Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Vertical Analysis TGBL

Caricato da

Manish bansalCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Vertical Analysis TGBL

Caricato da

Manish bansalCopyright:

Formati disponibili

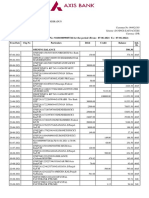

Balance Sheet of Tata Global Beverage

Mar-19 Mar-18 Mar-17

Particulars Amount

Percent

Amount

Percent

Amount

Percent

(₹) (₹) (₹)

EQUITIES AND LIABILITIES

SHAREHOLDER'S FUNDS

Equity Share Capital 63.11 1.26% 63.11 1.29% 63.11 1.43%

Total Share Capital 63.11 1.26% 63.11 1.29% 63.11 1.43%

Revaluation Reserves 21.86 0.44% - 0.00% - 0.00%

Reserves and Surplus 4,358.71 87.10% 4,150.24 84.83% 3,721.44 84.28%

Total Reserves and Surplus 4,380.57 87.53% 4,150.24 84.83% 3,721.44 84.28%

Total Shareholders Funds 4,443.68 88.79% 4,213.35 86.12% 3,784.55 85.71%

Share Capital Suspense - 0.00% - 0.00% - 0.00%

NON-CURRENT LIABILITIES

Long Term Borrowings - 0.00% - 0.00% - 0.00%

Other Long Term Liabilities - 0.00% - 0.00% - 0.00%

Long Term Provisions 115.25 2.30% 109.65 2.24% 119.91 2.72%

Total Non-Current Liabilities 115.25 2.30% 109.65 2.24% 119.91 2.72%

CURRENT LIABILITIES

Short Term Borrowings 4.53 0.09% 84.25 1.72% 32.26 0.73%

Trade Payables 239.42 4.78% 248.46 5.08% 244.33 5.53%

Other Current Liabilities 180.92 3.62% 189.16 3.87% 177.44 4.02%

Short Term Provisions 20.65 0.41% 47.30 0.97% 57.05 1.29%

Total Current Liabilities 445.52 8.90% 569.17 11.63% 511.08 11.57%

Total Capital And Liabilities 5,004.45 100.00% 4,892.17 100.00% 4,415.54 100.00%

ASSETS

NON-CURRENT ASSETS

Tangible Assets 223.84 4.47% 207.59 4.24% 197.76 4.48%

Intangible Assets 18.06 0.36% 19.21 0.39% 16.03 0.36%

Capital Work-In-Progress 10.52 0.21% 11.49 0.23% 7.38 0.17%

Intangible Assets Under

6.73 0.13% 1.16 0.02% 4.12 0.09%

Development

Other Assets 0.65 0.01% 0.67 0.01% 0.69 0.02%

Fixed Assets 259.80 5.19% 240.12 4.91% 225.98 5.12%

Non-Current Investments 2,318.59 46.33% 2,284.28 46.69% 2,903.97 65.77%

Deferred Tax Assets [Net] 33.86 0.68% 99.01 2.02% 38.86 0.88%

Long Term Loans And Advances 16.77 0.34% 20.44 0.42% 24.73 0.56%

Other Non-Current Assets 167.28 3.34% 147.89 3.02% 185.25 4.20%

Total Non-Current Assets 2,796.30 55.88% 2,791.74 57.07% 3,378.79 76.52%

CURRENT ASSETS

Current Investments 497.74 9.95% 536.98 10.98% 67.70 1.53%

Inventories 846.91 16.92% 744.40 15.22% 764.19 17.31%

Trade Receivables 181.92 3.64% 136.66 2.79% 99.62 2.26%

Cash And Cash Equivalents 472.95 9.45% 535.27 10.94% 20.78 0.47%

Short Term Loans And Advances 8.13 0.16% 8.10 0.17% 11.97 0.27%

OtherCurrentAssets 200.50 4.01% 139.02 2.84% 72.49 1.64%

Total Current Assets 2,208.15 44.12% 2,100.43 42.93% 1,036.75 23.48%

Total Assets 5,004.45 100.00% 4,892.17 100.00% 4,415.54 100.00%

Beverage

Mar-16 Mar-15

Amount Amount

Percent Percent

(₹) (₹)

