Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Budget 2020 Stock Watchlist 202001291051168950835 PDF

Caricato da

Satyabrata NaikTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Budget 2020 Stock Watchlist 202001291051168950835 PDF

Caricato da

Satyabrata NaikCopyright:

Formati disponibili

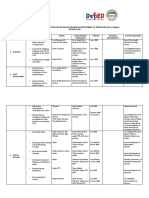

RETAIL RESEARCH 28 January 2020

Budget 2020 – Stock Watchlist

The following table lists the sectoral expectations from the forthcoming Budget which will likely impact stocks under HDFC

Securities’ coverage.

Sensitivity Analysis to Budget

Our Coverage

Sectors Budget Expectations Impact proposals

Companies impacted

Positive Negative Neutral

Likely reduction in personal Should improve sentiments and increase

Symphony, Crompton

income tax rates demand of appliances and household √ - -

Consumer, Salzer

electrical goods.

Appliances Electronic, Orient

Import duty on Could provide level field for domestic

Electric Ltd, Havells

electrical/electronic goods manufacturers. √ - -

India, V Guard

may be raised

Uniform GST rate for auto Uniform rate of 18% for all auto Subros, Minda Inds,

components components will help vs 18%/28% for √ - √ Harita Seating,

different components. Ramkrishna Forgings

Rebate on ex-showroom prices Would reduce the on-road price of the Maruti Suzuki, Tata

√ - -

of small cars vehicle and boost demand Motors

Higher Rural spending 2W and tractor industry could benefit if

M&M, Hero Moto,

rural consumers have higher spending √ - -

and Bajaj Auto

power

Likely reduction in personal Beneficial for consumer sentiments and Bajaj, Hero Moto,

Auto and Auto

income tax rates overall demand for sector. Eicher, TVS, Maruti,

Ancillaries √ - -

Tata Motors and

M&M

Announcement on the Though this could be with a staggered

scrappage policy for CVs implementation and limited fiscal Eicher, Tata Motors

√ - -

impact, it could still improve sentiments and M&M

towards CV manufacturers.

Extend higher depreciation Currently it is on purchases made till

Eicher, Maruti, Tata

rate for new vehicles March 2020. This may be extended by a √ - -

Motors and M&M

year.

Increase in FDI limit Increasing permissible limit of FDI from Interglobe Aviation,

Aviation √ - -

49% to 100% in aviation sector Spice Jet

Steps to develop broader debt Likely to improve corporate debt market

market resulting in better price discovery and √ - - BSE, CDSL and Banks

higher treasury operations

Further increase in income tax Positive for banks

deduction exemption limit on

√ - -

interest on savings account

deposits

Higher-than expected market Will be negative for investment portfolio;

borrowings due to fiscal higher borrowing can also lead to rise in

Banking - √ -

slippage may put pressure on cost of funds

All Banks

bond yields.

A TARP like program (Troubled This will help Banks and NBFCs to

Assets Relief Program) could postpone recognition of NPAs, improve

be introduced for restoring the capital adequacy and lend more

flow of liquidity to the resources √ - -

businesses and give an

extension to lenders for

recovery from select sectors.

RETAIL RESEARCH Page |1

RETAIL RESEARCH

Sensitivity Analysis to Budget

Our Coverage

Sectors Budget Expectations Impact proposals

Companies impacted

Positive Negative Neutral

Duty exemption under FTAs The move will provide a level-playing L&T, KEC

should be limited to raw field to domestic manufacturers of the International,

materials and not for finished finished goods. √ - - Kalpataru Power

goods Transmission, BHEL,

Cummins

Increase in investments in key Railway EPC and equipment

Capital Goods / Infrastructure sectors such as manufacturers would be the prime

Industrials Railways could see a jump. beneficiaries

√ - - KEC, Cummins, BEL

100% electrification, network

de-congestion, upgradation &

modernization and safety

Continued visibility on Likely to boost project awards and

reasonable budgetary execution in roads, railways, urban infra √ - - L&T, BEML

allocation

Increase in budget allocation Expect increase in spending to boost Deccan Cement,

for infrastructure projects and cement demand growth for FY21 to 6-7% UltraTech Cement,

PMAY against 1-2% for FY20. To drive pricing √ - - Ambuja Cement, ACC,

power and profitability for the STAR Cement, Orient

Cement

manufacturers. Cement, Dalmia

Removal of Clean energy cess Positive for companies - estimated Bharat, Shree Cement,

on Coal benefit of Rs30/Ton √ - - JK Cement, Indian

Hume Pipe

Decontrolling urea prices Will benefit urea manufacturers by

reducing working capital requirements √ - -

and interest costs.

