Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Roca V CIR

Caricato da

Jemima Rachel CruzDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Roca V CIR

Caricato da

Jemima Rachel CruzCopyright:

Formati disponibili

FIRST DIVISION

[G.R. No. 241338. April 10, 2019.]

COMMISSIONER OF INTERNAL REVENUE , petitioner, vs. ROCA

SECURITY AND INVESTIGATION AGENCY, INC. , respondent.

NOTICE

Sirs/Mesdames :

Please take notice that the Court, First Division, issued a Resolution dated April

10, 2019 which reads as follows:

"G.R. No. 241338 (Commissioner of Internal Revenue v. Roca Security

and Investigation Agency, Inc.)

After review of the records, the Court resolves to DENY the petition for failure to

su ciently show that the Court of Tax Appeals (CTA) En Banc committed any

reversible error in its March 7, 2018 Decision, 1 as to warrant the exercise of the Court's

appellate jurisdiction. HTcADC

As correctly held by the CTA En Banc, the Final Assessment Notice (FAN) issued

by the Commissioner of Internal Revenue (CIR) is void as it violates respondent's right

to due process. Section 228 2 of the National Internal Revenue Code (NIRC) gives the

taxpayer being assessed a period of sixty (60) days from the date of ling a protest

assailing the Preliminary Assessment Notice (PAN) within which to submit relevant

supporting documents. In this case, the respondent led its protest on April 18, 2013.

It had sixty (60) days from that date, or until June 17, 2013 , to present its relevant

documents to support its protest against the PAN. Clearly, the FAN issued by the CIR

o n April 12, 2013 and received by respondent only on April 19, 2013 violated the

latter's right to due process as the latter had only one (1) day (instead of 60 days) to

present its relevant documents in support of its protest. Besides, the 60-day period to

protest alluded to in Section 228 of the NIRC refers to one made against the PAN and

not the FAN as the CIR insists, as only upon expiration of the said period does a

contested assessment "become nal." Therefore, the CTA En Banc properly found the

CIR to have violated the statutory guidelines in terms of affording respondent taxpayer

the right to due process.

WHEREFORE , the petition is DENIED . The March 7, 2018 Decision of the Court

of Tax Appeals in CTA EB No. 1523 is AFFIRMED . CAIHTE

SO ORDERED. " Del Castillo, J. , on o cial business. Jardeleza, J. , on o cial

leave.

Very truly yours,

(SGD.) LIBRADA C. BUENA

Division Clerk of Court

CD Technologies Asia, Inc. 2019 cdasiaonline.com

Footnotes

1. Rollo, pp. 8-23; penned by Associate Justice Esperanza R. Fabon-Victorino with Presiding

Justice Roman G. Del Rosario, Associate Justices Juanito C. Castañeda, Jr., Lovell R.

Bautista, Erlinda P. Uy (on leave), Caesar A. Casanova, Cielito N. Mindaro-Grulla, Ma.

Belen M. Ringpis-Liban, and Catherine T. Manahan, concurring.

2. SEC. 228. Protesting of Assessment . — When the Commissioner or his duly authorized

representative finds that proper taxes should be assessed, he shall first notify the

taxpayer of his findings: Provided, however, That a pre-assessment notice shall not be

required in the following cases:

xxx xxx xxx

Such assessment may be protested administratively by filing a request for

reconsideration or reinvestigation within thirty (30) days from receipt of the assessment

in such form and manner as may be prescribed by implementing rules and regulations.