63.11 1.55% 61.84 1.69%

63.11 1.55% 61.84 1.69%

21.86 0.54% 21.86 0.60%

2,810.93 69.15% 2,416.67 66.11%

2,832.79 69.69% 2,438.54 66.71%

2,895.90 71.24% 2,500.38 68.40%

- 0.00% 1.27 0.03%

- 0.00% 325.00 8.89%

- 0.00% 72.54 1.98%

177.87 4.38% 114.02 3.12%

177.87 4.38% 511.56 13.99%

52.61 1.29% 152.50 4.17%

198.38 4.88% 143.88 3.94%

544.95 13.41% 153.48 4.20%

195.21 4.80% 192.61 5.27%

991.15 24.38% 642.47 17.57%

4,064.92 100.00% 3,655.68 100.00%

183.21 4.51% 168.91 4.62%

16.05 0.39% 24.43 0.67%

10.10 0.25% 11.09 0.30%

- 0.00% 0.18 0.00%

- 0.00% - 0.00%

209.36 5.15% 204.61 5.60%

2,264.34 55.70% 2,231.86 61.05%

39.48 0.97% 45.75 1.25%

120.50 2.96% 71.79 1.96%

70.50 1.73% 70.50 1.93%

2,704.18 66.52% 2,624.51 71.79%

- 0.00% - 0.00%

889.71 21.89% 819.27 22.41%

124.09 3.05% 93.62 2.56%

239.20 5.88% 21.01 0.57%

104.47 2.57% 93.36 2.55%

3.27 0.08% 3.91 0.11%

1,360.74 33.48% 1,031.17 28.21%

4,064.92 100.00% 3,655.68 100.00%

Profit & Loss account of Tata Global Beverag

Mar-19 Mar-18 Mar-17

Particulars Amount

Percent

Amount

Percent

Amount

(₹) (₹) (₹)

INCOME

Revenue From Operations [Gross] 3,331.71 100.00% 3,131.68 100.00% 2,987.39

Less: Excise/Sevice Tax/Other Levies - 0.00% - 0.00% -

Revenue From Operations [Net] 3,331.71 100.00% 3,131.68 100.00% 2,987.39

Other Operating Revenues 97.95 2.94% 85.64 2.73% 76.50

Total Operating Revenues 3,429.66 102.94% 3,217.32 102.73% 3,063.89

Other Income 182.51 5.48% 147.58 4.71% 96.34

Total Revenue 3,612.17 108.42% 3,364.90 107.45% 3,160.23

EXPENSES

Cost Of Materials Consumed 2,055.97 61.71% 1,871.55 59.76% 1,867.72

Purchase Of Stock-In Trade 23.65 0.71% 33.00 1.05% 23.03

Operating And Direct Expenses 75.81 2.28% 69.45 2.22% 72.61

Changes In Inventories Of FG,WIP And

0.16 0.00% -1.67 -0.05% -1.79

Stock-In Trade

Employee Benefit Expenses 216.85 6.51% 208.13 6.65% 187.82

Finance Costs 13.18 0.40% 13.65 0.44% 49.10

Depreciation And Amortisation Expenses 31.68 0.95% 27.20 0.87% 23.70

Other Expenses 618.95 18.58% 535.48 17.10% 551.85

Total Expenses 3,036.25 91.13% 2,756.79 88.03% 2,774.04

Profit/Loss Before Exceptional,

575.92 17.29% 608.11 19.42% 386.19

ExtraOrdinary Items And Tax

Exceptional Items - 0.00% 115.36 3.68% -

Profit/Loss Before Tax 575.92 17.29% 723.47 23.10% 386.19

Tax Expenses-Continued Operations

Current Tax 160.57 4.82% 188.91 6.03% 110.24

Less: MAT Credit Entitlement - 0.00% - 0.00% -

Deferred Tax 4.42 0.13% 0.24 0.01% -0.05

Total Tax Expenses 164.99 4.95% 189.15 6.04% 110.19

Profit/Loss After Tax And Before

410.93 12.33% 534.32 17.06% 276.00

ExtraOrdinary Items

Profit/Loss From Continuing Operations 410.93 12.33% 534.32 17.06% 276.00

Profit/Loss For The Period 410.93 12.33% 534.32 17.06% 276.00

a Global Beverage

Mar-17 Mar-16 Mar-15

Amount Amount

Percent Percent Percent

(₹) (₹)

