Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

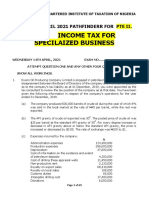

Cfap 05

Caricato da

Abid AliDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Cfap 05

Caricato da

Abid AliCopyright:

Formati disponibili

Time Allowed: 90 minutes

Q1 (15)

Following information is available for tax year 2020 in respect of one of your clients.

Income Statement is as follows: PKR

Sales 42,000,000

Cost of Goods Sold (23,600,000)

Gross Profit 18,400,000

Other Operating Expenses (1,000,000)

Profit before tax 17,400,000

Breakup of sales is as follows: PKR

Local sales - own manufactured 26,000,000

Exports - own manufactured 10,000,000

Sale of imported goods without any value addition 6,000,000

42,000,000

Cost of goods sold comprises of: PKR

Manufacturing 20,000,000

Imports 3,600,000

23,600,000

Detail of tax deducted at source and advance tax pais is as follows: PKR

Tax deducted u/s 153 from local sales - own manufactured 1,040,000

Advance tax paid u/s 148 on imports 300,000

Tax deducted u/s 154 from exports 100,000

You, being tax consultant, are required to calculate tax liability, if your client is

a) Individual

b) Listed Company

(Ignore minimum tax u/s 113 and alternative corporate tax u/s 113C)

Q2 (15)

Following information is available for tax year 2020 in respect of one of your client (type of person is Individual) ;

PKR

Export Sales 10,000,000

Cost of Sales (5,000,000)

Operating Expenses (4,000,000)

Profit before tax 1,000,000

Tax deducted u/s 154 100,000

Advance tax on cash withdrawals u/s 231A 50,000

Advance tax on purchase of motor vehicle u/s 231B 200,000

Requirement:

(i) Being a tax consultant, suggest whether your client should avail option under section 154(5) of ITO 2001

(ii) What will be your answer if in above data operating expenses are nil and rest of figures remain same.

(Ignore minimum tax u/s 113 and alternative corporate tax u/s 113C)

Time Allowed: 90 minutes

ar 2020 in respect of one of your client (type of person is Individual) ;

Potrebbero piacerti anche

- Chapter-13 (SOLVED PAST PAPTERS OF ICMA STAGE IV PDFDocumento14 pagineChapter-13 (SOLVED PAST PAPTERS OF ICMA STAGE IV PDFDani QureshiNessuna valutazione finora

- VAT-problems-key by Andrew Gil AmbrayDocumento10 pagineVAT-problems-key by Andrew Gil AmbrayMark Gelo WinchesterNessuna valutazione finora

- ICMA Sales Tax (1) - 1Documento13 pagineICMA Sales Tax (1) - 1Numan Rox100% (1)

- PRACTICEDocumento4 paginePRACTICEGleeson Jay NiedoNessuna valutazione finora

- Excercise ProblemsDocumento7 pagineExcercise ProblemsKatherine EderosasNessuna valutazione finora

- Asdos Pert 2Documento2 pagineAsdos Pert 2mutiaoooNessuna valutazione finora

- PROJ Jul22 BBAHONS AFM8 Final 20221205090359Documento10 paginePROJ Jul22 BBAHONS AFM8 Final 20221205090359Melokuhle MhlongoNessuna valutazione finora

- c4 Grande Finale Solving 2023 Nov (Set 1)Documento7 paginec4 Grande Finale Solving 2023 Nov (Set 1)charlesmicky82Nessuna valutazione finora

- Tutorial 5 A212 Foreign OperationsDocumento9 pagineTutorial 5 A212 Foreign OperationsFatinNessuna valutazione finora

- Income StatementDocumento4 pagineIncome Statementl201046Nessuna valutazione finora

- Statement of Comprehensive Income: Problem 1: True or FalseDocumento17 pagineStatement of Comprehensive Income: Problem 1: True or FalsePaula Bautista100% (3)

