Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Comparative Analysis On Non Performing Assets of Private and Public Sector Banks

Caricato da

sai thesisTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Comparative Analysis On Non Performing Assets of Private and Public Sector Banks

Caricato da

sai thesisCopyright:

Formati disponibili

A

PROJECT REPORT

ON

COMPARATIVE ANALYSIS ON

NON PERFORMING ASSETS

OF PRIVATE AND PUBLIC SECTOR BANKS

SUBMITTED IN PARTIAL FULFILLMENT OF REQUIRMENT OF

PG PROGRAME

Institute of business management and research

Ahmadabad

SUBMITTED BY:

JIGAR J. SONI ( 5 )

Session: 2007-2009

[Comparative analysis on NPA of Private & Public sector Banks] Page 1

A

PROJECT REPORT

ON

COMPARATIVE ANALYSIS ON

NON PERFORMING ASSETS

OF PRIVATE AND PUBLIC SECTOR BANKS

SUBMITTED IN PARTIAL FULFILLMENT OF REQUIRMENT OF

PG PROGRAME

Institute of business management and research

Ahmadabad

SUBMITTED BY:

JIGAR J. SONI ( 5 )

Session: 2007-2009

[Comparative analysis on NPA of Private & Public sector Banks] Page 2

ANNEXURE –A (COVER PAGE)

IBMR- INSTITUTE OF BUSINESS MANAGEMNT & RESEARCH

Code:-2911

Project title:

COMPARATIVE ANALYSIS ON

NON PERFORMING ASSETS

OF PRIVATE AND PUBLIC SECTOR BANKS

By:

Jigar J. Soni

Nirav N. Gusai

A project report submitted in partial fulfillment of the requirement for the

degree of MASTER OF BUSINESS ADMINISTRATION of SIKKIM MANIPAL

UNIVERSITY, INDIA.

Sikkim –Manipal university of Health, Medical and technological Sciences

Distance education wing

Syndicate house

Manipal-576 104

[Comparative analysis on NPA of Private & Public sector Banks] Page 3

ANNEXURE B (STUDENT DECLARATION)

We here by declare that the project report entitled COMPARATIVE ANALYSIS

ON NON PERFORMING ASSETS OF PRIVATE AND PUBLIC SECTOR BANKS

submitted in partial fulfillment of the requirements for the degree of masters of

business Administration to Sikkim-Manipal University, India, are our original

work and not submitted for the award of any other degree, diploma, fellowship,

or any other similar title or prizes.

Reg.No: Name

520781709 JIGAR J. SONI

Date:

Place:

[Comparative analysis on NPA of Private & Public sector Banks] Page 4

ANNEXURE –C (EXAMINER’S CERTIFICATE)

The project report by Jigar Soni & Nirav Gusai on COMPARATIVE

ANALYSIS ON NON PERFORMING ASSETS OF PRIVATE AND PUBLIC

SECTOR BANKS is approved and is acceptable in quality and form.

Internal examiner External examiner

Name:- Name:-

Qualification: - Qualification:-

Designation: - Designation:-

[Comparative analysis on NPA of Private & Public sector Banks] Page 5

ANNUXERE – D (UNIVERSITY STUDY CENTRE CERTIFICATE)

This is to certify that the project report entitled COMPARATIVE ANALYSIS ON

NON PERFORMING ASSETS OF PRIVATE AND PUBLIC SECTORS BANKS

Submitted in partial fulfillment of the requirement for the degree of MASTER OF

BUSINESS ADMINISTRATION of SIKKIM MANIPAL UNIVERSITY of Health, Medical

and Technological science.

Jigar Soni and Nirav Gusai has worked under my supervision and that no

part of this report has been submitted for the award of any other degree,

Diploma , fellowship or other similar titles or prizes and that the work has been

published in any journal or Magazine.

Name Reg. no

Jigar Soni 520781709

Certified

(Guide’s Name and Qualification)

[Comparative analysis on NPA of Private & Public sector Banks] Page 6

ACKNOWLEDGEMENT

With a deep sense of gratitude I express we thanks to all those who have

been instrumental in the development of the project report.

I am also grateful to Institute of Business Management And Research,

Ahmedabad who gave me a valuable opportunity of involving me in real

live business project. I am thankful to all the professors whose positive

attitude, guidance and faith in my ability spurred me to perform well.

I am also indebted to all lecturers, friends and associates for their valuable

advice, stimulated suggestions and overwhelming support without which

the project would not have been a success.

[Comparative analysis on NPA of Private & Public sector Banks] Page 7

INTRODUCTION

The accumulation of huge non-performing assets in banks has

assumed great importance. The depth of the problem of bad debts was

first realized only in early 1990s. The magnitude of NPAs in banks and

financial institutions is over Rs.1,50,000 crores.

While gross NPA reflects the quality of the loans made by

banks, net NPA shows the actual burden of banks. Now it is increasingly

evident that the major defaulters are the big borrowers coming from the

non-priority sector. The banks and financial institutions have to take the

initiative to reduce NPAs in a time bound strategic approach.

Public sector banks figure prominently in the debate not only

because they dominate the banking industries, but also since they have

much larger NPAs compared with the private sector banks. This raises a

concern in the industry and academia because it is generally felt that

NPAs reduce the profitability of a banks, weaken its financial health and

erode its solvency.

For the recovery of NPAs a broad framework has evolved

for the management of NPAs under which several options are provided for

debt recovery and restructuring. Banks and FIs have the freedom to

design and implement their own policies for recovery and write-off

incorporating compromise and negotiated settlements.

[Comparative analysis on NPA of Private & Public sector Banks] Page 8

RESEARCH METHODOLOGY

Type of Research

The research methodology adopted for carrying out the study were

In this project Descriptive research methodologies were use.

At the first stage theoretical study is attempted.

At the second stage Historical study is attempted.

At the Third stage Comparative study of NPA is undertaken.

Scope of the Study

Concept of Non Performing Asset

Guidelines

Impact of NPAs

Reasons for NPAs

Preventive Measures

Tools to manage NPAs

Sampling plan

To prepare this Project we took five banks from public sector as well as

five banks from private sector.