Within sixty (60) days from filing of the protest, all relevant supporting documents shall

have been submitted; otherwise, the assessment shall become final.

xxx xxx xxx

CD Technologies Asia, Inc. 2019 cdasiaonline.com

Potrebbero piacerti anche

- Duty Free Philippines V BIRDocumento4 pagineDuty Free Philippines V BIRTheodore0176Nessuna valutazione finora

- Ignacio v. Pampanga Bus Co., Inc.Documento11 pagineIgnacio v. Pampanga Bus Co., Inc.Laura MangantulaoNessuna valutazione finora

- Securities and Exchange Commission v. Prosperity - Com, Inc.Documento4 pagineSecurities and Exchange Commission v. Prosperity - Com, Inc.Lydia Marie MirabelNessuna valutazione finora

- Armando Contreras vs. Judge Cesar Solis, A.M. No. RTJ-94-1266, August 21, 1996Documento6 pagineArmando Contreras vs. Judge Cesar Solis, A.M. No. RTJ-94-1266, August 21, 1996Lou Ann AncaoNessuna valutazione finora

- Cir V. Philippine Daily Inquirer GR No. 213943, Mar 22, 2017 Facts: PDI Is A Corporation Engaged in The Business of Newspaper PublicationDocumento3 pagineCir V. Philippine Daily Inquirer GR No. 213943, Mar 22, 2017 Facts: PDI Is A Corporation Engaged in The Business of Newspaper PublicationCesyl Patricia BallesterosNessuna valutazione finora

- 203-Abella v. Barrios A.C. No. 7332 June 18, 2013Documento5 pagine203-Abella v. Barrios A.C. No. 7332 June 18, 2013Jopan SJNessuna valutazione finora

- New Sampaguita VS Phils., 435 SCRA 565Documento57 pagineNew Sampaguita VS Phils., 435 SCRA 565June DoriftoNessuna valutazione finora

- People vs. Gonzalez, Jr.Documento2 paginePeople vs. Gonzalez, Jr.Irish AnnNessuna valutazione finora

- Mercantile Bar Exam Questions 2012Documento31 pagineMercantile Bar Exam Questions 2012vylletteNessuna valutazione finora

- EB 1452 LANECO V BIR 20170405 & EB 1246 CIR V South Entertainment Gallery, Inc 20160104 PDFDocumento34 pagineEB 1452 LANECO V BIR 20170405 & EB 1246 CIR V South Entertainment Gallery, Inc 20160104 PDFcherryNessuna valutazione finora

- TAX - TranscibedDocumento14 pagineTAX - TranscibedPriscilla DawnNessuna valutazione finora

- RP Vs Pilipinas ShellDocumento4 pagineRP Vs Pilipinas ShellAirelle AvilaNessuna valutazione finora

- 2nd Batch Digests CivproDocumento37 pagine2nd Batch Digests CivproJerik SolasNessuna valutazione finora

- Pub Corp Case Digest Page 11-14Documento41 paginePub Corp Case Digest Page 11-14Haze Q.Nessuna valutazione finora

- SJS V LinaDocumento2 pagineSJS V LinaRay SantosNessuna valutazione finora

- Election Law I-IVDocumento74 pagineElection Law I-IVAnonymous rpayYFB3PwNessuna valutazione finora

- In Re IBP Membership Dues Delinquency of Atty. Marcial EdillonDocumento1 paginaIn Re IBP Membership Dues Delinquency of Atty. Marcial EdillonDana Denisse RicaplazaNessuna valutazione finora

- 16 RemDocumento7 pagine16 RemEmmagine E EyanaNessuna valutazione finora

- Consti, 11-99, 09-94Documento7 pagineConsti, 11-99, 09-94Jose Antonio BarrosoNessuna valutazione finora

- Legprof Canons 18-22Documento9 pagineLegprof Canons 18-22beth_afanNessuna valutazione finora

- Gentle Supreme Philippines, Inc. v. Consulta PDFDocumento6 pagineGentle Supreme Philippines, Inc. v. Consulta PDFDaley CatugdaNessuna valutazione finora

- 07 People v. AbatDocumento6 pagine07 People v. AbatJason ToddNessuna valutazione finora

- Tax2-Case Digests Atty. AcasDocumento107 pagineTax2-Case Digests Atty. AcasHi Law School0% (1)

- Cayao Vs RamoleteDocumento3 pagineCayao Vs Ramoletemichelle_calzada_1Nessuna valutazione finora

