Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Updates 2014 2017 Tax Jurisprudence

Caricato da

Trisha Angelica Bliss Ta-aTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Updates 2014 2017 Tax Jurisprudence

Caricato da

Trisha Angelica Bliss Ta-aCopyright:

Formati disponibili

Updates on Tax Jurisprudence

2014-2017

Mickey Ingles

(Cases in bold are those penned by J. Del Castillo)

GENERAL PRINCIPLES

As re: the no-estoppel rule and the lifeblood theory in taxation

• The no-estoppel rule (government cannot be estopped by the acts of its agents) is not

absolute. Hence, when the taxpayer raises the defense of prescription only on appeal

and the State does not question the timeliness of the defense, the State can be bound

by the acts of its agents. (China Bank v. CIR, G.R. No. 172509, February 4, 2015,

where it also took the BIR more than 12 years to collect the tax.)

As re: taxes implementing the state’s police power

• The Socialized Housing Tax (SHT) imposed by Quezon City is an example of a tax that

is used to implement the state’s police power. (Ferrer v. City Mayor Bautista, G.R. No.

210551, June 30, 2015, where the SC upheld the validity of the SHT which it found to

serve the regulatory purpose of removing slum areas in QC)

As re: the Constitutional exemption of non-stock, non-profit educational institutions

(covers both income tax exemption and real property exemption)

• When the revenues are actually, directly, and exclusively used for educational

purposes, the NSNP educational institution shall be exempt from income tax, VAT, and

local business tax. (CIR v. DLSU, G.R. No. 196596, November 8, 2016)

o Test: use of the income

• And when the assets are actually, directly, and exclusively used for educational

purposes, the NSNP educational institution shall be exempt from real property tax.

o Test: use of the property

As re: exemption from taxes

• The essence of tax exemption is the immunity or freedom from a charge or burden to

which others are subjected. It is a waiver of the government’s right to collect what

would have been otherwise collectible. (Secretary of Finance v. Lazatin, G.R. No.

210588, November 29, 2016)

o It is the freedom from the imposition and payment of a particular tax.

§ Hence, a Revenue Regulation that requires tax-exempt entities to pay

taxes with the possibility of a subsequent refund is invalid. The tax-

exempt entities shouldn’t be required to pay in the first place. (Secretary

of Finance v. Lazatin)

As re: set-off of taxes

• As a rule, taxes cannot be subject to compensation because the government

and the taxpayer are not creditors and debtors of each other. However, there

are some cases where the court has allowed the determination of a taxpayer’s

liability in a case for refund, thereby allowing the offsetting of taxes. Note

that these are all refund cases where the court allowed the offsetting of taxes,

because it would have been absurd to grant a refund after finding out that the

taxpayer owed the government pala.

o In these cases, the court allowed offsetting only because the

determination of the taxpayer’s liability is intertwined with the

resolution of the claim for tax refund of erroneously or illegally

collected taxes under Section 229, NIRC.

o Also, the offsetting will not be allowed if the period to assess deficiency

taxes in the excess of the amount claimed for refund has already

Mickey Ingles, Ateneo Law 1

prescribed. (CIR v. Toledo Power Company, G.R. No. 196415, December

2, 2015)

INCOME TAX

As re: constitutionality of the 20% deduction provision for PWDs

• The grant of discount and the corresponding deduction for businesses have been held

as valid and constitutional, as a proper exercise of police power. (Drugstores

Association of the Philippines v. National Council of Disability Affairs, G.R. No. 194561,

September 14, 2016)

As re: minimum wage earners

• The Supreme Court has declared R.R. 10-2008 unconstitutional. The R.R. stated that

a minimum wage earner (MWE) loses his/her exempt status and is thus taxable on

his/her entire income if the MWE receives other benefits in excess of a statutory limit

(in this case, the previous P30,000 limit under exclusions from gross income). (Soriano

v. Secretary of Finance, G.R. No. 184450, January 24, 2017)

o The R.R. added a requirement that was not found in R.A. 9504. It effectively

changed the definition of a MWE. A R.R. cannot expand a law. It did not even

clarify the law.

o Hence, the proper rules are as follows:

§ A MWE who receives taxable income in excess of the minimum wage will

be taxed on the excess, but the MWE will not lose his/her status as such.