OBJECTIVES OF THE STUDY

The basic idea behind undertaking the Grand Project on NPA was

to:

To evaluate NPAs (Gross and Net) in different banks.

To study the past trends of NPA

[Comparative analysis on NPA of Private & Public sector Banks] Page 9

To calculate the weighted of NPA in risk management in Banking

To analyze financial performance of banks at different level of NPA

To evaluate profitability positions of banks

To evaluate NPA level in different economic situation.

To Know the Concept of Non Performing Asset

To Know the Impact of NPAs

To Know the Reasons for NPAs

To learn Preventive Measures

Source of data collection

The data collected for the study was secondary data in Nature.

[Comparative analysis on NPA of Private & Public sector Banks] Page 10

((( CONTENTS )))

CHAPTER SUBJECT COVERED PAGE

NO. NO.

1 Introduction to NPAs

2 Research Methodology

Scope of Research

Type of Research

Sources of Data Collection

Objective of Study

Data Collection

3 Introduction to Topic

Definition

History of Indian Banking

Non Performing Assets

Factor for rise in NPAs

Problem due to NPAs

Types of NPAs

Income Recognition

Reporting of NPAs

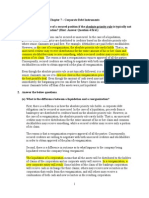

4 Provisioning Norms

General

Floating provisions

Leased Assets

Guideline under special circumstances

5 Impact, Reasons and Symptoms of NPAs

Internal & External Factor

Early Symptoms

6 Preventive Measurement

Early Recognition of Problem

Identifying Borrowers with genuine Intent

[Comparative analysis on NPA of Private & Public sector Banks] Page 11

Timeliness

Focus on Cash flow

Management Effectiveness

Multiple Financing

7 Tools for Recovery

Willful default

Inability to Pay

Special Cases

Role of ARCIL

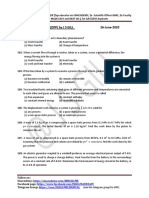

8 Analysis

Deposit-Investment-Advances

Gross NPAs and Net NPAs

Priority and Non-Priority Sector

9 Finding, Suggestions and Conclusions

10 Bibliography

[Comparative analysis on NPA of Private & Public sector Banks] Page 12

Introduction to the topic

The three letters “NPA” Strike terror in banking sector and business circle

today. NPA is short form of “Non Performing Asset”. The dreaded NPA

rule says simply this: when interest or other due to a bank remains unpaid

for more than 90 days, the entire bank loan automatically turns a non

performing asset. The recovery of loan has always been problem for

banks and financial institution. To come out of these first we need to think

is it possible to avoid NPA, no can not be then left is to look after the factor

responsible for it and managing those factors.

Definitions:

An asset, including a leased asset, becomes non-performing when it

ceases to generate income for the bank.

A ‘non-performing asset’ (NPA) was defined as a credit facility in respect

of which the interest and/ or instalment of principal has remained ‘past

due’ for a specified period of time.

With a view to moving towards international best practices and to ensure

greater transparency, it has been decided to adopt the ‘90 days’

overdue’ norm for identification of NPAs, from the year ending March 31,

2004. Accordingly, with effect from March 31, 2004, a non-performing

asset (NPA) shall be a loan or an advance where;

Interest and/ or instalment of principal remain overdue for a

period of more than 90 days in respect of a term loan,

[Comparative analysis on NPA of Private & Public sector Banks] Page 13

The account remains ‘out of order’ for a period of more than 90

days, in respect of an Overdraft/Cash Credit (OD/CC),

The bill remains overdue for a period of more than 90 days in

the case of bills purchased and discounted,

Interest and/or instalment of principal remains overdue for two

harvest seasons but for a period not exceeding two half years

in the case of an advance granted for agricultural purposes,

and

Any amount to be received remains overdue for a period of

more than 90 days in respect of other accounts.

As a facilitating measure for smooth transition to 90 days norm,

banks have been advised to move over to charging of interest at monthly

rests, by April 1, 2002. However, the date of classification of an advance

as NPA should not be changed on account of charging of interest at

monthly rests. Banks should, therefore, continue to classify an account as

NPA only if the interest charged during any quarter is not serviced fully

within 180 days from the end of the quarter with effect from April 1, 2002

and 90 days from the end of the quarter with effect from March 31, 2004.

[Comparative analysis on NPA of Private & Public sector Banks] Page 14

HISTORY OF INDIAN BANKING

A bank is a financial institution that provides banking and other financial

services. By the term bank is generally understood an institution that

holds a Banking Licenses. Banking licenses are granted by financial

supervision authorities and provide rights to conduct the most fundamental

banking services such as accepting deposits and making loans. There are

also financial institutions that provide certain banking services without

meeting the legal definition of a bank, a so-called Non-bank. Banks are a

subset of the financial services industry.

The word bank is derived from the Italian banca, which is derived from

German and means bench. The terms bankrupt and "broke" are similarly

derived from banca rotta, which refers to an out of business bank, having

its bench physically broken. Moneylenders in Northern Italy originally did

business in open areas, or big open rooms, with each lender working from

his own bench or table.

Typically, a bank generates profits from transaction fees on financial

services or the interest spread on resources it holds in trust for clients

while paying them interest on the asset. Development of banking industry

in India followed below stated steps.

Banking in India has its origin as early as the Vedic period. It is

believed that the transition from money lending to banking must

have occurred even before Manu, the great Hindu Jurist, who has

devoted a section of his work to deposits and advances and laid

down rules relating to rates of interest.

[Comparative analysis on NPA of Private & Public sector Banks] Page 15

Banking in India has an early origin where the indigenous bankers

played a very important role in lending money and financing foreign

trade and commerce. During the days of the East India Company,

was the turn of the agency houses to carry on the banking

business. The General Bank of India was first Joint Stock Bank to

be established in the year 1786. The others which followed were

the Bank Hindustan and the Bengal Bank.

In the first half of the 19th century the East India Company

established three banks; the Bank of Bengal in 1809, the Bank of

Bombay in 1840 and the Bank of Madras in 1843. These three

banks also known as Presidency banks were amalgamated in 1920

and a new bank, the Imperial Bank of India was established in

1921. With the passing of the State Bank of India Act in 1955 the

undertaking of the Imperial Bank of India was taken by the newly

constituted State Bank of India.

