Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Cesar Larrobis Case

Caricato da

Darlene GanubTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Cesar Larrobis Case

Caricato da

Darlene GanubCopyright:

Formati disponibili

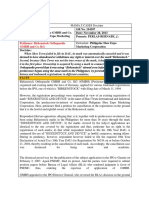

4 SPS. CESAR A. LARROBIS, JR. AND VIRGINIA S. LARROBIS VS.

PHILIPPINE VETERANS

BANK, G.R. NO. 135706, 1 OCTOBER 2004 [440 SCRA 34]

Facts:

Petitioner spouses contracted a monetary loan with herein respondent bank secured by a REM

executed on their lot. Respondent bank then went bankrupt and was placed under

receivership/liquidation by the Central Bank. Sometime after, respondent bank sent a demand letter

for the amount of the insurance premiums advanced by it over the mortgaged property of petitioners.

More than 14 years from the time the loan became due and demandable, respondent bank moved for

the extrajudicial foreclosure of the mortgaged property and was sold to it as being the lone bidder.

Petitioners moved to declare the foreclosure null and void contending that the respondent bank being

placed under receivership did not interrupt the running of the prescriptive period. RTC ruled in favor of

respondents.

Issues:

(1) Whether or not foreclosure of mortgage is included in the acts prohibited during

receivership/liquidation proceedings.

(2) Whether or not the period within which the respondent bank was placed under receivership and

liquidation proceedings interrupted the running of the prescriptive period in bringing actions.

Ruling: NO.

(1) While it is true that foreclosure falls within the broad definition of “doing business,” it should not be

considered included, however, in the acts prohibited whenever banks are “prohibited from doing

business” during receivership and liquidation proceedings. This is consistent with the purpose of

receivership proceedings, i.e., to receive collectibles and preserve the assets of the bank in

substitution of its former management, and prevent the dissipation of its assets to the detriment of the

creditors of the bank.

There is also no truth to respondent’s claim that it could not continue doing business from the time it

was under receivership. As correctly pointed out by petitioner, respondent was even able to send

petitioners a demand letter, through Francisco Go, for the insurance premiums advanced by

respondent bank over the mortgaged property of petitioners. How it could send a demand letter on

unpaid insurance premiums and not foreclose the mortgage during the time it was “prohibited from

doing business” was not adequately explained by respondent.

(2) A close scrutiny of the Provident case shows that the Court arrived at said conclusion, which is an

exception to the general rule, due to the peculiar circumstances of Provident Savings Bank at the

time. The Superintendent of Banks, which was instructed to take charge of the assets of the bank in

the name of the Monetary Board, had no power to act as a receiver of the bank and carry out the

obligations specified in Sec. 29 of the Central Bank Act.

In this case, it is not disputed that Philippine Veterans Bank was placed under receivership by the

Monetary Board of the Central Bank pursuant to Section 29 of the Central Bank Act on insolvency of

banks. Unlike Provident Savings Bank, there was no legal prohibition imposed upon herein

respondent to deter its receiver and liquidator from performing their obligations under the law. Thus,

the ruling laid down in the Provident case cannot apply in the case at bar.

(In contrast to Provident Savings Bank v. CA, this is the General Rule)

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- E.I. Dupont vs. FranciscoDocumento3 pagineE.I. Dupont vs. FranciscoDarlene Ganub83% (6)

- Ago Realty Vs ReyesDocumento1 paginaAgo Realty Vs ReyesDarlene Ganub50% (4)

- NOTARIZE WimberlyLienFinalPreNotaryDocumento4 pagineNOTARIZE WimberlyLienFinalPreNotaryDaniel MontesNessuna valutazione finora

- I. Robbery Cases: Criminal Law Review Case DigestsDocumento49 pagineI. Robbery Cases: Criminal Law Review Case DigestsDarlene GanubNessuna valutazione finora

- Apply For Chevening LeafletDocumento2 pagineApply For Chevening LeafletDarlene GanubNessuna valutazione finora

- ACC 109 - Intermediate Accounting 4 Mock PHINMA Exam 2S1920 KEY ANSWERDocumento19 pagineACC 109 - Intermediate Accounting 4 Mock PHINMA Exam 2S1920 KEY ANSWERRosemarie Villanueva86% (7)

