Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Nike

Caricato da

Adhiraj Mukherjee0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

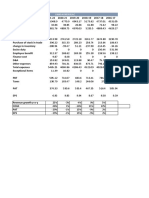

18 visualizzazioni3 pagineThis document shows the financial performance of a company from 2002 to 2011 including revenues, costs of goods sold, selling general and administrative expenses, operating income, taxes, net income, capital expenditures, free cash flow, and equity value per share. The key metrics increased each year with revenues growing at 6-7% annually and net income growing from $755,384 in 2002 to $1,833,664 in 2011. The equity value per share increased from $58.13 in 2002 to over $100 in 2011 based on the assumptions shown.

Descrizione originale:

Titolo originale

nike

Copyright

© © All Rights Reserved

Formati disponibili

XLSX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThis document shows the financial performance of a company from 2002 to 2011 including revenues, costs of goods sold, selling general and administrative expenses, operating income, taxes, net income, capital expenditures, free cash flow, and equity value per share. The key metrics increased each year with revenues growing at 6-7% annually and net income growing from $755,384 in 2002 to $1,833,664 in 2011. The equity value per share increased from $58.13 in 2002 to over $100 in 2011 based on the assumptions shown.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato XLSX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

18 visualizzazioni3 pagineNike

Caricato da

Adhiraj MukherjeeThis document shows the financial performance of a company from 2002 to 2011 including revenues, costs of goods sold, selling general and administrative expenses, operating income, taxes, net income, capital expenditures, free cash flow, and equity value per share. The key metrics increased each year with revenues growing at 6-7% annually and net income growing from $755,384 in 2002 to $1,833,664 in 2011. The equity value per share increased from $58.13 in 2002 to over $100 in 2011 based on the assumptions shown.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato XLSX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 3

1 2 3 4 5 6 7

2002 2003 2004 2005 2006 2007 2008

Revenues 10153.02 10812.96 11515.8 12264.33 13000.19 13780.2 14607.02

COGS 6091.81 6487.777 6851.904 7297.277 7670.113 8130.32 8545.104

SG&A 2842.844 2973.565 3109.267 3250.048 3380.05 3513.952 3651.754

Operating Income 1218.362 1351.62 1554.634 1717.006 1950.029 2135.932 2410.158

Tax 462.9775 513.6157 590.7608 652.4625 741.0109 811.654 915.8599

PAT 755.3844 838.0046 963.8728 1064.544 1209.018 1324.278 1494.298

CAPEX, net Depreciation

Changes in NWC 8.8 -174.9 -186.3 -198.4 -195 -206.7 -219.1

Free Cash Flow 764.1844 663.1046 777.5728 866.144 1014.018 1117.578 1275.198

Terminal Value

Total flows 764.1844 663.1046 777.5728 866.144 1014.018 1117.578 1275.198

Present values of flows 699.3543 555.3671 595.989 607.556 650.9399 656.5563 685.6002

Enterprise Value(NPV) 17078.81

Less: Current outstanding debts 1296.6

Equity Value 15782.21

Current shares outstanding 271.5

Equity value per share 58.1297

8 9 10

2009 2010 2011 Assumptions

15483.44 16412.44 17397.19 2002 2003 2004 2005

9057.81 9519.217 10090.37 Revenue Growth 7% 6.50% 6.50% 6.50%

3870.859 4103.111 4349.297 COGS/Sales 60% 60% 59.50% 59.50%

2554.767 2790.115 2957.522 SG&A/Sales 28% 27.50% 27% 26.50%

970.8115 1060.244 1123.858 Tax Rate 38% 38% 38% 38%

1583.956 1729.871 1833.664

-232.3 -246.2 -261 WACC 9.27%

1351.656 1483.671 1572.664 Terminal Value Growt 3%

25834.83

1351.656 1483.671 27407.49

665.0564 668.0812 11294.31

Assumptions

2006 2007 2008 2009 2010 2011

6% 6% 6% 6% 6% 6%

59% 59% 58.50% 58.50% 58% 58%

26% 25.50% 25% 25% 25% 25%

38% 38% 38% 38% 38% 38%

Potrebbero piacerti anche

- The Valuation and Financing of Lady M Case StudyDocumento4 pagineThe Valuation and Financing of Lady M Case StudyUry Suryanti Rahayu100% (3)