The Reserve Bank of India which is the Central Bank was created

in 1935 by passing Reserve Bank of India Act, 1934 which was

followed up with the Banking Regulations in 1949. These acts

bestowed Reserve Bank of India (RBI) with wide ranging powers for

licensing, supervision and control of banks. Considering the

proliferation of weak banks, RBI compulsorily merged many of them

with stronger banks in 1969.

The three decades after nationalization saw a phenomenal

expansion in the geographical coverage and financial spread of the

banking system in the country. As certain rigidities and weaknesses

were found to have developed in the system, during the late

eighties the Government of India felt that these had to be

[Comparative analysis on NPA of Private & Public sector Banks] Page 16

addressed to enable the financial system to play its role in ushering

in a more efficient and competitive economy. Accordingly, a high-

level committee was set up on 14 August 1991 to examine all

aspects relating to the structure, organization, functions and

procedures of the financial system. Based on the recommendations

of the Committee (Chairman: Shri M. Narasimham), a

comprehensive reform of the banking system was introduced in

1992-93. The objective of the reform measures was to ensure that

the balance sheets of banks reflected their actual financial health.

One of the important measures related to income recognition, asset

classification and provisioning by banks, on the basis of objective

criteria was laid down by the Reserve Bank. The introduction of

capital adequacy norms in line with international standards has

been another important measure of the reforms process.

1. Comprises balance of expired loans, compensation and other

bonds such as National Rural Development Bonds and Capital

Investment Bonds. Annuity certificates are excluded.

2. These represent mainly non- negotiable non- interest bearing

securities issued to International Financial Institutions like

International Monetary Fund, International Bank for

Reconstruction and Development and Asian Development Bank.

3. At book value.

4. Comprises accruals under Small Savings Scheme, Provident

Funds, Special Deposits of Non- Government

In the post-nationalization era, no new private sector banks were

allowed to be set up. However, in 1993, in recognition of the need

to introduce greater competition which could lead to higher

productivity and efficiency of the banking system, new private

sector banks were allowed to be set up in the Indian banking

[Comparative analysis on NPA of Private & Public sector Banks] Page 17

system. These new banks had to satisfy among others, the

following minimum requirements:

(i) It should be registered as a public limited company;

(ii) The minimum paid-up capital should be Rs 100 crore;

(iii) The shares should be listed on the stock exchange;

(iv) The headquarters of the bank should be preferably located

in a centre which does not have the headquarters of any

other bank; and

(v) The bank will be subject to prudential norms in respect of

banking operations, accounting and other policies as laid

down by the RBI. It will have to achieve capital adequacy

of eight per cent from the very beginning.

A high level Committee, under the Chairmanship of Shri M.

Narasimham, was constituted by the Government of India in

December 1997 to review the record of implementation of financial

system reforms recommended by the CFS in 1991 and chart the

reforms necessary in the years ahead to make the banking system

stronger and better equipped to compete effectively in international

economic environment. The Committee has submitted its report to

the Government in April 1998. Some of the recommendations of the

Committee, on prudential accounting norms, particularly in the

areas of Capital Adequacy Ratio, Classification of Government

guaranteed advances, provisioning requirements on standard

advances and more disclosures in the Balance Sheets of banks

have been accepted and implemented. The other

recommendations are under consideration.

The banking industry in India is in a midst of transformation, thanks

to the economic liberalization of the country, which has changed

[Comparative analysis on NPA of Private & Public sector Banks] Page 18

business environment in the country. During the pre-liberalization

period, the industry was merely focusing on deposit mobilization

and branch expansion. But with liberalization, it found many of its

advances under the non-performing assets (NPA) list. More

importantly, the sector has become very competitive with the entry

of many foreign and private sector banks. The face of banking is

changing rapidly. There is no doubt that banking sector reforms

have improved the profitability, productivity and efficiency of banks,

but in the days ahead banks will have to prepare themselves to

face new challenges.

Indian Banking: Key Developments

1969 Government acquires ownership in major banks

Almost all banking operations in manual mode

Some banks had Unit record Machines of IBM for IBR &

Pay roll

1970- 1980 Unprecedented expansion in geographical coverage, staff,

business & transaction volumes and directed lending to

agriculture, SSI & SB sector

Manual systems struggle to handle exponential rise in

transaction volumes --

Outsourcing of data processing to service bureau begins

Back office systems only in Multinational (MNC) banks'

offices

[Comparative analysis on NPA of Private & Public sector Banks] Page 19

1981- 1990 Regulator (read RBI) led IT introduction in Banks

Product level automation on stand alone PCs at branches

(ALPMs)

In-house EDP infrastructure with Unix boxes, batch

processing in Cobol for MIS.

Mainframes in corporate office

1991-1995 Expansion slows down

Banking sector reforms resulting in progressive de-

regulation of banking, introduction of prudential banking

norms entry of new private sector banks

Total Branch Automation (TBA) in Govt. owned and old

private banks begins

New private banks are set up with CBS/TBA form the start

1996-2000 New delivery channels like ATM, Phone banking and

Internet banking and convenience of any branch banking

and auto sweep products introduced by new private and

MNC banks

Retail banking in focus, proliferation of credit cards

Communication infrastructure improves and becomes

cheap. IDRBT sets up VSAT network for Banks

Govt. owned banks feel the heat and attempt to respond

using intermediary technology, TBA implementation surges

ahead under fiat from Central Vigilance

Commission (CVC), Y2K threat consumes last two years

[Comparative analysis on NPA of Private & Public sector Banks] Page 20

2000-2003 Alternate delivery channels find wide consumer acceptance

IT Bill passed lending legal validity to electronic transactions

Govt. owned banks and old private banks start

implementing CBSs, but initial attempts face problems

Banks enter insurance business launch debit cards

(Source: M.Y.KHAN, “INDIAN FINANCIAL SYSYEM”,3rd edition

Publication by TATA McGraw hill)

[Comparative analysis on NPA of Private & Public sector Banks] Page 21

NON PERFORMING ASSETS (NPA)

WHAT IS A NPA (NON PERFORMING ASSETS) ?