Workers who receive the statutory minimum wage as their basic pay

remain MWEs.

§ Also, the receipt of other income during the year does not disqualify

them as MWEs. But the taxable income they receive other than as MWEs

may be subjected to appropriate taxes.

• Hence, bonuses and other benefits received above the statutory

limit (which is now P82,000) are still taxable. (Soriano v.

Secretary of Finance)

As re: 19-lender rule for deposit substitutes

• What does “at any one time” mean?

o It means every transaction executed in the primary or secondary market in

connection with the purchase or sale of securities.

o Hence, when funds are simultaneously obtained from more than 20

lenders/investors—whether in the primary or secondary market—the

instrument is deemed a deposit substitute. (Banco de Oro v. Republic of the

Philippines, G.R. No. 198756, January 13, 2015, where the issue of the PEACE

Bonds was finally resolved; the interpretation was upheld but applied

prospectively upon reconsideration, Banco de Oro v. Republic of the Philippines,

G.R. No. 198756, August 16, 2016)

As re: the transfer of property through expropriation proceedings

• The transfer of property through expropriation proceedings is clearly a sale

or exchange with the meaning of Section 24 (D). So, the profit from the

transaction constitutes capital gains which is subject to capital gains tax to

be paid by the seller. Capital gains tax in expropriation proceedings remains

a liability of the seller. (Republic v. Salvador, G.R. 205428, June 7, 2017)

As re: preferential tax rate of private educational institutions

• For private educational institutions, they are entitled to the reduced rate of 10%

corporate income tax, if:

o The proprietary educational institution is non-profit; and

Mickey Ingles, Ateneo Law 2

o Its gross income from unrelated trade, business, or activity does not exceed

50% of its total gross income. (CIR v. DLSU, G.R. No. 196596, November 9,

2016)

As re: PAGCOR’s taxes

• PAGCOR’s income derived from gaming operations is subject to 5% franchise tax. For

income derived from the operation of other related services, it is subject to normal

corporate income tax. (PAGCOR v. BIR, G.R. No. 215427, December 10, 2014)

• PAGCOR’s contractees and licensees are subject to the same rule. (Bloombery Resorts

and Hotels, Inc. v. BIR, G.R. No. 212530, August 10, 2016)

As re: the loss of income tax exemption for income from properties of tax-exempt

corporations under Section 30

• This does not apply to non-stock, non-profit educational institutions, because the

Constitution clearly states that its revenues, as long as actually, directly, and

exclusively used for educational purposes, are exempt. (CIR v. DLSU, G.R. No. 196596,

November 9, 2016, which stated that the last paragraph of Section 30 does not qualify

the Constitution)

As re: the definition of dividends for income tax purposes

• The SC held that the cash given by a domestic corporation to a foreign shareholder for

the redemption of shares were not dividends as these were not distribution out of its

earnings or profits. (CIR v. Goodyear Philippines, Inc., G.R. No. 216130, August 3,

2016)

As re: declaration of loss for deduction purposes

• If the taxpayer fails to submit a Sworn Declaration of Loss, the deduction for casualty

loss will not be allowed. The SDL is needed to forewarn the BIR the extent of the loss

and to conduct its own investigation of the incident leading to the loss. (H. Tambunting

Pawnshop v. CIR, G.R. No. 173373, July 29, 2013)

DONOR’S TAX

As re: absence of donative intent for donor’s tax

• The absence of donative intent does not matter. Sec. 100 categorically states that the

amount by which the fair market value of the property exceeds the value of the

consideration shall be deemed a gift. (Philippine American Life and General Insurance

v. Secretary of Finance, G.R. No. 210987, November 24, 2014)

o Even if there is no actual donation, the difference in price is considered a

donation by fiction of law.

o NOTE: This has been modified by TRAIN, which allows transfers of insufficient

consideration if done in the course of business.

VALUE-ADDED TAX

As re: whether amounts earmarked for third parties should be subject to VAT

• Amounts earmarked by an HMO to its medical service providers on behalf of its clients

do not form part of its gross receipts for VAT purposes. (Medicard Philippines, Inc. v.

