Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Goodway Chemical FY 2019

Caricato da

Bhavin Sagar0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

44 visualizzazioni30 paginesadasass

Titolo originale

Goodway Chemical FY 2019 - Copy

Copyright

© © All Rights Reserved

Formati disponibili

PDF o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentosadasass

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

44 visualizzazioni30 pagineGoodway Chemical FY 2019

Caricato da

Bhavin Sagarsadasass

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

Sei sulla pagina 1di 30

GOODWAY CHEMICALS PVT LTD.

REGD ADD: 6" FLOOR, $ 6-7, PINNACLE BUSINESS PARK,

MAHAKAL! CAVES ROAD, SHANTI NAGAR,

ANDHERI (E), MUMBAI 400 093. INDIA.

Tel: +81 2267085496

coun EMAIL: goodwaycpl@gmallcom &

eS ESRC info@goodwaychemicals.com

cin No: UzatooMzoo7eTcx714

Director’s Report

To

‘The Members,

Goodway Chemicals Private Li

ed.

Your Directors have pleasure in submitting their 12" Annual Report of the Company together with the

Audited Statements of Accounts for the year ended 31st March, 2019.

4. FINANCIAL RESULTS

The Company's financial performances for the year under review along with previous year’s figures

are given hereunder

Particulars For the Year ended | For the Year ended

34% March, 2019. 31% March, 2018

Amount (in Rs.) Amount (in Rs.

Net Sales /Income from:

Business Operations 93,60,08,450_ 59,76,28,079

Other Income. 28,90,072 14,75,289

Total Income 93,88,98,521 59,91,03,368_

Less : Expenses 91,25,25,165 57,96,21,999

Profit before Depreciation 2,63,73.356 1,94,81,369

Less: Depreciation 34,99,175 22,15,506

Prior Period Adjustment. 2 =

Profit after depreciation and Interest 2,28,74,181 41,72,65,863

Less: Current Income Tax 69,95.545 51,00,000

Less: Provision for tax for previous year = =

Less: Deferred Tax 2,78,282 53,021

Net Profit/ (Loss) after Tax 1,61,56,918 1,24,12,842

Eaming per share (Basic) 10.77 8.08

Earning per Share(Diluted) 10.77. 8.08

or Goodway Charsisals Pvt LS For Goodway Chemicals PyLLtd

He eT

GOODWAY CHEMICALS PVT LTD.

REGD ADD: 6 FLOOR, S 6-7, PINNACLE BUSINESS PARK,

MAHAKALI CAVES ROAD, SHANTI NAGAR,

[ANDHERI (E), MUMBAI 400 093. INDIA.

TEL: 491 22 67085496

EMAIL: goodwaycpl@gmail.com &

OODWAY CHEMICALS info@goodwaychemicals.com

2

‘CIN NO: U24100MH2007PTC1734

REVIEW OF OPERATIONS

‘Your Company has achieved satisfactory performance during the period under review. The Company

has achieved total revenue of Rs. 93,88,08,521/ as compared to previous year revenue of

Rs.59,91,09,368/-. These revenues comprises of sale of products of Rs. 93,60,08,450/- (Previous year

Re, 59,76.28,079).) and other operating revenues of Rs. 28,90,072I-. The company has earned net

profit of Rs.2.28,74,181/- as compared to previous year net Profit of Rs. 1,72,65,863/- The company

hopes to perform similarly in future.

DIVIDEND

Due to conservation policy and future expansion, no Dividend is recommended by the Board of

directors.

TRANSFER OF UNCLAIMED DIVIDEND TO INVESTOR EDUCTION AND PROTECTION FUND

‘The provisions of Section 125(2) of the Companies Act, 2013 do not apply as there was no dividend

deciared and paid last year.

[AMOUNTS TRANSFERRED TO RESERVES

“The Company has not transferred any amount to reserves during the year.

SHARE CAPITAL

The Authorised share capital of the company is Rs 4,50,00,000/- (Consisting of 15,00,000 equity

“hares of Re, 10/-each and Issued and Paid up share capital ofthe company is Rs. 4,50,00,000/-

Consisting of 15,00,000 equity shares of Rs. 10 each,

MATERIAL CHANGES AND COMMITMENT IF ANY AFFECTING THE FINANCIAL POSITION OF

THE COMPANY OCCURRED BETWEEN THE END OF THE FINANCIAL YEAR TO WHICH THIS

FINANCIAL STATEMENTS RELATE AND THE DATE OF THE REPORT

There has been no such material changes and commitments affecting the financial position of the

Company ocurred between the end of the financial year to which this financial statement relate as

on the date of this report.

CONSERVATION OF ENERGY, TECHNOLOGY ABSORPTION, FOREIGN EXCHANGE

EARNINGS AND OUTGO

‘The provision of Section 134(m) of the Companies Act, 2013 read with Rule 8(3) of Companies

‘Accounts Rule, 2014 do not apply to our company. However the foreign exchange inflow — outflow

review during the year is 2s follows For Goodway Chemnigais Pvt. Ltd

day t

Earnings in Foreign Currency: 82,00,460 $ SS

7) Dieser

Expenditure in Foreign Currency: 13,32,250 Seo Goodway Ch

kok Der

GOODWAY CHEMICALS PVT LTD.

EGO ADD: 6" FLOOR, S6-7, PINNACLE BUSINESS PARK

MAHAKALI CAVES ROAD, SHANTI NAGAR,

ANDHERI (E), MUMBAI 400 093. INDIA.

TEL: 491.22 67085496

aeowan EMAIL goodwayepl@gmai.com &

way CHEMICALS info@goodwaychemicals.com

can NO: U24100MH2007°TC1724

9, STATEMENT CONCERNING DEVELOPMENT AND IMPLEMENTATION OF RISK

MANAGEMENT POLICY OF THE COMPANY

‘The Company does not have any Risk Management Policy as the elements of risk threatening the

Company's existence are very minimal.

10, DETAILS OF POLICY DEVELOPED AND IMPLEMENTED BY THE COMPANY ON ITs

CORPORATE SOCIAL RESPONSIBILITY INITIATIVES

‘The Company has not developed and implemented any Corporate Social Responsibility initiatives as

the said provisions are not applicable.

44, PARTICULARS OF LOANS, GUARANTEES OR INVESTMENTS MADE UNDER SECTION 186

OF THE COMPANIES ACT, 2013

‘There were no loans, guarantees or Investment made by the Company under Section 186 of the

Companies Act, 2013 during the year under review

42. PARTICULARS OF CONTRACTS OR [ARRANGEMENTS MADE WITH RELATED PARTIES

During the Financial year 2018-19, your company has not entered into transactions with related

parties as defined under Section 2(76) of the Companies Act, 2013 read with Companies

(Specifications of Definitions Details) Rules,2014

43, EXPLANATION OR COMMENTS ON QUALIFICATIONS, RESERVATIONS OR ADVERSE

REMARKS OR DISCLAIMERS MADE BY THE AUDITORS AND THE PRACTICING COMPANY

‘SECRETARY IN THEIR REPORTS.