Clearing the subsidy backlog Estimated at Rs390bn by March-end, will

Chemicals /

payable to fertilizer companies improve cashflows and reduce interest √ - -

Fertilisers

costs Coromandel

Increase in the Subsidy Likely to benefit the fertilizer companies International

allocation of urea and complex by easing out their working capital √ - -

fertilisers requirements

Higher allocation in Pradhan Govt intends to increase coverage under

Mantri Fasal Bima Yojana PMFBY scheme from 50% of cropped √ - -

(PMFBY) area in 2018-19

Likely reduction in personal Reduction in personal income tax rates Hindustan Unilever,

income tax rates should improve sentiments and benefit Colgate Palmolive

small ticket discretionary consumption √ - - India, Dabur Ltd, ITC

Ltd and Jyothy

Laboratories Ltd

Higher allocation to rural Will aid recovery in rural Hindustan Unilever,

FMCG centric schemes demand/consumption Emami, Dabur Ltd,

√ - - Marico, ITC Ltd and

Jyothy Laboratories

Ltd

Increase in tax/cess on To raise revenues and discourage

cigarettes consumption the Govt may raise tax/cess - √ - ITC

on cigarettes

Tax benefit on R&D Pharma companies currently get 150%

deduction till FY20 and 100% till FY21.

√ - -

This may rise to 200% or extend the Cadila Healthcare,

Healthcare/Pharma 150% deduction for a few years Jubilant Life Sciences

Higher allocation to schemes Higher allocation for Schemes like and Alkem Labs

Ayushman Bharat, Pradhan Mantri Jan √ - -

Arogya Yojana (PMJAY)

RETAIL RESEARCH Page |2

RETAIL RESEARCH

Sensitivity Analysis to Budget

Our Coverage

Sectors Budget Expectations Impact proposals

Companies impacted

Positive Negative Neutral

Increase in budgeted amount Construction EPCs, metro rollling stock

L&T, GE T&D India Ltd,

for metro projects manufacturers and metro signalling √ - -

BEL, EIL

technology players would benefit

Expect PMGSY share to be Road EPC players to strengthen the rural Sadbhav Engineering, J

higher than Rs 209bn. connectivity √ - - Kumar Infraprojects,

Infrastructure

JMC Projects

Overall railway capital Government stress to strengthen railway

KEC Int, L&T,

expenditure could be pegged Infrastructure could benefit companies

√ - - Kalpataru Power, JMC

at Rs.1.74tn involved in modernization of stations and

Projects

electrification of railways

Extension of SEZ sunset clause Extension of tax benefits for the SEZs by

TCS, Infosys, HCL Tech,

IT for Income tax which is coming 3-5 more years √ - -

Wipro

into force on Apr 01, 2020

Increased fund allocation for Marginally positive for the overall

TCI Exp, Gateway

infra projects like Sagarmala logistics space

Logistics √ - - Distripark, Container

project, Multimodal logistics

Corporation

parks, coastal roadways etc

Capital infusion in Insurance Infusion of Rs. 10,000-12,000 Cr.

√ - - New India Assurance

Sector

Potential increase in FDI in Increase in FDI in insurance companies to SBI Life, ICICI

insurance 74% from 49% currently. Prudential, Max

√ - - Financial, ICICI

Lombard, New India

NBFCs Assurance

Long term capital gains on This could benefit broking companies

ICICI Sec, Motilal

equities/equity MFs may be even though the holding period may be √ - -

Oswal, BSE

abolished extended to 2 years vs the current 1 year

For 50 large NBFCs, Govt could This could give breathing space for Cholamandalam

defer principal repayments for stressed NBFCs √ - - Finance, M&M

a specified period. Finance, STFC

Inclusion of Natural Gas under Given GoI’s target of achieving higher

GST consumption of natural gas in energy

Oil & Gas √ - - IGL, MGL, Gujarat Gas

mix, this step will help increase adoption

of gas as a fuel

Increase Custom Duty on Duty may be doubled from the current

Tamil Nadu Newsprint

Paper Products import of coated paper, 10% to help domestic manufactures √ - -

Paper

paperboard, handmade paper. compete with global players

Announce Atal Distribution The scheme involving cutting losses,

System Improvement Yojana negating tariff gaps, setting up smart NTPC, Apar Industries,

Power to replace current UDAY meters across 250mn households will √ - - KEC International,

boost demand for products/services in Kalpataru Power, L&T

T&D sector.