- Tutorial 2Documento3 pagineTutorial 2One AshleyNessuna valutazione finora

- The Land Titles System and Practice in The Kingdom of Saudi ArabiaDocumento7 pagineThe Land Titles System and Practice in The Kingdom of Saudi ArabiaDarby MarNessuna valutazione finora

- Final - List of Impressive Opening SentencesDocumento3 pagineFinal - List of Impressive Opening SentencesDarlene GanubNessuna valutazione finora

- UFC v. Barrio Fiesta Manufacturing CorporationDocumento6 pagineUFC v. Barrio Fiesta Manufacturing CorporationDarlene GanubNessuna valutazione finora

- Assignment No. 8 Insurance To Other Insurance ClauseDocumento39 pagineAssignment No. 8 Insurance To Other Insurance ClauseDarlene GanubNessuna valutazione finora

- AHBL - Independent EHS Compliance Audit Report-310117Documento54 pagineAHBL - Independent EHS Compliance Audit Report-310117Darlene GanubNessuna valutazione finora

- Civil Law Review UsufructDocumento3 pagineCivil Law Review UsufructDarlene Ganub100% (1)

- Smith v. Court of AppealsDocumento3 pagineSmith v. Court of AppealsDarlene GanubNessuna valutazione finora

- Ecole de Cuisine Manille, Inc. v. Renaud Cointreau - CieDocumento2 pagineEcole de Cuisine Manille, Inc. v. Renaud Cointreau - CieDarlene GanubNessuna valutazione finora

- Levi Strauss Inc Vs Clinton ApparelleDocumento3 pagineLevi Strauss Inc Vs Clinton ApparelleDarlene GanubNessuna valutazione finora

- Shang Properties Realty v. St. Francis Development Corp.Documento4 pagineShang Properties Realty v. St. Francis Development Corp.Darlene GanubNessuna valutazione finora

- Malt Design, and Thereby Commits Unfair Competition Against The LatterDocumento2 pagineMalt Design, and Thereby Commits Unfair Competition Against The LatterDarlene GanubNessuna valutazione finora

- 3GPP TS 33.187: Technical SpecificationDocumento14 pagine3GPP TS 33.187: Technical SpecificationDarlene GanubNessuna valutazione finora

- Birkenstock Orthopaedie GMBH and Co. KG vs. Philippine Shoe Expo Marketing CorporationDocumento4 pagineBirkenstock Orthopaedie GMBH and Co. KG vs. Philippine Shoe Expo Marketing CorporationDarlene GanubNessuna valutazione finora

- Pearl and Dean vs. ShoemartDocumento3 paginePearl and Dean vs. ShoemartDarlene Ganub100% (1)

- Criminal Law Review Case Digests First WaveDocumento41 pagineCriminal Law Review Case Digests First WaveDarlene GanubNessuna valutazione finora

- 1 4F Criminal Law Review First Wave Arts 8 13Documento79 pagine1 4F Criminal Law Review First Wave Arts 8 13Darlene GanubNessuna valutazione finora

- Singapore ICT MasterplanDocumento27 pagineSingapore ICT MasterplanDarlene GanubNessuna valutazione finora

- Communication Technologies in IoT DomainDocumento140 pagineCommunication Technologies in IoT DomainDarlene GanubNessuna valutazione finora

- Smart Logistics in The Development of Smart CitiesDocumento22 pagineSmart Logistics in The Development of Smart CitiesDarlene GanubNessuna valutazione finora

- 577563-SC-Ending-Waste Oracle PrimaveraDocumento16 pagine577563-SC-Ending-Waste Oracle PrimaveraDarlene GanubNessuna valutazione finora

- How Oracle Solutions Help Manage The Smart City: Human ResourcesDocumento1 paginaHow Oracle Solutions Help Manage The Smart City: Human ResourcesDarlene GanubNessuna valutazione finora

- 30313208-PD8100-2015 Smart Cities Overview British StandardDocumento40 pagine30313208-PD8100-2015 Smart Cities Overview British StandardDarlene GanubNessuna valutazione finora

- Earthquake and Tsunami Version 2: Matt WilliamsDocumento107 pagineEarthquake and Tsunami Version 2: Matt WilliamsDarlene GanubNessuna valutazione finora

- University of Mindanao Vs Bangko Sentral NG PilipinasDocumento5 pagineUniversity of Mindanao Vs Bangko Sentral NG PilipinasDarlene GanubNessuna valutazione finora