‘The qualifications, reservations or adverse remarks made by the ‘Auditors in their report are self

explanatory. The provisions relating fo submission of Secretarial Audit Reportis not applicable to the

‘Company,

14, COMPANY'S POLICY RELATING TO DIRECTORS APPOINTMENT, PAYMENT OF

REMUNERATION AND DISCHARGE OF THEIR DUTIES

The provisions of Section 178(1) relating to constitution ‘of Nomination and Remuneration Committee

are not applicable to the Company and hence the Company has not devised any policy relating to

appointment of Directors, payment of Managerial remuneration, Directors qualifications, positive

attributes, independence of Directors and other related matters as provided under Section 178(3) of

the Companies Act, 2013.

48, NUMBER OF BOARD MEETINGS CONDUCTED DURING THE YEAR UNDER REVIEW

During the Financial Year 201; 8-19, the Company held Eight’ Board Meetings of the Board of Directors

as per Section 173 of Companies Act, 2013 which is summarized below. The provisions of Companies

Ree were coh dspypilagonsidering the ge ee. between two meetings.

SURO Nes 4 Goodway Chemicals Pye Ltd

—s preser Kak ‘De at

Dbector

GOODWAY CHEMICALS PVT LTD.

Peco ADD: 6" FLOOR, 5 6-7, PINNACLE BUSINESS PARK,

MAHAKALI CAVES ROAD, SHANTI NAGAR,

NOMER (e), MUMBA 400 093. INDIA

‘et 991 22 67085496

EMAIL eoodwayepl@gmaiicom &

coonway CHEMICALS ‘info@goodwaychemicals.com

NN: U2si00MH2007PTCA714

| Date of Board Meeting Board Strength No.of Directors Present |

42/04/2018 2 2

44/08/2018 2 2

42/09/2018 2 2

25/10/2018 2 2

20/10/2018 2 2

08/12/2018 2 2

20/02/2019 2 2

26/03/2019 2 2

1

46, DIRECTORS RESPONSIBILITY STATEMENT

In accordance with the provisions of Section 134(6) of the Companies Act, 2013 the Board hereby

submits its responsibility statement:

(a) in the preparation ofthe annual accounts, the applicable accounting standards had been followed

along with proper explanation relating to material departures;

(0) the Directors had selected such accounting policies and applied them consistently and made

judgments and estimates that are reasonable and prudent so as to give a true and fair view of the

state of affairs of the Company at the end of the nancial year and of the loss of the Company for that

period;

() The Directors had taken proper and sufficient care for the maintenance of adequate accounting

records in accordance with the provisions of this Act for safeguarding the assets of the Company and

for preventing and detecting fraud and other irregularities;

(@) The Directors had prepared the annual accounts on a going concem basis; and

(©) The Directors had laid down intemal financial controls to be followed by the Company and that

such internal financial controls are adequate and were operating effectively.

( The Directors had devised proper systems to ensure compliance with the provisions of all

applicable laws and that such systems were adequate and operating effectively.

47, SUBSIDIARIES, JOINT VENTURES AND ASSOCIATE COMPANIES

‘The Company does not have any Subsidiary, Joint venture or Associate Company

For Goodway Chemicals Pvt. Ltd Fer Goodway Chemicals Pvt Ltd

‘ en

SEO h ons Kk

——iieor Director

GOODWAY CHEMICALS PVT LTD.

REGD ADD: 6" FLOOR, S 6-7, PINNACLE BUSINESS PARK,

MAHAKAL! CAVES ROAD, SHANTI NAGAR,

ANDHERI (E), MUMBAI 400 093. INDIA.

TeL:+91 22 67085496

coo! >a EMAIL: goodwaycpl@gmail.com &

WAT CREMICALS info@goodwaychemicals.com

CIN No: UzazooMH2007PTC1714

48. DEPOSITS

‘The Company has neither accepted nor renewed any deposits during the year under review.

49, DIRECTORS AND KEY MANAGERIAL PERSONNEL

During the period under review, there wes no such appointment/ re-appointment and resignation of

directors and Key Managerial person

20. DECLARATION OF INDEPENDENT DIRECTORS

The provisions of Section 149 pertaini

our Company

to the appointment of Independent Directors do not apply to

24. STATUTORY AUDITORS

Jagdish H. Gujarathi, Chartered Accountant are appointed for audi

20. The directors recommend ratification of their appointment.

ll the end of financial year 2019-

‘The observations of the Auditors, if any are explained wherever necessary, in appropriate notes to

the accounts. The Auditor's Report does not contain qualification, reservation or adverse remark.

22, DISCLOSURE OF COMPOSITION OF AUDIT COMMITTEE AND PROVIDING VIGIL MECHANISM

‘The provisions of Section 177 of the Companies Act, 2013 read with Rule 6 and 7 of the Companies

(Meetings of the Board and its Powers) Rules, 2013 is not applicable to the Company.

23, DISCLOSURE UNDER THE SEXUAL HARASSMENT OF WOMEN AT WORKPLACE

(PREVENTION, PROHIBITION AND REDRESSAL) ACT, 2013.

‘The company has formed an Sexual Harassment policy and also formed Internal Compliants

committee (ICC) as prescribed under the act. However the company has not received any

‘complaints on sexual harassment under Sexual Harassment of Women at the Workplace (Prevention,

Prohibition an Redressal) Act, 2013 during the financial year 2018-19.

24, REPORTING OF FRAUDS.

There have been no instances of fraud reported by the Statutory Auditors under the Acts & Rules

framed there under either to the Company or to the Central Government.

25. DETAILS OF SIGNIFICANT AND MATERIAL ORDER PASSED BY THE REGULATORS/COURT

RIBUNALS IMPACTING THE GOING Ci STATUS AND TH PANY’

OPERATIONS IN FUTURE

NIL

Fer Goodway Chemicals Pvt. Ltd

CEL De

Director

GOODWAY CHEMICALS PVT LTD.

REGD ADD: 6" FLOOR, $ 6-7, PINNACLE BUSINESS PARK,

MAHAKALI CAVES ROAD, SHANTI NAGAR,

‘ANDHERI (E), MUMBAI 400 093. INDIA,

TEL: +91 22 67085496

EMAIL; goodwaycpl@gmail.com &

info@goodwaychemicals.com

CIN NO; U24100MH2007PTC1714

26. SHARES:

a. BUY BACK OF SECURITIES

‘The Company has not bought back any ofits securities during the year under review.

b. SWEAT EQUITY

The Company has not issued any Sweat Equity Shares during the year under review.

c, BONUS SHARES

No Bonus Shares were issued during the year under review.

d, EMPLOYEES STOCK OPTION PLAN

‘The Company has not provided any Stock Option Scheme to the employees.

27. EXTRACT OF THE ANNUAL RETURN.

‘The extract of the annual return in Form No. MGT ~ 9 is attached as annexure

FOR AND ON BEHALF OF THE BOARD OF DIRECTORS OF

M/S. GOODWAY CHEMICALS PVT. LTD.

Cw AZAD

‘SUNIL DESAI 7 RAHUL DESAI

Director Director

Din: 01456520 Din: 01472662

Date: 03/09/2019

Place: Mumbai.

Jagdish H. Gujarathi

M.Com. F.C.A.