- Accounting Unit 1Documento75 pagineAccounting Unit 1Huzaifa Abdullah50% (2)

- 2021statement of Cash Flow HandoutDocumento38 pagine2021statement of Cash Flow HandoutMerveille SadyNessuna valutazione finora

- 5 6336743075766863237 PDFDocumento75 pagine5 6336743075766863237 PDFshagufta afrin100% (1)

- Income TaxesDocumento37 pagineIncome TaxesAngelaMariePeñarandaNessuna valutazione finora

- Problem SolutionsDocumento5 pagineProblem Solutionsmd nayonNessuna valutazione finora

- Ia Assignment 2Documento2 pagineIa Assignment 2Shekinah SesbrenoNessuna valutazione finora

- Solutions:: I. In-Transit ItemDocumento6 pagineSolutions:: I. In-Transit ItemMary EdsylleNessuna valutazione finora

- Accounting For Managers (Assignment One (E-Finance) ) Question OneDocumento7 pagineAccounting For Managers (Assignment One (E-Finance) ) Question OnehananNessuna valutazione finora

- Statement of Comprehensive IncomeDocumento4 pagineStatement of Comprehensive Incomebobo tangaNessuna valutazione finora

- Financial Accounting hw1Documento5 pagineFinancial Accounting hw1Jermaine M. SantoyoNessuna valutazione finora

- Prefinal Exam - SolutionDocumento7 paginePrefinal Exam - SolutionKarlo PalerNessuna valutazione finora

- IDT CA FINAL Full Question Paper 20may 2016Documento22 pagineIDT CA FINAL Full Question Paper 20may 2016Bhanu DangNessuna valutazione finora

- UPSA 2019 Tutorial Questions Fs WITH ANSWERSDocumento14 pagineUPSA 2019 Tutorial Questions Fs WITH ANSWERSLaud ListowellNessuna valutazione finora

- Financial Statement Analysis - AssignmentDocumento6 pagineFinancial Statement Analysis - AssignmentJennifer JosephNessuna valutazione finora

- H.B Commerce ClassesDocumento3 pagineH.B Commerce ClassesPavan BachaniNessuna valutazione finora

- Assignment 2Documento6 pagineAssignment 2TAWHID ARMANNessuna valutazione finora

- CFAS 16 and 18Documento2 pagineCFAS 16 and 18Cath OquialdaNessuna valutazione finora

- Comprehensive Income & NcahsDocumento6 pagineComprehensive Income & NcahsNuarin JJ67% (3)

- Taxation AccountingDocumento10 pagineTaxation Accountingjanahh.omNessuna valutazione finora

- Corporate Taxes Part 1 (VAT, EWT and Income Tax) CaseDocumento4 pagineCorporate Taxes Part 1 (VAT, EWT and Income Tax) CaseMikaela L. RoqueNessuna valutazione finora

- Homework CH 5 1Documento46 pagineHomework CH 5 1LNessuna valutazione finora

- Chapter 4Documento26 pagineChapter 4Kritika JainNessuna valutazione finora

- Pr. 4-146-Income StatementDocumento13 paginePr. 4-146-Income StatementElene SamnidzeNessuna valutazione finora

- 05 Current Taxation 05 Current TaxationDocumento28 pagine05 Current Taxation 05 Current TaxationShehrozSTNessuna valutazione finora

- Chapter 2 Statement of Comprehensive IncomeDocumento4 pagineChapter 2 Statement of Comprehensive IncomebwimeeeNessuna valutazione finora

- Worksheet-4 On CFSDocumento6 pagineWorksheet-4 On CFSNavya KhemkaNessuna valutazione finora

- Assignment1 - Profit and Loss Exercise E FinanceDocumento8 pagineAssignment1 - Profit and Loss Exercise E Financees.eldeebNessuna valutazione finora

- Illustrative Examples - Financial StatementsDocumento6 pagineIllustrative Examples - Financial StatementsChuchi SubardiagaNessuna valutazione finora

