Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Sterlite Technologies (STEOPT) : Growth Delayed Long Term Growth Intact

Caricato da

Atul RajoraDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Sterlite Technologies (STEOPT) : Growth Delayed Long Term Growth Intact

Caricato da

Atul RajoraCopyright:

Formati disponibili

Result Update

October 22, 2010

Rating matrix

Rating : Strong Buy Sterlite Technologies (STEOPT)

Target : Rs 113

Target Period : 12-15 months Rs 86

Potential Upside : 31%

WHAT’S CHANGED…

Trailing 4 quarters growth (Rs Crore)

Q3FY10 Q4FY10 Q1FY11 Q2FY11 PRICE TARGET ................................................................................ From Rs 125 Rs 113

Net Sales 867 662 492 509 EPS (FY11E) ..................................................................................... From Rs 8.8 Rs 7.7

EBITDA 104 110 83 91 EPS (FY12E) .................................................................................... From Rs 10.4 Rs 9.4

PAT 74 72 56 58 RATING ......................................................................................................... Unchanged

Valuation summary Growth delayed long term growth intact…

Year to March 31 FY09 FY10 FY11E FY12E Sterlite Technologies (STL) reported a disappointing set of results in

NP (Rs crore) 91 246 286 350 Q2FY11. The company reported revenues of Rs 509 crore in Q2FY11 (I-

Adj. NP(Rs crore) 91 246 286 350 direct estimates: Rs 623 crore), implying a growth of 9.4% YoY and

EPS (Rs) 2.7 6.9 7.7 9.4 3.6% QoQ. EBITDA margins contracted 129bps to 17.8% due to lower

Growth (%) -12.2 152.3 11.4 21.4 fiber prices globally and stabilisation of the newly commissioned fiber

P/E (x) 31.3 12.4 11.2 9.2 capacity. Consequently, PAT grew at a moderate 5.3% YoY to Rs 57.5

Price / Book (x) 4.5 3.3 2.5 2.0

crore.

ROCE (%) 16.5 27.8 24.5 23.0 Weak power segment performance

RoNA (%) 8.4 20.0 16.1 16.5

The subdued topline performance was primarily by flat revenues of the

RoE (%) 15.3 32.0 26.1 24.1

key Power Transmission business (65% of sales). The segment’s

Stock data revenues grew at a mere 0.3% YoY and degrew 2.7% QoQ to Rs 330

Market Capitalisation Rs 3053 crore crore due to slowdown of ordering from key customer PGCIL (delays in

Debt (Q2FY11) Rs 792 crore project awarded from change in bidding to two-stage process). On the

Cash (Q2FY11) Rs 256 crore other hand, Telecom Products & Solutions revenues growth was higher at

31% YoY to Rs 179 crore (but still constrained due to delays in

EV (Q2FY11) Rs 3589 crore

stabilization of new capacity).

52 week H/L Rs 124/51

H2FY11E also likely to be challenging

Equity capital Rs 71 crore

Face value Rs 2 As a result of the weak Q2FY11 results, the management has announced

DII Holding (%) 14.0

that its FY11E sales guidance (+25% earlier) will be lowered.

Nevertheless, the management expects growth momentum to pick-up in

FII Holding (%) 5.6

FY12E with the stabilisation of the recently commissioned capacity and

increased power sector ordering. However, we expect fiber optic pricing

Price movement to continue to remain under pressure due to sluggishness of Chinese

demand (40% of global demand in FY10).

160 7,500

6,000

Outlook & Valuation

120

Negative surprise for the quarter came in form of downward revision of

(In d ex)

4,500

(R s)

80

3,000 revenue and profitability guidance for FY11E. This is mainly on account

40 1,500 of delay in ordering from Power Grid Corporation and

stabilisation issues on the new expanded optic fiber capacity. The

0 0

A ug-09 Dec-09 A pr-10 A ug-10

downward revision though not quantified was the key dampener for the

stock correcting by ~14%in past two trading sessions. The

STL Nifty (RHS)

management expects to come out with the revised guidelines in next 30

days time.

Analyst’s name

Chirag J. Shah

In the meantime, we would advise caution in the counter in the short to

shah.chirag@icicisecurities.com medium term (3-6 months) as the negative sentiments would be a key

overhang on the stock. Though there might be some volatility in the

Sanjay Manyal short term but that will not dampen the growth prospects for the

Sanjay.manyal@icicisecurities.com company.

