Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

AVERAGE

Caricato da

Clyde RamosCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

AVERAGE

Caricato da

Clyde RamosCopyright:

Formati disponibili

CAT CUP THREE

AVERAGE ROUND

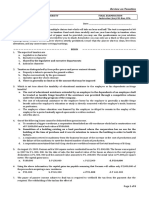

Average 1. Taxpayers are husband and wife. The gross compensation

income of the wife is P60,000 while the business income of the husband

is P100,000. They have six (6) qualified dependent children but within

the years one child died. Their total exemptions is -

a. P61,000 c. P64,000

b. P100,000 d. P96,000

ANS: B

Basic personal exemptions:

Wife P50,000

Husband 50,000 P100,000

Additional exemptions 100,000

(P25,000 x 4)

Total exemptions P200,000

Average 2. In 2008, Padolino's wife died of a car accident. His

dependents are as follows:

A, child, 22 years old, employed on July 12, 2008

B, child, 21 years old on January 2, 2008.

C, child 18 years old, married on January 31, 2008.

D, child, 17 years old, gainfully employed on October 1, 2008.

E, child, 15 afflicted with sore eyes on May 6, 2008.

F, child 13 died of an accident in 2008.

G, brother, 28 paralytic.

For taxable year 2008, Padolino can claim additional exemptions of -

a. P8,000 c. P24,000

b. P32,000 d. 100,000

ANS: D

Padolino is entitled to an additional exemption on F, E, D, C and B.

However, the law allows only a maximum number of four (4) dependents.

He can, therefore, claim an additional exemption of P100,000 only.

Average 3. Which of the following income derived from within the

Philippines by a resident individual is not subject to the rates in

Section 24 (A) of the NIRC?

a. Salary received by a managing partner of a general

professional partnership.

b. A passive income in the form of a price won in a raffle

amounting to P4,000.

c. A gain from sale of a motor vehicle as another income of a

taxable who is a compensation income earner.

d. A gain on sale of a real property for private use of the

family of the taxpayer.

ANS: D

The salary of a managing partner of a general professional partnership

is included in gross income. Hence it is subject to the graduated

rates of tax on income.

11TH REGIONAL MID YEAR CONVENTION

CAT CUP THREE

AVERAGE ROUND

Average 4. Maliksi, single, supporting his 58-year old mother, is a

business income earner. During the year, his net income was P150,000.

Gross compensation income P150,000 He also paid a total

Less: Deductions premium of P3,000 to

Health insurance P 2,400 an insurance company

(maximum) for his health

Basic personal 50,000 52,400 insurance. How much is

Taxable income P97,600 his taxable income?

a. P127,600 c. P122,600

b. P127,000 d. P97,600

ANS: D

Average 5.In 2007, Rustom, Filipino, legally separated from his wife,

Mina, left for the united States with his daughter, Robina, to

permanently reside therein. In 2008 he earned P2 million as income

from his beauty parlor in that country.

Which of the following statements is correct?

a. For Philippine income tax purposes, Rustom may deduct from his gross

income his personal exemption of P25,000 or the amount allowed in

that country, whichever is lower.

b. For Philippine income tax purposes, Rustom's gross income is subject

to a creditable withholding tax of 10%.

c. Rustom's gross income of P2 million is not taxable in the

Philippines.

d. For Philippine income tax purposes, he is no longer entitled to

claim additional exemption on Robina because he is already

classified as a nonresident alien engaged in business in foreign

country.

ANS: C

Average 6 One of the following is not a transaction deemed sale:

a. Transfer, use or consumption not in the course of business of goods

or properties originally intended for sale or for use in the course

of business.

b. Distribution or transfer to shareholders or investors of goods or

properties as share in the profits of a VAT-registered person or

creditors in payment of debt.

c. Retirement from or cessation from business, with respect to all

goods on hand as of the date of such retirement or cessation.

d. Consignment of goods if actual sale is made within 60 days following

the date such goods were consigned.

11TH REGIONAL MID YEAR CONVENTION

CAT CUP THREE

AVERAGE ROUND

ANS: D

Average 7. Tax credit for input taxes shall be allowed if:

a. Both the seller and the purchaser are VAT-registered.

b. Either one of the seller or the purchaser is VAT-registered.

c. Neither one of the seller or the purchaser is VAT-registered as long

as VAT invoice is issued.

d. The seller is VAT-registered regardless of whether the purchaser is

VAT-registered or not.