100.00% 2,991.31 100.00% 2,797.95 100.00%

0.00% 6.82 0.23% 0.24 0.01%

100.00% 2,984.49 99.77% 2,797.71 99.99%

2.56% 99.43 3.32% 86.81 3.10%

102.56% 3,083.92 103.10% 2,884.52 103.09%

3.22% 106.57 3.56% 155.16 5.55%

105.79% 3,190.49 106.66% 3,039.68 108.64%

62.52% 1,888.96 63.15% 1,872.87 66.94%

0.77% 11.93 0.40% 1.53 0.05%

2.43% - 0.00% - 0.00%

-0.06% -3.95 -0.13% -27.99 -1.00%

6.29% 186.88 6.25% 161.92 5.79%

1.64% 29.61 0.99% 34.19 1.22%

0.79% 22.79 0.76% 19.94 0.71%

18.47% 657.87 21.99% 559.25 19.99%

92.86% 2,794.09 93.41% 2,621.71 93.70%

12.93% 396.40 13.25% 417.97 14.94%

0.00% 264.57 8.84% -68.92 -2.46%

12.93% 660.97 22.10% 349.05 12.48%

3.69% 130.03 4.35% 55.91 2.00%

0.00% 39.00 1.30% - 0.00%

0.00% 6.27 0.21% 4.14 0.15%

3.69% 97.30 3.25% 60.05 2.15%

9.24% 563.67 18.84% 289.00 10.33%

9.24% 563.67 18.84% 289.00 10.33%

9.24% 563.67 18.84% 289.00 10.33%

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Employment Issues in Insolvency (2013)Documento9 pagineEmployment Issues in Insolvency (2013)Iqbal MohammedNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hierarchy of ControlsDocumento6 pagineHierarchy of ControlsMANOJ KUMARNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- B009 Dhruvil Shah Wealth Management WGz0kGfcZbDocumento5 pagineB009 Dhruvil Shah Wealth Management WGz0kGfcZbDhruvil ShahNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Introduction To Partnership Accounting For Partnership FormationDocumento19 pagineIntroduction To Partnership Accounting For Partnership FormationKarl SolomeroNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- U85300TG2016PTC109270 T Dnblz22xyhch41Documento14 pagineU85300TG2016PTC109270 T Dnblz22xyhch41Aparna DineshNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Statement of Axis Account No:921010009005726 For The Period (From: 07-06-2021 To: 07-06-2022)Documento22 pagineStatement of Axis Account No:921010009005726 For The Period (From: 07-06-2021 To: 07-06-2022)TusharNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Chapter 8 MowenDocumento25 pagineChapter 8 MowenRosamae PialaneNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Pelatihan Awareness Integrated Management System Qhse: Based OnDocumento77 paginePelatihan Awareness Integrated Management System Qhse: Based OnAchmad FiqriNessuna valutazione finora

- Exide Life Insurance - PO 1200011572Documento16 pagineExide Life Insurance - PO 1200011572Joan AliNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- WeTransfer On Companies and CommunitiesDocumento51 pagineWeTransfer On Companies and CommunitiescgoulartNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- SHRM - Training & DevelopmentDocumento49 pagineSHRM - Training & DevelopmentFidan HajiyevaNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Quarter 1 Module 2 Recognize A Potential MarketDocumento30 pagineQuarter 1 Module 2 Recognize A Potential MarketOllie Butial100% (7)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Korn Ferry Core Job Model 2019 - Job Profiles - Ref LevelsDocumento525 pagineKorn Ferry Core Job Model 2019 - Job Profiles - Ref LevelsAbdulaziz AlzahraniNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Third Attempt, Full Research ProposalDocumento15 pagineThird Attempt, Full Research ProposalsenayNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- C3 Ethics, Fraud, and Internal ControlDocumento12 pagineC3 Ethics, Fraud, and Internal ControlLee SuarezNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- N65-Z - SKZ - 14052020075409 PDFDocumento2 pagineN65-Z - SKZ - 14052020075409 PDFSahil DanadanNessuna valutazione finora

- Chap 005Documento153 pagineChap 005Kim NgânNessuna valutazione finora

- Aarong ProjectDocumento29 pagineAarong ProjectIfaz AhmedNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- 314 Presantation Ja d1Documento28 pagine314 Presantation Ja d1Daiyan Shahriar 2011112030Nessuna valutazione finora

- Jahnavi Singh ResumeDocumento2 pagineJahnavi Singh ResumeSayantan 'Ace' DasNessuna valutazione finora

- Business Model Canvas (BMC) : Just Coconut IncorporationDocumento16 pagineBusiness Model Canvas (BMC) : Just Coconut IncorporationJamie RamosNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- PR File OmpanyDocumento15 paginePR File OmpanybassemNessuna valutazione finora

- Mrs Sohini Mitra QueryDocumento3 pagineMrs Sohini Mitra QuerysoumenmukherjeeskailNessuna valutazione finora

- All About Digital MarketingDocumento2 pagineAll About Digital Marketingtopwebsite 2Nessuna valutazione finora

- HR Strategy Problem StatementDocumento2 pagineHR Strategy Problem StatementrahulthiNessuna valutazione finora

- Using Single Blend Optimizer To Quickly Maximize Bunker ProfitsDocumento6 pagineUsing Single Blend Optimizer To Quickly Maximize Bunker ProfitsNAMONessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Order Appealed Against 2Documento27 pagineOrder Appealed Against 2Jyoti MeenaNessuna valutazione finora

- Sydnee Bush - Creative ResumeDocumento1 paginaSydnee Bush - Creative Resumesyd25Nessuna valutazione finora

- Designing An Information Management System For OLA A Information System Management Presentation Report by Aditya KhandelwalDocumento19 pagineDesigning An Information Management System For OLA A Information System Management Presentation Report by Aditya KhandelwalAditya Khandelwal100% (2)

- Partnering To Build Customer Engagement, Value, and RelationshipDocumento32 paginePartnering To Build Customer Engagement, Value, and RelationshipSơn Trần BảoNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)