Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Public Add Notes

Caricato da

Albertus MuheuaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Public Add Notes

Caricato da

Albertus MuheuaCopyright:

Formati disponibili

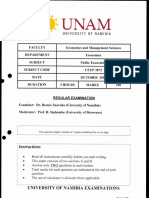

Essentials/Features/Characteristics of a Good Tax System

1. Should lead to fair and equal distribution of wealth in the community.

2. Should be composed in such a way that it yields sufficient revenue to the government

3. The cost on collection of taxes should not be excessive.

4. The burden of taxes should be distributed in proportion to the ability of the tax payer, i e it

should be progressive in character.

5. The system of taxation should be fairly simple, It should also be easy to administer.

What is the significance of the distinction between domestic debt and external debt?

• The first focuses on the currency in which the debt is issued (with external debt defined as foreign

currency debt and domestic debt as local currency debt).

•The second focuses on the residence of the creditor (external debt is debt owed to non-residents,

while domestic debt is owed to residents).

• The third focuses on the place of issuance and the legislation that regulates the debt contract (external

debt is debt issued in foreign countries and under the jurisdiction of a foreign court, while domestic debt

are all debt issued in the domestic market.

“Ricardian Equivalence is the view that deficits do not alter interest rates because citizens today see that

deficits today will be financed with higher taxes tomorrow and citizens save in order to have the funds

to pay those higher taxes”.

• He argued that rational, forward-looking households do understand that issuing bonds “today”

requires to raise taxes “tomorrow” such that the financing scheme is neutral w.r.t. consumption. Or also

known as “The Ricardian Neutrality Theorem”

• Ricardian Equivalence theorem suggests that when a government tries to stimulate demand by

increasing debt-financed government spending, demand remains unchanged. As rational consumers will

save the extra money in order to pay future tax they will incur. • The rise in private saving exactly offsets

the fall in public saving (Mankiw, 2012) and therefore aggregate demand remains unchanged. • The

question at issue in the Ricardian equivalence debate is whether a given path of public expenditure is

best financed by raising taxes or issuing debt. Ricardian equivalence teaches that fiscal policy changes

cannot be used by governments in order to stimulate economic growth as the households are rational

and realize that these policy changes are temporary and therefore alter their behavior. • The theory

opposes the classical and Keynesian view, where fiscal policy changes alter economic growth.

Some arguments

• Proponents of the Ricardian view assume that people are rational when making decisions such as

choosing how much of their income to consume and how much to save. When the government borrows

to pay for current spending, rational consumers look ahead to anticipate the future taxes required to

support this debt. • One argument for the traditional view is that people are myopic: they see a

decrease in taxes in such a way that their current consumption increases because of this new “wealth.”

They don’t see that when expansionary fiscal policy is financed through bonds, they will have to pay

more taxes in the future since bonds are just a tax-postponements.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Final ResolutionDocumento2 pagineFinal ResolutionAlbertus MuheuaNessuna valutazione finora

- UntitledDocumento17 pagineUntitledAlbertus Muheua0% (1)

- Public Add NotesDocumento1 paginaPublic Add NotesAlbertus MuheuaNessuna valutazione finora

- X y X y : ECO 305 - FALL 2003 - September 25Documento6 pagineX y X y : ECO 305 - FALL 2003 - September 25irushadNessuna valutazione finora

- Microeconomic Theory: Basic Principles and Extensions, 9eDocumento32 pagineMicroeconomic Theory: Basic Principles and Extensions, 9eTahir FarooqNessuna valutazione finora

- According To WilliamsDocumento1 paginaAccording To WilliamsAlbertus MuheuaNessuna valutazione finora

- CH 03Documento42 pagineCH 03natiatsiqvadzeNessuna valutazione finora

- Econ11 HW PDFDocumento207 pagineEcon11 HW PDFAlbertus MuheuaNessuna valutazione finora

- Sociology ASS 1Documento3 pagineSociology ASS 1Albertus MuheuaNessuna valutazione finora

- CH 04Documento49 pagineCH 04Albertus MuheuaNessuna valutazione finora

- Dasmani's QuizDocumento9 pagineDasmani's QuizFrederick AdjepongNessuna valutazione finora

- Lec03 PDFDocumento6 pagineLec03 PDFAlbertus MuheuaNessuna valutazione finora

- Dasmani's QuizDocumento9 pagineDasmani's QuizFrederick AdjepongNessuna valutazione finora

- Public Management ASS 1Documento2 paginePublic Management ASS 1Albertus MuheuaNessuna valutazione finora

- X y X y : ECO 305 - FALL 2003 - September 25Documento6 pagineX y X y : ECO 305 - FALL 2003 - September 25irushadNessuna valutazione finora

- 3070 PSet-1 SolutionsDocumento10 pagine3070 PSet-1 SolutionsvikasNessuna valutazione finora

- 3070 PSet-4 SolutionsDocumento11 pagine3070 PSet-4 SolutionsvikasNessuna valutazione finora

- Business ManagementDocumento3 pagineBusiness ManagementAlbertus MuheuaNessuna valutazione finora

- Slys TemplateDocumento1 paginaSlys TemplateAlbertus MuheuaNessuna valutazione finora

- Answers To Homework 3 Fall 2014Documento12 pagineAnswers To Homework 3 Fall 2014Brandon RossmanNessuna valutazione finora

- Public Management ASS 1Documento2 paginePublic Management ASS 1Albertus MuheuaNessuna valutazione finora

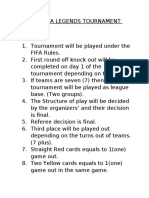

- Okondomba LEGENDSDocumento2 pagineOkondomba LEGENDSAlbertus MuheuaNessuna valutazione finora