CIR, G.R. No. 222743, April 5, 2017, where the HMO also issued two official receipts—

one pertaining to the VATable portion that represented compensation for its services,

the other pertaining to the non-VATable portion pertaining to the amounts earmarked

for medical utilization)

o By earmarking said amounts, the HMO recognizes that it possesses said funds

not as an owner but as mere administrator of the same. (Medicard Philippines,

Inc. v. CIR)

Mickey Ingles, Ateneo Law 3

As re: ecozones and VAT

• Since ecozones (such as the Clark Special Economic Zone and Clark Freeport Zone)

are considered foreign territories, a R.R. which imposes VAT on the importation of

petroleum products into the ecozones is invalid. (Secretary of Finance v. Lazatin, G.R.

No. 210588, November 29, 2016)

o Articles brought into and remain in ecozones are not taxable importations,

because the goods remain in foreign territory.

o As long as the goods remain in the ecozone or re-exported to a foreign

jurisdiction, they are tax-free.

§ But once introduced into the Philippines customs territory, it shall then

be considered “technical importation” subject to taxes and customs

duties. (Secretary of Finance v. Lazatin)

As re: erroneous impositions of VAT

• If suppliers erroneously impose VAT on goods sold to an entity within a separate

customs territory, the purchaser’s (i.e. the entity in the ecozone) recourse is against

the supplier, not the government. The purchaser can’t run after the government.

o The supplier is the proper party to claim the refund because VAT is an indirect

tax and the supplier is the one statutorily liable. (Coral Bay Nickel Corporation

v. CIR, G.R. No. 190506, June 13, 2016)

As re: VAT exemption of cooperatives

• To enjoy VAT exemption, the cooperative must:

o Be registered with the CDA; and

o Sell exclusively to its members, or

§ if it sells both to members and nonmembers, the sale must be of its

produce, whether in its original or processed state. (CIR v. United Cadiz

Sugar Farmers Association Multi-purpose Cooperative, G.R. No. 209776,

December 7, 2016, where the cooperative sold refined sugar—the

exemption for raw sugar didn’t apply to them, but they were still exempt

because they were an agricultural cooperative that fit the requisites for

exemption)

o In other words, if the agricultural cooperative only sells produce or goods that

it manufactures on its own, its entire sales is VAT-exempt. (CIR v. United Cadiz)

As re: invoicing requirements for VAT-zero rated sales

• For zero-rated transactions, the failure to print the word “zero-rated” on the VAT

invoices or official receipts is fatal to claims for a refund or credit of unutilized input

VAT on the zero-rated sales. (Northern Mindanao Power Corporation v. CIR, G.R. No.

185115, February 18, 2015)

DOCUMENTARY STAMP TAX

As re: DST for transfer of properties pursuant to a merger

• The transfer of real property to a surviving corporation pursuant to a merger

is not subject to DST, because the property is not deemed “sold.” Properties

subject to a merger are merely absorbed by operation of law. (CIR v. La

Tondeña Distillers, Inc., G.R. No. 175188, July 15, 2015)

GOVERNMENT REMEDIES

As re: letters of authority

• The CIR or his duly authorized representative may delegate and authorize the

examination of any taxpayer and the assessment of the correct amount of tax.

Mickey Ingles, Ateneo Law 4

o Hence, it is clear that unless authorized by the CIR or his duly authorized

representative, an examination of a taxpayer cannot ordinarily be undertaken.

The authority is embodied in a Letter of Authority (LOA).

o Without the LOA, an assessment or examination is a nullity. Due process

requires that revenue officers secure a LOA before examining and assessing a

taxpayer. (Medicard Philippines, Inc. v. CIR, G.R. No. 222743, April 5, 2017)

o Speaking of LOAs, a LOA should cover a taxable period not exceeding one

taxable year. It cannot cover the audit of unverified prior years. If the audit

includes more than one taxable period, the other periods or years shall be

specifically identified. (CIR v. DLSU, G.R. No. 196596, November 9, 2016)

§ But, having a LOA that covers a specific taxable year and unverified prior

years does not make the LOA void. The assessment for the specific

taxable year indicated in the LOA is valid. (CIR v. DLSU)

As re: delegable powers of the CIR

• The CIR may also delegate the power to approve and recommend the filing of criminal

cases under the NIRC. It is not a non-delegable function. (People v. Valeriano, G.R.