Extension of timeline for Could be extended by 1 year to Mar

Profit-linked deduction for 2021. √ - -

affordable housing projects Mahindra Life Space,

Lenders should be allowed a This could unlock value in distressed real Brigade, DLF, Godrej

Real Estate

one-time restructuring of estate players and also benefit Properties,Kolte Patil,

certain real estate loans – like Banks/NBFCs √ - - Dilip Buildcon,

projects stuck due to approvals

or finance.

Likely reduction in personal Helps in increasing disposable income Titan, ABFRL, Avenue

Retail income tax rates and thus improves overall consumption √ - - Supermart, Bata, V-

Mart

RETAIL RESEARCH Page |3

RETAIL RESEARCH

Disclaimer:

This report has been prepared by HDFC Securities Ltd and is meant for sole use by the recipient and not for circulation. The information and opinions contained

herein have been compiled or arrived at, based upon information obtained in good faith from sources believed to be reliable. Such information has not been

independently verified and no guaranty, representation of warranty, express or implied, is made as to its accuracy, completeness or correctness. All such

information and opinions are subject to change without notice. This document is for information purposes only. Descriptions of any company or companies or their

securities mentioned herein are not intended to be complete and this document is not, and should not be construed as an offer or solicitation of an offer, to buy or

sell any securities or other financial instruments.

This report is not directed to, or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity who is a citizen or

resident or located in any locality, state, country or other jurisdiction where such distribution, publication, reproduction, availability or use would be contrary to law

or regulation or what would subject HSL or its affiliates to any registration or licensing requirement within such jurisdiction.

If this report is inadvertently sent or has reached any person in such country, especially, United States of America, the same should be ignored and brought to the

attention of the sender. This document may not be reproduced, distributed or published in whole or in part, directly or indirectly, for any purposes or in any

manner.

Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations, which could have an adverse effect on their value or

price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively

assume currency risk.

It should not be considered to be taken as an offer to sell or a solicitation to buy any security. HSL may from time to time solicit from, or perform broking, or other

services for, any company mentioned in this mail and/or its attachments.

HSL and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the

company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market

maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other

potential conflict of interests with respect to any recommendation and other related information and opinions.

HSL, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made

or any action taken on basis of this report, including but not restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in

the NAVs, reduction in the dividend or income, etc.

HSL and other group companies, its directors, associates, employees may have various positions in any of the stocks, securities and financial instruments dealt in

the report, or may make sell or purchase or other deals in these securities from time to time or may deal in other securities of the companies / organizations

described in this report.

HSL or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject

company for any other assignment in the past twelve months.

HSL or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from t date of

this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or

other advisory service in a merger or specific transaction in the normal course of business.

HSL or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of

the research report. Accordingly, neither HSL nor Research Analysts have any material conflict of interest at the time of publication of this report. Compensation of

our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions. HSL may have issued other reports that

are inconsistent with and reach different conclusion from the information presented in this report.

Research entity has not been engaged in market making activity for the subject company. Research analyst has not served as an officer, director or employee of the

subject company. We have not received any compensation/benefits from the subject company or third party in connection with the Research Report.

HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East),

Mumbai 400 042 Phone: (022) 3075 3400 Fax: (022) 2496 5066

Compliance Officer: Binkle R. Oza Email: complianceofficer@hdfcsec.com Phone: (022) 3045 3600

HDFC Securities Limited, SEBI Reg. No.: NSE, BSE, MSEI, MCX: INZ000186937; AMFI Reg. No. ARN: 13549; PFRDA Reg. No. POP: 11092018; IRDA Corporate Agent

License No.: CA0062; SEBI Research Analyst Reg. No.: INH000002475; SEBI Investment Adviser Reg. No.: INA000011538; CIN - U67120MH2000PLC152193

Mutual Funds Investments are subject to market risk. Please read the offer and scheme related documents carefully before investing.