CHARTERED ACCOUNTANT

8-102/103, “Labh Ashish”, Old Police Lane, Neat Agarkar Chowk, Andheri (E). Mumbai 400 069.

*Esmail : jgujarathi@yahoo.com

INDEPENDENT AUDITOR'S REPORT

TO THE MEMBERS OF

GOOPWAY CHEMICALS PVT. LTD.

Report on thé Financia! Statements

We have sudited the accompanying financial statemems of Goodway Chemicals Pvt,

Ltd. (“the company"), which comprise the Balance Sheet as at 31 March 2019, the

Statement of Profit and’ Loss, the Cash Flow Statement for the year then ended.

summary of significant accounting policies and other explanatory information,

Management's Responsibility for the Standalone Financial Statements

The Company's Bourd of Directors és responsible for the matters in’section 134(5) of

the Companies Act, 2013 (“the Act”) with respect to the preparation of these financial

statements that give a true and fait view of the financial position, financial

perlormance and cash flows of the Company in aecontince with the accounting

principles generally accepted in India. ingluding the Accounting Standatds specified

under Section 133 of the Act, read with Rule 7 of the Companies (Accounts) Rules,

2014. This responsibility olso includes the maintenance of adequate accounting

records in accordance with the provision of the Act for safeguirding of the ussets of

the Company and for preventing and detecting the frauds and other imegularities:

selection and application of appropriate accounting policies; making judaments tnd

estimates that are reasonable and prudent: and design, impleinentation arid

maintenanee of internal financial control; that were operating effectively for ensuring

the accuracy and completeness of the accounting records, relevent to the preparation

and presentation of the financial statements that give a true and fair view and are free

froin niaterial misstatement, whether die to fds oF error.

Auditor's Responsibility,

Our responsibility is to express an opinion on these financial statemetits based on our

audit

We have taken into account the provisions of the Act, the accounting and auditing

‘standards and matters which are required to be ineluded in the audit report under the

provisions of the Act and the Rules made there under.

We conducted our audit in accordance with the Standards on Auditing spevified under

seétion 143(10) of the Act. Those Standards tequire that we comply wil ethicul,

reguiremems’and plan and perform the audit 10 obtain reasonable asstirance ubout

vhethor the Financial statemients are free from material: misstatement,

Aw audit involves performing procedures to obtain audit evidence about the amotints

and digelosures in the financial’ Stiteménts, The procedures selectee) depend ont the

auditor's judgment, inchiding the assessment of the risks of matzrial misstutement of

the: financial statements, whether due: to fraud or etror. In making those risk

assessmenis, the auditor considers internal financial contol relevant to the Company’=

preparation of the financial statements thit give we ‘and fairview in order (0 design

audit procedures’ that are appropriate ln the circumstances. An auilit also includes

‘evaluating the appropriateness of aceounting policies used and the feasonableness-of

the accounting estimates made by Company's Directors, as well as evaluating the

overall presentation of the Tinancial statements.

We believe that ihe-audit evidence we have’ obtained is sufficient and appropriate to

provide a basis for our audit opinion on the financial statements

Opinion

In our opiaion and 46 the best oF our information and aseording to the explanations

given ta us. the aforesaid financial statements, give the information required by the

Act in the manner so required and give a true and fair view in conformity with he

accounting principles generally secepted in India;

a) In the case of the Balantic Sheet, of the state of affairs of the Company as.at

Marci 31,2019;

b) In the case of the Statement of Profit and Loss, of the profit for the year ended on,

that date; and

©) tthe ease of the Cash Flow Siatemént, of the cash flows for the-year ended'on

that date.

Report on other Legal and Regulstory Requirements

Ag requived by the Companies (Auditor's Report) Onter, 2016, issued by the Cerital

Goverment of India in terms of sub-section (|1) of seetion 143 of the Companies

‘Act, 2013, we give in the Annexure a statement on the matters specified in paragraphs

3. & 4 of the otder, to the extent applicable.

‘As required by Seetion 143) of the Act, we report that:

We have obtained all the information and explanations which to the best of our

knowledge and belief were neeessery for the purpose of our abel,

tn our opinion proper books of account as nequired by Inw have been kept Py she

Compasy s0 fit as appears from our examination of those books

“the Bauinds Sheet, and Statement of Profit anid Loss and Cash Flow Statsment, dealt

«with by this Report are In agreement with the books of seeount.

in our opinion, the Balance Sheet, Statenient of Profit and Loss, and Cash Flow

Statontent comply with the Accounting Standards referred to in seetion 133,07 the Act,

read with Rule 7 of the Companies (Accounts) Rules, 2014:

Gin the basis of the-svrinen representations eodived fiom the directors as om 31st

March, 2019 taken on resard bythe Board of Directors, none of the direstors is

disqualified as on 2at March, 2019, from being appointed a 4 director in terms of

Section 164(2) of the Act.

FOR J.H. GUIARATHI

Chartered Accountants

Membership No. 036302

Place: Mumbai

Dated: 03.09.2019

j i i Off. ; 2683 2557

Jagdish H. Gujarathi eeia /seaui24060

Com. FCA.

CHARTERED ACCOUNTANT

'B-102/103, "Labh Ashish”, Old Police Lane, Near Agarkar Chowk, Andheri (E}, Mumbst - 400 068.

‘@ E-mail : jgujsrathi@yehoo.com

“The Annexure referred to in paragraph under the heading “Report on Other

Legal and Regulatory matters” of our repart of eve date.

On the basis of such Cheeks as we considered appropriate and according to the

faformation and explanation given to us daring the course of our aut, we report that:

1. (a) The company is mainwining proper records showing, full particulars

including quantitative detsils and situation of its fined assets

(b) The Fixed Assets have been physically verified by the iminagement ina

phuged manner, designed to cover all the items over a period of three years,

‘which in our opinion, is reasonable having regard to the size of the company

‘and nature of its business. Pursiuint to the program, a’portion of the fixed asset

has. been physically verified by the management during the year and no

‘material discrepancies between the books records and the physical fixed assets

have been noticed.

{c)) The litle deeds of immovable properties are held in the nathe of the

‘company as verified-and certified by the management

2. (a) Asexpluined to us, the management bas éarried out physical verification of

inventories at reasonable intervals,

(b) In oar opinion, the procedures, of physical verification followed by the

rmianagement are reasonable and adequate in relation to the size of the Company

and nature of the business.

{c) ‘The Company is maintaining proper reeords of inventory and no material

diserepancy was noticed during the physical verification.

3, ‘The Company’ has not granted any loans, secured or unsecuced, to companies,

firms or other parties covered in the register maintained under Section 189 of

the Companies Act, 2013

4, In our opinion and according to the informtion aid explanations giver to us,

the company has complied with the provisions of section 185 and (86 of the

Companies Act, 2013 Ia respect of loans, investments, guarantees; and

security

5, The Company has'niot accepted any deposits fom the public and hence the

directives issued by the Reserve Bank of India and the provisions of Sections

73 w 76 or any other relevant provisions of the Act and the Companies

(Acooprance of Deposit) Rules, 2015 with regard to the deposits accepted

from the public are not applicable.

