 1 B Problem 8 ActivityAnonnNessuna valutazione finora

- Bac 203 Cat 2Documento3 pagineBac 203 Cat 2Brian MutuaNessuna valutazione finora

- Advanced Accounting 2BDocumento4 pagineAdvanced Accounting 2BHarusiNessuna valutazione finora

- Final Account ProblemDocumento22 pagineFinal Account ProblemAbhijeet Anand100% (1)

- Financial Analysis ProblemDocumento16 pagineFinancial Analysis ProblemShreyashi DasNessuna valutazione finora

- FFS - NumericalsDocumento5 pagineFFS - NumericalsFunny ManNessuna valutazione finora

- Capital Budgeting - 2021Documento7 pagineCapital Budgeting - 2021Mohamed ZaitoonNessuna valutazione finora

- Example: 2 Preparation of Personal Financial Statements and Calculation of RatiosDocumento2 pagineExample: 2 Preparation of Personal Financial Statements and Calculation of RatiosSocio Fact'sNessuna valutazione finora

- The Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingDocumento8 pagineThe Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingArif UddinNessuna valutazione finora

- AFE3871 Assingment 2 Memo 1Documento45 pagineAFE3871 Assingment 2 Memo 1SoblessedNessuna valutazione finora

- Model Solution Solution To The Question No. 1Documento5 pagineModel Solution Solution To The Question No. 1HossainNessuna valutazione finora

- Bsa Quiz 2.0 - Pure ProbsDocumento4 pagineBsa Quiz 2.0 - Pure ProbsCyrss BaldemosNessuna valutazione finora

- Appropriation Ordinance 2022Documento5 pagineAppropriation Ordinance 2022Romulo Sierra Jr.Nessuna valutazione finora

- Westmont PLCDocumento5 pagineWestmont PLCmutuamutisya306Nessuna valutazione finora

- 11th AccountsDocumento8 pagine11th AccountsShubham sumbriaNessuna valutazione finora

- Trial BalDocumento1 paginaTrial BalSun ShineNessuna valutazione finora

- Discounted Cash Flow: A Theory of the Valuation of FirmsDa EverandDiscounted Cash Flow: A Theory of the Valuation of FirmsNessuna valutazione finora

- Corporate Actions: A Guide to Securities Event ManagementDa EverandCorporate Actions: A Guide to Securities Event ManagementNessuna valutazione finora

- Middle EastDocumento45 pagineMiddle Eastswetaagarwal2706100% (1)

- IndiaDocumento114 pagineIndiastutivadalia100% (1)

- WrigleyDocumento4 pagineWrigleyswetaagarwal2706Nessuna valutazione finora

- Assurance PlanDocumento1 paginaAssurance Planswetaagarwal2706Nessuna valutazione finora

- Demographic Divisions: Roots or WingsDocumento16 pagineDemographic Divisions: Roots or Wingsswetaagarwal2706Nessuna valutazione finora

- HobbiesDocumento1 paginaHobbiesswetaagarwal2706Nessuna valutazione finora

- Study of Consumer Buying Behavior in Two Wheeler: Submitted To: Dr. S.K.PandeyDocumento24 pagineStudy of Consumer Buying Behavior in Two Wheeler: Submitted To: Dr. S.K.Pandeyswetaagarwal2706Nessuna valutazione finora

- U.S. Bancorp Investments Client Relationship Summary: What Investment Services and Advice Can You Provide Me?Documento23 pagineU.S. Bancorp Investments Client Relationship Summary: What Investment Services and Advice Can You Provide Me?Rodrigo SantosNessuna valutazione finora

- Swot Analysis On Investment ProductDocumento11 pagineSwot Analysis On Investment Productashish sunny0% (1)

- Mission of SEBIDocumento7 pagineMission of SEBIananth100% (1)

- On Consumer Perspective Towards Various Investment Sectors in The Leading SolutionDocumento26 pagineOn Consumer Perspective Towards Various Investment Sectors in The Leading SolutionAbhishek Choudhary89% (9)

- Mutual Fund NISM VA Question BankDocumento12 pagineMutual Fund NISM VA Question Banksimplypaisa89% (18)

