Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Tax II Part 2.1

Caricato da

Gillian Caye Geniza Briones0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

94 visualizzazioni3 pagineTax 2

Copyright

© © All Rights Reserved

Formati disponibili

DOC, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoTax 2

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOC, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

94 visualizzazioni3 pagineTax II Part 2.1

Caricato da

Gillian Caye Geniza BrionesTax 2

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOC, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 3

III.

VALUE-ADDED TAX

A. S105 – S115 of the Tax Code

B. RA No. 9238 as amended by RA No. 10963 (effective January 1, 2018)

C. Relevant VAT Regulations

1. RR 13-2018 (IRR under TRAIN Law)

2. RR 16-2005 as amended by RR 4-2007 (IRR under NIRC)

D. Nature, Characteristic and Purpose

1. Tolentino v. Sec of Finance GR No. 115455 Oct 30, 1995

2. Diaz vs. Sec. of Finance, GR No. 193007, July 19, 2011

3. VAT Ruling 040-98 Nov 23, 1998

4. http://money.cnn.com/2010/04/13/news/economy/new_zealand_vat.fortune/in

dex.htm

5. http://money.cnn.com/2008/12/01/news/economy/tully_vat.fortune/index.htm

?postversion=2008120209

E. Persons liable

1. S105

2. Commissioner of Internal Revenue vs. Court of Appeals, et al. G.R. No.

125355, March 30, 2000

F. Definition of

1. “in the course of trade of business”

2. “subsistence and livelihood”

G. VAT Tax Rates

1. 12%

2. Zero rated

3. Exempt

H. Vatable Activities

1. Sale of Goods or Properties S106

a. 12% S106(A)(1)

(1) Definitions

(a) Goods or properties

b. 0% S106(A)(2)

(1) Definitions

(a) RMC 17 - 96 (as amended by RR 6-97)

(b) Export sales

i RMO 9 - 2000 BOI-registered manufacturers-exporters

ii RMC 74 - 99 PEZA enterprises

(c) Foreign currency denominated sales

(d) Effectively-zero rate sales

c. Transactions deemed sale S106(B)

(1) “isolated transaction criteria” vs. “incidental transaction criteria”

BIR Ruling 113-98 July 23, 1998

(2) VAT Ruling 027-96 Sept 23, 1996

d. Changes in or Cessation of Status S106 (C)

e. Determination of Tax Base

Syllabus for Taxation II (SY 2019-2020) 4

Atty. Jon Ligon

2. Importation of Goods

a. S107

b. Determination of Tax Base

3. Sale of Services and Use or Lease of Properties S108

a. 12% S108(A)

(1) Definitions

(a) RA No. 9238 (effective: January 1, 2004)

(b) Sale or exchange of services

(c) Situs-of-service criteria BIR Ruling 110-97 Oct 23, 1997

(2) CIR vs. CA & Commonwealth Mgt & Services Corp GR 125355 Mar

30, 2000

(3) BIR Ruling No. 213-2015

b. 0%

(1) S108(B)

c. Determination of Tax Base

d. Relevant issuances

(1) RMC 3-96/RR 13-2012 Sale/Lease of Real Property

(2) RMC 4-96 Media Business

(3) RMC 5-96 Franchise Grantees

(4) RMC 6-96 Common Carriers

(5) RMC 7-96 Hotels and Restaurants

(6) RMC 11-96 Non-Life Insurance Companies

(7) RMC 13-96 Dealers in Securities and Lending Investors

(8) RMC 23-96 Rental payable to non-resident foreign corporations

(9) RMC 28-2001 Movie Houses

(10) RMC 45-2001 Pawnshop Operators

(11) RMC 4-2003 HMOs

(12) RMC 6-2003 Professionals

(13) RMC 23-2003 Brokers

(14) RMC 39-2007

(15) RMC 77-2008 Director’s Fees

(16) RMC 63-2010 Tollway Operator

(17) RMC 39-2007 Security Agency

I. Exempt Transactions S109

1. Misamis Oriental Coco Traders vs. Sec of Finance 238 SCRA 63

2. RMC 7-94

3. Revenue Regulation 16-2011

4. Revenue Regulation 03-2012

5. St. Luke’s Medical Center vs. CIR CTA Case No. 5068 Mar 17, 1999

6. Tambunting Pawnshop, Inc. v. Commissioner of Internal Revenue, G.R. No.

179085, January 21, 2010

J. Tax Credit S110

1. Credits for Input Tax

2. Transitional Input Tax S111(A)

3. Presumptive Input Tax S111(B)

K. Computation of VAT Payable

Syllabus for Taxation II (SY 2019-2020) 5

Atty. Jon Ligon

1. Output tax

2. Input tax

3. Excess Output over Input / Excess Input over Output

L. Refunds S112

M. Compliance Requirements

1. Registration

a. Persons Commencing Business S236 (G)

b. Persons Becoming Liable to VAT S236(H)

c. Atlas Consolidated Mining vs. CIR GR 134467 Nov. 17, 1999

d. Optional Registration S236(I)

e. Cancellation of Registration S236(F)