6 As informed to us, the maintenance of Cost Records has not been specified by

the Central Government under sub-section (1) of Section 148 of the Act, in

respect of the activities carried on by the company,

7. According. to the records off the coripany, tmndspuied’ story ues

including Prov ident Fund, Investor Edueation aad Protection Fund, Employees’

were Insurance, Tncome-tax, Sales-tax, Wealth) Tax, Service Tax, Cusiery

Duty, Exeise Duty, cess tothe extent opplicable and any ether sats dues.

fave generally been regularly deposited with whe -epproprisis authorities.

Recording t0 the information and explanations given’ to us there were,

seatanding statutory dues as on 31° of March, 2018 for a period of more thet

Six months from the date they became payable.

(b) According to the inform

amounts payable in respect ‘of income tx, wealth tax, service tax. stiles 1X,

customs duty and excise duty which have not been deposited of account of any

disputes, There is demand order under Sales ts tet for the period 201 The

company has preferred. ‘an appeal against dues order ‘of Rs 16,85.500!-

8, Th our opinion asd according t the information dnl explanations given to uss

the Compaity has rot defaulted ia the repayment of dues to banks.

9. Based ‘upon the audit, procedures: performed and the inforhalien and

explanations given by the mimagement, the compiny his not raiged moneys

by way of initial public offeror further publie offer including debt instruments

and verm Loans. Accordingly. the provisions of clause 3 (x) of the Order ane

zat applicable to the Company and henee not commented upon

Lw.Based upon’ the audit procedures performed and the information and

explanations given by the management, we report that 10 fraud by the

Company or on the company by its officers or employees has been noticed or

reported during the year. :

H1Based upon the audit procedures perforried and the information and

explanations given by the management, the managerial remuneration has been

paid or provided in accordance with the requisite approvals mandated by the

provisions of section 197 read with Schedule V to the Companies Act:

12.dh our opiiion, the Company is not a Nidhi Company. Therefore, the

provisions of clause 4 (sil) of the Order are not applicable to the Company,

13.1n our opinion, all ‘transactions with the related. parties are in compliance with

esion ITT and 188 of Conpatiies Act, 2013 and the details have been

seen {in the Financial Statements as Fequired by the applicable secounting

standards.

{4:Based upon: the audit prodedures performed and the {nforinaott and

explanations given by the management, the eompany as Po made any

preferential allotment, or private placement of shares er fully. or partly

convertible debentures during the year undet review, Accordingly, the

provisions.of clause 3 (xiv) of the Onder St not applicable to the. Company

dnd hence not ‘commented upon. Based upon the audit procedures performed

sind the information and explanations given by the manugement, the company

fae not entered into any non-casit transactions with directors or persons

connected with him. ‘Accordingly, the provisions of clause 3 (xv) of the Order

re not applicable to the Company and hence not commented Upon.

{5.1m oar opinion, the company is not requited to be registered und seeti

aoe ne Reserve Bank of india Act, 1934 and accordingly. the provisions of

thawe 3 (avi) of the Order are not applicable to the Company sand hetwce not

commented upon,

FOR JH. GUJARATHT

Chartered Accountants

aw

Membership No, 036302

Place; Mumbai

Dated: 03/09/2019

. : . (Off. | 26832557,

Jagdish H. Gujarathi Mebite : 9820124060

M.Com. F.C.A.

CHARTERED ACCOUNTANT

B-102/103, *Labh Ashish", Old Police Lane, Near Agarkar Chowk, Andheri (E), Mumbai - 400 069.

® E-mail : jgujarathi@yshoo.com

(aunewure B” Report on the Internal Finaiicial Controls under Clause (of Sub-

Section 3 of Seetion 143 of the Companies ct, 2013 (the Act")

We have audited the internal finunvial controls over finaneiilt reporting of Goodway:

Chemicals Pvt Ltd. (“the Company") as of March 31. 2019 in conjunction with our

audit of the standalone financial statements of the Company for the year ended on

that dare:

Management's Responsibility for Internal Financial Controls

These responsibilities include the design, implementation sind nidintenatee of

fideguste intemal financial controls that were operating effecilvely for ensuring the

onfetly an efficient conduct of its business. including adhorenee to company’s

Polisies. the safeguarding of its assets, the prevention and detection of fave sind

errors, the accuracy and completeness of the accounting records, and the timely

prepixition of reliable financial information, as required unviet the Companies Act,

2013,

Auditors’ Responsibitity

Cur esponsibility fs to express a} opinion on the Compimy’s iaternil financial

controls aver financial reporting based on our audit, We conducted our metre

accordance with the Guidance Note on Audit of Intemal Financial Controls Over

Financial Reporting (the “Guidance Note”) and the Standards on Audi ing, issued by

ICAI and deemed to be prescribed under section 143(10) of the Companies Act,

2013, to the extent applicable to an audit of Intemal financial contrals, tyoth

applicable to an audit of Internal Financia! Conirls ane, both issutd by the etn

of Chartered Accountants Of India. Those Standards:xnd the Guidanee-Note require

that we comply with ethical requirements anid plan and pertorm:the audit 16 obtain

feasonsble assurance about whether adequate internal financial “vomede

financial reporting was established and maintained and if stich controls operated

effectively in all material respects,

ix ‘audit involves: performing procedures 10 obiain audit evilence about the

Adeijuiey OF the internal financial controls system over finsineial Feporting and their

gperaing offectiveness. Our audit of internal financial controls over finance)

FRporting included obtaining an undersianding of intemal fuuncial concle over

Financial reporting, assessing the risk tha a uatstial weakness exits ancl testinis and

Svaliating the design and operating effectiveness of intemal contol based a the

i proceslures selected depend on the auditor's judgement, ineluding

feat of the financial statements,

‘We believe that the audit evidence we have obtained is sufficient and appropriate 10

provide a basis for our audit opinion on the Compuny"¢ intemal finandial controls

system over financial reporting.

Meaning of Internal Financial Controls over Financial Reporting

A company's internal financial control over financial reporting is & process desigiyed

‘o provide reasonable assuiance regarding the reliability of financial reporting and

the preparition of financial statements for extemal purposes in accordance with

generally accepted accounting principles. A company’s intemal finsneia} control over

finanickal reporting ineludes those policies and procedures that (1) pertain to the

miimenance of records that, in reasonable detail, accurately and fairly reflect the

transactions and dispositions of the assets of the company: (2) provide reasontble

assurance that transactions are recorded as necessary to permit preparation of

financial statements in accondance with generally accepied accounting principlesand

that receipts and expenditures of the company are being made only it accordance

with authorizations of managemetit and directors of the company: and (3) provide:

reasonable assurance regarding prevention or timely detection of unauthorized

acquisition, use, or disposition of the company’s assets that could have «1 material,

effect on the fihancial statements.