- The Valuation and Financing of Lady M Case StudyDocumento4 pagineThe Valuation and Financing of Lady M Case StudyUry Suryanti RahayuNessuna valutazione finora

- Lupin's Foray Into Japan - SolutionDocumento14 pagineLupin's Foray Into Japan - Solutionvardhan100% (1)

- Wonder Study GuideDocumento52 pagineWonder Study GuideJoseph Lin67% (3)

- Boston Beer ExcelDocumento6 pagineBoston Beer ExcelNarinderNessuna valutazione finora

- HanssonDocumento11 pagineHanssonJust Some EditsNessuna valutazione finora

- AFDMDocumento6 pagineAFDMAhsan IqbalNessuna valutazione finora

- Sui Southern Gas Company Limited: Analysis of Financial Statements Financial Year 2004 - 2001 Q Financial Year 2010Documento17 pagineSui Southern Gas Company Limited: Analysis of Financial Statements Financial Year 2004 - 2001 Q Financial Year 2010mumairmalikNessuna valutazione finora

- Hindustan Petrolium Corporation LTD: ProsDocumento9 pagineHindustan Petrolium Corporation LTD: ProsChandan KokaneNessuna valutazione finora

- DCF Valuation Pre Merger Southern Union CompanyDocumento20 pagineDCF Valuation Pre Merger Southern Union CompanyIvan AlimirzoevNessuna valutazione finora

- FM 2 AssignmentDocumento337 pagineFM 2 AssignmentAvradeep DasNessuna valutazione finora

- Automobile Sales: Assets and Working CapitalDocumento16 pagineAutomobile Sales: Assets and Working CapitalKshitishNessuna valutazione finora

- Britannia IndustriesDocumento12 pagineBritannia Industriesmundadaharsh1Nessuna valutazione finora

- Ghazi Fabrics: Ratio Analysis of Last Five YearsDocumento6 pagineGhazi Fabrics: Ratio Analysis of Last Five YearsASIF RAFIQUE BHATTINessuna valutazione finora

- MSFTDocumento83 pagineMSFTJohn wickNessuna valutazione finora

- Caso TeuerDocumento46 pagineCaso Teuerjoaquin bullNessuna valutazione finora

- Primo BenzinaDocumento30 paginePrimo BenzinaSofía MargaritaNessuna valutazione finora

- Radico KhaitanDocumento38 pagineRadico Khaitantapasya khanijouNessuna valutazione finora

- 2006 2007 2008 Sales Net Sales Less CogsDocumento17 pagine2006 2007 2008 Sales Net Sales Less CogsMohammed ArifNessuna valutazione finora

- Book1 2Documento10 pagineBook1 2Aakash SinghalNessuna valutazione finora

- Horizontal Vertical AnalysisDocumento4 pagineHorizontal Vertical AnalysisAhmedNessuna valutazione finora

- Fin 448 Final PracticeDocumento2 pagineFin 448 Final PracticeMay ChenNessuna valutazione finora

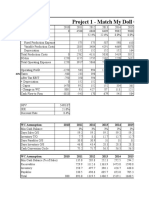

- Project 1 - Match My Doll Clothing Line: WC Assumption: 2010 2011 2012 2013 2014 2015Documento4 pagineProject 1 - Match My Doll Clothing Line: WC Assumption: 2010 2011 2012 2013 2014 2015rohitNessuna valutazione finora

- Allahabad Bank Sep 09Documento5 pagineAllahabad Bank Sep 09chetandusejaNessuna valutazione finora

- JSW SteelDocumento34 pagineJSW SteelShashank PatelNessuna valutazione finora

- Exhibit 1: Income Taxes 227.6 319.3 465.0 49.9Documento11 pagineExhibit 1: Income Taxes 227.6 319.3 465.0 49.9rendy mangunsongNessuna valutazione finora