No. 199480, October 12, 2016)

As re: abatements

• An application for tax abatement is considered approved only upon the

issuance of a termination letter by the BIR. The presentation of the

termination letter is essential as it proves that the taxpayer’s application for

tax abatement has been approved. Without a termination letter, the tax

assessment cannot be considered closed and terminated. (Asiatrust

Development v. CIR, G.R. No. 201530, April 19, 2017)

As re: assessments

• Since it is a demand to pay, the final assessment notice must indicate the definite

amount of tax to be paid and the due date for the payment. Without the definite

amount or the date when the tax must be paid, it is not a valid demand and is therefore

an invalid assessment. (CIR v. Fitness by Design, Inc., G.R. No. 215957, November 9,

2016)

As re: assessments and refunds

• In a case filed by a taxpayer for refund of taxes, the CIR may no longer assess

the taxpayer for deficiency taxes in excess of the amount claimed for refund,

especially if the period to assess had already prescribed. (CIR v. Toledo Power

Company, G.R. No. 196415, December 2, 2015)

As re: validity of assessments

• See Samar-I Electric Cooperative v. CIR (G.R. No. 193100, December 10, 2014), which

stated that when the legal and factual bases can be found in a series of correspondence

between the BIR and the taxpayer (and not in the formal letter of demand and final

assessment notice), there was substantial compliance with the requirements of Section

228, as the taxpayer was informed in writing.

• CIR v. Fitness by Design, Inc. has also added that the basis for allegations of fraud

(needed to extend the prescriptive period to 10 years, instead of 3) must also be

indicated in the FAN to give the taxpayer a chance to refute them.

As re: waivers

• Take note of CIR v. Next Mobile (G.R. No. 212825, December 7, 2015), where the

Supreme Court upheld waivers that did not comply with either RMO 20-90 or RDAO

05-01 because the taxpayer was estopped from questioning the validity of 5 waivers

executed by an unauthorized agent. The Court held that the taxpayer deliberately

executed defective waivers and could therefore no longer question their validity.

Mickey Ingles, Ateneo Law 5

o Next Mobile does not seem to overturn CIR v. Kudos Metal Corporation (G.R.

No. 178087, May 5, 2010), as the Court still recognized the general rule that a

waiver that does not comply with BIR regulations (then RMO 20-90 and RDAO

05-01) is invalid. The Court treated Next Mobile as an exception to the rule

“due to its peculiar circumstances.”

• See CIR v. Standard Chartered Bank (G.R. No. 192173, July 29, 2015) where the

taxpayer impugned the validity of a waiver and made partial payments of the assessed

deficiency tax. The SC said that the taxpayer is not estopped as it did not waive the

defense of prescription as regards the tax deficiencies and continued to raise the

defense of prescription during trial.

As re: power of CTA to issue injunctions on national taxes

• Despite the wording of the CTA law (Section 11, RA 1125, as amended by RA 9282,

Section 9), the CTA can issue injunctive writs to restrain the collection of taxes and to

even dispense with the deposit of the amount claimed or the bond, whenever the

method employed by the CIR in the collection of the tax jeopardizes the interests of

the taxpayer for being patently in violation of the law. (Spouses Emmanuel and Jinkee

Pacquiao v. Court of Tax Appeals, G.R. No. 213394, April 6, 2016)

o Whenever the method employed by the CIR in the collection of tax is not

sanctioned by law, the bond requirement should be dispensed with.

o This prevents the absurd situation where the collection via summary methods

already violated the law yet the taxpayer still needs to file a bond just to get

an injunction.

As re: suspension of prescriptive period for reinvestigations acted upon by the BIR

• The BIR must have acted on the request before the period to collect ends. (CIR v.

United Salvage and Towage (Phils.), Inc., G.R. No. 197515, July 2, 2014, where the

CIR acted on the request for reinvestigation only after the period to collect expired.)

As re: suspension of prescriptive period for taxpayer’s change of address

• When records show that the BIR is aware of the taxpayer’s new address, the period is

not suspended, even without a formal written notice of the change of address. (CIR v.

BASF Coating + Inks Phils., Inc., G.R. No. 198677, November 26, 2014, where the

taxpayer’s records with the BIR clearly showed its new address. The BIR also still

insisted on sending the FAN to its old address, even after the PAN was “returned to

sender.”)