2. Invoicing and Accounting

a. S113

b. S237

c. RR 8-99

d. Last paragraph of S109

e. RMC 61-2003

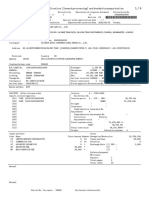

3. Return and Payment of VAT S114

a. BIR Form 2550M

b. BIR Form 2550Q

4. Withholding VAT

a. Creditable S114(C)

b. Final

c. BIR Form 1600

5. Summary List of Sales and Purchases

N. Power of the Commissioner to Suspend Business Operations S115

a. RMO 3-2009 – Guidelines in the conduct of survellance

Syllabus for Taxation II (SY 2019-2020) 6

Atty. Jon Ligon

Potrebbero piacerti anche

- How to Exercise Statutory Powers Properly: Cayman Islands Administrative LawDa EverandHow to Exercise Statutory Powers Properly: Cayman Islands Administrative LawNessuna valutazione finora

- Deductiblity of Certain Expenses:: Tax Reference Materials Updated As of 6 February 2014 A. Income TaxDocumento1 paginaDeductiblity of Certain Expenses:: Tax Reference Materials Updated As of 6 February 2014 A. Income TaxColleen GuimbalNessuna valutazione finora

- Syllabus in Taxation 2Documento27 pagineSyllabus in Taxation 2Emiaj Francinne MendozaNessuna valutazione finora

- Trade and Development Issues in CARICOM: Key Considerations for Navigating DevelopmentDa EverandTrade and Development Issues in CARICOM: Key Considerations for Navigating DevelopmentRoger HoseinNessuna valutazione finora

- AUSL Tax 2 SyllabusDocumento4 pagineAUSL Tax 2 Syllabuskaira marie carlosNessuna valutazione finora

- SyllabusDocumento9 pagineSyllabusbedanNessuna valutazione finora

- Tax Law Review Syllabus Part 2Documento20 pagineTax Law Review Syllabus Part 2chaynagirlNessuna valutazione finora

- CIR Vs American ExpressDocumento4 pagineCIR Vs American ExpressEAYNessuna valutazione finora

- Tax I Syllabus Part IiiDocumento11 pagineTax I Syllabus Part IiiForth BridgeNessuna valutazione finora

- Syllabus in Tax 2: A. Value-Added Tax - (Secs. 105 To 115 of The NIRC As Amended by RA 10963)Documento4 pagineSyllabus in Tax 2: A. Value-Added Tax - (Secs. 105 To 115 of The NIRC As Amended by RA 10963)Pat EspinozaNessuna valutazione finora

- Tax 2 Course OutlineDocumento10 pagineTax 2 Course OutlineBoy Omar Garangan DatudaculaNessuna valutazione finora

- (UP) Taxation 2 Syllabus 2012-1013Documento14 pagine(UP) Taxation 2 Syllabus 2012-1013Eins Balagtas100% (4)

- Tax 2 Syllabus 2020 PDFDocumento9 pagineTax 2 Syllabus 2020 PDFroy rebosuraNessuna valutazione finora

- VatDocumento4 pagineVatmonaileNessuna valutazione finora

- Tax Review Syllabus 2023 Bar Part 1 8.24.22Documento7 pagineTax Review Syllabus 2023 Bar Part 1 8.24.22Deanne KimberlyNessuna valutazione finora

- TAXATION 2 Syllabus Updated Nov 2018Documento9 pagineTAXATION 2 Syllabus Updated Nov 2018Agot GaidNessuna valutazione finora

- Tax 2 SyllabusDocumento10 pagineTax 2 SyllabusJunnieson BonielNessuna valutazione finora

- Tax 2 SyllabusDocumento9 pagineTax 2 SyllabusAlvin RufinoNessuna valutazione finora