Action for enforcement of security interest can be initiated only if the

secured asset is classified as Nonperforming asset.

Non performing asset means an asset or account of borrower ,which has

been classified by bank or financial institution as sub –standard , doubtful

or loss asset, in accordance with the direction or guidelines relating to

assets classification issued by RBI .

An amount due under any credit facility is treated as “past due” when it

is not been paid within 30 days from the due date. Due to the

improvement in the payment and settlement system, recovery climate, up

gradation of technology in the banking system etc, it was decided to

dispense with “past due “concept, with effect from March 31, 2001.

Accordingly as from that date, a Non performing asset shell be an

advance where

i. Interest and/or installment of principal remain overdue for a period

of more than 180 days in respect of a term loan,

ii. The account remains ‘out of order ‘ for a period of more than 180

days ,in respect of an overdraft/cash credit (OD/CC)

iii. The bill remains overdue for a period of more than 180 days in case

of bill purchased or discounted.

iv. Interest and/or principal remains overdue for two harvest season

but for a period not exceeding two half years in case of an advance

granted for agricultural purpose ,and

v. Any amount to be received remains overdue for a period of more

than 180 days in respect of other accounts

With a view to moving towards international best practices and to

ensure greater transparency, it has been decided to adopt ’90 days

overdue ‘norms for identification of NPAs ,from the year ending March

31,2004,a non performing asset shell be a loan or an advance where;

i. Interest and/or installment of principal remain overdue for a

period of more than 90 days in respect of a term loan,

[Comparative analysis on NPA of Private & Public sector Banks] Page 22

ii. The account remains ‘out of order ‘ for a period of more than

90 days ,in respect of an overdraft/cash credit (OD/CC)

iii. The bill remains overdue for a period of more than 90 days

in case of bill purchased or discounted.

iv. Interest and/or principal remains overdue for two harvest

season but for a period not exceeding two half years in case

of an advance granted for agricultural purpose ,and

v. Any amount to be received remains overdue for a period of

more than 90 days in respect of other accounts

Out of order

An account should be treated as out of order if the outstanding

balance remains continuously in excess of sanctioned limit /drawing

power. in case where the out standing balance in the principal operating

account is less than the sanctioned amount /drawing power, but there are

no credits continuously for six months as on the date of balance sheet or

credit are not enough to cover the interest debited during the same

period ,these account should be treated as ‘out of order’.

Overdue

Any amount due to the bank under any credit facility is ‘overdue’ if it

is not paid on due date fixed by the bank.

FACTORS FOR RISE IN NPAs

The banking sector has been facing the serious problems of the

rising NPAs. But the problem of NPAs is more in public sector banks

when compared to private sector banks and foreign banks. The NPAs in

PSB are growing due to external as well as internal factors.

EXTERNAL FACTORS :-

----------------------------------

[Comparative analysis on NPA of Private & Public sector Banks] Page 23

Ineffective recovery tribunal

The Govt. has set of numbers of recovery tribunals, which

works for recovery of loans and advances. Due to their negligence

and ineffectiveness in their work the bank suffers the consequence

of non-recover, their by reducing their profitability and liquidity.

Willful Defaults

There are borrowers who are able to payback loans but are

intentionally withdrawing it. These groups of people should be

identified and proper measures should be taken in order to get back

the money extended to them as advances and loans.

Natural calamities

This is the measure factor, which is creating alarming rise in

NPAs of the PSBs. every now and then India is hit by major natural

calamities thus making the borrowers unable to pay back there

loans. Thus the bank has to make large amount of provisions in

order to compensate those loans, hence end up the fiscal with a

reduced profit.

Mainly ours farmers depends on rain fall for cropping. Due

to irregularities of rain fall the farmers are not to achieve the

production level thus they are not repaying the loans.

Industrial sickness

Improper project handling , ineffective management , lack of

adequate resources , lack of advance technology , day to day

changing govt. Policies give birth to industrial sickness. Hence the

[Comparative analysis on NPA of Private & Public sector Banks] Page 24

banks that finance those industries ultimately end up with a low

recovery of their loans reducing their profit and liquidity.

Lack of demand

Entrepreneurs in India could not foresee their product demand and

starts production which ultimately piles up their product thus making

them unable to pay back the money they borrow to operate these

activities. The banks recover the amount by selling of their assets,

which covers a minimum label. Thus the banks record the non

recovered part as NPAs and has to make provision for it.

Change on Govt. policies

With every new govt. banking sector gets new policies for its

operation. Thus it has to cope with the changing principles and

policies for the regulation of the rising of NPAs.

The fallout of handloom sector is continuing as most of the

weavers Co-operative societies have become defunct largely due

to withdrawal of state patronage. The rehabilitation plan worked out

by the Central government to revive the handloom sector has not

yet been implemented. So the over dues due to the handloom

sectors are becoming NPAs.

INTERNAL FACTORS :-

---------------------------------

Defective Lending process

[Comparative analysis on NPA of Private & Public sector Banks] Page 25

There are three cardinal principles of bank lending that have been

followed by the commercial banks since long.

i. Principles of safety

ii. Principle of liquidity

iii. Principles of profitability

i. Principles of safety :-

By safety it means that the borrower is in a position to repay the

loan both principal and interest. The repayment of loan depends

upon the borrowers:

a. Capacity to pay

b. Willingness to pay

Capacity to pay depends upon:

1. Tangible assets

2. Success in business

Willingness to pay depends on:

1. Character

2. Honest

3. Reputation of borrower

The banker should, there fore take utmost care in ensuring that the

enterprise or business for which a loan is sought is a sound one

and the borrower is capable of carrying it out successfully .he

should be a person of integrity and good character.

[Comparative analysis on NPA of Private & Public sector Banks] Page 26

Inappropriate technology

Due to inappropriate technology and management information

system, market driven decisions on real time basis can not be

taken. Proper MIS and financial accounting system is not

implemented in the banks, which leads to poor credit collection,

thus NPA. All the branches of the bank should be computerized.