ANS: A

Average 8. An 80% learning curve was in effect for a certain

industry. The first time the task was performed, it required a time of

800 minutes. When the task was performed for the eighth time, the

cumulative average time per task, rounded to the nearest minute,

equaled:

a. 6,400 minutes

d. 800 minutes

c. 512 minutes

d. 410 minutes

ANS: D

SUPPORTING CALCULATION:

Task Cumulative Average Time/Task

1 800

2 640 (800 x .8)

4 512 (640 x .8)

8 409.6 (512 x .8)

Average 9. Mr. Maasikaso, single, has the following dependents who are

living with and entirely dependent upon him for chief support:

Adrea, child with ex-girlfriend

Barbara, legitimate child of his sister, legally adopted by Mr.

Maasikaso

Carida, Mother, 85 years old, widow, bedridden

Donata, godmother, 80 years old

Mr. Maasikaso can claim additional personal exemption on -

a. Andrea only c. Andrea, Barbara and Caridad

b. Andrea and Barbara d. Andrea, Barbara, Caridad and

Donata

ANS: B

An illegitimate child is a qualified dependent for purposes of

11TH REGIONAL MID YEAR CONVENTION

CAT CUP THREE

AVERAGE ROUND

additional exemption.

An adopted child is qualified if legally adopted; children by natural

adoption do not qualify as dependent for purposes of additional

exemption.

Average 10. Which of the following income is subject to final tax if

received by an individual taxpayer?

I. Share of a partner in the net income of a business partnership.

II. Cash dividend received by a stockholder from a domestic

corporation.

III. Winnings in lotto.

IV. Raffle prizes amounting to P6,000.

a. I and II c. I,II and IV

b. III and IV d. I,II,III and IV

ANS: A

11TH REGIONAL MID YEAR CONVENTION

Potrebbero piacerti anche

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Da EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Nessuna valutazione finora

- Ans For Remaining Questions PDFDocumento23 pagineAns For Remaining Questions PDFKyla Nicole Cortez40% (5)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Da EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Valutazione: 5 su 5 stelle5/5 (1)

- Bit Coin Buy and Sell AgreementDocumento4 pagineBit Coin Buy and Sell AgreementTanayaa Nandvidkar100% (1)

- Phil Tax System and Income Tax Finals By: MCFJMLN: KeywordsDocumento38 paginePhil Tax System and Income Tax Finals By: MCFJMLN: KeywordsReyzel Anne FaylognaNessuna valutazione finora

- Midterm Quiz 1 - Fringe Benefit TaxDocumento3 pagineMidterm Quiz 1 - Fringe Benefit TaxJessica Aningat100% (1)

- Tax QuizDocumento8 pagineTax Quizcleofe janeNessuna valutazione finora

- Taxation With AnswersDocumento8 pagineTaxation With AnswersMarion Tamani Jr.50% (2)

- A. Taxable in The PhilippinesDocumento20 pagineA. Taxable in The PhilippinesJohn Patrick GuingabNessuna valutazione finora

- IFRS in Your Pocket 2021Documento145 pagineIFRS in Your Pocket 2021Rob BakerNessuna valutazione finora

- ClincherDocumento3 pagineClincherClyde Ramos100% (2)

- ClincherDocumento3 pagineClincherClyde Ramos100% (2)

- p7-10 HelpDocumento8 paginep7-10 HelpAJ SuttonNessuna valutazione finora

- Full Download Managerial Economics Applications Strategies and Tactics 14th Edition Mcguigan Solutions ManualDocumento36 pagineFull Download Managerial Economics Applications Strategies and Tactics 14th Edition Mcguigan Solutions Manualthuyradzavichzuk100% (38)

- Project (Air India)Documento81 pagineProject (Air India)Amulay Oberoi100% (2)

- Principles of Economics Chapter 22Documento30 paginePrinciples of Economics Chapter 22Lu CheNessuna valutazione finora

- Intro To Income TaxDocumento4 pagineIntro To Income TaxJennifer Arcadio100% (1)

- Quiz IndividualDocumento4 pagineQuiz IndividualRezhel Vyrneth TurgoNessuna valutazione finora

- Tax Lecture Gross IncomeDocumento6 pagineTax Lecture Gross IncomeAngelojason De LunaNessuna valutazione finora