Inherent Limitations of Internal Financial Controts over Financial Reporting

Because of the inherent limitutions of intetnal financial comrols over financial

reporting. including the possibility of collusion or improper manageinentt override of”

controls, material misstatements due to esror or fraud may occur and not be detected,

Also, projections of any evaluation of the internal financial controls over financial

reporting. to future periods are subject to the risk thiit the internal financial control

over financial reporting: may Become inadequate because of changes in conditions, or

that the degree of compliance with the policies or procedures may deterioriite

Opinion

In our opinion, the Compliny has, in all material respects, an adequate intemal

Financial controls system over financial reporting snd such intemal financial controls

over financial reporting were operating effectively as at March 31, 2019, based on

the essential components of internal control stated in the Guidance Note on Audit of

Internal Financial Controls Over Financial Reporting issued by the Institute of

Chartered Accountants of India”,

Ford MGujarathl,

‘Chartered Accountants

MémBership No, 036302

Place: Mumbai

Date: 03/09/2019,

‘GOODWAY CHEMICALS PVT. LTD.

Balance Sheet as on 31.03.2019

Date: 3rd September, 2019

1. EQUITY AND LIABILITIES:

‘hase

trea | gatemeese| —cyommmse

ec roe } saper) (pese

1) ssi since ote erin .

share wa

a ee cet | assaa| —amsoen

Seema ] etee| Sear

Botcnekien 7 *Rees| tine

Seeley : eau

S Sitccieee eee :

ven) races serearoa|

u psses

—_—

=

oe 1 waar

So ee

iene 4 oar

abemeasians

oe | nmenu| — ssrario

learn | sadiossces|Saoetacae

aie S|) iiMees|| sacntones

BS es Mee) Meloes

Soa ee

Soca mies akan

specs ‘ » | paca

oo NER

Aston coueroerce recat

FOR GOODWAY CHEMICAL PVT. LTD.

Sud hw “EAA De

DIRECTOR DIRECTOR

[autnorived

lauty stares of Rs 10/- each

lartsued

leputy saves of Rs. 10/- each

lor subseribed & ald up

[suty ares of Rs 10/- each

{e1Reconcilstion of Number of shares srvosya019 syr03/20e

Eguty Spares Number Number

(pening Batance 1¥5,00,000,00 —_10,00,000.00

Changes dring the year : 500,000.00

‘losing Batance 15,00,000.90 _15,00,000.00

{oh Terma/Righs ataches to Equity Shares:

1) The company has only one class of equity share having» par value of Ri.10/ per share, Each

holder of eculty stares enti to one vote per share

| During the year ended 3Yst Narch 2019, the amount per share as dividend recognized as

istribulons ts ety shareholders Rs.ML. Bt March 2019, RN).

1) othe even af bauidation ofthe company. the elders of Equity Shares wil be ented to receive

remaining asets of the company, after distribution of al perferential amount. The distribution wit

bein proportion to the No.of eauty shares held by the shorelders.

{SISUNICR OSA 900,000.00, on 90,000.00 60%,

afpasiun s DeSAL 6,00,000.00 @ 6,00, 000.00 40%

‘Note 2 RESERVES AND SURPLUS =

surplus

JOvening balance 1.93,63,537.87 |

+ et Profit et Los) Forte cist year 169,56.917.59|

|. Tranter from Reserves (48, 463.00]

For Goodway Chemicals Pvt Ltd For Goodway Chemicals Pvt. Ltd

|(a} Loans repayable on demand

|Ecom Banks

lacs Bark 0/0 Ale

res Bank

las Bank Term Loan

lAcuapay Axis Bank Crest Card

saya) mance Service Loan

lec. Finance tu Loan

HOFC Bank Loan

inusind Bank Loan

standard Chartered Bank Loan

|raTA Capital Loan

12,46,94,225.25 | 6,57.65,846.21

2,99,30,119.85 -

2,11,95,501.00 | 2,19,28,754.00

25,00,000.00, .

18,39,424.00 -

25,79,392.00 -

24,89,460.49 :

15,36,595.00 :

36,67, 847.88 .

19,23,886.00 :

Tease saa | 6,76,94,597 21

For Goodway Chemicals Pvt. Ltd

Rk De

Director

[sundry Creditors For Goods.

[AAR] WPEXCHEN LLP

Jagarwal Bulk Activities

|ASHA MINERALS & CHEMICALS INDUSTRIES

[ASTERISK CHEMICALS PVT.LTD

IBALNER LAWRIE & CO. LT

lbPT CHEMICALS AUSTRALIA PTY LTD

lonELiM CORPORATION

DESIRE CHEMICALS PVT.LTD

loots cHemicans

least india Drums & Barrels Mautacturing Co

[ECOGREEN OLEOCHEMICALS (SINGAPORE) PTE LTD

[Fortune Enterprises

|FRP SERVICES & CO INDIA PVT LTD.

|HEMAN CHOKESY

co NDIA PVT LTD

|JEvENKAY PETROGELS PYT LTD

[J.N CHEMICALS

JKADILLAC CHEMICALS PYT LTD

KAPPA CHEMICALS-2

KRUPA CONTAINERS PYT LTD

IKUSA CHEMICALS PVT. LTD.

|LANXESS SALES NETHERLANDS 8 V

LEHMANN f& VOSS & CO.

IMIVON CHEMICALS

INishigandha Polymers Pvt Lic

JONWARD CHEMICALS PVT.LTD

JPRASOL CHEMICALS LTD

ISHIVAM ROAD CARRIERS

ISINGH & COMPANY

JSOVIKA CHEMICALS PVT.LTD

[7 & DGALIAKOT CONTAINERS PYT LTD

ICHARE EXPRESS & LOGISTICS PVT.LTD

Vinati Organics Ltd

|WiLMAR TRADING PTE LTD

|VASHRAY CONTAINEURS LIMITED

Sundry Creditors For Expenses

[ABC Consultant

JALLcARGO LOGISTICS LIMITED.

JANTRAWEB TECHNOLOGIES PVT LTD

JASHTE LOGISTICS PVT LTD.

JBANAS BULK CARRIER

|BHANUSHAL! EXPRESS PARCEL SERVICE

[BLU GOPINATHAN NAIR

IcHemexci.

loatapoint Systems

JDEV INTERNATIONAL EXPRESS

DHL EXPRESS (INDIA) PVT LTD

DUCOM INSTRUMENTS PVT LTD

DURALABEL GRAPHICS PYT.LTD

ESSES CONSULTING ENGINEERS

FAITH BUSINESS SOLUTION

: aero

. (200

5.38¢18.00

Sasszs00| 87618700

srazaotso) 22330830

(ean se875) :

: 35.26.4834

(20.00000.00), 2,00, 00.0]

rat7e028] 169448020

ssanyesa0| 7.773670

78,2600

: 6,040.00

: 3,08405.80

2.00,200.00) 20,0,00.0}

: 12.23,405.63

94.77.00 :

(6.00,0000]

134,193.35 (25,31, 100.10)]

(rajee000.00)] (1.0.0.0

sa229.90] ‘1445.02.00

sovssasza0] 299819540

ssvsz.t :

161087400

gssawo0] 22.20.6890

> (3297.73)

(3.38.0

35,50,879.53

: 1103.76.00

3.1956.60 :

: sa7er200

s9a0si240 :

: 170%

carsi40] —_49706n.00

2s.08 32230

10,97 40.00

. 1,9,500.00

: as1500

1274.00

‘ (eer)

sosses} 2.971850

35.190.0 11.90.00

coo] 3.88238.00

‘0.62000 ‘0.2000

Shenson "30000

2053.82 60200

zrai6a0 tis

e79215.00

Paden mateo

ano :