- Securitization in Financial Services - CERSAIDocumento3 pagineSecuritization in Financial Services - CERSAIrenuka agarwalNessuna valutazione finora

- Labor Standards Bqa PDFDocumento132 pagineLabor Standards Bqa PDFGar OnNessuna valutazione finora

- Opening Day Balance SheetDocumento1 paginaOpening Day Balance SheetCoTrios Health ChainsNessuna valutazione finora

- CCPL MidDocumento7 pagineCCPL MidMuhammad AliNessuna valutazione finora

- Risk and Return: Investment and Portfolio ManagementDocumento13 pagineRisk and Return: Investment and Portfolio ManagementBantamkak FikaduNessuna valutazione finora

- Factoring Is A: Invoice DiscountingDocumento5 pagineFactoring Is A: Invoice DiscountingnoushinesabaNessuna valutazione finora

- NBFCFINALPPTpdfDocumento21 pagineNBFCFINALPPTpdf9977425172Nessuna valutazione finora

- An Overview of The Investment Process #1Documento7 pagineAn Overview of The Investment Process #1Lea AndreleiNessuna valutazione finora

- Contract To Purchase (Condo Unit)Documento4 pagineContract To Purchase (Condo Unit)Joezel PolintanNessuna valutazione finora

- Credit Transactions - Erma Industries Vs SBCDocumento2 pagineCredit Transactions - Erma Industries Vs SBCJp tan brito100% (1)

- Evelyn Ruiz Vs Bernardo Dimailig (G.R. No. 204280 November 9, 2016) TOPIC: Real Estate Mortgage PONENTE: Del Castillo, JDocumento2 pagineEvelyn Ruiz Vs Bernardo Dimailig (G.R. No. 204280 November 9, 2016) TOPIC: Real Estate Mortgage PONENTE: Del Castillo, Jneil peirceNessuna valutazione finora

- Lok AdalatDocumento30 pagineLok AdalatAman MujeebNessuna valutazione finora

- National Grade 9 Assessment 2018 Mathematics P2Documento11 pagineNational Grade 9 Assessment 2018 Mathematics P2Jada arthurNessuna valutazione finora

- Theme 5 Management Science and Financial Management Course GuideDocumento48 pagineTheme 5 Management Science and Financial Management Course Guidedanielnebeyat7Nessuna valutazione finora

- Obligations and Contracts Homework 2020Documento1 paginaObligations and Contracts Homework 2020Lexus A LR100% (1)

- Paf 2014 2 Questions+test2Documento3 paginePaf 2014 2 Questions+test2raaasaaNessuna valutazione finora

- (1923) Act 3135-Real Estate Mortgage LawDocumento3 pagine(1923) Act 3135-Real Estate Mortgage LawDuko Alcala EnjambreNessuna valutazione finora

- LOANDocumento3 pagineLOANJapon, Jenn RossNessuna valutazione finora

- Never Never Nest: Cedric MountDocumento4 pagineNever Never Nest: Cedric MountPratyush AsthanaNessuna valutazione finora

- Kittle v. Biden Exhibits To ComplaintDocumento129 pagineKittle v. Biden Exhibits To ComplaintAshley PoseyNessuna valutazione finora

- BBM 206 BCM 2209 Principles of Finance End Sem Exam Final Jan-Feb 2017Documento3 pagineBBM 206 BCM 2209 Principles of Finance End Sem Exam Final Jan-Feb 2017Hillary Odunga100% (1)

- Statement of Financial PositionDocumento7 pagineStatement of Financial PositionshengNessuna valutazione finora

- ADB Concept PaperDocumento34 pagineADB Concept PaperNidhi BahotNessuna valutazione finora

- FR - Study Hub - Flash CardsDocumento14 pagineFR - Study Hub - Flash CardsFalguni PurohitNessuna valutazione finora

- College of Computing and Information Sciences: Midterm Assessment Spring 2021 SemesterDocumento3 pagineCollege of Computing and Information Sciences: Midterm Assessment Spring 2021 SemesterSohaib RiazNessuna valutazione finora

- Sbi Consent From Seller To Stand As Interim Guarantor 10022020Documento3 pagineSbi Consent From Seller To Stand As Interim Guarantor 10022020Suresh K RNessuna valutazione finora