As re: options of the taxpayer when the CIR’s representative does not act on his protest

• The taxpayer does not have the option to appeal to the CIR in case the CIR’s

representative does not act on his protest. The taxpayer must choose between waiting

for the decision or going straight to the CTA. (PAGCOR v. BIR, G.R. No. 208731,

January 27, 2016)

As re: the form and validity of a Final Decision on a Disputed Assessment

• The FDDA must state the facts and the law in order to give the taxpayer a chance for

an intelligent appeal with the CTA.

o If it doesn’t, it’s considered void.

o A void FDDA does not invalidate the underlying assessment (because an

assessment and a FDDA are different). If the FDDA is void, it is as if there was

no decision by the CIR—tantamount to a denial by inaction by the CIR, which

may still be appealed to the CTA. (CIR v. Liquigaz Philippines Corporation, G.R.

No. 215534, April 18, 2016)

As re: supervening events in the period to claim a refund on national taxes

• A taxpayer who realizes a transaction is tax-exempt through a BIR Ruling should not

reckon the 2-year period from the issuance of the BIR Ruling. BIR Rulings merely

confirm what is in the Tax Code. The period begins from actual payment of tax, not

Mickey Ingles, Ateneo Law 6

from the discovery of excessive payment of the tax. (CIR v. Meralco, G.R. No. 181459,

June 9, 2014)

COURT OF TAX APPEALS

As re: jurisdiction of the CTA

• Banco de Oro v. Republic (G.R. No. 198756, August 16, 2016) has stated that the CTA

may take cognizance of cases directly challenging the constitutionality or validity of a

tax law, regulation, or administrative issuance (such as revenue orders, revenue

memorandum circulars, and rulings).

o The CTA likewise has jurisdiction over CIR issuances which have been reviewed

by the Secretary of Finance, such as a BIR Ruling. (BDO v. Republic)

• It is the CTA, not the CA, that has jurisdiction over appeals on tax collection cases

originally decided by the RTC.

o Hence, when the BIR wrongly appeals to the CA, the CA cannot refer the records

of the case to the CTA for proper disposition. The mode of appeal was wrong to

begin with, making the RTC judgment final and executory. (Mitsubishi Motors

Philippines Corporation v. Bureau of Customs, G.R. No. 209830, June 17, 2015)

• In local tax collection cases, the amount of the claim determines where the case should

be filed.

o When the claim does not exceed P300,000 (or P400,000 in Metro Manila), the

case should be filed in the MTC, not the RTC. The RTC exercises appellate

jurisdiction in those cases. (China Banking Corporation v. City Treasurer of

Manila, G.R. No. 204117, July 1, 2015)

As re: questioning interlocutory orders of the RTC in local tax cases

• The CTA has exclusive jurisdiction over a special civil action for certiorari

assailing an interlocutory order issued by the RTC in a local tax case. (CE

Casecnan Water and Energy, Inc. v. the Province of Nueva Ecija, G.R. 196278,

June 17, 2015)

As re: questioning interlocutory orders of the CTA

• The proper remedy for interlocutory orders issued by the CTA division is Rule 65

straight to the Supreme Court. (CIR v. CTA and CBK Power Company Limited, G.R. No.

203054, July 29, 2015)

LOCAL TAXES and REAL PROPERTY TAX

As re: local taxes accruing exclusively to LGUs

• When a provision of law redirects amusement tax collection from the city to the hands

of movie producers, that provision is void and unconstitutional. (Film Development

Council of the Philippines v. Colon Heritage Realty Corporation, G.R. No. 203754, June

16, 2015)

As re: limitations on local taxes

• A local ordinance which imposes local business tax on the gross receipts on persons

who transport passengers or freight for hire and common carriers was held invalid.

(City of Manila v. Colet, G.R. No. 120051, December 10, 2014)

As re: imposing business taxes on places of amusement

• Golf courses are also not considered places of amusement because people don’t go to

golf courses to watch a performance. They go there to play golf. (Alta Vista Golf and

Country Club v. Cebu, G.R. No. 180235, January 20, 2016—but what about people

who go there to watch golfers?)

Mickey Ingles, Ateneo Law 7

As re: whether it is mandatory to go to the DOJ Secretary in questioning the validity of an

ordinance

• In pure questions of law, the appeal to the DOJ is not mandatory. It can be brought

straight to the RTC. (Alta Vista Golf and Country Club v. Cebu, G.R. No. 180235,

January 20, 2016)

As re: which law will govern in real property taxes between the Civil Code or the Lcoal

Government Code

• As between the Civil Code and the LGC, the latter shall prevail, as it is a special law

granting the LGUs the power to impose real property tax. (Manila Electric Company v.