: (10,00 0}

For Goodway Chemicsis Pvt Ltd

Rit Der

Director

Icusanar ROADWAYS (3.284.001 40,500.00

nant on TRANSPORT 2,40,312.00 4,93,784.00

Ren Later OSA * (20,000.00)

ener notors 5606.73

nciamart.com 11,55,660,00 1,22,070.00

nTERTEK Nola PRIVATE LTD aaisaar] 13,975.60)

Innovative Impex ss 132,422.00

H Gusarathi 1,85,750.00 135,500.00

lat canes scienrinc

lat Raja stationery Mart 1950.00 >

Lai Tuli Bhavan Transport : 9509.00

lan arts : 1,020.00

Lavest Gusararit 10,172.00) 1328.00

lvor pric @ Pack evr Lo 1770.00

Lu Vite Pare Gymihana Club -

IJ Gusarati 34,200.00 30,000.00

kas SIPPING PY LTD > (2,265.0)

Wane my TRIP ; 21,108.00

anal X, Ganga : 20,125.00

INEWPORT INDIA PYT LTD (s.573.9) ;

JOU & NATURAL GAS CORPORATION LTD 23,823.00 ;

lom « shopping & Logistics 44,502.00 14,502.00

low pe Taaves 416.78 .

PALGHAR JANSEVA ROAD CARRIER 2,59,896.00

Pooja Constructions :

Poonam J Guarathi 30,000.00 30,000.00

paiva puasrics uiTED 5,593.00

PUSHPA W vatoikan 427,500.00 2

rane TenPo seRvices fi 51,620.00

ROOTS CORPORATION LD 7267 ;

RUSEX iPex Q 43.656.40

sacar WAREHOUSING CO 1,63,064.39 20,853.07

sat TELECOM : 3,550.00

canst ENTERPRISES : (50,740,0)

caksH STAR ENTERPRISES arise] 437,203.00

saRo! ENGINEERING WH PVT.LTD angssz0] (52,945.00)

SEQUEIRA ELECTRICAL WORKS 1422.00 :

|svax puBLicaTiONs PYF LTD (1.45,40.00)

SHEKH TAREE HUSSAIN 19,950.00 7

sHREE sananre Locistics 6776.47

SHEE SHAKTI ENGG WORKS ;

SRUSHTIOHARA Ex 27,166.99

sundry creditors (innate Ex) - 4500.00

stan iNoUSTRIES 4,36402.00 :

SUNIL MuNDADA (2.20,000.00}

[TRADE Link TRANSPORT 11,013.00 2,09,514.00

fruRiiNi Pow PLY & LAMNATES 2.54991 :

[reansuink exPRess 3 78.10

UNE NEW DESIGNS & PROJECTS PvT LTD 72,46,270.00 >

lweoawr cops caRRieR 3,93,056.00 1,76,624.00

Neat Gibal Logistics Pt te 174,948.30 3.a7.271.62

lvchaRe EXPRESS & LOGISTICS PYT LTD 1916.34 .

nat TERIOR HUB 15,075.00 .

lv Trans v express - 126.00

lvvonan services - (15,0000)

fran MING LINE : (33,506.00

[ZARA VENTURES PVT LTD

For Goodway Chemicals Pvt. Lid For Goodway Chericals Pvt Utd

Seer RA De

Note 5 SHORT TERM PROVISIONS :

(a) Provision for employee benefits

Salary Payable 8,00,368.00 2,12, 167,00

(b) Others

JADI @ 4% (16,469,14)]

[TDs Payable 25,86,029.36| 43,49,280.00

IMVAT payable 2017-18

|Net off Provision For income Tax

Net off Provision For Income Tax AY 18-19

-48,11,369.00

3,297.58

45,54,977.00

Note 6 OTHER CURRENT LIABILITIES :

[Rahul Desai Current A/c

ISunil Desai Current A/c

|Rent Deposit-Cigna

For SGheccigais Put, Ltd For Goodway Chemicals Pvt Utd

SURE hak ae De

Director

Director

385,240.62

3,68,235.50

14,85,450.00

sojo@uig,

eA eV

PIT Ag Sieojwaya Aempoog Jog

FD Against Lc

|Accrued Interest an FD

\Fived Deposits (Federal Bank)

[FO ats Bank

[FD Indusind Bank

148,433.46

"25,000.00,

10,00,000.00

rwoamtee hea Utd For Goodway Chemiczels Pvt. Ltd

SLR! CEA De

Director

[Trade receivables outstanding for a period tess than six}

months from the date they are due for payment

lunsecured, considered good

JACME SUJAN CHEMICALS

|BALAJI MEHANDI CENTER

\CHEMICAL PROCESS CONSULTANTS

CHEMSPEC CHEMICALS PVT LTD

|COGO FREIGHT PVT LTD

|EXOL CORPORATION LIMITED

JFORTH INDUSTRIAL INC

|GANESH BENZOPLAST LTD

lceHLOT MEHANDI CENTER

|GNANAM SRINIVAS CHEMICALS & EQUIPMENTS P LTD

|GRAUER WEIL (INDIA) LIMITED, VAPI

eMANI INDUSTRIES LTD-UNIT I

|HERANBA INDUSTRIES LTD -Ut

MIKAL TO

HINDON INDIA PVT LTO

HARMONY ORGANICS PRIVATE LIMITED:

| HAWK PETROLEUM PTE LTD

MPULSORA DE SERVICIOS SION S.A DE C.V

INDIAN DYESTUFF & CHEMICALS MFG . CO.

]KAJAL DULHAN MEHANDI CENTER

KAPPA CHEMICALS

IKUNSHAN TAIDAH CHEMICALS O., LTD

|LUBZ CORPORATION {INDIA}

JNANDAN PETROCHEM LIMITED

JOSAm SPECIALITY CHEMICALS PVT LTD

p.m. HANA (HK) LTD

PARIKH CHEMICAL INDUSTRIES

JPHARMA PRODUCTS

PUsA CHEMICALS

|PUROHIT HEENA PRODUCT

IREDE KIMYA URUNLER! LTD

RAJ MEHANDI CENTER

sau ois

ISHRIMALI MEHANDI CENTER

SIODHI TRADE ENTERPRISE

ISTAR OXALATE PVT LTO

\VIVACIOUS PHARATEX PRIVATED LIMITED

IYOGESHWAR CHEMICALS LTD

«| gerseuon

- 87,933.60

1,12,407.00, 30,622.00

279760 :

788,360.00 :

. 80,284.00

2 | aussi]

150900970) saa073h.t4

: 7D

65,702.00 :

- 51,766.00

29,05,32.00 :

aan7a6.00 :

3607 99 :

‘8,600 :

21 an22,398-0

m2.

S| eaoa0ne

2 | Sostazacon

. 7,641.00

34,38,376.89 70,15,502.06

my oars

sozser20| ‘at 91920

~ 3,929.00

4,58,720.00 4,18,168.00

2,56,05,403,76 2,08,50,009.83

S060 :

. 43,11,320.00

ssassea00| —2.07.800.00

: 10,967.00

16.93,168 00 :

: 73400

err)

; yearn

S| p6o\e0

S| Sez0 00

930400

66,387.00] __3,53,835.00 |

7,79,94,777-45 | _6,01,93,671.1

or Goodway Chemicals et US

rade receivables outstanding fora period exceeding

six months from the date they are. due for payment

lUnsecured, considered good

|ASHA FLUID INDUSTRIES PVT LTD 22,128.00)!