ICICIdirect.com | Equity Research

Sterlite Technologies (STEOPT)

However on longer term view we believe the growth prospect has

spilled over to FY12E and longer term potential remains intact. We have

revised our estimates for FY11E and FY12E respectively and value the

company at 12x FY12E earnings. Our target price stands at Rs 114 (From

Rs 125 earlier as the guidance has been pruned down)

Exhibit 1: Key Financials

Rs crore Q2FY11 Q2FY10 Q1FY11 YoY Gr(%) QoQ Gr(%)

Total Revenues 509 466 492 9.4 3.6

EBITDA 91 89 83 1.9 9.1

EBITDA Margin(%) 17.8 19.1 16.9 - -

Reported Net Profit 58 55 56 5.3 3.5

Source: Company, ICICIdirect.com Research

ICICIdirect.com | Equity Research

Page 2

Sterlite Technologies (STEOPT)

Exhibit 2: Trend of order book

Order book of STL stood at Rs 2,200 crore in Q2FY11. Of

3,000 2,600

the total order book, Power Transmission business order

2,400

book was at Rs 1,600 crore. PGCIL continues to remain 2,150 2,200

2,250

the largest customer with a 33% share of total order

1,600 1,725

(R s cro re)

book. 1,415

1,320 1,370

1,500

750

Q 2F Y 09

Q 3F Y 09

Q 4F Y 09

Q 1F Y 10

Q 2F Y 10

Q 3F Y 10

Q 4F Y 10

Q 1F Y 11

Q 2F Y 11

Source: Company, ICICIdirect.com Research

Exhibit 3: Trend of revenues

Revenues grew at a moderate rate of 9.4% YoY and 3.6%

1,000 867

QoQ to Rs 509 crore in Q2FY11. International revenues

accounted for 29% of the total revenues in H1FY10.

750 666 642 662

578

(R s cro re)

492 509

436 466

500

250

0

Q 2F Y 09

Q 3F Y 09

Q 4F Y 09

Q 1F Y 10

Q 2F Y 10

Q 3F Y 10

Q 4F Y 10

Q 1F Y 11

Q 2F Y 11

Source: Company, ICICIdirect.com Research

Exhibit 4: Trend of segment-wise sales

Flat sales growth of the key Power Transmission business 600

448 480

(~65% of total sales) was primarily responsible for the 427 401 419

moderate topline growth in Q2FY11 450 388

329 340 330

278 296

(R s)

300 215

177 182 179

140 136 152

150

0

Q 2F Y 09

Q 3F Y 09

Q 4F Y 09

Q 1F Y 10

Q 2F Y 10

Q 3F Y 10

Q 4F Y 10

Q 1F Y 11

Q 2F Y 11

Pow er Telecom

Source: Company, ICICIdirect.com Research

ICICIdirect.com | Equity Research

Page 3

Sterlite Technologies (STEOPT)

Exhibit 5: Trend of EBITDA margins

EBITDA margins have declined 130bps YoY in Q2FY11 due 35.0

to issues associated with stabilization of new capacity and 30.0

pricing pressures in the fiber optics market 25.0

20.0

(% )

15.0

10.0

5.0

0.0

Q 2F Y 09

Q 3F Y 09

Q 4F Y 09

Q 1F Y 10

Q 2F Y 10

Q 3F Y 10

Q 4F Y 10

Q 1F Y 11

Q 2F Y 11

Pow er Telecom O v erall

Source: Company, ICICIdirect.com Research

Estimates changes

We have reduced our FY11E and FY12E sales volume assumptions for

both the Power Transmission and Telecom Products & Solution

businesses. The power conductor sales volumes have been lowered by in

FY11E-12E due to the delays in project awarded by PGCIL from change in

bidding to two-stage process. In the Telecom Products & Solution

business, we have lowered sales volume of optical fibers and fiber optic

cables marginally due to our concerns on the stabilization of new

capacity.

Consequently, we have reduced our FY11E-12E revenue estimates by

10.6% and 8.5%, respectively, and our FY11E-12E PAT estimates by 8.2%

and 4.9%, respectively (Note : our earlier estimates were lower than

consensus estimates).