City Assessor and City Treasurer of Lucena City, G.R. No. 166102, August 5, 2015)

• Hence, in determining whether machinery is real property subject to RPT, the definition

and requirements under the LGC are controlling over the Civil Code. (Manila Electric

Company v. City Assessor and City Treasurer of Lucena City, which stated that the

1964 case of Board of Assessment Appeals v. Manila Electric Co. is no longer controlling

because of the enactment of the LGC)

o In this case, MERALCO insisted that their transformers, electric posts,

transmission lines, insulators, and electric meters were not immovables under

the Civil Code because Article 415 (5) imposed additional requirements for

machinery to be considered immovable. (The additional requirements were 1)

being placed in the tenement by the owner of such tenement and 2) destined

for use in the industry or work in the tenement).

o The SC stated that this would mean imposing additional requirements for

classifying machinery as real property for RPT purposes not provided for in the

LGC.

• The transformers, electric posts, transmission lines, insulators, and electric meters of

MERALCO may qualify as “machinery” under the LGC subject to RPT. (Manila Electric

Company v. City Assessor and City Treasurer of Lucena City, G.R. No. 166102, August

5, 2015)

o Using the LGC definition of “machinery,” the SC stated that even if these are

not permanently attached, they are still actually, directly, and exclusively used

to meet the needs of the particular industry and by their very nature and

purpose necessary for the business’ purpose.

As re: Special Education Fund

• The LGU can impose SEF at a rate of less than 1%. Nothing in the LGC states that it

has to be 1%. (Demaala v. COA, G.R. No. 199752, February 17, 2015)

As re: exemption from RPT of government instrumentalities

• The Philippine Economic Zone Authority (PEZA) is also exempt from real property tax

as it is an instrumentality. (City of Lapu-Lapu v. Philippine Economic Zone Authority,

G.R. No. 184203, November 26, 2014)

As re: exemption from RPT of cooperatives

• The RPT exemption given to cooperatives applies even if the land owned by the

cooperative is leased to a taxable entity.

o The exemption is given without distinction. The law doesn’t care if the property

owned by the cooperative is used by the cooperative or not. (Provincial Assessor

of Agusan del Sur v. Filipinas Palm Oil Plantation, Inc., G.R. No. 183416,

October 5, 2016, where the cooperative leased the land to a private

corporation)

As re: payment under protest in RPC cases

• The protest contemplated here is needed when there is a question on the

reasonableness or correctness of the amount assessed. It involves a question of fact.

o A claim for tax exemption, whether full or partial, raises a question of

correctness. Hence, payment under protest is required. It does not question the

Mickey Ingles, Ateneo Law 8

authority of the local assessor to assess real property tax. (National Power

Corporation v. Province of Quezon, G.R. No. 171586, January 25, 2010)

• However, when the taxpayer questions the legality or validity of an assessment—a

question of law—direct recourse to the local courts is allowed. (National Power

Corporation v. Municipal Government of Navotas, G.R. No. 192300, November 24,

2014, where what was being questioned was the authority of the assessor to impose

the assessment and the authority of the treasurer collect real property taxes. The issue

involved the interpretation of a BOT contract and as to which party actually, directly,

and exclusively used machinery and equipment for exemption purposes under Section

234 (c))

• Posting a surety bond before filing an appeal of the assessment with the LBAA is

substantial compliance of the requirement of payment under protest. (Manila Electric

Company v. City Assessor and City Treasurer of Lucena City, G.R. No. 166102, August

5, 2015)

Mickey Ingles, Ateneo Law 9

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Expanded Withholding TaxDocumento2 pagineExpanded Withholding TaxCheivy SolimanNessuna valutazione finora

- Property Tax in Himachal PradeshDocumento3 pagineProperty Tax in Himachal PradeshShimon OberoiNessuna valutazione finora

- HorngrenIMA14eSM ch16Documento53 pagineHorngrenIMA14eSM ch16Piyal HossainNessuna valutazione finora