- Projected 2013 2014 2015 2016 2017Documento11 pagineProjected 2013 2014 2015 2016 2017Aijaz AslamNessuna valutazione finora

- Nike Case Study VrindaDocumento4 pagineNike Case Study VrindaAnchal ChokhaniNessuna valutazione finora

- Tech MahindraDocumento17 pagineTech Mahindrapiyushpatil749Nessuna valutazione finora

- Altagas Green Exhibits With All InfoDocumento4 pagineAltagas Green Exhibits With All InfoArjun NairNessuna valutazione finora

- DCF TVSDocumento17 pagineDCF TVSSunilNessuna valutazione finora

- AttachmentDocumento19 pagineAttachmentSanjay MulviNessuna valutazione finora

- The Valuation and Financing of Lady M Confections: 23600 Cash BEP 1888000,00Documento4 pagineThe Valuation and Financing of Lady M Confections: 23600 Cash BEP 1888000,00Rahul VenugopalanNessuna valutazione finora

- Safari 3Documento4 pagineSafari 3Bharti SutharNessuna valutazione finora

- Lady M SolutionDocumento4 pagineLady M SolutionRahul VenugopalanNessuna valutazione finora

- Add Dep Less Tax OCF Change in Capex Change in NWC FCFDocumento5 pagineAdd Dep Less Tax OCF Change in Capex Change in NWC FCFGullible KhanNessuna valutazione finora

- Flow Valuation, Case #KEL778Documento20 pagineFlow Valuation, Case #KEL778SreeHarshaKazaNessuna valutazione finora

- AmcDocumento19 pagineAmcTimothy RenardusNessuna valutazione finora

- Discounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No FormulasDocumento2 pagineDiscounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No Formulasrito2005Nessuna valutazione finora

- Case 8-Group 16Documento14 pagineCase 8-Group 16reza041Nessuna valutazione finora

- Tiffany & Co's Analysis: Student Name Institutional Affiliation Course Name Instructor Name DateDocumento6 pagineTiffany & Co's Analysis: Student Name Institutional Affiliation Course Name Instructor Name DateOmer KhanNessuna valutazione finora

- PasfDocumento14 paginePasfAbhishek BhatnagarNessuna valutazione finora

- Book 1Documento2 pagineBook 1justingordanNessuna valutazione finora

- Common Size Income Statement - TATA MOTORS LTDDocumento6 pagineCommon Size Income Statement - TATA MOTORS LTDSubrat BiswalNessuna valutazione finora

- Valuation GroupNo.12Documento4 pagineValuation GroupNo.12John DummiNessuna valutazione finora

- Bharat Hotels Valuation Case StudyDocumento3 pagineBharat Hotels Valuation Case StudyRohitNessuna valutazione finora

- Sangam and Excel Mini Case Solution TemplateDocumento3 pagineSangam and Excel Mini Case Solution TemplateSHUBHAM DIXITNessuna valutazione finora

- Private Sector Banks Comparative Analysis 1HFY22Documento12 paginePrivate Sector Banks Comparative Analysis 1HFY22Tushar Mohan0% (1)

- Rosetta Stone IPODocumento5 pagineRosetta Stone IPOFatima Ansari d/o Muhammad AshrafNessuna valutazione finora

- Projections & ValuationDocumento109 pagineProjections & ValuationPulokesh GhoshNessuna valutazione finora

- Financial Model of Dmart - 5Documento4 pagineFinancial Model of Dmart - 5Shivam DubeyNessuna valutazione finora

- Supreme Annual Report 15 16Documento104 pagineSupreme Annual Report 15 16adoniscalNessuna valutazione finora

- SuganyaDocumento3 pagineSuganyaSenthil KumarNessuna valutazione finora

- Pinkerton (B)Documento3 paginePinkerton (B)Anupam Chaplot100% (1)

- Fin 421 AssignmentDocumento6 pagineFin 421 AssignmentKassaf ChowdhuryNessuna valutazione finora