Exhibit 6: Changes in earning estimates

FY11E FY12E

(Rs crore) New Old % change New Old % change

Sales 2,602 2912 10.6 3,174 3469 8.5

EBITDA 433 462 6.4 513 543 5.5

PAT 286 312 8.2 350 368 4.9

Source: Company, ICICIdirect.com Research

ICICIdirect.com | Equity Research

Page 4

Sterlite Technologies (STEOPT)

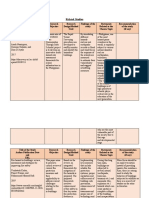

ICICIdirect.com coverage universe (Capital Goods)

Thermax NP (Rs Cr) EPS (Rs) PE (x) P/BV (x) RoCE (%) RoE(%)

Idirect Code THERMA CMP 790 FY10 141 11.9 66.6 9.0 34.2 14.1

Target 825 FY11E 363 34.0 23.2 7.4 43.3 31.2

Mcap (Rs Cr) 7901 Upside (%) 4.4 FY12E 518 43.5 18.2 5.7 45.3 35.3

BGR Energy NP (Rs Cr) EPS (Rs) PE (x) P/ABV (x) RoCE (%) RoE(%)

Idirect Code BGRENE CMP 770 FY10 201.0 27.9 27.6 7.9 23.0 31.8

Target 827 FY11E 304.8 42.3 18.2 5.9 25.2 36.9

Mcap (Rs Cr) 5544 Upside (%) 7.4 FY12E 372.0 51.7 14.9 4.4 23.6 33.8

Hindustan Dorr Oliver NP (Rs Cr) EPS (Rs) PE (x) P/BV (x) RoCE (%) RoE(%)

Idirect Code HINDOR CMP 135 FY10 56 7.7 17.5 4.3 34.2 27.9

Target 164 FY11E 74 10.3 13.1 3.3 30.5 29.0

Mcap (Rs Cr) 972 Upside (%) 21.5 FY12E 98 13.6 9.9 2.5 32.0 29.6

Sterlite Technologies NP (Rs Cr) EPS (Rs) PE (x) P/BV (x) RoCE (%) RoE(%)

Idirect Code STEOPT CMP 86 FY10 246 6.9 12.4 3.3 27.8 32.0

Target 113 FY11E 286 7.7 11.2 2.5 24.5 26.1

Mcap (Rs Cr) 3053 Upside (%) 31.4 FY12E 350 9.4 9.2 2.0 23.0 24.1

Source: Company, ICICIdirect.com Research

ICICIdirect.com | Equity Research

Page 5

Sterlite Technologies (STEOPT)

RATING RATIONALE

ICICIdirect.com endeavours to provide objective opinions and recommendations. ICICIdirect.com assigns

ratings to its stocks according to their notional target price vs. current market price and then categorises them

as Strong Buy, Buy, Add, Reduce and Sell. The performance horizon is 2 years unless specified and the

notional target price is defined as the analysts' valuation for a stock.

Strong Buy: 20% or more;

Buy: Between 10% and 20%;

Add: Up to 10%;

Reduce: Up to -10%

Sell: -10% or more;

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com

ICICIdirect.com Research Desk,

ICICI Securities Limited,

7th Floor , Akruti Centre Point,

MIDC Main Road, Marol Naka,

Andheri (East)

Mumbai – 400 093

research@icicidirect.com

ANALYST CERTIFICATION

We /I, Chirag ShahPGDBM, Sanjay Manyal MBA research analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect

our personal views about any and all of the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s)

or view(s) in this report. Analysts aren't registered as research analysts by FINRA and might not be an associated person of the ICICI Securities Inc.

Disclosures:

ICICI Securities Limited (ICICI Securities) and its affiliates are a full-service, integrated investment banking, investment management and brokerage and financing group. We along with affiliates are leading

underwriter of securities and participate in virtually all securities trading markets in India. We and our affiliates have investment banking and other business relationship with a significant percentage of

companies covered by our Investment Research Department. Our research professionals provide important input into our investment banking and other business selection processes. ICICI Securities

generally prohibits its analysts, persons reporting to analysts and their dependent family members from maintaining a financial interest in the securities or derivatives of any companies that the analysts

cover.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and

meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without

prior written consent of ICICI Securities. While we would endeavour to update the information herein on reasonable basis, ICICI Securities, its subsidiaries and associated companies, their directors and

employees (“ICICI Securities and affiliates”) are under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities

from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities

policies, in circumstances where ICICI Securities is acting in an advisory capacity to this company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This

report and information herein is solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial

instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their

receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific

circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment

objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate

the investment risks. The value and return of investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities and affiliates accept no liabilities for any

loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the

risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to

change without notice.