- Syllabus Part 1 - NIRC Remedies (Revised Latest)Documento8 pagineSyllabus Part 1 - NIRC Remedies (Revised Latest)Jonathan UyNessuna valutazione finora

- Tax 1 Syllabus. (Aug.2021) v2Documento20 pagineTax 1 Syllabus. (Aug.2021) v2Ellyssa TimonesNessuna valutazione finora

- UCC Taxation-2 Syllabus VAT Updated PDFDocumento2 pagineUCC Taxation-2 Syllabus VAT Updated PDFAnjessette MantillaNessuna valutazione finora

- Substantial EvidenceDocumento15 pagineSubstantial EvidenceArahbells100% (1)

- Syllabus Tax I .Aug. 2019Documento20 pagineSyllabus Tax I .Aug. 2019Renzo Ross Sarte100% (1)

- Remedies Under The NircDocumento9 pagineRemedies Under The NircKenneth ArlanticoNessuna valutazione finora

- Vii. Remedies of The Government: Syllabus For Taxation II (SY 2018-2019) Atty. Jon LigonDocumento5 pagineVii. Remedies of The Government: Syllabus For Taxation II (SY 2018-2019) Atty. Jon LigonAstrid Gopo BrissonNessuna valutazione finora

- Syllabi-2017 Customs Broker Licensure Examination (CBLE)Documento5 pagineSyllabi-2017 Customs Broker Licensure Examination (CBLE)lito77100% (2)

- CELESTE JOY R. TUMBOKON (Assessment p.2 - Answer Key)Documento1 paginaCELESTE JOY R. TUMBOKON (Assessment p.2 - Answer Key)Celeste Tumbokon IINessuna valutazione finora

- Taxable ServicesDocumento19 pagineTaxable ServicesYaman SalujaNessuna valutazione finora

- Tax Rev FGHDocumento2 pagineTax Rev FGHDenardConwiBesaNessuna valutazione finora

- And Inclusion Law) Revenue Regulations 13-2018Documento2 pagineAnd Inclusion Law) Revenue Regulations 13-2018Rnemcdg100% (1)

- Tax 2 Syllabus 2019 PDFDocumento10 pagineTax 2 Syllabus 2019 PDFKarinNessuna valutazione finora

- Syllabus - Tax 2 PDFDocumento20 pagineSyllabus - Tax 2 PDFmadam pitzNessuna valutazione finora

- Income Taxation Part 6Documento5 pagineIncome Taxation Part 6KanraMendozaNessuna valutazione finora

- D. Excise TaxDocumento8 pagineD. Excise TaxReymar Pan-oyNessuna valutazione finora

- Local and Real Property Tax SyllabusDocumento9 pagineLocal and Real Property Tax SyllabusAnderson David TorresNessuna valutazione finora

- Part 2 Basic Taxation Syllabus Local TaxationDocumento5 paginePart 2 Basic Taxation Syllabus Local TaxationMackz KevinNessuna valutazione finora

- Revised Syllabus ITO 2019Documento5 pagineRevised Syllabus ITO 2019satiumesh9Nessuna valutazione finora

- Syllabi 2017 Customs Broker Licensure ExaminationDocumento5 pagineSyllabi 2017 Customs Broker Licensure Examinationmarjo estrellaNessuna valutazione finora

- Reconcilation of Audit and FinanceDocumento48 pagineReconcilation of Audit and FinanceAbdul WahidNessuna valutazione finora

- Tax Law CasesDocumento4 pagineTax Law CasesCarmz SumileNessuna valutazione finora

- Vat Syllabi Train Jun 2020 2Documento13 pagineVat Syllabi Train Jun 2020 2Susannie AcainNessuna valutazione finora

- Real Property Tax and Local Tax OutlineDocumento9 pagineReal Property Tax and Local Tax OutlineGlenn Juris BetguenNessuna valutazione finora

- Tax Reference Materials Updated As of 15 August 2012 A. Income TaxDocumento3 pagineTax Reference Materials Updated As of 15 August 2012 A. Income TaxColleen GuimbalNessuna valutazione finora

- Securities and Exchange Commission: Vol. 80 Thursday, No. 53 March 19, 2015Documento126 pagineSecurities and Exchange Commission: Vol. 80 Thursday, No. 53 March 19, 2015MarketsWikiNessuna valutazione finora

- Tax 1 - OutlineDocumento16 pagineTax 1 - Outlineautumn moonNessuna valutazione finora

- Local Tax - SyllabusDocumento8 pagineLocal Tax - Syllabusmark_aure_1Nessuna valutazione finora

