Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Microsoft Word - ECO-V - 20UA147ECO5

Caricato da

Tn nandiTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Microsoft Word - ECO-V - 20UA147ECO5

Caricato da

Tn nandiCopyright:

Formati disponibili

QP Code : 20UA147ECO5 4 / 32 B.Com.

-AU-16157

=Y„Ã[˝Ã[˝ TˆUÓa]…c˜ ÂU„Eı ◊X∂oˆ◊_◊FTˆ ◊[˝bÃ^m◊_ ◊[˝„[˝ªJÙXÁY…[˝ÔEı AEı◊ªRÙO Y◊Ã[˝[˝ÓÃ^ ◊[˝[˝Ã[˝S› Y“ÿô«ˆTˆ EıÃ[˝”X :

Prepare the statement of cost considering the above information and the additional

information as mentioned below :

%◊Tˆ◊Ã[˝N˛ TˆUÓ (Addl. informations ) :

(i) Rent, rates A[˝e insurance EıÁÃ[˝FÁXÁÃ[˝ LXÓ (60%) A[˝e %◊Zı„aÃ[˝ LXÓ (40%).

Rent, rates and insurance relate to factory (60%) and office (40%)

(ii) Electricity %◊Zı„aÃ[˝ LXÓ (70%) A[˝e office (30%).

Electricity relates to factory (70%) and office (30%).

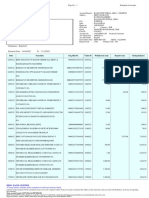

2. ◊X∂oˆ◊_◊FTˆ TˆUÓa]…c˜ 01.06.2017-ÂTˆ £Ã[˝” 50,00,000 ªRÙOÁEıÁÃ[˝ AEı◊ªRÙO [˝ÁQÕˆ› ◊X]ÔÁS ªJ«Ù◊N˛ a+◊EÔıTˆ :

The following information relates to a building contract for Rs. 50,00,000 started on

01.06.2017 :

31st March, 31st March,

2018 2019

Rs. Rs.

Materials issued 11,00,000 8,70,000

Direct wages 9,80,000 8,30,000

Direct expenses 60,000 50,000

General overhead apportioned ? ?

(30% of the direct wages)

Plant issued 6,60,000 2,00,000

Materials returned 33,000 12,000

Materials cost due to fire 52,500 —

Insurance claim received on the

materials lost 44,000 —

Materials at site (31st March) 28,600 11,000

Plant at site (31st March) 6,05,000 7,40,000

Value of work certified 31,00,000 50,00,000

Cost of work not certified 60,000 —

Cash received from contractor 90% 90%

(% of work entitled)

2017-18 A[˝e 2018-19 Ac˜O V«c˜O [˝ªK˜„Ã[˝Ã[˝ ªJ«Ù◊N˛EıÁ^Ô aey‘Á‹ôˆ ◊c˜aÁ[˝ (Contract account) A[˝e ªJ«Ù◊N˛

EıÁ^ÔÁ„VÃ^EıÁÃ[˝›Ã[˝ ◊c˜aÁ[˝ (Contractee account) Y“ÿô«ˆTˆ EıÃ[˝”X A[˝e %a]Áä EıÁL (work-in-progress)

◊Eı\ˆÁ„[˝ 31.03.2018 TˆÁ◊Ã[˝„FÃ[˝ =•Tˆ¤ Y‰y Y“V◊`ÔTˆ c˜„[˝ TˆÁ ÂVFÁX*

Prepare Contract account and Contractee account for two years 2017-18 and 2018-19

and show how the work-in-progress will appear in the Balance Sheet as on 31.03.2018.