ICICI Securities and its affiliates might have managed or co-managed a public offering for the subject company in the preceding twelve months. ICICI Securities and affiliates might have received

compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of public offerings, corporate finance, investment

banking or other advisory services in a merger or specific transaction. ICICI Securities and affiliates expect to receive compensation from the companies mentioned in the report within a period of three

months following the date of publication of the research report for services in respect of public offerings, corporate finance, investment banking or other advisory services in a merger or specific

transaction. It is confirmed that , Chirag ShahPGDBM, Sanjay Manyal MBA research analysts and the authors of this report have not received any compensation from the companies mentioned in the

report in the preceding twelve months. Our research professionals are paid in part based on the profitability of ICICI Securities, which include earnings from Investment Banking and other business.

ICICI Securities or its subsidiaries collectively do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of the

research report.

It is confirmed that , Chirag ShahPGDBM, Sanjay Manyal MBA research analysts and the authors of this report or any of their family members does not serve as an officer, director or advisory board

member of the companies mentioned in the report.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. ICICI Securities and affiliates may act upon or make use

of information contained in the report prior to the publication thereof.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution,

publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and

to observe such restriction.

ICICIdirect.com | Equity Research

Page 6

Potrebbero piacerti anche

- Sona BLW Precision Forgings: Order Book Leaps New Product Elongates Growth VisibilityDocumento9 pagineSona BLW Precision Forgings: Order Book Leaps New Product Elongates Growth VisibilityVivek S MayinkarNessuna valutazione finora

- 1 BHEL 13nov23 Kotak InstDocumento10 pagine1 BHEL 13nov23 Kotak InstRajesh SinghNessuna valutazione finora

- Latest Ceat ReportDocumento6 pagineLatest Ceat Reportshubhamkumar.bhagat.23mbNessuna valutazione finora

- JSW Energy: Fully PricedDocumento13 pagineJSW Energy: Fully Pricedmihir_ajNessuna valutazione finora

- Idfc (Idfc) : Strong Growth Ahead, Dilution ExpectedDocumento7 pagineIdfc (Idfc) : Strong Growth Ahead, Dilution ExpectedKaushal KumarNessuna valutazione finora

- Motilal Oswal PVR Q2FY21 Result UpdateDocumento12 pagineMotilal Oswal PVR Q2FY21 Result Updateumaj25Nessuna valutazione finora

- Unichem Lab (UNILAB) : Riding Strong On Base BusinessDocumento6 pagineUnichem Lab (UNILAB) : Riding Strong On Base Businesscos.secNessuna valutazione finora

- Simplex Infrastructures: Performance HighlightsDocumento11 pagineSimplex Infrastructures: Performance Highlightskrishna615Nessuna valutazione finora

- Cummins India: Capitalising On Infrastructure ThrustDocumento16 pagineCummins India: Capitalising On Infrastructure Thrustaussie707Nessuna valutazione finora

- GVK Power & Infra (GVKPOW) : Consolidation at Present LevelsDocumento8 pagineGVK Power & Infra (GVKPOW) : Consolidation at Present LevelsKaushal KumarNessuna valutazione finora

- Indian Overseas Bank (INDOVE) : Inexpensive Valuations For A TurnaroundDocumento7 pagineIndian Overseas Bank (INDOVE) : Inexpensive Valuations For A TurnaroundsansugeorgeNessuna valutazione finora

- Ashok Leyland: Robust Volume GuidanceDocumento4 pagineAshok Leyland: Robust Volume GuidancemittleNessuna valutazione finora

- DB Corp Limited (DBCORP) : Better-Than-Expected NumbersDocumento5 pagineDB Corp Limited (DBCORP) : Better-Than-Expected Numbersjass200910Nessuna valutazione finora

- Unichem Lab (UNILAB) : On TrackDocumento6 pagineUnichem Lab (UNILAB) : On Trackcos.secNessuna valutazione finora

- Angel One - Update - Jul23 - HSIE-202307170719227368733Documento9 pagineAngel One - Update - Jul23 - HSIE-202307170719227368733Ram JaneNessuna valutazione finora