- Cashflow - Questions With SolutionsDocumento32 pagineCashflow - Questions With Solutionsasad.anisonsNessuna valutazione finora

- Review Notes #2 - Comprehensive Problem PDFDocumento3 pagineReview Notes #2 - Comprehensive Problem PDFtankofdoom 4Nessuna valutazione finora

- Facn311 Test 1 Solution 2019Documento10 pagineFacn311 Test 1 Solution 20196lackzamokuhleNessuna valutazione finora

- IAS 7 - Statement of CashflowsDocumento7 pagineIAS 7 - Statement of CashflowsidarausungNessuna valutazione finora

- Installment SalesDocumento12 pagineInstallment SalesRusselle Therese DaitolNessuna valutazione finora

- 3 Exam Part IDocumento6 pagine3 Exam Part IRJ DAVE DURUHANessuna valutazione finora

- Quiz - Solution - PAS - 1 - and - PAS - 2.pdf Filename - UTF-8''Quiz (Solution) % PDFDocumento3 pagineQuiz - Solution - PAS - 1 - and - PAS - 2.pdf Filename - UTF-8''Quiz (Solution) % PDFSamuel BandibasNessuna valutazione finora

- Statement of Changes in Comprehensive IncomeDocumento33 pagineStatement of Changes in Comprehensive Incomeellyzamae quiraoNessuna valutazione finora

- Question 2 FR April 2022 Question 2 CaputDocumento6 pagineQuestion 2 FR April 2022 Question 2 CaputLaud ListowellNessuna valutazione finora

- Module 3 - SW On MFTG Acctg & CfsDocumento2 pagineModule 3 - SW On MFTG Acctg & CfsestebandgonoNessuna valutazione finora

- P6MYS 2012 Dec ADocumento15 pagineP6MYS 2012 Dec AFakhrul Azman NawiNessuna valutazione finora

- Acc Concepts PP QnsDocumento9 pagineAcc Concepts PP Qnsmoots altNessuna valutazione finora

- Sample Problem IncomeDocumento4 pagineSample Problem IncomeJoyce Ann Agdippa Barcelona100% (1)

- Financial Management Master Budget ExerciseDocumento10 pagineFinancial Management Master Budget ExerciseJerickho JNessuna valutazione finora

- Semi-Finals Solutions MartinezDocumento10 pagineSemi-Finals Solutions MartinezGeraldine Martinez DonaireNessuna valutazione finora

- April 2021 Pathfinder For PTE 2 LevelDocumento65 pagineApril 2021 Pathfinder For PTE 2 LevelAdedotun OmonijoNessuna valutazione finora

- KMC Should Prepare Corporate Income Tax For ThatDocumento3 pagineKMC Should Prepare Corporate Income Tax For Thatgatete samNessuna valutazione finora

- Discontinued OperationDocumento17 pagineDiscontinued OperationLois Avril ValenciaNessuna valutazione finora

- 12 Accounts Imp ch10 PDFDocumento14 pagine12 Accounts Imp ch10 PDFmukesh kumarNessuna valutazione finora

- 01 ELMS Activity 3Documento2 pagine01 ELMS Activity 3Gonzaga FamNessuna valutazione finora

- Equity Valuation: Models from Leading Investment BanksDa EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNessuna valutazione finora

- Jensen-1991-Corporate Control and The Politics of FinanceDocumento23 pagineJensen-1991-Corporate Control and The Politics of Financeebrahimnejad64Nessuna valutazione finora

- Full Download Test Bank For Labour Relations 5th by Suffield PDF Full ChapterDocumento36 pagineFull Download Test Bank For Labour Relations 5th by Suffield PDF Full Chapteralbigeoisungeld.5h2u100% (21)

- Capital Asset Pricing ModelDocumento10 pagineCapital Asset Pricing Modeljackie555Nessuna valutazione finora

- Book 1Documento2 pagineBook 1agus suyadiNessuna valutazione finora

- Lesson 1 Analyzing Recording TransactionsDocumento6 pagineLesson 1 Analyzing Recording TransactionsklipordNessuna valutazione finora