- Midterm Exam Tax1Documento4 pagineMidterm Exam Tax1ZanderNessuna valutazione finora

- Tax MockboardDocumento8 pagineTax MockboardJaneNessuna valutazione finora

- BLT 2011 First Pre-Board FebruaryDocumento11 pagineBLT 2011 First Pre-Board FebruaryLester AguinaldoNessuna valutazione finora

- Nfjpia Nmbe Taxation 2017 AnsDocumento9 pagineNfjpia Nmbe Taxation 2017 AnsJeric RebandaNessuna valutazione finora

- Nfjpia Nmbe Taxation 2017 AnsDocumento10 pagineNfjpia Nmbe Taxation 2017 AnsjaysonNessuna valutazione finora

- Tax Review QuestionsDocumento11 pagineTax Review QuestionsAbigail Regondola BonitaNessuna valutazione finora

- Tax - 2nd Monthly Assessment - QuestionsDocumento12 pagineTax - 2nd Monthly Assessment - QuestionsGRACELYN SOJORNessuna valutazione finora

- Nfjpia Nmbe Taxation 2017 AnsDocumento9 pagineNfjpia Nmbe Taxation 2017 AnsEstudyante100% (2)

- Law & TaxDocumento13 pagineLaw & TaxrylNessuna valutazione finora

- Tax QuestionsDocumento10 pagineTax QuestionsJake ManansalaNessuna valutazione finora

- ACC 311 Income Taxation QuizDocumento3 pagineACC 311 Income Taxation QuizHilarie JeanNessuna valutazione finora

- Taxation GroupDocumento19 pagineTaxation GroupJoanne Castillo100% (1)

- Drill Discssion Inc and ExcDocumento32 pagineDrill Discssion Inc and ExcJao FloresNessuna valutazione finora

- Armhyla Olivar FM Taxation 8Documento4 pagineArmhyla Olivar FM Taxation 8Grace Umbaña YangaNessuna valutazione finora

- Chapter 3,4,5,6 (Income Tax)Documento14 pagineChapter 3,4,5,6 (Income Tax)Txos Vaj50% (4)

- 2nd Semester Income Taxation Module 10 Exercises On Gross Income - Exclusion and Inclusions Part 2Documento3 pagine2nd Semester Income Taxation Module 10 Exercises On Gross Income - Exclusion and Inclusions Part 2nicole tolayba100% (1)

- Quiz 2 ExclusionsDocumento3 pagineQuiz 2 ExclusionshotgirlsummerNessuna valutazione finora

- Preboard CompreDocumento191 paginePreboard CompreInny Agin100% (1)

- An Exemption Provided by Law To Take Care of PersonalDocumento5 pagineAn Exemption Provided by Law To Take Care of PersonalQueen ValleNessuna valutazione finora

- TAX 1 - Income Tax - 1Documento8 pagineTAX 1 - Income Tax - 1Yella Mae Pariña RelosNessuna valutazione finora

- Finals Tax301Documento9 pagineFinals Tax301Pauline De VillaNessuna valutazione finora

- Income Tax 1Documento31 pagineIncome Tax 1Barbie EboniaNessuna valutazione finora

- Income Tax Semifinals ExamDocumento5 pagineIncome Tax Semifinals ExamFeelingerang MAYoraNessuna valutazione finora

- EeeDocumento9 pagineEeeNico evansNessuna valutazione finora

- DeductionsDocumento31 pagineDeductionsJane Tuazon50% (2)

- TaxDocumento4 pagineTaxCielito AlvarezNessuna valutazione finora

- Practice.-Aim-Higher 2Documento73 paginePractice.-Aim-Higher 2Kae Abegail GarciaNessuna valutazione finora

- 3.4.1 Answer Key - Assignment - General Principles of Income TaxDocumento5 pagine3.4.1 Answer Key - Assignment - General Principles of Income Taxsam imperialNessuna valutazione finora

- Master of AccountingDocumento5 pagineMaster of AccountingPhilip CastroNessuna valutazione finora

- Tax ComprehensiveDocumento11 pagineTax ComprehensiveDawn digolNessuna valutazione finora

- Toaz - Info Reviewers For Deductions Taxation PRDocumento30 pagineToaz - Info Reviewers For Deductions Taxation PRLa JewelNessuna valutazione finora

- Accounting Hawk - TAXATIONDocumento14 pagineAccounting Hawk - TAXATIONClaire BarbaNessuna valutazione finora