- Alembic Angel 020810Documento12 pagineAlembic Angel 020810giridesh3Nessuna valutazione finora

- Oil and Natural Gas CorporationDocumento13 pagineOil and Natural Gas CorporationDHEERAJ RAJNessuna valutazione finora

- CMP: Inr913 TP: Inr1030 (+13%) Buy Beats Expectation With Strong Operating PerformanceDocumento10 pagineCMP: Inr913 TP: Inr1030 (+13%) Buy Beats Expectation With Strong Operating Performanceyousufch069Nessuna valutazione finora

- Tata Elxsi 4qfy19 Result Update19Documento6 pagineTata Elxsi 4qfy19 Result Update19Ashutosh GuptaNessuna valutazione finora

- IVRCL Infrastructure: Performance HighlightsDocumento11 pagineIVRCL Infrastructure: Performance HighlightsPratik GanatraNessuna valutazione finora

- Opto Circuits (India) (OPTCIR) : Strong Performance Improves OutlookDocumento4 pagineOpto Circuits (India) (OPTCIR) : Strong Performance Improves OutlookhitpunNessuna valutazione finora

- Cyient: Poor Quarter Recovery Likely in The Current QuarterDocumento9 pagineCyient: Poor Quarter Recovery Likely in The Current QuarterADNessuna valutazione finora

- HMCL 20240211 Mosl Ru PG012Documento12 pagineHMCL 20240211 Mosl Ru PG012Realm PhangchoNessuna valutazione finora

- Tanla Solutions (TANSOL) : Rebound in Core Business SegmentsDocumento5 pagineTanla Solutions (TANSOL) : Rebound in Core Business SegmentsashishkrishNessuna valutazione finora

- Nomura - May 6 - CEATDocumento12 pagineNomura - May 6 - CEATPrem SagarNessuna valutazione finora

- UPL ChokseyDocumento6 pagineUPL Chokseypranab.gupta.kwicNessuna valutazione finora

- CMP: INR141 TP: INR175 (+24%) Biggest Beneficiary of Improved PricingDocumento10 pagineCMP: INR141 TP: INR175 (+24%) Biggest Beneficiary of Improved PricingPratik PatilNessuna valutazione finora

- Tata Motors: Weakness Persists But Faith IntactDocumento13 pagineTata Motors: Weakness Persists But Faith IntactDinesh ChoudharyNessuna valutazione finora

- Koutons Retail India (KOURET) : Dismal PerformanceDocumento6 pagineKoutons Retail India (KOURET) : Dismal Performancevir_4uNessuna valutazione finora

- Dixon Technologies Q1FY22 Result UpdateDocumento8 pagineDixon Technologies Q1FY22 Result UpdateAmos RiveraNessuna valutazione finora

- Welspun Corp (WELGUJ) : Volumes To Grow, Margins To ContractDocumento6 pagineWelspun Corp (WELGUJ) : Volumes To Grow, Margins To Contract5vipulsNessuna valutazione finora

- Serba Dinamik Holdings: Weaker Earnings Amid Rising Balance Sheet RisksDocumento6 pagineSerba Dinamik Holdings: Weaker Earnings Amid Rising Balance Sheet RisksRichbull TraderNessuna valutazione finora

- Alkyl Amines Report 2020Documento7 pagineAlkyl Amines Report 2020SRINIVASAN TNessuna valutazione finora

- Q2FY22 Result Update Indo Count Industries LTD: Higher Realization Aids FinancialsDocumento10 pagineQ2FY22 Result Update Indo Count Industries LTD: Higher Realization Aids FinancialsbradburywillsNessuna valutazione finora

- Voltas LatestDocumento10 pagineVoltas LatestSambaran DasNessuna valutazione finora

- JK Tyres and Industries (JKIND) : Rock Bottom Margins, Upside Potential StrongDocumento8 pagineJK Tyres and Industries (JKIND) : Rock Bottom Margins, Upside Potential Strongvipin51Nessuna valutazione finora

- V.I.P. Industries (VIP IN) : Q1FY21 Result UpdateDocumento6 pagineV.I.P. Industries (VIP IN) : Q1FY21 Result UpdatewhitenagarNessuna valutazione finora

- Endurance Technologies: CMP: INR1,400 TP: INR1,750 (+25%)Documento10 pagineEndurance Technologies: CMP: INR1,400 TP: INR1,750 (+25%)Live NIftyNessuna valutazione finora