- Instructions For Form 965-B: (Rev. January 2021)Documento4 pagineInstructions For Form 965-B: (Rev. January 2021)tarles666Nessuna valutazione finora

- Fat PaulyDocumento24 pagineFat PaulyHaroun Nor MangorsiNessuna valutazione finora

- Evolution of Philippine TaxationDocumento6 pagineEvolution of Philippine TaxationGuki Suzuki0% (1)

- Unit 12Documento75 pagineUnit 12AbuShahidNessuna valutazione finora

- Lab 3-2 PHM Reliable Catering Weekly Payroll ReportDocumento1 paginaLab 3-2 PHM Reliable Catering Weekly Payroll ReportAitor AguadoNessuna valutazione finora

- Cash Flow and Financial Planning Class ExerciseDocumento2 pagineCash Flow and Financial Planning Class ExerciseCANessuna valutazione finora

- Curriculum Vitae: Mithilesh JhaDocumento2 pagineCurriculum Vitae: Mithilesh Jhashardoolsingh70Nessuna valutazione finora

- Oracle Apps Interview QuestionsDocumento41 pagineOracle Apps Interview Questionsqeulkite100% (1)

- ECo 447 PUBLIC SECTOR ECONOMICS ORIGINALDocumento92 pagineECo 447 PUBLIC SECTOR ECONOMICS ORIGINALBenjamin AkosaNessuna valutazione finora

- Application - Form - Car LoanDocumento6 pagineApplication - Form - Car LoanSanjay SolankiNessuna valutazione finora

- MI Prelim 2 H2 Econs P2 AnswersDocumento11 pagineMI Prelim 2 H2 Econs P2 AnswersMelissaNessuna valutazione finora

- NTC Memorandum Circular No 9-8-91 IDocumento4 pagineNTC Memorandum Circular No 9-8-91 Inyan nyan nyanNessuna valutazione finora

- Up Industrial Area Development Act 1976Documento19 pagineUp Industrial Area Development Act 1976Shyam SinghNessuna valutazione finora

- CMA Part 1A Macroeconomics)Documento33 pagineCMA Part 1A Macroeconomics)mah800100% (3)

- Registration Under GSTDocumento13 pagineRegistration Under GSTsuyash dugarNessuna valutazione finora

- Missioner of Internal Revenue vs. Kudos Metal Corporation, 620 SCRA 232, May 05, 2010Documento18 pagineMissioner of Internal Revenue vs. Kudos Metal Corporation, 620 SCRA 232, May 05, 2010specialsectionNessuna valutazione finora

- ACT NO. 3815 The Revised Penal Code of The Philippines AN ACT REVISING THE Penal Code and Other Penal LawsDocumento10 pagineACT NO. 3815 The Revised Penal Code of The Philippines AN ACT REVISING THE Penal Code and Other Penal LawsLemUyNessuna valutazione finora

- (Revised) Post Uplb S 046 13 Nanotech RevDocumento50 pagine(Revised) Post Uplb S 046 13 Nanotech RevGladys Bernabe de VeraNessuna valutazione finora

- Construction Industry in NepalDocumento13 pagineConstruction Industry in NepalRamesh Pokharel57% (7)

- Itb 11.2 PDFDocumento5 pagineItb 11.2 PDFMaria Erika LomibaoNessuna valutazione finora

- Tax in Voice TN 1171801 BQ 30601Documento1 paginaTax in Voice TN 1171801 BQ 30601deepak kumarNessuna valutazione finora

- StrataxDocumento40 pagineStrataxAsh PadillaNessuna valutazione finora

- Business Administration 2020 Eng PDFDocumento29 pagineBusiness Administration 2020 Eng PDFNiNi TsiklauriNessuna valutazione finora

- 2021 S C M R 437Documento3 pagine2021 S C M R 437Yahia MustafaNessuna valutazione finora

- Tax 2 - Remedies CasesDocumento96 pagineTax 2 - Remedies Casesmccm92Nessuna valutazione finora

- OD219666944028845000Documento1 paginaOD219666944028845000Imran KhanNessuna valutazione finora

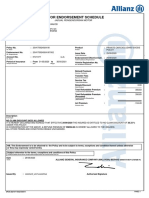

- Motor Endorsement ScheduleDocumento5 pagineMotor Endorsement ScheduleVan De CostaNessuna valutazione finora