Improper SWOT analysis

The improper strength, weakness, opportunity and threat analysis

is another reason for rise in NPAs. While providing unsecured

advances the banks depend more on the honesty, integrity, and

financial soundness and credit worthiness of the borrower.

• Banks should consider the borrowers own capital

investment.

• it should collect credit information of the borrowers from_

a. From bankers.

b. Enquiry from market/segment of trade, industry,

business.

c. From external credit rating agencies.

[Comparative analysis on NPA of Private & Public sector Banks] Page 27

• Analyze the balance sheet.

True picture of business will be revealed on analysis of

profit/loss a/c and balance sheet.

• Purpose of the loan

When bankers give loan, he should analyze the purpose of

the loan. To ensure safety and liquidity, banks should grant

loan for productive purpose only. Bank should analyze the

profitability, viability, long term acceptability of the project

while financing.

Poor credit appraisal system

Poor credit appraisal is another factor for the rise in NPAs. Due to

poor credit appraisal the bank gives advances to those who are not

able to repay it back. They should use good credit appraisal to

decrease the NPAs.

Managerial deficiencies

The banker should always select the borrower very carefully and

should take tangible assets as security to safe guard its interests.

When accepting securities banks should consider the_

[Comparative analysis on NPA of Private & Public sector Banks] Page 28

1. Marketability

2. Acceptability

3. Safety

4. Transferability.

The banker should follow the principle of diversification of

risk based on the famous maxim “do not keep all the eggs in one

basket”; it means that the banker should not grant advances to a

few big farms only or to concentrate them in few industries or in a

few cities. If a new big customer meets misfortune or certain traders

or industries affected adversely, the overall position of the bank will

not be affected.

Like OSCB suffered loss due to the OTM Cuttack, and

Orissa hand loom industries. The biggest defaulters of OSCB are

the OTM (117.77lakhs), and the handloom sector Orissa hand loom

WCS ltd (2439.60lakhs).

Absence of regular industrial visit

The irregularities in spot visit also increases the NPAs. Absence

of regularly visit of bank officials to the customer point decreases

the collection of interest and principals on the loan. The NPAs due

to willful defaulters can be collected by regular visits.

Re loaning process

Non remittance of recoveries to higher financing agencies and re

loaning of the same have already affected the smooth operation of

the credit cycle.

[Comparative analysis on NPA of Private & Public sector Banks] Page 29

Due to re loaning to the defaulters and CCBs and PACs, the NPAs

of OSCB is increasing day by day.

PROBLEMS DUE TO NPA

1. Owners do not receive a market return on there capital .in the worst

case, if the banks fails, owners loose their assets. In modern times

this may affect a broad pool of shareholders.

2. Depositors do not receive a market return on saving. In the worst

case if the bank fails, depositors loose their assets or uninsured

balance.

3. Banks redistribute losses to other borrowers by charging higher

interest rates, lower deposit rates and higher lending rates repress

saving and financial market, which hamper economic growth.

4. Non performing loans epitomize bad investment. They misallocate

credit from good projects, which do not receive funding, to failed

projects. Bad investment ends up in misallocation of capital, and by

extension, labour and natural resources.

Non performing asset may spill over the banking system and contract the

money stock, which may lead to economic contraction. This spill over

effect can channelize through liquidity or bank insolvency:

a) When many borrowers fail to pay interest, banks may experience

liquidity shortage. This can jam payment across the country,

b) Illiquidity constraints bank in paying depositors

.c) Undercapitalized banks exceeds the banks capital base.

The three letters Strike terror in banking sector and business circle today.

NPA is short form of “Non Performing Asset”. The dreaded NPA rule says

[Comparative analysis on NPA of Private & Public sector Banks] Page 30

simply this: when interest or other due to a bank remains unpaid for more

than 90 days, the entire bank loan automatically turns a non performing

asset. The recovery of loan has always been problem for banks and

financial institution. To come out of these first we need to think is it

possible to avoid NPA, no can not be then left is to look after the factor

responsible for it and managing those factors.

Interest and/or instalment of principal remains overdue for two

harvest seasons but for a period not exceeding two half years

in the case of an advance granted for agricultural purposes,

and

Any amount to be received remains overdue for a period of

more than 90 days in respect of other accounts.

As a facilitating measure for smooth transition to 90 days norm, banks

have been advised to move over to charging of interest at monthly rests,

by April 1, 2002. However, the date of classification of an advance as NPA

should not be changed on account of charging of interest at monthly rests.

Banks should, therefore, continue to classify an account as NPA only if the

interest charged during any quarter is not serviced fully within 180 days

from the end of the quarter with effect from April 1, 2002 and 90 days from

the end of the quarter with effect from March 31, 2004.

'Out of Order' status:

An account should be treated as 'out of order' if the

outstanding balance remains continuously in excess of the sanctioned

limit/drawing power. In cases where the outstanding balance in the

principal operating account is less than the sanctioned limit/drawing

[Comparative analysis on NPA of Private & Public sector Banks] Page 31

power, but there are no credits continuously for six months as on the date

of Balance Sheet or credits are not enough to cover the interest debited

during the same period, these accounts should be treated as 'out of

order'.

‘Overdue’:

Any amount due to the bank under any credit facility is

‘overdue’ if it is not paid on the due date fixed by the bank.

Types of NPA

A] Gross NPA

B] Net NPA

A] Gross NPA:

Gross NPAs are the sum total of all loan assets that are classified as

NPAs as per RBI guidelines as on Balance Sheet date. Gross NPA

reflects the quality of the loans made by banks. It consists of all the

non standard assets like as sub-standard, doubtful, and loss assets.