RETAIL RESEARCH Page |4

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Module 2 TechnologyDocumento20 pagineModule 2 Technologybenitez1Nessuna valutazione finora

- FHHR 013 Red Tag Procedure PDFDocumento5 pagineFHHR 013 Red Tag Procedure PDFN3N5YNessuna valutazione finora

- Essay Final ProjectDocumento7 pagineEssay Final Projectapi-740591437Nessuna valutazione finora

- Bulletin PDFDocumento2 pagineBulletin PDFEric LitkeNessuna valutazione finora

- Sickle Cell DiseaseDocumento10 pagineSickle Cell DiseaseBrooke2014Nessuna valutazione finora

- Datos Adjuntos Sin Título 00013Documento3 pagineDatos Adjuntos Sin Título 00013coyana9652Nessuna valutazione finora

- VC AndrewsDocumento3 pagineVC AndrewsLesa O'Leary100% (1)

- Laudon - Mis16 - PPT - ch11 - KL - CE (Updated Content For 2021) - Managing Knowledge and Artificial IntelligenceDocumento45 pagineLaudon - Mis16 - PPT - ch11 - KL - CE (Updated Content For 2021) - Managing Knowledge and Artificial IntelligenceSandaru RathnayakeNessuna valutazione finora

- Mindray PM 9000 User ID10240 PDFDocumento378 pagineMindray PM 9000 User ID10240 PDFJuan FernandoNessuna valutazione finora

- Atom SDDocumento5 pagineAtom SDatomsa shiferaNessuna valutazione finora

- MiddleWare Technology - Lab Manual JWFILESDocumento171 pagineMiddleWare Technology - Lab Manual JWFILESSangeetha BajanthriNessuna valutazione finora

- Ransomware: Prevention and Response ChecklistDocumento5 pagineRansomware: Prevention and Response Checklistcapodelcapo100% (1)

- MQXUSBDEVAPIDocumento32 pagineMQXUSBDEVAPIwonderxNessuna valutazione finora

- Jurnal Vol. IV No.1 JANUARI 2013 - SupanjiDocumento11 pagineJurnal Vol. IV No.1 JANUARI 2013 - SupanjiIchsan SetiadiNessuna valutazione finora

- Medabots-Rokusho Version (European) - Medal Codes (Part 1) (GBA Cheats) - CodeTwink ForumsDocumento5 pagineMedabots-Rokusho Version (European) - Medal Codes (Part 1) (GBA Cheats) - CodeTwink Forumsdegraded 4resterNessuna valutazione finora

- Shaker ScreenDocumento2 pagineShaker ScreenRiaz EbrahimNessuna valutazione finora

- 2.1 DRH Literary Translation-An IntroductionDocumento21 pagine2.1 DRH Literary Translation-An IntroductionHassane DarirNessuna valutazione finora

- Guidelines For Plenipotentiary - 1Documento6 pagineGuidelines For Plenipotentiary - 1Oladimeji Ibukun IjaodolaNessuna valutazione finora

- Nse 2Documento5 pagineNse 2dhaval gohelNessuna valutazione finora

- Beautiful SpotsDocumento2 pagineBeautiful SpotsLouise Yongco100% (1)

- Four Hour Body Experiment Tracker TemplateDocumento4 pagineFour Hour Body Experiment Tracker Templatechanellekristyweaver100% (1)

- Rocker ScientificDocumento10 pagineRocker ScientificRody JHNessuna valutazione finora

- Switching Lab-05b Configuring InterVLAN RoutingDocumento2 pagineSwitching Lab-05b Configuring InterVLAN RoutingHernan E. SalvatoriNessuna valutazione finora

- Uh 60 ManualDocumento241 pagineUh 60 ManualAnonymous ddjwf1dqpNessuna valutazione finora

- Sample Interview Questions For Planning EngineersDocumento16 pagineSample Interview Questions For Planning EngineersPooja PawarNessuna valutazione finora

- Flowrox Valve Solutions Catalogue E-VersionDocumento16 pagineFlowrox Valve Solutions Catalogue E-Versionjavier alvarezNessuna valutazione finora

- Forces L2 Measuring Forces WSDocumento4 pagineForces L2 Measuring Forces WSAarav KapoorNessuna valutazione finora

- Pontevedra 1 Ok Action PlanDocumento5 paginePontevedra 1 Ok Action PlanGemma Carnecer Mongcal50% (2)

- Topic 1 - ICT Tools at USP - Theoretical Notes With Google AppsDocumento18 pagineTopic 1 - ICT Tools at USP - Theoretical Notes With Google AppsAvantika PrasadNessuna valutazione finora

- Electromagnetism WorksheetDocumento3 pagineElectromagnetism WorksheetGuan Jie KhooNessuna valutazione finora