- Finance 2Documento208 pagineFinance 2B SNessuna valutazione finora

- Dec 2021 enDocumento21 pagineDec 2021 enMohammed ShbairNessuna valutazione finora

- AirThread SecBC Group9Documento4 pagineAirThread SecBC Group9Vishal BhanushaliNessuna valutazione finora

- Maruti Suzuki Balance SheetDocumento6 pagineMaruti Suzuki Balance SheetMasoud AfzaliNessuna valutazione finora

- Mercury Athletic Footwear Case (Work Sheet)Documento16 pagineMercury Athletic Footwear Case (Work Sheet)Bharat KoiralaNessuna valutazione finora

- United States Census Figures Back to 1630Da EverandUnited States Census Figures Back to 1630Nessuna valutazione finora

- Netra Early Warnings Signals Through Charts - May 2022Documento16 pagineNetra Early Warnings Signals Through Charts - May 2022Adhiraj MukherjeeNessuna valutazione finora

- FA-Depreciation - Inventory SolvedDocumento13 pagineFA-Depreciation - Inventory SolvedAdhiraj MukherjeeNessuna valutazione finora

- Fiction of Motivated Soyl UbDocumento2 pagineFiction of Motivated Soyl UbAdhiraj MukherjeeNessuna valutazione finora

- Task 2Documento1 paginaTask 2Adhiraj MukherjeeNessuna valutazione finora

- FA-Depreciation - Inventory SolvedDocumento13 pagineFA-Depreciation - Inventory SolvedAdhiraj MukherjeeNessuna valutazione finora

- Operations Research: Case Let 1: Production PlanningDocumento1 paginaOperations Research: Case Let 1: Production PlanningAdhiraj MukherjeeNessuna valutazione finora

- Renault's Ride Into India: Discussion QuestionsDocumento1 paginaRenault's Ride Into India: Discussion QuestionsAdhiraj MukherjeeNessuna valutazione finora

- Inference:: Lower Slightly Lower LowerDocumento14 pagineInference:: Lower Slightly Lower LowerAdhiraj MukherjeeNessuna valutazione finora

- Suzlon Case 15juneDocumento2 pagineSuzlon Case 15juneAdhiraj MukherjeeNessuna valutazione finora

- Inference:: Lower Slightly Lower LowerDocumento14 pagineInference:: Lower Slightly Lower LowerAdhiraj MukherjeeNessuna valutazione finora

- TIB Class Exercise: Consumer Connected Wearable Smart DevicesDocumento1 paginaTIB Class Exercise: Consumer Connected Wearable Smart DevicesAdhiraj MukherjeeNessuna valutazione finora

- Introduction To Financial System: 5.a Commercial BankDocumento6 pagineIntroduction To Financial System: 5.a Commercial BankAdhiraj MukherjeeNessuna valutazione finora

- Suzlon Case 15juneDocumento2 pagineSuzlon Case 15juneAdhiraj MukherjeeNessuna valutazione finora

- Operations Research: Case Let 1: Production PlanningDocumento1 paginaOperations Research: Case Let 1: Production PlanningAdhiraj MukherjeeNessuna valutazione finora

- Trade, Commerce and PetroliumDocumento4 pagineTrade, Commerce and PetroliumAdhiraj MukherjeeNessuna valutazione finora

- Legal History Project .....Documento16 pagineLegal History Project .....sayed abdul jamayNessuna valutazione finora

- Ity of OS Ngeles: GENERAL APPROVAL - Initial Approval - Concrete and Masonry Strengthening Using TheDocumento3 pagineIty of OS Ngeles: GENERAL APPROVAL - Initial Approval - Concrete and Masonry Strengthening Using TheAntonio CastilloNessuna valutazione finora

- Tips and TricksDocumento1 paginaTips and TricksTOPdeskNessuna valutazione finora

- Puyo vs. Judge Go (2018)Documento2 paginePuyo vs. Judge Go (2018)Mara VinluanNessuna valutazione finora

- 090 People V RealDocumento3 pagine090 People V RealTeodoro Jose BrunoNessuna valutazione finora