It can be calculated with the help of following ratio:

[Comparative analysis on NPA of Private & Public sector Banks] Page 32

Potrebbero piacerti anche

- Eft How It Works Flier PDFDocumento2 pagineEft How It Works Flier PDFMikeDouglas100% (3)

- Design of Single Storey Residential BuildingDocumento38 pagineDesign of Single Storey Residential Buildingsai thesis100% (2)

- Regional Rural Banks of India: Evolution, Performance and ManagementDa EverandRegional Rural Banks of India: Evolution, Performance and ManagementNessuna valutazione finora

- Tabarsum NON PERFORMING ASSETS AXIS BANKDocumento73 pagineTabarsum NON PERFORMING ASSETS AXIS BANKSagar Paul'g100% (4)

- MBA FinanceDocumento11 pagineMBA Financeranjithc240% (1)

- Final Project NPA MANAGEMENT IN BANKSDocumento88 pagineFinal Project NPA MANAGEMENT IN BANKSmanish223283% (18)

- Synopsis On NPA Project For MBA PDFDocumento3 pagineSynopsis On NPA Project For MBA PDFSachin100% (1)

- Alpen Bank AnalysisDocumento11 pagineAlpen Bank Analysismadhavjoshi63Nessuna valutazione finora

- Module 2: Corporate Liquidation: Integrated Review Ii: Advanced Financial Accounting and ReportingDocumento4 pagineModule 2: Corporate Liquidation: Integrated Review Ii: Advanced Financial Accounting and ReportingDarren Joy CoronaNessuna valutazione finora

- HERBERT HERNANDEZ 2019 Tax Return PDFDocumento31 pagineHERBERT HERNANDEZ 2019 Tax Return PDFSwazelleDiane50% (2)

- What Is FactoringDocumento22 pagineWhat Is Factoringshah faisal100% (1)

- NIS 2015 To Foreclose or Not To Foreclose Rande JohnsenDocumento22 pagineNIS 2015 To Foreclose or Not To Foreclose Rande JohnsenIsabel SantamariaNessuna valutazione finora

- A Study On Non Performing Assets of Sbi and Canara BankDocumento75 pagineA Study On Non Performing Assets of Sbi and Canara BankeshuNessuna valutazione finora

- Comparative Analysis On NPA of Private & Public Sector BanksDocumento86 pagineComparative Analysis On NPA of Private & Public Sector BanksNagireddy Kalluri100% (1)

- A Project Report On Non Performing Asset of Commercial Bank in India at IdbiDocumento75 pagineA Project Report On Non Performing Asset of Commercial Bank in India at IdbiBabasab Patil (Karrisatte)100% (1)

- Synopsis Major Project of Cooperative BankDocumento6 pagineSynopsis Major Project of Cooperative BankRiyas Parakkattil0% (1)

- A Project Report On Non-Performing Assets of Bank of MaharashtraDocumento80 pagineA Project Report On Non-Performing Assets of Bank of MaharashtraBabasab Patil (Karrisatte)Nessuna valutazione finora

- Mba ProjeactDocumento39 pagineMba Projeactkurapati AdiNessuna valutazione finora

- A Study On Non Performing Assets at SBI, BengaluruDocumento79 pagineA Study On Non Performing Assets at SBI, BengaluruRahul KumarNessuna valutazione finora

- Working Management of Axis BankDocumento53 pagineWorking Management of Axis BankAayushi Sharma50% (2)

- Project Report On Working Capital Assessment CANARA BANKDocumento73 pagineProject Report On Working Capital Assessment CANARA BANKAsrar67% (6)

- A Study On RDCC BankDocumento94 pagineA Study On RDCC BankBettappa patil33% (3)

- HDFC Black Book - Print PDFDocumento42 pagineHDFC Black Book - Print PDFShruti PalekarNessuna valutazione finora

- Banking Project Topics-2Documento4 pagineBanking Project Topics-2Mike KukrejaNessuna valutazione finora

- Corporate BankingDocumento63 pagineCorporate BankingRicha SinhaNessuna valutazione finora

- TYBBA Fin ProjectDocumento30 pagineTYBBA Fin ProjectShaikh FarheenNessuna valutazione finora

- CAMELS Project of Axis BankDocumento47 pagineCAMELS Project of Axis Bankjatinmakwana90Nessuna valutazione finora

- Comprative Study On Npa of Public & Private Sector Banks - M.com Sem 4Documento61 pagineComprative Study On Npa of Public & Private Sector Banks - M.com Sem 4Sagar MaharanaNessuna valutazione finora

- Review of LiteratureDocumento8 pagineReview of LiteratureFurkan BelimNessuna valutazione finora

- Consumer Satisfaction On Nashik Merchamt BankDocumento40 pagineConsumer Satisfaction On Nashik Merchamt BankKunal Hire-Patil100% (2)

- Comparative Analysis of Non-Performing Assets of Public Sector Banks, Private Sector Banks & Foreign Banks Research Marketing ShardaDocumento70 pagineComparative Analysis of Non-Performing Assets of Public Sector Banks, Private Sector Banks & Foreign Banks Research Marketing ShardaRahul Gujjar100% (2)

- SBI Priject Working Capital ManagementDocumento65 pagineSBI Priject Working Capital ManagementJaidev Sourot100% (1)

- Comparative Analysis of Non Performing Assets of Public Sector, Private Sector & Foreign BanksDocumento73 pagineComparative Analysis of Non Performing Assets of Public Sector, Private Sector & Foreign BanksGaurav S. Godwani0% (1)

- Varchha Bank ReportDocumento79 pagineVarchha Bank ReportSatish Prajapati33% (3)

- Finance Project TopicDocumento18 pagineFinance Project Topicchandrakant_jagNessuna valutazione finora

- Comprative Analysis of Services Provided by HDFC and Axis BankDocumento58 pagineComprative Analysis of Services Provided by HDFC and Axis BankNitinAgnihotriNessuna valutazione finora

- Chetan 2021Documento87 pagineChetan 2021Jai GaneshNessuna valutazione finora

- IDBI BANK SHWETA GUPTApdf PDFDocumento49 pagineIDBI BANK SHWETA GUPTApdf PDFshweta GuptaNessuna valutazione finora

- Bank of IndiaDocumento57 pagineBank of Indiadeegaur100% (1)

- TJSBDocumento59 pagineTJSBMonik Maru Fakra He63% (8)

- Project Report On Impact of NPA in The Performance of Financial InstitutionDocumento96 pagineProject Report On Impact of NPA in The Performance of Financial InstitutionManu Yuvi100% (1)

- Credit SaraswatDocumento76 pagineCredit Saraswatsahil1508100% (1)

