Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

USB Acquires UBB Corporation

Caricato da

khoirul nasDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

USB Acquires UBB Corporation

Caricato da

khoirul nasCopyright:

Formati disponibili

TUGAS PRAKTIKUM AKUNTANSI KEUANGAN LANJUTAN FATA 2017

TUGAS LAB 2

BUSINESS COMBINATION

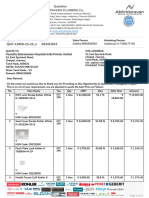

On January 2, 2020, USB Corporation issues 92,600 shares of its $19 par common share with market

value of $48.3 per share to acquire UBB Corporation and UBB Corporation is dissolved after this

acquisition. In addition, USB pays the following expenses in cash at the time of the merger:

• Accounting and legal fees $426,100

• Finders’ fee $203,500

• Registration and issuance costs of securities $199,700

Statement of Financial Position and fair value information for the two companies on December 31,

2020, immediately before acquisition, is as follows (in $000):

USB UBB

Book Value Book Value Fair Value

Cash 739 170.4 170.4

Account Receivable-net 1,155.8 265 215

Inventories 2,164 649.1 649.1

Land 2,309.2 689 816.2

Buildings-net 4,370 1,092 1,373.6

Equipment-net 3,456 1,630.98 1,630.98

Total Assets 14,194 4,496.18 4,855.28

Account Payable 1,638 264.2 264.2

Bonds Payable 2,966 1,234 879.3

Capital Stock, $19 par 5,078 1,377

Additional paid-in capital 2,401 735.4

Retained Earnings 2,111 885.58

Total liabilities and owners’ equity 14,194 4,496.18

Instruction:

1. Prepare all necessary journal entries for the acquisition including:

a. To record investment in UBB

b. To record other investment cost

c. To record allocation of the cost acquiring UBB Corporation to identifiable net asset

according to their fair value and to goodwill or gain on bargaining purchase.

d. Prepare a Statement of Financial Position for USB Corporation as of January 2, 2020,

immediately after the acquisition!

DINI – JOSEPHINE – LUMONGGA FATA 2017

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Solution Manual Cost Accounting Carter Chapter 8Documento25 pagineSolution Manual Cost Accounting Carter Chapter 8khoirul nasNessuna valutazione finora

- Speech Material - Mrs. Ersa Triwahyuni For PAW 2019Documento17 pagineSpeech Material - Mrs. Ersa Triwahyuni For PAW 2019khoirul nasNessuna valutazione finora

- UTS TatkelDocumento1 paginaUTS Tatkelkhoirul nasNessuna valutazione finora

- Format Jawaban Lab 4Documento5 pagineFormat Jawaban Lab 4khoirul nasNessuna valutazione finora

- Mentoring AkDocumento11 pagineMentoring Akkhoirul nasNessuna valutazione finora

- RADR Valuation Method Capital BudgetingDocumento6 pagineRADR Valuation Method Capital Budgetingkhoirul nasNessuna valutazione finora

- Time Value of MoneyDocumento15 pagineTime Value of MoneyJann Aldrin PulaNessuna valutazione finora

- Kelompok Prabu 2018Documento453 pagineKelompok Prabu 2018Maret Dyah Brillianty100% (1)

- Enterprise Risk ManagementDocumento11 pagineEnterprise Risk Managementdeepakfame100% (1)

- Simple Loan Calculator: Loan Values Loan SummaryDocumento11 pagineSimple Loan Calculator: Loan Values Loan SummarymerrwonNessuna valutazione finora

- Measure a Company's Operating ProfitabilityDocumento4 pagineMeasure a Company's Operating ProfitabilityJonhmark AniñonNessuna valutazione finora

- Exam Midterm - Emad Mohamed Attia Supply ChainDocumento6 pagineExam Midterm - Emad Mohamed Attia Supply ChainEmad Attia100% (1)

- Micro Small & Medium Enterprises: 11 September 2022Documento80 pagineMicro Small & Medium Enterprises: 11 September 2022Ramesh ReddyNessuna valutazione finora