- Tax On Individuals: Non-Resident Individual CitizenDocumento3 pagineTax On Individuals: Non-Resident Individual CitizenJan Aguilar EstefaniNessuna valutazione finora

- Release Order Notification (Inward Processing) and Bonded TransportationDocumento10 pagineRelease Order Notification (Inward Processing) and Bonded TransportationAung LattNessuna valutazione finora

- Tax 1 Course OutlineDocumento5 pagineTax 1 Course OutlineChanel GarciaNessuna valutazione finora

- Bilant Lb. Engleza ModelDocumento5 pagineBilant Lb. Engleza ModelklarckkentNessuna valutazione finora

- Bilant LB Engleza Model 2003Documento5 pagineBilant LB Engleza Model 2003Monica FrangetiNessuna valutazione finora

- Viii. Local Government Taxation (Local Government Code) : CasesDocumento6 pagineViii. Local Government Taxation (Local Government Code) : CasesRnemcdgNessuna valutazione finora

- Release Order Notification (Inward Processing) and Bonded TransportationDocumento14 pagineRelease Order Notification (Inward Processing) and Bonded TransportationAung LattNessuna valutazione finora

- 2019 P T D (Trib - PDF 6Documento15 pagine2019 P T D (Trib - PDF 6Ali WaqarNessuna valutazione finora

- TAX II OUTLINEupdated 2020cleanDocumento14 pagineTAX II OUTLINEupdated 2020cleanAsia WyNessuna valutazione finora

- Sonali Securities WTR (Jan'22-June'22) 75ADocumento8 pagineSonali Securities WTR (Jan'22-June'22) 75Alimon islamNessuna valutazione finora

- SRO GUIDE 2010-2011: Advalorem Rate / Rate of ExemptionDocumento93 pagineSRO GUIDE 2010-2011: Advalorem Rate / Rate of ExemptionmnasirmehmoodNessuna valutazione finora

- 112) Uy Chico v. Union Life, 29 Phil. 163 (1915)Documento1 pagina112) Uy Chico v. Union Life, 29 Phil. 163 (1915)Gillian Caye Geniza BrionesNessuna valutazione finora

- CBADocumento10 pagineCBAGillian Caye Geniza BrionesNessuna valutazione finora

- People V CarlosDocumento1 paginaPeople V CarlosGillian Caye Geniza BrionesNessuna valutazione finora

- EDC V CameronDocumento1 paginaEDC V CameronGillian Caye Geniza BrionesNessuna valutazione finora

- 112) Uy Chico v. Union Life, 29 Phil. 163 (1915)Documento1 pagina112) Uy Chico v. Union Life, 29 Phil. 163 (1915)Gillian Caye Geniza BrionesNessuna valutazione finora

- Cba 9-16Documento7 pagineCba 9-16JIJAMNNessuna valutazione finora

- People V InvencionDocumento2 paginePeople V InvencionGillian Caye Geniza BrionesNessuna valutazione finora

- PAFLU Vs CloribelDocumento1 paginaPAFLU Vs CloribelGillian Caye Geniza BrionesNessuna valutazione finora

- Akbayan Vs AquinoDocumento2 pagineAkbayan Vs AquinoGillian Caye Geniza BrionesNessuna valutazione finora

- Manila Electric Company Vs Quisumbing 1999Documento1 paginaManila Electric Company Vs Quisumbing 1999Gillian Caye Geniza BrionesNessuna valutazione finora

- Associated Labor Union vs. Borromeo 75736Documento2 pagineAssociated Labor Union vs. Borromeo 75736Gillian Caye Geniza BrionesNessuna valutazione finora

- Credit TransactionsDocumento2 pagineCredit TransactionsGillian Caye Geniza BrionesNessuna valutazione finora

- In Re Production of Court Records and DocumentsDocumento5 pagineIn Re Production of Court Records and DocumentsGillian Caye Geniza BrionesNessuna valutazione finora

- Manila Electric Company Vs Quisumbing 2000Documento3 pagineManila Electric Company Vs Quisumbing 2000Gillian Caye Geniza Briones100% (2)

- PT Cerna vs. CADocumento2 paginePT Cerna vs. CAGillian Caye Geniza BrionesNessuna valutazione finora

- US vs. GregorioDocumento1 paginaUS vs. GregorioGillian Caye Geniza BrionesNessuna valutazione finora

- Gaw vs. ChuaDocumento1 paginaGaw vs. ChuaGillian Caye Geniza BrionesNessuna valutazione finora