- Report On Sutex BankDocumento55 pagineReport On Sutex Bankjkpatel221Nessuna valutazione finora

- Rayudu DocumentDocumento55 pagineRayudu DocumentPinky KusumaNessuna valutazione finora

- A Compre Hensive Proje CT Re PortDocumento126 pagineA Compre Hensive Proje CT Re PortKAUSHLESH CHOUDHARYNessuna valutazione finora

- A Study On Non Performing Assets With Special Reference To Canara BankDocumento55 pagineA Study On Non Performing Assets With Special Reference To Canara BankNaveena Shankara100% (1)

- Bank of IndiaDocumento22 pagineBank of IndiaLeeladhar Nagar100% (1)

- Cash Management in SBI Effect On Their Customers .Docx (3) - 1 (3) (Repaired)Documento75 pagineCash Management in SBI Effect On Their Customers .Docx (3) - 1 (3) (Repaired)anas khanNessuna valutazione finora

- Bank of IndiaDocumento49 pagineBank of IndiaJasmeet Singh100% (1)

- A Project Report On Asset Liability Management in Andhra BankDocumento91 pagineA Project Report On Asset Liability Management in Andhra BankBabasab Patil (Karrisatte)50% (2)

- A Summer Training Project Report On: "Financial Statement Analysis" OF Orissa State Co-Operative Bank Ltd. BhubaneswarDocumento74 pagineA Summer Training Project Report On: "Financial Statement Analysis" OF Orissa State Co-Operative Bank Ltd. BhubaneswarNaman JainNessuna valutazione finora

- S. No Title: List of Projects & Working Papers Completed at IIFDocumento33 pagineS. No Title: List of Projects & Working Papers Completed at IIFantimamalkaniNessuna valutazione finora

- Comparative Analysis On Non Performing Assets of Private and Public Sector BanksDocumento106 pagineComparative Analysis On Non Performing Assets of Private and Public Sector BanksNeerajNessuna valutazione finora

- Non Performing Assets of BanksDocumento109 pagineNon Performing Assets of BanksJIGAR87% (23)

- Comparative Analysis On Non Performing Assets of Private and Public Sector BanksDocumento108 pagineComparative Analysis On Non Performing Assets of Private and Public Sector BanksAmit SinghNessuna valutazione finora

- Aproject Reporton MbaDocumento8 pagineAproject Reporton Mbarameshraj1991Nessuna valutazione finora

- Non Performing Assets of BanksDocumento110 pagineNon Performing Assets of BanksAvinash AndyNessuna valutazione finora

- Npa ProjectDocumento67 pagineNpa ProjectYemmiganur townNessuna valutazione finora

- Comparion of Net Financing AssetsDocumento77 pagineComparion of Net Financing AssetsNikhil SharmaNessuna valutazione finora

- Empirical Study On Non Performing Assets of BankDocumento6 pagineEmpirical Study On Non Performing Assets of Bankkapil1248Nessuna valutazione finora

- Anirudh Minor ProjectDocumento21 pagineAnirudh Minor Projectanirudh sharmaNessuna valutazione finora

- Non-Performing Asset of Public and Private Sector Banks in India: A Descriptive StudyDocumento8 pagineNon-Performing Asset of Public and Private Sector Banks in India: A Descriptive StudySujata MansukhaniNessuna valutazione finora

- Impact of COVID-19 On Banking PeforamanceDocumento11 pagineImpact of COVID-19 On Banking PeforamanceAli NadafNessuna valutazione finora

- Non-Performing Asset of Public and Private Sector Banks in India A Descriptive Study SUSHENDRA KUMAR MISRADocumento5 pagineNon-Performing Asset of Public and Private Sector Banks in India A Descriptive Study SUSHENDRA KUMAR MISRAharshita khadayteNessuna valutazione finora

- A Comparative Study of Non Performing Assets in Public and Private Sector Banks in IndiaDocumento5 pagineA Comparative Study of Non Performing Assets in Public and Private Sector Banks in IndiaPruthviraj RathoreNessuna valutazione finora

- Camel ModelDocumento3 pagineCamel ModelGokulapriyan ANessuna valutazione finora

- SynopsisDocumento9 pagineSynopsisKuNaL HaJaReNessuna valutazione finora

- Is Lab Manual IT 801Documento32 pagineIs Lab Manual IT 801sai thesisNessuna valutazione finora

- Amita Resume UpdatedDocumento2 pagineAmita Resume Updatedsai thesisNessuna valutazione finora

- Amita Resume UpdatedDocumento2 pagineAmita Resume Updatedsai thesisNessuna valutazione finora

- LD Certificate and AcknowledgementDocumento5 pagineLD Certificate and Acknowledgementsai thesisNessuna valutazione finora

- Wireless Room Freshener Spraying Robot With Video VisionDocumento5 pagineWireless Room Freshener Spraying Robot With Video Visionsai thesisNessuna valutazione finora

- Lakshmi Narain College of Technology, Bhopal: Vocational Training Report OnDocumento4 pagineLakshmi Narain College of Technology, Bhopal: Vocational Training Report Onsai thesisNessuna valutazione finora

- MYDocumento4 pagineMYsai thesisNessuna valutazione finora

- Executive Summary: Introduction To The ProblemDocumento34 pagineExecutive Summary: Introduction To The Problemsai thesisNessuna valutazione finora

- Reliancejio 161023183053 PDFDocumento12 pagineReliancejio 161023183053 PDFVinal PatelNessuna valutazione finora

- RELIANCEDocumento58 pagineRELIANCEajay sharmaNessuna valutazione finora

- Case Study For Kotra Sewage Treatment PlantDocumento4 pagineCase Study For Kotra Sewage Treatment Plantsai thesisNessuna valutazione finora

- Design of Single Storey Residential BuildingDocumento47 pagineDesign of Single Storey Residential Buildingsai thesisNessuna valutazione finora

- Reliancejio 161023183053 PDFDocumento12 pagineReliancejio 161023183053 PDFVinal PatelNessuna valutazione finora

- Executive Summary: Introduction To The ProblemDocumento34 pagineExecutive Summary: Introduction To The Problemsai thesisNessuna valutazione finora