- Silva v. Lee, Jr. Case DigestDocumento1 paginaSilva v. Lee, Jr. Case DigestjenellNessuna valutazione finora

- Coca-Cola Bottlers Philippines, Inc. Vs Court of AppealsDocumento3 pagineCoca-Cola Bottlers Philippines, Inc. Vs Court of AppealsMarilou Olaguir SañoNessuna valutazione finora

- Afroyim Vs RuskDocumento5 pagineAfroyim Vs Ruskgsbentor_jrNessuna valutazione finora

- CIR v. Gatamco DigestDocumento1 paginaCIR v. Gatamco DigestJomar TenezaNessuna valutazione finora

- SPECPRO Case Digest Set 1Documento6 pagineSPECPRO Case Digest Set 1CJVNessuna valutazione finora

- ADR First50-RevisedDocumento58 pagineADR First50-RevisedBenedict AlvarezNessuna valutazione finora

- Orient Freight International v. Keihin-Everett ForwardingDocumento13 pagineOrient Freight International v. Keihin-Everett ForwardingJanelle Leano MarianoNessuna valutazione finora

- Agustin Barrera, Et. Al. vs. Tanjoco, Et. Al.Documento2 pagineAgustin Barrera, Et. Al. vs. Tanjoco, Et. Al.Jacqueline Carlotta SydiongcoNessuna valutazione finora

- Self Defense (Beninsig Vs People)Documento3 pagineSelf Defense (Beninsig Vs People)FaithMayfairNessuna valutazione finora

- Consolidated Tax Digested CasesDocumento34 pagineConsolidated Tax Digested CasesEmmaNessuna valutazione finora

- Baviera V PaglinawanDocumento3 pagineBaviera V PaglinawanDominique PobeNessuna valutazione finora

- Legal Medicine 2020Documento2 pagineLegal Medicine 2020Kobe Lawrence VeneracionNessuna valutazione finora

- IPL CasesDocumento17 pagineIPL CasesSheera Laine V. ManzanoNessuna valutazione finora

- City of Iloilo vs. Smart CommunicationsDocumento7 pagineCity of Iloilo vs. Smart CommunicationsDivinoCzarA.AndalesNessuna valutazione finora

- Commercial Law 2011Documento19 pagineCommercial Law 2011lexangel79Nessuna valutazione finora

- Subpoena NDCDocumento3 pagineSubpoena NDCOCP Santiago CityNessuna valutazione finora

- Maglalang Vs PagcorDocumento4 pagineMaglalang Vs Pagcorcmptmarissa0% (1)

- Filipino Merchants Insurance Co., Inc. vs. Court of AppealsDocumento7 pagineFilipino Merchants Insurance Co., Inc. vs. Court of AppealsJaja Ordinario Quiachon-AbarcaNessuna valutazione finora

- Romy Vs CastroDocumento2 pagineRomy Vs CastroKristine VillanuevaNessuna valutazione finora

- Secretary VS CtaDocumento4 pagineSecretary VS CtaJarvy PinonganNessuna valutazione finora

- MISNET v. CIR (2019) : Ewt Was Still Under ProtestDocumento2 pagineMISNET v. CIR (2019) : Ewt Was Still Under Protestcompiler123Nessuna valutazione finora

- BOY SCOUTS OF THE PHILIPPINES v. COMMISSION ON AUDIT Dissenting Opinion, Justice Antonio T. CarpioDocumento36 pagineBOY SCOUTS OF THE PHILIPPINES v. COMMISSION ON AUDIT Dissenting Opinion, Justice Antonio T. CarpioJustice Antonio T. CarpioNessuna valutazione finora

- 1 BofA Vs CA GR No. 120135Documento2 pagine1 BofA Vs CA GR No. 120135Anty CastilloNessuna valutazione finora

- 2020 UNGOS LABREV - Labrel ReviewerDocumento35 pagine2020 UNGOS LABREV - Labrel ReviewerAyra ArcillaNessuna valutazione finora