- 64 BPI Vs MendozaDocumento2 pagine64 BPI Vs MendozaGillian Caye Geniza BrionesNessuna valutazione finora

- Maliksi v. COMELECDocumento3 pagineMaliksi v. COMELECGillian Caye Geniza BrionesNessuna valutazione finora

- Ang V CADocumento3 pagineAng V CAGillian Caye Geniza BrionesNessuna valutazione finora

- People Vs MonerDocumento4 paginePeople Vs MonerGillian Caye Geniza BrionesNessuna valutazione finora

- Evid 20-25Documento9 pagineEvid 20-25Gillian Caye Geniza BrionesNessuna valutazione finora

- Assignment For Feb 1, 2020 - EvidenceDocumento2 pagineAssignment For Feb 1, 2020 - EvidenceGillian Caye Geniza BrionesNessuna valutazione finora

- 50 Fiscal of Pampanga VsDocumento2 pagine50 Fiscal of Pampanga VsAnonymous FXdJL87Ix1Nessuna valutazione finora

- 44Documento12 pagine44111111Nessuna valutazione finora

- Progressive Development Corp vs. NLMDocumento1 paginaProgressive Development Corp vs. NLMGillian Caye Geniza BrionesNessuna valutazione finora

- Feb 4 Cred TransDocumento10 pagineFeb 4 Cred TransGillian Caye Geniza BrionesNessuna valutazione finora

- Tax2 SyllabusDocumento3 pagineTax2 SyllabusGillian Caye Geniza BrionesNessuna valutazione finora

- Legal FormsDocumento2 pagineLegal FormsGillian Caye Geniza BrionesNessuna valutazione finora

- M2U SA 839134 Jul 2023Documento4 pagineM2U SA 839134 Jul 2023Mamy PokoNessuna valutazione finora

- TERMS & CONDITIONS: Bajaj Finserv Club Mahindra Offer, 2017: TH THDocumento3 pagineTERMS & CONDITIONS: Bajaj Finserv Club Mahindra Offer, 2017: TH THBittuKmrNessuna valutazione finora

- Notary Affidavit - EnglishDocumento3 pagineNotary Affidavit - Englishzack quipperNessuna valutazione finora

- Quotation 71034Documento1 paginaQuotation 71034Pranav ParikhNessuna valutazione finora

- Fourth Floor Lighting Layout: Bureau of DesignDocumento1 paginaFourth Floor Lighting Layout: Bureau of DesignJuan IstilNessuna valutazione finora

- Gamechanger AgendaDocumento5 pagineGamechanger AgendaaxfNessuna valutazione finora

- The Role of Public Sectors in Developing INDIADocumento8 pagineThe Role of Public Sectors in Developing INDIAL. Lawliet.Nessuna valutazione finora

- MCS (Third Amendment) Ordinance, 2018Documento17 pagineMCS (Third Amendment) Ordinance, 2018Moneylife Foundation93% (40)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Documento1 paginaTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)SuryaNessuna valutazione finora

- The One-Tier and Two-Tier Board Structures and Hybrids in Asia - Convergence and What Really Matters For Corporate GovernanceDocumento34 pagineThe One-Tier and Two-Tier Board Structures and Hybrids in Asia - Convergence and What Really Matters For Corporate GovernanceHoangNessuna valutazione finora

- Bài 12 - Bài tập thực hànhDocumento2 pagineBài 12 - Bài tập thực hànhDuyên BùiNessuna valutazione finora

- Land LawDocumento1 paginaLand LawRabby NawabNessuna valutazione finora

- West Bengal Board of Secondary Education: Form of Application For Migration Certificate (In Ward/Out Ward)Documento2 pagineWest Bengal Board of Secondary Education: Form of Application For Migration Certificate (In Ward/Out Ward)mirajtanveer123Nessuna valutazione finora

- Balanced Scorecard and Performance Management in The U.S. Postal ServiceDocumento24 pagineBalanced Scorecard and Performance Management in The U.S. Postal ServiceAlexandreVazVelosoNessuna valutazione finora

- New Ogfr Form 23Documento1 paginaNew Ogfr Form 23beobanki1100% (1)

- Villa Azalea by IkigaiDocumento40 pagineVilla Azalea by IkigaikartikypatilNessuna valutazione finora

- Application Form / Borang Permohonan: Sila Isi Borang Permohonan Dengan Lengkap. Huruf BesarDocumento3 pagineApplication Form / Borang Permohonan: Sila Isi Borang Permohonan Dengan Lengkap. Huruf Besarモンケ D。ルフュNessuna valutazione finora