- Doing Business in The Democratic Republic of CongoDocumento13 pagineDoing Business in The Democratic Republic of CongoWaynersonNessuna valutazione finora

- QKJNDocumento1 paginaQKJNDineshNessuna valutazione finora

- RTO Programme Pitchbook 20191213Documento7 pagineRTO Programme Pitchbook 20191213Kung FooNessuna valutazione finora

- Effective Interest AmortizationDocumento25 pagineEffective Interest AmortizationSheila Grace BajaNessuna valutazione finora

- Financial Statement and Cash Flow AnalysisDocumento31 pagineFinancial Statement and Cash Flow AnalysismialossNessuna valutazione finora

- Prepare Trial BalanceDocumento7 paginePrepare Trial BalanceLiliney Del VillarNessuna valutazione finora

- Question Paper Unsolved - International FinanceDocumento15 pagineQuestion Paper Unsolved - International FinanceAbhijeet Kulshreshtha100% (1)

- Ledger Posting 2.2 MR.Z Established Computer Care Ltd. During August She Completed The Following TransactionsDocumento4 pagineLedger Posting 2.2 MR.Z Established Computer Care Ltd. During August She Completed The Following TransactionsSvijayakanthan SelvarajNessuna valutazione finora

- Techical Education and Skills Development Authority Regional Training Center - I Trainees'/Learners' Attendance Sheet Masonry NC IiDocumento3 pagineTechical Education and Skills Development Authority Regional Training Center - I Trainees'/Learners' Attendance Sheet Masonry NC IiKaJong JaclaNessuna valutazione finora

- IAL Economics Unit 2 Exemplar ResponsesDocumento44 pagineIAL Economics Unit 2 Exemplar ResponsesCaleb HartnellNessuna valutazione finora

- PDIC Deposit Insurance CoverageDocumento40 paginePDIC Deposit Insurance CoverageAleah Jehan AbuatNessuna valutazione finora

- Public Notice of MMCS Ownership Stake in Manono Lithium RightsDocumento2 paginePublic Notice of MMCS Ownership Stake in Manono Lithium RightsRobert AmsterdamNessuna valutazione finora

- Sobha 3R Aug11 - 2022Documento7 pagineSobha 3R Aug11 - 2022Arka MitraNessuna valutazione finora

- Taco 02Documento1 paginaTaco 02Koushik RoyNessuna valutazione finora

- The Fifteen Principles of Personal FinanceDocumento5 pagineThe Fifteen Principles of Personal FinancePRECIOUS50% (2)

- CplusINDO 05Documento108 pagineCplusINDO 05mas zak danielNessuna valutazione finora

- AccountStatement 17 NOV 2023 To 17 DEC 2023Documento3 pagineAccountStatement 17 NOV 2023 To 17 DEC 2023yoxavex125Nessuna valutazione finora

- MANISH Reliance Fresh Repaired)Documento55 pagineMANISH Reliance Fresh Repaired)manishvikasNessuna valutazione finora

- Financial Accounting - IIDocumento4 pagineFinancial Accounting - IIPadmini VasanthNessuna valutazione finora

- Financial ratio analysis and evaluationDocumento3 pagineFinancial ratio analysis and evaluationDwinanda SeptiadhiNessuna valutazione finora

- DB Aabghhiebehc0x0996Documento3 pagineDB Aabghhiebehc0x0996Nayak RatikantNessuna valutazione finora

- Bangladesh's Fastest Growing Economy and Lessons from East AsiaDocumento10 pagineBangladesh's Fastest Growing Economy and Lessons from East AsiaMuhammad NasirNessuna valutazione finora

- BASF Report 2020Documento324 pagineBASF Report 2020Rafael FalconNessuna valutazione finora

- House Property ChapterDocumento64 pagineHouse Property ChapterManohar LalNessuna valutazione finora

- Plumbing Quote FeebacksDocumento13 paginePlumbing Quote Feebacksarchventure projectsNessuna valutazione finora