- CSC Personal Data SheetDocumento10 pagineCSC Personal Data SheetMaria LeeNessuna valutazione finora

- Halden Galway Int'L Corp.: GWP Packaging Malaysia SDN BHDDocumento13 pagineHalden Galway Int'L Corp.: GWP Packaging Malaysia SDN BHDCharles YapNessuna valutazione finora

- Stat Con Notes 1 (GujildeDocumento3 pagineStat Con Notes 1 (GujildeDave UrotNessuna valutazione finora

- RR No 21-2018 PDFDocumento3 pagineRR No 21-2018 PDFJames Salviejo PinedaNessuna valutazione finora

- USNORTHCOM FaithfulPatriotDocumento33 pagineUSNORTHCOM FaithfulPatriotnelson duringNessuna valutazione finora

- CV Business Adm Mgr-S.DridiDocumento2 pagineCV Business Adm Mgr-S.DridiMoaatazz NouisriNessuna valutazione finora

- Cada IntmgtAcctg3Exer1Documento7 pagineCada IntmgtAcctg3Exer1KrishNessuna valutazione finora

- AY Program For June 18th 2016Documento6 pagineAY Program For June 18th 2016Darnelle Allister-CelestineNessuna valutazione finora

- Module 6 - Technology in The Delivery of Healthcare and Ceps On Ethico-Moral Practice in NursingDocumento10 pagineModule 6 - Technology in The Delivery of Healthcare and Ceps On Ethico-Moral Practice in NursingKatie HolmesNessuna valutazione finora

- Conference Steel Joist InstituteDocumento3 pagineConference Steel Joist Instituteinsane88Nessuna valutazione finora

- Medical Ethics PaperDocumento4 pagineMedical Ethics PaperinnyNessuna valutazione finora

- Bharat Sookshma Udyam SurakshaDocumento12 pagineBharat Sookshma Udyam SurakshaPrakhar ShuklaNessuna valutazione finora

- Deadweight Loss and Price DiscriminationDocumento21 pagineDeadweight Loss and Price Discrimination0241ASHAYNessuna valutazione finora

- PlaceDocumento4 paginePlaceMark EvansNessuna valutazione finora

- Accountancy Topic:-Depreciation. SlidesDocumento83 pagineAccountancy Topic:-Depreciation. SlidesAkash SahNessuna valutazione finora

- The Meaning of Independence DayDocumento285 pagineThe Meaning of Independence DayCheryl MillerNessuna valutazione finora

- DAT Business EthicsDocumento6 pagineDAT Business EthicsMary Erat Dumaluan GulangNessuna valutazione finora

- Allen v. United States, 157 U.S. 675 (1895)Documento5 pagineAllen v. United States, 157 U.S. 675 (1895)Scribd Government DocsNessuna valutazione finora

- Alan Scott - New Critical Writings in Political Sociology Volume Three - Globalization and Contemporary Challenges To The Nation-State (2009, Ashgate - Routledge) PDFDocumento469 pagineAlan Scott - New Critical Writings in Political Sociology Volume Three - Globalization and Contemporary Challenges To The Nation-State (2009, Ashgate - Routledge) PDFkaranNessuna valutazione finora

- Federal Register / Vol. 70, No. 199 / Monday, October 17, 2005 / NoticesDocumento2 pagineFederal Register / Vol. 70, No. 199 / Monday, October 17, 2005 / NoticesJustia.comNessuna valutazione finora

- Anmol Kushwah (9669369115) : To Be Filled by InterviewerDocumento6 pagineAnmol Kushwah (9669369115) : To Be Filled by InterviewermbaNessuna valutazione finora

- Driver CPC - Periodic Training LeafletDocumento8 pagineDriver CPC - Periodic Training Leafletkokuroku100% (1)

- Vimal KumarDocumento2 pagineVimal KumarAkash ParnamiNessuna valutazione finora

- Citric Acid SDS11350 PDFDocumento7 pagineCitric Acid SDS11350 PDFSyafiq Mohd NohNessuna valutazione finora