- A Study On Changing Investment Pattern Among Youth: G.H.Patel Post Graduate Institute of Business ManagementDocumento50 pagineA Study On Changing Investment Pattern Among Youth: G.H.Patel Post Graduate Institute of Business ManagementNaveen SahaNessuna valutazione finora

- FIN4020-CHAPTER 2-SAMPLE MCQsDocumento2 pagineFIN4020-CHAPTER 2-SAMPLE MCQsSyahrul Aman IsmailNessuna valutazione finora

- 1 Concept and Role of A Mutual FundDocumento7 pagine1 Concept and Role of A Mutual FundEquity NestNessuna valutazione finora

- Groww Nifty Total Market Index Fund KIMDocumento37 pagineGroww Nifty Total Market Index Fund KIMG1 ROYALNessuna valutazione finora

- Ketan Parekh ScamDocumento32 pagineKetan Parekh Scamolkpq0% (1)

- Harish Project of NJ India InvestmentDocumento82 pagineHarish Project of NJ India InvestmentharishmnNessuna valutazione finora

- A Study of Investment Pattern in Working Women - To Make Them More CompetentDocumento3 pagineA Study of Investment Pattern in Working Women - To Make Them More CompetentAditi Sharma100% (1)

- OYO - Oravel Stays Limited ProspectusDocumento642 pagineOYO - Oravel Stays Limited ProspectusSuraj MahendrakarNessuna valutazione finora

- Research Proposal On Emerging Patterns of The Indian EconomyDocumento7 pagineResearch Proposal On Emerging Patterns of The Indian Economybhanu.chanduNessuna valutazione finora

- Hedge FundsDocumento265 pagineHedge FundsMatt EbrahimiNessuna valutazione finora

- CS Executive Important Questions and TopicsDocumento10 pagineCS Executive Important Questions and Topics251105Nessuna valutazione finora

- SAPM-1 Assignment-2021 - Rahul MJDocumento6 pagineSAPM-1 Assignment-2021 - Rahul MJMujeeb Ur RahmanNessuna valutazione finora

- BCG Global Asset Management 2020 May 2020 R - tcm9 247209 PDFDocumento27 pagineBCG Global Asset Management 2020 May 2020 R - tcm9 247209 PDFLawrence HNessuna valutazione finora

- Chapter 13 Investing FundamentalsDocumento3 pagineChapter 13 Investing Fundamentalsiljuneli3801Nessuna valutazione finora

- Anand Rathi ReportDocumento31 pagineAnand Rathi Reportdev0078950% (2)

- CFP Syllabus Module 1 FPSB Investment Planning Specialist GuideDocumento41 pagineCFP Syllabus Module 1 FPSB Investment Planning Specialist Guideanand maheshwariNessuna valutazione finora

- Ijrpr2741 Study On Investor Perception Towards Stock Market InvestmentDocumento19 pagineIjrpr2741 Study On Investor Perception Towards Stock Market InvestmentAbhay RanaNessuna valutazione finora

- Vatsal Black BookDocumento37 pagineVatsal Black BookParth PatelNessuna valutazione finora

- FEMA - Direct Investment by Residents in JV & Wholly Owned Subs. Abroad PDFDocumento56 pagineFEMA - Direct Investment by Residents in JV & Wholly Owned Subs. Abroad PDFNidhi SinglaNessuna valutazione finora

- 5 6071047602743279747Documento2 pagine5 6071047602743279747ratanNessuna valutazione finora

- Investing For Dummies (Artikel)Documento22 pagineInvesting For Dummies (Artikel)Riska KurniaNessuna valutazione finora

- Security Analysis and Portfolio Management by Rohini Singh 2018Documento446 pagineSecurity Analysis and Portfolio Management by Rohini Singh 2018Aman Kumar SharanNessuna valutazione finora

- Uti Mcom ProjectDocumento42 pagineUti Mcom ProjectParinShah100% (3)

- Cash Flow School WebinarDocumento7 pagineCash Flow School WebinarNehaKapoorNessuna valutazione finora

- Practice Questions For AMFI TestDocumento36 paginePractice Questions For AMFI TestSuraj KumarNessuna valutazione finora