- Tax - Midterm NTC 2017Documento12 pagineTax - Midterm NTC 2017Red YuNessuna valutazione finora

- Instruction: Write The Letter of Your Choice On The Space Provided Before The NumberDocumento4 pagineInstruction: Write The Letter of Your Choice On The Space Provided Before The NumberASDDD100% (2)

- Taxation Compiled Questions With AnswersDocumento18 pagineTaxation Compiled Questions With AnswersJeneleen TalledoNessuna valutazione finora

- Summative TestDocumento5 pagineSummative TestRichard de Leon0% (1)

- Introduction To Income TaxDocumento4 pagineIntroduction To Income Taxkimberlyann ongNessuna valutazione finora

- Taxation Exam: MidtermDocumento33 pagineTaxation Exam: MidtermSim BelsondraNessuna valutazione finora

- Fringe Benefit - QuizDocumento3 pagineFringe Benefit - QuizArlea AsenciNessuna valutazione finora

- Income Tax ExamDocumento4 pagineIncome Tax ExamErwin Labayog Medina0% (1)

- Test 1-Theory (1 PT Each) - Write Only The Letter Which Corresponds To Your Chosen AnswerDocumento3 pagineTest 1-Theory (1 PT Each) - Write Only The Letter Which Corresponds To Your Chosen AnswerJazel Mae CelerinosNessuna valutazione finora

- Tax QuizDocumento2 pagineTax QuizEarl Russell S PaulicanNessuna valutazione finora

- Tax Review - FinalsDocumento8 pagineTax Review - FinalsRobert Castillo100% (2)

- Tax Pre TestDocumento4 pagineTax Pre TestSebastian GarciaNessuna valutazione finora

- TAX.02 Exercises On Individual TaxationDocumento5 pagineTAX.02 Exercises On Individual Taxationleon gumboc100% (1)

- Tax Pre TestDocumento5 pagineTax Pre TestKryzzel Anne JonNessuna valutazione finora

- Cpa Review School of The Philippines ManilaDocumento5 pagineCpa Review School of The Philippines ManilaSamuel Cedrick AbalosNessuna valutazione finora

- Master in Business Laws and Taxation - QaDocumento9 pagineMaster in Business Laws and Taxation - QaClyde RamosNessuna valutazione finora

- PAPS1013: E-Commerce: Effect On FS Audit: An OverviewDocumento12 paginePAPS1013: E-Commerce: Effect On FS Audit: An OverviewClyde RamosNessuna valutazione finora

- RED - Audit SamplingDocumento10 pagineRED - Audit SamplingClyde RamosNessuna valutazione finora

- S E (F'R - C? E H.Eerlriijc: Ii Iffir:J:IleierlDocumento12 pagineS E (F'R - C? E H.Eerlriijc: Ii Iffir:J:IleierlClyde RamosNessuna valutazione finora

- Still Be Used in Correcting Entries. When Books Are Closed, Closing Entries Have AlreadyDocumento3 pagineStill Be Used in Correcting Entries. When Books Are Closed, Closing Entries Have AlreadyClyde RamosNessuna valutazione finora

- Mas: CVP and Break-Even Analysis Concept Summary: Period of TimeDocumento3 pagineMas: CVP and Break-Even Analysis Concept Summary: Period of TimeClyde RamosNessuna valutazione finora

- Afar Corporate LiquidationDocumento3 pagineAfar Corporate LiquidationClyde RamosNessuna valutazione finora

- AFAR PartnershipDocumento3 pagineAFAR PartnershipClyde RamosNessuna valutazione finora

- Syllabus Accounting 141OBE RQATDocumento6 pagineSyllabus Accounting 141OBE RQATClyde RamosNessuna valutazione finora

- Mas: Variable and Absorption Costing Concept Summary: Comparison As To Treatment of Operating CostsDocumento3 pagineMas: Variable and Absorption Costing Concept Summary: Comparison As To Treatment of Operating CostsClyde RamosNessuna valutazione finora

- Rey Ocampo Online! Financial Accounting and Reporting: Pfrs QuizDocumento11 pagineRey Ocampo Online! Financial Accounting and Reporting: Pfrs QuizClyde RamosNessuna valutazione finora

- PWC Print ElimsDocumento6 paginePWC Print ElimsClyde RamosNessuna valutazione finora