- UntitledDocumento85 pagineUntitledAlbertus MuheuaNessuna valutazione finora

- Development Planning 2019Documento27 pagineDevelopment Planning 2019Albertus MuheuaNessuna valutazione finora

- ReferencesDocumento1 paginaReferencesAlbertus MuheuaNessuna valutazione finora

- Theoreis of Econmics Growth 2019Documento73 pagineTheoreis of Econmics Growth 2019Albertus MuheuaNessuna valutazione finora

- Economics of Growth and Development 2nd Test 2018Documento1 paginaEconomics of Growth and Development 2nd Test 2018Albertus MuheuaNessuna valutazione finora

- Ceup3872 2016 NorDocumento3 pagineCeup3872 2016 NorAlbertus MuheuaNessuna valutazione finora

- 2019 - Topic 13 - Excess Burden of Taxation and Optimal TaxationDocumento11 pagine2019 - Topic 13 - Excess Burden of Taxation and Optimal TaxationAlbertus MuheuaNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Customer Inquiry ReportDocumento4 pagineCustomer Inquiry ReportDian LelaNessuna valutazione finora

- Husky Recostado - PaperFreakDocumento16 pagineHusky Recostado - PaperFreakJika KikutakaNessuna valutazione finora

- LBP Form No. 2 RevisedDocumento80 pagineLBP Form No. 2 RevisedJhumar YuNessuna valutazione finora

- ZaykaDocumento15 pagineZaykaAndrea AmprinoNessuna valutazione finora

- CHE655 - Plant Design Project #5 Summer 2010 Design of An Ehtyl Benzene Production ProcessDocumento13 pagineCHE655 - Plant Design Project #5 Summer 2010 Design of An Ehtyl Benzene Production ProcessAyşe ÖztürkNessuna valutazione finora

- AudioEncyclopediaofIIEP EntrepreneurialSpiritDocumento3 pagineAudioEncyclopediaofIIEP EntrepreneurialSpiritJessica Lizette MayaNessuna valutazione finora

- MGT 504 - MidtermDocumento12 pagineMGT 504 - MidtermhamzaNessuna valutazione finora

- Q40 Bidding DocumentDocumento47 pagineQ40 Bidding DocumentYashveer TakooryNessuna valutazione finora

- 667 Ton Declared ValueDocumento2 pagine667 Ton Declared Valuenurun nahar chowdhuryNessuna valutazione finora

- Modern and Minimal Black and White Company Profile PresentationDocumento20 pagineModern and Minimal Black and White Company Profile PresentationKaren MunozNessuna valutazione finora

- Excel Homework Exercises ANSWERSDocumento45 pagineExcel Homework Exercises ANSWERSJyoti BarwarNessuna valutazione finora

- 01 Activity 1Documento1 pagina01 Activity 1Monaliza PepitoNessuna valutazione finora

- Ucsp Worksheet Q2 W1 FinalDocumento8 pagineUcsp Worksheet Q2 W1 FinalCHRISTIAN DAVED BARROZONessuna valutazione finora

- BMGT 26 International Trade and AgreementsDocumento10 pagineBMGT 26 International Trade and AgreementsJULIUS CAESAR MANABATNessuna valutazione finora

- Vp-En SOGITECH PDFDocumento8 pagineVp-En SOGITECH PDFSgk ManikandanNessuna valutazione finora

- List of Coal Plants To Shut DownDocumento10 pagineList of Coal Plants To Shut DownSurendar JaipalNessuna valutazione finora

- The Law of ContractDocumento19 pagineThe Law of ContractEmmanuel AbaiteyNessuna valutazione finora

- Why Spiral Column Can Sustain More Load Compared To The Tied ColumnDocumento2 pagineWhy Spiral Column Can Sustain More Load Compared To The Tied ColumnARIFUL ISLAMNessuna valutazione finora

- Sans 10160-4 (2017) PDFDocumento53 pagineSans 10160-4 (2017) PDFPhillipus Kruger100% (2)

- Marketing StrategyDocumento15 pagineMarketing StrategyDimbag Gold WilliyantoNessuna valutazione finora

- Introduction To Operations Research 10th Edition Hillier Test BankDocumento36 pagineIntroduction To Operations Research 10th Edition Hillier Test Bankdorothy100% (14)

- Questionnaires (Honda Atlas)Documento17 pagineQuestionnaires (Honda Atlas)Tayyab AwaysNessuna valutazione finora

- StoreDocumento1 paginaStoreChance DengNessuna valutazione finora

- Quote US105785Documento4 pagineQuote US105785Yamydal Bog-aconNessuna valutazione finora

- Cement - Mortar: Material Testing EquipmentDocumento49 pagineCement - Mortar: Material Testing EquipmentjohanNessuna valutazione finora

- 2022-08-16T23-02 Transaction #5265065346943735-10443044 PDFDocumento3 pagine2022-08-16T23-02 Transaction #5265065346943735-10443044 PDFsajawal zamanNessuna valutazione finora

- Tally Notes in Hindi PDFDocumento11 pagineTally Notes in Hindi PDFvikee kevat83% (911)

- Gender and The Economic Crisis in Europe: Politics, Institutions and IntersectionalityDocumento290 pagineGender and The Economic Crisis in Europe: Politics, Institutions and IntersectionalitynoizatuNessuna valutazione finora

- Microeconomics Australia in The Global Environment Australian 1st Edition Parkin Solutions ManualDocumento17 pagineMicroeconomics Australia in The Global Environment Australian 1st Edition Parkin Solutions Manualdetectchittrahjgn100% (20)

- AfriansyahDocumento28 pagineAfriansyah20312262Nessuna valutazione finora