- Spec Com Case DigestDocumento5 pagineSpec Com Case DigestJan GonzalesNessuna valutazione finora

- Dingcong vs. Kanaan PDFDocumento2 pagineDingcong vs. Kanaan PDFCharm Divina LascotaNessuna valutazione finora

- 03 Heirs of Borlado Vs CADocumento1 pagina03 Heirs of Borlado Vs CAPrincess Montañano SantiagoNessuna valutazione finora

- Sasot vs. PeopleDocumento2 pagineSasot vs. PeopleEANessuna valutazione finora

- Untitled DocumentDocumento22 pagineUntitled DocumentKhym OhNessuna valutazione finora

- CIR V Roca Security Inc.Documento2 pagineCIR V Roca Security Inc.Jemima Rachel CruzNessuna valutazione finora

- Cruz v. Dalisay DigestDocumento1 paginaCruz v. Dalisay DigestKimberly SisonNessuna valutazione finora

- Saudi Arabian Airlines vs. Court of AppealsDocumento4 pagineSaudi Arabian Airlines vs. Court of AppealsElla QuiNessuna valutazione finora

- Guevarra v. Eala (CivPro Rule 8, Case 7)Documento2 pagineGuevarra v. Eala (CivPro Rule 8, Case 7)gmjay89Nessuna valutazione finora

- Cta Eb CV 02176 D 2021feb16 RefDocumento10 pagineCta Eb CV 02176 D 2021feb16 RefFirenze PHNessuna valutazione finora

- Petitioner vs. vs. Respondent: Special First DivisionDocumento3 paginePetitioner vs. vs. Respondent: Special First DivisionPam MarceloNessuna valutazione finora

- 10 - CIR v. Yusen Logistics Center, Inc.Documento3 pagine10 - CIR v. Yusen Logistics Center, Inc.Carlota VillaromanNessuna valutazione finora

- Bpi V Iac 164 Scra 630 August 19,1988Documento5 pagineBpi V Iac 164 Scra 630 August 19,1988Romarie AbrazaldoNessuna valutazione finora

- Polanski DecisionDocumento13 paginePolanski DecisionTHROnlineNessuna valutazione finora

- Substitution Case DigestsDocumento14 pagineSubstitution Case DigestsCarla January OngNessuna valutazione finora

- Lonzanida Vs COMELEC & LADLAD CaseDocumento6 pagineLonzanida Vs COMELEC & LADLAD CaseIHannan MangotaraNessuna valutazione finora

- Atty. Ismael G. Khan Jr. Vs - Atty. Rizalino T. SimbilloDocumento2 pagineAtty. Ismael G. Khan Jr. Vs - Atty. Rizalino T. SimbilloJheza Catalina Tee - Dimayuga100% (5)

- Columbia Pictures Inc. vs. CA 237 SCRA 367 1994Documento5 pagineColumbia Pictures Inc. vs. CA 237 SCRA 367 1994Cecil BernabeNessuna valutazione finora

- LTD Case DigestsDocumento4 pagineLTD Case DigestsDatu TahilNessuna valutazione finora

- ARTICLE 8 ReviewerDocumento8 pagineARTICLE 8 ReviewerMigoy DANessuna valutazione finora

- Saudi Arabia Airlines Vs CA DigestDocumento5 pagineSaudi Arabia Airlines Vs CA DigestAbilene Joy Dela CruzNessuna valutazione finora

- Case DigestsDocumento7 pagineCase DigestsTeresa Dumangas BuladacoNessuna valutazione finora

- Civil Procedure-eCasebriefsDocumento184 pagineCivil Procedure-eCasebriefsStacySchiano100% (2)

- Einstein V 357Documento32 pagineEinstein V 357internetcasesNessuna valutazione finora

- Neri v. Blue Ribbon CommitteeDocumento5 pagineNeri v. Blue Ribbon CommitteejenizacallejaNessuna valutazione finora