- AFM Module 1Documento8 pagineAFM Module 1santhosh GowdaNessuna valutazione finora

- Soal PRE-TEST BASIC LEVELDocumento9 pagineSoal PRE-TEST BASIC LEVELIndrianiNessuna valutazione finora

- LVB Moratorium To End As Cabinet Okays Dbs Deal Unacademy Raises Fresh Funds at $2 BN Valuation Up1Documento18 pagineLVB Moratorium To End As Cabinet Okays Dbs Deal Unacademy Raises Fresh Funds at $2 BN Valuation Up1makiNessuna valutazione finora

- TheoriesDocumento25 pagineTheoriesjuennaguecoNessuna valutazione finora

- Lesson 2 ONLINEDocumento10 pagineLesson 2 ONLINEFrancis Dave Nagum Mabborang IINessuna valutazione finora

- Siobhan Stewart 92 %Documento2 pagineSiobhan Stewart 92 %Roland Lovelace OpokuNessuna valutazione finora

- Fsac 230Documento11 pagineFsac 230mahssounys.mNessuna valutazione finora

- Employees' State Insurance General Regulations 1950Documento102 pagineEmployees' State Insurance General Regulations 1950P VenkatesanNessuna valutazione finora

- Business PlanDocumento14 pagineBusiness PlanJELIAN BATALLERNessuna valutazione finora

- Agreement For Liquidation Auction ServicesDocumento3 pagineAgreement For Liquidation Auction ServicesNeelamgaNessuna valutazione finora

- Financial Statement Analysis Lenovo Final 1Documento18 pagineFinancial Statement Analysis Lenovo Final 1api-32197850550% (2)

- Plotics of DevelopmentDocumento13 paginePlotics of DevelopmentAbdela Aman MtechNessuna valutazione finora

- Ssm-Arry Urus SDN Bhd-Mar17Documento6 pagineSsm-Arry Urus SDN Bhd-Mar17xidaNessuna valutazione finora

- Coal India Limited ProjectDocumento61 pagineCoal India Limited ProjectShubham KhuranaNessuna valutazione finora

- Fall10mid1 ProbandsolnDocumento8 pagineFall10mid1 Probandsolnivanata72Nessuna valutazione finora

- Evergreen Event Driven Marketing PDFDocumento2 pagineEvergreen Event Driven Marketing PDFEricNessuna valutazione finora

- Work Order: Add: IGST Add: SGST Add: CGST 0.00 5,022.00 5,022.00Documento1 paginaWork Order: Add: IGST Add: SGST Add: CGST 0.00 5,022.00 5,022.00VinodNessuna valutazione finora

- Presentation On Financial InstrumentsDocumento20 paginePresentation On Financial InstrumentsMehak BhallaNessuna valutazione finora

- RADHIKA Restaurant MBA Project Report Prince DudhatraDocumento72 pagineRADHIKA Restaurant MBA Project Report Prince DudhatrapRiNcE DuDhAtRa77% (75)

- Auditing and Consulting Business PlanDocumento36 pagineAuditing and Consulting Business PlanHACHALU FAYE0% (1)

- Amla PDFDocumento75 pagineAmla PDFKristine AbellaNessuna valutazione finora

- Term Report - Mahmood Iqbal-05157Documento5 pagineTerm Report - Mahmood Iqbal-05157Mahmood IqbalNessuna valutazione finora

- 651593285MyGov 5th September, 2023 & Agenda KenyaDocumento29 pagine651593285MyGov 5th September, 2023 & Agenda KenyaJudy KarugaNessuna valutazione finora

- Aron Smith: Head of MarketingDocumento2 pagineAron Smith: Head of MarketingRAYMOND DUNCANNessuna valutazione finora

- Control Effectiveness Rating (Key 2)Documento3 pagineControl Effectiveness Rating (Key 2)CORAL ALONSONessuna valutazione finora