- Customer Satisfaction of Jio SimDocumento94 pagineCustomer Satisfaction of Jio SimChandra Shekar100% (3)

- Reliancejio 161023183053 PDFDocumento12 pagineReliancejio 161023183053 PDFVinal PatelNessuna valutazione finora

- RELIANCEDocumento58 pagineRELIANCEajay sharmaNessuna valutazione finora

- RELIANCEDocumento58 pagineRELIANCEajay sharmaNessuna valutazione finora

- Esa Vkret VK Q - Fuoklh GKSDJ DK 'Kifkiwozd Fueu Dfku DJRK GWW FD %&Documento2 pagineEsa Vkret VK Q - Fuoklh GKSDJ DK 'Kifkiwozd Fueu Dfku DJRK GWW FD %&NAVEEN ROYNessuna valutazione finora

- Customer Satisfaction of Jio SimDocumento94 pagineCustomer Satisfaction of Jio SimChandra Shekar100% (3)

- Customer Satisfaction Survey On AirtelDocumento58 pagineCustomer Satisfaction Survey On Airtelsai thesisNessuna valutazione finora

- Customer Satisfaction Survey On AirtelDocumento58 pagineCustomer Satisfaction Survey On Airtelsai thesisNessuna valutazione finora

- Syllabus SSE 2019 PDFDocumento14 pagineSyllabus SSE 2019 PDFgunjanNessuna valutazione finora

- Daily Practice Problem (DPP) by J S GILL 26-June-2020Documento2 pagineDaily Practice Problem (DPP) by J S GILL 26-June-2020sai thesisNessuna valutazione finora

- Memo 3Documento1 paginaMemo 3sai thesisNessuna valutazione finora

- A Study of Consumer Behavior With Respect To Financial News Paper at Business StandardDocumento42 pagineA Study of Consumer Behavior With Respect To Financial News Paper at Business Standardsai thesisNessuna valutazione finora

- Memo 2Documento1 paginaMemo 2sai thesisNessuna valutazione finora

- Design & Analysis of Disc Brake Rotor by Using Ansys SoftwareDocumento3 pagineDesign & Analysis of Disc Brake Rotor by Using Ansys Softwaresai thesisNessuna valutazione finora

- CE SyllabusDocumento52 pagineCE Syllabussai thesisNessuna valutazione finora

- Karnataka Prohibition of Charging Exorbitant Interest Act, 2004Documento6 pagineKarnataka Prohibition of Charging Exorbitant Interest Act, 2004Latest Laws TeamNessuna valutazione finora

- Request For Prosecution Judge Ann Melinda Craggs Et Al Received MCSO SW SubstationDocumento10 pagineRequest For Prosecution Judge Ann Melinda Craggs Et Al Received MCSO SW SubstationNeil GillespieNessuna valutazione finora

- Pub - Accounting A Foundation PDFDocumento705 paginePub - Accounting A Foundation PDFwivadaNessuna valutazione finora

- Partnership Accounts FormatDocumento7 paginePartnership Accounts FormatJamsheed Rasheed100% (1)

- NAMARCO v. MarquezDocumento2 pagineNAMARCO v. MarquezMikaela PamatmatNessuna valutazione finora

- FA Batch 2 Aug 2011 Raghu Iyer NotesDocumento377 pagineFA Batch 2 Aug 2011 Raghu Iyer Notesaradhana avinashNessuna valutazione finora

- Final Research EyerusalemDocumento28 pagineFinal Research Eyerusalemabadi67% (3)

- Uhm Early Pay OffDocumento3 pagineUhm Early Pay OffDeanne Mitzi SomolloNessuna valutazione finora

- Fabozzi CH 07 HW AnswersDocumento11 pagineFabozzi CH 07 HW AnswersDingo Baby100% (1)

- Philippine Credit Card Authorization FormDocumento1 paginaPhilippine Credit Card Authorization FormJack Roquid RodriguezNessuna valutazione finora

- Case Digest CreditDocumento32 pagineCase Digest CreditEnzoNessuna valutazione finora

- Sps Agner v. BPIDocumento2 pagineSps Agner v. BPIKarla Lois de GuzmanNessuna valutazione finora

- 01 Handout FINAC2 Lease Accounting Debt Restructuring PDFDocumento4 pagine01 Handout FINAC2 Lease Accounting Debt Restructuring PDFNil Allen Dizon FajardoNessuna valutazione finora

- STC-NMB BANK - May 2020 PDFDocumento13 pagineSTC-NMB BANK - May 2020 PDFaashish koiralaNessuna valutazione finora

- Debt Settlement Letter SampleDocumento13 pagineDebt Settlement Letter Samplehassan789cppNessuna valutazione finora

- ObligationsDocumento9 pagineObligationsJane Constantino0% (1)

- Account Statement From 20 May 2019 To 20 Nov 2019Documento8 pagineAccount Statement From 20 May 2019 To 20 Nov 2019SDE PONNERINessuna valutazione finora

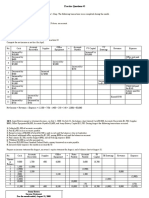

- Practice Questions # 3 - With AnswersDocumento14 paginePractice Questions # 3 - With AnswersAhadullah KhawajaNessuna valutazione finora

- 資產 (Assets) 業主權益 (Owner's Equity) : (Paid-in capital in excess of par value)Documento1 pagina資產 (Assets) 業主權益 (Owner's Equity) : (Paid-in capital in excess of par value)顏子傑Nessuna valutazione finora

- Capital CodeDocumento2 pagineCapital CodeKiran MaliNessuna valutazione finora

- C. Warranty Against EvictionDocumento5 pagineC. Warranty Against EvictionMelissa Kayla ManiulitNessuna valutazione finora

- FRIA NotesDocumento11 pagineFRIA NotesDanice MuñozNessuna valutazione finora

- SBI ATMDebit Card Application FormDocumento4 pagineSBI ATMDebit Card Application Formrajeev11juneNessuna valutazione finora

- Tax2 - Ch1-5 Estate Taxes ReviewerDocumento8 pagineTax2 - Ch1-5 Estate Taxes ReviewerMaia Castañeda100% (15)