FORTH INDUSTRIAL INC (657,510.70) 3

Ik APOORVA CHEMICALS 11,41,584.00 :

KEY LIFE SCIENCES PYT LTD. 10,14,016.00 =

|SIOOHI TRADE ENTERPRISE 2,06,820.00 :

|STAR OXALATE PVT LTD: 408,870.00 :

|WiLBER CHEMICALS 10,00,000.00 :

37,13,779.30

Note 12 CASH AND CASH EQUIVALENTS :

Tt

IFederat Bank - 758.60

indusind Bank Current A/c 1,238.19 1,238.19

laxis Current A/c 5,24,166.61 | 13,00,578.40

lindusind Bank CC A/c 2,23,339.90 2,56,356.15

|Bassein Catholic Bank 1,00,000.00 :

lb. Cash on hand 1,03,079.45 1,07,114.45

For ome ‘

Director

Note 13 SHORT TERM LOANS & ADVANCES :

Loans and advances to related parties,

Sumit Desai Deposit

lMema Desal

lb. others

|Unsecured, considered good

|vichare Courier-Deposit

kappa Chemicals Deposit

Francis Rocriques Loan

ladvance to Statt

|curunath Bavadane Loan

Jvogenda Singh Loan

|warendra Singh Neg!

JRanjana Gatkwad Loan

raft Loan Account

neal Mishra

Excise

INet GVAT Receivable 12-13

Duty Drawoack Receivable

ICST Deposit Paid in Appeal 2012-13

|CGsT Refundable

\SGST Refundable

Gt Refundable

JMEIS Scheme (Export)

INet CoST Receivable

INet SGST Receivable

INet 16ST Receivabte

|var1 PRoJECT

[Business Advance A/c

Furniture Expenses (WIP)

JPre Emi Depastt Axis Bank

10,447.00 10,447.00

24,17,147.00 21,28,627.00

74,27,594.00| __21,39,074.00,

: 1,000.00

: 300,000.00

22,600.00, 124,200,00,

: 8,200.00

55,000.00 :

39,800.00

00,000.00

2,50,000.00

563,415.93 583,415.93

9,510.47 9,510.47

7.21,915.00

44,565.00 .

35,43,964.00 | 49,84,170.00

35,22,208,00 54,01,818.00

90,19,136.92 2,380.00

15,30,815,11 33,49,580.13

20,30,256.58 25,26,718.52

20,30,256.58 25,26,718.52

1,98,77.925.33 | —1,01,77,030.26

4,36, 90,400.00

1,06, 68,261.68

: £87,31,980.00

4,44,082,00

Chemicals Pvt Ltd

Rok Dee"

Director

‘GOODWAY CHEMICALS PYT. LTD.

Profit and Loss Aecounts forthe year ended 31.03.2019

[Revenue from operations

1 Jorner income

tu, |rotat Revenue (+H)

W.Jxpenses:

purchases of Stock-mn-Trade

|cnanges in inventories of finished goods work-iprogres

land Stocksin-Trade

lemptoyee benetits expense

Jrinance costs

Depreciation and amorttzation expense (Note 7)

other expenses

Total expenses

profi before exceptional and extraordinary items and

tax (HIV)

Vi exceptional tems

[Pratt before extracedinary tems and tax (V= Vi)

‘it lestrecesinary tems

1%. [Profi before tax (vile Vi)

x}Tax expense:

i current tax

2) Deterred tax

2) Owidend Distribution Tax

Profit (Loss) for the parted fram continuing eperations|

aco

2x} Proit toss) from aiscantnuing operators

>xtfTax expense of aiscontinutng operations

[Profit (oss) from Discontinuing operations (after tax)

pax)

Xv[Profie (Loss) forthe period (tt + XIV)

-xvl|Earnings per equity share:

(1) Basic

(2) Ouse

so} 93,60,08,449.58 59,76,28,079.02

1| 28,90,071.85 14575,288.90

D5 aa, 9a STAT] 59,91, 03, 367.92

m2 43,47,947.45| 51,90,00,706.26

18] 67,43,741.10] (68, 11,694.84

13] 1,30,85,13.00 1,26,95,547.00

x 145,48, 830.19 (64,34,287.03,

34,99.175.00| 22,15,506.00|

ai] 6.53,16,816.36 483,03 153.79

F604 340.84 | 80,16, 97 505.24

2,28,74,180.59 1,72,65,862.68,

Pe rEER OG) T7268

726,74, 100.59 T7265 86.68

169,95,545.00 51,00,000.00

278,282.00 53,021.00

1,61,56,917.59 1,21.12.841.68

"AS PER OUR REPORT OF EVEN DATE

[Sale of products

91,78,55,544.58

'58,22,71,960.02

[other operating revenues

JOther operating

1,81,52,905.00

¥,53,56,119.00,

For Goodway’ Put Ltd

SUP po

———— director

Kak De .

[Rent Received =

Interest on FDR 90,341.32 4,50,225.55

[Compensation charges s 5,20,000.00

[Exchange Rate Diff 70,47,280.53, 5,05,063.35

Total

For Goodway Chemicals Pvt. Ltd

rector

Note 18 CHANGES IN INVENTORIES :

‘Note 19 EMPLOYEE BENEFITS EXPENSE :

(a) Salaries and incentives

Inventories (at commencement)

Finished Goods 98,26, 144.84 30, 14,450.00

inventories (at close)

Finished Goods (65, 69,886.00

Total

1,49,31,164.00

41,26,07,412.00

(b) Bonus

65,700.00

74,625.00

(c) Leave Encashment

58,449.00

13,510.00

Note 20 FINANCE COSTS:

Bank Interest

Interest On Bank Loan

Interest on Office Loan

Interest on Office Renovation

Interest on TL Axis Bank

Interest on OD A/c

Interest on Aqua Pay

Interest on TDS

Interest paid on VAT

89,69,181.21

23,41,300.37

19,44,508.00

10,64,136.85,

42,367.34

186,275.00

1,061.42

34,72,951.00

13,67,035.48

10,12,235.30

3,01,185.54

451,890.00

58,805.00

70,184.71

10,94,000.00 -

Charges 7,73,076.63, 23,87,057.39

Business Promotion Exp 20,35,272.00 18,39,400.79

IcFS Charges 85,371.00 :

JCMS Charges 809.00 .