- Kajaria Ceramics: Higher Trading Kept Growth IntactDocumento4 pagineKajaria Ceramics: Higher Trading Kept Growth IntactearnrockzNessuna valutazione finora

- Ashok Leyland: Performance HighlightsDocumento9 pagineAshok Leyland: Performance HighlightsSandeep ManglikNessuna valutazione finora

- SH Kelkar: All-Round Performance Outlook Remains StrongDocumento8 pagineSH Kelkar: All-Round Performance Outlook Remains StrongJehan BhadhaNessuna valutazione finora

- Larsen & Toubro: Performance HighlightsDocumento14 pagineLarsen & Toubro: Performance HighlightsrajpersonalNessuna valutazione finora

- AxisCap - PEL - FN - 29 Feb 2024Documento6 pagineAxisCap - PEL - FN - 29 Feb 2024Mohammed Israr ShaikhNessuna valutazione finora

- PSP Projects LTD - Q1FY24 Result Update - 28072023 - 28-07-2023 - 10Documento8 paginePSP Projects LTD - Q1FY24 Result Update - 28072023 - 28-07-2023 - 10samraatjadhavNessuna valutazione finora

- Voltamp Transformers LTD: Major Beneficiary of Central Sponsored Schemes CMP: INR 785 Target: INR 1,110Documento11 pagineVoltamp Transformers LTD: Major Beneficiary of Central Sponsored Schemes CMP: INR 785 Target: INR 1,110Darwish MammiNessuna valutazione finora

- Amara Raja Batteries: Performance HighlightsDocumento10 pagineAmara Raja Batteries: Performance HighlightssuneshsNessuna valutazione finora

- IVRCL Infrastructure: Performance HighlightsDocumento7 pagineIVRCL Infrastructure: Performance Highlightsanudeep05Nessuna valutazione finora

- Lumax Inds - Q3FY22 Result Update - 15022022 - 15-02-2022 - 14Documento7 pagineLumax Inds - Q3FY22 Result Update - 15022022 - 15-02-2022 - 14Mridul Kumar BanerjeeNessuna valutazione finora

- CEAT Annual Report 2019Documento5 pagineCEAT Annual Report 2019Roberto GrilliNessuna valutazione finora

- Bharat Forge: Performance HighlightsDocumento13 pagineBharat Forge: Performance HighlightsarikuldeepNessuna valutazione finora

- ICICIdirect TataMotors Q3FY11Documento11 pagineICICIdirect TataMotors Q3FY11Mukesh ModiNessuna valutazione finora

- Indian Hotel - Q4FY22 Results - DAMDocumento8 pagineIndian Hotel - Q4FY22 Results - DAMRajiv BharatiNessuna valutazione finora

- Kotak On Jindal Stainless HisarDocumento6 pagineKotak On Jindal Stainless HisarKrishna PaladuguNessuna valutazione finora

- Tvs Motor PincDocumento6 pagineTvs Motor Pincrajarun85Nessuna valutazione finora

- JBM Auto (Q2FY21 Result Update)Documento7 pagineJBM Auto (Q2FY21 Result Update)krippuNessuna valutazione finora

- Voltamp Transformers (VAMP IN) : Q4FY21 Result UpdateDocumento6 pagineVoltamp Transformers (VAMP IN) : Q4FY21 Result UpdateDarwish MammiNessuna valutazione finora

- MM Forgings (Q1FY24 Result Update) - 15-Aug-2023Documento10 pagineMM Forgings (Q1FY24 Result Update) - 15-Aug-2023instiresmilanNessuna valutazione finora

- Sadbhav Engineering (SADE IN) : Q4FY20 Result UpdateDocumento8 pagineSadbhav Engineering (SADE IN) : Q4FY20 Result UpdatewhitenagarNessuna valutazione finora

- Adhunik Metaliks Ltd. (ADHMET) : Robust PerformanceDocumento7 pagineAdhunik Metaliks Ltd. (ADHMET) : Robust Performancejassu75Nessuna valutazione finora

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsDa EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNessuna valutazione finora

- CH 02Documento42 pagineCH 02المؤسس kNessuna valutazione finora

- GR&C - Quantitative Research - InternsDocumento2 pagineGR&C - Quantitative Research - InternsArvind RameshNessuna valutazione finora