- Case - LHRC & TLS Vs Mizengo Pinda & Another Misc Civil Cause No 24 of 2013Documento28 pagineCase - LHRC & TLS Vs Mizengo Pinda & Another Misc Civil Cause No 24 of 2013jonas msigala100% (6)

- J Plus Asia Development Corporation RevisedDocumento11 pagineJ Plus Asia Development Corporation Revised'Joshua Crisostomo'Nessuna valutazione finora

- Balram Prasad v. Kunal SahaDocumento210 pagineBalram Prasad v. Kunal SahaBar & BenchNessuna valutazione finora

- United Interactive™ MOU White LabelDocumento3 pagineUnited Interactive™ MOU White LabelUnited Interactive™Nessuna valutazione finora

- Article 40Documento9 pagineArticle 40Kristia CapioNessuna valutazione finora

- Lazaro vs. Social Security CommissionDocumento1 paginaLazaro vs. Social Security CommissionCharmila SiplonNessuna valutazione finora

- Bugaring V Espanol (2001)Documento8 pagineBugaring V Espanol (2001)AbbyElbamboNessuna valutazione finora

- Himachal Pradesh General Sales Tax Act, 1968 PDFDocumento175 pagineHimachal Pradesh General Sales Tax Act, 1968 PDFLatest Laws TeamNessuna valutazione finora

- Manotok Vs CADocumento2 pagineManotok Vs CAMonica B. AsebuqueNessuna valutazione finora

- EvidenceDocumento13 pagineEvidenceRex FloresNessuna valutazione finora

- 2016 2017 OLSC AnnRepDocumento34 pagine2016 2017 OLSC AnnRepSulakShana SumaruthNessuna valutazione finora

- Maria Perez-Cabrera, A072 365 767 (BIA Mar. 15, 2012)Documento3 pagineMaria Perez-Cabrera, A072 365 767 (BIA Mar. 15, 2012)Immigrant & Refugee Appellate Center, LLCNessuna valutazione finora

- Craigslist ScamsDocumento1 paginaCraigslist ScamsJean-Paul PuryearNessuna valutazione finora

- Feist v. Rural Telephone Service CoDocumento2 pagineFeist v. Rural Telephone Service CoMichelle Montenegro - AraujoNessuna valutazione finora

- 34 Valencia Vs JimenezDocumento5 pagine34 Valencia Vs JimenezLegaspiCabatchaNessuna valutazione finora

- PALE 032017casesDocumento3 paginePALE 032017casesScarlette CooperaNessuna valutazione finora

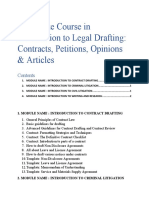

- CONTENTS INDEX - Certificate Course in Introduction To Legal DraftingDocumento4 pagineCONTENTS INDEX - Certificate Course in Introduction To Legal DraftingManan Mehra100% (1)

- Essential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsDa EverandEssential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsValutazione: 3 su 5 stelle3/5 (2)

- A Student's Guide to Law School: What Counts, What Helps, and What MattersDa EverandA Student's Guide to Law School: What Counts, What Helps, and What MattersValutazione: 5 su 5 stelle5/5 (4)

- The Absolute Beginner's Guide to Cross-ExaminationDa EverandThe Absolute Beginner's Guide to Cross-ExaminationNessuna valutazione finora

- Employment Law: a Quickstudy Digital Law ReferenceDa EverandEmployment Law: a Quickstudy Digital Law ReferenceValutazione: 1 su 5 stelle1/5 (1)

- Commentaries on the Laws of England, Volume 1: A Facsimile of the First Edition of 1765-1769Da EverandCommentaries on the Laws of England, Volume 1: A Facsimile of the First Edition of 1765-1769Valutazione: 4 su 5 stelle4/5 (6)

- Form Your Own Limited Liability Company: Create An LLC in Any StateDa EverandForm Your Own Limited Liability Company: Create An LLC in Any StateNessuna valutazione finora

- Legal Writing in Plain English, Third Edition: A Text with ExercisesDa EverandLegal Writing in Plain English, Third Edition: A Text with ExercisesNessuna valutazione finora