JADI Duty Pats 16,469.14

[clearing & Forwarding 1,14,01,620.29 41,14,97,462.89

|commission paid 1,57,75,997.00 41,36,40,179.00

|Computer Expenses 44,751.00 1,29,822.00

Certificate Origin Charges 32,606.00 >

Conveyance 13,028.00 2,24,956.00

custom Cess 825.99 5,291.27

[custom Penalty Charges 8,495.88 -

lbirector remuneration 50,00,000.00 £0,00,000.00

iscount 2,05,348.24 199.10

Donation 16,200.00 7

Detention Charges 2,000.00 -

Electricity Charges 19,190.00

Freight Charges 83,30,696.33 46,32,461.50

J6sr Penalty 200.00

insurance Charges 4,908.00 12,169.59

Labour Charges 41,50,000.00 -

Late Fees on TDS 32,000.00, :

lc Charges 30,890.63 8,11,151.88

l.c Discounting Charges - 116,430.00

License Fees 41,750.00 :

Legal Exe 8,780.00 00.00

Laboratory Expenses 10,500.00 -

Labet & Ribbon Expenses 1,97,380.00 :

Loan Processing Fees 17,42,612.00 20,750.00

|Warketing Expenses 21,93,729.28 15,18,451.93

|Membership & Subscription 73,825.00 53,160.00

lottice Expenses 2,71,572.00 154,327.00

lottice waintenance 77,000.00 48,687.00

lottice miscellaneuos Exp 119,088.00 25,926.00

Jother Clearing Exp. 13,92,403.90 5,71,299.58

Packing & Forwarding 46,995.00 3,48,015.00

|Payments to the auditor (Note 214) 30,000.00 100,000.00

[Petrol Expenses 4,762.00 5,798.00

Postage Expenses 2,86,489.75 346,722.13

Printing & Stationery 96,439.00 74,886.00

lProtessionat & Consultancy Fees 43,84,836.86 5,73,715.70

Property Tax 2,25, 389.00 :

Pest Control Charges 5,310.00 :

Professional Tax 46,996.00 11,800.00

Rate Difference 21,25,589.02 2,745571.40

Director

For Goodway Chemicals Pvt Ltd For Goodway Chemicals Pvt. Lid

eae CKartk Deo

76,816.00

12,79,472.23

10,000.00

1,18 483.65

4,23,650.00

4575,448.00

16,040.00

19,50, 786.18,

2,20,745.36

1600.00

10,36,444.00

59,719.00

10,15,400,00

[Travelling & Conveyance Exp

[Warehousing Charges

Payment to the auditor as stated above includes:

Pvt Ltd

2,09,568.40

49,408.00

98,250.00

350,00

3,86,338.00

12,24,751.90

1,48, 756.84

2,544.00

718,970.00,

22,435.50

“Far Goodway Chemicels Pvt Ltd

SRA

Potrebbero piacerti anche

- Qtrly - Reportq1 FY 2008 2009Documento2 pagineQtrly - Reportq1 FY 2008 2009Bhavin SagarNessuna valutazione finora

- Amalgamation - Share India Securities - Turnaround Corporate AdvisorsDocumento5 pagineAmalgamation - Share India Securities - Turnaround Corporate AdvisorsBhavin SagarNessuna valutazione finora

- Companiees DataDocumento51 pagineCompaniees Datasales100% (1)

- Bse Sme Ipo IndexDocumento4 pagineBse Sme Ipo IndexBhavin SagarNessuna valutazione finora

- Capital Reduction - Escorts LTD - GalacticoDocumento10 pagineCapital Reduction - Escorts LTD - GalacticoBhavin SagarNessuna valutazione finora

- Revised Underwriting Agreement 31.03Documento14 pagineRevised Underwriting Agreement 31.03Bhavin SagarNessuna valutazione finora

- Yap 31 1 19Documento345 pagineYap 31 1 19Bhavin SagarNessuna valutazione finora

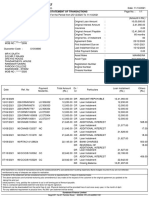

- Statement of Transactions: Sundaram Finance LimitedDocumento1 paginaStatement of Transactions: Sundaram Finance LimitedBhavin SagarNessuna valutazione finora

- CPhI China'09Documento1 paginaCPhI China'09Bhavin SagarNessuna valutazione finora

- Underwriters AgreementDocumento15 pagineUnderwriters AgreementBhavin SagarNessuna valutazione finora

- Toaz - Info Data 1xlsx PRDocumento1.033 pagineToaz - Info Data 1xlsx PRBhavin SagarNessuna valutazione finora

- Demerger May 2021 - Tips Industries LTD by Inga Advisors MumbaiDocumento4 pagineDemerger May 2021 - Tips Industries LTD by Inga Advisors MumbaiBhavin SagarNessuna valutazione finora

- Enigma IndiabuilsDocumento36 pagineEnigma IndiabuilsKaran Mehta50% (2)

- Nebbia Mutual NDADocumento3 pagineNebbia Mutual NDABhavin SagarNessuna valutazione finora

- Revised Market Making Agreement 31.03Documento13 pagineRevised Market Making Agreement 31.03Bhavin SagarNessuna valutazione finora

- August 2021 - Shipping Corporation of India LTD by Corporate ProfessionalsDocumento10 pagineAugust 2021 - Shipping Corporation of India LTD by Corporate ProfessionalsBhavin SagarNessuna valutazione finora

- piVentures-Term Sheet - TemplateDocumento6 paginepiVentures-Term Sheet - TemplateBhavin SagarNessuna valutazione finora

- Amalgmation - August 2020 - Arihant Capital Shree Renuka Sugars LTDDocumento10 pagineAmalgmation - August 2020 - Arihant Capital Shree Renuka Sugars LTDBhavin SagarNessuna valutazione finora

- NDADocumento7 pagineNDABhavin SagarNessuna valutazione finora

- Revised SME IPO Data Performers 2021Documento13 pagineRevised SME IPO Data Performers 2021Bhavin SagarNessuna valutazione finora

- Revised RV - Draft Valuation Report - Hakuna MatataDocumento11 pagineRevised RV - Draft Valuation Report - Hakuna MatataBhavin SagarNessuna valutazione finora

- List of Valuation ReportsDocumento18 pagineList of Valuation ReportsBhavin SagarNessuna valutazione finora

- Removed HEM SECURITIES - MAGAZINE - DEC (8) - 5Documento1 paginaRemoved HEM SECURITIES - MAGAZINE - DEC (8) - 5Bhavin SagarNessuna valutazione finora

- piVentures-Term Sheet - TemplateDocumento6 paginepiVentures-Term Sheet - TemplateBhavin SagarNessuna valutazione finora

- Overall Strategies For All VerticalsDocumento2 pagineOverall Strategies For All VerticalsBhavin SagarNessuna valutazione finora

- Performance of Sectoral Indices - 2021Documento80 paginePerformance of Sectoral Indices - 2021Bhavin SagarNessuna valutazione finora

- 7868 01 Spaceship Roadmap Concept For Powerpoint 16x9Documento5 pagine7868 01 Spaceship Roadmap Concept For Powerpoint 16x9Bhavin SagarNessuna valutazione finora

- 01 Business Partnership Powerpoint TemplateDocumento12 pagine01 Business Partnership Powerpoint TemplateBhavin SagarNessuna valutazione finora

- 02 Corporate Orange Powerpoint Presentations 16x9 1Documento13 pagine02 Corporate Orange Powerpoint Presentations 16x9 1Bhavin SagarNessuna valutazione finora

- 01 Business Partnership Powerpoint TemplateDocumento12 pagine01 Business Partnership Powerpoint TemplateBhavin SagarNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)