- DIFFICULTDocumento3 pagineDIFFICULTClyde RamosNessuna valutazione finora

- Master in Business Laws and Taxation - QaDocumento9 pagineMaster in Business Laws and Taxation - QaClyde RamosNessuna valutazione finora

- Mas1 PDFDocumento1 paginaMas1 PDFClyde RamosNessuna valutazione finora

- BLT QaDocumento9 pagineBLT QaClyde RamosNessuna valutazione finora

- PWC QaDocumento14 paginePWC QaClyde RamosNessuna valutazione finora

- PWC 1Documento20 paginePWC 1Clyde RamosNessuna valutazione finora

- Freedom of Trade Commerce and Intercourse 1Documento6 pagineFreedom of Trade Commerce and Intercourse 1Aman GuptaNessuna valutazione finora

- Summer Training Project Report On Real EstateDocumento61 pagineSummer Training Project Report On Real EstateKajal Heer100% (4)

- The Relationship Between Inflation and Economic GrowthDocumento21 pagineThe Relationship Between Inflation and Economic Growthasmar farajovaNessuna valutazione finora

- The Business, Tax, and Financial EnvironmentsDocumento58 pagineThe Business, Tax, and Financial EnvironmentsMuhammad Usama IqbalNessuna valutazione finora

- 3republic Bilipptnes Fffilanila: of TbeDocumento26 pagine3republic Bilipptnes Fffilanila: of TbeMichael De CastroNessuna valutazione finora

- Directorate of Health Services, West Bengal Pay Slip Government of West BengalDocumento1 paginaDirectorate of Health Services, West Bengal Pay Slip Government of West BengalBiman MondalNessuna valutazione finora

- Land Law ProjectDocumento15 pagineLand Law ProjectShubhankar ThakurNessuna valutazione finora

- BUS 5040 - Final ProjectDocumento16 pagineBUS 5040 - Final ProjectHafsat SaliuNessuna valutazione finora

- REALTISTATEDocumento28 pagineREALTISTATEManas Ranjan PattuNessuna valutazione finora

- Marathon Batch Final With Cover and Index PDFDocumento106 pagineMarathon Batch Final With Cover and Index PDFChandreshNessuna valutazione finora

- MBA - Financial Management Final ExamDocumento13 pagineMBA - Financial Management Final ExamJessica BoehmNessuna valutazione finora

- Ratio Analysis 1Documento31 pagineRatio Analysis 1Avinash SahuNessuna valutazione finora

- TAXATION 2 Chapter 14 VAT Payable and Compliance RequirementsDocumento4 pagineTAXATION 2 Chapter 14 VAT Payable and Compliance RequirementsKim Cristian MaañoNessuna valutazione finora

- Slip Gaji AriesDocumento1 paginaSlip Gaji AriesDaniel Tommy PassarellaNessuna valutazione finora

- BPC Annual Report 2010 PDFDocumento38 pagineBPC Annual Report 2010 PDFSonam PhuntshoNessuna valutazione finora

- M1 Foundation in Financial Planning and Tax Planning Syllabus FinalDocumento10 pagineM1 Foundation in Financial Planning and Tax Planning Syllabus FinalCalvin YeohNessuna valutazione finora

- Challan No. ITNS 280Documento2 pagineChallan No. ITNS 280RAHUL AGARWALNessuna valutazione finora

- Value Added Tax Act Sri LankaDocumento12 pagineValue Added Tax Act Sri LankaEdgar SenevirathnaNessuna valutazione finora

- BIR Ruling DA-141-99Documento3 pagineBIR Ruling DA-141-99racheltanuy6557100% (1)

- R R MarblesDocumento9 pagineR R Marblessri sai digital careNessuna valutazione finora

- Americans For Prosperity Taxpayer Scorecard, 215th Legislative SessionDocumento19 pagineAmericans For Prosperity Taxpayer Scorecard, 215th Legislative SessionAFPHQ_NewJerseyNessuna valutazione finora

- Acemoglu Etal - The Colonial Origins of Comparative DevelopmentDocumento34 pagineAcemoglu Etal - The Colonial Origins of Comparative DevelopmentGiri SubramaniamNessuna valutazione finora

- Everytown Gun Safety Action Fund - 990 Tax FormDocumento118 pagineEverytown Gun Safety Action Fund - 990 Tax FormCNBC.comNessuna valutazione finora