=w¯Ã[˝ / Answer :

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Your RBC Personal Banking Account StatementDocumento2 pagineYour RBC Personal Banking Account Statementbrar manpreetNessuna valutazione finora

- Ross Paul JohnDocumento4 pagineRoss Paul JohnITNessuna valutazione finora

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento5 pagineDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancemanojNessuna valutazione finora

- Emarketer The Great Realignment StatPackDocumento49 pagineEmarketer The Great Realignment StatPackMyriam PerezNessuna valutazione finora

- Questions Chapter 8Documento19 pagineQuestions Chapter 8SA 10Nessuna valutazione finora

- Integrated Accounting Learning Module Attachment (Do Not Copy)Documento15 pagineIntegrated Accounting Learning Module Attachment (Do Not Copy)Jasper PelicanoNessuna valutazione finora

- IPG UserGuide VirtualTerminal v2023-2Documento47 pagineIPG UserGuide VirtualTerminal v2023-2thiago_potroNessuna valutazione finora

- ROPO in Poland ReportDocumento42 pagineROPO in Poland Reporttomasz_karwatkaNessuna valutazione finora

- Service Management - Zoho Desk ScopeDocumento2 pagineService Management - Zoho Desk ScopeRinu GeorgeNessuna valutazione finora

- Assignment Topic-: Mobile Shop: Group - 7Documento9 pagineAssignment Topic-: Mobile Shop: Group - 7Prince NarwariyaNessuna valutazione finora

- What Is BankingDocumento2 pagineWhat Is BankingMix Adda247Nessuna valutazione finora

- UntitledDocumento7 pagineUntitledKit BalagapoNessuna valutazione finora

- SRWE Module 2Documento27 pagineSRWE Module 2Andreea DragomirNessuna valutazione finora

- 2024 01 31 StatementDocumento6 pagine2024 01 31 StatementAlex NeziNessuna valutazione finora

- Resume VivekDocumento3 pagineResume VivekVivek seenivasagamNessuna valutazione finora

- LycaMobile USER GUIDEDocumento3 pagineLycaMobile USER GUIDEjandraqNessuna valutazione finora

- Lesson 1Documento12 pagineLesson 1riyaz878100% (2)

- Travel Process For ClientDocumento26 pagineTravel Process For Clientcelestetorino1Nessuna valutazione finora

- Dbs Group Fact Sheet: Corporate InformationDocumento10 pagineDbs Group Fact Sheet: Corporate InformationleekosalNessuna valutazione finora

- Operating Room Nurse Checklist - Use of EquipmentDocumento2 pagineOperating Room Nurse Checklist - Use of EquipmentDina BaroudiNessuna valutazione finora

- Hero Housing - Sanction - 09.09.2022 - MCDocumento12 pagineHero Housing - Sanction - 09.09.2022 - MCvishwesheswaran1Nessuna valutazione finora

- INTERSHIPDocumento7 pagineINTERSHIPAnupam VatsNessuna valutazione finora

- Distribution Channel Adopted by The Nestle - Pakistan: Case StudyDocumento10 pagineDistribution Channel Adopted by The Nestle - Pakistan: Case StudyHusnain AhmedNessuna valutazione finora

- Check Trade Service FTU EDocumento4 pagineCheck Trade Service FTU EChu Minh LanNessuna valutazione finora

- SephoraDocumento3 pagineSephoraİradə MuradlıNessuna valutazione finora

- 7090 M CEM Packet Transport Platforms 0084 DS RevB 0820Documento4 pagine7090 M CEM Packet Transport Platforms 0084 DS RevB 0820许安Nessuna valutazione finora

- Naukri ATULKUMARJAIN (26y 0m)Documento3 pagineNaukri ATULKUMARJAIN (26y 0m)emailbbishtNessuna valutazione finora

- Credit Card Cancellation FormDocumento2 pagineCredit Card Cancellation Formwms_klangNessuna valutazione finora

- Computer Network - PresentationDocumento52 pagineComputer Network - PresentationCatalina AyalaNessuna valutazione finora

- Trolley Bags - Bags & Luggage - Luggage & Apparel - BestpriceDocumento9 pagineTrolley Bags - Bags & Luggage - Luggage & Apparel - BestpricePrakriti SinghNessuna valutazione finora