- LadderforLeaders2023 273 PDFDocumento699 pagineLadderforLeaders2023 273 PDFsantosh kumarNessuna valutazione finora

- PMI UNION DigestDocumento2 paginePMI UNION DigestkrizzledelapenaNessuna valutazione finora

- Sub - Order - Labels - 2 PDFDocumento3 pagineSub - Order - Labels - 2 PDFHIRENKUMAR KACHHADIYANessuna valutazione finora

- JK Govt 7th CPC Order DownloadDocumento16 pagineJK Govt 7th CPC Order DownloadRenuka SharmaNessuna valutazione finora

- Invoice 2223COB646 49433Documento1 paginaInvoice 2223COB646 49433Abhishek sharmaNessuna valutazione finora

- Study Material - Most Imp Formulas - Percentage Lyst8648Documento4 pagineStudy Material - Most Imp Formulas - Percentage Lyst8648Fight 4 FitnessNessuna valutazione finora

- Ds Tata Power Solar Systems Limited 1: Purchase OrderDocumento8 pagineDs Tata Power Solar Systems Limited 1: Purchase OrderPrateek MondolNessuna valutazione finora

- Chapter 4 Economic Development of Nations: International Business, 8e (Wild/Wild)Documento28 pagineChapter 4 Economic Development of Nations: International Business, 8e (Wild/Wild)霍晓琳Nessuna valutazione finora

- Debit Memo Omar ReyesDocumento1 paginaDebit Memo Omar ReyesCesar MedinaNessuna valutazione finora

- International Relations: July Monthly Current AffairsDocumento47 pagineInternational Relations: July Monthly Current AffairsVishal MauryaNessuna valutazione finora

- Career Objective: CA Rohit GuptaDocumento2 pagineCareer Objective: CA Rohit GuptaVishal RameshNessuna valutazione finora

- 047-Lopez Realty vs. Fontecha 247 Scra 183, 192Documento6 pagine047-Lopez Realty vs. Fontecha 247 Scra 183, 192wewNessuna valutazione finora

- Privatisation and Commmercialisation-NewsletterDocumento6 paginePrivatisation and Commmercialisation-NewsletterMaggie EmordiNessuna valutazione finora

- The Hidden Wealth of Nations: The Scourge of Tax HavensDa EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensValutazione: 4 su 5 stelle4/5 (11)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyDa EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNessuna valutazione finora

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDa EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNessuna valutazione finora

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsDa EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNessuna valutazione finora

- Public Finance: Legal Aspects: Collective monographDa EverandPublic Finance: Legal Aspects: Collective monographNessuna valutazione finora

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesDa EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesValutazione: 4 su 5 stelle4/5 (9)

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderDa EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNessuna valutazione finora

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionDa EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionValutazione: 5 su 5 stelle5/5 (27)

- Taxes Have Consequences: An Income Tax History of the United StatesDa EverandTaxes Have Consequences: An Income Tax History of the United StatesNessuna valutazione finora

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyDa EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyValutazione: 4 su 5 stelle4/5 (52)

- How to get US Bank Account for Non US ResidentDa EverandHow to get US Bank Account for Non US ResidentValutazione: 5 su 5 stelle5/5 (1)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProDa EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProValutazione: 4.5 su 5 stelle4.5/5 (43)

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderDa EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderValutazione: 5 su 5 stelle5/5 (4)

- The Great Multinational Tax Rort: how we’re all being robbedDa EverandThe Great Multinational Tax Rort: how we’re all being robbedNessuna valutazione finora

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessDa EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessValutazione: 5 su 5 stelle5/5 (5)

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionDa EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionNessuna valutazione finora

- Beat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012Da EverandBeat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012Nessuna valutazione finora

- Decrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationDa EverandDecrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationNessuna valutazione finora

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsDa EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsValutazione: 3.5 su 5 stelle3.5/5 (9)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingDa EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingValutazione: 5 su 5 stelle5/5 (3)

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationDa EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNessuna valutazione finora

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCDa EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCValutazione: 4 su 5 stelle4/5 (5)

- Stiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreDa EverandStiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreValutazione: 4.5 su 5 stelle4.5/5 (13)

- Canadian International Taxation: Income Tax Rules for ResidentsDa EverandCanadian International Taxation: Income Tax Rules for ResidentsNessuna valutazione finora