- MOG-HSEQ-P-005 Rev A3 Corporate HSE Training Awarness and Competence ProcedureDocumento18 pagineMOG-HSEQ-P-005 Rev A3 Corporate HSE Training Awarness and Competence ProcedureSamerNessuna valutazione finora

- 13.0 - Violence in The Workplace v3.0 EnglishDocumento16 pagine13.0 - Violence in The Workplace v3.0 Englishkhalid_ghafoor6226Nessuna valutazione finora

- Project Manager TasksDocumento19 pagineProject Manager TasksRodagom MogNessuna valutazione finora

- For You Dow Fire and Explosion IndexDocumento9 pagineFor You Dow Fire and Explosion IndexcristinatubleNessuna valutazione finora

- Retail Banking and Wealth ManagementDocumento36 pagineRetail Banking and Wealth ManagementSAMBITPRIYADARSHINessuna valutazione finora

- HIRARC On ConstructionDocumento33 pagineHIRARC On ConstructionMohd Zulhaidy85% (33)

- Rashtriya Ispat Nigam LimitedDocumento539 pagineRashtriya Ispat Nigam Limitedmohd7861100% (1)

- Risk ManagementDocumento25 pagineRisk ManagementMarissa Adraincem50% (2)

- NEA EHS Plan Dana KushmaDocumento53 pagineNEA EHS Plan Dana KushmaUmesh DahalNessuna valutazione finora

- FFIEC CAT June 2015 PDF2Documento59 pagineFFIEC CAT June 2015 PDF2mykillerdroneNessuna valutazione finora

- Ch12 HW SolutionsDocumento16 pagineCh12 HW Solutionsgilli1tr100% (1)

- Near MissDocumento15 pagineNear MisssjmpakNessuna valutazione finora

- Business Ethics Unit 1Documento29 pagineBusiness Ethics Unit 1Rakshit SharmaNessuna valutazione finora

- Urban Ecology and Urban Ecosystems, Understanding The Links To Human Health and Well BeingDocumento8 pagineUrban Ecology and Urban Ecosystems, Understanding The Links To Human Health and Well BeingSofía I. Morales NavarroNessuna valutazione finora

- Formulation of Portfolio Strategy - IMDocumento9 pagineFormulation of Portfolio Strategy - IMKhyati KhokharaNessuna valutazione finora

- Bank Loan Classification and ProvisioningDocumento19 pagineBank Loan Classification and ProvisioningsahhhhhhhNessuna valutazione finora

- 1.decision AnalysisDocumento27 pagine1.decision Analysismanu192Nessuna valutazione finora

- RESEARCHKAYDocumento10 pagineRESEARCHKAYLadyvince BaldonNessuna valutazione finora

- E Conservationmagazine27Documento132 pagineE Conservationmagazine27InisNessuna valutazione finora

- ASEAN GAP Environmental Management ModuleDocumento56 pagineASEAN GAP Environmental Management ModuleASEAN100% (1)

- Dwnload Full Managing The Law The Legal Aspects of Doing Business 5th Edition Mcinnes Test Bank PDFDocumento36 pagineDwnload Full Managing The Law The Legal Aspects of Doing Business 5th Edition Mcinnes Test Bank PDFsinciputlateradiefk7u100% (8)

- Nature and The Insurance Industry - Taking Action Towards A Nature-Positive EconomyDocumento64 pagineNature and The Insurance Industry - Taking Action Towards A Nature-Positive EconomycaranpaimaNessuna valutazione finora

- WORKPLACE READINESS FOR COVID Part 3Documento37 pagineWORKPLACE READINESS FOR COVID Part 3LNessuna valutazione finora

- 1statement of Standard 1Documento23 pagine1statement of Standard 1Ivan de Jesus Candelero MoralesNessuna valutazione finora

- Module 1 Financial MGT 2Documento16 pagineModule 1 Financial MGT 2Rey Phoenix PasilanNessuna valutazione finora

- IIARF CBOK Who Owns Risk 2015 Oct UpdateDocumento32 pagineIIARF CBOK Who Owns Risk 2015 Oct Updategeneralcpcr7648Nessuna valutazione finora

- PIFM 2-3 - MergedDocumento108 paginePIFM 2-3 - Mergedchilukuri sandeepNessuna valutazione finora

- CHN Rle ReviewerDocumento10 pagineCHN Rle ReviewerKenneth Fe AgronNessuna valutazione finora