- The Power of Our Supreme Court: How Supreme Court Cases Shape DemocracyDa EverandThe Power of Our Supreme Court: How Supreme Court Cases Shape DemocracyValutazione: 5 su 5 stelle5/5 (2)

- So You Want to be a Lawyer: The Ultimate Guide to Getting into and Succeeding in Law SchoolDa EverandSo You Want to be a Lawyer: The Ultimate Guide to Getting into and Succeeding in Law SchoolNessuna valutazione finora

- Getting Permission: Using & Licensing Copyright-Protected Materials Online & OffDa EverandGetting Permission: Using & Licensing Copyright-Protected Materials Online & OffValutazione: 4.5 su 5 stelle4.5/5 (20)

- Legal Forms for Starting & Running a Small Business: 65 Essential Agreements, Contracts, Leases & LettersDa EverandLegal Forms for Starting & Running a Small Business: 65 Essential Agreements, Contracts, Leases & LettersNessuna valutazione finora

- Legal Forms for Everyone: Leases, Home Sales, Avoiding Probate, Living Wills, Trusts, Divorce, Copyrights, and Much MoreDa EverandLegal Forms for Everyone: Leases, Home Sales, Avoiding Probate, Living Wills, Trusts, Divorce, Copyrights, and Much MoreValutazione: 3.5 su 5 stelle3.5/5 (2)

- Dictionary of Legal Terms: Definitions and Explanations for Non-LawyersDa EverandDictionary of Legal Terms: Definitions and Explanations for Non-LawyersValutazione: 5 su 5 stelle5/5 (2)

- Legal Writing in Plain English: A Text with ExercisesDa EverandLegal Writing in Plain English: A Text with ExercisesValutazione: 3 su 5 stelle3/5 (2)

- The Trademark Guide: How You Can Protect and Profit from Trademarks (Third Edition)Da EverandThe Trademark Guide: How You Can Protect and Profit from Trademarks (Third Edition)Nessuna valutazione finora

- Nolo's Deposition Handbook: The Essential Guide for Anyone Facing or Conducting a DepositionDa EverandNolo's Deposition Handbook: The Essential Guide for Anyone Facing or Conducting a DepositionValutazione: 5 su 5 stelle5/5 (1)

- Legal Writing: QuickStudy Laminated Reference GuideDa EverandLegal Writing: QuickStudy Laminated Reference GuideNessuna valutazione finora

- Solve Your Money Troubles: Strategies to Get Out of Debt and Stay That WayDa EverandSolve Your Money Troubles: Strategies to Get Out of Debt and Stay That WayValutazione: 4 su 5 stelle4/5 (8)

- How to Make Patent Drawings: Save Thousands of Dollars and Do It With a Camera and Computer!Da EverandHow to Make Patent Drawings: Save Thousands of Dollars and Do It With a Camera and Computer!Valutazione: 5 su 5 stelle5/5 (1)

- He Had It Coming: How to Outsmart Your Husband and Win Your DivorceDa EverandHe Had It Coming: How to Outsmart Your Husband and Win Your DivorceNessuna valutazione finora

- Torts: QuickStudy Laminated Reference GuideDa EverandTorts: QuickStudy Laminated Reference GuideValutazione: 5 su 5 stelle5/5 (1)

- Admissibility of Expert Witness TestimonyDa EverandAdmissibility of Expert Witness TestimonyValutazione: 5 su 5 stelle5/5 (1)

- Flora and Vegetation of Bali Indonesia: An Illustrated Field GuideDa EverandFlora and Vegetation of Bali Indonesia: An Illustrated Field GuideValutazione: 5 su 5 stelle5/5 (2)

- Nolo's Encyclopedia of Everyday Law: Answers to Your Most Frequently Asked Legal QuestionsDa EverandNolo's Encyclopedia of Everyday Law: Answers to Your Most Frequently Asked Legal QuestionsValutazione: 4 su 5 stelle4/5 (18)